Mga Batayang Estadistika

| Nilai Portofolio | $ 876,438,230 |

| Posisi Saat Ini | 62 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

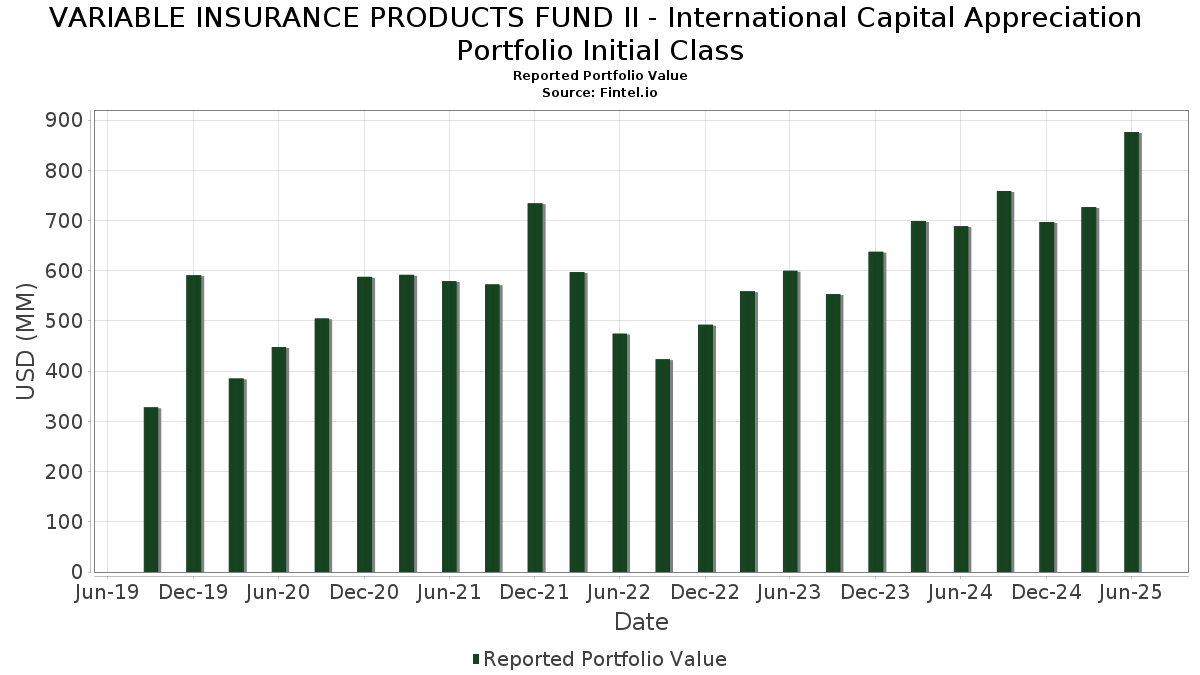

VARIABLE INSURANCE PRODUCTS FUND II - International Capital Appreciation Portfolio Initial Class telah mengungkapkan total kepemilikan 62 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 876,438,230 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama VARIABLE INSURANCE PRODUCTS FUND II - International Capital Appreciation Portfolio Initial Class adalah Taiwan Semiconductor Manufacturing Company Limited (TW:2330) , Tencent Holdings Limited (DE:NNND) , Schneider Electric S.E. - Depositary Receipt (Common Stock) (US:SBGSY) , Rolls-Royce Holdings plc (GB:RR.) , and ASML Holding N.V. (NL:ASML) . Posisi baru VARIABLE INSURANCE PRODUCTS FUND II - International Capital Appreciation Portfolio Initial Class meliputi: Deutsche Telekom AG (DE:DTE) , Bank Hapoalim B.M. (IL:POLI) , Commerzbank AG (CH:CBK) , Bank Leumi le-Israel B.M. (IL:LUMI) , and Synopsys, Inc. (US:SNPS) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.40 | 14.59 | 1.6642 | 1.6642 | |

| 0.77 | 14.90 | 1.7000 | 1.5582 | |

| 17.53 | 17.54 | 2.0008 | 1.4564 | |

| 0.66 | 12.74 | 1.4532 | 1.4532 | |

| 0.40 | 12.57 | 1.4344 | 1.4344 | |

| 0.66 | 12.34 | 1.4078 | 1.4078 | |

| 0.02 | 11.71 | 1.3362 | 1.3362 | |

| 0.13 | 11.45 | 1.3060 | 1.3060 | |

| 0.12 | 11.43 | 1.3041 | 1.3041 | |

| 0.03 | 10.42 | 1.1890 | 1.1890 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 3.12 | 0.3561 | -0.9261 | |

