Mga Batayang Estadistika

| Nilai Portofolio | $ 181,051,681 |

| Posisi Saat Ini | 51 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

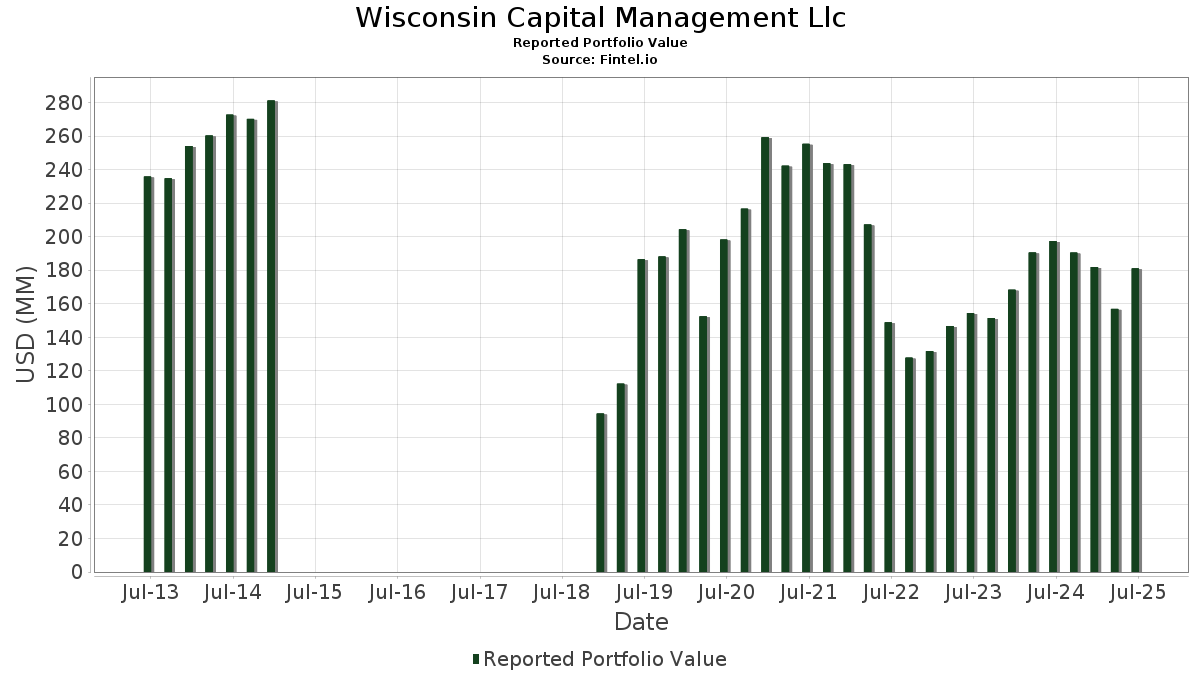

Wisconsin Capital Management Llc telah mengungkapkan total kepemilikan 51 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 181,051,681 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Wisconsin Capital Management Llc adalah NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Visa Inc. (US:V) , Alphabet Inc. (US:GOOGL) , and Mastercard Incorporated (US:MA) . Posisi baru Wisconsin Capital Management Llc meliputi: AAR Corp. (US:AIR) , CoreWeave, Inc. (US:CRWV) , Nu Holdings Ltd. (US:NU) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 5.47 | 3.0201 | 3.0201 | |

| 0.15 | 23.14 | 12.7819 | 2.9415 | |

| 0.04 | 3.00 | 1.6550 | 1.6550 | |

| 0.02 | 2.94 | 1.6215 | 1.6215 | |

| 0.02 | 11.55 | 6.3793 | 0.8348 | |

| 0.01 | 1.40 | 0.7712 | 0.7712 | |

| 0.00 | 8.17 | 4.5126 | 0.5155 | |

| 0.07 | 0.92 | 0.5104 | 0.5104 | |

| 0.13 | 5.65 | 3.1180 | 0.4313 | |

| 0.01 | 2.00 | 1.1052 | 0.2245 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -2.4547 | ||

