Mga Batayang Estadistika

| Nilai Portofolio | $ 143,414,397 |

| Posisi Saat Ini | 108 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

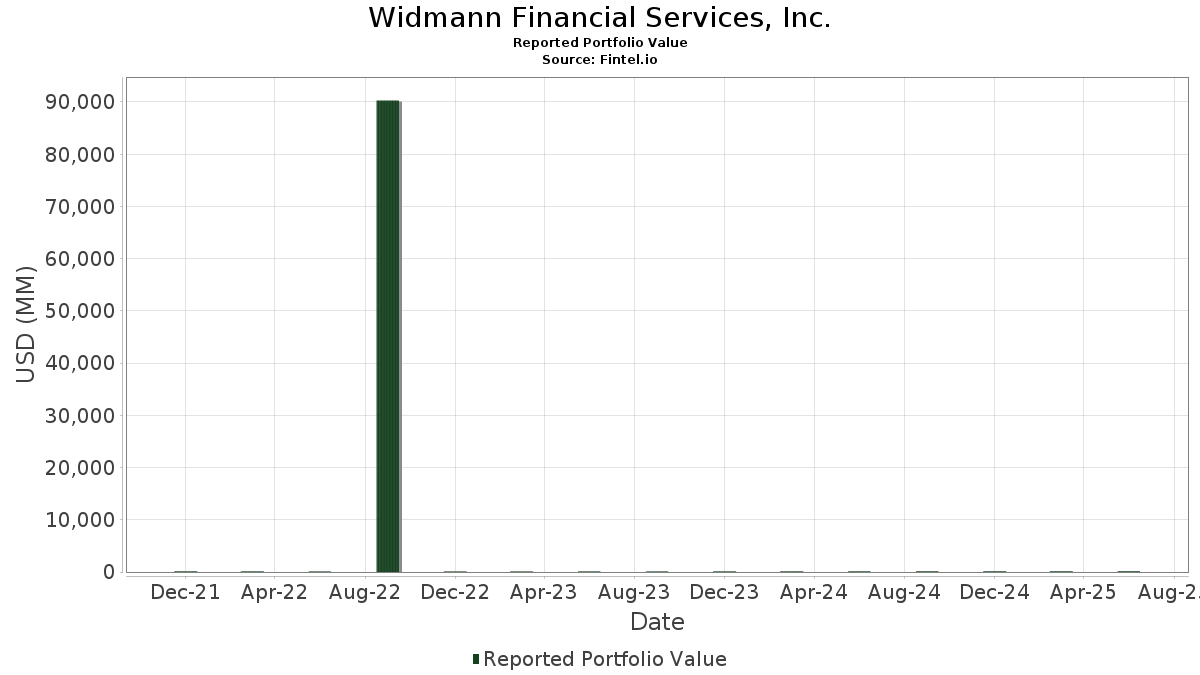

Widmann Financial Services, Inc. telah mengungkapkan total kepemilikan 108 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 143,414,397 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Widmann Financial Services, Inc. adalah iShares Trust - iShares Core MSCI EAFE ETF (US:IEFA) , Microsoft Corporation (US:MSFT) , American Century ETF Trust - Avantis U.S. Small Cap Value ETF (US:AVUV) , iShares Trust - iShares Russell 1000 Value ETF (US:IWD) , and Apple Inc. (US:AAPL) . Posisi baru Widmann Financial Services, Inc. meliputi: Barrick Mining Corporation (US:B) , Capital Group Dividend Value ETF (US:CGDV) , GE Vernova Inc. (US:GEV) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 2.08 | 1.4533 | 1.1868 | |

