Mga Batayang Estadistika

| Nilai Portofolio | $ 161,545,393 |

| Posisi Saat Ini | 429 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

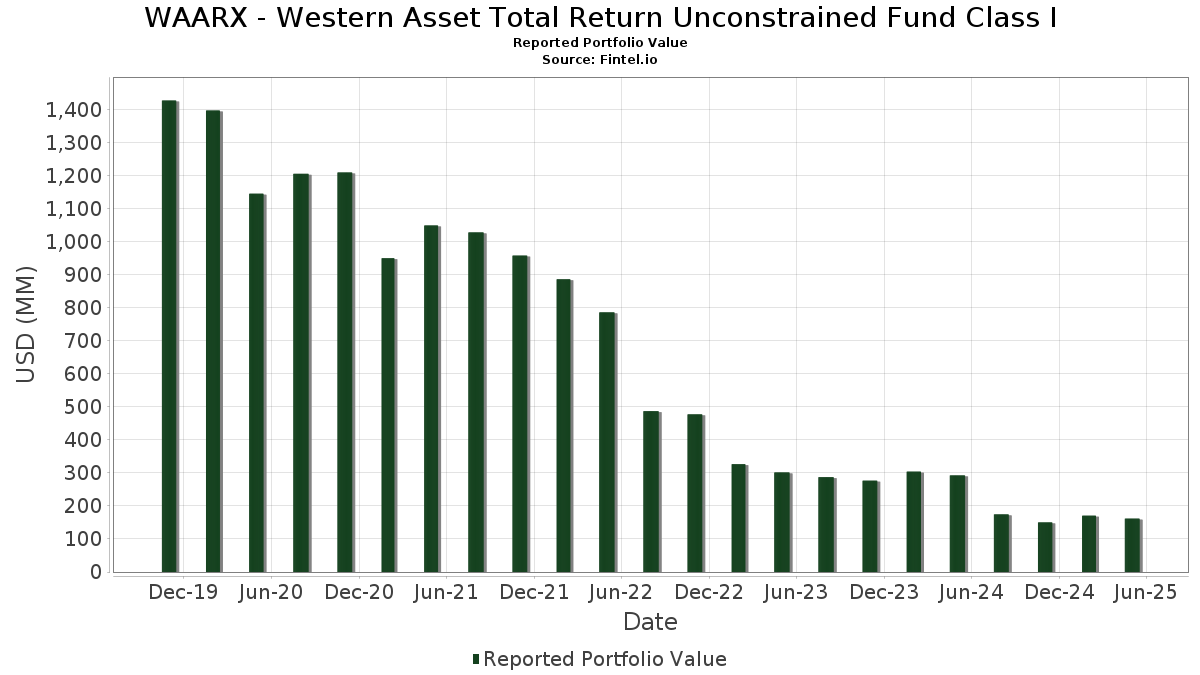

WAARX - Western Asset Total Return Unconstrained Fund Class I telah mengungkapkan total kepemilikan 429 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 161,545,393 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama WAARX - Western Asset Total Return Unconstrained Fund Class I adalah WA Premier Institutional Government Reserves - Premium Shares (US:US52470G4947) , Fannie Mae or Freddie Mac (US:US01F0306609) , United Sates Treasury Bond Bond (US:US912810QN19) , Uniform Mortgage-Backed Security, TBA (US:US01F0426654) , and United States Treas Bds Bond (US:US912810RD28) . Posisi baru WAARX - Western Asset Total Return Unconstrained Fund Class I meliputi: Fannie Mae or Freddie Mac (US:US01F0306609) , United Sates Treasury Bond Bond (US:US912810QN19) , Uniform Mortgage-Backed Security, TBA (US:US01F0426654) , United States Treas Bds Bond (US:US912810RD28) , and Ginnie Mae (US:US21H0526606) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 12.13 | 8.9183 | 8.9183 | ||

| 12.85 | 9.4509 | 6.2718 | ||

| 2.13 | 1.5663 | 2.8480 | ||

| 3.77 | 2.7749 | 1.5278 | ||

| 0.93 | 0.6823 | 0.6823 | ||

| 2.35 | 1.7276 | 0.6810 | ||

| 0.46 | 0.3406 | 0.3406 | ||

| 0.45 | 0.3282 | 0.3282 | ||

| 0.42 | 0.3088 | 0.3088 | ||

| 0.33 | 0.2415 | 0.2415 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 17.92 | 17.92 | 13.1772 | -5.7153 | |

| 1.36 | 0.9990 | -3.3790 | ||

| 0.82 | 0.6026 | -1.7800 | ||

| 1.13 | 0.8307 | -1.7018 | ||

| 0.23 | 0.1715 | -1.3201 | ||

| 0.71 | 0.5199 | -1.0289 | ||

| 0.44 | 0.3204 | -0.8301 | ||

| 2.98 | 2.1910 | -0.3233 | ||

| 0.23 | 0.1678 | -0.1934 | ||

| -0.25 | -0.1874 | -0.1874 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-23 untuk periode pelaporan 2025-05-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US52470G4947 / WA Premier Institutional Government Reserves - Premium Shares | 17.92 | -33.56 | 17.92 | -33.56 | 13.1772 | -5.7153 | |||

| US01F0306609 / Fannie Mae or Freddie Mac | 12.85 | 73.65 | 9.4509 | 6.2718 | |||||

| US912810QN19 / United Sates Treasury Bond Bond | 12.13 | 8.9183 | 8.9183 | ||||||

| US01F0426654 / Uniform Mortgage-Backed Security, TBA | 3.77 | 29.97 | 2.7749 | 1.5278 | |||||

| US912810RD28 / United States Treas Bds Bond | 3.09 | -4.87 | 2.2695 | -0.0035 | |||||

| US21H0526606 / Ginnie Mae | 2.98 | -49.10 | 2.1910 | -0.3233 | |||||

| US91282CJR34 / United States Treasury Note/Bond - When Issued | 2.41 | 0.42 | 1.7714 | 0.0909 | |||||

| US21H0626695 / GINNIE MAE | 2.35 | -3.57 | 1.7276 | 0.6810 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 2.24 | 5.12 | 1.6472 | 0.1544 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.20 | -0.32 | 1.6172 | 0.0714 | |||||

| United States Treasury Note/Bond / DBT (US91282CJX02) | 2.18 | 0.14 | 1.5996 | 0.0779 | |||||

| US01F0506687 / Fannie Mae or Freddie Mac | 2.13 | -171.37 | 1.5663 | 2.8480 | |||||

| BRSTNCNTF204 / Brazil Notas do Tesouro Nacional Serie F | 2.11 | 9.10 | 1.5531 | 0.1974 | |||||

| US31418EER71 / FANNIE MAE POOL UMBS P#MA4643 3.00000000 | 1.68 | -3.90 | 1.2329 | 0.0109 | |||||

| US255396AC73 / Dividend Solar Loans 2018-1 LLC | 1.53 | -5.50 | 1.1253 | -0.0092 | |||||

| IN0020220060 / India Government Bond | 1.49 | 5.58 | 1.0992 | 0.1076 | |||||

| IN0020200070 / India Government Bond | 1.49 | 5.59 | 1.0974 | 0.1075 | |||||

| United States Treasury Note/Bond / DBT (US91282CLM19) | 1.47 | 0.00 | 1.0804 | 0.0508 | |||||

