Mga Batayang Estadistika

| Nilai Portofolio | $ 34,849,384 |

| Posisi Saat Ini | 122 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

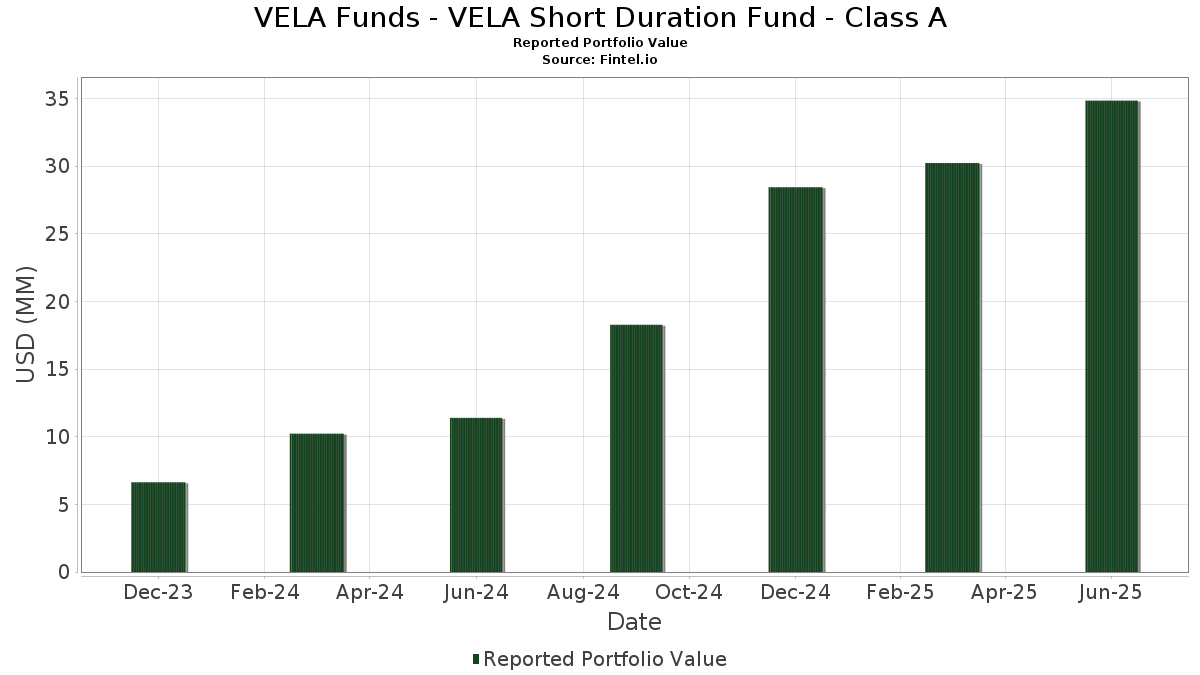

VELA Funds - VELA Short Duration Fund - Class A telah mengungkapkan total kepemilikan 122 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 34,849,384 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama VELA Funds - VELA Short Duration Fund - Class A adalah First American Funds Inc - First American Treasury Obligations Fund Class X (US:FXFXX) , United States Treasury Note/Bond - When Issued (US:US91282CJS17) , US TREASURY N/B 4.625% 11-15-26 (US:US91282CJK80) , United States Treasury Note/Bond (US:US91282CJP77) , and Oaktree Strategic Credit Fund (US:US67403AAA79) . Posisi baru VELA Funds - VELA Short Duration Fund - Class A meliputi: First American Funds Inc - First American Treasury Obligations Fund Class X (US:FXFXX) , United States Treasury Note/Bond - When Issued (US:US91282CJS17) , US TREASURY N/B 4.625% 11-15-26 (US:US91282CJK80) , United States Treasury Note/Bond (US:US91282CJP77) , and Oaktree Strategic Credit Fund (US:US67403AAA79) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.75 | 2.1339 | 2.1339 | ||

| 0.41 | 1.1604 | 1.1604 | ||

| 0.35 | 0.9961 | 0.9961 | ||

| 0.35 | 0.9891 | 0.9891 | ||

| 0.34 | 0.9707 | 0.9707 | ||

| 0.30 | 0.8627 | 0.8627 | ||

| 0.26 | 0.7493 | 0.7493 | ||

| 0.25 | 0.7171 | 0.7171 | ||

| 0.25 | 0.7110 | 0.7110 | ||

| 0.24 | 0.6877 | 0.6877 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.21 | 0.5840 | -0.4357 | ||

