Mga Batayang Estadistika

| Nilai Portofolio | $ 299,499,044 |

| Posisi Saat Ini | 66 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

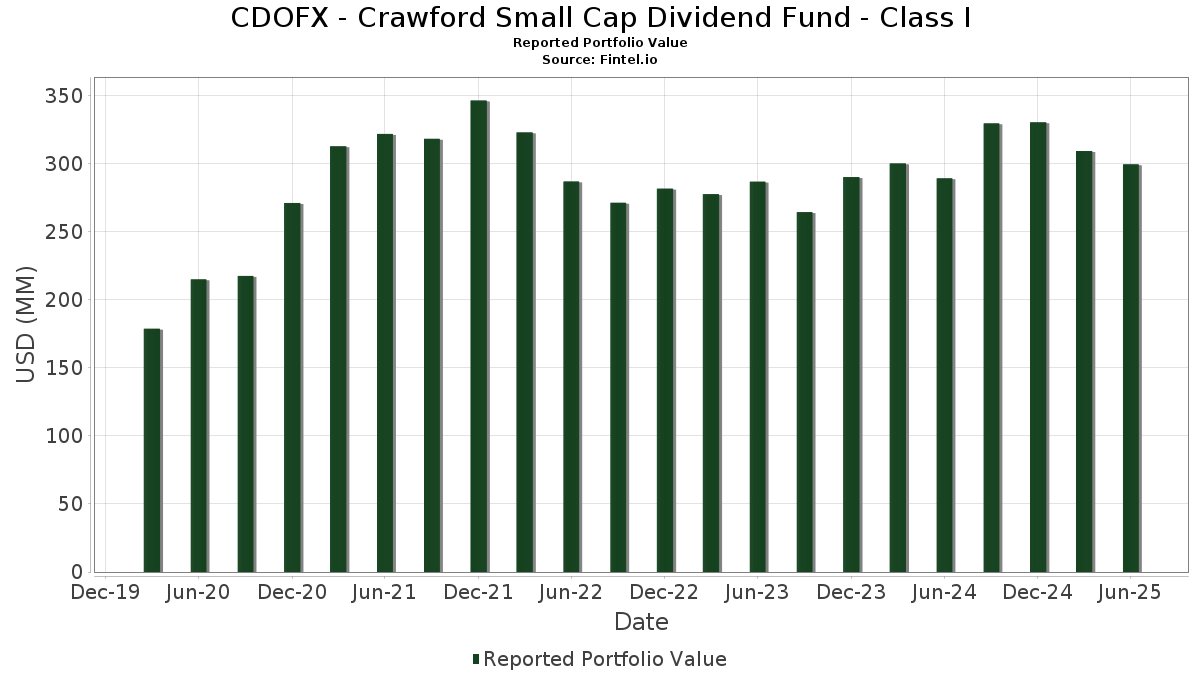

CDOFX - Crawford Small Cap Dividend Fund - Class I telah mengungkapkan total kepemilikan 66 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 299,499,044 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama CDOFX - Crawford Small Cap Dividend Fund - Class I adalah AZZ Inc. (US:AZZ) , ESCO Technologies Inc. (US:ESE) , Moog, Inc. - Class A (US:MOGA) , DT Midstream, Inc. (US:DTM) , and Pegasystems Inc. (US:PEGA) . Posisi baru CDOFX - Crawford Small Cap Dividend Fund - Class I meliputi: Federated Hermes Money Market Obligations Trust - Federated Hermes Tre Obli Fd Inst Shares USD (US:TOIXX) , The Scotts Miracle-Gro Company (US:SMG) , FirstCash Holdings, Inc. (US:FCFS) , California Water Service Group (US:CWT) , and Cognex Corporation (US:CGNX) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 3.96 | 1.3269 | 1.3269 | |

| 0.03 | 3.38 | 1.1327 | 1.1327 | |

| 0.07 | 2.98 | 0.9977 | 0.9977 | |

| 0.04 | 5.16 | 1.7294 | 0.5258 | |

| 0.04 | 3.61 | 1.2119 | 0.4409 | |

| 0.12 | 6.45 | 2.1612 | 0.4329 | |

| 0.07 | 5.27 | 1.7685 | 0.3876 | |

| 0.03 | 1.09 | 0.3665 | 0.3665 | |

| 6.31 | 2.1149 | 0.2868 | ||

| 0.10 | 5.54 | 1.8579 | 0.2822 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.12 | 3.69 | 1.2375 | -0.6104 | |

| 0.03 | 4.26 | 1.4285 | -0.4495 | |

| 0.04 | 6.18 | 2.0707 | -0.4155 | |

| 0.16 | 6.26 | 2.0982 | -0.2721 | |

| 0.34 | 5.95 | 1.9945 | -0.2595 | |

| 0.06 | 4.44 | 1.4877 | -0.2501 | |

| 0.14 | 1.89 | 0.6342 | -0.2486 | |

| 0.23 | 6.14 | 2.0596 | -0.2318 | |

| 0.08 | 4.34 | 1.4549 | -0.2244 | |

| 0.28 | 2.74 | 0.9202 | -0.2181 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-27 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AZZ / AZZ Inc. | 0.07 | -12.85 | 6.73 | -1.52 | 2.2554 | 0.0394 | |||