| 0.02 | 7.98 | 5.5659 | 0.9225 | |

| 0.03 | 0.60 | 0.4184 | 0.4184 | |

| 0.01 | 5.69 | 3.9664 | 0.3558 | |

| 0.01 | 0.49 | 0.3421 | 0.3421 | |

| 0.03 | 4.32 | 3.0120 | 0.2826 | |

| 0.00 | 0.36 | 0.2500 | 0.2500 | |

| 0.02 | 1.42 | 0.9881 | 0.2315 | |

| 0.00 | 0.31 | 0.2144 | 0.2144 | |

| 0.00 | 0.30 | 0.2118 | 0.2118 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 5.83 | 4.0681 | -0.6132 | |

| 0.03 | 3.72 | 2.5927 | -0.4583 | |

| 0.01 | 1.76 | 1.2244 | -0.3689 | |

| 0.01 | 2.94 | 2.0516 | -0.3516 | |

| 0.01 | 2.35 | 1.6374 | -0.3371 | |

| 0.02 | 2.36 | 1.6482 | -0.3273 | |

| 0.01 | 1.67 | 1.1621 | -0.2826 | |

| 0.01 | 1.10 | 0.7669 | -0.2230 | |

| 0.02 | 0.89 | 0.6220 | -0.1883 | |

| 0.03 | 6.15 | 4.2909 | -0.1839 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 0.11 | 1.99 | 9.05 | 12.55 | 6.3102 | 0.0643 | |||

| MSFT / Microsoft Corporation | 0.02 | 0.78 | 7.98 | 33.55 | 5.5659 | 0.9225 | |||

| AVUV / American Century ETF Trust - Avantis U.S. Small Cap Value ETF | 0.07 | 10.91 | 6.48 | 15.91 | 4.5158 | 0.1757 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.03 | 3.49 | 6.15 | 6.82 | 4.2909 | -0.1839 | |||

| AAPL / Apple Inc. | 0.03 | 4.81 | 5.83 | -3.19 | 4.0681 | -0.6132 | |||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.01 | 4.08 | 5.69 | 22.38 | 3.9664 | 0.3558 | |||

| IBM / International Business Machines Corporation | 0.02 | -0.34 | 4.43 | 18.12 | 3.0909 | 0.1764 | |||

| IWP / iShares Trust - iShares Russell Mid-Cap Growth ETF | 0.03 | 4.15 | 4.32 | 22.94 | 3.0120 | 0.2826 | |||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.09 | 0.88 | 4.27 | 11.34 | 2.9781 | -0.0012 | |||

| XOM / Exxon Mobil Corporation | 0.03 | 4.44 | 3.72 | -5.32 | 2.5927 | -0.4583 | |||

| IWS / iShares Trust - iShares Russell Mid-Cap Value ETF | 0.02 | 4.66 | 3.24 | 9.76 | 2.2584 | -0.0332 | |||

| MCD / McDonald's Corporation | 0.01 | 1.68 | 2.94 | -4.88 | 2.0516 | -0.3516 | |||

| HD / The Home Depot, Inc. | 0.01 | 2.45 | 2.56 | 2.49 | 1.7827 | -0.1549 | |||

| IWO / iShares Trust - iShares Russell 2000 Growth ETF | 0.01 | 6.46 | 2.44 | 19.09 | 1.7010 | 0.1098 | |||

| JNJ / Johnson & Johnson | 0.02 | 0.91 | 2.36 | -7.08 | 1.6482 | -0.3273 | |||

| RTX / RTX Corporation | 0.02 | -1.00 | 2.35 | 9.14 | 1.6402 | -0.0341 | |||

| PG / The Procter & Gamble Company | 0.01 | -1.18 | 2.35 | -7.60 | 1.6374 | -0.3371 | |||

| NVDA / NVIDIA Corporation | 0.01 | 316.81 | 2.08 | 507.58 | 1.4533 | 1.1868 | |||

| T / AT&T Inc. | 0.07 | 0.85 | 2.02 | 3.21 | 1.4109 | -0.1121 | |||

| KO / The Coca-Cola Company | 0.03 | 1.57 | 2.02 | 0.35 | 1.4057 | -0.1551 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 1.21 | 1.97 | 11.82 | 1.3724 | 0.0048 | |||

