Mga Batayang Estadistika

| Nilai Portofolio | $ 1,113,698,699 |

| Posisi Saat Ini | 69 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

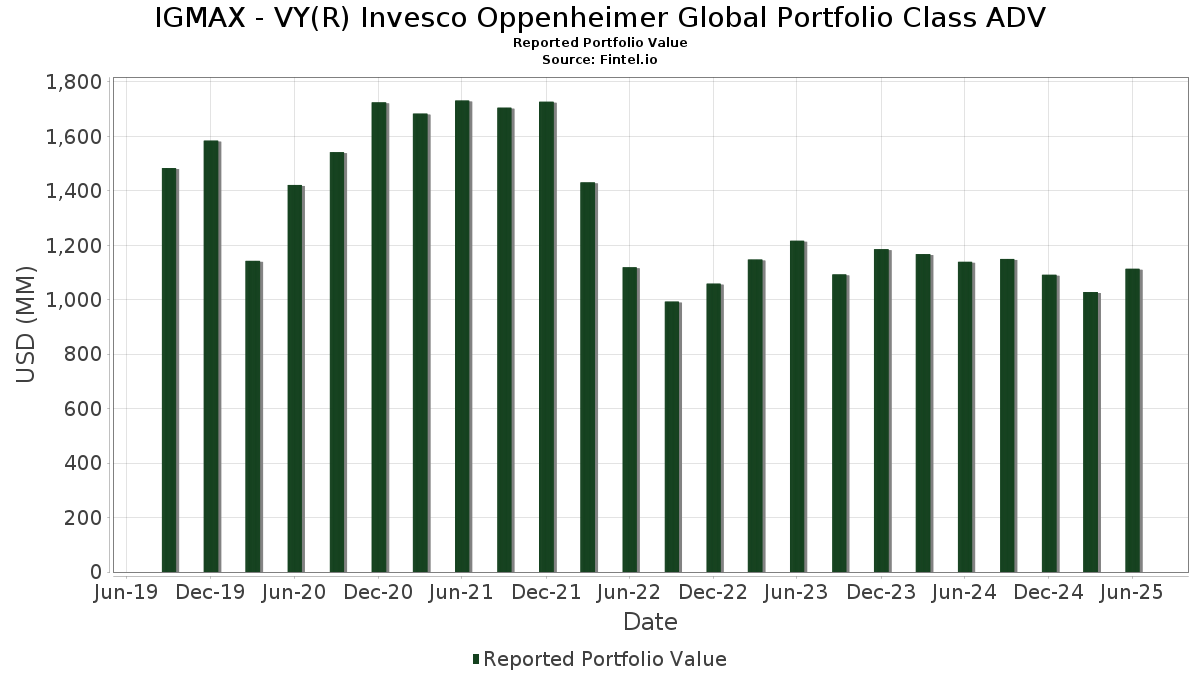

IGMAX - VY(R) Invesco Oppenheimer Global Portfolio Class ADV telah mengungkapkan total kepemilikan 69 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,113,698,699 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama IGMAX - VY(R) Invesco Oppenheimer Global Portfolio Class ADV adalah Cisco Systems, Inc. (US:CSCO) , Robinhood Markets, Inc. (US:HOOD) , Microsoft Corporation (US:MSFT) , StandardAero, Inc. (US:SARO) , and Enel SpA (IT:ENEL) . Posisi baru IGMAX - VY(R) Invesco Oppenheimer Global Portfolio Class ADV meliputi: Robinhood Markets, Inc. (US:HOOD) , Siemens Energy AG (IT:ENR) , Spotify Technology S.A. (CH:SPF) , Sportradar Group AG (US:SRAD) , and Trip.com Group Limited (HK:9961) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.44 | 40.97 | 3.6266 | 3.6266 | |

| 0.26 | 30.95 | 2.7395 | 2.7395 | |

| 0.04 | 29.95 | 2.6505 | 2.6505 | |

| 0.89 | 25.09 | 2.2204 | 2.2204 | |

| 0.22 | 20.26 | 1.7936 | 1.7936 | |

| 0.07 | 32.97 | 2.9185 | 1.3916 | |

| 0.21 | 12.10 | 1.0709 | 1.0709 | |

| 0.06 | 11.05 | 0.9780 | 0.9780 | |

| 0.12 | 19.96 | 1.7663 | 0.7860 | |

| 0.09 | 11.46 | 1.0144 | 0.6298 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.14 | 12.88 | 1.1400 | -2.9586 | |

| 0.39 | 11.36 | 1.0056 | -2.1079 | |

| 0.27 | 11.11 | 0.9836 | -1.8324 | |

| 1.57 | 1.57 | 0.1386 | -1.4420 | |

| 0.13 | 9.80 | 0.8678 | -0.9961 | |

| 0.36 | 20.38 | 1.8036 | -0.9918 | |

| 0.11 | 22.95 | 2.0310 | -0.9229 | |

| 0.03 | 7.82 | 0.6918 | -0.8378 | |

| 0.07 | 15.46 | 1.3687 | -0.8218 | |

| 0.16 | 15.86 | 1.4039 | -0.7518 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-26 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| CSCO / Cisco Systems, Inc. | 0.73 | -2.32 | 50.31 | 9.82 | 4.4530 | 0.0289 | |||

