Mga Batayang Estadistika

| Nilai Portofolio | $ 197,703,346 |

| Posisi Saat Ini | 172 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

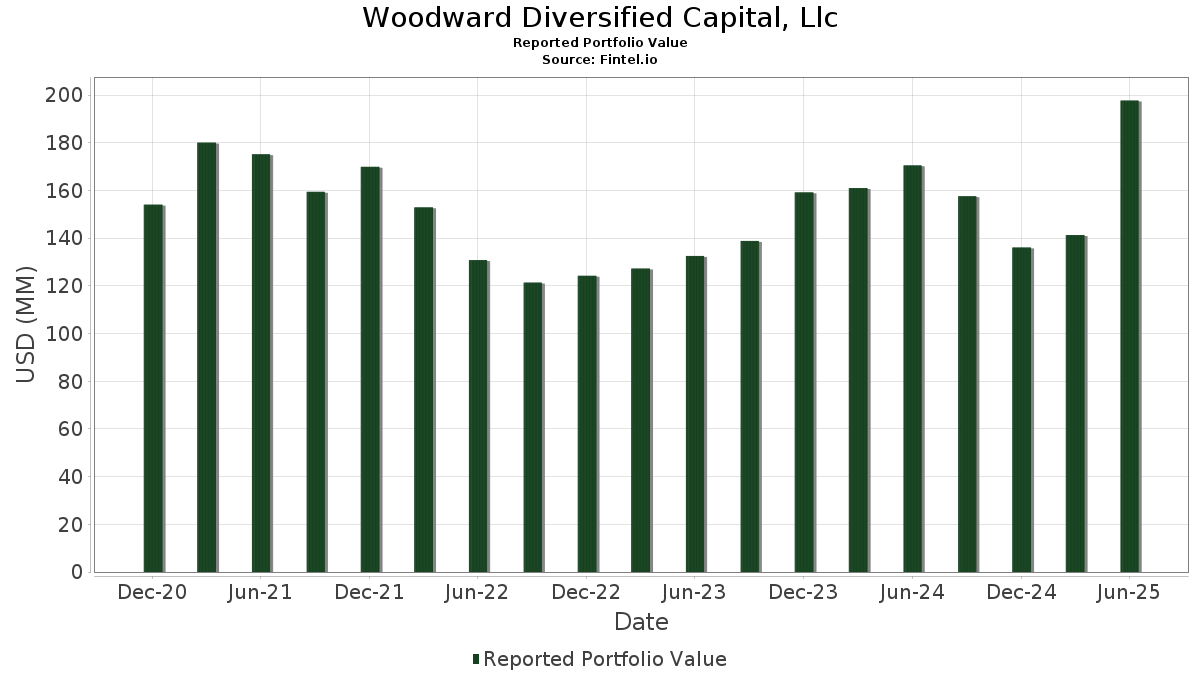

Woodward Diversified Capital, Llc telah mengungkapkan total kepemilikan 172 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 197,703,346 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Woodward Diversified Capital, Llc adalah Reliance, Inc. (US:RS) , Apple Inc. (US:AAPL) , NVIDIA Corporation (US:NVDA) , Exxon Mobil Corporation (US:XOM) , and Chevron Corporation (US:CVX) . Posisi baru Woodward Diversified Capital, Llc meliputi: NuScale Power Corporation (US:SMR) , ProShares Trust - ProShares Ultra QQQ (US:QLD) , Cummins Inc. (US:CMI) , EMCOR Group, Inc. (US:EME) , and Accenture plc (US:ACN) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 2.12 | 1.0721 | 1.0721 | |

| 0.01 | 4.62 | 2.3368 | 0.6604 | |

| 0.00 | 1.13 | 0.5707 | 0.5707 | |

| 0.02 | 1.00 | 0.5034 | 0.5034 | |

| 0.00 | 1.59 | 0.8035 | 0.4807 | |

| 0.01 | 1.78 | 0.8998 | 0.3696 | |

| 0.03 | 2.10 | 1.0602 | 0.3477 | |

| 0.01 | 3.41 | 1.7234 | 0.3291 | |

| 0.01 | 0.60 | 0.3039 | 0.3039 | |

| 0.01 | 2.46 | 1.2456 | 0.2762 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.08 | 24.59 | 12.4399 | -3.5080 | |

