Mga Batayang Estadistika

| Nilai Portofolio | $ 536,459,613 |

| Posisi Saat Ini | 67 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

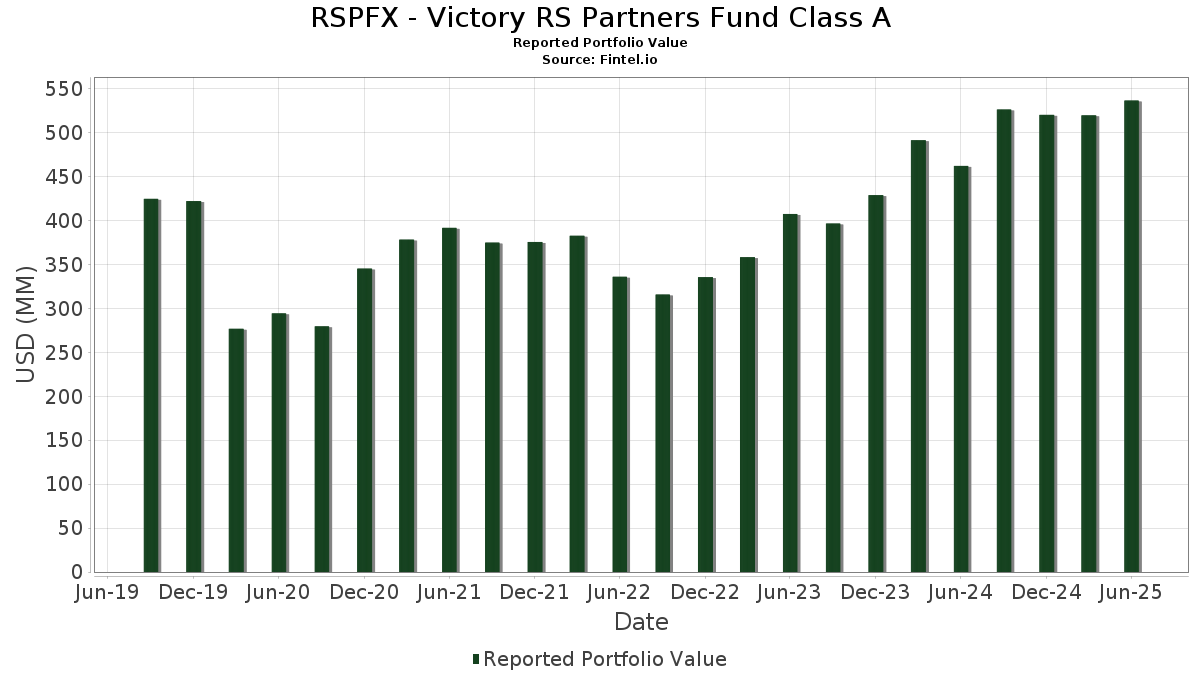

RSPFX - Victory RS Partners Fund Class A telah mengungkapkan total kepemilikan 67 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 536,459,613 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama RSPFX - Victory RS Partners Fund Class A adalah Globe Life Inc. (US:GL) , Old National Bancorp (US:ONB) , White Mountains Insurance Group, Ltd. (US:WTM) , Ameris Bancorp (US:ABCB) , and UMB Financial Corporation (US:UMBF) . Posisi baru RSPFX - Victory RS Partners Fund Class A meliputi: The St. Joe Company (US:JOE) , Matson, Inc. (US:MATX) , Knife River Corporation (US:KNF) , YETI Holdings, Inc. (US:YETI) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.17 | 8.14 | 1.5039 | 1.5039 | |

| 0.85 | 12.39 | 2.2877 | 1.1876 | |

| 0.37 | 13.31 | 2.4585 | 1.0025 | |

| 0.05 | 5.28 | 0.9745 | 0.9745 | |

| 0.04 | 3.19 | 0.5892 | 0.5892 | |

| 0.18 | 8.82 | 1.6283 | 0.5673 | |

| 0.09 | 2.75 | 0.5081 | 0.5081 | |

| 0.25 | 15.94 | 2.9449 | 0.4954 | |

| 0.05 | 9.95 | 1.8382 | 0.3768 | |

| 0.05 | 10.39 | 1.9189 | 0.3558 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.12 | 8.06 | 1.4888 | -1.0235 | |

| 0.24 | 7.79 | 1.4394 | -0.8958 | |

| 0.08 | 7.59 | 1.4018 | -0.8350 | |

| 0.62 | 10.58 | 1.9539 | -0.7972 | |

| 0.01 | 4.66 | 0.8599 | -0.6133 | |

| 0.19 | 10.48 | 1.9360 | -0.4560 | |

| 0.14 | 15.07 | 2.7838 | -0.3491 | |

| 0.13 | 3.57 | 0.6592 | -0.3439 | |

| 0.33 | 6.86 | 1.2676 | -0.3256 | |

| 0.11 | 3.21 | 0.5930 | -0.2862 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GL / Globe Life Inc. | 0.17 | 3.95 | 20.53 | -1.91 | 3.7927 | -0.1517 | |||