| 0.20 | 0.5648 | -0.4042 | ||

| 0.20 | 0.5648 | -0.4027 | ||

| 0.10 | 0.2863 | -0.3684 | ||

| 0.25 | 0.7027 | -0.2505 | ||

| 0.14 | 0.3972 | -0.2275 | ||

| 0.50 | 1.4244 | -0.2238 | ||

| 0.14 | 0.4074 | -0.2194 | ||

| 0.40 | 1.1467 | -0.1820 | ||

| 0.34 | 0.9700 | -0.1509 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-29 untuk periode pelaporan 2025-06-30. Investor ini belum mengungkapkan sekuritas yang diperhitungkan dalam bentuk saham, sehingga kolom terkait saham dalam tabel di bawah ini dihilangkan. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|

| FXFXX / First American Funds Inc - First American Treasury Obligations Fund Class X | 0.75 | 2.1339 | 2.1339 | |||

| US91282CJS17 / United States Treasury Note/Bond - When Issued | 0.50 | 0.00 | 1.4244 | -0.2238 | ||

| US91282CJK80 / US TREASURY N/B 4.625% 11-15-26 | 0.45 | 124.75 | 1.2945 | 0.6290 | ||

| US91282CJP77 / United States Treasury Note/Bond | 0.45 | 80.48 | 1.2916 | 0.4626 | ||

| US67403AAA79 / Oaktree Strategic Credit Fund | 0.43 | 33.02 | 1.2294 | 0.1598 | ||

| US138616AM99 / Cantor Fitzgerald LP | 0.42 | 14.91 | 1.2105 | -0.0052 | ||

| ESNT / Essent Group Ltd. | 0.41 | 33.98 | 1.1805 | 0.1626 | ||

| EQT / EQT Corporation | 0.41 | 1.1604 | 1.1604 | |||

| US345397C502 / Ford Motor Credit Co LLC | 0.40 | 13.84 | 1.1503 | -0.0189 | ||

| US91282CJC64 / United States Treasury Note/Bond | 0.40 | 100.50 | 1.1498 | 0.4847 | ||

| United States Treasury Note/Bond / DBT (US91282CKS97) | 0.40 | 166.23 | 1.1478 | 0.6491 | ||

| United States Treasury Note / DBT (US91282CKK61) | 0.40 | -0.25 | 1.1467 | -0.1820 | ||

| United States Treasury Note / DBT (US91282CLB53) | 0.40 | 14.25 | 1.1442 | -0.0142 | ||

| United States Treasury Note / DBT (US91282CKB62) | 0.40 | 59.76 | 1.1426 | 0.3157 | ||

| United States Treasury Note / DBT (US91282CKH33) | 0.40 | 100.50 | 1.1426 | 0.4813 | ||

| US91282CJL63 / UST NOTES 4.875% 11/30/2025 | 0.40 | 100.00 | 1.1420 | 0.4803 | ||

| US91282CHH79 / United States Treasury Note/Bond | 0.40 | 100.00 | 1.1409 | 0.4813 | ||

| US552848AG81 / MGIC Investment Corp | 0.40 | 15.61 | 1.1395 | -0.0002 | ||

| United States Treasury Note / DBT (US91282CJV46) | 0.40 | 59.60 | 1.1395 | 0.3152 | ||

| US91282CFP14 / United States Treasury Note/Bond | 0.40 | 99.50 | 1.1393 | 0.4804 | ||

| United States Treasury Note / DBT (US91282CLH24) | 0.40 | 100.50 | 1.1369 | 0.4803 | ||

| United States Treasury Note/Bond / DBT (US91282CLP40) | 0.40 | 101.01 | 1.1338 | 0.4795 | ||