| 0.06 | 6.64 | 3.3600 | -2.0466 | |

| 0.07 | 6.00 | 3.0328 | -1.0849 | |

| 0.05 | 10.32 | 5.2202 | -0.7042 | |

| 0.04 | 6.05 | 3.0602 | -0.6046 | |

| 0.01 | 1.73 | 0.8751 | -0.4528 | |

| 0.01 | 1.39 | 0.7015 | -0.3140 | |

| 0.01 | 0.89 | 0.4519 | -0.2839 | |

| 0.02 | 2.52 | 1.2725 | -0.2718 | |

| 0.00 | 0.43 | 0.2199 | -0.2606 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-18 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| RS / Reliance, Inc. | 0.08 | 0.39 | 24.59 | 9.13 | 12.4399 | -3.5080 | |||

| AAPL / Apple Inc. | 0.05 | 33.47 | 10.32 | 23.28 | 5.2202 | -0.7042 | |||

| NVDA / NVIDIA Corporation | 0.05 | 1.87 | 8.36 | 48.53 | 4.2281 | 0.2448 | |||

| XOM / Exxon Mobil Corporation | 0.06 | -4.08 | 6.64 | -13.06 | 3.3600 | -2.0466 | |||

| CVX / Chevron Corporation | 0.04 | 36.49 | 6.05 | 16.84 | 3.0602 | -0.6046 | |||

| WFC / Wells Fargo & Company | 0.07 | -7.67 | 6.00 | 3.04 | 3.0328 | -1.0849 | |||

| GNLX / Genelux Corporation | 1.78 | 21.71 | 5.10 | 29.35 | 2.5815 | -0.2102 | |||

| MSFT / Microsoft Corporation | 0.01 | 47.19 | 4.62 | 95.06 | 2.3368 | 0.6604 | |||

| AMZN / Amazon.com, Inc. | 0.02 | 16.12 | 4.33 | 33.90 | 2.1918 | -0.0983 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 46.31 | 3.41 | 72.94 | 1.7234 | 0.3291 | |||

| META / Meta Platforms, Inc. | 0.00 | 25.33 | 3.12 | 60.56 | 1.5775 | 0.2026 | |||

| JNJ / Johnson & Johnson | 0.02 | 25.16 | 2.52 | 15.26 | 1.2725 | -0.2718 | |||

| GOOGL / Alphabet Inc. | 0.01 | 57.76 | 2.46 | 79.84 | 1.2456 | 0.2762 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.00 | -2.91 | 2.26 | 40.25 | 1.1423 | 0.0028 | |||

| SMR / NuScale Power Corporation | 0.05 | 2.12 | 1.0721 | 1.0721 | |||||

| BSV / Vanguard Bond Index Funds - Vanguard Short-Term Bond ETF | 0.03 | 107.07 | 2.10 | 108.35 | 1.0602 | 0.3477 | |||

| IBM / International Business Machines Corporation | 0.01 | 5.50 | 2.06 | 25.11 | 1.0411 | -0.1235 | |||

| PG / The Procter & Gamble Company | 0.01 | 54.98 | 1.92 | 44.94 | 0.9709 | 0.0333 | |||

| WMT / Walmart Inc. | 0.02 | 44.71 | 1.89 | 61.23 | 0.9552 | 0.1260 | |||

| BAC / Bank of America Corporation | 0.04 | 28.24 | 1.87 | 45.49 | 0.9465 | 0.0359 | |||

| NFLX / Netflix, Inc. | 0.00 | 23.17 | 1.80 | 76.92 | 0.9110 | 0.1904 | |||

| VZ / Verizon Communications Inc. | 0.04 | 25.84 | 1.80 | 20.05 | 0.9088 | -0.1504 | |||

| AVGO / Broadcom Inc. | 0.01 | 44.20 | 1.78 | 137.38 | 0.8998 | 0.3696 | |||

| HD / The Home Depot, Inc. | 0.00 | 48.49 | 1.75 | 48.60 | 0.8832 | 0.0515 | |||