| US21H0506640 / Ginnie Mae | 1.36 | -86.68 | 0.9990 | -3.3790 | |||||

| US52476DAB38 / Legacy Mortgage Asset Trust 2021-GS2 | 1.28 | 1.67 | 0.9425 | 0.0594 | |||||

| US3133KYWN56 / FNCT UMBS 2.0 RB5153 03-01-42 | 1.21 | -3.37 | 0.8862 | 0.0124 | |||||

| US01F0626634 / Uniform Mortgage-Backed Security, TBA | 1.13 | -80.85 | 0.8307 | -1.7018 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.12 | -3.11 | 0.8248 | 0.0141 | |||||

| US92539AAC80 / Verus Securitization Trust, Series 2022-6, Class A3 | 1.12 | -2.62 | 0.8200 | 0.0178 | |||||

| US05608RAQ83 / BX TR 2021-ARIA G 1ML+320 10/15/2036 144A | 1.02 | -0.97 | 0.7476 | 0.0286 | |||||

| US06036FBG54 / BANK 2018-BNK15 | 0.99 | -2.74 | 0.7313 | 0.0147 | |||||

| BRSTNCNTF212 / Brazil Notas do Tesouro Nacional Serie F | 0.97 | 10.01 | 0.7114 | 0.0954 | |||||

| US3132DVMC62 / FHLMC 30YR UMBS SUPER | 0.95 | -4.72 | 0.6980 | -0.0000 | |||||

| US1248EPCP61 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.93 | 2.98 | 0.6862 | 0.0514 | |||||

| IRS USD / DIR (000000000) | 0.93 | 0.6823 | 0.6823 | ||||||

| ZAG000077488 / Republic of South Africa Government Bond | 0.92 | 5.63 | 0.6759 | 0.0658 | |||||

| US404030AJ72 / H+E EQUIPMENT SERVICES COMPANY GUAR 144A 12/28 3.875 | 0.88 | 0.80 | 0.6451 | 0.0352 | |||||

| US912810TV08 / US TREASURY N/B 4.75% 11-15-53 | 0.84 | -6.64 | 0.6211 | -0.0126 | |||||

| US38237JAC71 / GoodLeap Sustainable Home Solutions Trust 2022-1 | 0.84 | -21.41 | 0.6161 | -0.1306 | |||||

| US3133KYWP05 / UMBS, 20 Year | 0.83 | -2.59 | 0.6089 | 0.0141 | |||||

| US3133KYT414 / Federal Home Loan Mortgage Corporation | 0.82 | -3.40 | 0.6062 | 0.0080 | |||||

| XS1989380172 / Netflix Inc | 0.82 | 9.77 | 0.6033 | 0.0795 | |||||

| United States Treasury Inflation Indexed Bonds / DBT (US91282CLE92) | 0.82 | -75.92 | 0.6026 | -1.7800 | |||||

| US694308KE68 / Pacific Gas and Electric Co | 0.80 | 0.13 | 0.5883 | 0.0287 | |||||

| XS2592804434 / Teva Pharmaceutical Finance Netherlands II BV | 0.78 | 9.08 | 0.5746 | 0.0724 | |||||

| United States Treasury Note/Bond / DBT (US912810UE63) | 0.78 | 0.39 | 0.5700 | 0.0289 | |||||

| US05609KAQ22 / BX TRUST 1ML+372.55 10/15/2036 144A | 0.74 | 0.54 | 0.5438 | 0.0283 | |||||

| US36250GAX34 / GS Mortgage Securities Corp II | 0.74 | -6.46 | 0.5428 | -0.0100 | |||||

| US01F0606677 / Uniform Mortgage-Backed Security, TBA | 0.71 | -80.42 | 0.5199 | -1.0289 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3622AC4M91) | 0.68 | -4.87 | 0.5027 | -0.0003 | |||||

| XS1877860533 / Cooperatieve Rabobank UA | 0.68 | 8.93 | 0.5024 | 0.0631 | |||||

| US31418EAB65 / FN MA4501 | 0.63 | -4.24 | 0.4657 | 0.0025 | |||||

| US46654PAQ90 / J.P. Morgan Chase Commercial Mortgage Securities Trust 2021-HTL5 | 0.63 | -0.32 | 0.4652 | 0.0205 | |||||

| US225313AJ46 / Credit Agricole SA | 0.63 | -0.63 | 0.4627 | 0.0186 | |||||

| US958667AC17 / WESTERN MIDSTREAM OPERAT SR UNSECURED 02/30 4.05 | 0.63 | -0.32 | 0.4616 | 0.0209 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.63 | -4.43 | 0.4607 | 0.0011 | |||||

| US24023AAA88 / DC_23-DC | 0.62 | -0.16 | 0.4563 | 0.0212 | |||||

| US225401AU28 / Credit Suisse Group AG | 0.62 | 0.16 | 0.4544 | 0.0223 | |||||

| US78458MAL81 / SMR 2022-IND Mortgage Trust | 0.62 | -0.32 | 0.4527 | 0.0201 | |||||

| US05591XAA90 / BRSP 2021-FL1 Ltd | 0.61 | -1.62 | 0.4457 | 0.0135 | |||||

| US80007RAE53 / Sands China Ltd | 0.59 | -0.68 | 0.4326 | 0.0175 | |||||

| US91282CJL63 / UST NOTES 4.875% 11/30/2025 | 0.55 | -0.18 | 0.4055 | 0.0183 | |||||

| US90932LAH06 / United Airlines Inc | 0.53 | -1.48 | 0.3914 | 0.0129 | |||||

| US3140XH5K96 / Fannie Mae Pool | 0.52 | -6.10 | 0.3853 | -0.0052 | |||||

| Palmer Square Loan Funding 2022-3 Ltd / ABS-CBDO (US69690CAU71) | 0.52 | -0.57 | 0.3821 | 0.0159 | |||||

| Jamestown CLO XII Ltd / ABS-CBDO (US47047JAQ76) | 0.50 | 0.00 | 0.3696 | 0.0177 | |||||

| US12433RAA05 / BX Trust 2018-GW MZ | 0.50 | -0.20 | 0.3669 | 0.0169 | |||||

| US893045AE41 / Trans-Allegheny Interstate Line Co | 0.49 | 0.41 | 0.3604 | 0.0182 | |||||

| US88167AAE10 / Teva Pharmaceutical Fin Neth 10/01/2026 3.150 Bond | 0.49 | 1.03 | 0.3598 | 0.0207 | |||||

| US912810RC45 / United States Treas Bds Bond | 0.48 | -4.75 | 0.3538 | -0.0001 | |||||

| US80007RAN52 / Sands China Ltd | 0.48 | 0.63 | 0.3504 | 0.0190 | |||||

| Mountain View CLO XVI Ltd / ABS-CBDO (US62432UAU51) | 0.47 | -1.26 | 0.3465 | 0.0122 | |||||

| US09659W2P81 / BNP Paribas SA | 0.47 | 0.21 | 0.3440 | 0.0170 | |||||

| US00120NAG97 / AGL 2023-25A D | 0.46 | 0.3406 | 0.3406 | ||||||

| US126307BH94 / CSC Holdings LLC | 0.46 | -7.63 | 0.3385 | -0.0110 | |||||

| US12667GXC22 / Alternative Loan Trust 2005-28CB | 0.45 | -2.78 | 0.3346 | 0.0074 | |||||