| ESE / ESCO Technologies Inc. | 0.03 | -22.23 | 6.67 | -6.23 | 2.2349 | -0.0709 | |||

| MOGA / Moog, Inc. - Class A | 0.04 | 0.00 | 6.62 | 4.40 | 2.2204 | 0.1625 | |||

| DTM / DT Midstream, Inc. | 0.06 | -16.24 | 6.52 | -4.58 | 2.1854 | -0.0307 | |||

| PEGA / Pegasystems Inc. | 0.12 | 55.39 | 6.45 | 21.01 | 2.1612 | 0.4329 | |||

| TOIXX / Federated Hermes Money Market Obligations Trust - Federated Hermes Tre Obli Fd Inst Shares USD | 6.31 | 11.93 | 2.1149 | 0.2868 | |||||

| ORI / Old Republic International Corporation | 0.16 | -12.61 | 6.26 | -14.34 | 2.0982 | -0.2721 | |||

| LMAT / LeMaitre Vascular, Inc. | 0.08 | -1.96 | 6.25 | -2.95 | 2.0939 | 0.0064 | |||

| MWA / Mueller Water Products, Inc. | 0.26 | -2.28 | 6.19 | -7.59 | 2.0751 | -0.0974 | |||

| HCKT / The Hackett Group, Inc. | 0.24 | 2.66 | 6.19 | -10.70 | 2.0743 | -0.1730 | |||

| THG / The Hanover Insurance Group, Inc. | 0.04 | -17.48 | 6.18 | -19.42 | 2.0707 | -0.4155 | |||

| USPH / U.S. Physical Therapy, Inc. | 0.08 | -0.63 | 6.17 | 7.39 | 2.0698 | 0.2050 | |||

| PRGO / Perrigo Company plc | 0.23 | -8.73 | 6.14 | -13.03 | 2.0596 | -0.2318 | |||

| SXI / Standex International Corporation | 0.04 | 6.90 | 6.06 | 3.64 | 2.0309 | 0.1351 | |||

| BDC / Belden Inc. | 0.05 | -15.95 | 6.05 | -2.90 | 2.0295 | 0.0069 | |||

| VMI / Valmont Industries, Inc. | 0.02 | -15.98 | 6.01 | -3.86 | 2.0144 | -0.0128 | |||

| IRT / Independence Realty Trust, Inc. | 0.34 | 2.75 | 5.95 | -14.38 | 1.9945 | -0.2595 | |||

| POWI / Power Integrations, Inc. | 0.10 | -0.47 | 5.87 | 10.17 | 1.9678 | 0.2396 | |||

| TRNO / Terreno Realty Corporation | 0.10 | 28.63 | 5.54 | 14.08 | 1.8579 | 0.2822 | |||

| FELE / Franklin Electric Co., Inc. | 0.06 | 6.01 | 5.54 | 1.34 | 1.8569 | 0.0839 | |||

| LFUS / Littelfuse, Inc. | 0.02 | -4.02 | 5.42 | 10.61 | 1.8169 | 0.2276 | |||

| ASO / Academy Sports and Outdoors, Inc. | 0.12 | -3.25 | 5.34 | -4.95 | 1.7909 | -0.0320 | |||

| TPB / Turning Point Brands, Inc. | 0.07 | -2.79 | 5.27 | 23.92 | 1.7685 | 0.3876 | |||

| CNMD / CONMED Corporation | 0.10 | 3.07 | 5.24 | -11.12 | 1.7560 | -0.1554 | |||

| LAZ / Lazard, Inc. | 0.11 | -1.01 | 5.16 | 9.69 | 1.7309 | 0.2041 | |||

| AEIS / Advanced Energy Industries, Inc. | 0.04 | 0.00 | 5.16 | 39.03 | 1.7294 | 0.5258 | |||

| FUL / H.B. Fuller Company | 0.08 | -6.84 | 4.92 | -0.14 | 1.6487 | 0.0511 | |||

| SSB / SouthState Corporation | 0.05 | 3.01 | 4.73 | 2.12 | 1.5848 | 0.0834 | |||

| HNI / HNI Corporation | 0.09 | -10.05 | 4.54 | -0.24 | 1.5206 | 0.0456 | |||

| MSM / MSC Industrial Direct Co., Inc. | 0.05 | -10.13 | 4.52 | -1.63 | 1.5169 | 0.0249 | |||

| TCBK / TriCo Bancshares | 0.11 | -7.12 | 4.49 | -5.91 | 1.5047 | -0.0427 | |||

| CDRE / Cadre Holdings, Inc. | 0.14 | 0.00 | 4.48 | 7.56 | 1.5030 | 0.1510 | |||

