Mga Batayang Estadistika

| Nilai Portofolio | $ 297,789 |

| Posisi Saat Ini | 64 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

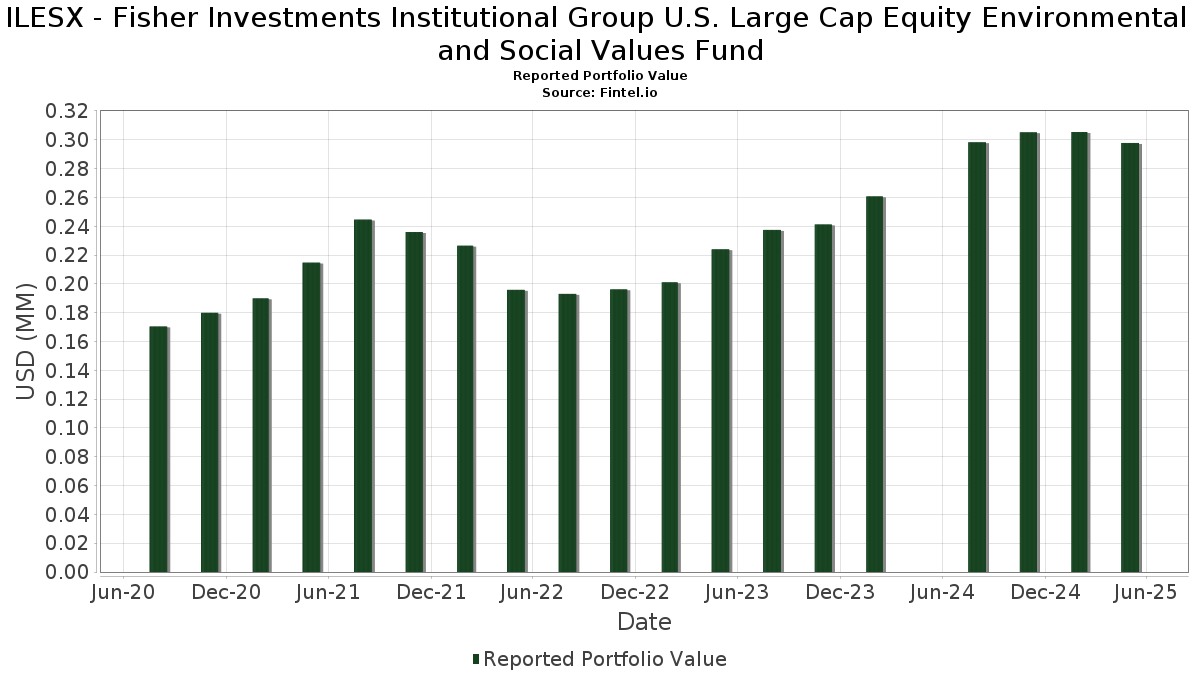

ILESX - Fisher Investments Institutional Group U.S. Large Cap Equity Environmental and Social Values Fund telah mengungkapkan total kepemilikan 64 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 297,789 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama ILESX - Fisher Investments Institutional Group U.S. Large Cap Equity Environmental and Social Values Fund adalah NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Alphabet Inc. (US:GOOGL) . Posisi baru ILESX - Fisher Investments Institutional Group U.S. Large Cap Equity Environmental and Social Values Fund meliputi: Ralph Lauren Corporation (US:RL) , Jefferies Financial Group Inc. (US:JEF) , Flowserve Corporation (US:FLS) , Acuity Inc. (US:AYI) , and First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | 1.3954 | 1.3954 | |

| 0.00 | 0.02 | 7.5811 | 1.2734 | |

| 0.00 | 0.00 | 1.1107 | 1.1107 | |

| 0.00 | 0.00 | 0.7213 | 0.7213 | |

| 0.00 | 0.00 | 0.6987 | 0.6987 | |

| 0.00 | 0.01 | 1.6968 | 0.5794 | |

| 0.00 | 0.00 | 0.4822 | 0.4822 | |

| 0.00 | 0.02 | 7.8112 | 0.2770 | |

| 0.00 | 0.01 | 3.1168 | 0.2456 | |

| 0.00 | 0.01 | 2.4343 | 0.2086 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.02 | 6.2776 | -1.0154 | |