| US03666HAE18 / Antares Holdings LP | 0.38 | 14.97 | 1.0957 | -0.0060 | ||

| US87854XAE13 / TechnipFMC PLC | 0.38 | 65.65 | 1.0866 | 0.3289 | ||

| US90932LAG23 / United Airlines Inc | 0.37 | 26.10 | 1.0619 | 0.0880 | ||

| Newmark Group Inc / DBT (US65158NAD49) | 0.37 | 17.83 | 1.0553 | 0.0183 | ||

| US693070AD69 / P & O Princess Cruises P L C Guaranteed Debentures 7.875% 06/15/2027 | 0.37 | 17.46 | 1.0548 | 0.0157 | ||

| RDN / Radian Group Inc. | 0.36 | 41.25 | 1.0364 | 0.1876 | ||

| US04010LBE20 / Ares Capital Corp. | 0.36 | 75.24 | 1.0290 | 0.3501 | ||

| US911365BQ63 / United Rentals North America, Inc. | 0.36 | 17.76 | 1.0218 | 0.0177 | ||

| Harley-Davidson Financial Services, Inc. / DBT (US41283LBB09) | 0.36 | 41.27 | 1.0144 | 0.1842 | ||

| US98379KAA07 / XPO INC | 0.36 | 17.16 | 1.0136 | 0.0130 | ||

| United States Treasury Note / DBT (US91282CKE02) | 0.35 | 16.94 | 1.0047 | 0.0107 | ||

| United States Treasury Note / DBT (US91282CKA89) | 0.35 | 16.61 | 1.0019 | 0.0106 | ||

| US577081BD37 / Mattel Inc | 0.35 | 16.61 | 1.0013 | 0.0096 | ||

| United States Treasury Note / DBT (US91282CJT99) | 0.35 | 40.00 | 0.9995 | 0.1755 | ||

| US226373AQ18 / Crestwood Midstream Partners LP / Crestwood Midstream Finance Corp | 0.35 | 40.56 | 0.9992 | 0.1763 | ||

| US37046US851 / General Motors Financial Co Inc | 0.35 | 0.9961 | 0.9961 | |||

| US92735LAA08 / Vine Energy Holdings, LLC | 0.35 | 0.9891 | 0.9891 | |||

| US832248AZ15 / Smithfield Foods Inc | 0.35 | 17.29 | 0.9878 | 0.0146 | ||

| US91282CEN74 / United States Treasury Note/Bond | 0.34 | 40.57 | 0.9794 | 0.1751 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 0.34 | 0.9707 | 0.9707 | |||

| US126650BP48 / CVS PASS THROUGH TRUST PASS THRU CE 12/28 6.036 | 0.34 | 0.00 | 0.9700 | -0.1509 | ||

| US49326MAA36 / Keycorp Capital 1 1.3651 7/01/28 Bond | 0.34 | 38.93 | 0.9674 | 0.1628 | ||

| US974637AC45 / WINNEBAGO INDUSTRIES INC | 0.33 | 1.23 | 0.9390 | -0.1334 | ||

| US07274EAJ29 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.25% 01-21-29 | 0.31 | 1.29 | 0.8973 | -0.1265 | ||

| A1EP34 / American Electric Power Company, Inc. - Depositary Receipt (Common Stock) | 0.31 | 53.69 | 0.8900 | 0.2191 | ||

| United States Treasury Note / DBT (US91282CKV27) | 0.31 | 20.55 | 0.8689 | 0.0331 | ||

| US744320BF81 / Prudential Financial Inc | 0.30 | 1.00 | 0.8666 | -0.1251 | ||

| United States Treasury Note/Bond / DBT (US91282CKR15) | 0.30 | 0.00 | 0.8659 | -0.1335 | ||

| United States Treasury Note / DBT (US91282CKZ31) | 0.30 | 0.33 | 0.8653 | -0.1326 | ||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0.30 | 0.8627 | 0.8627 | |||

| US46647PCY07 / JPMorgan Chase & Co | 0.30 | -0.33 | 0.8622 | -0.1363 | ||

| US45780RAA95 / Installed Building Products Inc | 0.30 | 1.35 | 0.8554 | -0.1204 | ||

| United States Treasury Note / DBT (US91282CLG41) | 0.30 | 0.67 | 0.8550 | -0.1293 | ||

| US013092AB74 / Albertsons Cos LLC / Safeway Inc / New Albertsons LP / Albertson's LLC | 0.30 | 0.00 | 0.8544 | -0.1327 | ||

