Mga Batayang Estadistika

| Nilai Portofolio | $ 253,783,983 |

| Posisi Saat Ini | 79 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

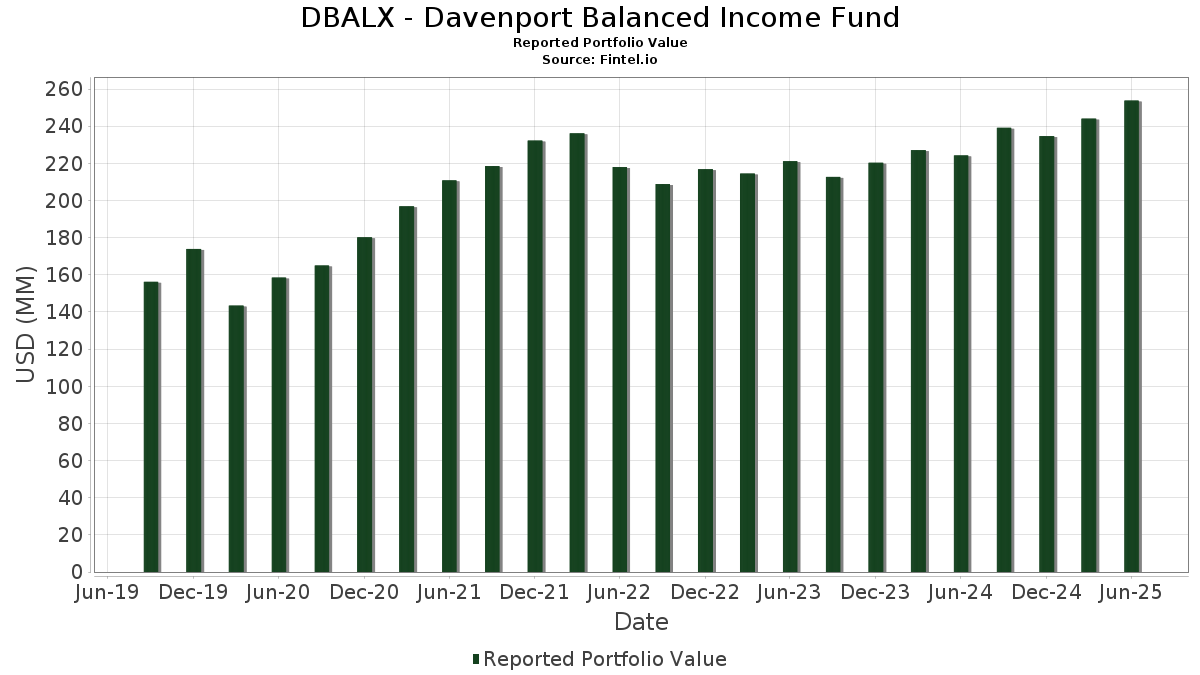

DBALX - Davenport Balanced Income Fund telah mengungkapkan total kepemilikan 79 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 253,783,983 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama DBALX - Davenport Balanced Income Fund adalah First American Funds Inc - First American Treasury Obligations Fund Class X (US:FXFXX) , L3Harris Technologies, Inc. (US:LHX) , Oracle Corporation (US:ORCL) , Anheuser-Busch InBev SA/NV - Depositary Receipt (Common Stock) (US:BUD) , and META PLATFORMS INC (US:US30303M8N52) . Posisi baru DBALX - Davenport Balanced Income Fund meliputi: First American Funds Inc - First American Treasury Obligations Fund Class X (US:FXFXX) , META PLATFORMS INC (US:US30303M8N52) , Charles Schwab Corp/The (US:US808513CG89) , MPLX, L.P. 4.125%, Due 03/01/2027 (US:US55336VAK61) , and Bristol-Myers Squibb Co (US:US110122DZ89) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 15.14 | 5.9373 | 3.3144 | ||

