Mga Batayang Estadistika

| Nilai Portofolio | $ 62,529,650 |

| Posisi Saat Ini | 123 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

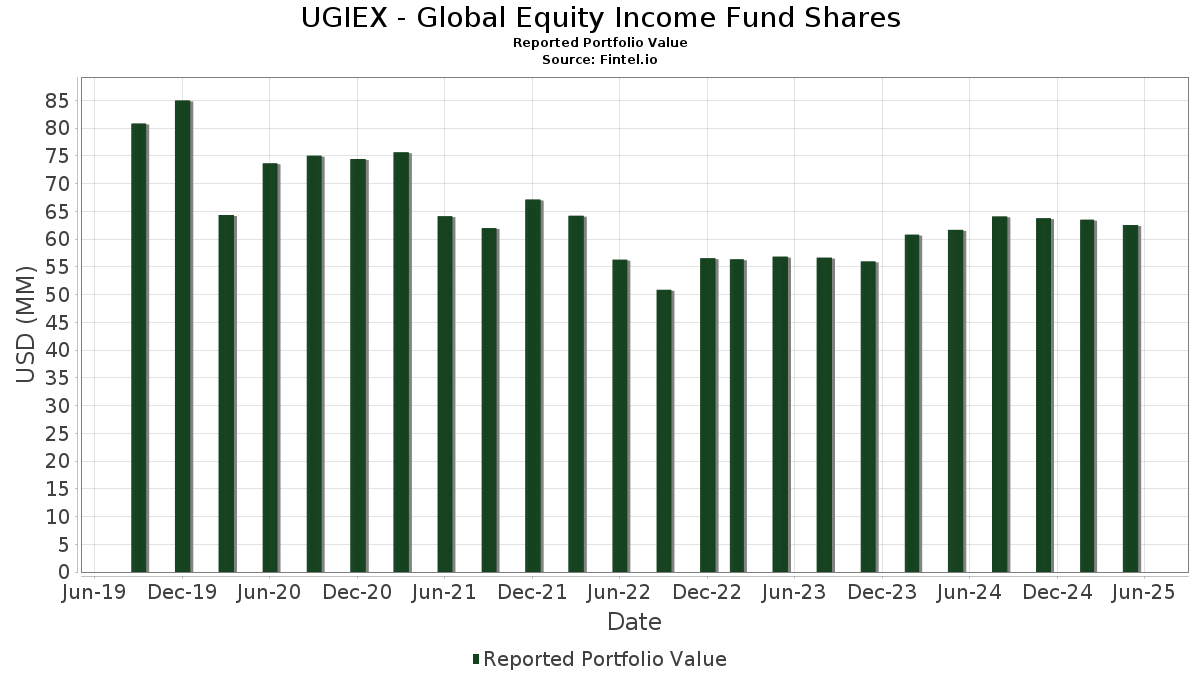

UGIEX - Global Equity Income Fund Shares telah mengungkapkan total kepemilikan 123 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 62,529,650 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama UGIEX - Global Equity Income Fund Shares adalah Apple Inc. (US:AAPL) , Cisco Systems, Inc. (US:CSCO) , Compagnie de Saint-Gobain S.A. (CH:GOB) , Heidelberg Materials AG - Depositary Receipt (Common Stock) (US:HDLMY) , and Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) (US:BBVA) . Posisi baru UGIEX - Global Equity Income Fund Shares meliputi: Fujikura Ltd. (JP:5803) , Kinross Gold Corporation - Equity Right (US:KGCRF) , EMCOR Group, Inc. (US:EME) , SBI Holdings, Inc. (US:SBHGF) , and FirstGroup plc (DE:FGR) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 0.61 | 0.9591 | 0.9591 | |

| 0.03 | 0.51 | 0.8006 | 0.8006 | |

| 0.00 | 0.44 | 0.6868 | 0.6868 | |

| 0.01 | 0.41 | 0.6544 | 0.6544 | |

| 0.00 | 0.41 | 0.6498 | 0.6498 | |

| 0.04 | 0.39 | 0.6148 | 0.6148 | |

| 0.01 | 0.39 | 0.6100 | 0.6100 | |

| 0.00 | 0.34 | 0.5435 | 0.5435 | |

| 0.00 | 0.34 | 0.5338 | 0.5338 | |

| 0.00 | 0.54 | 0.8459 | 0.5256 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 1.27 | 2.0072 | -3.5217 | |