| 0.00 | 0.01 | 1.7354 | -0.9513 | |

| 0.00 | 0.00 | 1.0008 | -0.5582 | |

| 0.00 | 0.00 | 1.0654 | -0.5329 | |

| 0.00 | 0.00 | 0.8091 | -0.3818 | |

| 0.00 | 0.00 | 1.0487 | -0.3114 | |

| 0.00 | 0.00 | 1.0846 | -0.2914 | |

| 0.00 | 0.00 | 1.2771 | -0.2871 | |

| 0.00 | 0.00 | 0.5073 | -0.2627 | |

| 0.00 | 0.00 | 1.4605 | -0.2518 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-30 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.00 | -7.53 | 0.02 | 0.00 | 7.8112 | 0.2770 | |||

| MSFT / Microsoft Corporation | 0.00 | 0.00 | 0.02 | 15.79 | 7.5811 | 1.2734 | |||

| AAPL / Apple Inc. | 0.00 | 0.00 | 0.02 | -18.18 | 6.2776 | -1.0154 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.00 | 0.01 | -8.33 | 3.9961 | 0.0038 | |||

| GOOGL / Alphabet Inc. | 0.00 | 3.85 | 0.01 | 12.50 | 3.1168 | 0.2456 | |||

| HD / The Home Depot, Inc. | 0.00 | 4.55 | 0.01 | 0.00 | 2.8468 | 0.0175 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 2.7844 | -0.0033 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | -6.45 | 0.01 | -12.50 | 2.5730 | -0.0873 | |||

| AXP / American Express Company | 0.00 | 0.00 | 0.01 | 0.00 | 2.4706 | 0.0308 | |||

| NFLX / Netflix, Inc. | 0.00 | -14.29 | 0.01 | 16.67 | 2.4343 | 0.2086 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 2.4216 | 0.0001 | |||

| V / Visa Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 2.0864 | 0.0870 | |||

| BAC / Bank of America Corporation | 0.00 | 0.00 | 0.01 | 0.00 | 1.8984 | -0.0150 | |||

| CRM / Salesforce, Inc. | 0.00 | 5.00 | 0.01 | 0.00 | 1.8729 | -0.0587 | |||

| C / Citigroup Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 1.7719 | -0.0428 | |||

| LLY / Eli Lilly and Company | 0.00 | -22.22 | 0.01 | -37.50 | 1.7354 | -0.9513 | |||

| ROK / Rockwell Automation, Inc. | 0.00 | 33.33 | 0.01 | 66.67 | 1.6968 | 0.5794 | |||

| BLK / BlackRock, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 1.6466 | 0.0613 | |||

| USB / U.S. Bancorp | 0.00 | 0.00 | 0.00 | 0.00 | 1.4650 | -0.0558 | |||

| MS / Morgan Stanley | 0.00 | 9.68 | 0.00 | 0.00 | 1.4629 | 0.1249 | |||

| JNJ / Johnson & Johnson | 0.00 | -12.50 | 0.00 | -20.00 | 1.4605 | -0.2518 | |||

| HEI / HEICO Corporation | 0.00 | 0.00 | 0.00 | 33.33 | 1.4098 | 0.2083 | |||

| RL / Ralph Lauren Corporation | 0.00 | 0.00 | 1.3954 | 1.3954 | |||||

| BKR / Baker Hughes Company | 0.00 | 0.00 | 0.00 | -25.00 | 1.3074 | -0.2108 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 0.00 | 0.00 | 1.2913 | 0.1500 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 1.2866 | 0.0598 | |||

| EMR / Emerson Electric Co. | 0.00 | 10.34 | 0.00 | 0.00 | 1.2839 | 0.1403 | |||

| EOG / EOG Resources, Inc. | 0.00 | -7.89 | 0.00 | -25.00 | 1.2771 | -0.2871 | |||

