Mga Batayang Estadistika

| Nilai Portofolio | $ 1,163,366,126 |

| Posisi Saat Ini | 133 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

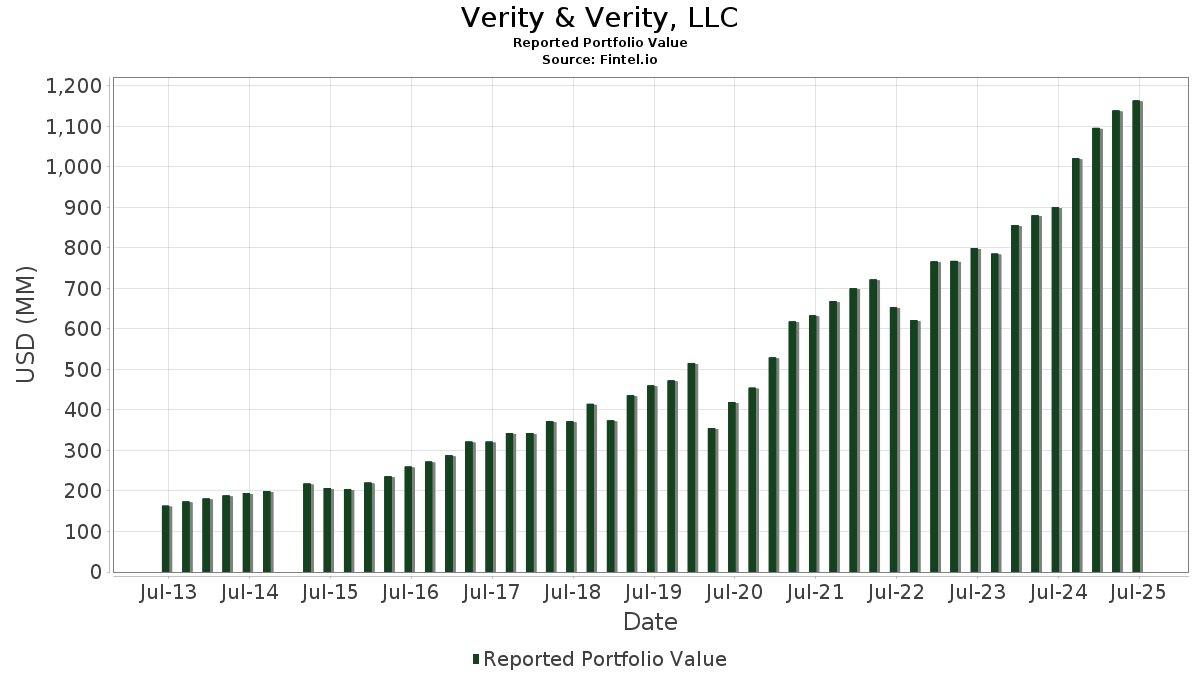

Verity & Verity, LLC telah mengungkapkan total kepemilikan 133 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,163,366,126 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Verity & Verity, LLC adalah Broadcom Inc. (US:AVGO) , Microsoft Corporation (US:MSFT) , JPMorgan Chase & Co. (US:JPM) , RTX Corporation (US:RTX) , and AbbVie Inc. (US:ABBV) . Posisi baru Verity & Verity, LLC meliputi: Atlantic Union Bankshares Corporation (US:AUB) , Zoetis Inc. (US:ZTS) , The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund (US:XLU) , Oscar Health, Inc. (US:OSCR) , and Eaton Corporation plc (US:ETN) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.21 | 58.79 | 5.0536 | 1.8801 | |

