Mga Batayang Estadistika

| Nilai Portofolio | $ 679,088,908 |

| Posisi Saat Ini | 134 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

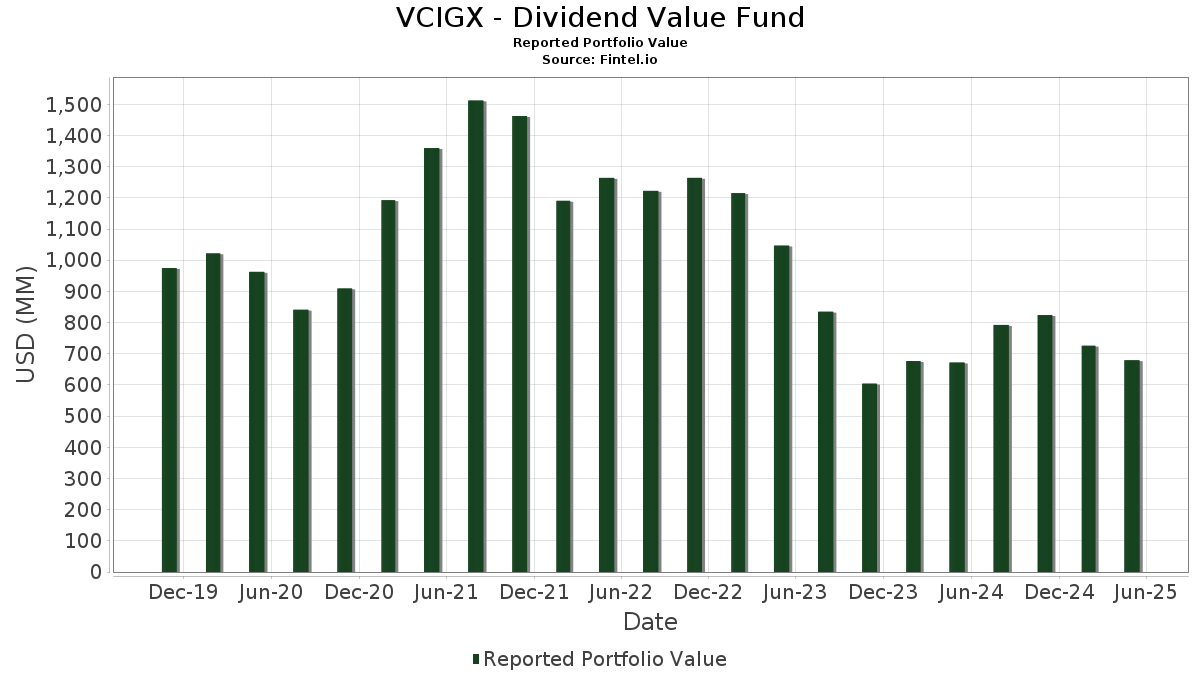

VCIGX - Dividend Value Fund telah mengungkapkan total kepemilikan 134 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 679,088,908 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama VCIGX - Dividend Value Fund adalah Microsoft Corporation (US:MSFT) , Wells Fargo & Company (US:WFC) , State Street Institutional Liquid Reserves Fund - Institutional Class (7-Day Yield) (US:US85749P1012) , CVS Health Corporation (US:CVS) , and Comcast Corporation (US:CMCSA) . Posisi baru VCIGX - Dividend Value Fund meliputi: STMicroelectronics N.V. (MX:STM1 N) , Industria de Diseño Textil, S.A. - Depositary Receipt (Common Stock) (US:IDEXY) , CSX Corporation (US:CSX) , Western Digital Corporation (US:WDC) , and Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares (US:NVDD) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 13.00 | 1.9097 | 0.6584 | |

