Mga Batayang Estadistika

| Nilai Portofolio | $ 24,105,000 |

| Posisi Saat Ini | 47 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

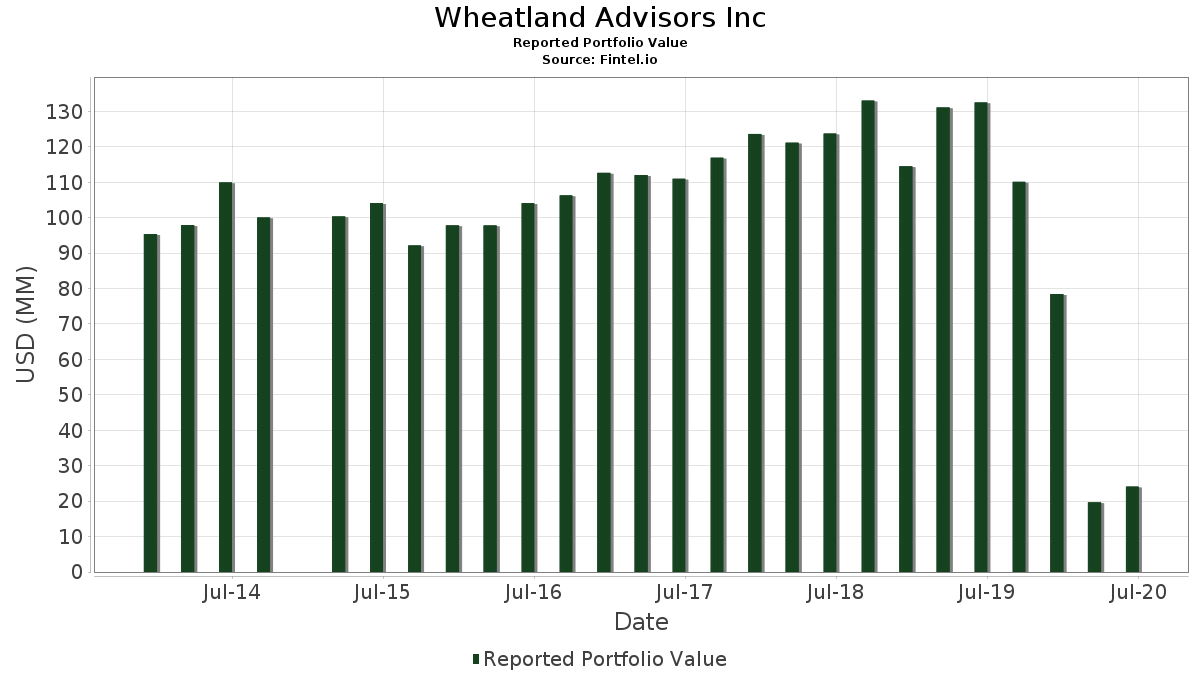

Wheatland Advisors Inc telah mengungkapkan total kepemilikan 47 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 24,105,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Wheatland Advisors Inc adalah Microsoft Corporation (US:MSFT) , Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF (US:VYM) , Verizon Communications Inc. (US:VZ) , Intel Corporation (US:INTC) , and AT&T Inc. (US:T) . Posisi baru Wheatland Advisors Inc meliputi: Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF (US:VCSH) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.28 | 1.1533 | 1.1533 | |

| 0.00 | 0.27 | 1.1284 | 1.1284 | |

| 0.00 | 0.24 | 0.9790 | 0.9790 | |

| 0.00 | 0.23 | 0.9376 | 0.9376 | |

| 0.00 | 0.22 | 0.9002 | 0.9002 | |

| 0.00 | 0.21 | 0.8836 | 0.8836 | |

| 0.01 | 0.21 | 0.8795 | 0.8795 | |

| 0.00 | 0.21 | 0.8712 | 0.8712 | |

| 0.01 | 0.20 | 0.8463 | 0.8463 | |

| 0.00 | 0.20 | 0.8421 | 0.8421 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 0.95 | 3.9494 | -0.8958 | |

| 0.02 | 1.07 | 4.4389 | -0.8638 | |

| 0.00 | 0.23 | 0.9376 | -0.8470 | |

| 0.01 | 0.39 | 1.6055 | -0.7485 | |

| 0.01 | 0.75 | 3.0948 | -0.6675 | |

| 0.01 | 0.80 | 3.3271 | -0.6182 | |

| 0.01 | 0.84 | 3.4848 | -0.6080 | |

| 0.02 | 1.05 | 4.3684 | -0.5734 | |

| 0.01 | 0.41 | 1.6926 | -0.5444 | |

| 0.02 | 0.69 | 2.8500 | -0.5106 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2020-07-28 untuk periode pelaporan 2020-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.01 | 0.09 | 2.94 | 29.15 | 12.2049 | 0.6233 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.01 | 0.70 | 1.14 | 12.12 | 4.7210 | -0.4394 | |||

| VZ / Verizon Communications Inc. | 0.02 | 0.01 | 1.07 | 2.59 | 4.4389 | -0.8638 | |||

| INTC / Intel Corporation | 0.02 | -2.03 | 1.05 | 8.33 | 4.3684 | -0.5734 | |||

| CSCO / Cisco Systems, Inc. | 0.02 | -2.39 | 0.95 | 15.82 | 3.9494 | -0.2298 | |||