| 0.39 | 12.17 | 1.0464 | 1.0464 | |

| 0.13 | 11.55 | 0.9929 | 0.9929 | |

| 0.09 | 9.76 | 0.8387 | 0.8387 | |

| 0.96 | 18.42 | 1.5830 | 0.7557 | |

| 0.08 | 37.85 | 3.2538 | 0.7271 | |

| 0.13 | 16.01 | 1.3762 | 0.5436 | |

| 0.27 | 28.47 | 2.4476 | 0.4252 | |

| 0.12 | 35.96 | 3.0911 | 0.3748 | |

| 0.18 | 18.14 | 1.5590 | 0.3690 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.38 | 9.12 | 0.7843 | -1.1473 | |

| 0.26 | 11.53 | 0.9910 | -0.9665 | |

| 0.02 | 0.83 | 0.0709 | -0.7039 | |

| 0.32 | 17.09 | 1.4691 | -0.6657 | |

| 0.28 | 31.46 | 2.7044 | -0.5189 | |

| 0.21 | 30.55 | 2.6264 | -0.4986 | |

| 0.28 | 22.91 | 1.9694 | -0.4755 | |

| 0.17 | 31.96 | 2.7474 | -0.4460 | |

| 0.06 | 10.35 | 0.8892 | -0.3457 | |

| 0.27 | 11.53 | 0.9911 | -0.3206 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-12 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AVGO / Broadcom Inc. | 0.21 | -1.18 | 58.79 | 62.70 | 5.0536 | 1.8801 | |||

| MSFT / Microsoft Corporation | 0.08 | -0.71 | 37.85 | 31.57 | 3.2538 | 0.7271 | |||

| JPM / JPMorgan Chase & Co. | 0.12 | -1.63 | 35.96 | 16.26 | 3.0911 | 0.3748 | |||

| RTX / RTX Corporation | 0.24 | -1.66 | 34.61 | 8.40 | 2.9746 | 0.1711 | |||

| ABBV / AbbVie Inc. | 0.17 | -0.78 | 31.96 | -12.10 | 2.7474 | -0.4460 | |||

| GILD / Gilead Sciences, Inc. | 0.28 | -13.37 | 31.46 | -14.28 | 2.7044 | -0.5189 | |||

| CVX / Chevron Corporation | 0.21 | 0.32 | 30.55 | -14.13 | 2.6264 | -0.4986 | |||

| STT / State Street Corporation | 0.27 | 4.10 | 28.47 | 23.65 | 2.4476 | 0.4252 | |||

| AMGN / Amgen Inc. | 0.10 | 0.96 | 27.11 | -9.52 | 2.3299 | -0.3010 | |||

| PEP / PepsiCo, Inc. | 0.20 | 34.06 | 27.05 | 18.05 | 2.3254 | 0.3130 | |||

| AAPL / Apple Inc. | 0.12 | -0.07 | 25.42 | -7.70 | 2.1853 | -0.2336 | |||

| ENB / Enbridge Inc. | 0.55 | -0.65 | 24.93 | 1.62 | 2.1425 | -0.0116 | |||

| TXN / Texas Instruments Incorporated | 0.11 | 0.36 | 23.16 | 15.95 | 1.9905 | 0.2367 | |||

| OKE / ONEOK, Inc. | 0.28 | 0.03 | 22.91 | -17.70 | 1.9694 | -0.4755 | |||

| VZ / Verizon Communications Inc. | 0.53 | -2.33 | 22.91 | -6.83 | 1.9692 | -0.1901 | |||

| PRU / Prudential Financial, Inc. | 0.19 | -0.16 | 20.31 | -3.95 | 1.7457 | -0.1112 | |||

| CSCO / Cisco Systems, Inc. | 0.28 | -1.62 | 19.63 | 10.61 | 1.6871 | 0.1287 | |||

| NEE / NextEra Energy, Inc. | 0.28 | 0.41 | 19.42 | -1.68 | 1.6696 | -0.0652 | |||

| IBM / International Business Machines Corporation | 0.07 | -7.99 | 19.34 | 9.08 | 1.6620 | 0.1053 | |||