| US31418EBJ82 / Fannie Mae Pool | 0.45 | -3.44 | 0.3303 | 0.0041 | |||||

| US444859AZ50 / Humana Inc. 8.15% Senior Notes 6/15/38 | 0.45 | -2.41 | 0.3285 | 0.0078 | |||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | 0.45 | 0.3282 | 0.3282 | ||||||

| US3137F9YZ86 / FEDERAL HOME LN MTG MLT CTF GT K124 X1 CSTR 12/25/2030 | 0.44 | -4.16 | 0.3225 | 0.0020 | |||||

| US21H0306660 / Ginnie Mae II pool | 0.44 | -83.76 | 0.3204 | -0.8301 | |||||

| OHA Credit Funding 18 Ltd / ABS-CBDO (US67706JAL89) | 0.42 | -1.41 | 0.3100 | 0.0106 | |||||

| US05608BAQ32 / BX Commercial Mortgage Trust 2019-IMC | 0.42 | 0.3088 | 0.3088 | ||||||

| US126682AA14 / CWHEQ REVOLVING HOME EQUITY LOAN TRUST SERIES 2007 CWHEL 2007-A A | 0.42 | -4.34 | 0.3084 | 0.0011 | |||||

| US3133KQUT11 / Freddie Mac Pool | 0.42 | -4.37 | 0.3066 | 0.0018 | |||||

| US207942AB90 / Fannie Mae Connecticut Avenue Securities | 0.41 | -0.97 | 0.3021 | 0.0118 | |||||

| US254010AE13 / Dignity Health | 0.40 | -8.41 | 0.2968 | -0.0114 | |||||

| US12548MBH79 / CIFC Funding 2015-I Ltd | 0.40 | 0.25 | 0.2955 | 0.0146 | |||||

| US62886HBN08 / NCL Corp Ltd | 0.40 | -0.74 | 0.2944 | 0.0119 | |||||

| EMLC / VanEck ETF Trust - VanEck J.P. Morgan EM Local Currency Bond ETF | 0.02 | 0.00 | 0.40 | 4.18 | 0.2940 | 0.0255 | |||

| US63873VAL71 / Natixis Commercial Mortgage Securities Trust 2019-FAME | 0.39 | 7.14 | 0.2872 | 0.0319 | |||||

| US20754EAB11 / Connecticut Avenue Securities Trust, Series 2023-R06, Class 1M2 | 0.38 | 0.00 | 0.2818 | 0.0131 | |||||

| US654744AB77 / Nissan Motor Co Ltd | 0.38 | 0.27 | 0.2772 | 0.0141 | |||||

| US90276WAR88 / UBS Commercial Mortgage Trust 2017-C7 | 0.37 | 0.54 | 0.2714 | 0.0138 | |||||

| United States Treasury Note/Bond / DBT (US91282CLL36) | 0.37 | 0.55 | 0.2692 | 0.0136 | |||||

| US36362MAG24 / Gallatin CLO X 2023-1 Ltd | 0.36 | -0.28 | 0.2668 | 0.0124 | |||||

| Bain Capital Credit CLO 2019-1 / ABS-CBDO (US05683VBG86) | 0.36 | -0.28 | 0.2658 | 0.0121 | |||||

| US67516BAE11 / Ocean Trails Clo X | 0.35 | -2.50 | 0.2588 | 0.0065 | |||||

| MF1 2024-FL16 / ABS-CBDO (US55287EAA55) | 0.35 | -0.28 | 0.2580 | 0.0117 | |||||

| SWCH Commercial Mortgage Trust 2025-DATA / ABS-MBS (US78489CAA71) | 0.35 | -0.57 | 0.2556 | 0.0106 | |||||

| United States Treasury Note/Bond / DBT (US91282CLW90) | 0.35 | -1.42 | 0.2549 | 0.0087 | |||||

| US59156RAP38 / Metlife Inc. 6.4% Jr Sub 12/15/36 | 0.35 | -1.99 | 0.2538 | 0.0066 | |||||

| Clover CLO 2018-1 LLC / ABS-CBDO (US18914GAN16) | 0.34 | -0.87 | 0.2525 | 0.0096 | |||||

| Sycamore Tree CLO 2024-5 Ltd / ABS-CBDO (US87122YAJ47) | 0.34 | -0.29 | 0.2519 | 0.0114 | |||||

| PPM CLO 8 Ltd / ABS-CBDO (US69382DAJ37) | 0.34 | 0.00 | 0.2512 | 0.0120 | |||||

| US88732JAN81 / Time Warner Cable 7.3% Senior Notes 7/1/38 | 0.34 | 0.89 | 0.2509 | 0.0136 | |||||

| XS2385150417 / Provincia de Buenos Aires/Government Bonds | 0.34 | -39.50 | 0.2507 | -0.1430 | |||||

| 5727 / Sands China Ltd. - Corporate Bond/Note | 0.34 | 0.00 | 0.2501 | 0.0119 | |||||

| US64035DAD84 / Nelnet Student Loan Trust 2021-A | 0.34 | -7.18 | 0.2473 | -0.0064 | |||||

| US12515HAZ82 / CD 2017-CD5 Mortgage Trust | 0.33 | 0.61 | 0.2427 | 0.0128 | |||||

| US10554TAD72 / Braskem Netherlands Finance BV | 0.33 | 0.2415 | 0.2415 | ||||||

| US3140QMK378 / Fannie Mae Pool | 0.33 | -4.39 | 0.2410 | 0.0010 | |||||

| Hayfin US XV Ltd / ABS-CBDO (US420916AL24) | 0.32 | -1.52 | 0.2382 | 0.0083 | |||||

| US040114HT09 / Argentine Republic Government International Bond | 0.32 | 0.2379 | 0.2379 | ||||||

| US517834AF40 / Las Vegas Sands Corp | 0.32 | -0.62 | 0.2347 | 0.0097 | |||||

| US23636ABC45 / Danske Bank A/S | 0.32 | 0.00 | 0.2337 | 0.0110 | |||||

| US95003WAN65 / Wells Fargo Commercial Mortgage Trust 2022-ONL | 0.31 | 2.28 | 0.2315 | 0.0162 | |||||

| Warwick Capital CLO 3 Ltd / ABS-CBDO (US93655PAG28) | 0.31 | -1.89 | 0.2292 | 0.0071 | |||||

| Morgan Stanley Residential Mortgage Loan Trust 2024-INV2 / ABS-MBS (US617939AA13) | 0.31 | -13.76 | 0.2260 | -0.0237 | |||||

| US161175CL69 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.31 | -0.65 | 0.2259 | 0.0092 | |||||

| US06051GKJ75 / Bank of America Corp | 0.30 | 0.34 | 0.2204 | 0.0114 | |||||

| US80007RAQ83 / Sands China Ltd | 0.30 | 0.00 | 0.2202 | 0.0106 | |||||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 0.30 | 0.2171 | 0.2171 | ||||||

| 720 East CLO VII Ltd / ABS-CBDO (US81800WAN11) | 0.30 | -1.99 | 0.2170 | 0.0060 | |||||

| US48126PAA03 / KazMunayGas National Co JSC | 0.29 | 0.2167 | 0.2167 | ||||||

| US345397B694 / Ford Motor Credit Co LLC | 0.29 | -1.68 | 0.2153 | 0.0070 | |||||

| OHA Credit Funding 11 Ltd / ABS-CBDO (US67115VAW28) | 0.29 | -0.68 | 0.2144 | 0.0090 | |||||