| US65343HAA95 / Nexstar Escrow, Inc. | 0.30 | 1.36 | 0.8531 | -0.1208 | ||

| US92682RAA05 / Viking Ocean Cruises Ship VII Ltd | 0.30 | 1.02 | 0.8514 | -0.1216 | ||

| US655664AS97 / Nordstrom Inc. | 0.29 | 2.08 | 0.8402 | -0.1114 | ||

| US04018VAA17 / Ares Finance Co III LLC | 0.29 | 21.07 | 0.8369 | 0.0396 | ||

| US854502AM31 / Stanley Black & Decker Inc | 0.29 | -2.01 | 0.8353 | -0.1499 | ||

| US55261FAL85 / M&T Bank Corp., Series G | 0.27 | 1.90 | 0.7647 | -0.1046 | ||

| US39807UAD81 / Greystar Real Estate Partners LLC | 0.27 | 1.53 | 0.7564 | -0.1035 | ||

| US731068AA07 / Polaris Inc | 0.26 | 0.7493 | 0.7493 | |||

| US10112RBG83 / BOSTON PROPERTIES LP | 0.26 | 0.38 | 0.7480 | -0.1130 | ||

| US86765KAA79 / Sunoco LP / Sunoco Finance Corp | 0.26 | 68.63 | 0.7351 | 0.2304 | ||

| US03674XAQ97 / Antero Resources Corp | 0.26 | 0.00 | 0.7315 | -0.1132 | ||

| US25466AAN19 / Discover Bank | 0.26 | 0.39 | 0.7302 | -0.1116 | ||

| BMW Vehicle Owner Trust 2024-A / ABS-O (US096919AD78) | 0.25 | 0.00 | 0.7214 | -0.1124 | ||

| US65480CAE57 / Nissan Motor Acceptance Co LLC | 0.25 | 66.45 | 0.7209 | 0.2187 | ||

| US438123AC59 / Honda Auto Receivables 2023-4 Owner Trust | 0.25 | -0.40 | 0.7199 | -0.1136 | ||

| Madison Park Funding XXXVII Ltd / ABS-CBDO (US55817EAW66) | 0.25 | 0.7171 | 0.7171 | |||

| Hyundai Capital America / DBT (US44891ACW53) | 0.25 | -0.40 | 0.7166 | -0.1158 | ||

| GM Financial Consumer Automobile Receivables Trust 2024-1 / ABS-O (US36268GAD79) | 0.25 | 0.00 | 0.7159 | -0.1124 | ||

| US91282CFZ95 / TREASURY NOTE | 0.25 | 67.79 | 0.7149 | 0.2211 | ||

| United States Treasury Note / DBT (US91282CLQ23) | 0.25 | 0.40 | 0.7147 | -0.1079 | ||

| Volkswagen Group of America Finance LLC / DBT (US928668CK66) | 0.25 | 0.00 | 0.7139 | -0.1105 | ||

| US3130AK6H44 / Federal Home Loan Banks | 0.25 | 0.00 | 0.7129 | -0.1135 | ||

| Ford Credit Auto Owner Trust 2024-C / ABS-O (US34532UAD19) | 0.25 | 0.40 | 0.7115 | -0.1083 | ||

| United States Treasury Bill / DBT (US912797LW51) | 0.25 | 0.81 | 0.7114 | -0.1023 | ||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.25 | 0.7110 | 0.7110 | |||

| US96926JAC18 / William Carter Co/The | 0.25 | 0.40 | 0.7096 | -0.1090 | ||

| United States Treasury Note/Bond / DBT (US91282CLL36) | 0.25 | 67.57 | 0.7073 | 0.2191 | ||

| US448977AE87 / Hyundai Auto Receivables Trust 2022-A | 0.25 | 0.41 | 0.7061 | -0.1052 | ||

| US446150AV63 / Huntington Bancshares Inc/OH | 0.25 | -14.88 | 0.7027 | -0.2505 | ||

| US693475BC86 / PNC Financial Services Group Inc/The | 0.24 | 0.6877 | 0.6877 | |||

| US902973BC96 / US Bancorp | 0.24 | 0.6866 | 0.6866 | |||

| US501889AD16 / LKQ Corp | 0.24 | 0.84 | 0.6811 | -0.1003 | ||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.23 | -6.20 | 0.6495 | -0.1497 | ||