| ORCL / Oracle Corporation | 0.00 | 0.00 | 0.00 | 0.00 | 1.2239 | 0.0392 | |||

| NUE / Nucor Corporation | 0.00 | 0.00 | 0.00 | -25.00 | 1.1761 | -0.2503 | |||

| ADBE / Adobe Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 1.1160 | -0.0216 | |||

| JEF / Jefferies Financial Group Inc. | 0.00 | 0.00 | 1.1107 | 1.1107 | |||||

| KBH / KB Home | 0.00 | 0.00 | 0.00 | 0.00 | 1.0921 | -0.1540 | |||

| BIIB / Biogen Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 1.0905 | -0.0485 | |||

| MRK / Merck & Co., Inc. | 0.00 | -8.70 | 0.00 | -25.00 | 1.0846 | -0.2914 | |||

| PG / The Procter & Gamble Company | 0.00 | 0.00 | 0.00 | 0.00 | 1.0848 | 0.0138 | |||

| CMI / Cummins Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 1.0804 | -0.1134 | |||

| NSC / Norfolk Southern Corporation | 0.00 | 0.00 | 0.00 | 0.00 | 1.0797 | 0.0437 | |||

| AMGN / Amgen Inc. | 0.00 | -31.25 | 0.00 | -25.00 | 1.0654 | -0.5329 | |||

| COST / Costco Wholesale Corporation | 0.00 | -25.00 | 0.00 | -25.00 | 1.0487 | -0.3114 | |||

| SLB / Schlumberger Limited | 0.00 | 9.41 | 0.00 | 0.00 | 1.0330 | -0.1153 | |||

| ABBV / AbbVie Inc. | 0.00 | -30.43 | 0.00 | -50.00 | 1.0008 | -0.5582 | |||

| ADSK / Autodesk, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.9952 | 0.1060 | |||

| ABT / Abbott Laboratories | 0.00 | -18.52 | 0.00 | -33.33 | 0.9876 | -0.2206 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | 0.00 | 0.00 | -33.33 | 0.9760 | -0.0433 | |||

| AMD / Advanced Micro Devices, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.8559 | 0.1112 | |||

| TROW / T. Rowe Price Group, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.8492 | -0.0763 | |||

| OTIS / Otis Worldwide Corporation | 0.00 | 0.00 | 0.00 | 0.00 | 0.8332 | -0.0081 | |||

| MRVL / Marvell Technology, Inc. | 0.00 | 0.00 | 0.00 | -33.33 | 0.8091 | -0.3818 | |||

| PFE / Pfizer Inc. | 0.00 | -1.00 | 0.00 | 0.00 | 0.7815 | -0.0755 | |||

| FLS / Flowserve Corporation | 0.00 | 0.00 | 0.7213 | 0.7213 | |||||

| AYI / Acuity Inc. | 0.00 | 0.00 | 0.6987 | 0.6987 | |||||

| SCHW / The Charles Schwab Corporation | 0.00 | 0.00 | 0.00 | 0.00 | 0.6532 | 0.0858 | |||

| YUM / Yum! Brands, Inc. | 0.00 | 0.00 | 0.00 | -50.00 | 0.6289 | -0.0303 | |||

| HAL / Halliburton Company | 0.00 | 14.46 | 0.00 | -50.00 | 0.6255 | -0.0843 | |||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 0.00 | 0.00 | 0.5460 | 0.0103 | |||||

| UPS / United Parcel Service, Inc. | 0.00 | 23.08 | 0.00 | 0.00 | 0.5245 | 0.0227 | |||

| KLAC / KLA Corporation | 0.00 | 0.00 | 0.00 | 0.00 | 0.5087 | 0.0490 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.00 | 0.00 | -50.00 | 0.5073 | -0.2627 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.00 | 0.00 | 0.4822 | 0.4822 | |||||

| MDT / Medtronic plc | 0.00 | 0.00 | 0.00 | 0.00 | 0.4462 | -0.0312 | |||

| GIS / General Mills, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.4194 | -0.0327 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | 0.00 | 0.00 | 0.2899 | 0.0136 | ||||

| VTRS / Viatris Inc. | 0.00 | 0.00 | 0.00 | 0.0030 | -0.0000 |