Mga Batayang Estadistika

| Nilai Portofolio | $ 61,207,191 |

| Posisi Saat Ini | 57 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

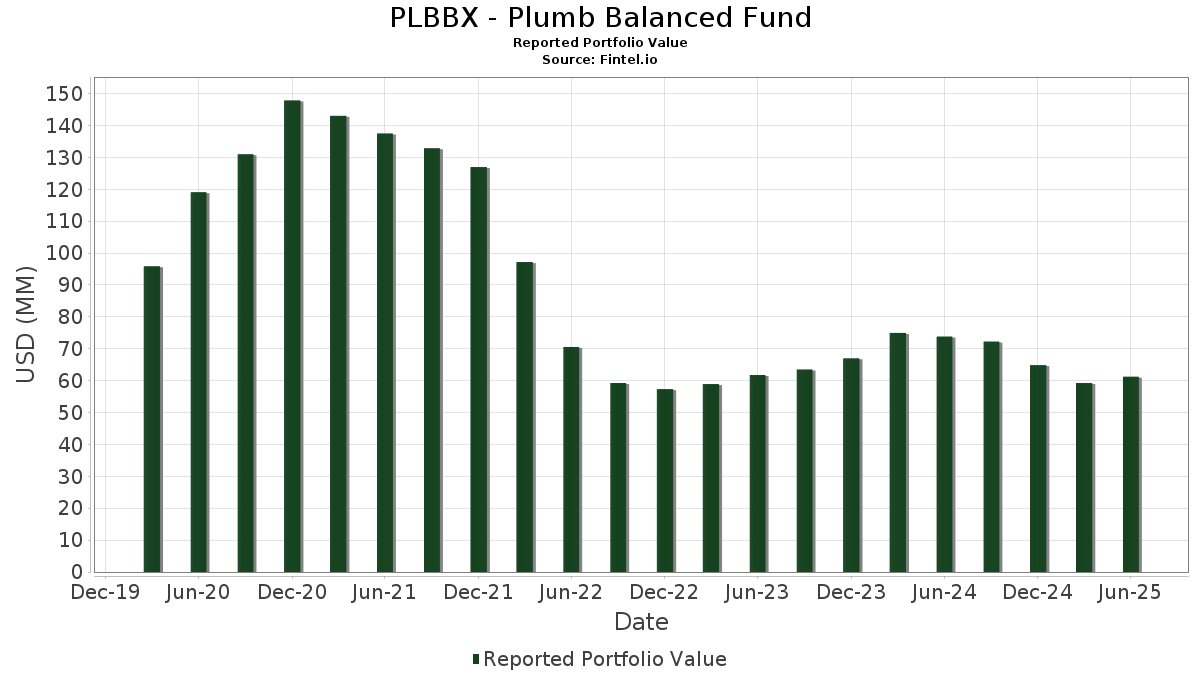

PLBBX - Plumb Balanced Fund telah mengungkapkan total kepemilikan 57 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 61,207,191 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PLBBX - Plumb Balanced Fund adalah NVIDIA Corporation (US:NVDA) , MercadoLibre, Inc. (US:MELI) , Visa Inc. (US:V) , American Express Company (US:AXP) , and Mastercard Incorporated (US:MA) . Posisi baru PLBBX - Plumb Balanced Fund meliputi: Pinnacle Finl Partners Inc Sub Bond (US:US72346QAC87) , EXPEDIA INC COMPANY GUAR 02/26 5 (US:US30212PAM77) , Banc of California NA (US:US05990KAD81) , Masco Corporation 7.750% Debentures 08/01/29 (US:US574599AT32) , and El Paso Nat Gas Co Debentures 7.5% 11/15/26 (US:US283695BE39) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 1.59 | 2.5977 | 2.5977 | |

| 0.03 | 3.95 | 6.4347 | 2.3300 | |

| 0.01 | 1.06 | 1.7232 | 1.7232 | |

| 0.01 | 0.83 | 1.3448 | 1.3448 | |

| 0.00 | 2.21 | 3.6061 | 0.7942 | |

| 0.00 | 0.41 | 0.6641 | 0.6641 | |

| 0.04 | 1.77 | 2.8862 | 0.6528 | |

| 0.00 | 2.61 | 4.2580 | 0.6457 | |

| 0.00 | 0.77 | 1.2528 | 0.5310 | |

| 0.01 | 0.69 | 1.1233 | 0.4773 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.13 | 0.13 | 0.2046 | -1.4847 | |