| MET / MetLife, Inc. | 0.24 | -1.30 | 19.29 | -1.14 | 1.6578 | -0.0555 | |||

| NNN / NNN REIT, Inc. | 0.44 | -1.36 | 19.20 | -0.14 | 1.6505 | -0.0380 | |||

| VICI / VICI Properties Inc. | 0.57 | 0.18 | 18.48 | 0.12 | 1.5887 | -0.0325 | |||

| OWL / Blue Owl Capital Inc. | 0.96 | 103.95 | 18.42 | 95.51 | 1.5830 | 0.7557 | |||

| UPS / United Parcel Service, Inc. | 0.18 | 45.85 | 18.14 | 33.85 | 1.5590 | 0.3690 | |||

| MO / Altria Group, Inc. | 0.31 | -0.21 | 17.98 | -2.52 | 1.5452 | -0.0744 | |||

| LYB / LyondellBasell Industries N.V. | 0.30 | 4.50 | 17.41 | -14.12 | 1.4961 | -0.2837 | |||

| JNJ / Johnson & Johnson | 0.11 | -0.01 | 17.33 | -7.91 | 1.4900 | -0.1629 | |||

| XOM / Exxon Mobil Corporation | 0.16 | -1.07 | 17.09 | -10.33 | 1.4694 | -0.2047 | |||

| GLW / Corning Incorporated | 0.32 | -38.80 | 17.09 | -29.69 | 1.4691 | -0.6657 | |||

| MDT / Medtronic plc | 0.19 | -1.12 | 16.91 | -4.08 | 1.4537 | -0.0946 | |||

| TGT / Target Corporation | 0.16 | 5.98 | 16.26 | 0.18 | 1.3973 | -0.0277 | |||

| DELL / Dell Technologies Inc. | 0.13 | 25.55 | 16.01 | 68.86 | 1.3762 | 0.5436 | |||

| LMT / Lockheed Martin Corporation | 0.03 | 0.25 | 15.65 | 3.94 | 1.3452 | 0.0229 | |||

| CNQ / Canadian Natural Resources Limited | 0.49 | 1.07 | 15.41 | 3.04 | 1.3243 | 0.0112 | |||

| CMCSA / Comcast Corporation | 0.43 | 1.25 | 15.40 | -2.07 | 1.3239 | -0.0573 | |||

| CINF / Cincinnati Financial Corporation | 0.10 | -0.82 | 15.05 | -0.01 | 1.2939 | -0.0283 | |||

| GPC / Genuine Parts Company | 0.12 | 1.73 | 14.34 | 3.58 | 1.2323 | 0.0168 | |||

| SBUX / Starbucks Corporation | 0.15 | 27.21 | 14.08 | 18.83 | 1.2102 | 0.1697 | |||

| FNF / Fidelity National Financial, Inc. | 0.24 | -0.14 | 13.68 | -13.98 | 1.1756 | -0.2207 | |||

| AJG / Arthur J. Gallagher & Co. | 0.04 | 0.09 | 13.22 | -7.19 | 1.1366 | -0.1146 | |||

| WEC / WEC Energy Group, Inc. | 0.12 | 9.69 | 13.02 | 4.87 | 1.1190 | 0.0289 | |||

| AMP / Ameriprise Financial, Inc. | 0.02 | -0.34 | 12.97 | 9.88 | 1.1152 | 0.0783 | |||

| PSX / Phillips 66 | 0.11 | 1.42 | 12.66 | -2.01 | 1.0881 | -0.0465 | |||

| PG / The Procter & Gamble Company | 0.08 | -1.61 | 12.53 | -8.02 | 1.0768 | -0.1192 | |||

| PLD / Prologis, Inc. | 0.12 | 1.23 | 12.18 | -4.82 | 1.0467 | -0.0767 | |||

| AUB / Atlantic Union Bankshares Corporation | 0.39 | 12.17 | 1.0464 | 1.0464 | |||||