| 3.87 | 1.5192 | 1.5192 | ||

| 3.07 | 1.2047 | 1.2047 | ||

| 0.10 | 2.45 | 0.9597 | 0.9597 | |

| 0.02 | 5.06 | 1.9854 | 0.8054 | |

| 0.02 | 1.42 | 0.5583 | 0.5583 | |

| 0.02 | 5.16 | 2.0252 | 0.5434 | |

| 0.08 | 4.21 | 1.6523 | 0.4629 | |

| 0.00 | 4.23 | 1.6579 | 0.2787 | |

| 0.02 | 5.19 | 2.0362 | 0.2718 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.48 | 0.5807 | -1.4497 | ||

| 0.06 | 2.98 | 1.1693 | -0.4305 | |

| 0.03 | 4.55 | 1.7859 | -0.3807 | |

| 0.07 | 3.31 | 1.2972 | -0.2492 | |

| 0.03 | 4.35 | 1.7055 | -0.2173 | |

| 0.03 | 2.96 | 1.1609 | -0.2101 | |

| 0.01 | 3.18 | 1.2470 | -0.2011 | |

| 0.01 | 2.59 | 1.0159 | -0.1983 | |

| 0.04 | 2.19 | 0.8591 | -0.1766 | |

| 0.11 | 2.26 | 0.8865 | -0.1682 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-19 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FXFXX / First American Funds Inc - First American Treasury Obligations Fund Class X | 15.14 | 135.08 | 5.9373 | 3.3144 | |||||

| LHX / L3Harris Technologies, Inc. | 0.02 | 0.00 | 5.19 | 19.85 | 2.0362 | 0.2718 | |||

| ORCL / Oracle Corporation | 0.02 | -9.24 | 5.16 | 41.95 | 2.0252 | 0.5434 | |||

| BUD / Anheuser-Busch InBev SA/NV - Depositary Receipt (Common Stock) | 0.07 | 0.00 | 5.14 | 11.63 | 2.0143 | 0.1405 | |||

| US30303M8N52 / META PLATFORMS INC | 5.12 | 1.63 | 2.0070 | -0.0438 | |||||

| AMT / American Tower Corporation | 0.02 | 72.01 | 5.06 | 74.73 | 1.9854 | 0.8054 | |||

| US3130AK6H44 / Federal Home Loan Banks | 5.00 | 0.34 | 1.9620 | -0.0683 | |||||

| FFCB 5.26%, Due 11/14/2033 / DBT (US3133ERA437) | 4.99 | 0.22 | 1.9587 | -0.0710 | |||||

| FFCB 5.33%, Due 10/17/2039 / DBT (US3133ERXL05) | 4.91 | -1.11 | 1.9271 | -0.0962 | |||||

| CVX / Chevron Corporation | 0.03 | 0.00 | 4.55 | -14.42 | 1.7859 | -0.3807 | |||

| CMCSA / Comcast Corporation | 0.12 | 0.00 | 4.44 | -3.29 | 1.7424 | -0.1283 | |||

| NEE / NextEra Energy, Inc. | 0.06 | 0.00 | 4.38 | -2.08 | 1.7168 | -0.1037 | |||

| JNJ / Johnson & Johnson | 0.03 | 0.00 | 4.35 | -7.90 | 1.7055 | -0.2173 | |||

| FRFHF / Fairfax Financial Holdings Limited | 0.00 | 0.00 | 4.23 | 24.84 | 1.6579 | 0.2787 | |||

| BAM / Brookfield Asset Management Ltd. | 0.08 | 26.43 | 4.21 | 44.28 | 1.6523 | 0.4629 | |||

| NSC / Norfolk Southern Corporation | 0.02 | 0.00 | 4.06 | 8.07 | 1.5909 | 0.0623 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 0.00 | 3.91 | 18.17 | 1.5333 | 0.1861 | |||

| U.S. Treasury Bill 0.000%, Due 8/26/2025 / DBT (US912797QL42) | 3.87 | 1.5192 | 1.5192 | ||||||

| US808513CG89 / Charles Schwab Corp/The | 3.81 | -0.16 | 1.4952 | -0.0600 | |||||

| PM / Philip Morris International Inc. | 0.02 | 0.00 | 3.81 | 14.76 | 1.4939 | 0.1419 | |||