| 0.00 | 0.64 | 1.0403 | -1.3809 | |

| 0.01 | 1.08 | 1.7562 | -0.6461 | |

| 0.00 | 1.52 | 2.4764 | -0.5821 | |

| 0.01 | 1.38 | 2.2470 | -0.5408 | |

| 0.03 | 1.37 | 2.2384 | -0.4288 | |

| 0.01 | 1.77 | 2.8807 | -0.3509 | |

| 0.01 | 1.64 | 2.6740 | -0.3172 | |

| 0.00 | 1.41 | 2.3018 | -0.1993 | |

| 1.55 | 2.5211 | -0.1379 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-27 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.03 | 11.11 | 3.95 | 61.98 | 6.4347 | 2.3300 | |||

| MELI / MercadoLibre, Inc. | 0.00 | -9.09 | 2.61 | 21.82 | 4.2580 | 0.6457 | |||

| V / Visa Inc. | 0.01 | 0.00 | 2.49 | 1.30 | 4.0490 | -0.0804 | |||

| AXP / American Express Company | 0.01 | 0.00 | 2.23 | 18.53 | 3.6376 | 0.4675 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 2.22 | 2.49 | 3.6161 | -0.0283 | |||

| MSFT / Microsoft Corporation | 0.00 | 0.00 | 2.21 | 32.51 | 3.6061 | 0.7942 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 3.33 | 2.04 | 19.16 | 3.3240 | 0.4416 | |||

| GOOGL / Alphabet Inc. | 0.01 | 0.00 | 2.03 | 13.95 | 3.3017 | 0.3082 | |||

| TOST / Toast, Inc. | 0.04 | 0.00 | 1.77 | 33.56 | 2.8862 | 0.6528 | |||

| VSEC / VSE Corporation | 0.01 | -15.62 | 1.77 | -7.87 | 2.8807 | -0.3509 | |||

| AAPL / Apple Inc. | 0.01 | 0.00 | 1.64 | -7.65 | 2.6740 | -0.3172 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 1.59 | 2.5977 | 2.5977 | |||||

| US72346QAC87 / Pinnacle Finl Partners Inc Sub Bond | 1.55 | -2.03 | 2.5211 | -0.1379 | |||||

| LLY / Eli Lilly and Company | 0.00 | -11.36 | 1.52 | -16.35 | 2.4764 | -0.5821 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | -13.33 | 1.41 | -4.92 | 2.3018 | -0.1993 | |||

| FI / Fiserv, Inc. | 0.01 | 6.67 | 1.38 | -16.73 | 2.2470 | -0.5408 | |||

| CPRT / Copart, Inc. | 0.03 | 0.00 | 1.37 | -13.32 | 2.2384 | -0.4288 | |||

| US30212PAM77 / EXPEDIA INC COMPANY GUAR 02/26 5 | 1.30 | 0.00 | 2.1200 | -0.0701 | |||||

| Morgan Stanley Finance LLC / DBT (US61766YSW20) | 1.26 | 0.00 | 2.0485 | -0.0687 | |||||

| US05990KAD81 / Banc of California NA | 1.18 | 0.26 | 1.9159 | -0.0583 | |||||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 1.13 | 36.39 | 1.8449 | 0.4478 | |||

| US574599AT32 / Masco Corporation 7.750% Debentures 08/01/29 | 1.11 | -0.81 | 1.8068 | -0.0767 | |||||

| XOM / Exxon Mobil Corporation | 0.01 | -16.67 | 1.08 | -24.46 | 1.7562 | -0.6461 | |||

| ELF / e.l.f. Beauty, Inc. | 0.01 | 1.06 | 1.7232 | 1.7232 | |||||

| US283695BE39 / El Paso Nat Gas Co Debentures 7.5% 11/15/26 | 1.04 | -0.67 | 1.6914 | -0.0677 | |||||