| 0.05 | 22.01 | 3.2324 | 0.6214 | |

| 0.17 | 13.17 | 1.9337 | 0.5063 | |

| 0.14 | 3.44 | 0.5046 | 0.5046 | |

| 0.07 | 11.51 | 1.6907 | 0.4725 | |

| 0.12 | 3.21 | 0.4714 | 0.4714 | |

| 0.01 | 2.46 | 0.3610 | 0.3610 | |

| 0.08 | 2.37 | 0.3483 | 0.3483 | |

| 0.07 | 6.71 | 0.9849 | 0.3440 | |

| 0.04 | 2.28 | 0.3355 | 0.3355 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.11 | 0.11 | 0.0155 | -1.5344 | |

| 0.02 | 7.74 | 1.1361 | -0.5723 | |

| 0.04 | 11.64 | 1.7089 | -0.5292 | |

| 0.16 | 4.29 | 0.6307 | -0.4777 | |

| 0.08 | 5.26 | 0.7723 | -0.3581 | |

| 0.00 | 0.00 | -0.3520 | ||

| 0.05 | 7.37 | 1.0823 | -0.3493 | |

| 0.02 | 2.99 | 0.4394 | -0.3425 | |

| 0.01 | 0.19 | 0.0274 | -0.3092 | |

| 0.15 | 12.05 | 1.7692 | -0.2569 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-28 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.05 | 1.56 | 22.01 | 17.77 | 3.2324 | 0.6214 | |||

| WFC / Wells Fargo & Company | 0.21 | -6.40 | 15.44 | -10.63 | 2.2675 | -0.1462 | |||

| US85749P1012 / State Street Institutional Liquid Reserves Fund - Institutional Class (7-Day Yield) | 14.92 | -11.42 | 14.92 | -11.44 | 2.1918 | -0.1626 | |||

| CVS / CVS Health Corporation | 0.22 | -7.98 | 14.40 | -10.33 | 2.1142 | -0.1287 | |||

| CMCSA / Comcast Corporation | 0.41 | 0.35 | 14.19 | -3.31 | 2.0839 | 0.0335 | |||

| C / Citigroup Inc. | 0.19 | -4.67 | 14.07 | -10.19 | 2.0662 | -0.1225 | |||

| SRE / Sempra | 0.17 | 17.36 | 13.17 | 28.88 | 1.9337 | 0.5063 | |||

| LHX / L3Harris Technologies, Inc. | 0.05 | 22.47 | 13.00 | 45.19 | 1.9097 | 0.6584 | |||

| CAH / Cardinal Health, Inc. | 0.08 | -12.51 | 12.76 | 4.36 | 1.8745 | 0.1657 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.01 | 13.63 | 12.27 | 2.58 | 1.8022 | 0.1308 | |||

| SSNC / SS&C Technologies Holdings, Inc. | 0.15 | -8.46 | 12.05 | -16.93 | 1.7692 | -0.2569 | |||

| JPM / JPMorgan Chase & Co. | 0.04 | -27.18 | 11.64 | -27.36 | 1.7089 | -0.5292 | |||

| BDX / Becton, Dickinson and Company | 0.07 | 72.53 | 11.51 | 32.04 | 1.6907 | 0.4725 | |||

| MDT / Medtronic plc | 0.13 | 10.29 | 10.47 | -0.54 | 1.5382 | 0.0669 | |||

| ICE / Intercontinental Exchange, Inc. | 0.05 | -4.55 | 8.91 | -0.92 | 1.3087 | 0.0521 | |||

| BAX / Baxter International Inc. | 0.29 | 0.67 | 8.85 | -11.03 | 1.3002 | -0.0900 | |||

| WTY / Willis Towers Watson Public Limited Company | 0.03 | -4.30 | 8.69 | -10.81 | 1.2759 | -0.0850 | |||

| ENB / Enbridge Inc. | 0.18 | -4.78 | 8.14 | 3.57 | 1.1959 | 0.0975 | |||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0.08 | -18.37 | 8.13 | -9.90 | 1.1938 | -0.0667 | |||

| V / Visa Inc. | 0.02 | -37.17 | 7.74 | -36.74 | 1.1361 | -0.5723 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 1.57 | 1.49 | 7.62 | -10.93 | 1.1191 | -0.0762 | |||