| SO / The Southern Company | 0.13 | -1.29 | 12.03 | -1.43 | 1.0342 | -0.0377 | |||

| PPH / VanEck ETF Trust - VanEck Pharmaceutical ETF | 0.13 | 11.55 | 0.9929 | 0.9929 | |||||

| TFC / Truist Financial Corporation | 0.27 | -26.11 | 11.53 | -22.81 | 0.9911 | -0.3206 | |||

| OGE / OGE Energy Corp. | 0.26 | -46.44 | 11.53 | -48.28 | 0.9910 | -0.9665 | |||

| CMI / Cummins Inc. | 0.04 | -1.65 | 11.46 | 2.75 | 0.9854 | 0.0057 | |||

| HSY / The Hershey Company | 0.06 | -24.18 | 10.35 | -26.43 | 0.8892 | -0.3457 | |||

| QCOM / QUALCOMM Incorporated | 0.06 | 0.60 | 10.26 | 4.30 | 0.8819 | 0.0180 | |||

| CNI / Canadian National Railway Company | 0.09 | 9.76 | 0.8387 | 0.8387 | |||||

| PFE / Pfizer Inc. | 0.38 | -56.64 | 9.12 | -58.52 | 0.7843 | -1.1473 | |||

| HD / The Home Depot, Inc. | 0.02 | -1.24 | 8.94 | -1.20 | 0.7686 | -0.0262 | |||

| ABT / Abbott Laboratories | 0.06 | -1.15 | 7.88 | 1.35 | 0.6775 | -0.0055 | |||

| LOW / Lowe's Companies, Inc. | 0.03 | 0.01 | 7.18 | -4.85 | 0.6170 | -0.0456 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.05 | 4.63 | 6.66 | 8.16 | 0.5721 | 0.0317 | |||

| PM / Philip Morris International Inc. | 0.03 | 2.77 | 5.26 | 17.93 | 0.4523 | 0.0604 | |||

| KO / The Coca-Cola Company | 0.06 | -0.09 | 4.59 | -1.29 | 0.3949 | -0.0139 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 3.64 | -8.72 | 0.3132 | -0.0374 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.10 | -1.63 | 3.14 | -10.63 | 0.2695 | -0.0386 | |||

| ACN / Accenture plc | 0.01 | -2.13 | 2.70 | -6.28 | 0.2322 | -0.0209 | |||

| ORCL / Oracle Corporation | 0.01 | 0.68 | 2.64 | 57.40 | 0.2268 | 0.0796 | |||

| BDX / Becton, Dickinson and Company | 0.02 | 1.03 | 2.61 | -24.02 | 0.2244 | -0.0774 | |||

| WMT / Walmart Inc. | 0.03 | 1.51 | 2.59 | 13.05 | 0.2227 | 0.0215 | |||

| PH / Parker-Hannifin Corporation | 0.00 | 0.61 | 2.43 | 15.63 | 0.2086 | 0.0243 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.01 | 4.62 | 2.42 | 10.37 | 0.2076 | 0.0154 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 1.95 | -8.81 | 0.1674 | -0.0201 | |||

| BX / Blackstone Inc. | 0.01 | 3.19 | 1.81 | 10.45 | 0.1554 | 0.0116 | |||

| AFG / American Financial Group, Inc. | 0.01 | 0.00 | 1.60 | -3.86 | 0.1372 | -0.0087 | |||

| MLPX / Global X Funds - Global X MLP & Energy Infrastructure ETF | 0.02 | 0.00 | 1.51 | -1.82 | 0.1299 | -0.0053 | |||

| V / Visa Inc. | 0.00 | -7.40 | 1.42 | -6.21 | 0.1221 | -0.0109 | |||

| MS / Morgan Stanley | 0.01 | -3.21 | 1.24 | 16.84 | 0.1062 | 0.0134 | |||

| BAC / Bank of America Corporation | 0.03 | 3.07 | 1.20 | 16.88 | 0.1030 | 0.0130 | |||