| 0.39 | 25.06 | 2.8596 | -0.4128 | |

| 0.15 | 11.12 | 1.2689 | -0.3535 | |

| 0.56 | 14.55 | 1.6601 | -0.3521 | |

| 0.03 | 11.53 | 1.3160 | -0.3273 | |

| 0.02 | 12.91 | 1.4731 | -0.3122 | |

| 0.00 | 13.33 | 1.5208 | -0.3015 | |

| 0.04 | 11.52 | 1.3140 | -0.2839 | |

| 0.02 | 11.10 | 1.2670 | -0.2770 | |

| 0.02 | 10.48 | 1.1957 | -0.2371 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-22 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 1.11 | 6.54 | 40.69 | 38.54 | 4.6427 | 0.5380 | |||

| NNND / Tencent Holdings Limited | 0.39 | 6.14 | 25.06 | 7.03 | 2.8596 | -0.4128 | |||

| SBGSY / Schneider Electric S.E. - Depositary Receipt (Common Stock) | 0.08 | 19.60 | 20.42 | 39.10 | 2.3296 | 0.2783 | |||

| RR. / Rolls-Royce Holdings plc | 1.54 | 4.18 | 20.39 | 42.06 | 2.3269 | 0.3206 | |||

| ASML / ASML Holding N.V. | 0.03 | -0.99 | 20.13 | 19.90 | 2.2962 | -0.0496 | |||

| SAP / SAP SE | 0.07 | -1.42 | 19.91 | 12.50 | 2.2722 | -0.2018 | |||

| HIA1 / Hitachi, Ltd. | 0.67 | 14.53 | 19.55 | 41.78 | 2.2310 | 0.3035 | |||

| ENR / Siemens Energy AG | 0.16 | -22.03 | 18.50 | 56.53 | 2.1110 | 0.4591 | |||

| SPF / Spotify Technology S.A. | 0.02 | -5.93 | 18.22 | 31.23 | 2.0788 | 0.1385 | |||

| US31635A1051 / Fidelity Cash Central Fund | 17.53 | 350.15 | 17.54 | 350.22 | 2.0008 | 1.4564 | |||

| SAF / Safran SA | 0.05 | 4.46 | 17.13 | 29.39 | 1.9543 | 0.1044 | |||

| HEI / Heidelberg Materials AG | 0.07 | -9.51 | 16.20 | 25.09 | 1.8481 | 0.0385 | |||

| HDFCB / HDFC Bank Ltd | 0.69 | 7.02 | 16.00 | 17.24 | 1.8257 | -0.0817 | |||

| MIH / Mitsubishi Heavy Industries, Ltd. | 0.63 | -17.47 | 15.75 | 20.26 | 1.7974 | -0.0332 | |||

| SHOP / Shopify Inc. | 0.13 | 6.37 | 15.56 | 28.51 | 1.7750 | 0.0831 | |||

| IBE / Iberdrola, S.A. | 0.77 | 855.60 | 14.90 | 1,728.22 | 1.7000 | 1.5582 | |||

| CNSWF / Constellation Software Inc. | 0.00 | 8.90 | 14.80 | 26.09 | 1.6889 | 0.0483 | |||

| ICICIBANK / ICICI Bank Limited | 0.87 | 4.00 | 14.79 | 11.88 | 1.6869 | -0.1599 | |||

| DS81 / DSV A/S | 0.06 | 5.63 | 14.71 | 31.02 | 1.6784 | 0.1093 | |||

| DTE / Deutsche Telekom AG | 0.40 | 14.59 | 1.6642 | 1.6642 | |||||

| ASM / ASM International NV | 0.02 | -2.11 | 14.57 | 39.50 | 1.6629 | 0.2029 | |||

| 6758 / Sony Group Corporation | 0.56 | -1.66 | 14.55 | 1.06 | 1.6601 | -0.3521 | |||

| BA. / BAE Systems plc | 0.55 | 51.03 | 14.24 | 173.27 | 1.6251 | 0.8762 | |||

| BHARTIARTL / Bharti Airtel Limited | 0.60 | -1.67 | 14.10 | 14.04 | 1.6087 | -0.1191 | |||

| ZURN / Zurich Insurance Group AG | 0.02 | 11.77 | 14.04 | 12.05 | 1.6021 | -0.1493 | |||

| GOB / Compagnie de Saint-Gobain S.A. | 0.12 | 9.41 | 13.96 | 29.03 | 1.5926 | 0.0807 | |||

| AVGO / Broadcom Inc. | 0.05 | -21.23 | 13.76 | 29.69 | 1.5699 | 0.0872 | |||

| RELX / RELX PLC - Depositary Receipt (Common Stock) | 0.25 | 0.24 | 13.57 | 8.15 | 1.5479 | -0.2051 | |||

| MELI / MercadoLibre, Inc. | 0.01 | -5.06 | 13.50 | 27.21 | 1.5402 | 0.0571 | |||