| XOM / Exxon Mobil Corporation | 0.07 | 6.60 | 7.53 | -2.06 | 1.1058 | 0.0318 | |||

| AVGO / Broadcom Inc. | 0.03 | -13.16 | 7.50 | 5.41 | 1.1022 | 0.1075 | |||

| FIS / Fidelity National Information Services, Inc. | 0.09 | 11.56 | 7.38 | 24.89 | 1.0831 | 0.2580 | |||

| RTX / RTX Corporation | 0.05 | -29.92 | 7.37 | -28.08 | 1.0823 | -0.3493 | |||

| SHELL / Shell plc | 0.21 | -3.32 | 6.98 | -4.64 | 1.0253 | 0.0024 | |||

| TRV / The Travelers Companies, Inc. | 0.02 | -7.35 | 6.78 | -1.18 | 0.9953 | 0.0372 | |||

| LH / Labcorp Holdings Inc. | 0.03 | 1.71 | 6.77 | 0.86 | 0.9950 | 0.0566 | |||

| WMB / The Williams Companies, Inc. | 0.11 | -18.29 | 6.73 | -15.03 | 0.9882 | -0.1181 | |||

| DG / Dollar General Corporation | 0.07 | 11.52 | 6.71 | 46.20 | 0.9849 | 0.3440 | |||

| BC94 / Samsung Electronics Co., Ltd. - Depositary Receipt (Common Stock) | 0.01 | -4.39 | 6.70 | 3.01 | 0.9841 | 0.0754 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.08 | -12.90 | 6.43 | -15.34 | 0.9445 | -0.1168 | |||

| AZN / Astrazeneca plc | 0.04 | 2.25 | 6.29 | -2.48 | 0.9243 | 0.0227 | |||

| TMUS / T-Mobile US, Inc. | 0.03 | -10.27 | 6.28 | -19.43 | 0.9224 | -0.1666 | |||

| DIS / The Walt Disney Company | 0.05 | 1.75 | 6.15 | 1.07 | 0.9028 | 0.0531 | |||

| KHC / The Kraft Heinz Company | 0.23 | -12.40 | 6.06 | -23.75 | 0.8893 | -0.2202 | |||

| APD / Air Products and Chemicals, Inc. | 0.02 | -7.56 | 5.97 | -18.45 | 0.8765 | -0.1460 | |||

| MET / MetLife, Inc. | 0.07 | -7.23 | 5.84 | -15.41 | 0.8580 | -0.1069 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.09 | -4.78 | 5.63 | 6.73 | 0.8266 | 0.0898 | |||

| HPQ / HP Inc. | 0.22 | 19.80 | 5.47 | -3.36 | 0.8035 | 0.0125 | |||

| COF / Capital One Financial Corporation | 0.03 | 0.42 | 5.47 | -5.28 | 0.8034 | -0.0036 | |||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 5.35 | 34.72 | 5.35 | 34.73 | 0.7864 | 0.2311 | |||

| EA / Electronic Arts Inc. | 0.04 | -25.31 | 5.28 | -16.83 | 0.7752 | -0.1115 | |||

| CSCO / Cisco Systems, Inc. | 0.08 | -33.90 | 5.26 | -35.01 | 0.7723 | -0.3581 | |||

| CB / Chubb Limited | 0.02 | -4.77 | 5.17 | -0.86 | 0.7586 | 0.0306 | |||

| HLN / Haleon plc - Depositary Receipt (Common Stock) | 0.89 | -4.78 | 4.98 | 5.88 | 0.7321 | 0.0743 | |||

| CCI / Crown Castle Inc. | 0.05 | -3.32 | 4.98 | 3.11 | 0.7312 | 0.0566 | |||

| NOC / Northrop Grumman Corporation | 0.01 | -13.48 | 4.94 | -9.16 | 0.7250 | -0.0343 | |||

| VZ / Verizon Communications Inc. | 0.11 | -16.84 | 4.89 | -15.18 | 0.7175 | -0.0872 | |||