| CPSS / Consumer Portfolio Services, Inc. | 0.12 | -1.66 | 1.16 | 11.49 | 0.1001 | 0.0084 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 8.90 | 1.07 | 9.89 | 0.0918 | 0.0065 | |||

| PPG / PPG Industries, Inc. | 0.01 | -4.41 | 1.03 | -0.58 | 0.0889 | -0.0024 | |||

| MCD / McDonald's Corporation | 0.00 | -5.38 | 1.03 | -11.58 | 0.0887 | -0.0137 | |||

| KVUE / Kenvue Inc. | 0.05 | 12.33 | 1.01 | -1.93 | 0.0872 | -0.0037 | |||

| NDAQ / Nasdaq, Inc. | 0.01 | 7.80 | 1.01 | 27.07 | 0.0872 | 0.0171 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 0.98 | 4.72 | 0.0839 | 0.0020 | |||

| KLAC / KLA Corporation | 0.00 | 6.24 | 0.87 | 39.94 | 0.0748 | 0.0202 | |||

| NVDA / NVIDIA Corporation | 0.01 | -2.27 | 0.85 | 42.45 | 0.0730 | 0.0206 | |||

| AXP / American Express Company | 0.00 | -19.99 | 0.83 | -5.05 | 0.0711 | -0.0055 | |||

| ADM / Archer-Daniels-Midland Company | 0.02 | -91.49 | 0.83 | -90.65 | 0.0709 | -0.7039 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 16.61 | 0.80 | -30.54 | 0.0691 | -0.0325 | |||

| META / Meta Platforms, Inc. | 0.00 | 9.70 | 0.75 | 40.64 | 0.0646 | 0.0176 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | -1.25 | 0.66 | -1.63 | 0.0572 | -0.0022 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -27.17 | 0.65 | -19.58 | 0.0555 | -0.0150 | |||

| NKE / NIKE, Inc. | 0.01 | 9.26 | 0.58 | 22.18 | 0.0503 | 0.0083 | |||

| WSO / Watsco, Inc. | 0.00 | 0.30 | 0.58 | -12.86 | 0.0502 | -0.0086 | |||

| SYY / Sysco Corporation | 0.01 | 8.46 | 0.58 | 9.49 | 0.0496 | 0.0033 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0.02 | 1.50 | 0.57 | -3.87 | 0.0491 | -0.0030 | |||

| ZTS / Zoetis Inc. | 0.00 | 0.55 | 0.0474 | 0.0474 | |||||

| ED / Consolidated Edison, Inc. | 0.01 | 24.55 | 0.55 | 13.07 | 0.0469 | 0.0045 | |||

| INTU / Intuit Inc. | 0.00 | 4.59 | 0.54 | 34.16 | 0.0463 | 0.0110 | |||

| FDS / FactSet Research Systems Inc. | 0.00 | 8.05 | 0.53 | 6.37 | 0.0459 | 0.0018 | |||

| HBAN / Huntington Bancshares Incorporated | 0.03 | -17.53 | 0.50 | -7.98 | 0.0427 | -0.0047 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.00 | 0.46 | 0.0393 | 0.0393 | |||||

| ES / Eversource Energy | 0.01 | 3.11 | 0.42 | 5.60 | 0.0357 | 0.0012 | |||

| DUK / Duke Energy Corporation | 0.00 | -22.09 | 0.41 | -24.49 | 0.0352 | -0.0125 | |||

| SCHK / Schwab Strategic Trust - Schwab 1000 Index ETF | 0.01 | 0.00 | 0.40 | 10.74 | 0.0346 | 0.0027 | |||

| AFL / Aflac Incorporated | 0.00 | -19.52 | 0.39 | -23.76 | 0.0331 | -0.0112 | |||

