Mga Batayang Estadistika

| Nilai Portofolio | $ 1,439,388,030 |

| Posisi Saat Ini | 141 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

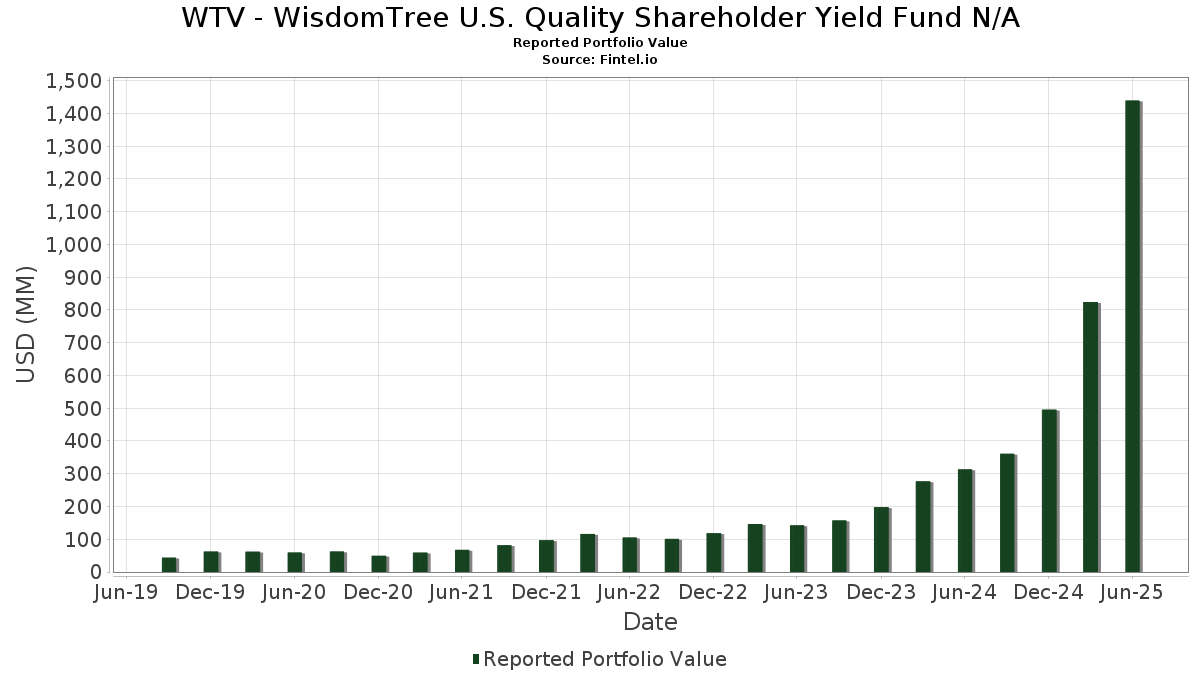

WTV - WisdomTree U.S. Quality Shareholder Yield Fund N/A telah mengungkapkan total kepemilikan 141 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,439,388,030 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama WTV - WisdomTree U.S. Quality Shareholder Yield Fund N/A adalah NRG Energy, Inc. (US:NRG) , Meta Platforms, Inc. (US:META) , Altria Group, Inc. (US:MO) , Incyte Corporation (US:INCY) , and The Kroger Co. (US:KR) . Posisi baru WTV - WisdomTree U.S. Quality Shareholder Yield Fund N/A meliputi: Walmart Inc. (US:WMT) , NVIDIA Corporation (US:NVDA) , Charles River Laboratories International, Inc. (US:CRL) , Harley-Davidson, Inc. (US:HOG) , and Carrier Global Corporation (US:CARR) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 24.84 | 1.7301 | 1.5270 | |

| 0.37 | 20.96 | 1.4597 | 1.4597 | |

| 0.21 | 20.44 | 1.4235 | 1.4235 | |

| 0.11 | 17.88 | 1.2456 | 1.2456 | |

| 0.14 | 20.86 | 1.4527 | 1.1297 | |

| 0.35 | 14.11 | 0.9828 | 0.9828 | |

| 0.09 | 13.78 | 0.9596 | 0.9596 | |

| 0.58 | 13.75 | 0.9579 | 0.9579 | |

| 0.42 | 13.75 | 0.9577 | 0.9577 | |

| 0.18 | 13.01 | 0.9064 | 0.9064 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.8695 | ||

