Mga Batayang Estadistika

| Nilai Portofolio | $ 157,493,000 |

| Posisi Saat Ini | 54 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

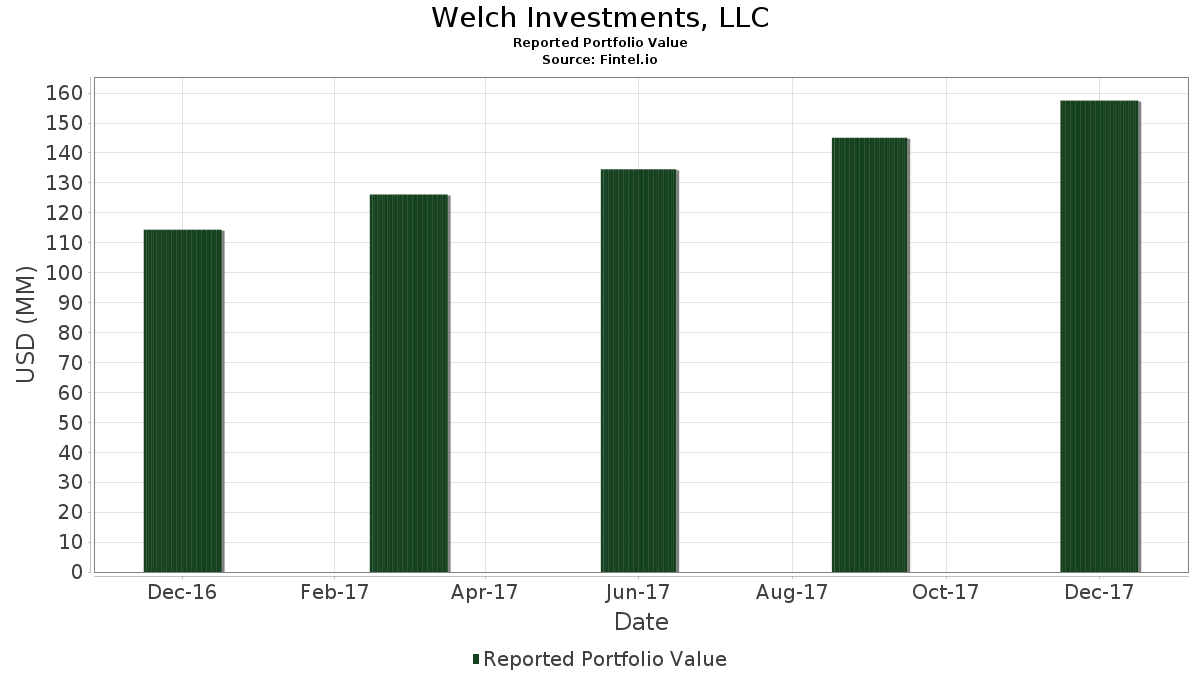

Welch Investments, LLC telah mengungkapkan total kepemilikan 54 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 157,493,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Welch Investments, LLC adalah AbbVie Inc. (US:ABBV) , The Home Depot, Inc. (US:HD) , Emerson Electric Co. (US:EMR) , Intel Corporation (US:INTC) , and The Southern Company (US:SO) . Posisi baru Welch Investments, LLC meliputi: iShares Trust - iShares Core S&P 500 ETF (US:IVV) , Norfolk Southern Corporation (US:NSC) , Regions Financial Corporation (US:RF) , Alphabet Inc. (US:GOOGL) , and Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) (US:BBVA) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 6.01 | 3.8173 | 3.8173 | |

| 0.08 | 5.49 | 3.4827 | 3.4827 | |

| 0.11 | 5.41 | 3.4351 | 3.4351 | |

| 0.03 | 5.28 | 3.3500 | 3.3500 | |

| 0.06 | 5.21 | 3.3100 | 3.3100 | |

| 0.04 | 5.11 | 3.2433 | 3.2433 | |

| 0.02 | 5.06 | 3.2122 | 3.2122 | |

| 0.10 | 5.05 | 3.2071 | 3.2071 | |

| 0.04 | 5.03 | 3.1919 | 3.1919 | |

| 0.02 | 5.01 | 3.1843 | 3.1843 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.27 | 0.1702 | -0.0449 | |