| AMGN / Amgen Inc. | 0.01 | 2.87 | 1.73 | -7.78 | 0.8751 | -0.4528 | |||

| TSLA / Tesla, Inc. | 0.01 | 26.32 | 1.71 | 54.93 | 0.8660 | 0.0835 | |||

| ABBV / AbbVie Inc. | 0.01 | 33.36 | 1.67 | 18.16 | 0.8460 | -0.1558 | |||

| T / AT&T Inc. | 0.06 | 22.15 | 1.60 | 25.04 | 0.8110 | -0.0967 | |||

| CSCO / Cisco Systems, Inc. | 0.02 | 44.84 | 1.60 | 62.86 | 0.8076 | 0.1138 | |||

| VGT / Vanguard World Fund - Vanguard Information Technology ETF | 0.00 | 184.78 | 1.59 | 248.25 | 0.8035 | 0.4807 | |||

| CAT / Caterpillar Inc. | 0.00 | 46.88 | 1.58 | 72.84 | 0.7985 | 0.1523 | |||

| GOOG / Alphabet Inc. | 0.01 | 1.58 | 1.50 | 15.35 | 0.7603 | -0.1619 | |||

| MELI / MercadoLibre, Inc. | 0.00 | -17.50 | 1.43 | 10.52 | 0.7231 | -0.1922 | |||

| SHOP / Shopify Inc. | 0.01 | -20.03 | 1.39 | -3.41 | 0.7015 | -0.3140 | |||

| PM / Philip Morris International Inc. | 0.01 | 47.68 | 1.33 | 69.60 | 0.6719 | 0.1171 | |||

| VIS / Vanguard World Fund - Vanguard Industrials ETF | 0.00 | 75.66 | 1.32 | 98.79 | 0.6667 | 0.1974 | |||

| PH / Parker-Hannifin Corporation | 0.00 | 77.34 | 1.20 | 103.73 | 0.6084 | 0.1907 | |||

| VDC / Vanguard World Fund - Vanguard Consumer Staples ETF | 0.01 | 103.30 | 1.19 | 103.43 | 0.6004 | 0.1876 | |||

| VOX / Vanguard World Fund - Vanguard Communication Services ETF | 0.01 | 105.84 | 1.16 | 137.63 | 0.5880 | 0.2413 | |||

| VPU / Vanguard World Fund - Vanguard Utilities ETF | 0.01 | 137.46 | 1.14 | 145.49 | 0.5790 | 0.2489 | |||

| VCR / Vanguard World Fund - Vanguard Consumer Discretionary ETF | 0.00 | 1.13 | 0.5707 | 0.5707 | |||||

| BLK / BlackRock, Inc. | 0.00 | 81.20 | 1.11 | 101.08 | 0.5626 | 0.1708 | |||

| BIV / Vanguard Bond Index Funds - Vanguard Intermediate-Term Bond ETF | 0.01 | 101.43 | 1.10 | 103.32 | 0.5579 | 0.1743 | |||

| COP / ConocoPhillips | 0.01 | 71.25 | 1.10 | 46.33 | 0.5548 | 0.0243 | |||

| RDVY / First Trust Exchange-Traded Fund VI - First Trust Rising Dividend Achievers ETF | 0.02 | -3.68 | 1.08 | 3.24 | 0.5474 | -0.1945 | |||

| VFH / Vanguard World Fund - Vanguard Financials ETF | 0.01 | 53.37 | 1.07 | 63.50 | 0.5396 | 0.0776 | |||

| KMI / Kinder Morgan, Inc. | 0.04 | 41.35 | 1.05 | 45.76 | 0.5302 | 0.0210 | |||

| VTIP / Vanguard Malvern Funds - Vanguard Short-Term Inflation-Protected Securities ETF | 0.02 | 107.67 | 1.04 | 109.46 | 0.5268 | 0.1745 | |||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | 0.01 | -3.89 | 1.03 | -1.72 | 0.5205 | -0.2206 | |||