| MOO / VanEck ETF Trust - VanEck Agribusiness ETF | 0.02 | 2.12 | 1.79 | 10.72 | 1.2465 | -0.0076 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.40 | 1.76 | 18.22 | 1.2259 | 0.0701 | |||

| CVX / Chevron Corporation | 0.01 | 0.02 | 1.76 | -14.38 | 1.2244 | -0.3689 | |||

| TSLA / Tesla, Inc. | 0.01 | 0.36 | 1.67 | 23.04 | 1.1622 | 0.1097 | |||

| ABBV / AbbVie Inc. | 0.01 | 1.15 | 1.67 | -10.38 | 1.1621 | -0.2826 | |||

| VZ / Verizon Communications Inc. | 0.03 | 0.20 | 1.50 | -4.40 | 1.0451 | -0.1729 | |||

| TT / Trane Technologies plc | 0.00 | -0.91 | 1.48 | 28.70 | 1.0323 | 0.1384 | |||

| MAIN / Main Street Capital Corporation | 0.02 | 0.01 | 1.44 | 4.50 | 1.0049 | -0.0664 | |||

| MCHP / Microchip Technology Incorporated | 0.02 | 0.09 | 1.42 | 45.63 | 0.9881 | 0.2315 | |||

| C / Citigroup Inc. | 0.02 | 0.98 | 1.34 | 21.12 | 0.9360 | 0.0748 | |||

| PFE / Pfizer Inc. | 0.05 | 0.38 | 1.30 | -4.00 | 0.9048 | -0.1449 | |||

| F / Ford Motor Company | 0.12 | -0.65 | 1.29 | 7.49 | 0.9010 | -0.0329 | |||

| DUK / Duke Energy Corporation | 0.01 | 3.48 | 1.27 | 0.08 | 0.8825 | -0.0996 | |||

| IRM / Iron Mountain Incorporated | 0.01 | 0.00 | 1.25 | 19.16 | 0.8721 | 0.0571 | |||

| DIS / The Walt Disney Company | 0.01 | -0.50 | 1.18 | 24.95 | 0.8248 | 0.0898 | |||

| SO / The Southern Company | 0.01 | 8.27 | 1.18 | 8.05 | 0.8242 | -0.0250 | |||

| MO / Altria Group, Inc. | 0.02 | -0.44 | 1.11 | -2.79 | 0.7766 | -0.1130 | |||

| PEP / PepsiCo, Inc. | 0.01 | -1.99 | 1.10 | -13.74 | 0.7669 | -0.2230 | |||

| GWW / W.W. Grainger, Inc. | 0.00 | -1.36 | 1.06 | 3.84 | 0.7359 | -0.0534 | |||

| CGW / Invesco Exchange-Traded Fund Trust II - Invesco S&P Global Water Index ETF | 0.02 | 10.96 | 1.06 | 24.56 | 0.7358 | 0.0775 | |||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.00 | -4.07 | 1.04 | 0.68 | 0.7239 | -0.0770 | |||

| PPG / PPG Industries, Inc. | 0.01 | 2.27 | 1.03 | 6.31 | 0.7174 | -0.0338 | |||

| BA / The Boeing Company | 0.00 | -0.75 | 0.98 | 21.88 | 0.6802 | 0.0588 | |||

| TFC / Truist Financial Corporation | 0.02 | -3.01 | 0.95 | 1.38 | 0.6648 | -0.0661 | |||

| MRK / Merck & Co., Inc. | 0.01 | 7.29 | 0.95 | -5.41 | 0.6594 | -0.1169 | |||

| JCI / Johnson Controls International plc | 0.01 | -1.68 | 0.93 | 29.65 | 0.6469 | 0.0910 | |||

| GIS / General Mills, Inc. | 0.02 | -1.31 | 0.89 | -14.48 | 0.6220 | -0.1883 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | 2.67 | 0.86 | -1.84 | 0.5968 | -0.0804 | |||