| US20602DAB73 / CONCENTRIX CORP 6.6 8/28 | 0.21 | 0.48 | 0.5976 | -0.0897 | ||

| US023771T402 / American Airlines, Inc. | 0.21 | 2.96 | 0.5976 | -0.0715 | ||

| US17888HAA14 / Civitas Resources Inc | 0.21 | -33.66 | 0.5840 | -0.4357 | ||

| United States Treasury Note/Bond / DBT (US91282CMF58) | 0.20 | 0.5771 | 0.5771 | |||

| US91282CGP05 / United States Treasury Note/Bond | 0.20 | 0.50 | 0.5741 | -0.0862 | ||

| United States Treasury Note/Bond / DBT (US91282CMB45) | 0.20 | 0.50 | 0.5738 | -0.0864 | ||

| United States Treasury Note / DBT (US91282CMS79) | 0.20 | 0.5725 | 0.5725 | |||

| US80282KBE55 / Santander Holdings USA, Inc. | 0.20 | 0.00 | 0.5708 | -0.0902 | ||

| US38141GXX77 / Goldman Sachs Group Inc/The | 0.20 | 0.00 | 0.5707 | -0.0900 | ||

| US949746TD35 / Wells Fargo & Co | 0.20 | -32.65 | 0.5648 | -0.4042 | ||

| US00790RAA23 / Advanced Drainage Systems Inc | 0.20 | 1.02 | 0.5648 | -0.0820 | ||

| US172967MV07 / Citigroup Inc | 0.20 | -32.42 | 0.5648 | -0.4027 | ||

| US398905AN98 / Group 1 Automotive Inc | 0.19 | 2.66 | 0.5503 | -0.0699 | ||

| US756109BQ63 / Realty Income Corp | 0.16 | 6.67 | 0.4558 | -0.0383 | ||

| BCO / The Brink's Company | 0.15 | 0.4406 | 0.4406 | |||

| US06051GLX50 / BANK OF AMERICA CORP SR UNSECURED 09/27 VAR | 0.15 | 0.00 | 0.4313 | -0.0685 | ||

| US61747YEX94 / Morgan Stanley | 0.15 | -0.66 | 0.4292 | -0.0687 | ||

| HSBC26D / HSBC Holdings PLC | 0.15 | 0.00 | 0.4285 | -0.0685 | ||

| United States Treasury Note/Bond / DBT (US91282CMW81) | 0.15 | 0.4279 | 0.4279 | |||

| US02557TAD19 / American Electric Power Co Inc | 0.15 | 0.00 | 0.4276 | -0.0681 | ||

| Federal Farm Credit Banks Funding Corp / DBT (US3133ERSQ56) | 0.15 | 0.00 | 0.4269 | -0.0663 | ||

| US3130AK6H44 / Federal Home Loan Banks | 0.15 | -0.67 | 0.4268 | -0.0673 | ||

| Hyundai Capital America / DBT (US44891ADS33) | 0.15 | 0.4267 | 0.4267 | |||

| US22966RAC07 / CubeSmart LP | 0.15 | 0.00 | 0.4261 | -0.0660 | ||

| US3130AK6H44 / Federal Home Loan Banks | 0.15 | -0.67 | 0.4252 | -0.0693 | ||

| US02376UAA34 / American Airlines Pass Through Trust, Series 2016-1, Class AA | 0.14 | 0.00 | 0.4113 | -0.0632 | ||

| US808513BK01 / Charles Schwab Corp/The | 0.14 | -24.74 | 0.4074 | -0.2194 | ||

| Government National Mortgage Association / ABS-O (US38384NTQ87) | 0.14 | -26.46 | 0.3972 | -0.2275 | ||

| First National of Nebraska Inc / DBT (US32119CAA27) | 0.10 | 0.2868 | 0.2868 | |||

| US01741RAH57 / Allegheny Technologies Inc | 0.10 | -49.49 | 0.2863 | -0.3684 | ||

| US07274NAY94 / Bayer US Finance II LLC | 0.10 | 0.00 | 0.2849 | -0.0450 | ||

| US04622DAA90 / Assured Guaranty US Holdings Inc. | 0.10 | 0.2814 | 0.2814 | |||

| US10112RAY09 / Boston Properties LP | 0.10 | 1.04 | 0.2786 | -0.0407 |