| ONB / Old National Bancorp | 0.77 | -2.28 | 16.44 | -1.59 | 3.0363 | -0.1111 | |||

| WTM / White Mountains Insurance Group, Ltd. | 0.01 | 19.61 | 16.32 | 11.53 | 3.0151 | 0.2573 | |||

| ABCB / Ameris Bancorp | 0.25 | 9.13 | 15.94 | 22.64 | 2.9449 | 0.4954 | |||

| UMBF / UMB Financial Corporation | 0.14 | -12.85 | 15.07 | -9.36 | 2.7838 | -0.3491 | |||

| PB / Prosperity Bancshares, Inc. | 0.20 | 5.07 | 13.86 | 3.42 | 2.5604 | 0.0347 | |||

| NTB / The Bank of N.T. Butterfield & Son Limited | 0.31 | 1.93 | 13.59 | 15.96 | 2.5097 | 0.3021 | |||

| RNST / Renasant Corporation | 0.37 | 62.66 | 13.31 | 72.26 | 2.4585 | 1.0025 | |||

| FNB / F.N.B. Corporation | 0.85 | 95.70 | 12.39 | 112.14 | 2.2877 | 1.1876 | |||

| EEFT / Euronet Worldwide, Inc. | 0.12 | -2.14 | 12.00 | -7.15 | 2.2157 | -0.2186 | |||

| FCPT / Four Corners Property Trust, Inc. | 0.45 | 1.88 | 11.99 | -4.48 | 2.2156 | -0.1504 | |||

| GTES / Gates Industrial Corporation plc | 0.52 | -5.93 | 11.94 | 17.67 | 2.2053 | 0.2936 | |||

| SEE / Sealed Air Corporation | 0.37 | 1.64 | 11.49 | 9.12 | 2.1231 | 0.1385 | |||

| EHC / Encompass Health Corporation | 0.09 | 0.00 | 11.34 | 21.08 | 2.0953 | 0.3300 | |||

| BKH / Black Hills Corporation | 0.20 | 1.34 | 11.23 | -6.26 | 2.0738 | -0.1831 | |||

| ATMU / Atmus Filtration Technologies Inc. | 0.30 | 21.02 | 11.08 | 20.00 | 2.0458 | 0.3067 | |||

| KMPR / Kemper Corporation | 0.17 | -0.04 | 10.83 | -3.48 | 2.0010 | -0.1140 | |||

| NOMD / Nomad Foods Limited | 0.62 | -16.21 | 10.58 | -27.55 | 1.9539 | -0.7972 | |||

| TXNM / TXNM Energy, Inc. | 0.19 | -21.60 | 10.48 | -17.43 | 1.9360 | -0.4560 | |||

| GPOR / Gulfport Energy Corporation | 0.05 | 14.63 | 10.39 | 25.23 | 1.9189 | 0.3558 | |||

| ALG / Alamo Group Inc. | 0.05 | 4.71 | 9.95 | 28.32 | 1.8382 | 0.3768 | |||

| PAGP / Plains GP Holdings, L.P. - Limited Partnership | 0.51 | 0.00 | 9.83 | -9.04 | 1.8163 | -0.2206 | |||

| PRI / Primerica, Inc. | 0.04 | 2.54 | 9.72 | -1.37 | 1.7947 | -0.0616 | |||

| CXT / Crane NXT, Co. | 0.18 | 6.53 | 9.56 | 11.71 | 1.7662 | 0.1533 | |||

| VVX / V2X, Inc. | 0.18 | 58.16 | 8.82 | 56.57 | 1.6283 | 0.5673 | |||

| ENSG / The Ensign Group, Inc. | 0.05 | 0.00 | 8.44 | 19.21 | 1.5589 | 0.2249 | |||

| TKR / The Timken Company | 0.12 | 8.54 | 8.40 | 9.57 | 1.5519 | 0.1070 | |||

| JOE / The St. Joe Company | 0.17 | 8.14 | 1.5039 | 1.5039 | |||||

| CAKE / The Cheesecake Factory Incorporated | 0.13 | -7.64 | 8.06 | 18.92 | 1.4897 | 0.2119 | |||

| HHH / Howard Hughes Holdings Inc. | 0.12 | -33.65 | 8.06 | -39.54 | 1.4888 | -1.0235 | |||

| NOG / Northern Oil and Gas, Inc. | 0.28 | 12.70 | 7.93 | 5.68 | 1.4642 | 0.0510 | |||

| EPRT / Essential Properties Realty Trust, Inc. | 0.24 | -35.68 | 7.79 | -37.13 | 1.4394 | -0.8958 | |||

| ACIW / ACI Worldwide, Inc. | 0.17 | 24.18 | 7.68 | 4.21 | 1.4188 | 0.0299 | |||