| LT / Larsen & Toubro Limited | 0.31 | 9.09 | 13.46 | 14.86 | 1.5353 | -0.1019 | |||

| IGQ5 / 3i Group plc | 0.24 | -1.67 | 13.36 | 18.35 | 1.5241 | -0.0532 | |||

| RMS / Hermès International Société en commandite par actions | 0.00 | -1.60 | 13.33 | 2.22 | 1.5208 | -0.3015 | |||

| AI / L'Air Liquide S.A. | 0.06 | -1.67 | 13.32 | 6.75 | 1.5197 | -0.2241 | |||

| TT / Trane Technologies plc | 0.03 | -1.28 | 12.97 | 28.15 | 1.4802 | 0.0655 | |||

| MUV2 / Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München | 0.02 | -1.68 | 12.91 | 1.06 | 1.4731 | -0.3122 | |||

| LSEG / London Stock Exchange Group plc | 0.09 | 15.15 | 12.78 | 13.38 | 1.4580 | -0.1171 | |||

| FER / Ferrovial SE | 0.24 | -1.82 | 12.76 | 17.55 | 1.4554 | -0.0611 | |||

| POLI / Bank Hapoalim B.M. | 0.66 | 12.74 | 1.4532 | 1.4532 | |||||

| CBK / Commerzbank AG | 0.40 | 12.57 | 1.4344 | 1.4344 | |||||

| MTX / MTU Aero Engines AG | 0.03 | 19.01 | 12.50 | 113.47 | 1.4264 | 0.4016 | |||

| BAM / Brookfield Asset Management Ltd. | 0.23 | 3.56 | 12.50 | 18.16 | 1.4261 | -0.0522 | |||

| WTKWY / Wolters Kluwer N.V. - Depositary Receipt (Common Stock) | 0.07 | -0.06 | 12.39 | 7.66 | 1.4133 | -0.1945 | |||

| LUMI / Bank Leumi le-Israel B.M. | 0.66 | 12.34 | 1.4078 | 1.4078 | |||||

| DB1 / Deutsche Börse AG | 0.04 | 21.71 | 12.21 | 34.75 | 1.3927 | 0.1268 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.05 | 24.23 | 11.95 | 11.30 | 1.3630 | -0.1369 | |||

| SNPS / Synopsys, Inc. | 0.02 | 11.71 | 1.3362 | 1.3362 | |||||

| V / Visa Inc. | 0.03 | -3.18 | 11.53 | -1.91 | 1.3160 | -0.3273 | |||

| AJG / Arthur J. Gallagher & Co. | 0.04 | 8.63 | 11.52 | 0.72 | 1.3140 | -0.2839 | |||

| EBS / Erste Group Bank AG | 0.13 | 11.45 | 1.3060 | 1.3060 | |||||

| MMYT / MakeMyTrip Limited | 0.12 | 11.43 | 1.3041 | 1.3041 | |||||

| HOLN / Holcim AG | 0.15 | 38.82 | 11.12 | -4.20 | 1.2689 | -0.3535 | |||

| MA / Mastercard Incorporated | 0.02 | -1.96 | 11.10 | 0.51 | 1.2670 | -0.2770 | |||

| WCN / Waste Connections, Inc. | 0.06 | 16.60 | 10.92 | 11.75 | 1.2461 | -0.1197 | |||

| TRI / Thomson Reuters Corporation | 0.05 | -1.67 | 10.91 | 14.59 | 1.2451 | -0.0858 | |||

| MCO / Moody's Corporation | 0.02 | -2.44 | 10.75 | 5.08 | 1.2270 | -0.2033 | |||

| IHG / InterContinental Hotels Group PLC - Depositary Receipt (Common Stock) | 0.09 | -1.05 | 10.73 | 5.07 | 1.2245 | -0.2029 | |||

| LIN / Linde plc | 0.02 | 6.41 | 10.59 | 7.23 | 1.2086 | -0.1720 | |||

| RACE / Ferrari N.V. | 0.02 | 4.83 | 10.51 | 21.16 | 1.1993 | -0.0131 | |||

| SPGI / S&P Global Inc. | 0.02 | -1.51 | 10.48 | 2.21 | 1.1957 | -0.2371 | |||

| AON / Aon plc | 0.03 | 10.42 | 1.1890 | 1.1890 | |||||

| PGHN / Partners Group Holding AG | 0.00 | -63.27 | 3.12 | -65.98 | 0.3561 | -0.9261 | |||

| AMRIZE LTD / EC (CH1430134226) | 0.06 | 2.92 | 0.3334 | 0.3334 | |||||

| CA21037X1345 / CONSTELLATION SOFTWARE INC | 0.00 | 0.00 | 0.00 | 0.0000 | -0.0000 |