| T / AT&T Inc. | 0.03 | -3.71 | 0.95 | -0.10 | 3.9494 | -0.8958 | |||

| PG / The Procter & Gamble Company | 0.01 | -4.08 | 0.84 | 4.35 | 3.4848 | -0.6080 | |||

| JNJ / Johnson & Johnson | 0.01 | 0.07 | 0.82 | 7.28 | 3.4225 | -0.4872 | |||

| BAX / Baxter International Inc. | 0.01 | -2.61 | 0.80 | 3.35 | 3.3271 | -0.6182 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | -2.02 | 0.75 | 0.81 | 3.0948 | -0.6675 | |||

| TFC / Truist Financial Corporation | 0.02 | -0.76 | 0.74 | 20.92 | 3.0699 | -0.0416 | |||

| LLY / Eli Lilly and Company | 0.00 | -4.45 | 0.70 | 13.16 | 2.9247 | -0.2427 | |||

| WTRG / Essential Utilities, Inc. | 0.02 | 0.01 | 0.69 | 3.93 | 2.8500 | -0.5106 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | 0.00 | 0.68 | 57.21 | 2.8044 | 0.6182 | |||

| PEP / PepsiCo, Inc. | 0.00 | 2.42 | 0.64 | 12.78 | 2.6716 | -0.2314 | |||

| MMM / 3M Company | 0.00 | -1.22 | 0.64 | 12.83 | 2.6633 | -0.2295 | |||

| MPC / Marathon Petroleum Corporation | 0.01 | -7.90 | 0.48 | 45.73 | 1.9830 | 0.3154 | |||

| WMT / Walmart Inc. | 0.00 | -1.27 | 0.47 | 4.03 | 1.9291 | -0.3436 | |||

| K / Kellanova | 0.01 | 0.09 | 0.46 | 10.14 | 1.8917 | -0.2131 | |||

| WBA / Walgreens Boots Alliance, Inc. | 0.01 | 0.00 | 0.41 | -7.27 | 1.6926 | -0.5444 | |||

| RDS.A / Shell Plc - ADR (Representing Ordinary Shares - Class A) | 0.01 | -10.92 | 0.39 | -16.41 | 1.6055 | -0.7485 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | -8.89 | 0.37 | 23.03 | 1.5515 | 0.0060 | |||

| CPB / The Campbell's Company | 0.01 | 0.00 | 0.37 | 7.27 | 1.5308 | -0.2181 | |||

| PPL / PPL Corporation | 0.01 | 6.51 | 0.37 | 11.52 | 1.5267 | -0.1511 | |||

| MDT / Medtronic plc | 0.00 | -2.44 | 0.37 | -0.81 | 1.5225 | -0.3586 | |||

| NTR / Nutrien Ltd. | 0.01 | -0.49 | 0.33 | -5.76 | 1.3566 | -0.4076 | |||

| COP / ConocoPhillips | 0.01 | 0.01 | 0.32 | 36.71 | 1.3441 | 0.1392 | |||

| TMP / Tompkins Financial Corporation | 0.00 | 0.00 | 0.29 | -9.82 | 1.2197 | -0.4378 | |||

| SYY / Sysco Corporation | 0.01 | 0.00 | 0.28 | 19.74 | 1.1574 | -0.0272 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.00 | 0.28 | 1.1533 | 1.1533 | |||||

| AAPL / Apple Inc. | 0.00 | 0.27 | 1.1284 | 1.1284 | |||||

| SYK / Stryker Corporation | 0.00 | 0.00 | 0.26 | 8.51 | 1.0579 | -0.1369 | |||

| US8865471085 / Tiffany & Co. | 0.00 | -4.76 | 0.24 | -10.29 | 1.0122 | -0.3706 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.00 | 0.24 | 8.68 | 0.9873 | -0.1261 | |||

| ABBV / AbbVie Inc. | 0.00 | 0.24 | 0.9790 | 0.9790 | |||||

| RTX / RTX Corporation | 0.00 | -1.34 | 0.23 | -35.61 | 0.9376 | -0.8470 | |||

| EMR / Emerson Electric Co. | 0.00 | 0.23 | 0.9376 | 0.9376 | |||||

| DIS / The Walt Disney Company | 0.00 | 0.22 | 0.9002 | 0.9002 | |||||

| PSX / Phillips 66 | 0.00 | 0.21 | 0.8836 | 0.8836 | |||||

| PFE / Pfizer Inc. | 0.01 | 0.21 | 0.8795 | 0.8795 | |||||

| CMI / Cummins Inc. | 0.00 | 0.21 | 0.8712 | 0.8712 | |||||

| JCI / Johnson Controls International plc | 0.01 | 0.20 | 0.8463 | 0.8463 | |||||

| BDX / Becton, Dickinson and Company | 0.00 | 0.20 | 0.8421 | 0.8421 | |||||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.00 | 0.20 | 0.8421 | 0.8421 | |||||

| FNB / F.N.B. Corporation | 0.02 | -0.60 | 0.16 | 1.27 | 0.6638 | -0.1395 | |||

| HIX / Western Asset High Income Fund II Inc. | 0.02 | 0.00 | 0.10 | 23.81 | 0.4314 | 0.4314 | |||

| GE / General Electric Company | 0.01 | -14.88 | 0.09 | -26.56 | 0.3900 | -0.2608 |