Mga Batayang Estadistika

| Nilai Portofolio | $ 170,315,000 |

| Posisi Saat Ini | 39 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

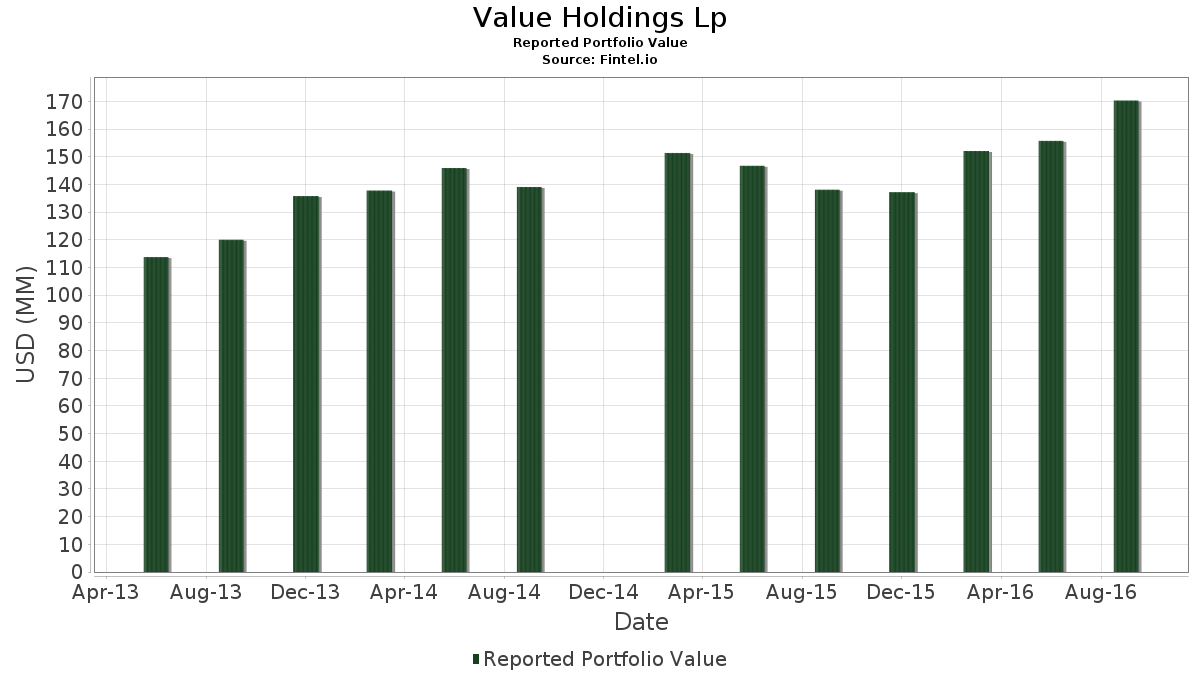

Value Holdings Lp telah mengungkapkan total kepemilikan 39 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 170,315,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Value Holdings Lp adalah MKS Inc. (US:MKSI) , Global Payments Inc. (US:GPN) , Westinghouse Air Brake Technologies Corporation (US:WAB) , Total System Services, Inc. (US:TSS) , and THOR Industries, Inc. (US:THO) . Posisi baru Value Holdings Lp meliputi: SPDR Series Trust - SPDR S&P Oil & Gas Exploration & Production ETF (US:XOP) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 3.47 | 2.0356 | 2.0356 | |

| 0.29 | 1.98 | 1.1596 | 1.1596 | |

| 0.13 | 10.93 | 6.4193 | 1.0543 | |

| 0.02 | 1.75 | 1.0246 | 1.0246 | |

| 0.18 | 1.67 | 0.9799 | 0.9799 | |

| 0.05 | 1.40 | 0.8191 | 0.8191 | |

| 0.05 | 1.04 | 0.6106 | 0.6106 | |

| 0.10 | 10.91 | 6.4040 | 0.5896 | |

| 0.04 | 1.00 | 0.5877 | 0.5877 | |

| 0.04 | 0.91 | 0.5349 | 0.5349 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.24 | 11.24 | 6.5972 | -1.5286 | |

| 0.13 | 9.44 | 5.5427 | -0.9016 | |

| 0.35 | 10.24 | 6.0118 | -0.5596 | |

| 0.01 | 1.16 | 0.6805 | -0.5111 | |

| 0.25 | 10.35 | 6.0764 | -0.4038 | |

| 0.00 | 0.00 | -0.4032 | ||

| 0.00 | 0.00 | -0.3313 | ||

| 0.17 | 12.73 | 7.4744 | -0.2174 | |

| 0.07 | 5.39 | 3.1635 | -0.1616 | |

| 0.10 | 4.61 | 2.7050 | -0.1515 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2016-11-10 untuk periode pelaporan 2016-09-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MKSI / MKS Inc. | 0.27 | 0.00 | 13.22 | 15.48 | 7.7644 | 0.4123 | |||

| GPN / Global Payments Inc. | 0.17 | -1.19 | 12.73 | 6.26 | 7.4744 | -0.2174 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.15 | 1.34 | 12.38 | 17.82 | 7.2677 | 0.5223 | |||

| TSS / Total System Services, Inc. | 0.24 | 0.00 | 11.24 | -11.22 | 6.5972 | -1.5286 | |||