| GD / General Dynamics Corporation | 0.00 | 48.33 | 0.82 | 58.75 | 0.5692 | 0.1697 | |||

| CVS / CVS Health Corporation | 0.01 | -0.75 | 0.78 | 1.04 | 0.5441 | -0.0557 | |||

| BND / Vanguard Bond Index Funds - Vanguard Total Bond Market ETF | 0.01 | 0.00 | 0.75 | 0.27 | 0.5246 | -0.0584 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.52 | 0.75 | -5.07 | 0.5224 | -0.0910 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.63 | 0.74 | 4.35 | 0.5193 | -0.0352 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.00 | 0.74 | 14.80 | 0.5141 | 0.0150 | |||

| CATH / Global X Funds - Global X S&P 500 Catholic Values ETF | 0.01 | 0.00 | 0.70 | 11.84 | 0.4874 | 0.0013 | |||

| IWN / iShares Trust - iShares Russell 2000 Value ETF | 0.00 | -9.05 | 0.68 | -5.01 | 0.4762 | -0.0821 | |||

| WMT / Walmart Inc. | 0.01 | 0.72 | 0.64 | 12.08 | 0.4469 | 0.0031 | |||

| GE / General Electric Company | 0.00 | 3.74 | 0.62 | 33.55 | 0.4331 | 0.0714 | |||

| B / Barrick Mining Corporation | 0.03 | 0.60 | 0.4184 | 0.4184 | |||||

| MMM / 3M Company | 0.00 | -0.64 | 0.59 | 2.99 | 0.4091 | -0.0334 | |||

| FDVV / Fidelity Covington Trust - Fidelity High Dividend ETF | 0.01 | 2.51 | 0.55 | 7.60 | 0.3853 | -0.0140 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 10.41 | 0.55 | 30.64 | 0.3838 | 0.0561 | |||

| TBIL / The RBB Fund, Inc. - F/m US Treasury 3 Month Bill ETF | 0.01 | 5.95 | 0.53 | 5.75 | 0.3723 | -0.0193 | |||

| GLW / Corning Incorporated | 0.01 | 0.01 | 0.53 | 14.87 | 0.3719 | 0.0113 | |||

| CGDV / Capital Group Dividend Value ETF | 0.01 | 0.49 | 0.3421 | 0.3421 | |||||

| CSCO / Cisco Systems, Inc. | 0.01 | 7.69 | 0.49 | 20.95 | 0.3387 | 0.0271 | |||

| GOOGL / Alphabet Inc. | 0.00 | 5.48 | 0.46 | 20.05 | 0.3220 | 0.0236 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.00 | 0.00 | 0.45 | 18.21 | 0.3127 | 0.0180 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | 0.00 | 0.41 | -24.07 | 0.2862 | -0.1339 | |||

| ABT / Abbott Laboratories | 0.00 | 10.29 | 0.39 | 13.04 | 0.2725 | 0.0040 | |||

| MDT / Medtronic plc | 0.00 | 2.81 | 0.38 | -0.26 | 0.2670 | -0.0312 | |||

| ORCL / Oracle Corporation | 0.00 | -26.72 | 0.37 | 14.38 | 0.2558 | 0.0071 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.36 | 0.2500 | 0.2500 | |||||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.41 | 0.36 | -8.25 | 0.2483 | -0.0537 | |||

| IR / Ingersoll Rand Inc. | 0.00 | 0.00 | 0.35 | 4.13 | 0.2463 | -0.0177 | |||

| IYW / iShares Trust - iShares U.S. Technology ETF | 0.00 | 0.00 | 0.35 | 23.57 | 0.2416 | 0.0234 | |||

| DOW / Dow Inc. | 0.01 | -6.53 | 0.34 | -29.22 | 0.2404 | -0.1374 | |||

| BAC / Bank of America Corporation | 0.01 | 0.00 | 0.34 | 13.38 | 0.2368 | 0.0042 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 5.15 | 0.34 | 0.00 | 0.2367 | -0.0269 | |||