| AMZN / Amazon.com, Inc. | 0.02 | 5.81 | 4.85 | 2.19 | 0.7125 | 0.0492 | |||

| EXC / Exelon Corporation | 0.11 | -3.32 | 4.76 | -4.15 | 0.6994 | 0.0053 | |||

| APO / Apollo Global Management, Inc. | 0.04 | 6.53 | 4.75 | -6.74 | 0.6974 | -0.0139 | |||

| BAC / Bank of America Corporation | 0.11 | 33.81 | 4.75 | 28.10 | 0.6969 | 0.1793 | |||

| AVB / AvalonBay Communities, Inc. | 0.02 | 11.66 | 4.71 | 2.08 | 0.6917 | 0.0471 | |||

| KO / The Coca-Cola Company | 0.07 | -12.16 | 4.69 | -11.06 | 0.6885 | -0.0480 | |||

| PCG / PG&E Corporation | 0.28 | -3.32 | 4.68 | -0.13 | 0.6870 | 0.0326 | |||

| FNF / Fidelity National Financial, Inc. | 0.08 | -8.44 | 4.55 | -22.29 | 0.6689 | -0.1500 | |||

| LIN / Linde plc | 0.01 | -29.40 | 4.53 | -29.32 | 0.6657 | -0.2302 | |||

| PPG / PPG Industries, Inc. | 0.04 | -28.63 | 4.50 | -30.16 | 0.6604 | -0.2391 | |||

| META / Meta Platforms, Inc. | 0.01 | 20.58 | 4.45 | 16.86 | 0.6536 | 0.1214 | |||

| BTI / British American Tobacco p.l.c. - Depositary Receipt (Common Stock) | 0.10 | -16.97 | 4.41 | -3.60 | 0.6482 | 0.0085 | |||

| VMC / Vulcan Materials Company | 0.02 | -20.24 | 4.41 | -14.51 | 0.6474 | -0.0730 | |||

| SEE / Sealed Air Corporation | 0.14 | -8.20 | 4.40 | -13.53 | 0.6469 | -0.0647 | |||

| AMT / American Tower Corporation | 0.02 | 3.91 | 4.35 | 8.48 | 0.6387 | 0.0786 | |||

| GM / General Motors Company | 0.09 | -27.66 | 4.32 | -26.96 | 0.6344 | -0.1918 | |||

| 6758 / Sony Group Corporation | 0.16 | -48.65 | 4.29 | -45.87 | 0.6307 | -0.4777 | |||

| CG / The Carlyle Group Inc. | 0.09 | 108.79 | 4.20 | 89.40 | 0.6164 | 0.3067 | |||

| WM / Waste Management, Inc. | 0.02 | -4.77 | 4.16 | -1.42 | 0.6110 | 0.0214 | |||

| ORCL / Oracle Corporation | 0.02 | 1.18 | 4.10 | 0.86 | 0.6024 | 0.0342 | |||

| GOOGL / Alphabet Inc. | 0.02 | -14.14 | 4.04 | -13.40 | 0.5934 | -0.0585 | |||

| MRK / Merck & Co., Inc. | 0.05 | 6.50 | 4.04 | -11.28 | 0.5926 | -0.0429 | |||

| SAN / Santander UK plc - Preferred Stock | 0.04 | -17.09 | 3.86 | -24.32 | 0.5666 | -0.1457 | |||

| BA / The Boeing Company | 0.02 | -3.31 | 3.79 | 14.79 | 0.5563 | 0.0953 | |||

| ELV / Elevance Health, Inc. | 0.01 | -12.72 | 3.77 | -15.58 | 0.5530 | -0.0702 | |||

| RTO / Rentokil Initial plc - Depositary Receipt (Common Stock) | 0.78 | 38.58 | 3.69 | 30.32 | 0.5423 | 0.1464 | |||

| LDOS / Leidos Holdings, Inc. | 0.02 | -18.91 | 3.65 | -7.34 | 0.5359 | -0.0143 | |||

| D / Dominion Energy, Inc. | 0.06 | 80.69 | 3.64 | 80.93 | 0.5352 | 0.2537 | |||