| Tesla Sustainable Energy Trust 2024-1 / ABS-O (US88164AAC80) | 0.29 | -2.03 | 0.2129 | 0.0061 | |||||

| US90263ABB52 / UCFC Manufactured Housing Contract | 0.29 | -16.67 | 0.2101 | -0.0301 | |||||

| CarVal CLO XI C Ltd / ABS-CBDO (US14688RAJ95) | 0.28 | -41.94 | 0.2070 | -0.1323 | |||||

| XS2575900977 / Lloyds Banking Group PLC | 0.28 | 7.25 | 0.2068 | 0.0227 | |||||

| AMMC CLO 23 Ltd / ABS-CBDO (US00177JBS33) | 0.28 | 0.36 | 0.2067 | 0.0100 | |||||

| Apex Credit CLO 2020 LTD / ABS-CBDO (US03756ABL08) | 0.28 | -1.07 | 0.2049 | 0.0077 | |||||

| US61772TBN37 / Morgan Stanley Capital I Trust 2021-L7 | 0.28 | -4.83 | 0.2030 | -0.0005 | |||||

| US25714PEW41 / Dominican Republic International Bond | 0.27 | 1.11 | 0.2010 | 0.0118 | |||||

| US34528QGA67 / Ford Credit Floorplan Master Owner Trust A | 0.27 | 0.1997 | 0.1997 | ||||||

| US25470XBF15 / DISH DBS Corp. | 0.27 | -4.58 | 0.1996 | 0.0003 | |||||

| XS2066744231 / Carnival PLC | 0.27 | 34.33 | 0.1992 | 0.0580 | |||||

| MF12025-FL19LLC / ABS-CBDO (US55287KAA16) | 0.27 | 0.1990 | 0.1990 | ||||||

| OCP CLO 2016-11 Ltd / ABS-CBDO (US67110DBL01) | 0.27 | -0.74 | 0.1984 | 0.0079 | |||||

| US212015AT84 / Continental Resources Inc/OK | 0.27 | -2.19 | 0.1978 | 0.0057 | |||||

| US74365PAF53 / Prosus NV | 0.27 | 1.13 | 0.1977 | 0.0114 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.27 | -2.55 | 0.1974 | 0.0042 | |||||

| PRPM 2024-NQM4 Trust / ABS-MBS (US69381UAA51) | 0.27 | 0.1973 | 0.1973 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.27 | -3.97 | 0.1958 | 0.0017 | |||||

| US195325DZ51 / Colombia Government International Bond | 0.26 | 0.1912 | 0.1912 | ||||||

| Blueberry Park CLO Ltd / ABS-CBDO (US09609QAG38) | 0.26 | -2.26 | 0.1910 | 0.0053 | |||||

| US893647BT37 / TransDigm Inc | 0.26 | 0.00 | 0.1904 | 0.0096 | |||||

| US3132DVL943 / Uniform Mortgage-Backed Securities | 0.26 | -4.48 | 0.1883 | 0.0002 | |||||

| Angel Oak Mortgage Trust 2024-10 / ABS-MBS (US034933AA90) | 0.25 | -5.93 | 0.1875 | -0.0020 | |||||

| US55955GAD51 / Magnetite XXV Ltd | 0.25 | 0.00 | 0.1851 | 0.0092 | |||||

| Subway Funding LLC / ABS-O (US864300AA61) | 0.25 | -1.57 | 0.1851 | 0.0062 | |||||

| MU / Micron Technology, Inc. - Depositary Receipt (Common Stock) | 0.25 | -0.79 | 0.1851 | 0.0075 | |||||

| Palmer Square Loan Funding 2024-1 Ltd / ABS-CBDO (US69703NAG97) | 0.25 | 0.40 | 0.1847 | 0.0089 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.25 | -5.66 | 0.1844 | -0.0016 | |||||

| Galaxy XXII CLO Ltd / ABS-CBDO (US36320TBK88) | 0.25 | 0.1837 | 0.1837 | ||||||

| US21623PAJ66 / Cook Park CLO Ltd | 0.25 | -0.80 | 0.1835 | 0.0072 | |||||

| Magnetite XXXIX Ltd / ABS-CBDO (US559924AN50) | 0.25 | 0.1826 | 0.1826 | ||||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 0.25 | -0.80 | 0.1825 | 0.0070 | |||||

| US61947DAD12 / MOSAIC SOLAR LOAN TRUST 2021-1 SER 2021-1A CL D REGD 144A P/P 3.71000000 | 0.25 | -11.11 | 0.1824 | -0.0135 | |||||

| AASET 2025-1 / ABS-O (US00258PAA12) | 0.25 | -3.53 | 0.1813 | 0.0025 | |||||

| Clover CLO 2021-3 LLC / ABS-CBDO (US18915FAG72) | 0.25 | 0.1809 | 0.1809 | ||||||

| Switch ABS Issuer LLC / ABS-O (US871044AL72) | 0.24 | 0.1796 | 0.1796 | ||||||

| US35671DBC83 / Freeport-McMoRan Inc. Bond | 0.24 | -2.83 | 0.1767 | 0.0030 | |||||

| Goldentree Loan Management US Clo 6 Ltd / ABS-CBDO (US38137WBE49) | 0.24 | -1.25 | 0.1748 | 0.0065 | |||||

| US313385MQ65 / Federal Home Loan Bank Discount Notes | 0.24 | 0.1739 | 0.1739 | ||||||

| US71424VAA89 / Permian Resources Operating LLC | 0.24 | 0.00 | 0.1736 | 0.0080 | |||||

| US01F0206619 / FNMA TBA 30 YR 2 SINGLE FAMILY MORTGAGE | 0.23 | -93.29 | 0.1715 | -1.3201 | |||||

| US36179XFH44 / Government National Mortgage Association (GNMA) | 0.23 | -4.53 | 0.1710 | 0.0005 | |||||

| Palmer Square Loan Funding 2024-1 Ltd / ABS-CBDO (US69703NAE40) | 0.23 | 0.1700 | 0.1700 | ||||||

| US3140X6L746 / Fannie Mae Pool | 0.23 | -4.17 | 0.1698 | 0.0010 | |||||

| US126307AS68 / CSC Holdings LLC | 0.23 | -55.73 | 0.1678 | -0.1934 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.23 | -5.04 | 0.1668 | 0.0000 | |||||

| US127097AK92 / Coterra Energy Inc | 0.23 | 0.00 | 0.1666 | 0.0081 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 0.23 | -1.74 | 0.1664 | 0.0048 | |||||

| US35563PBH10 / Seasoned Credit Risk Transfer Trust Series 2017-2 | 0.23 | -25.50 | 0.1657 | -0.0459 | |||||

| US36179W5F11 / Ginnie Mae II Pool | 0.22 | -5.08 | 0.1651 | -0.0003 | |||||

| Amur Equipment Finance Receivables XV LLC / ABS-O (US03237FAB13) | 0.22 | 0.1623 | 0.1623 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.22 | -4.41 | 0.1598 | 0.0007 | |||||

| HOMES 2024-NQM1 Trust / ABS-MBS (US40390TAA88) | 0.22 | -7.69 | 0.1589 | -0.0057 | |||||

| United Rentals North America Inc / DBT (US911365BR47) | 0.21 | 0.1567 | 0.1567 | ||||||