| 0.00 | 0.62 | 0.9713 | -1.1012 | |

| 0.01 | 0.61 | 0.9618 | -0.8367 | |

| 0.00 | 0.39 | 0.6229 | -0.7377 | |

| 0.00 | 0.00 | -0.4175 | ||

| 0.00 | 0.00 | -0.3839 | ||

| 0.00 | 0.33 | 0.5277 | -0.2627 | |

| 0.01 | 0.61 | 0.9699 | -0.2345 | |

| 0.01 | 0.41 | 0.6391 | -0.2297 | |

| 0.01 | 0.75 | 1.1831 | -0.2092 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-25 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.01 | -56.49 | 1.27 | -63.88 | 2.0072 | -3.5217 | |||

| CSCO / Cisco Systems, Inc. | 0.02 | -1.19 | 1.16 | -2.84 | 1.8329 | -0.0447 | |||

| GOB / Compagnie de Saint-Gobain S.A. | 0.01 | -1.35 | 1.08 | 11.05 | 1.6956 | 0.1749 | |||

| HDLMY / Heidelberg Materials AG - Depositary Receipt (Common Stock) | 0.00 | 0.46 | 0.98 | 30.87 | 1.5386 | 0.3692 | |||

| BBVA / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 0.06 | -1.28 | 0.96 | 11.76 | 1.5152 | 0.1663 | |||

| ABBV / AbbVie Inc. | 0.01 | -1.16 | 0.93 | -12.06 | 1.4728 | -0.1930 | |||

| ALV / Allianz SE | 0.00 | -1.28 | 0.92 | 14.38 | 1.4434 | 0.1868 | |||

| KPN / Koninklijke KPN N.V. | 0.19 | -1.22 | 0.90 | 21.62 | 1.4203 | 0.2583 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.01 | -1.08 | 0.88 | 4.90 | 1.3852 | 0.0714 | |||

| TSCDF / Tesco PLC | 0.17 | -1.36 | 0.88 | 7.62 | 1.3830 | 0.1042 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | 1.04 | 0.88 | -6.62 | 1.3801 | -0.0915 | |||

| ENGI / Engie SA | 0.04 | 0.78 | 0.86 | 21.64 | 1.3568 | 0.2462 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.00 | 0.85 | 16.30 | 1.3403 | 0.1932 | |||

| 5 / HSBC Holdings plc | 0.07 | -1.34 | 0.85 | -1.96 | 1.3395 | -0.0209 | |||

| C0Q / Coca-Cola HBC AG | 0.02 | -1.29 | 0.85 | 21.52 | 1.3359 | 0.2405 | |||

| CM / Canadian Imperial Bank of Commerce | 0.01 | -1.12 | 0.84 | 11.11 | 1.3255 | 0.1379 | |||

| IBE / Iberdrola, S.A. | 0.04 | -1.11 | 0.82 | 25.58 | 1.2866 | 0.2665 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | -1.02 | 0.77 | 0.26 | 1.2086 | 0.0080 | |||

| EOG / EOG Resources, Inc. | 0.01 | -1.12 | 0.75 | -15.45 | 1.1831 | -0.2092 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | -1.03 | 0.75 | -4.71 | 1.1808 | -0.0524 | |||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0.00 | -0.99 | 0.75 | -3.62 | 1.1766 | -0.0392 | |||

| JNJ / Johnson & Johnson | 0.00 | -1.00 | 0.71 | -6.86 | 1.1142 | -0.0768 | |||

| MH6 / Tokio Marine Holdings, Inc. | 0.02 | 0.00 | 0.70 | 18.78 | 1.1073 | 0.1793 | |||

| HD / The Home Depot, Inc. | 0.00 | -1.00 | 0.69 | -8.09 | 1.0937 | -0.0904 | |||

| PKG / Packaging Corporation of America | 0.00 | -0.93 | 0.68 | -10.21 | 1.0684 | -0.1157 | |||

| SU / Suncor Energy Inc. | 0.02 | -0.97 | 0.67 | -8.05 | 1.0644 | -0.0870 | |||

| SAN N / Banco Santander, S.A. | 0.08 | -0.97 | 0.67 | 23.22 | 1.0632 | 0.2034 | |||

| NTAP / NetApp, Inc. | 0.01 | 43.53 | 0.67 | 42.68 | 1.0601 | 0.3202 | |||

| FNF / Fidelity National Financial, Inc. | 0.01 | -0.99 | 0.66 | -16.01 | 1.0432 | -0.1924 | |||

