Mga Batayang Estadistika

| Nilai Portofolio | $ 71,549,846 |

| Posisi Saat Ini | 78 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

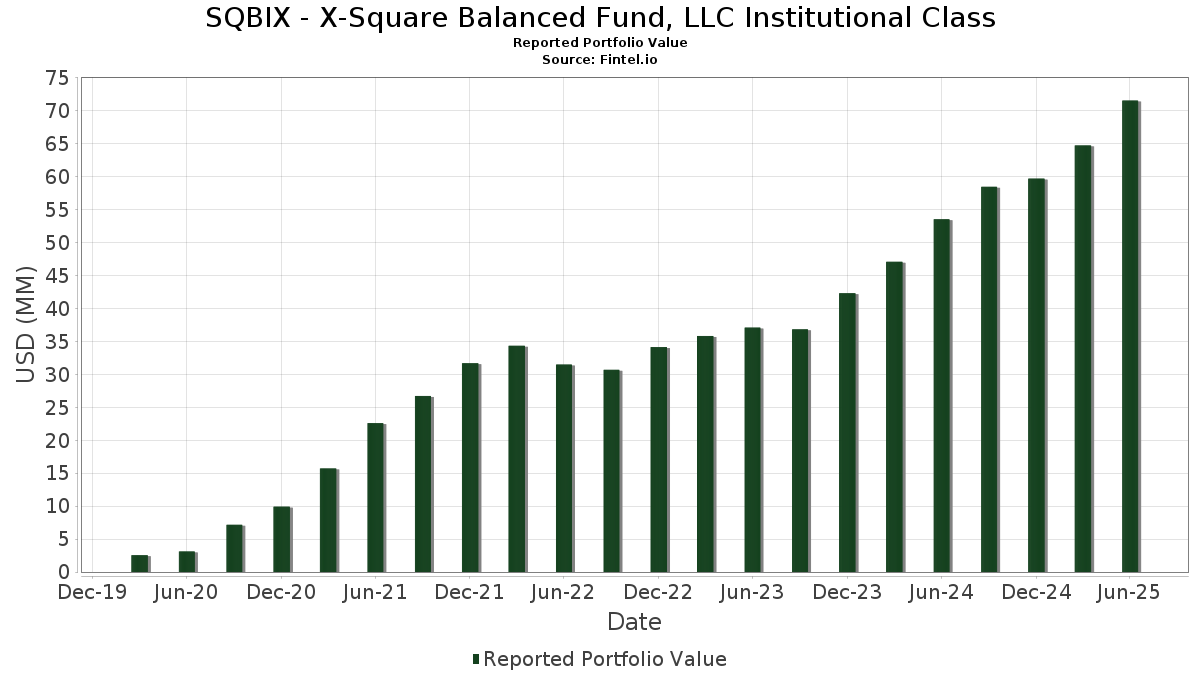

SQBIX - X-Square Balanced Fund, LLC Institutional Class telah mengungkapkan total kepemilikan 78 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 71,549,846 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama SQBIX - X-Square Balanced Fund, LLC Institutional Class adalah GNII II 2% 08/20/2051#MA7533 (US:US36179WLN64) , Government National Mortgage Association (GNMA) (US:US36179WP937) , Ginnie Mae II Pool (US:US36179WRZ31) , Ginnie Mae II Pool (US:US36179WTX64) , and Ginnie Mae II Pool (US:US3622ABE656) . Posisi baru SQBIX - X-Square Balanced Fund, LLC Institutional Class meliputi: GNII II 2% 08/20/2051#MA7533 (US:US36179WLN64) , Government National Mortgage Association (GNMA) (US:US36179WP937) , Ginnie Mae II Pool (US:US36179WRZ31) , Ginnie Mae II Pool (US:US36179WTX64) , and Ginnie Mae II Pool (US:US3622ABE656) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 3.19 | 4.4412 | 4.4412 | ||