| 0.01 | 2.00 | 1.1074 | -2.0011 | |

| 0.04 | 8.66 | 4.7844 | -1.2978 | |

| 0.03 | 3.44 | 1.9014 | -0.7924 | |

| 0.03 | 4.89 | 2.6987 | -0.7795 | |

| 0.03 | 9.96 | 5.5029 | -0.7434 | |

| 0.08 | 3.79 | 2.0907 | -0.6808 | |

| 0.01 | 5.53 | 3.0548 | -0.6517 | |

| 0.04 | 5.86 | 3.2362 | -0.6434 | |

| 0.02 | 9.10 | 5.0278 | -0.6095 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-07 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.15 | 2.81 | 23.14 | 49.87 | 12.7819 | 2.9415 | |||

| MSFT / Microsoft Corporation | 0.02 | 0.19 | 11.55 | 32.75 | 6.3793 | 0.8348 | |||

| V / Visa Inc. | 0.03 | 0.34 | 9.96 | 1.65 | 5.5029 | -0.7434 | |||

| GOOGL / Alphabet Inc. | 0.05 | 0.40 | 9.29 | 14.42 | 5.1291 | -0.0435 | |||

| MA / Mastercard Incorporated | 0.02 | 0.38 | 9.10 | 2.91 | 5.0278 | -0.6095 | |||

| AAPL / Apple Inc. | 0.04 | -1.73 | 8.66 | -9.23 | 4.7844 | -1.2978 | |||

| MELI / MercadoLibre, Inc. | 0.00 | -2.77 | 8.17 | 30.26 | 4.5126 | 0.5155 | |||

| AXP / American Express Company | 0.02 | 2.80 | 7.45 | 21.88 | 4.1135 | 0.2192 | |||

| AMZN / Amazon.com, Inc. | 0.03 | 2.12 | 7.14 | 17.76 | 3.9412 | 0.0795 | |||

| VSEC / VSE Corporation | 0.04 | -11.83 | 5.86 | -3.75 | 3.2362 | -0.6434 | |||

| TOST / Toast, Inc. | 0.13 | 0.29 | 5.65 | 33.93 | 3.1180 | 0.4313 | |||

| LLY / Eli Lilly and Company | 0.01 | 0.75 | 5.53 | -4.92 | 3.0548 | -0.6517 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | 5.47 | 3.0201 | 3.0201 | |||||

| FI / Fiserv, Inc. | 0.03 | 14.67 | 4.89 | -10.46 | 2.6987 | -0.7795 | |||

| ADSK / Autodesk, Inc. | 0.02 | 0.62 | 4.75 | 18.97 | 2.6220 | 0.0792 | |||

| ISRG / Intuitive Surgical, Inc. | 0.01 | -9.82 | 4.11 | -1.06 | 2.2700 | -0.3772 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.75 | 3.87 | 5.45 | 2.1362 | -0.2012 | |||

| CPRT / Copart, Inc. | 0.08 | 0.38 | 3.79 | -12.95 | 2.0907 | -0.6808 | |||

| SGOV / iShares Trust - iShares 0-3 Month Treasury Bond ETF | 0.03 | -18.57 | 3.44 | -18.55 | 1.9014 | -0.7924 | |||

| SYK / Stryker Corporation | 0.01 | -3.73 | 3.16 | 2.33 | 1.7466 | -0.2231 | |||

| AIR / AAR Corp. | 0.04 | 3.00 | 1.6550 | 1.6550 | |||||

| ELF / e.l.f. Beauty, Inc. | 0.02 | 2.94 | 1.6215 | 1.6215 | |||||

| XOM / Exxon Mobil Corporation | 0.03 | -7.17 | 2.79 | -15.87 | 1.5406 | -0.5721 | |||