| ENLAY / Enel SpA - Depositary Receipt (Common Stock) | 0.07 | -0.96 | 0.66 | 24.29 | 1.0415 | 0.2076 | |||

| TEL / TE Connectivity plc | 0.00 | -0.83 | 0.65 | 3.00 | 1.0297 | 0.0353 | |||

| DTEGY / Deutsche Telekom AG - Depositary Receipt (Common Stock) | 0.02 | -1.09 | 0.65 | 3.85 | 1.0228 | 0.0420 | |||

| CF / CF Industries Holdings, Inc. | 0.01 | -0.77 | 0.65 | 11.02 | 1.0187 | 0.1061 | |||

| TOG / Tokyo Gas Co.,Ltd. | 0.02 | 2.13 | 0.64 | 8.61 | 1.0154 | 0.0854 | |||

| 0WH / WH Group Limited | 0.68 | -0.80 | 0.63 | 11.74 | 0.9907 | 0.1077 | |||

| SYF / Synchrony Financial | 0.01 | -0.77 | 0.62 | -5.66 | 0.9736 | -0.0543 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | -53.24 | 0.62 | -53.41 | 0.9713 | -1.1012 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | -1.02 | 0.61 | -19.95 | 0.9699 | -0.2345 | |||

| MO / Altria Group, Inc. | 0.01 | -50.95 | 0.61 | -46.81 | 0.9618 | -0.8367 | |||

| 5803 / Fujikura Ltd. | 0.01 | 0.61 | 0.9591 | 0.9591 | |||||

| KLAC / KLA Corporation | 0.00 | 69.51 | 0.60 | 81.02 | 0.9489 | 0.4271 | |||

| HOLN / Holcim AG | 0.01 | -0.83 | 0.59 | 0.17 | 0.9366 | 0.0067 | |||

| ADRNY / Koninklijke Ahold Delhaize N.V. - Depositary Receipt (Common Stock) | 0.01 | -0.93 | 0.58 | 18.46 | 0.9226 | 0.1483 | |||

| ND5 / Nitto Denko Corporation | 0.03 | -0.93 | 0.58 | -8.52 | 0.9152 | -0.0807 | |||

| AFG / American Financial Group, Inc. | 0.00 | -0.88 | 0.57 | -2.55 | 0.9039 | -0.0206 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.01 | -0.84 | 0.57 | -3.54 | 0.9038 | -0.0296 | |||

| HPQ / HP Inc. | 0.02 | 182.29 | 0.55 | 127.57 | 0.8731 | 0.4914 | |||

| SHELL / Shell plc | 0.02 | -1.10 | 0.55 | -2.30 | 0.8713 | -0.0168 | |||

| AMP / Ameriprise Financial, Inc. | 0.00 | -0.73 | 0.55 | -5.98 | 0.8681 | -0.0503 | |||

| WRB / W. R. Berkley Corporation | 0.01 | -0.62 | 0.54 | 17.83 | 0.8548 | 0.1318 | |||

| B8O / Yangzijiang Shipbuilding (Holdings) Ltd. | 0.33 | 45.82 | 0.54 | 35.26 | 0.8472 | 0.2240 | |||

| AMAT / Applied Materials, Inc. | 0.00 | 165.07 | 0.54 | 162.75 | 0.8459 | 0.5256 | |||

| BMO / Bank of Montreal | 0.00 | -0.86 | 0.53 | 3.50 | 0.8402 | 0.0325 | |||

| LMT / Lockheed Martin Corporation | 0.00 | -0.82 | 0.52 | 6.10 | 0.8246 | 0.0520 | |||

| ANK / Sompo Holdings, Inc. | 0.02 | 0.00 | 0.51 | 1.59 | 0.8066 | 0.0168 | |||

| KGCRF / Kinross Gold Corporation - Equity Right | 0.03 | 0.51 | 0.8006 | 0.8006 | |||||

| GS / The Goldman Sachs Group, Inc. | 0.00 | -0.60 | 0.50 | -4.26 | 0.7822 | -0.0295 | |||

| CNQ / Canadian Natural Resources Limited | 0.02 | -0.60 | 0.47 | 6.82 | 0.7425 | 0.0511 | |||

| STLD / Steel Dynamics, Inc. | 0.00 | -24.03 | 0.46 | -21.75 | 0.7327 | -0.1891 | |||

| GLPEY / Galp Energia, SGPS, S.A. - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 0.45 | -2.81 | 0.7098 | -0.0179 | |||