| MET / MetLife, Inc. | 0.01 | 81.71 | 1.02 | 82.03 | 0.5176 | 0.1197 | |||

| TCBK / TriCo Bancshares | 0.02 | 1.00 | 0.5034 | 0.5034 | |||||

| PEP / PepsiCo, Inc. | 0.01 | 44.84 | 0.99 | 27.52 | 0.4994 | -0.0484 | |||

| MO / Altria Group, Inc. | 0.02 | 31.36 | 0.96 | 28.38 | 0.4855 | -0.0438 | |||

| MRK / Merck & Co., Inc. | 0.01 | 73.84 | 0.94 | 53.42 | 0.4769 | 0.0417 | |||

| SO / The Southern Company | 0.01 | 79.48 | 0.91 | 79.33 | 0.4612 | 0.1012 | |||

| PANW / Palo Alto Networks, Inc. | 0.00 | 11.73 | 0.90 | 33.93 | 0.4556 | -0.0201 | |||

| STWD / Starwood Property Trust, Inc. | 0.04 | 0.00 | 0.89 | 1.48 | 0.4524 | -0.1711 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.01 | 0.19 | 0.89 | -14.05 | 0.4519 | -0.2839 | |||

| LRCX / Lam Research Corporation | 0.01 | 10.04 | 0.88 | 47.41 | 0.4469 | 0.0225 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | 111.98 | 0.88 | 120.10 | 0.4433 | 0.1611 | |||

| AJG / Arthur J. Gallagher & Co. | 0.00 | 61.60 | 0.87 | 49.91 | 0.4422 | 0.0293 | |||

| GLD / SPDR Gold Trust | 0.00 | 0.18 | 0.83 | 5.99 | 0.4212 | -0.1348 | |||

| TWLO / Twilio Inc. | 0.01 | -6.59 | 0.83 | 18.69 | 0.4209 | -0.0754 | |||

| BCML / BayCom Corp | 0.03 | 0.00 | 0.83 | 10.07 | 0.4205 | -0.1139 | |||

| RTX / RTX Corporation | 0.01 | 10.99 | 0.83 | 22.22 | 0.4178 | -0.0599 | |||

| ABT / Abbott Laboratories | 0.01 | 30.55 | 0.82 | 33.82 | 0.4166 | -0.0188 | |||

| PRU / Prudential Financial, Inc. | 0.01 | 94.12 | 0.81 | 87.10 | 0.4108 | 0.1030 | |||

| MCD / McDonald's Corporation | 0.00 | 72.20 | 0.80 | 61.29 | 0.4047 | 0.0532 | |||

| MSTR / Strategy Inc | 0.00 | 0.16 | 0.77 | 40.63 | 0.3870 | 0.0015 | |||

| KO / The Coca-Cola Company | 0.01 | 78.18 | 0.76 | 75.93 | 0.3848 | 0.0789 | |||

| MMM / 3M Company | 0.00 | 24.70 | 0.75 | 29.36 | 0.3790 | -0.0312 | |||

| NSC / Norfolk Southern Corporation | 0.00 | 48.04 | 0.74 | 60.13 | 0.3722 | 0.0467 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | 76.59 | 0.71 | 87.53 | 0.3579 | 0.0906 | |||

| PFE / Pfizer Inc. | 0.03 | 75.41 | 0.70 | 68.02 | 0.3562 | 0.0592 | |||

| BK / The Bank of New York Mellon Corporation | 0.01 | 56.07 | 0.69 | 69.78 | 0.3496 | 0.0611 | |||

| GD / General Dynamics Corporation | 0.00 | 91.73 | 0.66 | 105.33 | 0.3318 | 0.1055 | |||

| FDN / First Trust Exchange-Traded Fund - First Trust Dow Jones Internet Index Fund | 0.00 | 0.71 | 0.65 | 22.14 | 0.3297 | -0.0481 | |||

| QLD / ProShares Trust - ProShares Ultra QQQ | 0.01 | 0.60 | 0.3039 | 0.3039 | |||||

| LAMR / Lamar Advertising Company | 0.00 | 75.30 | 0.59 | 87.34 | 0.2997 | 0.0755 | |||