| 0WP / WPP plc | 0.45 | 25.81 | 3.62 | 25.29 | 0.5318 | 0.1280 | |||

| HAS / Hasbro, Inc. | 0.05 | -27.76 | 3.55 | -25.98 | 0.5210 | -0.1486 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.11 | -23.71 | 3.54 | -29.63 | 0.5201 | -0.1829 | |||

| UNP / Union Pacific Corporation | 0.02 | -28.11 | 3.47 | -35.40 | 0.5090 | -0.2406 | |||

| DGE / Diageo plc | 0.13 | 9.32 | 3.45 | 9.31 | 0.5072 | 0.0659 | |||

| AAPL / Apple Inc. | 0.02 | -17.46 | 3.45 | -31.46 | 0.5067 | -0.1965 | |||

| TE Connectivity PLC / EC (IE000IVNQZ81) | 0.02 | 83.97 | 3.45 | 91.18 | 0.5060 | 0.2542 | |||

| STM1 N / STMicroelectronics N.V. | 0.14 | 3.44 | 0.5046 | 0.5046 | |||||

| HEN3 / Henkel AG & Co. KGaA - Preferred Stock | 0.04 | 55.58 | 3.32 | 44.10 | 0.4876 | 0.1656 | |||

| HD / The Home Depot, Inc. | 0.01 | -4.75 | 3.31 | -11.54 | 0.4864 | -0.0367 | |||

| HON / Honeywell International Inc. | 0.01 | 44.80 | 3.29 | 54.17 | 0.4837 | 0.1852 | |||

| HPE / Hewlett Packard Enterprise Company | 0.19 | 116.46 | 3.27 | 88.81 | 0.4809 | 0.2386 | |||

| IFF / International Flavors & Fragrances Inc. | 0.04 | 10.65 | 3.25 | 3.57 | 0.4773 | 0.0388 | |||

| IDEXY / Industria de Diseño Textil, S.A. - Depositary Receipt (Common Stock) | 0.12 | 3.21 | 0.4714 | 0.4714 | |||||

| PSA / Public Storage | 0.01 | 29.06 | 3.14 | 31.11 | 0.4618 | 0.1267 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.02 | -3.32 | 3.10 | 5.52 | 0.4546 | 0.0448 | |||

| JNJ / Johnson & Johnson | 0.02 | -4.77 | 3.09 | -10.43 | 0.4543 | -0.0282 | |||

| MAA / Mid-America Apartment Communities, Inc. | 0.02 | 10.54 | 3.07 | 2.99 | 0.4504 | 0.0344 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 44.08 | 3.04 | -8.42 | 0.4459 | -0.0173 | |||

| LW / Lamb Weston Holdings, Inc. | 0.05 | 43.50 | 3.03 | 54.36 | 0.4451 | 0.1707 | |||

| SCHW / The Charles Schwab Corporation | 0.03 | 77.97 | 3.01 | 97.64 | 0.4422 | 0.2294 | |||

| HES / Hess Corporation | 0.02 | -39.76 | 2.99 | -46.53 | 0.4394 | -0.3425 | |||

| CNH / CNH Industrial N.V. | 0.24 | -26.52 | 2.96 | -28.63 | 0.4346 | -0.1447 | |||

| TXN / Texas Instruments Incorporated | 0.02 | 30.15 | 2.95 | 21.43 | 0.4327 | 0.0937 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.02 | 0.07 | 2.94 | 7.14 | 0.4322 | 0.0485 | |||

| FTV / Fortive Corporation | 0.04 | 36.77 | 2.86 | 20.68 | 0.4201 | 0.0890 | |||

| JCI / Johnson Controls International plc | 0.03 | -46.22 | 2.76 | -36.36 | 0.4057 | -0.2007 | |||

| DTE / DTE Energy Company | 0.02 | -4.77 | 2.65 | -2.68 | 0.3899 | 0.0088 | |||

| FCX / Freeport-McMoRan Inc. | 0.07 | -4.78 | 2.60 | -0.72 | 0.3822 | 0.0160 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.01 | -4.76 | 2.60 | -13.73 | 0.3822 | -0.0393 | |||