| WD / Walker & Dunlop, Inc. | 0.06 | 14.39 | 4.48 | -5.54 | 1.5027 | -0.0367 | |||

| SYBT / Stock Yards Bancorp, Inc. | 0.06 | -27.57 | 4.44 | -17.16 | 1.4877 | -0.2501 | |||

| PAHC / Phibro Animal Health Corporation | 0.17 | -4.20 | 4.37 | 14.56 | 1.4666 | 0.2278 | |||

| BANF / BancFirst Corporation | 0.04 | -16.61 | 4.34 | -6.18 | 1.4565 | -0.0455 | |||

| BKH / Black Hills Corporation | 0.08 | -9.37 | 4.34 | -16.17 | 1.4549 | -0.2244 | |||

| WSFS / WSFS Financial Corporation | 0.08 | -5.25 | 4.32 | 0.46 | 1.4492 | 0.0535 | |||

| HLNE / Hamilton Lane Incorporated | 0.03 | -23.01 | 4.26 | -26.41 | 1.4285 | -0.4495 | |||

| IPAR / Interparfums, Inc. | 0.03 | -3.08 | 4.13 | 11.78 | 1.3844 | 0.1859 | |||

| STAG / STAG Industrial, Inc. | 0.11 | -4.21 | 4.13 | -3.80 | 1.3839 | -0.0078 | |||

| SMG / The Scotts Miracle-Gro Company | 0.06 | 3.96 | 1.3269 | 1.3269 | |||||

| HXL / Hexcel Corporation | 0.07 | 0.00 | 3.84 | 3.15 | 1.2860 | 0.0798 | |||

| JJSF / J&J Snack Foods Corp. | 0.03 | 0.00 | 3.83 | -13.89 | 1.2848 | -0.1590 | |||

| NSA / National Storage Affiliates Trust | 0.12 | -20.20 | 3.69 | -35.22 | 1.2375 | -0.6104 | |||

| MLAB / Mesa Laboratories, Inc. | 0.04 | 91.53 | 3.61 | 52.10 | 1.2119 | 0.4409 | |||

| PIPR / Piper Sandler Companies | 0.01 | 0.00 | 3.60 | 12.23 | 1.2065 | 0.1663 | |||

| FCFS / FirstCash Holdings, Inc. | 0.03 | 3.38 | 1.1327 | 1.1327 | |||||

| APAM / Artisan Partners Asset Management Inc. | 0.08 | -4.39 | 3.38 | 8.41 | 1.1326 | 0.1216 | |||

| WHD / Cactus, Inc. | 0.08 | 18.62 | 3.34 | 13.17 | 1.1205 | 0.1624 | |||

| FHB / First Hawaiian, Inc. | 0.13 | 4.71 | 3.33 | 6.94 | 1.1166 | 0.1063 | |||

| WBS / Webster Financial Corporation | 0.06 | -17.03 | 3.32 | -12.13 | 1.1146 | -0.1126 | |||

| HRB / H&R Block, Inc. | 0.06 | 0.00 | 3.23 | -0.03 | 1.0843 | 0.0348 | |||

| UTZ / Utz Brands, Inc. | 0.25 | 4.14 | 3.15 | -7.15 | 1.0575 | -0.0448 | |||

| RCKY / Rocky Brands, Inc. | 0.14 | 0.00 | 3.11 | 27.75 | 1.0434 | 0.2531 | |||

| COLM / Columbia Sportswear Company | 0.05 | 3.04 | 3.10 | -16.86 | 1.0403 | -0.1702 | |||

| LSTR / Landstar System, Inc. | 0.02 | 0.00 | 2.98 | -7.43 | 0.9983 | -0.0453 | |||

| CWT / California Water Service Group | 0.07 | 2.98 | 0.9977 | 0.9977 | |||||

| CTS / CTS Corporation | 0.07 | -13.58 | 2.94 | -11.37 | 0.9857 | -0.0904 | |||

| MAN / ManpowerGroup Inc. | 0.07 | 30.62 | 2.93 | -8.84 | 0.9823 | -0.0602 | |||

| III / Information Services Group, Inc. | 0.61 | -1.61 | 2.93 | 20.81 | 0.9811 | 0.1951 | |||

| WDFC / WD-40 Company | 0.01 | -3.80 | 2.89 | -10.07 | 0.9674 | -0.0735 | |||

| EMBC / Embecta Corp. | 0.28 | 2.92 | 2.74 | -21.80 | 0.9202 | -0.2181 | |||

| SCVL / Shoe Carnival, Inc. | 0.13 | -3.25 | 2.48 | -17.68 | 0.8319 | -0.1459 | |||

| LAKE / Lakeland Industries, Inc. | 0.14 | 3.73 | 1.89 | -30.50 | 0.6342 | -0.2486 | |||

| CGNX / Cognex Corporation | 0.03 | 1.09 | 0.3665 | 0.3665 |