| 0.38 | 22.40 | 1.5603 | -0.3432 | |

| 0.11 | 15.43 | 1.0750 | -0.2329 | |

| 0.11 | 10.16 | 0.7079 | -0.2129 | |

| 0.04 | 7.71 | 0.5368 | -0.1907 | |

| 0.02 | 6.46 | 0.4497 | -0.1705 | |

| 0.09 | 10.12 | 0.7046 | -0.1439 | |

| 0.33 | 8.54 | 0.5947 | -0.1430 | |

| 0.13 | 6.09 | 0.4241 | -0.1372 | |

| 0.18 | 6.03 | 0.4197 | -0.1337 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-29 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NRG / NRG Energy, Inc. | 0.17 | 68.10 | 26.61 | 182.79 | 1.8537 | 0.7134 | |||

| META / Meta Platforms, Inc. | 0.03 | 1,057.22 | 24.84 | 1,381.98 | 1.7301 | 1.5270 | |||

| MO / Altria Group, Inc. | 0.38 | 45.97 | 22.40 | 42.59 | 1.5603 | -0.3432 | |||

| INCY / Incyte Corporation | 0.32 | 61.65 | 21.78 | 81.81 | 1.5169 | 0.0655 | |||

| KR / The Kroger Co. | 0.30 | 1,601.62 | 21.44 | 2,919.01 | 1.4931 | 0.6053 | |||

| GM / General Motors Company | 0.43 | 67.66 | 21.28 | 75.43 | 1.4824 | 0.0125 | |||

| BALL / Ball Corporation | 0.37 | 20.96 | 1.4597 | 1.4597 | |||||

| JNJ / Johnson & Johnson | 0.14 | 749.27 | 20.86 | 682.30 | 1.4527 | 1.1297 | |||

| FOXA / Fox Corporation | 0.37 | 70.28 | 20.55 | 68.59 | 1.4316 | -0.0455 | |||

| WMT / Walmart Inc. | 0.21 | 20.44 | 1.4235 | 1.4235 | |||||

| EQH / Equitable Holdings, Inc. | 0.35 | 64.73 | 19.56 | 77.41 | 1.3623 | 0.0266 | |||

| CSL / Carlisle Companies Incorporated | 0.05 | 63.51 | 19.13 | 79.31 | 1.3328 | 0.0398 | |||

| BK / The Bank of New York Mellon Corporation | 0.21 | 67.92 | 18.89 | 82.42 | 1.3156 | 0.0610 | |||

| TLN / Talen Energy Corporation | 0.06 | 59.35 | 18.58 | 132.08 | 1.2942 | 0.3241 | |||

| MS / Morgan Stanley | 0.13 | 66.35 | 18.34 | 100.83 | 1.2774 | 0.1710 | |||

| FXI / Flex Ltd. | 0.36 | 64.09 | 18.07 | 147.66 | 1.2586 | 0.3745 | |||

| MOH / Molina Healthcare, Inc. | 0.06 | 3,596.75 | 17.97 | 4,262.14 | 1.2519 | 0.6344 | |||

| NVDA / NVIDIA Corporation | 0.11 | 17.88 | 1.2456 | 1.2456 | |||||

| UNM / Unum Group | 0.22 | 68.16 | 17.53 | 66.71 | 1.2212 | -0.0530 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.14 | 68.83 | 17.47 | 73.10 | 1.2168 | -0.0059 | |||

| ORI / Old Republic International Corporation | 0.44 | 70.21 | 17.01 | 66.84 | 1.1846 | -0.0506 | |||

| SYF / Synchrony Financial | 0.25 | 67.26 | 16.84 | 110.88 | 1.1729 | 0.2053 | |||

| CF / CF Industries Holdings, Inc. | 0.18 | 68.76 | 16.17 | 98.66 | 1.1260 | 0.1401 | |||

| AMP / Ameriprise Financial, Inc. | 0.03 | 68.41 | 15.97 | 85.68 | 1.1121 | 0.0702 | |||