| PPLT / abrdn Platinum ETF Trust - abrdn Physical Platinum Shares ETF | 0.00 | -6.37 | 0.59 | 26.07 | 0.2986 | -0.0332 | |||

| FITB / Fifth Third Bancorp | 0.01 | 83.98 | 0.57 | 92.93 | 0.2902 | 0.0799 | |||

| USB / U.S. Bancorp | 0.01 | 78.25 | 0.57 | 91.30 | 0.2896 | 0.0775 | |||

| DE / Deere & Company | 0.00 | 77.09 | 0.57 | 91.92 | 0.2883 | 0.0781 | |||

| JCI / Johnson Controls International plc | 0.01 | 76.19 | 0.56 | 132.37 | 0.2834 | 0.1127 | |||

| AEP / American Electric Power Company, Inc. | 0.01 | 79.76 | 0.55 | 71.03 | 0.2778 | 0.0501 | |||

| CSX / CSX Corporation | 0.02 | 88.52 | 0.55 | 109.58 | 0.2767 | 0.0915 | |||

| PLD / Prologis, Inc. | 0.01 | 83.38 | 0.54 | 72.61 | 0.2746 | 0.0518 | |||

| DDOG / Datadog, Inc. | 0.00 | -31.59 | 0.54 | -7.35 | 0.2745 | -0.1401 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -17.00 | 0.52 | -24.34 | 0.2614 | -0.2217 | |||

| IAU / iShares Gold Trust | 0.01 | -11.07 | 0.51 | -5.96 | 0.2558 | -0.1247 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.01 | 80.93 | 0.49 | 85.11 | 0.2456 | 0.0599 | |||

| BDX / Becton, Dickinson and Company | 0.00 | 124.26 | 0.49 | 68.99 | 0.2456 | 0.0419 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 75.17 | 0.48 | 81.82 | 0.2429 | 0.0558 | |||

| MA / Mastercard Incorporated | 0.00 | 0.36 | 0.47 | 2.86 | 0.2365 | -0.0851 | |||

| CMCSA / Comcast Corporation | 0.01 | 79.93 | 0.47 | 74.16 | 0.2356 | 0.0462 | |||

| JNK / SPDR Series Trust - SPDR Bloomberg High Yield Bond ETF | 0.00 | -11.26 | 0.47 | -9.36 | 0.2354 | -0.1282 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.01 | 0.00 | 0.46 | -9.23 | 0.2340 | -0.1264 | |||

| IEI / iShares Trust - iShares 3-7 Year Treasury Bond ETF | 0.00 | 61.00 | 0.46 | 62.28 | 0.2310 | 0.0319 | |||

| MDT / Medtronic plc | 0.01 | 76.96 | 0.45 | 71.97 | 0.2300 | 0.0426 | |||

| SNOW / Snowflake Inc. | 0.00 | -0.49 | 0.45 | 52.36 | 0.2285 | 0.0187 | |||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | 0.00 | 35.57 | 0.45 | 36.28 | 0.2262 | -0.0063 | |||

| BR / Broadridge Financial Solutions, Inc. | 0.00 | 52.30 | 0.44 | 52.63 | 0.2202 | 0.0184 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | -45.58 | 0.43 | -35.99 | 0.2199 | -0.2606 | |||

| C / Citigroup Inc. | 0.00 | 0.42 | 0.2114 | 0.2114 | |||||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | -43.25 | 0.42 | -37.22 | 0.2100 | -0.2584 | |||

| FTCS / First Trust Exchange-Traded Fund - First Trust Capital Strength ETF | 0.00 | -0.39 | 0.41 | 0.98 | 0.2087 | -0.0804 | |||

| AXP / American Express Company | 0.00 | 59.33 | 0.41 | 89.40 | 0.2080 | 0.0540 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 44.89 | 0.41 | -13.80 | 0.2058 | -0.1278 | |||

| CMI / Cummins Inc. | 0.00 | 0.40 | 0.2036 | 0.2036 | |||||

| EME / EMCOR Group, Inc. | 0.00 | 0.40 | 0.2008 | 0.2008 | |||||

| LLY / Eli Lilly and Company | 0.00 | 94.94 | 0.39 | 83.96 | 0.1976 | 0.0474 | |||