| GOOG / Alphabet Inc. | 0.00 | -35.51 | 0.38 | -26.77 | 0.0330 | -0.0130 | |||

| POOL / Pool Corporation | 0.00 | 7.43 | 0.38 | -1.54 | 0.0329 | -0.0013 | |||

| TT / Trane Technologies plc | 0.00 | 0.00 | 0.37 | 29.72 | 0.0319 | 0.0068 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 2.19 | 0.37 | 17.95 | 0.0316 | 0.0042 | |||

| SCHX / Schwab Strategic Trust - Schwab U.S. Large-Cap ETF | 0.01 | 0.00 | 0.35 | 10.90 | 0.0298 | 0.0023 | |||

| TPR / Tapestry, Inc. | 0.00 | 0.90 | 0.34 | 25.64 | 0.0296 | 0.0056 | |||

| WFC / Wells Fargo & Company | 0.00 | 0.00 | 0.34 | 11.55 | 0.0291 | 0.0025 | |||

| GE / General Electric Company | 0.00 | 0.96 | 0.33 | 30.00 | 0.0280 | 0.0060 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.02 | 0.00 | 0.32 | -2.41 | 0.0279 | -0.0013 | |||

| MRK / Merck & Co., Inc. | 0.00 | 10.11 | 0.32 | -2.70 | 0.0279 | -0.0015 | |||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0.00 | 0.31 | 0.0270 | 0.0270 | |||||

| BFB / Brown-Forman Corp. - Class B | 0.01 | 10.36 | 0.31 | -12.54 | 0.0264 | -0.0044 | |||

| ADI / Analog Devices, Inc. | 0.00 | 0.00 | 0.29 | 18.07 | 0.0253 | 0.0034 | |||

| KMI / Kinder Morgan, Inc. | 0.01 | 2.84 | 0.29 | 5.84 | 0.0250 | 0.0009 | |||

| EMR / Emerson Electric Co. | 0.00 | 0.00 | 0.29 | 21.70 | 0.0246 | 0.0039 | |||

| BN / Brookfield Corporation | 0.00 | 0.00 | 0.28 | 18.49 | 0.0242 | 0.0033 | |||

| VSCO / Victoria's Secret & Co. | 0.01 | 0.00 | 0.27 | -0.37 | 0.0230 | -0.0006 | |||

| USB / U.S. Bancorp | 0.01 | 0.27 | 0.0230 | 0.0230 | |||||

| OSCR / Oscar Health, Inc. | 0.01 | 0.26 | 0.0220 | 0.0220 | |||||

| CAT / Caterpillar Inc. | 0.00 | -4.10 | 0.25 | 12.89 | 0.0219 | 0.0021 | |||

| CFG / Citizens Financial Group, Inc. | 0.01 | -3.72 | 0.25 | 5.49 | 0.0215 | 0.0006 | |||

| XLI / The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund | 0.00 | 0.00 | 0.25 | 12.27 | 0.0213 | 0.0020 | |||

| DE / Deere & Company | 0.00 | 0.00 | 0.23 | 8.65 | 0.0195 | 0.0011 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.21 | 2.88 | 0.0184 | 0.0001 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.21 | 0.0178 | 0.0178 | |||||

| IUSG / iShares Trust - iShares Core S&P U.S. Growth ETF | 0.00 | 0.20 | 0.0175 | 0.0175 | |||||

| FAST / Fastenal Company | 0.00 | 70.99 | 0.20 | -7.31 | 0.0175 | -0.0018 | |||

| NMFC / New Mountain Finance Corporation | 0.01 | 0.00 | 0.11 | -4.55 | 0.0091 | -0.0006 | |||

| DFS / Discover Financial Services | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FDX / FedEx Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| OMC / Omnicom Group Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FIS / Fidelity National Information Services, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IYT / iShares Trust - iShares U.S. Transportation ETF | 0.00 | -100.00 | 0.00 | 0.0000 |