| AFL / Aflac Incorporated | 0.15 | 68.94 | 15.58 | 60.23 | 1.0856 | -0.0929 | |||

| MET / MetLife, Inc. | 0.19 | 66.33 | 15.43 | 66.60 | 1.0750 | -0.0474 | |||

| CVX / Chevron Corporation | 0.11 | 67.04 | 15.43 | 42.98 | 1.0750 | -0.2329 | |||

| CAT / Caterpillar Inc. | 0.04 | 64.25 | 15.07 | 93.34 | 1.0495 | 0.1053 | |||

| STLD / Steel Dynamics, Inc. | 0.12 | 67.82 | 14.97 | 71.74 | 1.0429 | -0.0134 | |||

| GOOGL / Alphabet Inc. | 0.08 | 125.62 | 14.62 | 157.15 | 1.0187 | 0.3295 | |||

| TPR / Tapestry, Inc. | 0.16 | 67.06 | 14.34 | 108.36 | 0.9986 | 0.1649 | |||

| FDX / FedEx Corporation | 0.06 | 1,505.50 | 14.27 | 1,234.42 | 0.9937 | 0.6976 | |||

| PII / Polaris Inc. | 0.35 | 14.11 | 0.9828 | 0.9828 | |||||

| BC / Brunswick Corporation | 0.25 | 1,583.70 | 13.93 | 863.62 | 0.9706 | 0.4488 | |||

| 87S / Roivant Sciences Ltd. | 1.23 | 65.79 | 13.87 | 85.18 | 0.9662 | 0.0586 | |||

| CRL / Charles River Laboratories International, Inc. | 0.09 | 13.78 | 0.9596 | 0.9596 | |||||

| HOG / Harley-Davidson, Inc. | 0.58 | 13.75 | 0.9579 | 0.9579 | |||||

| LUV / Southwest Airlines Co. | 0.42 | 13.75 | 0.9577 | 0.9577 | |||||

| EBAY / eBay Inc. | 0.18 | 60.78 | 13.73 | 76.76 | 0.9562 | 0.0152 | |||

| PYPL / PayPal Holdings, Inc. | 0.18 | 62.16 | 13.67 | 84.70 | 0.9522 | 0.0554 | |||

| CARR / Carrier Global Corporation | 0.18 | 13.01 | 0.9064 | 0.9064 | |||||

| NTAP / NetApp, Inc. | 0.12 | 58.27 | 12.92 | 92.00 | 0.8997 | 0.0845 | |||

| MTCH / Match Group, Inc. | 0.41 | 62.83 | 12.55 | 61.23 | 0.8744 | -0.0691 | |||

| CMCSA / Comcast Corporation | 0.34 | 65.71 | 12.18 | 60.28 | 0.8485 | -0.0724 | |||

| TWLO / Twilio Inc. | 0.10 | 66.49 | 12.16 | 111.48 | 0.8469 | 0.1503 | |||

| XOM / Exxon Mobil Corporation | 0.11 | 68.48 | 11.93 | 52.71 | 0.8307 | -0.1155 | |||

| J / Jacobs Solutions Inc. | 0.09 | 11.71 | 0.8156 | 0.8156 | |||||

| AIG / American International Group, Inc. | 0.13 | 68.20 | 11.26 | 65.59 | 0.7845 | -0.0396 | |||

| AMAT / Applied Materials, Inc. | 0.06 | 11.12 | 0.7743 | 0.7743 | |||||

| UNH / UnitedHealth Group Incorporated | 0.04 | 11.11 | 0.7741 | 0.7741 | |||||

| LW / Lamb Weston Holdings, Inc. | 0.21 | 11.09 | 0.7727 | 0.7727 | |||||

| HCA / HCA Healthcare, Inc. | 0.03 | 66.70 | 10.89 | 84.82 | 0.7588 | 0.0446 | |||

| AVY / Avery Dennison Corporation | 0.06 | 10.58 | 0.7367 | 0.7367 | |||||

| KBR / KBR, Inc. | 0.22 | 10.57 | 0.7364 | 0.7364 | |||||

| REG / Regency Centers Corporation | 0.15 | 65.91 | 10.48 | 60.22 | 0.7302 | -0.0626 | |||