| US3617MKK998 / GNMA | 0.21 | -6.22 | 0.1557 | -0.0022 | |||||

| US06539VAJ70 / BANK 2022-BNK39 | 0.21 | -0.94 | 0.1554 | 0.0062 | |||||

| US36179TUB96 / Ginnie Mae II Pool | 0.21 | -4.98 | 0.1547 | -0.0003 | |||||

| US345370DB39 / Ford Motor Co. | 0.21 | -0.97 | 0.1509 | 0.0052 | |||||

| US31418ECZ16 / Fannie Mae Pool | 0.20 | -3.33 | 0.1493 | 0.0015 | |||||

| Teva Pharmaceutical Finance Netherlands III BV / DBT (US88167AAT88) | 0.20 | 0.1485 | 0.1485 | ||||||

| US71647NBK46 / Petrobras Global Finance BV | 0.20 | 0.1483 | 0.1483 | ||||||

| W1BD34 / Warner Bros. Discovery, Inc. - Depositary Receipt (Common Stock) | 0.20 | 0.1480 | 0.1480 | ||||||

| US3132DN5L35 / Freddie Mac Pool | 0.20 | -4.33 | 0.1464 | 0.0002 | |||||

| US05964HAQ83 / Banco Santander SA | 0.20 | 0.51 | 0.1458 | 0.0071 | |||||

| 1261229 BC Ltd / DBT (US68288AAA51) | 0.20 | 0.1457 | 0.1457 | ||||||

| US3133KYWE57 / Freddie Mac Pool | 0.20 | -3.94 | 0.1435 | 0.0011 | |||||

| Spirit Loyalty Cayman Ltd / Spirit IP Cayman Ltd / DBT (US84859BAC54) | 0.19 | 0.1409 | 0.1409 | ||||||

| Golub Capital Partners CLO 76 B Ltd / ABS-CBDO (US38180BAJ61) | 0.19 | -1.04 | 0.1406 | 0.0050 | |||||

| US36179UPB25 / Ginnie Mae II Pool | 0.19 | -5.00 | 0.1398 | -0.0006 | |||||

| US3133KYV717 / FHLG 20YR 2% 12/01/2041#RB5138 | 0.19 | -4.06 | 0.1395 | 0.0014 | |||||

| US3622AAKS20 / GINNIE MAE II POOL P#784905 3.00000000 | 0.18 | -3.66 | 0.1359 | 0.0014 | |||||

| US912810SH23 / United States Treas Bds Bond | 0.18 | -6.19 | 0.1342 | -0.0020 | |||||

| US3137H9CB37 / FHLMC Multifamily Structured Pass-Through Certificates, Series K-150, Class X1 | 0.18 | -3.70 | 0.1339 | 0.0008 | |||||

| Magnetite XXII Ltd / ABS-CBDO (US55954HBC51) | 0.18 | -0.55 | 0.1329 | 0.0058 | |||||

| US3137FREM93 / GOVT CMO | 0.18 | -5.41 | 0.1293 | -0.0004 | |||||

| US3617MQCZ75 / GNMA | 0.18 | -2.78 | 0.1287 | 0.0022 | |||||

| US80007RAS40 / Sands China Ltd | 0.17 | -0.57 | 0.1278 | 0.0055 | |||||

| Neuberger Berman Loan Advisers Clo 43 Ltd / ABS-CBDO (US64134AAQ58) | 0.17 | 0.1246 | 0.1246 | ||||||

| US3132DQBZ81 / Freddie Mac Pool | 0.16 | -3.55 | 0.1205 | 0.0017 | |||||

| US55376CAD56 / MSWF COMMERCIAL MORTGAGE TRUST 2023-1 | 0.16 | -0.61 | 0.1198 | 0.0050 | |||||

| US3132DN6L26 / Freddie Mac Pool | 0.16 | -2.99 | 0.1192 | 0.0021 | |||||

| United States Treasury Note/Bond / DBT (US912810UA42) | 0.16 | -6.94 | 0.1190 | -0.0027 | |||||

| US16411QAK76 / CORP. NOTE | 0.16 | -0.62 | 0.1172 | 0.0050 | |||||

| US3622ACCK42 / Ginnie Mae II Pool | 0.16 | -4.82 | 0.1166 | 0.0001 | |||||

| US3617MKP781 / Ginnie Mae II Pool | 0.16 | -3.11 | 0.1150 | 0.0016 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.16 | -7.74 | 0.1144 | -0.0034 | |||||

| US3140XJGY33 / FNMA 30YR UMBS SUPER | 0.15 | -2.53 | 0.1136 | 0.0025 | |||||

| US3132DPAG37 / Freddie Mac Pool | 0.15 | -5.62 | 0.1111 | -0.0012 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.15 | -5.06 | 0.1107 | -0.0000 | |||||

| US3132DPWM66 / Freddie Mac Pool | 0.15 | -6.96 | 0.1082 | -0.0028 | |||||

| US67181DAB73 / Oak Street Investment Grade Net Lease Fund Series 2020-1 | 0.15 | -2.67 | 0.1077 | 0.0023 | |||||

| AMMC CLO 30 Ltd / ABS-CBDO (US03165UAJ79) | 0.14 | -1.41 | 0.1035 | 0.0033 | |||||

| US92676XAG25 / Viking Cruises Ltd | 0.14 | 0.1027 | 0.1027 | ||||||

| US25470XBE40 / DISH DBS Corp | 0.14 | -61.34 | 0.1020 | -0.1487 | |||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | 0.14 | 0.1020 | 0.1020 | ||||||

| US31418EDM93 / FANNIE MAE POOL FN MA4607 | 0.14 | -2.84 | 0.1010 | 0.0017 | |||||

| US984245AU46 / YPF SA | 0.14 | -25.27 | 0.1002 | -0.0280 | |||||

| US31418EDL11 / FANNIE MAE POOL UMBS P#MA4606 2.00000000 | 0.14 | -3.57 | 0.0999 | 0.0013 | |||||

| US 5YR NOTE (CBT) / DIR (000000000) | 0.13 | 0.0967 | 0.0967 | ||||||

| US3133D4QF30 / Freddie Mac Pool | 0.13 | -2.96 | 0.0966 | 0.0017 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.13 | -5.07 | 0.0965 | -0.0002 | |||||

| US29379VBR33 / Enterprise Products Operating LLC | 0.13 | -0.79 | 0.0930 | 0.0035 | |||||

| US983133AC37 / Wynn Resorts Finance LLC / Wynn Resorts Capital Corp | 0.13 | -0.79 | 0.0926 | 0.0041 | |||||

| Florida Gas Transmission Co LLC / DBT (US340711BC39) | 0.12 | 0.0888 | 0.0888 | ||||||

| US3133KYVF32 / Freddie Mac Pool | 0.12 | -4.84 | 0.0875 | 0.0004 | |||||

| US38383FR629 / GNR 2022-9 GA | 0.12 | -4.84 | 0.0872 | 0.0001 | |||||

| US38378XSQ50 / Government National Mortgage Association | 0.12 | -4.96 | 0.0847 | -0.0003 | |||||

| US023771T402 / American Airlines, Inc. | 0.11 | -0.87 | 0.0839 | 0.0026 | |||||

| US36179UKY72 / Ginnie Mae II Pool | 0.11 | -4.31 | 0.0822 | 0.0003 | |||||

| US26884LAF67 / EQT Corp. | 0.11 | -25.17 | 0.0810 | -0.0223 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.11 | -3.67 | 0.0775 | 0.0011 | |||||

