Mga Batayang Estadistika

| Nilai Portofolio | $ 228,813,648 |

| Posisi Saat Ini | 60 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

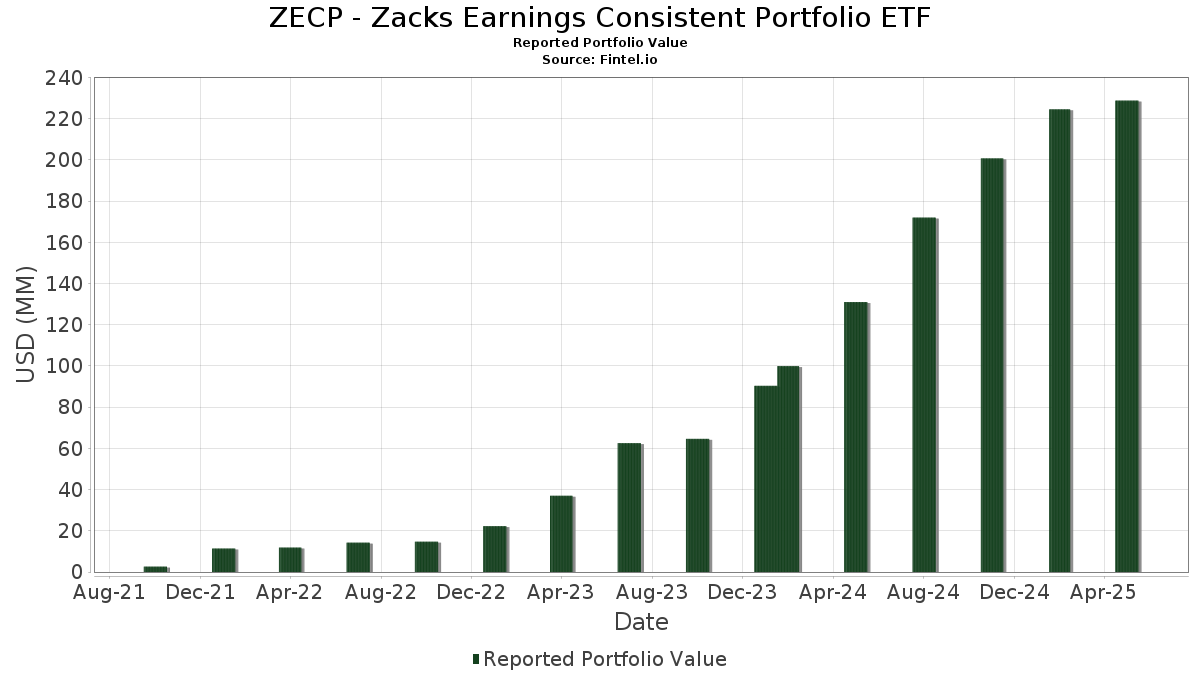

ZECP - Zacks Earnings Consistent Portfolio ETF telah mengungkapkan total kepemilikan 60 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 228,813,648 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama ZECP - Zacks Earnings Consistent Portfolio ETF adalah Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Alphabet Inc. (US:GOOGL) , Netflix, Inc. (US:NFLX) , and JPMorgan Chase & Co. (US:JPM) . Posisi baru ZECP - Zacks Earnings Consistent Portfolio ETF meliputi: Salesforce, Inc. (US:CRM) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 2.52 | 1.0842 | 1.0842 | |

| 0.03 | 14.92 | 6.4102 | 1.0185 | |

| 0.05 | 3.05 | 1.3100 | 0.8305 | |

| 0.02 | 3.75 | 1.6091 | 0.8039 | |

| 0.01 | 7.67 | 3.2945 | 0.6847 | |

| 0.03 | 3.69 | 1.5831 | 0.4757 | |

| 0.00 | 3.34 | 1.4361 | 0.2966 | |

| 0.02 | 5.09 | 2.1858 | 0.2324 | |

| 0.04 | 4.74 | 2.0340 | 0.2264 | |

| 0.02 | 4.94 | 2.1204 | 0.2146 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.01 | 0.0049 | -2.2634 | |