| AN / AutoNation, Inc. | 0.05 | 64.31 | 10.28 | 101.59 | 0.7163 | 0.0982 | |||

| G / Genpact Limited | 0.23 | 10.28 | 0.7162 | 0.7162 | |||||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.11 | 65.94 | 10.16 | 33.72 | 0.7079 | -0.2129 | |||

| COKE / Coca-Cola Consolidated, Inc. | 0.09 | 1,646.60 | 10.12 | 44.46 | 0.7046 | -0.1439 | |||

| UNP / Union Pacific Corporation | 0.04 | 41,490.48 | 10.05 | 40,088.00 | 0.6999 | 0.6869 | |||

| SPG / Simon Property Group, Inc. | 0.06 | 737.44 | 10.03 | 696.82 | 0.6988 | 0.3502 | |||

| GD / General Dynamics Corporation | 0.03 | 9.95 | 0.6933 | 0.6933 | |||||

| CCK / Crown Holdings, Inc. | 0.10 | 1,374.15 | 9.80 | 1,773.80 | 0.6827 | 0.1621 | |||

| MNST / Monster Beverage Corporation | 0.15 | 68.44 | 9.64 | 80.29 | 0.6716 | 0.0236 | |||

| USFD / US Foods Holding Corp. | 0.12 | 71.55 | 9.57 | 101.84 | 0.6663 | 0.0920 | |||

| EXEL / Exelixis, Inc. | 0.22 | 69.28 | 9.52 | 102.08 | 0.6633 | 0.0923 | |||

| SNV / Synovus Financial Corp. | 0.18 | 61.90 | 9.40 | 79.28 | 0.6546 | 0.0194 | |||

| ALSN / Allison Transmission Holdings, Inc. | 0.09 | 387.61 | 8.83 | 510.50 | 0.6154 | 0.1543 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.00 | 61.70 | 8.80 | 70.62 | 0.6133 | -0.0120 | |||

| WSM / Williams-Sonoma, Inc. | 0.05 | 64.72 | 8.65 | 70.22 | 0.6028 | -0.0132 | |||

| ADT / ADT Inc. | 1.01 | 63.69 | 8.56 | 70.33 | 0.5966 | -0.0127 | |||

| KHC / The Kraft Heinz Company | 0.33 | 65.26 | 8.54 | 40.23 | 0.5947 | -0.1430 | |||

| CART / Maplebear Inc. | 0.19 | 68.17 | 8.47 | 90.70 | 0.5902 | 0.0519 | |||

| QCOM / QUALCOMM Incorporated | 0.05 | 62.17 | 8.43 | 68.15 | 0.5873 | -0.0203 | |||

| RRJ / RenaissanceRe Holdings Ltd. | 0.03 | 71.41 | 8.32 | 73.47 | 0.5793 | -0.0016 | |||

| CSCO / Cisco Systems, Inc. | 0.12 | 65.88 | 8.25 | 86.50 | 0.5746 | 0.0387 | |||

| NTRS / Northern Trust Corporation | 0.06 | 66.20 | 8.23 | 113.60 | 0.5732 | 0.1064 | |||

| TE Connectivity PLC / EC (IE000IVNQZ81) | 0.05 | 64.03 | 8.23 | 95.76 | 0.5730 | 0.0639 | |||

| RF / Regions Financial Corporation | 0.35 | 60.58 | 8.18 | 73.81 | 0.5696 | -0.0004 | |||

| FIS / Fidelity National Information Services, Inc. | 0.10 | 65.18 | 8.11 | 80.08 | 0.5650 | 0.0192 | |||

| RL / Ralph Lauren Corporation | 0.03 | 65.01 | 8.02 | 105.06 | 0.5587 | 0.0847 | |||

| PRI / Primerica, Inc. | 0.03 | 68.85 | 7.96 | 62.40 | 0.5546 | -0.0394 | |||

| HRB / H&R Block, Inc. | 0.14 | 67.44 | 7.96 | 67.37 | 0.5541 | -0.0218 | |||

| GL / Globe Life Inc. | 0.06 | 68.97 | 7.90 | 59.44 | 0.5501 | -0.0501 | |||

| PFG / Principal Financial Group, Inc. | 0.10 | 65.51 | 7.84 | 55.83 | 0.5461 | -0.0636 | |||