| BN / Brookfield Corporation | 0.06 | 0.00 | 3.75 | 18.00 | 1.4705 | 0.1766 | |||

| HCA, Inc. 5.450%, due 04/01/31 / DBT (US404119CT49) | 3.60 | 1.46 | 1.4128 | -0.0330 | |||||

| TEL / TE Connectivity plc | 0.02 | 0.00 | 3.50 | 19.36 | 1.3713 | 0.1782 | |||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 3.43 | 0.56 | 1.3462 | -0.0439 | |||||

| MKL / Markel Group Inc. | 0.00 | 0.00 | 3.33 | 6.84 | 1.3042 | 0.0365 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.07 | 0.00 | 3.31 | -12.90 | 1.2972 | -0.2492 | |||

| BDX / Becton, Dickinson and Company | 0.02 | 46.45 | 3.26 | 10.12 | 1.2803 | 0.0731 | |||

| US55336VAK61 / MPLX, L.P. 4.125%, Due 03/01/2027 | 3.23 | 0.37 | 1.2676 | -0.0439 | |||||

| US110122DZ89 / Bristol-Myers Squibb Co | 3.22 | 0.56 | 1.2616 | -0.0408 | |||||

| MDT / Medtronic plc | 0.04 | 0.00 | 3.21 | -2.99 | 1.2600 | -0.0888 | |||

| ELV / Elevance Health, Inc. | 0.01 | 0.00 | 3.18 | -10.58 | 1.2470 | -0.2011 | |||

| US718172DB29 / PHILIP MORRIS INTERNATIONAL INC | 3.09 | 1.54 | 1.2136 | -0.0275 | |||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 3.07 | 1.2047 | 1.2047 | ||||||

| US78016HZQ63 / Royal Bank of Canada | 3.04 | 1.84 | 1.1912 | -0.0236 | |||||

| US09247XAT81 / BlackRock Inc | 3.03 | 1.30 | 1.1895 | -0.0300 | |||||

| WFC / Wells Fargo & Company | 0.04 | 0.00 | 3.03 | 11.59 | 1.1893 | 0.0827 | |||

| LAMR / Lamar Advertising Company | 0.02 | 0.00 | 3.02 | 6.65 | 1.1835 | 0.0313 | |||

| US68389XCF06 / Oracle Corp | 3.00 | -0.37 | 1.1773 | -0.0497 | |||||

| FHLB 5.6%, Due 12/27/2034 / DBT (US3133ERCG49) | 3.00 | 0.00 | 1.1764 | -0.0450 | |||||

| US98978VAU70 / Zoetis Inc | 3.00 | -0.17 | 1.1751 | -0.0472 | |||||

| US10373QBU31 / BP Capital Markets America Inc | 2.99 | 1.74 | 1.1713 | -0.0241 | |||||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | 0.00 | 2.98 | -8.78 | 1.1699 | -0.1620 | |||

| BMY / Bristol-Myers Squibb Company | 0.06 | 0.00 | 2.98 | -24.11 | 1.1693 | -0.4305 | |||

| JCI / Johnson Controls International plc | 0.03 | -33.31 | 2.96 | -12.06 | 1.1609 | -0.2101 | |||

| SLB / Schlumberger Limited | 0.09 | 30.48 | 2.94 | 5.50 | 1.1522 | 0.0182 | |||

| MCD / McDonald's Corporation | 0.01 | 0.00 | 2.87 | -6.45 | 1.1261 | -0.1241 | |||

| C / Citigroup Inc. | 0.03 | 0.00 | 2.85 | 19.92 | 1.1195 | 0.1500 | |||

| ENB / Enbridge Inc. | 0.06 | 0.00 | 2.73 | 2.28 | 1.0713 | -0.0164 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.09 | 0.00 | 2.70 | -9.19 | 1.0580 | -0.1515 | |||

| UPS / United Parcel Service, Inc. | 0.03 | 0.00 | 2.63 | -8.21 | 1.0299 | -0.1355 | |||