| 0.06 | 12.97 | 5.5732 | -0.9725 | |

| 0.01 | 5.00 | 2.1458 | -0.4687 | |

| 0.01 | 2.23 | 0.9570 | -0.3948 | |

| 0.00 | 1.83 | 0.7875 | -0.2212 | |

| 0.02 | 3.10 | 1.3335 | -0.1850 | |

| 0.07 | 2.76 | 1.1839 | -0.1712 | |

| 0.03 | 1.44 | 0.6167 | -0.1262 | |

| 0.01 | 5.44 | 2.3372 | -0.1170 | |

| 0.01 | 3.52 | 1.5112 | -0.1093 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-30 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.03 | 5.95 | 14.92 | 22.86 | 6.4102 | 1.0185 | |||

| AAPL / Apple Inc. | 0.06 | 5.94 | 12.97 | -12.02 | 5.5732 | -0.9725 | |||

| GOOGL / Alphabet Inc. | 0.06 | 5.95 | 10.66 | 6.86 | 4.5773 | 0.1509 | |||

| NFLX / Netflix, Inc. | 0.01 | 5.95 | 7.67 | 30.45 | 3.2945 | 0.6847 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | 5.93 | 7.21 | 5.67 | 3.0992 | 0.0685 | |||

| WMT / Walmart Inc. | 0.07 | 5.24 | 6.86 | 5.35 | 2.9457 | 0.0564 | |||

| PG / The Procter & Gamble Company | 0.04 | 5.93 | 6.35 | 3.52 | 2.7256 | 0.0049 | |||

| AXP / American Express Company | 0.02 | 5.96 | 6.13 | 3.53 | 2.6337 | 0.0049 | |||

| CAT / Caterpillar Inc. | 0.02 | 5.95 | 5.59 | 7.20 | 2.3993 | 0.0866 | |||

| HD / The Home Depot, Inc. | 0.01 | 5.98 | 5.44 | -1.59 | 2.3372 | -0.1170 | |||

| CTAS / Cintas Corporation | 0.02 | 5.93 | 5.09 | 15.64 | 2.1858 | 0.2324 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.02 | 5.97 | 5.01 | 4.12 | 2.1513 | 0.0159 | |||

| LLY / Eli Lilly and Company | 0.01 | 5.85 | 5.00 | -15.20 | 2.1458 | -0.4687 | |||

| RSG / Republic Services, Inc. | 0.02 | 5.91 | 4.94 | 14.98 | 2.1204 | 0.2146 | |||

| SNPS / Synopsys, Inc. | 0.01 | 5.96 | 4.77 | 7.51 | 2.0486 | 0.0796 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.04 | 5.93 | 4.74 | 16.28 | 2.0340 | 0.2264 | |||

| AEP / American Electric Power Company, Inc. | 0.04 | 5.94 | 4.33 | 3.39 | 1.8601 | 0.0008 | |||

| AMP / Ameriprise Financial, Inc. | 0.01 | 6.02 | 4.27 | 0.47 | 1.8344 | -0.0521 | |||

| CAH / Cardinal Health, Inc. | 0.02 | 73.13 | 3.75 | 106.50 | 1.6091 | 0.8039 | |||

| TJX / The TJX Companies, Inc. | 0.03 | 45.23 | 3.69 | 47.75 | 1.5831 | 0.4757 | |||

| RTX / RTX Corporation | 0.03 | 5.94 | 3.64 | 8.72 | 1.5642 | 0.0775 | |||

| AMAT / Applied Materials, Inc. | 0.02 | 5.93 | 3.53 | 5.07 | 1.5142 | 0.0246 | |||

| ACN / Accenture plc | 0.01 | 6.00 | 3.52 | -3.64 | 1.5112 | -0.1093 | |||

| INTU / Intuit Inc. | 0.00 | 6.10 | 3.34 | 30.23 | 1.4361 | 0.2966 | |||

| ORCL / Oracle Corporation | 0.02 | 5.92 | 3.27 | 5.58 | 1.4060 | 0.0299 | |||

| MCO / Moody's Corporation | 0.01 | 5.94 | 3.20 | 0.79 | 1.3737 | -0.0351 | |||

| BSX / Boston Scientific Corporation | 0.03 | 5.94 | 3.16 | 7.45 | 1.3568 | 0.0519 | |||