| 49337WAH3 / Keyspan Corp 5.875% Notes 04/01/33 | 1.03 | 0.29 | 1.6699 | -0.0507 | |||||

| Morgan Stanley Finance LLC / DBT (US61766YTG60) | 1.02 | 1.50 | 1.6583 | -0.0300 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 0.99 | -0.10 | 1.6129 | -0.0561 | |||||

| ADSK / Autodesk, Inc. | 0.00 | 0.00 | 0.93 | 18.22 | 1.5130 | 0.1910 | |||

| US022671AA91 / Amalgamated Financial Corp | 0.93 | 1.31 | 1.5129 | -0.0303 | |||||

| US097023CN34 / Boeing Co/The | 0.93 | 1.87 | 1.5108 | -0.0223 | |||||

| AIR / AAR Corp. | 0.01 | 0.83 | 1.3448 | 1.3448 | |||||

| KMI / Kinder Morgan, Inc. | 0.03 | 0.00 | 0.81 | 3.06 | 1.3172 | -0.0035 | |||

| SNPS / Synopsys, Inc. | 0.00 | 50.00 | 0.77 | 79.67 | 1.2528 | 0.5310 | |||

| PSX / Phillips 66 | 0.01 | 0.00 | 0.72 | -3.38 | 1.1661 | -0.0810 | |||

| US06428CAD65 / Bank of America NA | 0.70 | -0.14 | 1.1407 | -0.0395 | |||||

| MOD / Modine Manufacturing Company | 0.01 | 40.00 | 0.69 | 79.90 | 1.1233 | 0.4773 | |||

| AMD / Advanced Micro Devices, Inc. | 0.00 | -67.86 | 0.64 | -55.63 | 1.0403 | -1.3809 | |||

| BGC / BGC Group, Inc. | 0.06 | 0.00 | 0.61 | 11.45 | 1.0000 | 0.0738 | |||

| US637432PA73 / National Rural Utilities Cooperative Finance Corp | 0.58 | 1.74 | 0.9528 | -0.0149 | |||||

| US037735CG04 / Appalachian Power 6.375% Bonds 4/1/36 | 0.53 | 0.57 | 0.8646 | -0.0233 | |||||

| UNPD / Union Pacific Corporation - Depositary Receipt (Common Stock) | 0.51 | 0.99 | 0.8289 | -0.0181 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.50 | 1.63 | 0.8161 | -0.0135 | |||||

| US95001DC731 / Wells Fargo & Co | 0.50 | 0.20 | 0.8146 | -0.0269 | |||||

| US89678FAA84 / TriState Capital Holdings Inc | 0.50 | 0.60 | 0.8146 | -0.0228 | |||||

| Massachusetts Educational Financing Authority / DBT (US57563RST76) | 0.50 | 0.61 | 0.8084 | -0.0229 | |||||

| US404119CA57 / HCA Inc | 0.47 | 2.16 | 0.7706 | -0.0097 | |||||

| US337930AD30 / Flagstar Bancorp Inc | 0.47 | 0.00 | 0.7613 | -0.0256 | |||||

| CRWV / CoreWeave, Inc. | 0.00 | 0.41 | 0.6641 | 0.6641 | |||||

| ANSS / ANSYS, Inc. | 0.00 | 0.00 | 0.35 | 11.08 | 0.5722 | 0.0393 | |||

| US92343EAL65 / Verisign Inc Gtd Fxd Rt Sr Bond | 0.35 | 0.29 | 0.5702 | -0.0180 | |||||

| SYK / Stryker Corporation | 0.00 | 0.00 | 0.30 | 6.09 | 0.4834 | 0.0135 | |||

| US626738AD06 / Murphy Oil USA, Inc. | 0.25 | 0.40 | 0.4078 | -0.0114 | |||||

| MEG / Montrose Environmental Group, Inc. | 0.01 | 0.22 | 0.3566 | 0.3566 | |||||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 0.13 | -87.49 | 0.13 | -87.54 | 0.2046 | -1.4847 | |||

| US126650BQ21 / CVS Pass-Through Trust | 0.12 | -4.07 | 0.1927 | -0.0145 | |||||

| BFLY / Butterfly Network, Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 0.0114 | -0.0020 |