| WPM / Wheaton Precious Metals Corp. | 0.00 | 0.38 | 0.1908 | 0.1908 | |||||

| CVBF / CVB Financial Corp. | 0.02 | 0.38 | 0.1902 | 0.1902 | |||||

| WRB / W. R. Berkley Corporation | 0.00 | 26.60 | 0.37 | 31.07 | 0.1857 | -0.0131 | |||

| ACN / Accenture plc | 0.00 | 0.36 | 0.1840 | 0.1840 | |||||

| COST / Costco Wholesale Corporation | 0.00 | 48.18 | 0.36 | 55.36 | 0.1833 | 0.0180 | |||

| SHY / iShares Trust - iShares 1-3 Year Treasury Bond ETF | 0.00 | 21.01 | 0.35 | 21.31 | 0.1786 | -0.0276 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.35 | 0.1777 | 0.1777 | |||||

| DHR / Danaher Corporation | 0.00 | 0.35 | 0.1763 | 0.1763 | |||||

| CI / The Cigna Group | 0.00 | 0.35 | 0.1757 | 0.1757 | |||||

| LHX / L3Harris Technologies, Inc. | 0.00 | 0.35 | 0.1750 | 0.1750 | |||||

| DD / DuPont de Nemours, Inc. | 0.00 | 0.34 | 0.1714 | 0.1714 | |||||

| IGSB / iShares Trust - iShares 1-5 Year Investment Grade Corporate Bond ETF | 0.01 | 62.33 | 0.33 | 63.73 | 0.1693 | 0.0245 | |||

| TMUS / T-Mobile US, Inc. | 0.00 | 38.81 | 0.33 | 24.16 | 0.1690 | -0.0216 | |||

| CCI / Crown Castle Inc. | 0.00 | 0.33 | 0.1684 | 0.1684 | |||||

| SPOT / Spotify Technology S.A. | 0.00 | 0.33 | 0.1681 | 0.1681 | |||||

| ENB / Enbridge Inc. | 0.01 | 0.00 | 0.33 | 2.17 | 0.1673 | -0.0616 | |||

| CRM / Salesforce, Inc. | 0.00 | 43.20 | 0.33 | 45.58 | 0.1669 | 0.0064 | |||

| WPC / W. P. Carey Inc. | 0.01 | 0.32 | 0.1607 | 0.1607 | |||||

| GILD / Gilead Sciences, Inc. | 0.00 | 0.32 | 0.1602 | 0.1602 | |||||

| HBAN / Huntington Bancshares Incorporated | 0.02 | 82.34 | 0.31 | 104.61 | 0.1574 | 0.0492 | |||

| MPC / Marathon Petroleum Corporation | 0.00 | 0.31 | 0.1548 | 0.1548 | |||||

| ORCL / Oracle Corporation | 0.00 | 0.30 | 0.1516 | 0.1516 | |||||

| CAH / Cardinal Health, Inc. | 0.00 | 0.30 | 0.1514 | 0.1514 | |||||

| GS / The Goldman Sachs Group, Inc. | 0.00 | -96.11 | 0.30 | 116.79 | 0.1507 | 0.0746 | |||

| GLPI / Gaming and Leisure Properties, Inc. | 0.01 | 44.28 | 0.30 | 32.14 | 0.1500 | -0.0086 | |||

| AMD / Advanced Micro Devices, Inc. | 0.00 | -1.38 | 0.29 | 36.11 | 0.1491 | -0.0040 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0.01 | -4.42 | 0.29 | -9.40 | 0.1462 | -0.0796 | |||

| WM / Waste Management, Inc. | 0.00 | -7.92 | 0.28 | -8.82 | 0.1412 | -0.0759 | |||

| FNF / Fidelity National Financial, Inc. | 0.00 | 0.27 | 0.1359 | 0.1359 | |||||

| BA / The Boeing Company | 0.00 | 0.00 | 0.27 | 22.94 | 0.1357 | -0.0188 | |||

| OXY / Occidental Petroleum Corporation | 0.01 | -17.30 | 0.27 | -29.47 | 0.1356 | -0.1339 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.00 | -0.04 | 0.27 | 11.76 | 0.1350 | -0.0340 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.00 | 21.75 | 0.26 | 16.89 | 0.1334 | -0.0261 | |||