| LOGN / Logitech International S.A. | 0.01 | -0.74 | 0.45 | -16.60 | 0.7057 | -0.1357 | |||

| MAS / Masco Corporation | 0.01 | -0.79 | 0.44 | -17.67 | 0.6915 | -0.1441 | |||

| KMTUF / Komatsu Ltd. | 0.01 | 65.52 | 0.44 | 71.37 | 0.6902 | 0.2773 | |||

| EME / EMCOR Group, Inc. | 0.00 | 0.44 | 0.6868 | 0.6868 | |||||

| IKTSF / Intertek Group plc | 0.01 | -0.92 | 0.43 | -1.38 | 0.6775 | -0.0067 | |||

| MPC / Marathon Petroleum Corporation | 0.00 | -28.12 | 0.42 | -23.13 | 0.6667 | -0.1959 | |||

| CI / The Cigna Group | 0.00 | 165.73 | 0.42 | 172.55 | 0.6582 | 0.4177 | |||

| IMB / Imperial Brands PLC | 0.01 | -0.77 | 0.42 | 6.96 | 0.6557 | 0.0454 | |||

| ISUZF / Isuzu Motors Limited | 0.03 | -0.65 | 0.42 | 1.47 | 0.6545 | 0.0123 | |||

| SBHGF / SBI Holdings, Inc. | 0.01 | 0.41 | 0.6544 | 0.6544 | |||||

| FGR / FirstGroup plc | 0.00 | 0.41 | 0.6498 | 0.6498 | |||||

| CHRW / C.H. Robinson Worldwide, Inc. | 0.00 | -0.63 | 0.41 | -6.18 | 0.6479 | -0.0392 | |||

| RS / Reliance, Inc. | 0.00 | -0.43 | 0.41 | -1.92 | 0.6465 | -0.0093 | |||

| BBY / Best Buy Co., Inc. | 0.01 | -0.68 | 0.41 | -26.76 | 0.6391 | -0.2297 | |||

| CINF / Cincinnati Financial Corporation | 0.00 | -0.38 | 0.40 | 1.79 | 0.6296 | 0.0131 | |||

| CL / Colgate-Palmolive Company | 0.00 | -55.30 | 0.39 | -54.50 | 0.6229 | -0.7377 | |||

| 669 / Techtronic Industries Company Limited | 0.04 | 0.39 | 0.6148 | 0.6148 | |||||

| VLO / Valero Energy Corporation | 0.00 | -0.43 | 0.39 | -1.77 | 0.6136 | -0.0081 | |||

| GEAGF / GEA Group Aktiengesellschaft | 0.01 | 0.39 | 0.6100 | 0.6100 | |||||

| DPW / Deutsche Post AG | 0.01 | -0.66 | 0.39 | 14.20 | 0.6093 | 0.0774 | |||

| GIL / Gildan Activewear Inc. | 0.01 | -0.67 | 0.38 | -14.38 | 0.6016 | -0.0977 | |||

| OC / Owens Corning | 0.00 | -0.46 | 0.38 | -13.27 | 0.5978 | -0.0896 | |||

| COF / Capital One Financial Corporation | 0.00 | -0.25 | 0.38 | -5.99 | 0.5960 | -0.0345 | |||

| DVN / Devon Energy Corporation | 0.01 | -0.52 | 0.37 | -16.93 | 0.5894 | -0.1165 | |||

| OGFGY / Origin Energy Limited - Depositary Receipt (Common Stock) | 0.05 | -0.92 | 0.37 | 1.38 | 0.5793 | 0.0111 | |||

| AXP / American Express Company | 0.00 | -0.24 | 0.37 | -2.41 | 0.5764 | -0.0122 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | -0.50 | 0.36 | -9.73 | 0.5721 | -0.0582 | |||

| MRK / Merck & Co., Inc. | 0.00 | -0.57 | 0.35 | -17.10 | 0.5508 | -0.1111 | |||

| MCK / McKesson Corporation | 0.00 | 0.34 | 0.5435 | 0.5435 | |||||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | -0.30 | 0.34 | -9.74 | 0.5422 | -0.0555 | |||

| BAH / Booz Allen Hamilton Holding Corporation | 0.00 | 0.34 | 0.5338 | 0.5338 | |||||

| NUE / Nucor Corporation | 0.00 | 5.55 | 0.33 | -31.70 | 0.5277 | -0.2627 | |||

| CLX / The Clorox Company | 0.00 | -0.40 | 0.33 | -15.94 | 0.5164 | -0.0956 | |||