| 1.80 | 2.5135 | 2.5135 | ||

| 0.80 | 1.1195 | 1.1195 | ||

| 0.01 | 0.67 | 0.9359 | 0.9359 | |

| 0.01 | 0.62 | 0.8710 | 0.8710 | |

| 0.02 | 0.35 | 0.4924 | 0.4924 | |

| 0.01 | 1.06 | 1.4761 | 0.3828 | |

| 0.00 | 0.70 | 0.9786 | 0.3349 | |

| 0.00 | 1.19 | 1.6541 | 0.3323 | |

| 0.01 | 0.97 | 1.3536 | 0.3219 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -0.9939 | ||

| 3.85 | 5.3622 | -0.7516 | ||

| 3.77 | 5.2509 | -0.7202 | ||

| 3.35 | 4.6656 | -0.6481 | ||

| 2.82 | 3.9273 | -0.5427 | ||

| 1.90 | 2.6552 | -0.3602 | ||

| 0.02 | 0.71 | 0.9838 | -0.2960 | |

| 0.02 | 0.84 | 1.1661 | -0.2782 | |

| 0.00 | 1.03 | 1.4362 | -0.2603 | |

| 1.36 | 1.9012 | -0.2591 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-06 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US36179WLN64 / GNII II 2% 08/20/2051#MA7533 | 3.85 | -2.90 | 5.3622 | -0.7516 | |||||

| US36179WP937 / Government National Mortgage Association (GNMA) | 3.77 | -2.64 | 5.2509 | -0.7202 | |||||

| US36179WRZ31 / Ginnie Mae II Pool | 3.35 | -2.76 | 4.6656 | -0.6481 | |||||

| United States Treasury Bill / DBT (US912797MG92) | 3.19 | 4.4412 | 4.4412 | ||||||

| US36179WTX64 / Ginnie Mae II Pool | 2.82 | -2.73 | 3.9273 | -0.5427 | |||||

| US3622ABE656 / Ginnie Mae II Pool | 1.90 | -2.51 | 2.6552 | -0.3602 | |||||

| United States Treasury Bill / DBT (US912797LW51) | 1.80 | 2.5135 | 2.5135 | ||||||

| WMT / Walmart Inc. | 0.02 | 2.12 | 1.56 | 13.76 | 2.1797 | 0.0579 | |||

| US91282CFF32 / United States Treasury Note/Bond | 1.52 | 0.93 | 2.1218 | -0.2065 | |||||

| META / Meta Platforms, Inc. | 0.00 | 3.15 | 1.40 | 32.14 | 1.9548 | 0.3163 | |||

| US36179VHR42 / G2 MA6540 2.5 3/20/50 | 1.36 | -2.57 | 1.9012 | -0.2591 | |||||

| SU / Suncor Energy Inc. | 0.04 | 2.48 | 1.32 | -0.90 | 1.8419 | -0.2155 | |||

| URI / United Rentals, Inc. | 0.00 | 3.25 | 1.22 | 24.19 | 1.7034 | 0.1839 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 3.34 | 1.19 | 22.13 | 1.6630 | 0.1554 | |||

| MELI / MercadoLibre, Inc. | 0.00 | 3.42 | 1.19 | 38.55 | 1.6541 | 0.3323 | |||

| PM / Philip Morris International Inc. | 0.01 | 2.96 | 1.18 | 18.24 | 1.6449 | 0.1033 | |||

| TJX / The TJX Companies, Inc. | 0.01 | 2.78 | 1.06 | 4.22 | 1.4804 | -0.0924 | |||

| MU / Micron Technology, Inc. | 0.01 | 5.38 | 1.06 | 49.44 | 1.4761 | 0.3828 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 2.76 | 1.03 | -6.28 | 1.4362 | -0.2603 | |||

| GOOG / Alphabet Inc. | 0.01 | 3.61 | 0.99 | 17.66 | 1.3753 | 0.0810 | |||

| TDG / TransDigm Group Incorporated | 0.00 | 3.70 | 0.98 | 13.97 | 1.3651 | 0.0393 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 5.18 | 0.97 | 45.36 | 1.3536 | 0.3219 | |||