| CTAS / Cintas Corporation | 0.00 | 0.26 | 0.1324 | 0.1324 | |||||

| HIG / The Hartford Insurance Group, Inc. | 0.00 | 0.25 | 0.1289 | 0.1289 | |||||

| ET / Energy Transfer LP - Limited Partnership | 0.01 | -32.23 | 0.25 | -33.94 | 0.1283 | -0.1433 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.00 | 0.25 | 0.1270 | 0.1270 | |||||

| AMAT / Applied Materials, Inc. | 0.00 | 0.24 | 0.1217 | 0.1217 | |||||

| CFG / Citizens Financial Group, Inc. | 0.01 | 0.24 | 0.1203 | 0.1203 | |||||

| IGIB / iShares Trust - iShares 5-10 Year Investment Grade Corporate Bond ETF | 0.00 | 0.24 | 0.1202 | 0.1202 | |||||

| BTI / British American Tobacco p.l.c. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.24 | 14.56 | 0.1197 | -0.0267 | |||

| RITM / Rithm Capital Corp. | 0.02 | 2.07 | 0.23 | 0.86 | 0.1185 | -0.0462 | |||

| FERG / Ferguson Enterprises Inc. | 0.00 | 0.23 | 0.1144 | 0.1144 | |||||

| PLTR / Palantir Technologies Inc. | 0.00 | 0.22 | 0.1133 | 0.1133 | |||||

| BX / Blackstone Inc. | 0.00 | 0.22 | 0.1124 | 0.1124 | |||||

| SNPS / Synopsys, Inc. | 0.00 | 0.22 | 0.1120 | 0.1120 | |||||

| EQT / EQT Corporation | 0.00 | -12.39 | 0.22 | -4.41 | 0.1099 | -0.0509 | |||

| BCAL / California BanCorp. | 0.01 | 0.21 | 0.1076 | 0.1076 | |||||

| UBER / Uber Technologies, Inc. | 0.00 | 0.21 | 0.1070 | 0.1070 | |||||

| HSY / The Hershey Company | 0.00 | 0.21 | 0.1065 | 0.1065 | |||||

| HEIA / Heico Corp. - Class A | 0.00 | 0.21 | 0.1060 | 0.1060 | |||||

| UPS / United Parcel Service, Inc. | 0.00 | 0.21 | 0.1055 | 0.1055 | |||||

| BSX / Boston Scientific Corporation | 0.00 | 0.20 | 0.1036 | 0.1036 | |||||

| MPWR / Monolithic Power Systems, Inc. | 0.00 | 0.20 | 0.1025 | 0.1025 | |||||

| RSG / Republic Services, Inc. | 0.00 | -80.39 | 0.20 | -45.21 | 0.1015 | -0.1012 | |||

| STLA / Stellantis N.V. | 0.02 | 0.20 | 0.1015 | 0.1015 | |||||

| DOC / Healthpeak Properties, Inc. | 0.01 | 0.19 | 0.0958 | 0.0958 | |||||

| OCUL / Ocular Therapeutix, Inc. | 0.01 | 0.00 | 0.10 | 25.61 | 0.0526 | -0.0055 | |||

| CPAC / Cementos Pacasmayo S.A.A. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.07 | 3.17 | 0.0331 | -0.0120 | |||

| TURB / Turbo Energy, S.A. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.03 | 3.45 | 0.0154 | -0.0054 | |||

| SACH / Sachem Capital Corp. | 0.01 | 0.00 | 0.02 | 0.00 | 0.0084 | -0.0030 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HDV / iShares Trust - iShares Core High Dividend ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PPI / Investment Managers Series Trust II - Astoria Real Assets ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DOCS / Doximity, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AZ / A2Z Cust2Mate Solutions Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EOG / EOG Resources, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| F / Ford Motor Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VHT / Vanguard World Fund - Vanguard Health Care ETF | 0.00 | -100.00 | 0.00 | 0.0000 |