| WSO / Watsco, Inc. | 0.01 | 0.00 | 2.59 | -13.12 | 1.0159 | -0.1983 | |||

| US037833EV87 / APPLE INC | 2.56 | 0.99 | 1.0021 | -0.0285 | |||||

| LOW / Lowe's Companies, Inc. | 0.01 | 0.00 | 2.52 | -4.88 | 0.9871 | -0.0904 | |||

| U.S. Treasury Notes 4.875%, Due 4/30/2026 / DBT (US91282CKK61) | 2.52 | -0.24 | 0.9866 | -0.0402 | |||||

| Wells Fargo Bank 4.811% DUE 01/15/2026 / DBT (US94988J6H59) | 2.51 | -0.08 | 0.9826 | -0.0384 | |||||

| US76541VNL70 / Richmond VA TXBL SER B 4.8% Due 03/01/20233 | 2.50 | 0.56 | 0.9787 | -0.0319 | |||||

| US031162CT53 / Amgen Inc | 2.48 | 1.55 | 0.9736 | -0.0218 | |||||

| SFD / Smithfield Foods, Inc. | 0.10 | 2.45 | 0.9597 | 0.9597 | |||||

| US337738AT51 / Fiserv, Inc. | 2.30 | 0.48 | 0.9013 | -0.0301 | |||||

| KVUE / Kenvue Inc. | 0.11 | 0.00 | 2.26 | -12.71 | 0.8865 | -0.1682 | |||

| WMT / Walmart Inc. | 0.02 | 0.00 | 2.24 | 11.40 | 0.8778 | 0.0594 | |||

| US096630AF58 / Boardwalk Pipelines, L.P. 4.45%, Due 07/15/2027 | 2.20 | 0.55 | 0.8623 | -0.0280 | |||||

| FNF / Fidelity National Financial, Inc. | 0.04 | 0.00 | 2.19 | -13.88 | 0.8591 | -0.1766 | |||

| GPC / Genuine Parts Company | 0.02 | 0.00 | 2.09 | 1.85 | 0.8205 | -0.0163 | |||

| BIP / Brookfield Infrastructure Partners L.P. - Limited Partnership | 0.06 | 0.00 | 2.07 | 12.43 | 0.8128 | 0.0622 | |||

| US94106LBV09 / CORP. NOTE | 2.04 | 0.69 | 0.8012 | -0.0247 | |||||

| US682680BH51 / ONEOK Inc | 2.02 | 0.10 | 0.7931 | -0.0299 | |||||

| US91282CHN48 / United States Treasury Note/Bond | 2.00 | -0.10 | 0.7846 | -0.0311 | |||||

| HPQ / HP Inc. | 0.08 | 0.00 | 1.99 | -11.68 | 0.7804 | -0.1370 | |||

| US91282CHT18 / US TNOTE 3.875% DUE 08/15/2033 | 1.97 | 0.72 | 0.7725 | -0.0239 | |||||

| BEP / Brookfield Renewable Partners L.P. - Limited Partnership | 0.08 | 0.00 | 1.96 | 15.12 | 0.7703 | 0.0755 | |||

| PEP / PepsiCo, Inc. | 0.01 | 0.00 | 1.90 | -11.90 | 0.7459 | -0.1337 | |||

| AVY / Avery Dennison Corporation | 0.01 | 0.00 | 1.81 | -1.41 | 0.7115 | -0.0379 | |||

| FDX / FedEx Corporation | 0.01 | 0.00 | 1.69 | -6.77 | 0.6642 | -0.0755 | |||

| US548661EK91 / Lowe's Cos., Inc. | 1.52 | 0.00 | 0.5978 | -0.0231 | |||||

| US3130AK6H44 / Federal Home Loan Banks | 1.48 | -70.31 | 0.5807 | -1.4497 | |||||

| ARE / Alexandria Real Estate Equities, Inc. | 0.02 | 1.42 | 0.5583 | 0.5583 | |||||

| STZ / Constellation Brands, Inc. | 0.01 | 0.00 | 1.21 | -11.36 | 0.4744 | -0.0813 | |||

| FFCB 5.55% DUE 01/02/2035 / DBT (US3133ERR522) | 1.00 | -0.40 | 0.3921 | -0.0166 |