| GRMN / Garmin Ltd. | 0.00 | 3.53 | 0.97 | -0.51 | 1.3488 | -0.1518 | |||

| GD / General Dynamics Corporation | 0.00 | 3.64 | 0.92 | 10.82 | 1.2864 | 0.0020 | |||

| CB / Chubb Limited | 0.00 | 3.33 | 0.92 | -0.87 | 1.2766 | -0.1491 | |||

| US3622AAVN14 / Ginnie Mae II Pool | 0.91 | -2.48 | 1.2631 | -0.1708 | |||||

| XPO / XPO, Inc. | 0.01 | 4.64 | 0.88 | 22.81 | 1.2316 | 0.1215 | |||

| TSLA / Tesla, Inc. | 0.00 | -19.15 | 0.87 | -0.91 | 1.2097 | -0.1418 | |||

| FAST / Fastenal Company | 0.02 | 107.60 | 0.86 | 12.57 | 1.1989 | 0.0183 | |||

| FTNT / Fortinet, Inc. | 0.01 | 4.24 | 0.85 | 14.42 | 1.1846 | 0.0390 | |||

| EXE / Expand Energy Corporation | 0.01 | 4.08 | 0.85 | 9.46 | 1.1779 | -0.0149 | |||

| CPRT / Copart, Inc. | 0.02 | 3.09 | 0.84 | -10.59 | 1.1661 | -0.2782 | |||

| TSCO / Tractor Supply Company | 0.02 | 3.74 | 0.82 | -0.73 | 1.1441 | -0.1308 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 4.78 | 0.82 | 20.89 | 1.1386 | 0.0953 | |||

| PHM / PulteGroup, Inc. | 0.01 | 0.00 | 0.81 | 2.68 | 1.1224 | -0.0889 | |||

| MA / Mastercard Incorporated | 0.00 | 4.23 | 0.80 | 6.78 | 1.1201 | -0.0405 | |||

| U.S. Treasury Note / DBT (US91282CMZ13) | 0.80 | 1.1195 | 1.1195 | ||||||

| APP / AppLovin Corporation | 0.00 | 0.00 | 0.75 | 32.16 | 1.0492 | 0.1700 | |||

| SHOP / Shopify Inc. | 0.01 | 5.98 | 0.75 | 28.18 | 1.0400 | 0.1407 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.01 | 4.93 | 0.74 | 17.22 | 1.0257 | 0.0579 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 4.32 | 0.73 | 8.20 | 1.0123 | -0.0239 | |||

| MO / Altria Group, Inc. | 0.01 | 4.30 | 0.72 | 1.84 | 1.0027 | -0.0869 | |||

| OXY / Occidental Petroleum Corporation | 0.02 | 0.00 | 0.71 | -14.96 | 0.9838 | -0.2960 | |||

| ORCL / Oracle Corporation | 0.00 | 7.64 | 0.70 | 68.35 | 0.9786 | 0.3349 | |||

| AMGN / Amgen Inc. | 0.00 | 4.21 | 0.70 | -6.56 | 0.9730 | -0.1805 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 6.19 | 0.69 | 33.46 | 0.9684 | 0.1650 | |||

| PEP / PepsiCo, Inc. | 0.01 | 0.67 | 0.9359 | 0.9359 | |||||

| HD / The Home Depot, Inc. | 0.00 | 4.80 | 0.66 | 4.80 | 0.9143 | -0.0512 | |||

| LEN / Lennar Corporation | 0.01 | 4.82 | 0.64 | 0.94 | 0.8991 | -0.0864 | |||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.01 | 0.62 | 0.8710 | 0.8710 | |||||

| JNJ / Johnson & Johnson | 0.00 | 4.85 | 0.61 | -3.31 | 0.8562 | -0.1254 | |||

| GNRC / Generac Holdings Inc. | 0.00 | 7.16 | 0.57 | 21.20 | 0.7891 | 0.0681 | |||