| THO / THOR Industries, Inc. | 0.13 | 0.00 | 10.93 | 30.84 | 6.4193 | 1.0543 | |||

| COHR / Coherent Corp. | 0.10 | 0.00 | 10.91 | 20.44 | 6.4040 | 0.5896 | |||

| CSGS / CSG Systems International, Inc. | 0.25 | 0.00 | 10.35 | 2.54 | 6.0764 | -0.4038 | |||

| ROL / Rollins, Inc. | 0.35 | 0.00 | 10.24 | 0.04 | 6.0118 | -0.5596 | |||

| NSP / Insperity, Inc. | 0.13 | 0.00 | 9.44 | -5.95 | 5.5427 | -0.9016 | |||

| EME / EMCOR Group, Inc. | 0.16 | 0.00 | 9.37 | 21.02 | 5.4992 | 0.5304 | |||

| TTEK / Tetra Tech, Inc. | 0.22 | 0.00 | 7.82 | 15.37 | 4.5921 | 0.2396 | |||

| PRIM / Primoris Services Corporation | 0.34 | 0.29 | 7.03 | 9.14 | 4.1282 | -0.0079 | |||

| XEC / Cimarex Energy Co. | 0.04 | 0.00 | 5.47 | 12.62 | 3.2111 | 0.0933 | |||

| MSM / MSC Industrial Direct Co., Inc. | 0.07 | 0.00 | 5.39 | 4.04 | 3.1635 | -0.1616 | |||

| US2296691064 / Cubic Corporation | 0.10 | 3.00 | 4.82 | 20.06 | 2.8324 | 0.2526 | |||

| AIT / Applied Industrial Technologies, Inc. | 0.10 | 0.00 | 4.61 | 3.55 | 2.7050 | -0.1515 | |||

| DRQ / Dril-Quip, Inc. | 0.06 | 0.00 | 3.47 | -4.60 | 2.0356 | 2.0356 | |||

| VMI / Valmont Industries, Inc. | 0.02 | 0.00 | 2.52 | -0.51 | 1.4778 | -0.1465 | |||

| SRCI / SRC Energy Inc | 0.29 | 56.33 | 1.98 | 62.69 | 1.1596 | 1.1596 | |||

| LCII / LCI Industries | 0.02 | 0.00 | 1.75 | 15.56 | 1.0246 | 1.0246 | |||

| GIFI / Gulf Island Fabrication, Inc. | 0.18 | 9.67 | 1.67 | 45.38 | 0.9799 | 0.9799 | |||

| RTEC / Rudolph Technologies, Inc. | 0.08 | 9.11 | 1.49 | 24.62 | 0.8737 | 0.1071 | |||

| HURC / Hurco Companies, Inc. | 0.05 | 6.01 | 1.40 | 6.90 | 0.8191 | 0.8191 | |||

| LFUS / Littelfuse, Inc. | 0.01 | -42.68 | 1.16 | -37.55 | 0.6805 | -0.5111 | |||

| ROG / Rogers Corporation | 0.02 | 0.00 | 1.07 | 0.00 | 0.6312 | -0.0590 | |||

| VECO / Veeco Instruments Inc. | 0.05 | 95.51 | 1.04 | 131.63 | 0.6106 | 0.6106 | |||

| ONTO / Onto Innovation Inc. | 0.04 | 15.45 | 1.00 | 24.04 | 0.5877 | 0.5877 | |||

| MRCY / Mercury Systems, Inc. | 0.04 | 8.80 | 0.91 | 7.56 | 0.5349 | 0.5349 | |||

| BW / Babcock & Wilcox Enterprises, Inc. | 0.05 | 41.86 | 0.84 | 59.51 | 0.4926 | 0.4926 | |||

| RAIL / FreightCar America, Inc. | 0.05 | 10.96 | 0.73 | 13.57 | 0.4274 | 0.0159 | |||

| GHM / Graham Corporation | 0.03 | -6.24 | 0.57 | -2.71 | 0.3370 | 0.3370 | |||

| MTRX / Matrix Service Company | 0.03 | 1,226.25 | 0.50 | 1,409.09 | 0.2924 | 0.2924 | |||

| PDFS / PDF Solutions, Inc. | 0.03 | 0.00 | 0.45 | 29.71 | 0.2666 | 0.2666 | |||

| MTDR / Matador Resources Company | 0.02 | 20.00 | 0.44 | 47.47 | 0.2572 | 0.2572 | |||

| COHU / Cohu, Inc. | 0.04 | 0.00 | 0.42 | 8.33 | 0.2443 | 0.2443 | |||

| PLPM / Planet Payment, Inc. | 0.10 | 425.91 | 0.38 | 336.05 | 0.2202 | 0.2202 | |||

| XOP / SPDR Series Trust - SPDR S&P Oil & Gas Exploration & Production ETF | 0.01 | 0.31 | 0.1808 | 0.1808 | |||||

| DGII / Digi International Inc. | 0.01 | 366.67 | 0.16 | 400.00 | 0.0939 | 0.0939 | |||

| OSPN / OneSpan Inc. | 0.01 | 166.67 | 0.14 | 187.76 | 0.0828 | 0.0828 | |||

| FSTR / L.B. Foster Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.1400 | ||||

| ROLL / RBC Bearings Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4032 | ||||

| ZBRA / Zebra Technologies Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.3313 |