| HOOD / Robinhood Markets, Inc. | 0.44 | 40.97 | 3.6266 | 3.6266 | |||||

| MSFT / Microsoft Corporation | 0.07 | 57.38 | 32.97 | 108.54 | 2.9185 | 1.3916 | |||

| SARO / StandardAero, Inc. | 0.99 | -8.40 | 31.18 | 8.82 | 2.7600 | -0.0071 | |||

| ENEL / Enel SpA | 3.27 | 0.97 | 31.06 | 18.21 | 2.7495 | 0.2118 | |||

| ENR / Siemens Energy AG | 0.26 | 30.95 | 2.7395 | 2.7395 | |||||

| 6758 / Sony Group Corporation | 1.16 | -15.66 | 30.04 | -13.33 | 2.6589 | -0.6884 | |||

| SPF / Spotify Technology S.A. | 0.04 | 29.95 | 2.6505 | 2.6505 | |||||

| TSLA / Tesla, Inc. | 0.09 | 3.71 | 28.29 | 27.12 | 2.5038 | 0.3549 | |||

| DIS / The Walt Disney Company | 0.22 | 0.97 | 26.93 | 26.86 | 2.3836 | 0.3336 | |||

| WMT / Walmart Inc. | 0.27 | -8.38 | 25.93 | 2.04 | 2.2948 | -0.1588 | |||

| NVDA / NVIDIA Corporation | 0.16 | -12.48 | 25.79 | 27.58 | 2.2825 | 0.3305 | |||

| LSE N / London Stock Exchange Group plc | 0.17 | 0.97 | 25.38 | -0.58 | 2.2463 | -0.2189 | |||

| SRAD / Sportradar Group AG | 0.89 | 25.09 | 2.2204 | 2.2204 | |||||

| DE / Deere & Company | 0.05 | 17.97 | 23.37 | 27.81 | 2.0682 | 0.3027 | |||

| BAC / Bank of America Corporation | 0.49 | -11.62 | 23.08 | 0.22 | 2.0426 | -0.1810 | |||

| AAPL / Apple Inc. | 0.11 | -18.78 | 22.95 | -24.98 | 2.0310 | -0.9229 | |||

| BARC / Barclays PLC | 4.81 | 16.24 | 22.20 | 42.85 | 1.9652 | 0.4642 | |||

| BAS / Leverage Shares Plc - Corporate Bond/Note | 0.44 | -18.75 | 21.52 | -19.83 | 1.9049 | -0.6876 | |||

| CEG / Constellation Energy Corporation | 0.07 | -4.59 | 21.46 | 52.73 | 1.8992 | 0.5424 | |||

| FOXA / Fox Corporation | 0.36 | -28.90 | 20.38 | -29.61 | 1.8036 | -0.9918 | |||

| ALAB / Astera Labs, Inc. | 0.22 | 20.26 | 1.7936 | 1.7936 | |||||

| NTRA / Natera, Inc. | 0.12 | 64.56 | 19.96 | 96.60 | 1.7663 | 0.7860 | |||

| MMM / 3M Company | 0.13 | 0.96 | 19.60 | 4.66 | 1.7348 | -0.0736 | |||

| MARUTI / Maruti Suzuki India Limited | 0.12 | 0.96 | 17.83 | 8.71 | 1.5779 | -0.0056 | |||

| RB N / Reckitt Benckiser Group plc | 0.24 | 0.97 | 16.24 | 1.72 | 1.4377 | -0.1043 | |||

| FCX / Freeport-McMoRan Inc. | 0.37 | 0.97 | 16.02 | 15.61 | 1.4178 | 0.0798 | |||

| OTIS / Otis Worldwide Corporation | 0.16 | -25.95 | 15.86 | -28.94 | 1.4039 | -0.7518 | |||

| GOLF / Acushnet Holdings Corp. | 0.21 | 0.97 | 15.52 | 7.08 | 1.3735 | -0.0259 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.07 | -23.91 | 15.46 | -31.83 | 1.3687 | -0.8218 | |||

| RELIANCE / Reliance Industries Limited | 0.79 | 0.97 | 13.79 | 18.87 | 1.2205 | 0.1003 | |||

| GRMN / Garmin Ltd. | 0.06 | 0.96 | 13.39 | -2.95 | 1.1850 | -0.1472 | |||

| FSLR / First Solar, Inc. | 0.08 | 0.96 | 13.37 | 32.19 | 1.1836 | 0.2067 | |||

| MSTR / Strategy Inc | 0.03 | 9.86 | 13.22 | 54.05 | 1.1705 | 0.3415 | |||

| ZTS / Zoetis Inc. | 0.08 | 0.96 | 13.16 | -4.37 | 1.1645 | -0.1641 | |||

| BBCA / PT Bank Central Asia Tbk | 24.22 | 0.97 | 12.95 | 5.16 | 1.1462 | -0.0431 | |||

| WPM / Wheaton Precious Metals Corp. | 0.14 | -73.77 | 12.88 | -69.66 | 1.1400 | -2.9586 | |||

| HIA1 / Hitachi, Ltd. | 0.44 | 0.94 | 12.79 | 24.95 | 1.1316 | 0.1435 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.11 | 0.97 | 12.52 | -13.40 | 1.1081 | -0.2880 | |||

| 9961 / Trip.com Group Limited | 0.21 | 12.10 | 1.0709 | 1.0709 | |||||

| LONN / Lonza Group AG | 0.02 | -32.97 | 12.04 | -22.41 | 1.0654 | -0.4327 | |||

| VRT / Vertiv Holdings Co | 0.09 | 61.80 | 11.46 | 187.80 | 1.0144 | 0.6298 | |||

| T / AT&T Inc. | 0.39 | -65.57 | 11.36 | -64.76 | 1.0056 | -2.1079 | |||

| ROK / Rockwell Automation, Inc. | 0.03 | -36.86 | 11.25 | -18.83 | 0.9962 | -0.3428 | |||

| AD / Koninklijke Ahold Delhaize N.V. | 0.27 | -65.92 | 11.11 | -61.89 | 0.9836 | -1.8324 | |||

| ABBV / AbbVie Inc. | 0.06 | 11.05 | 0.9780 | 0.9780 | |||||

| SHEL / Shell plc | 0.30 | 0.97 | 10.49 | -3.22 | 0.9284 | -0.1183 | |||

| META / Meta Platforms, Inc. | 0.01 | -60.61 | 10.32 | -40.12 | 0.9136 | -0.5638 | |||

| PLD / Prologis, Inc. | 0.10 | -32.46 | 10.22 | -36.49 | 0.9047 | -0.6495 | |||

| HCA / HCA Healthcare, Inc. | 0.03 | 0.96 | 10.09 | 11.93 | 0.8933 | 0.0225 | |||

| COIN / Coinbase Global, Inc. | 0.03 | -30.99 | 9.90 | 40.43 | 0.8762 | 0.1955 | |||

| HOLN / Holcim AG | 0.13 | -26.39 | 9.80 | -49.21 | 0.8678 | -0.9961 | |||

| ARM / Arm Holdings plc - Depositary Receipt (Common Stock) | 0.06 | -25.45 | 9.64 | 12.90 | 0.8530 | 0.0287 | |||

| CNE100002CC3 / Shenzhen Envicool Technology Co Ltd | 2.30 | 30.00 | 9.52 | -0.70 | 0.8429 | -0.0832 | |||

| CTRA / Coterra Energy Inc. | 0.34 | -8.90 | 8.72 | -19.99 | 0.7722 | -0.2808 | |||

| GRAB / Grab Holdings Limited | 1.62 | 48.95 | 8.13 | 65.39 | 0.7198 | 0.2450 | |||

| CRM / Salesforce, Inc. | 0.03 | -51.44 | 7.82 | -50.66 | 0.6918 | -0.8378 | |||

| INSP / Inspire Medical Systems, Inc. | 0.06 | 0.96 | 7.58 | -17.75 | 0.6711 | -0.2190 | |||

| TRGP / Targa Resources Corp. | 0.04 | -11.00 | 7.49 | -22.72 | 0.6631 | -0.2730 | |||

| AMRZ / Amrize AG | 0.13 | 6.59 | 0.5829 | 0.5829 | |||||

| JOBY / Joby Aviation, Inc. | 0.62 | 15.57 | 6.52 | 102.55 | 0.5768 | 0.2661 | |||

| ASAN / Asana, Inc. | 0.48 | -23.70 | 6.48 | -29.32 | 0.5737 | -0.3117 | |||

| IDEXY / Industria de Diseño Textil, S.A. - Depositary Receipt (Common Stock) | 0.12 | 0.96 | 6.46 | 5.78 | 0.5713 | -0.0180 | |||

| WAY / Waystar Holding Corp. | 0.14 | 5.76 | 0.5101 | 0.5101 | |||||

| OS / OneStream, Inc. | 0.19 | 5.44 | 0.4814 | 0.4814 | |||||

| Mixue Group / EC (CNE100006T36) | 0.08 | 5.35 | 0.4735 | 0.4735 | |||||

| VLO / Valero Energy Corporation | 0.04 | -19.35 | 4.83 | -17.92 | 0.4275 | -0.1407 | |||

| TFDXX / Blackrock Liquidity Funds - BlackRock Liquidity Funds FedFund Portfolio Institutional Class | 1.57 | -90.43 | 1.57 | -90.44 | 0.1386 | -1.4420 | |||

| TD SECURITIES (USA) LLC / RA (000000000) | 0.00 | 0.0000 | 0.0000 |