| GLNCY / Glencore plc - Depositary Receipt (Common Stock) | 0.07 | 6.70 | 0.57 | 13.45 | 0.7889 | 0.0198 | |||

| EOG / EOG Resources, Inc. | 0.00 | 5.89 | 0.56 | -1.23 | 0.7848 | -0.0949 | |||

| TGLS / Tecnoglass Inc. | 0.01 | 6.43 | 0.56 | 14.96 | 0.7832 | 0.0297 | |||

| FCX / Freeport-McMoRan Inc. | 0.01 | 7.96 | 0.55 | 23.66 | 0.7735 | 0.0807 | |||

| EXPE / Expedia Group, Inc. | 0.00 | 6.47 | 0.55 | 6.74 | 0.7734 | -0.0280 | |||

| PYPL / PayPal Holdings, Inc. | 0.01 | 7.08 | 0.55 | 22.05 | 0.7647 | 0.0705 | |||

| ALLY / Ally Financial Inc. | 0.01 | 7.18 | 0.53 | 14.41 | 0.7428 | 0.0243 | |||

| DG / Dollar General Corporation | 0.00 | 7.54 | 0.50 | 40.06 | 0.6977 | 0.1455 | |||

| ABBV / AbbVie Inc. | 0.00 | 6.64 | 0.48 | -5.54 | 0.6652 | -0.1144 | |||

| ICE / Intercontinental Exchange, Inc. | 0.00 | 8.18 | 0.45 | 15.25 | 0.6222 | 0.0235 | |||

| MKTX / MarketAxess Holdings Inc. | 0.00 | 7.66 | 0.42 | 11.20 | 0.5819 | 0.0022 | |||

| RH / RH | 0.00 | 9.68 | 0.42 | -11.51 | 0.5794 | -0.1460 | |||

| TFC / Truist Financial Corporation | 0.01 | 9.36 | 0.41 | 14.09 | 0.5767 | 0.0179 | |||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.01 | 8.00 | 0.40 | 4.94 | 0.5633 | -0.0315 | |||

| DPZ / Domino's Pizza, Inc. | 0.00 | 7.75 | 0.39 | 5.63 | 0.5502 | -0.0263 | |||

| AKAM / Akamai Technologies, Inc. | 0.00 | 9.21 | 0.37 | 8.12 | 0.5209 | -0.0121 | |||

| QXO / QXO, Inc. | 0.02 | 0.35 | 0.4924 | 0.4924 | |||||

| VALE / Vale S.A. - Depositary Receipt (Common Stock) | 0.04 | 9.58 | 0.35 | 6.36 | 0.4907 | -0.0189 | |||

| BAH / Booz Allen Hamilton Holding Corporation | 0.00 | 9.78 | 0.31 | 9.32 | 0.4254 | -0.0055 | |||

| RXO / RXO, Inc. | 0.01 | 17.52 | 0.22 | -3.48 | 0.3103 | -0.0449 | |||

| Z / Zillow Group, Inc. | 0.00 | 0.00 | 0.19 | 2.17 | 0.2625 | -0.0219 | |||

| COIN / Coinbase Global, Inc. | 0.00 | -70.68 | 0.17 | -40.36 | 0.2330 | -0.1994 | |||

| OFG / OFG Bancorp | 0.00 | 0.00 | 0.15 | 6.38 | 0.2103 | -0.0074 | |||

| NFE / New Fortress Energy Inc. | 0.03 | 25.73 | 0.09 | -50.00 | 0.1235 | -0.1487 | |||

| BHC / Bausch Health Companies Inc. | 0.01 | 0.00 | 0.07 | 2.78 | 0.1036 | -0.0078 | |||

| US912828YQ73 / U.S. Treasury Notes | 0.04 | 2.33 | 0.0617 | -0.0062 | |||||

| PLTR / Palantir Technologies Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9939 |