| US25179MAN39 / Devon Energy Corporation 4.75% 05/15/42 | 0.10 | -6.31 | 0.0772 | -0.0007 | |||||

| US3132DMVG76 / Freddie Mac Pool | 0.10 | -3.70 | 0.0768 | 0.0010 | |||||

| AUD/USD FORWARD / DFE (000000000) | 0.10 | 0.0743 | 0.0743 | ||||||

| XS2066744231 / Carnival PLC | 0.10 | 0.0736 | 0.0736 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.10 | -6.60 | 0.0735 | -0.0008 | |||||

| US212015AU57 / Continental Resources Inc/OK | 0.10 | 0.00 | 0.0706 | 0.0036 | |||||

| US3132DVLA16 / FR SD7521 | 0.09 | -5.05 | 0.0696 | -0.0001 | |||||

| US35729QAC24 / Fremont Home Loan Trust 2006-B | 0.09 | -1.06 | 0.0690 | 0.0026 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.09 | -5.15 | 0.0679 | -0.0003 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.09 | -5.21 | 0.0672 | -0.0002 | |||||

| US345370DA55 / Ford Motor Co | 0.09 | -1.10 | 0.0668 | 0.0024 | |||||

| US38379U5F92 / Government National Mortgage Association | 0.09 | -1.12 | 0.0650 | 0.0021 | |||||

| GCAT 2024-INV3 Trust / ABS-MBS (US36830FAS56) | 0.09 | -6.52 | 0.0639 | -0.0007 | |||||

| THREE-MONTH SOFR / DIR (000000000) | 0.09 | 0.0635 | 0.0635 | ||||||

| US25179MAL72 / Devon Energy Corporation 5.6% Senior Notes 07/15/41 | 0.09 | -5.56 | 0.0627 | -0.0005 | |||||

| US3140N6NC20 / Fannie Mae Pool | 0.08 | -3.45 | 0.0624 | 0.0014 | |||||

| US36179VHV53 / G2 MA6544 | 0.08 | -5.68 | 0.0614 | -0.0003 | |||||

| US3140XKHM58 / Fannie Mae Pool | 0.08 | -4.60 | 0.0611 | 0.0002 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.08 | -3.53 | 0.0610 | 0.0012 | |||||

| Jane Street Group / JSG Finance Inc / DBT (US47077WAE84) | 0.08 | 0.0604 | 0.0604 | ||||||

| US3132DPWC84 / Freddie Mac Pool | 0.08 | -3.66 | 0.0585 | 0.0007 | |||||

| US3133BQSA58 / Freddie Mac Pool | 0.08 | -4.82 | 0.0583 | -0.0003 | |||||

| US3133C1NL06 / UMBS | 0.08 | -7.06 | 0.0583 | -0.0019 | |||||

| US3132DPT732 / Freddie Mac Pool | 0.08 | -4.88 | 0.0580 | 0.0005 | |||||

| THREE-MONTH SOFR / DIR (000000000) | 0.08 | 0.0579 | 0.0579 | ||||||

| NZD/USD FORWARD / DFE (000000000) | 0.08 | 0.0579 | 0.0579 | ||||||

| US3622AB6B37 / Ginnie Mae II Pool | 0.08 | -3.70 | 0.0574 | 0.0004 | |||||

| US36168QAL86 / GFL Environmental Inc | 0.08 | 0.0566 | 0.0566 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.08 | -3.80 | 0.0564 | 0.0005 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.08 | -5.06 | 0.0559 | 0.0003 | |||||

| US3132DQC538 / Freddie Mac Pool | 0.08 | -3.85 | 0.0554 | 0.0005 | |||||

| US3140XK6S42 / Fannie Mae Pool | 0.07 | -6.33 | 0.0547 | -0.0008 | |||||

| US36179W5E46 / Government National Mortgage Association (GNMA) | 0.07 | -5.19 | 0.0541 | -0.0002 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.07 | -4.00 | 0.0536 | 0.0008 | |||||

| US073685AD12 / Beacon Roofing Supply Inc 4.875% 11/01/2025 144a Bond | 0.07 | 0.0529 | 0.0529 | ||||||

| US3140QPJ241 / Fannie Mae Pool | 0.07 | -4.05 | 0.0524 | 0.0001 | |||||

| Quikrete Holdings Inc / DBT (US74843PAA84) | 0.07 | 0.00 | 0.0523 | 0.0026 | |||||

| US37045VAZ31 / General Motors Co. | 0.07 | -1.43 | 0.0512 | 0.0018 | |||||

| US3617JYLP63 / GINNIE MAE II POOL P#BM7534 3.50000000 | 0.07 | -2.82 | 0.0509 | 0.0006 | |||||

| US701885AJ44 / PARSLEY ENERGY LLC / PARSLEY FIN | 0.07 | 0.00 | 0.0507 | 0.0027 | |||||

| US3140MRBS54 / Fannie Mae Pool | 0.07 | -6.94 | 0.0497 | -0.0014 | |||||

| US31418EDX58 / FN MA4617 | 0.07 | -4.35 | 0.0490 | 0.0000 | |||||

| US36178WDN65 / Ginnie Mae I Pool | 0.07 | -4.35 | 0.0489 | 0.0001 | |||||

| US36179TZ650 / Ginnie Mae II Pool | 0.07 | -5.80 | 0.0485 | -0.0000 | |||||

| US17307GK311 / Citigroup Mortgage Loan Trust Inc | 0.07 | 0.00 | 0.0482 | 0.0020 | |||||

| US31418ECG35 / FNCT UMBS 2.0 MA4570 03-01-42 | 0.07 | -2.99 | 0.0478 | 0.0007 | |||||

| US69356MAA45 / PM General Purchaser LLC | 0.06 | -34.02 | 0.0476 | -0.0207 | |||||

| US36179UEB44 / Ginnie Mae II Pool | 0.06 | -3.08 | 0.0464 | 0.0004 | |||||

| US911365BP80 / United Rentals North America Inc | 0.06 | -72.44 | 0.0463 | 0.0194 | |||||

| US3133KYVY21 / FR RB5131 | 0.06 | -3.12 | 0.0457 | 0.0004 | |||||

| US16411QAN16 / CORPORATE BONDS | 0.06 | 0.00 | 0.0452 | 0.0019 | |||||

| US3622ABFG20 / Ginnie Mae II Pool | 0.06 | -4.76 | 0.0446 | 0.0003 | |||||

| US3622ABCA86 / Ginnie Mae II Pool | 0.06 | -4.76 | 0.0446 | 0.0001 | |||||

| BLDR / Builders FirstSource, Inc. | 0.06 | 0.0444 | 0.0444 | ||||||

| US3622ABCD26 / Ginnie Mae II Pool | 0.06 | -3.28 | 0.0437 | 0.0004 | |||||

| US25179MBF95 / Devon Energy Corp | 0.06 | 0.00 | 0.0430 | 0.0018 | |||||

| US3622ABFC16 / Ginnie Mae II Pool | 0.06 | -6.45 | 0.0430 | -0.0006 | |||||

| FLYY / Spirit Aviation Holdings, Inc. | 0.01 | 0.06 | 0.0425 | 0.0425 | |||||

| US830867AA59 / Delta Air Lines Inc / SkyMiles IP Ltd | 0.06 | -34.12 | 0.0418 | -0.0180 | |||||

| US694308JW85 / Pacific Gas and Electric Co | 0.06 | 0.00 | 0.0416 | 0.0021 | |||||