| 0.00 | 0.25 | 0.1613 | -0.0186 | |

| 0.04 | 5.30 | 3.3646 | -0.0185 | |

| 0.06 | 4.88 | 3.0973 | -0.0122 | |

| 0.00 | 0.27 | 0.1702 | -0.0042 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2018-01-30 untuk periode pelaporan 2017-12-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| ABBV / AbbVie Inc. | 0.06 | -5.24 | 6.01 | 3.12 | 3.8173 | 3.8173 | |||

| HD / The Home Depot, Inc. | 0.03 | -0.57 | 5.69 | 15.23 | 3.6135 | 0.2090 | |||

| EMR / Emerson Electric Co. | 0.08 | 1.54 | 5.49 | 12.61 | 3.4827 | 3.4827 | |||

| INTC / Intel Corporation | 0.12 | -2.37 | 5.48 | 18.34 | 3.4776 | 0.2875 | |||

| SO / The Southern Company | 0.11 | 4.70 | 5.41 | 2.46 | 3.4351 | 3.4351 | |||

| PAYX / Paychex, Inc. | 0.08 | 0.78 | 5.36 | 14.43 | 3.4046 | 0.1745 | |||

| CVX / Chevron Corporation | 0.04 | 1.34 | 5.30 | 7.97 | 3.3646 | -0.0185 | |||

| MCD / McDonald's Corporation | 0.03 | -2.30 | 5.28 | 7.34 | 3.3500 | 3.3500 | |||

| MSFT / Microsoft Corporation | 0.06 | -0.26 | 5.21 | 14.52 | 3.3100 | 3.3100 | |||

| RTX / RTX Corporation | 0.04 | 1.95 | 5.11 | 12.04 | 3.2433 | 3.2433 | |||

| MMM / 3M Company | 0.02 | -0.80 | 5.06 | 11.24 | 3.2122 | 3.2122 | |||

| VZ / Verizon Communications Inc. | 0.10 | -0.42 | 5.05 | 6.49 | 3.2071 | 3.2071 | |||

| JNJ / Johnson & Johnson | 0.04 | 1.05 | 5.03 | 8.60 | 3.1919 | 3.1919 | |||

| LMT / Lockheed Martin Corporation | 0.02 | -0.38 | 5.01 | 3.08 | 3.1843 | 3.1843 | |||

| NEE / NextEra Energy, Inc. | 0.03 | -1.13 | 5.00 | 5.37 | 3.1779 | 3.1779 | |||

| CL / Colgate-Palmolive Company | 0.07 | 7.97 | 4.96 | 11.82 | 3.1468 | 0.0918 | |||

| AJG / Arthur J. Gallagher & Co. | 0.08 | -0.38 | 4.95 | 2.42 | 3.1455 | 3.1455 | |||

| GIS / General Mills, Inc. | 0.08 | 4.53 | 4.95 | 19.75 | 3.1449 | 3.1449 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.06 | 2.44 | 4.88 | 0.18 | 3.0979 | 3.0979 | |||

| XOM / Exxon Mobil Corporation | 0.06 | 5.98 | 4.88 | 8.14 | 3.0973 | -0.0122 | |||

| PEP / PepsiCo, Inc. | 0.04 | 2.91 | 4.85 | 10.76 | 3.0776 | 0.0612 | |||

| CINF / Cincinnati Financial Corporation | 0.06 | 3.39 | 4.77 | 1.23 | 3.0293 | 3.0293 | |||

| T / AT&T Inc. | 0.12 | 4.68 | 4.74 | 3.90 | 3.0122 | 3.0122 | |||

| PG / The Procter & Gamble Company | 0.05 | 4.29 | 4.73 | 5.32 | 3.0052 | 3.0052 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.09 | 0.34 | 4.70 | -4.20 | 2.9868 | 2.9868 | |||