| MDT / Medtronic plc | 0.09 | 62.61 | 7.78 | 57.74 | 0.5418 | -0.0557 | |||

| PPG / PPG Industries, Inc. | 0.07 | 63.01 | 7.72 | 69.57 | 0.5377 | -0.0139 | |||

| FI / Fiserv, Inc. | 0.04 | 64.39 | 7.71 | 28.35 | 0.5368 | -0.1907 | |||

| LDOS / Leidos Holdings, Inc. | 0.05 | 63.41 | 7.47 | 91.05 | 0.5204 | 0.0466 | |||

| ZM / Zoom Communications Inc. | 0.10 | 67.34 | 7.44 | 76.91 | 0.5183 | 0.0086 | |||

| SNX / TD SYNNEX Corporation | 0.05 | 62.71 | 7.43 | 112.40 | 0.5177 | 0.0937 | |||

| FITB / Fifth Third Bancorp | 0.18 | 60.10 | 7.32 | 67.97 | 0.5101 | -0.0181 | |||

| CSX / CSX Corporation | 0.22 | 65.98 | 7.28 | 84.05 | 0.5073 | 0.0278 | |||

| CTRA / Coterra Energy Inc. | 0.28 | 68.56 | 7.21 | 48.04 | 0.5021 | -0.0879 | |||

| FTV / Fortive Corporation | 0.14 | 7.16 | 0.4987 | 0.4987 | |||||

| EA / Electronic Arts Inc. | 0.04 | 63.72 | 7.15 | 80.95 | 0.4983 | 0.0192 | |||

| UHS / Universal Health Services, Inc. | 0.04 | 64.99 | 7.12 | 59.07 | 0.4962 | -0.0464 | |||

| TGT / Target Corporation | 0.07 | 66.39 | 7.11 | 57.30 | 0.4953 | -0.0525 | |||

| INGR / Ingredion Incorporated | 0.05 | 68.16 | 6.97 | 68.66 | 0.4858 | -0.0152 | |||

| MAR / Marriott International, Inc. | 0.03 | 69.85 | 6.89 | 94.83 | 0.4801 | 0.0514 | |||

| DVA / DaVita Inc. | 0.05 | 63.65 | 6.76 | 52.40 | 0.4711 | -0.0666 | |||

| CI / The Cigna Group | 0.02 | 201.93 | 6.46 | 188.17 | 0.4497 | -0.1705 | |||

| EOG / EOG Resources, Inc. | 0.05 | 67.61 | 6.35 | 56.31 | 0.4421 | -0.0498 | |||

| TAP / Molson Coors Beverage Company | 0.13 | 66.37 | 6.09 | 31.46 | 0.4241 | -0.1372 | |||

| SLB / Schlumberger Limited | 0.18 | 63.14 | 6.03 | 31.92 | 0.4197 | -0.1337 | |||

| WCC / WESCO International, Inc. | 0.03 | 58.14 | 5.93 | 88.57 | 0.4127 | 0.0320 | |||

| TMUS / T-Mobile US, Inc. | 0.02 | 67.99 | 5.77 | 50.08 | 0.4016 | -0.0639 | |||

| HOLX / Hologic, Inc. | 0.09 | 68.77 | 5.67 | 78.00 | 0.3952 | 0.0091 | |||

| TTC / The Toro Company | 0.08 | 64.25 | 5.65 | 59.60 | 0.3938 | -0.0355 | |||

| HSIC / Henry Schein, Inc. | 0.08 | 64.11 | 5.63 | 75.08 | 0.3920 | 0.0024 | |||

| SYY / Sysco Corporation | 0.07 | 66.17 | 5.61 | 67.74 | 0.3908 | -0.0145 | |||

| DREY INST PREF GOV MM-M / STIV (000000000) | 5.41 | 5.41 | 0.3768 | 0.3768 | |||||

| HLT / Hilton Worldwide Holdings Inc. | 0.02 | 62.01 | 5.31 | 89.65 | 0.3701 | 0.0306 | |||