| US3140XFCD10 / Fannie Mae Pool | 0.06 | -1.75 | 0.0415 | 0.0009 | |||||

| US36178WGQ69 / Ginnie Mae I Pool | 0.06 | -3.45 | 0.0413 | -0.0000 | |||||

| US31418DPR79 / Fannie Mae Pool | 0.06 | -3.51 | 0.0408 | 0.0002 | |||||

| US12668BDJ98 / Alternative Loan Trust 2005-76 | 0.06 | 1.85 | 0.0405 | 0.0021 | |||||

| US3617MB4M80 / GINNIE MAE II POOL | 0.05 | -5.26 | 0.0401 | -0.0003 | |||||

| US36178WDM82 / Ginnie Mae I Pool | 0.05 | -5.36 | 0.0391 | -0.0002 | |||||

| Jane Street Group / JSG Finance Inc / DBT (US47077WAD02) | 0.05 | 0.00 | 0.0369 | 0.0017 | |||||

| Venture Global LNG Inc / DBT (US92332YAE14) | 0.05 | 0.0366 | 0.0366 | ||||||

| US36179UGE64 / Ginnie Mae II Pool | 0.05 | -5.77 | 0.0364 | -0.0001 | |||||

| US57643BAA61 / Mastr Specialized Loan Trust | 0.05 | -3.92 | 0.0363 | 0.0005 | |||||

| US3617MB5B17 / GINNIE MAE II POOL P#BS1742 4.00000000 | 0.05 | -3.92 | 0.0363 | 0.0005 | |||||

| US3140XBLM04 / Fannie Mae Pool | 0.05 | -7.69 | 0.0360 | -0.0006 | |||||

| US161175BM51 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.05 | 2.22 | 0.0339 | 0.0018 | |||||

| US53219LAV18 / LifePoint Health Inc | 0.04 | 0.00 | 0.0316 | 0.0016 | |||||

| US958254AD64 / Western Midstream Operating LP | 0.04 | -6.67 | 0.0311 | -0.0008 | |||||

| US41162KAA16 / HarborView Mortgage Loan Trust 2006-13 | 0.04 | -4.55 | 0.0310 | -0.0003 | |||||

| Lightning Power LLC / DBT (US53229KAA79) | 0.04 | 0.0309 | 0.0309 | ||||||

| EquipmentShare.com Inc / DBT (US29450YAC30) | 0.04 | 0.0302 | 0.0302 | ||||||

| SPIRIT AIRLINES LLC / EC (000000000) | 0.01 | 0.04 | 0.0302 | 0.0302 | |||||

| THREE-MONTH SOFR / DIR (000000000) | 0.04 | 0.0297 | 0.0297 | ||||||

| US 2YR NOTE (CBT) / DIR (000000000) | 0.04 | 0.0275 | 0.0275 | ||||||

| Crescent Energy Finance LLC / DBT (US45344LAE39) | 0.04 | 0.0273 | 0.0273 | ||||||

| IRS USD / DIR (000000000) | 0.04 | 0.0264 | 0.0264 | ||||||

| AUST 10Y BOND / DIR (000000000) | 0.03 | 0.0241 | 0.0241 | ||||||

| US65536XAD57 / Nomura Asset Acceptance Corp Alternative Loan Trust Series 2006-AF2 | 0.03 | -11.11 | 0.0238 | -0.0017 | |||||

| US36179UML34 / Government National Mortgage Association | 0.03 | -6.06 | 0.0235 | -0.0000 | |||||

| US3140X4MM53 / Fannie Mae Pool | 0.03 | -3.12 | 0.0231 | 0.0000 | |||||

| Vistra Operations Co LLC / DBT (US92840VAR33) | 0.03 | 0.0230 | 0.0230 | ||||||

| Herc Holdings Escrow Inc / DBT (US42703NAA90) | 0.03 | 0.0227 | 0.0227 | ||||||

| Herc Holdings Escrow Inc / DBT (US42703NAB73) | 0.03 | 0.0227 | 0.0227 | ||||||

| BBD.A / Bombardier Inc. | 0.03 | 0.0224 | 0.0224 | ||||||

| US3617MKLU18 / GINNIE MAE I POOL GN BS8439 | 0.03 | -3.23 | 0.0224 | 0.0004 | |||||

| U.S. TREASURY BOND / DIR (000000000) | 0.03 | 0.0218 | 0.0218 | ||||||

| US3140FXKP65 / Fannie Mae Pool | 0.03 | -3.33 | 0.0215 | 0.0003 | |||||

| US36241LUX27 / Ginnie Mae II Pool | 0.03 | -6.90 | 0.0206 | 0.0002 | |||||

| US3617MB5S42 / GNMA | 0.03 | -3.70 | 0.0195 | 0.0003 | |||||

| US06051GKK49 / Bank of America Corp | 0.03 | 0.00 | 0.0195 | 0.0010 | |||||

| US25179MBD48 / Devon Energy Corp | 0.03 | 0.00 | 0.0191 | 0.0009 | |||||

| US25179MBE21 / Devon Energy Corp | 0.03 | -3.85 | 0.0191 | 0.0008 | |||||

| THREE-MONTH SOFR / DIR (000000000) | 0.03 | 0.0185 | 0.0185 | ||||||

| IRS USD / DIR (000000000) | 0.02 | 0.0181 | 0.0181 | ||||||

| US126650BP48 / CVS PASS THROUGH TRUST PASS THRU CE 12/28 6.036 | 0.02 | -4.00 | 0.0177 | -0.0003 | |||||

| US3617MB5P03 / Ginnie Mae I Pool | 0.02 | -4.17 | 0.0174 | 0.0003 | |||||

| US36179TXX89 / Ginnie Mae II Pool | 0.02 | -4.17 | 0.0170 | 0.0001 | |||||

| US525228AD49 / Lehman XS Trust Series 2006-GP3 | 0.02 | -4.35 | 0.0169 | 0.0001 | |||||

| BBD.A / Bombardier Inc. | 0.02 | 0.0152 | 0.0152 | ||||||

| US3136A54N33 / Fannie Mae REMICS | 0.02 | -4.76 | 0.0151 | 0.0003 | |||||

| Caesars Entertainment Inc / DBT (US12769GAC42) | 0.02 | -31.03 | 0.0148 | 0.0021 | |||||

| MXN/USD FORWARD / DFE (000000000) | 0.02 | 0.0140 | 0.0140 | ||||||

| US38378NF990 / Government National Mortgage Association | 0.02 | 12.50 | 0.0139 | 0.0026 | |||||

| US32051GQ578 / FIRST HORIZON ALTERNATIVE MORT FHAMS 2005 AA12 1A1 | 0.02 | 0.00 | 0.0131 | 0.0006 | |||||

| IRS USD / DIR (000000000) | 0.02 | 0.0113 | 0.0113 | ||||||

| US3140QP2U03 / Fannie Mae Pool | 0.01 | -6.67 | 0.0108 | 0.0001 | |||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.01 | 0.0099 | 0.0099 | ||||||

| US040114HS26 / Argentine Republic Government International Bond | 0.01 | 9.09 | 0.0092 | 0.0011 | |||||

| THREE-MONTH SOFR / DIR (000000000) | 0.01 | 0.0091 | 0.0091 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.01 | 0.0084 | 0.0084 | ||||||