| CMSQY / Computershare Limited - Depositary Receipt (Common Stock) | 0.01 | -0.25 | 0.33 | 0.62 | 0.5151 | 0.0059 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 286.69 | 0.32 | 136.50 | 0.5118 | 0.2895 | |||

| BIRG / Bank of Ireland Group plc | 0.02 | 0.32 | 0.5061 | 0.5061 | |||||

| CAH / Cardinal Health, Inc. | 0.00 | -43.18 | 0.32 | -22.03 | 0.4971 | -0.1314 | |||

| SYY / Sysco Corporation | 0.00 | -0.23 | 0.31 | -3.68 | 0.4965 | -0.0161 | |||

| OCBA / Oversea-Chinese Banking Corporation Limited | 0.02 | 0.00 | 0.30 | -1.63 | 0.4775 | -0.0056 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.00 | -0.33 | 0.30 | -4.13 | 0.4765 | -0.0189 | |||

| LYB / LyondellBasell Industries N.V. | 0.01 | -0.50 | 0.30 | -26.94 | 0.4754 | -0.1714 | |||

| IBKR / Interactive Brokers Group, Inc. | 0.00 | 0.30 | 0.4729 | 0.4729 | |||||

| VZ / Verizon Communications Inc. | 0.01 | -0.18 | 0.30 | 1.70 | 0.4726 | 0.0106 | |||

| SLF / Sun Life Financial Inc. | 0.00 | 0.00 | 0.29 | 15.75 | 0.4650 | 0.0654 | |||

| OGE / OGE Energy Corp. | 0.01 | -0.08 | 0.29 | -3.92 | 0.4637 | -0.0170 | |||

| NTR / Nutrien Ltd. | 0.00 | 0.28 | 0.4483 | 0.4483 | |||||

| OVV / Ovintiv Inc. | 0.01 | 0.28 | 0.4389 | 0.4389 | |||||

| WSM / Williams-Sonoma, Inc. | 0.00 | 0.27 | 0.4225 | 0.4225 | |||||

| SEH / Shin-Etsu Chemical Co., Ltd. | 0.01 | 0.00 | 0.27 | 6.00 | 0.4180 | 0.0251 | |||

| QBE / QBE Insurance Group Limited | 0.02 | 0.00 | 0.25 | 11.45 | 0.3992 | 0.0421 | |||

| DEVL / DBS Group Holdings Ltd | 0.01 | 0.00 | 0.25 | 1.22 | 0.3919 | 0.0058 | |||

| COL / Coles Group Limited | 0.02 | -0.66 | 0.24 | 11.11 | 0.3800 | 0.0403 | |||

| TJX / The TJX Companies, Inc. | 0.00 | -12.19 | 0.24 | -10.98 | 0.3720 | -0.0425 | |||

| CVE / Cenovus Energy Inc. | 0.02 | 0.00 | 0.23 | -4.49 | 0.3691 | -0.0166 | |||

| UPS / United Parcel Service, Inc. | 0.00 | -0.04 | 0.23 | -18.09 | 0.3649 | -0.0785 | |||

| EG / Everest Group, Ltd. | 0.00 | 0.00 | 0.22 | -1.83 | 0.3406 | -0.0043 | |||

| SGIOF / Shionogi & Co., Ltd. | 0.01 | 975.00 | 0.22 | 246.77 | 0.3397 | 0.2419 | |||

| SAN / Santander UK plc - Preferred Stock | 0.00 | 0.00 | 0.19 | -9.52 | 0.3003 | -0.0294 | |||

| RB N / Reckitt Benckiser Group plc | 0.00 | 0.00 | 0.19 | 2.76 | 0.2943 | 0.0091 | |||

| GLCNF / Glencore plc | 0.05 | 0.00 | 0.18 | -5.15 | 0.2911 | -0.0150 | |||

| TGT / Target Corporation | 0.00 | 0.00 | 0.17 | -24.45 | 0.2740 | -0.0864 | |||

| WU / The Western Union Company | 0.02 | 0.00 | 0.17 | -14.14 | 0.2682 | -0.0433 | |||

| SHELL PLC / EC (GB00BR1W9Z14) | 0.02 | 0.01 | 0.0095 | 0.0095 | |||||

| BATS / British American Tobacco p.l.c. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3839 | ||||

| SWKS / Skyworks Solutions, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4175 |