| PSX / Phillips 66 | 0.02 | 0.00 | 2.03 | -3.38 | 1.1222 | -0.2180 | |||

| KMI / Kinder Morgan, Inc. | 0.07 | 8.21 | 2.02 | 11.52 | 1.1181 | -0.0388 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | -70.24 | 2.00 | -58.91 | 1.1074 | -2.0011 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.01 | 6.13 | 2.00 | 44.90 | 1.1052 | 0.2245 | |||

| EMR / Emerson Electric Co. | 0.01 | -1.72 | 1.90 | 19.56 | 1.0501 | 0.0363 | |||

| SNPS / Synopsys, Inc. | 0.00 | 19.71 | 1.58 | 43.09 | 0.8753 | 0.1696 | |||

| PEP / PepsiCo, Inc. | 0.01 | 0.00 | 1.50 | -11.94 | 0.8311 | -0.2579 | |||

| CRWV / CoreWeave, Inc. | 0.01 | 1.40 | 0.7712 | 0.7712 | |||||

| BGC / BGC Group, Inc. | 0.12 | 0.00 | 1.23 | 11.55 | 0.6780 | -0.0232 | |||

| ADBE / Adobe Inc. | 0.00 | -0.10 | 1.20 | 0.76 | 0.6637 | -0.0962 | |||

| MRK / Merck & Co., Inc. | 0.01 | 0.00 | 1.17 | -11.80 | 0.6486 | -0.2000 | |||

| SCHA / Schwab Strategic Trust - Schwab U.S. Small-Cap ETF | 0.04 | 0.00 | 1.11 | 8.06 | 0.6149 | -0.0421 | |||

| SCHM / Schwab Strategic Trust - Schwab U.S. Mid-Cap ETF | 0.04 | 0.00 | 1.05 | 7.03 | 0.5810 | -0.0452 | |||

| GOOG / Alphabet Inc. | 0.01 | 0.00 | 1.03 | 13.53 | 0.5702 | -0.0092 | |||

| NU / Nu Holdings Ltd. | 0.07 | 0.92 | 0.5104 | 0.5104 | |||||

| CDNS / Cadence Design Systems, Inc. | 0.00 | 27.78 | 0.72 | 54.94 | 0.3993 | 0.1017 | |||

| MOD / Modine Manufacturing Company | 0.01 | 40.74 | 0.69 | 80.94 | 0.3828 | 0.1383 | |||

| MCHP / Microchip Technology Incorporated | 0.01 | 0.00 | 0.65 | 45.52 | 0.3587 | 0.0740 | |||

| IAU / iShares Gold Trust | 0.01 | 7.42 | 0.45 | 13.60 | 0.2494 | -0.0039 | |||

| ANSS / ANSYS, Inc. | 0.00 | 0.00 | 0.43 | 10.77 | 0.2390 | -0.0096 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 0.00 | 0.35 | 17.75 | 0.1907 | 0.0037 | |||

| SCHW / The Charles Schwab Corporation | 0.00 | 0.00 | 0.32 | 16.85 | 0.1764 | 0.0018 | |||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | 0.00 | 0.00 | 0.30 | 0.33 | 0.1666 | -0.0248 | |||

| TRI / Thomson Reuters Corporation | 0.00 | 0.00 | 0.29 | 16.60 | 0.1594 | 0.0014 | |||

| SPTS / SPDR Series Trust - SPDR Portfolio Short Term Treasury ETF | 0.01 | 18.07 | 0.29 | 18.60 | 0.1585 | 0.0039 | |||

| ABT / Abbott Laboratories | 0.00 | 0.00 | 0.27 | 2.64 | 0.1502 | -0.0188 | |||

| MEG / Montrose Environmental Group, Inc. | 0.01 | 0.22 | 0.1209 | 0.1209 | |||||

| TTEK / Tetra Tech, Inc. | 0.01 | 0.21 | 0.1157 | 0.1157 | |||||

| JNJ / Johnson & Johnson | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GDYN / Grid Dynamics Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -2.4547 | ||||

| ARM / Arm Holdings plc - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 |