| US38379RPH02 / Government National Mortgage Association | 0.01 | 0.00 | 0.0082 | 0.0002 | |||||

| THREE-MONTH SOFR / DIR (000000000) | 0.01 | 0.0079 | 0.0079 | ||||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AB20) | 0.01 | 0.0078 | 0.0078 | ||||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AA47) | 0.01 | 0.0077 | 0.0077 | ||||||

| JPY/USD FORWARD / DFE (000000000) | 0.01 | 0.0076 | 0.0076 | ||||||

| US88732JAJ79 / Time Warner Cable 6.55% Guaranteed Notes 5/1/37 | 0.01 | 11.11 | 0.0074 | 0.0004 | |||||

| US52522DAN12 / Lehman XS Trust Series 2006-16N | 0.01 | 0.00 | 0.0073 | 0.0004 | |||||

| Permian Resources Operating LLC / DBT (US71424VAB62) | 0.01 | 0.0073 | 0.0073 | ||||||

| US12669FJC86 / CHL Mortgage Pass-Through Trust 2003-60 | 0.01 | 0.00 | 0.0043 | 0.0001 | |||||

| EUR/USD FORWARD / DFE (000000000) | 0.01 | 0.0040 | 0.0040 | ||||||

| 10 YEAR U.S. TREASURY NOTE WEEK 5 / DIR (000000000) | 0.01 | 0.0039 | 0.0039 | ||||||

| US3622AAHA58 / Ginnie Mae II Pool | 0.00 | -25.00 | 0.0028 | -0.0002 | |||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.00 | 0.0026 | 0.0026 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.00 | 0.0021 | 0.0021 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | 0.00 | 0.0019 | 0.0019 | ||||||

| US12669B2W15 / CHL Mortgage Pass-Through Trust 2001-HYB1 | 0.00 | 0.00 | 0.0017 | -0.0000 | |||||

| US251563FE72 / Deutsche Mortgage Securities Inc Mortgage Loan Trust 2004-4 | 0.00 | 0.00 | 0.0017 | 0.0001 | |||||

| CNH/USD FORWARD / DFE (000000000) | 0.00 | 0.0013 | 0.0013 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | 0.00 | 0.0012 | 0.0012 | ||||||

| USD/EUR FORWARD / DFE (000000000) | 0.00 | 0.0010 | 0.0010 | ||||||

| 10 YEAR U.S. TREASURY NOTE WEEK 5 / DIR (000000000) | 0.00 | 0.0010 | 0.0010 | ||||||

| CAD/USD FORWARD / DFE (000000000) | 0.00 | 0.0010 | 0.0010 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.00 | 0.0007 | 0.0007 | ||||||

| 5 YEAR U.S. TREASURY NOTE WEEK 5 / DIR (000000000) | 0.00 | 0.0005 | 0.0005 | ||||||

| US38378NK511 / Government National Mortgage Association | 0.00 | 0.0005 | 0.0000 | ||||||

| 5 YEAR U.S. TREASURY NOTE WEEK 5 / DIR (000000000) | 0.00 | 0.0005 | 0.0005 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.00 | 0.0003 | 0.0003 | ||||||

| USD/AUD FORWARD / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| SPIRIT AVIA HOL RESTRICT / EC (000000000) | 0.00 | 0.00 | 0.0002 | 0.0002 | |||||

| 5 YEAR U.S. TREASURY NOTE WEEK 5 / DIR (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| 5 YEAR U.S. TREASURY NOTE WEEK 5 / DIR (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.00 | 0.0002 | 0.0002 | ||||||

| CHF/USD FORWARD / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| US46652DAQ88 / JP Morgan Chase Commercial Mortgage Securities Corp | 0.00 | 0.0001 | -0.0000 | ||||||

| US38376G5V89 / Government National Mortgage Association | 0.00 | 0.0000 | 0.0000 | ||||||

| CREDIT SUISSE ESCROW CL / DBT (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| USD/BRL FORWARD / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.00 | -0.0001 | -0.0001 | ||||||

| 5 YEAR U.S. TREASURY NOTE WEEK 5 / DIR (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.00 | -0.0004 | -0.0004 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | -0.00 | -0.0005 | -0.0005 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | -0.00 | -0.0005 | -0.0005 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.00 | -0.0005 | -0.0005 | ||||||

| INR/USD FORWARD / DFE (000000000) | -0.00 | -0.0012 | -0.0012 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.00 | -0.0013 | -0.0013 | ||||||

| 10 YEAR U.S. TREASURY NOTE WEEK 5 / DIR (000000000) | -0.00 | -0.0016 | -0.0016 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | -0.00 | -0.0022 | -0.0022 | ||||||

| USD/CAD FORWARD / DFE (000000000) | -0.00 | -0.0022 | -0.0022 | ||||||

| LONG GILT / DIR (000000000) | -0.00 | -0.0025 | -0.0025 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | -0.00 | -0.0025 | -0.0025 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.00 | -0.0026 | -0.0026 | ||||||

| 5 YEAR U.S. TREASURY NOTE / DIR (000000000) | -0.00 | -0.0034 | -0.0034 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | -0.01 | -0.0042 | -0.0042 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.01 | -0.0044 | -0.0044 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | -0.01 | -0.0050 | -0.0050 | ||||||

| 10 YEAR U.S. TREASURY NOTE WEEK 5 / DIR (000000000) | -0.01 | -0.0051 | -0.0051 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | -0.01 | -0.0053 | -0.0053 | ||||||

| 5 YEAR U.S. TREASURY NOTE WEEK 5 / DIR (000000000) | -0.01 | -0.0058 | -0.0058 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | -0.01 | -0.0062 | -0.0062 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | -0.01 | -0.0071 | -0.0071 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | -0.01 | -0.0073 | -0.0073 | ||||||

| USD/AUD FORWARD / DFE (000000000) | -0.01 | -0.0085 | -0.0085 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.01 | -0.0086 | -0.0086 | ||||||

| SOFR 1 YEAR MIDCURVE / DIR (000000000) | -0.02 | -0.0123 | -0.0123 | ||||||

| 5 YEAR U.S. TREASURY NOTE / DIR (000000000) | -0.02 | -0.0135 | -0.0135 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | -0.02 | -0.0152 | -0.0152 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | -0.02 | -0.0163 | -0.0163 | ||||||

| IRS USD / DIR (000000000) | -0.03 | -0.0202 | -0.0202 | ||||||

| 10 YEAR U.S. TREASURY NOTE / DIR (000000000) | -0.03 | -0.0220 | -0.0220 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.03 | -0.0253 | -0.0253 | ||||||

| USD/INR FORWARD / DFE (000000000) | -0.04 | -0.0279 | -0.0279 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.05 | -0.0336 | -0.0336 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.06 | -0.0449 | -0.0449 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | -0.07 | -0.0505 | -0.0505 | ||||||

| IRS USD / DIR (000000000) | -0.08 | -0.0553 | -0.0553 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.08 | -0.0563 | -0.0563 | ||||||

| US 10YR NOTE (CBT) / DIR (000000000) | -0.09 | -0.0697 | -0.0697 | ||||||

| THREE-MONTH SOFR / DIR (000000000) | -0.14 | -0.1044 | -0.1044 | ||||||

| US 10YR ULTRA / DIR (000000000) | -0.15 | -0.1098 | -0.1098 | ||||||

| US ULTRA BOND CBT / DIR (000000000) | -0.25 | -0.1874 | -0.1874 |