| KMB / Kimberly-Clark Corporation | 0.04 | 7.23 | 4.68 | 9.93 | 2.9735 | 2.9735 | |||

| ED / Consolidated Edison, Inc. | 0.05 | 1.19 | 4.62 | 6.54 | 2.9366 | 2.9366 | |||

| LEG / Leggett & Platt, Incorporated | 0.10 | 3.99 | 4.60 | 3.98 | 2.9182 | 2.9182 | |||

| IBM / International Business Machines Corporation | 0.03 | 4.98 | 4.55 | 11.02 | 2.8903 | 2.8903 | |||

| RDS.B / Shell Plc - ADR | 0.05 | -0.39 | 3.48 | 8.75 | 2.2090 | 2.2090 | |||

| RDS.A / Shell Plc - ADR (Representing Ordinary Shares - Class A) | 0.03 | -0.99 | 2.06 | 9.01 | 1.3055 | 1.3055 | |||

| GL / Globe Life Inc. | 0.01 | 15.86 | 0.93 | 31.22 | 0.5924 | 0.5924 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 0.57 | 0.3626 | 0.3626 | |||||

| PRA / ProAssurance Corporation | 0.01 | 1.80 | 0.47 | 6.59 | 0.2978 | 0.2978 | |||

| AAPL / Apple Inc. | 0.00 | 0.79 | 0.33 | 10.54 | 0.2064 | 0.2064 | |||

| Streettracks Gold TRUST / (863307104) | 0.00 | 0.28 | 0.0000 | ||||||

| RY / Royal Bank of Canada | 0.00 | -18.86 | 0.27 | -14.10 | 0.1702 | -0.0449 | |||

| IVE / iShares Trust - iShares S&P 500 Value ETF | 0.00 | 0.00 | 0.27 | 5.93 | 0.1702 | -0.0042 | |||

| SLV / iShares Silver Trust | 0.02 | 0.00 | 0.26 | 1.59 | 0.1619 | 0.1619 | |||

| DOW / Dow Inc. | 0.00 | -5.29 | 0.25 | -2.68 | 0.1613 | -0.0186 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.00 | -7.36 | 0.22 | -2.18 | 0.1422 | 0.1422 | |||

| SFBS / ServisFirst Bancshares, Inc. | 0.01 | 0.00 | 0.22 | 6.93 | 0.1371 | 0.1371 | |||

| KMI / Kinder Morgan, Inc. | 0.01 | 72.22 | 0.17 | 62.75 | 0.1054 | 0.1054 | |||

| KO / The Coca-Cola Company | 0.00 | 2.98 | 0.16 | 5.30 | 0.1010 | 0.1010 | |||

| NSC / Norfolk Southern Corporation | 0.00 | 0.16 | 0.0991 | 0.0991 | |||||

| BMY / Bristol-Myers Squibb Company | 0.00 | -6.72 | 0.13 | -10.20 | 0.0838 | 0.0838 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 5.17 | 0.12 | 18.45 | 0.0775 | 0.0775 | |||

| RF / Regions Financial Corporation | 0.01 | 0.12 | 0.0762 | 0.0762 | |||||

| NVDA / NVIDIA Corporation | 0.00 | 5.35 | 0.12 | 13.46 | 0.0749 | 0.0749 | |||

| V / Visa Inc. | 0.00 | 5.50 | 0.12 | 14.85 | 0.0737 | 0.0737 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.11 | 0.0724 | 0.0724 | |||||

| PM / Philip Morris International Inc. | 0.00 | 0.00 | 0.11 | -5.13 | 0.0705 | 0.0705 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | 14.80 | 0.11 | 1.85 | 0.0698 | 0.0698 | |||

| BBVA / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 0.01 | 0.10 | 0.0667 | 0.0667 | |||||

| VGK / Vanguard International Equity Index Funds - Vanguard FTSE Europe ETF | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 |