| GTX / Garrett Motion Inc. | 0.73 | -15.02 | 7.62 | 6.70 | 1.4083 | 0.0621 | |||

| SSB / SouthState Corporation | 0.08 | -35.52 | 7.59 | -36.07 | 1.4018 | -0.8350 | |||

| HTO / H2O America | 0.14 | 20.78 | 7.27 | 14.77 | 1.3436 | 0.1494 | |||

| IRT / Independence Realty Trust, Inc. | 0.40 | 52.75 | 7.12 | 27.27 | 1.3155 | 0.2611 | |||

| ICFI / ICF International, Inc. | 0.08 | 22.10 | 7.09 | 21.71 | 1.3091 | 0.2120 | |||

| GPK / Graphic Packaging Holding Company | 0.33 | 0.00 | 6.86 | -18.83 | 1.2676 | -0.3256 | |||

| BDC / Belden Inc. | 0.06 | 10.89 | 6.72 | 28.09 | 1.2417 | 0.2528 | |||

| RYI / Ryerson Holding Corporation | 0.31 | 0.00 | 6.62 | -6.05 | 1.2223 | -0.1049 | |||

| GVA / Granite Construction Incorporated | 0.07 | 2.45 | 6.25 | 27.04 | 1.1552 | 0.2277 | |||

| HAYW / Hayward Holdings, Inc. | 0.45 | 15.40 | 6.20 | 14.40 | 1.1447 | 0.1240 | |||

| MSGS / Madison Square Garden Sports Corp. | 0.03 | 0.00 | 5.70 | 7.29 | 1.0521 | 0.0519 | |||

| TMHC / Taylor Morrison Home Corporation | 0.09 | -9.12 | 5.59 | -7.03 | 1.0332 | -0.1005 | |||

| HG / Hamilton Insurance Group, Ltd. | 0.25 | -9.01 | 5.44 | -5.11 | 1.0047 | -0.0753 | |||

| PVH / PVH Corp. | 0.08 | 39.01 | 5.43 | 47.53 | 1.0030 | 0.3094 | |||

| USFD / US Foods Holding Corp. | 0.07 | -24.95 | 5.39 | -11.71 | 0.9957 | -0.1547 | |||

| MATX / Matson, Inc. | 0.05 | 5.28 | 0.9745 | 0.9745 | |||||

| STC / Stewart Information Services Corporation | 0.08 | -9.61 | 4.99 | -17.53 | 0.9221 | -0.2184 | |||

| BZH / Beazer Homes USA, Inc. | 0.21 | 0.00 | 4.79 | 9.73 | 0.8856 | 0.0622 | |||

| ENOV / Enovis Corporation | 0.15 | 17.45 | 4.75 | -3.61 | 0.8779 | -0.0511 | |||

| GPI / Group 1 Automotive, Inc. | 0.01 | -47.92 | 4.66 | -40.46 | 0.8599 | -0.6133 | |||

| ITGR / Integer Holdings Corporation | 0.04 | -7.25 | 4.64 | -3.35 | 0.8577 | -0.0476 | |||

| FLR / Fluor Corporation | 0.09 | -14.45 | 4.56 | 22.43 | 0.8430 | 0.1407 | |||

| CRC / California Resources Corporation | 0.10 | 0.00 | 4.56 | 3.88 | 0.8416 | 0.0150 | |||

| TITN / Titan Machinery Inc. | 0.22 | 0.00 | 4.35 | 16.26 | 0.8044 | 0.0986 | |||

| CDP / COPT Defense Properties | 0.13 | -33.71 | 3.57 | -32.97 | 0.6592 | -0.3439 | |||

| AXTA / Axalta Coating Systems Ltd. | 0.11 | -23.13 | 3.21 | -31.20 | 0.5930 | -0.2862 | |||

| KNF / Knife River Corporation | 0.04 | 3.19 | 0.5892 | 0.5892 | |||||

| YETI / YETI Holdings, Inc. | 0.09 | 2.75 | 0.5081 | 0.5081 | |||||

| UA / Under Armour, Inc. | 0.37 | -18.03 | 2.39 | -10.58 | 0.4419 | -0.0623 | |||

| US40428X1072 / HSBC U.S. Government Money Market Fund | 2.02 | -20.55 | 2.02 | -20.58 | 0.3736 | -0.1061 | |||

| GSAXX / Goldman Sachs Trust - Goldman Sachs Financial Square Government Fund | 2.02 | -20.55 | 2.02 | -20.58 | 0.3736 | -0.1061 | |||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 2.02 | -20.55 | 2.02 | -20.58 | 0.3736 | -0.1061 | |||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 2.02 | -20.55 | 2.02 | -20.58 | 0.3736 | -0.1061 | |||

| 928CZC900 / WELLDOC INC SERIES B PREFERRED STOCK | 1.59 | 0.00 | 0.59 | 0.00 | 0.1085 | -0.0022 |