| RS / Reliance, Inc. | 0.02 | 64.70 | 5.30 | 79.08 | 0.3691 | 0.0105 | |||

| VRSN / VeriSign, Inc. | 0.02 | 67.58 | 5.24 | 90.61 | 0.3649 | 0.0319 | |||

| WYNN / Wynn Resorts, Limited | 0.06 | 69.04 | 5.22 | 89.65 | 0.3637 | 0.0301 | |||

| BLD / TopBuild Corp. | 0.02 | 61.54 | 5.14 | 71.49 | 0.3583 | -0.0051 | |||

| GIS / General Mills, Inc. | 0.10 | 68.12 | 5.08 | 45.69 | 0.3536 | -0.0686 | |||

| STZ / Constellation Brands, Inc. | 0.03 | 64.02 | 5.07 | 45.41 | 0.3529 | -0.0693 | |||

| ADBE / Adobe Inc. | 0.01 | 62.09 | 4.92 | 63.52 | 0.3429 | -0.0219 | |||

| TOL / Toll Brothers, Inc. | 0.04 | 61.01 | 4.86 | 74.05 | 0.3383 | 0.0002 | |||

| EMN / Eastman Chemical Company | 0.06 | 62.88 | 4.75 | 38.00 | 0.3312 | -0.0862 | |||

| MDLZ / Mondelez International, Inc. | 0.07 | 68.26 | 4.69 | 67.21 | 0.3265 | -0.0131 | |||

| CLX / The Clorox Company | 0.04 | 67.43 | 4.60 | 36.54 | 0.3202 | -0.0878 | |||

| HST / Host Hotels & Resorts, Inc. | 0.29 | 68.26 | 4.40 | 81.89 | 0.3064 | 0.0134 | |||

| NVR / NVR, Inc. | 0.00 | 60.77 | 4.30 | 63.92 | 0.2994 | -0.0183 | |||

| IQV / IQVIA Holdings Inc. | 0.03 | 56.01 | 4.20 | 39.44 | 0.2929 | -0.0724 | |||

| MRK / Merck & Co., Inc. | 0.05 | 62.22 | 4.20 | 43.07 | 0.2928 | -0.0632 | |||

| MUSA / Murphy USA Inc. | 0.01 | 66.84 | 4.13 | 44.46 | 0.2879 | -0.0588 | |||

| THC / Tenet Healthcare Corporation | 0.02 | 66.39 | 4.05 | 117.81 | 0.2819 | 0.0567 | |||

| LMT / Lockheed Martin Corporation | 0.01 | 66.43 | 3.56 | 72.55 | 0.2479 | -0.0020 | |||

| AOS / A. O. Smith Corporation | 0.05 | 63.38 | 3.55 | 63.93 | 0.2473 | -0.0151 | |||

| HAL / Halliburton Company | 0.16 | 71.88 | 3.29 | 38.06 | 0.2292 | -0.0595 | |||

| KMB / Kimberly-Clark Corporation | 0.02 | 71.87 | 3.22 | 55.81 | 0.2240 | -0.0261 | |||

| GPN / Global Payments Inc. | 0.04 | 65.14 | 3.21 | 34.97 | 0.2234 | -0.0645 | |||

| MAS / Masco Corporation | 0.05 | 59.38 | 3.17 | 47.49 | 0.2211 | -0.0396 | |||

| ULTA / Ulta Beauty, Inc. | 0.01 | 69.08 | 3.03 | 115.83 | 0.2108 | 0.0409 | |||

| GPK / Graphic Packaging Holding Company | 0.13 | 64.92 | 2.77 | 33.83 | 0.1927 | -0.0577 | |||

| RAL / Ralliant Corporation | 0.05 | 2.22 | 0.1546 | 0.1546 | |||||

| MEDP / Medpace Holdings, Inc. | 0.01 | 58.62 | 1.84 | 63.47 | 0.1281 | -0.0083 | |||

| DREYFUS TRSY OBLIG CASH M / STIV (000000000) | 0.44 | 0.44 | 0.0305 | 0.0305 | |||||

| JBL / Jabil Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.8695 |