| EQT / EQT Corporation | 0.05 | -23.63 | 2.52 | -12.61 | 0.3696 | -0.0327 | |||

| PG / The Procter & Gamble Company | 0.01 | -32.88 | 2.51 | -34.41 | 0.3687 | -0.1661 | |||

| CDW / CDW Corporation | 0.01 | 2.46 | 0.3610 | 0.3610 | |||||

| TECK / Teck Resources Limited | 0.07 | 15.86 | 2.43 | 6.44 | 0.3569 | 0.0379 | |||

| CSX / CSX Corporation | 0.08 | 2.37 | 0.3483 | 0.3483 | |||||

| WDC / Western Digital Corporation | 0.04 | 2.28 | 0.3355 | 0.3355 | |||||

| AIR / Airbus SE | 0.01 | -3.32 | 2.27 | 2.48 | 0.3333 | 0.0239 | |||

| AEP / American Electric Power Company, Inc. | 0.02 | -19.74 | 2.25 | -21.67 | 0.3297 | -0.0707 | |||

| CI / The Cigna Group | 0.01 | -43.45 | 2.23 | -42.04 | 0.3279 | -0.2102 | |||

| KDP / Keurig Dr Pepper Inc. | 0.07 | 38.38 | 2.19 | 39.07 | 0.3215 | 0.1015 | |||

| CCK / Crown Holdings, Inc. | 0.02 | 20.63 | 2.04 | 32.57 | 0.2995 | 0.0846 | |||

| LLY / Eli Lilly and Company | 0.00 | -18.43 | 2.01 | -34.67 | 0.2949 | -0.1343 | |||

| STAG / STAG Industrial, Inc. | 0.05 | 284.42 | 1.80 | 280.34 | 0.2643 | 0.1981 | |||

| LEA / Lear Corporation | 0.02 | -3.31 | 1.75 | -6.96 | 0.2572 | -0.0059 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.01 | 1.70 | 0.2500 | 0.2500 | |||||

| EIX / Edison International | 0.03 | -4.77 | 1.58 | -2.65 | 0.2316 | 0.0053 | |||

| PRU / Prudential Financial, Inc. | 0.01 | -8.01 | 1.38 | -17.02 | 0.2028 | -0.0295 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.01 | -31.75 | 1.36 | -25.06 | 0.1995 | -0.0538 | |||

| HR / Healthcare Realty Trust Incorporated | 0.09 | 1.33 | 0.1954 | 0.1954 | |||||

| INTC / Intel Corporation | 0.06 | -7.47 | 1.23 | -23.76 | 0.1801 | -0.0447 | |||

| ALLE / Allegion plc | 0.01 | -52.21 | 1.21 | -50.88 | 0.1770 | -0.1381 | |||

| AYI / Acuity Inc. | 0.00 | -3.28 | 0.92 | -15.47 | 0.1349 | -0.0168 | |||

| WCC / WESCO International, Inc. | 0.01 | 0.87 | 0.1271 | 0.1271 | |||||

| REXR / Rexford Industrial Realty, Inc. | 0.01 | 0.44 | 0.0647 | 0.0647 | |||||

| PHG / Koninklijke Philips N.V. - Depositary Receipt (Common Stock) | 0.01 | -91.18 | 0.19 | -92.28 | 0.0274 | -0.3092 | |||

| US8575093013 / State Street Navigator Securities Lending Government Money Market Portfolio | 0.11 | -99.05 | 0.11 | -99.05 | 0.0155 | -1.5344 | |||

| FTRE / Fortrea Holdings Inc. | 0.02 | -75.95 | 0.07 | -92.60 | 0.0101 | -0.1184 | |||

| NSC / Norfolk Southern Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1148 | ||||

| MCHP / Microchip Technology Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.3520 | ||||

| STZ / Constellation Brands, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2093 | ||||

| MU / Micron Technology, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1575 |