| COST / Costco Wholesale Corporation | 0.00 | -18.29 | 0.33 | -14.47 | 0.2311 | -0.0700 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.00 | 0.00 | 0.33 | 22.76 | 0.2295 | 0.0210 | |||

| NFLX / Netflix, Inc. | 0.00 | 1.70 | 0.32 | 46.12 | 0.2232 | 0.0529 | |||

| RPM / RPM International Inc. | 0.00 | 0.00 | 0.31 | -4.85 | 0.2190 | -0.0380 | |||

| GEV / GE Vernova Inc. | 0.00 | 0.31 | 0.2144 | 0.2144 | |||||

| AEP / American Electric Power Company, Inc. | 0.00 | 0.00 | 0.31 | -4.97 | 0.2136 | -0.0370 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.00 | 13.43 | 0.30 | 8.19 | 0.2120 | -0.0070 | |||

| CEG / Constellation Energy Corporation | 0.00 | 0.30 | 0.2118 | 0.2118 | |||||

| SGOV / iShares Trust - iShares 0-3 Month Treasury Bond ETF | 0.00 | 36.36 | 0.30 | 36.65 | 0.2106 | 0.0386 | |||

| GOOG / Alphabet Inc. | 0.00 | 4.33 | 0.30 | 18.47 | 0.2058 | 0.0123 | |||

| WPC / W. P. Carey Inc. | 0.00 | -3.45 | 0.29 | -4.32 | 0.2008 | -0.0336 | |||

| OC / Owens Corning | 0.00 | 9.91 | 0.27 | 5.79 | 0.1914 | -0.0101 | |||

| V / Visa Inc. | 0.00 | 25.20 | 0.27 | 26.64 | 0.1894 | 0.0231 | |||

| HON / Honeywell International Inc. | 0.00 | 18.07 | 0.27 | 29.81 | 0.1889 | 0.0268 | |||

| AFL / Aflac Incorporated | 0.00 | 0.27 | 0.1878 | 0.1878 | |||||

| SPLG / SPDR Series Trust - SPDR Portfolio S&P 500 ETF | 0.00 | 20.20 | 0.27 | 33.17 | 0.1876 | 0.0303 | |||

| AMGN / Amgen Inc. | 0.00 | 36.43 | 0.26 | 22.27 | 0.1801 | 0.0160 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | 0.00 | 0.26 | 10.78 | 0.1795 | -0.0013 | |||

| WY / Weyerhaeuser Company | 0.01 | 8.01 | 0.25 | -5.38 | 0.1722 | -0.0302 | |||

| TGT / Target Corporation | 0.00 | 9.20 | 0.24 | 3.52 | 0.1641 | -0.0130 | |||

| CRBN / iShares Trust - iShares MSCI ACWI Low Carbon Target ETF | 0.00 | 0.24 | 0.1639 | 0.1639 | |||||

| NUE / Nucor Corporation | 0.00 | 0.00 | 0.23 | 7.87 | 0.1627 | -0.0056 | |||

| NAD / Nuveen Quality Municipal Income Fund | 0.02 | -8.99 | 0.22 | -11.07 | 0.1520 | -0.0378 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.00 | -10.03 | 0.22 | -1.37 | 0.1509 | -0.0199 | |||

| D / Dominion Energy, Inc. | 0.00 | 0.00 | 0.21 | 0.97 | 0.1455 | -0.0153 | |||

| BDJ / BlackRock Enhanced Equity Dividend Trust | 0.02 | 0.03 | 0.20 | 3.59 | 0.1411 | -0.0109 | |||

| CTVA / Corteva, Inc. | 0.00 | 0.20 | 0.1404 | 0.1404 | |||||

| AMT / American Tower Corporation | 0.00 | 0.20 | 0.1398 | 0.1398 | |||||

| GOLD / Barrick Mining Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| KHC / The Kraft Heinz Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WBA / Walgreens Boots Alliance, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AZZ / AZZ Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CMCSA / Comcast Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |