Mga Batayang Estadistika

| Nilai Portofolio | $ 170,575,472 |

| Posisi Saat Ini | 52 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

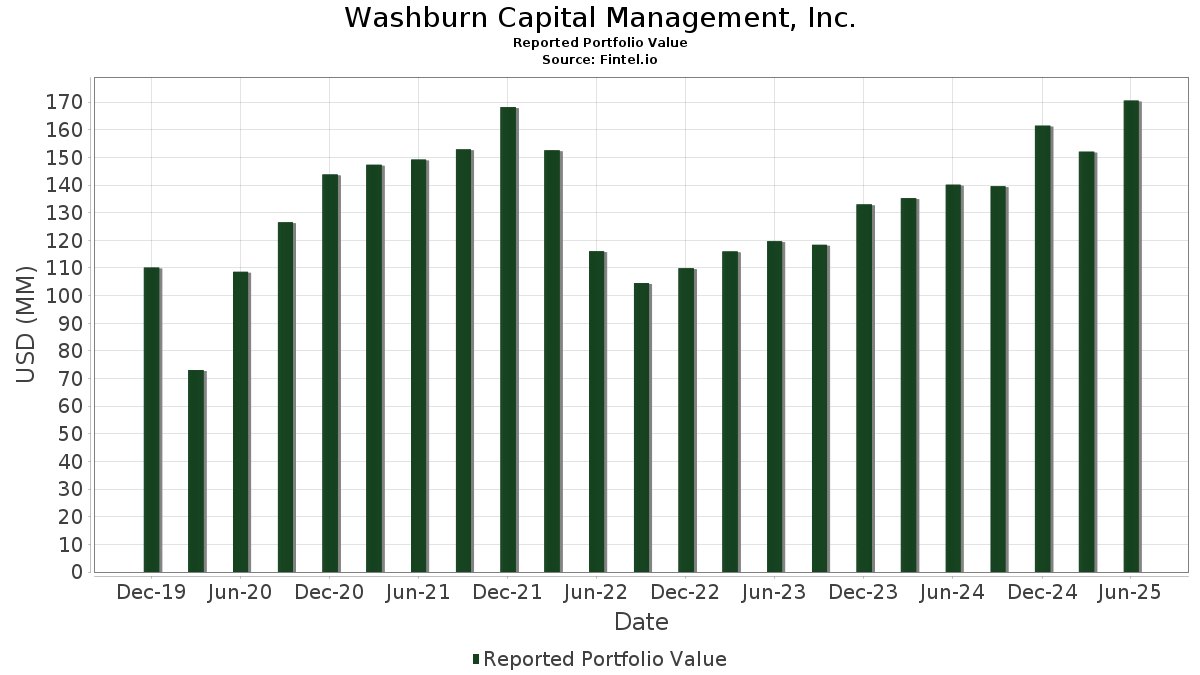

Washburn Capital Management, Inc. telah mengungkapkan total kepemilikan 52 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 170,575,472 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Washburn Capital Management, Inc. adalah SPDR S&P 500 ETF (US:SPY) , Vanguard Index Funds - Vanguard Total Stock Market ETF (US:VTI) , Invesco QQQ Trust, Series 1 (US:QQQ) , SPDR Dow Jones Industrial Average ETF Trust (US:DIA) , and NVIDIA Corporation (US:NVDA) . Posisi baru Washburn Capital Management, Inc. meliputi: iShares Trust - iShares MSCI USA Momentum Factor ETF (US:MTUM) , Constellation Energy Corporation (US:CEG) , Alexandria Real Estate Equities, Inc. (US:ARE) , Celestica Inc. (US:CLS) , and Sterling Infrastructure, Inc. (US:STRL) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 1.35 | 0.7932 | 0.7932 | |

| 0.00 | 2.44 | 1.4301 | 0.6691 | |

| 0.03 | 5.35 | 3.1366 | 0.6538 | |

| 0.00 | 1.02 | 0.6008 | 0.6008 | |

| 0.03 | 1.52 | 0.8890 | 0.5762 | |

| 0.01 | 0.95 | 0.5563 | 0.5563 | |

| 0.04 | 22.82 | 13.3756 | 0.3866 | |

| 0.01 | 4.09 | 2.3972 | 0.3375 | |

| 0.01 | 4.52 | 2.6518 | 0.3224 | |

| 0.01 | 1.56 | 0.9169 | 0.3181 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 12.63 | 7.4043 | -0.9215 | |

| 0.00 | 0.00 | -0.6668 | ||

| 0.01 | 3.07 | 1.7969 | -0.6500 | |

| 0.06 | 40.08 | 23.4958 | -0.6027 | |

| 0.05 | 3.21 | 1.8794 | -0.4594 | |

| 0.00 | 0.41 | 0.2402 | -0.3298 | |

| 0.00 | 0.00 | -0.3291 | ||

| 0.01 | 0.73 | 0.4291 | -0.3246 | |

| 0.00 | 1.88 | 1.1001 | -0.3086 | |

| 0.00 | 0.00 | -0.2999 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-05 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | 0.06 | -0.99 | 40.08 | 9.36 | 23.4958 | -0.6027 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.10 | 0.81 | 31.23 | 11.48 | 18.3070 | -0.1121 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.04 | -1.82 | 22.82 | 15.50 | 13.3756 | 0.3866 | |||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.03 | -4.96 | 12.63 | -0.26 | 7.4043 | -0.9215 | |||

| NVDA / NVIDIA Corporation | 0.03 | -2.80 | 5.35 | 41.72 | 3.1366 | 0.6538 | |||

| MSFT / Microsoft Corporation | 0.01 | -3.65 | 4.52 | 27.70 | 2.6518 | 0.3224 | |||

| META / Meta Platforms, Inc. | 0.01 | 1.93 | 4.09 | 30.56 | 2.3972 | 0.3375 | |||

| V / Visa Inc. | 0.01 | 0.53 | 3.61 | 1.86 | 2.1148 | -0.2138 | |||

| AMZN / Amazon.com, Inc. | 0.02 | -3.69 | 3.32 | 11.07 | 1.9465 | -0.0194 | |||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.05 | -15.21 | 3.21 | -9.90 | 1.8794 | -0.4594 | |||

| COST / Costco Wholesale Corporation | 0.00 | -0.28 | 3.13 | 4.40 | 1.8369 | -0.1369 | |||

| AAPL / Apple Inc. | 0.01 | -10.82 | 3.07 | -17.63 | 1.7969 | -0.6500 | |||

| GEV / GE Vernova Inc. | 0.00 | 21.60 | 2.44 | 110.80 | 1.4301 | 0.6691 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | -3.74 | 2.43 | 6.40 | 1.4233 | -0.0771 | |||

| PANW / Palo Alto Networks, Inc. | 0.01 | -5.17 | 2.03 | 13.68 | 1.1889 | 0.0164 | |||

| LLY / Eli Lilly and Company | 0.00 | -7.21 | 1.88 | -12.42 | 1.1001 | -0.3086 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 26.36 | 1.81 | 15.22 | 1.0608 | 0.0285 | |||

| AVGO / Broadcom Inc. | 0.01 | 4.32 | 1.56 | 71.87 | 0.9169 | 0.3181 | |||

| HD / The Home Depot, Inc. | 0.00 | -1.85 | 1.53 | -1.79 | 0.8993 | -0.1280 | |||

| SMCI / Super Micro Computer, Inc. | 0.03 | 122.72 | 1.52 | 219.16 | 0.8890 | 0.5762 | |||

| GE / General Electric Company | 0.01 | 27.63 | 1.39 | 64.11 | 0.8154 | 0.2582 | |||

| SOXX / iShares Trust - iShares Semiconductor ETF | 0.01 | -8.96 | 1.36 | 15.48 | 0.7962 | 0.0229 | |||

| MTUM / iShares Trust - iShares MSCI USA Momentum Factor ETF | 0.01 | 1.35 | 0.7932 | 0.7932 | |||||

| CAT / Caterpillar Inc. | 0.00 | -7.93 | 1.05 | 8.40 | 0.6128 | -0.0214 | |||

| CEG / Constellation Energy Corporation | 0.00 | 1.02 | 0.6008 | 0.6008 | |||||

| ABBV / AbbVie Inc. | 0.01 | -0.78 | 1.01 | -12.03 | 0.5915 | -0.1632 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 0.01 | 0.95 | 0.5563 | 0.5563 | |||||

| JPM / JPMorgan Chase & Co. | 0.00 | 21.37 | 0.90 | 43.52 | 0.5260 | 0.1147 | |||

| MS / Morgan Stanley | 0.01 | 0.11 | 0.77 | 20.94 | 0.4539 | 0.0327 | |||

| PLTR / Palantir Technologies Inc. | 0.01 | 36.92 | 0.77 | 121.26 | 0.4519 | 0.2227 | |||

| GOOG / Alphabet Inc. | 0.00 | -22.69 | 0.75 | -12.25 | 0.4373 | -0.1214 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.01 | -39.27 | 0.73 | -36.21 | 0.4291 | -0.3246 | |||

| SCHB / Schwab Strategic Trust - Schwab U.S. Broad Market ETF | 0.02 | -6.22 | 0.58 | 3.75 | 0.3411 | -0.0275 | |||

| CLS / Celestica Inc. | 0.00 | 0.45 | 0.2636 | 0.2636 | |||||

| TSLA / Tesla, Inc. | 0.00 | 38.92 | 0.45 | 69.96 | 0.2626 | 0.0896 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.00 | -55.77 | 0.41 | -52.77 | 0.2402 | -0.3298 | |||

| VRT / Vertiv Holdings Co | 0.00 | 0.00 | 0.36 | 78.33 | 0.2123 | 0.0784 | |||

| EQT / EQT Corporation | 0.01 | 0.00 | 0.35 | 9.18 | 0.2026 | -0.0056 | |||

| IYY / iShares Trust - iShares Dow Jones U.S. ETF | 0.00 | -27.97 | 0.34 | -20.33 | 0.1981 | -0.0802 | |||

| ABT / Abbott Laboratories | 0.00 | 0.00 | 0.33 | 2.49 | 0.1930 | -0.0181 | |||

| SPTM / SPDR Series Trust - SPDR Portfolio S&P 1500 Composite Stock Market ETF | 0.00 | 0.00 | 0.31 | 10.25 | 0.1833 | -0.0034 | |||

| EXE / Expand Energy Corporation | 0.00 | 0.00 | 0.28 | 4.87 | 0.1645 | -0.0111 | |||

| WMT / Walmart Inc. | 0.00 | 0.14 | 0.28 | 11.24 | 0.1629 | -0.0009 | |||

| BN / Brookfield Corporation | 0.00 | 0.00 | 0.27 | 18.50 | 0.1577 | 0.0078 | |||

| XOM / Exxon Mobil Corporation | 0.00 | 0.27 | 0.1571 | 0.1571 | |||||

| AEM / Agnico Eagle Mines Limited | 0.00 | 0.00 | 0.27 | 9.88 | 0.1569 | -0.0035 | |||

| CRH / CRH plc | 0.00 | 0.00 | 0.25 | 4.56 | 0.1480 | -0.0111 | |||

| VLO / Valero Energy Corporation | 0.00 | -1.93 | 0.24 | -0.42 | 0.1399 | -0.0173 | |||

| EBGEF / Enbridge Inc. - Preferred Stock | 0.01 | 0.00 | 0.24 | 2.17 | 0.1382 | -0.0133 | |||

| CCEP / Coca-Cola Europacific Partners PLC | 0.00 | 0.21 | 0.1223 | 0.1223 | |||||

| STRL / Sterling Infrastructure, Inc. | 0.00 | 0.21 | 0.1217 | 0.1217 | |||||

| GIL N / Gildan Activewear Inc. | 0.00 | 0.20 | 0.1184 | 0.1184 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.3291 | ||||

| CVX / Chevron Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.2999 | ||||

| UPS / United Parcel Service, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6668 | ||||

| LNTH / Lantheus Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2342 | ||||

| MCD / McDonald's Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1328 | ||||

| SKT / Tanger Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1439 | ||||

| ETN / Eaton Corporation plc | 0.00 | -100.00 | 0.00 | -100.00 | -0.2806 |