| JNJ / Johnson & Johnson | 0.02 | 5.96 | 3.14 | -0.35 | 1.3496 | -0.0497 | |||

| PEP / PepsiCo, Inc. | 0.02 | 5.95 | 3.10 | -9.24 | 1.3335 | -0.1850 | |||

| MET / MetLife, Inc. | 0.04 | 5.94 | 3.07 | -3.42 | 1.3208 | -0.0922 | |||

| MAR / Marriott International, Inc. | 0.01 | 5.88 | 3.07 | -0.42 | 1.3187 | -0.0494 | |||

| CSCO / Cisco Systems, Inc. | 0.05 | 187.13 | 3.05 | 182.31 | 1.3100 | 0.8305 | |||

| CDNS / Cadence Design Systems, Inc. | 0.01 | 5.89 | 2.98 | 21.38 | 1.2807 | 0.1901 | |||

| ABT / Abbott Laboratories | 0.02 | 5.91 | 2.93 | 2.52 | 1.2593 | -0.0102 | |||

| AMGN / Amgen Inc. | 0.01 | 6.00 | 2.86 | -0.83 | 1.2275 | -0.0517 | |||

| WRB / W. R. Berkley Corporation | 0.04 | 5.94 | 2.76 | 25.43 | 1.1866 | 0.2091 | |||

| TFC / Truist Financial Corporation | 0.07 | 5.94 | 2.76 | -9.70 | 1.1839 | -0.1712 | |||

| SYK / Stryker Corporation | 0.01 | 6.00 | 2.64 | 5.05 | 1.1349 | 0.0183 | |||

| HSY / The Hershey Company | 0.02 | 5.97 | 2.62 | -1.39 | 1.1247 | -0.0541 | |||

| MCD / McDonald's Corporation | 0.01 | 5.92 | 2.58 | 7.83 | 1.1066 | 0.0460 | |||

| SO / The Southern Company | 0.03 | 5.95 | 2.53 | 6.21 | 1.0883 | 0.0293 | |||

| CRM / Salesforce, Inc. | 0.01 | 2.52 | 1.0842 | 1.0842 | |||||

| AWK / American Water Works Company, Inc. | 0.02 | 5.94 | 2.51 | 11.40 | 1.0794 | 0.0781 | |||

| IBM / International Business Machines Corporation | 0.01 | 5.86 | 2.39 | 8.66 | 1.0247 | 0.0500 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.01 | 5.91 | 2.33 | -4.07 | 1.0015 | -0.0775 | |||

| EMR / Emerson Electric Co. | 0.02 | 5.94 | 2.28 | 3.97 | 0.9797 | 0.0062 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 5.90 | 2.23 | -1.20 | 0.9582 | -0.0440 | |||

| FI / Fiserv, Inc. | 0.01 | 5.92 | 2.23 | -26.86 | 0.9570 | -0.3948 | |||

| GD / General Dynamics Corporation | 0.01 | 5.92 | 2.12 | 16.77 | 0.9096 | 0.1047 | |||

| LH / Labcorp Holdings Inc. | 0.01 | 5.94 | 2.12 | 5.07 | 0.9086 | 0.0149 | |||

| MAA / Mid-America Apartment Communities, Inc. | 0.01 | 5.89 | 2.11 | -1.36 | 0.9046 | -0.0428 | |||

| BLK / BlackRock, Inc. | 0.00 | 5.94 | 2.08 | 6.18 | 0.8932 | 0.0238 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 5.94 | 1.83 | -19.32 | 0.7875 | -0.2212 | |||

| NEE / NextEra Energy, Inc. | 0.02 | 5.92 | 1.76 | 6.60 | 0.7568 | 0.0234 | |||

| CHD / Church & Dwight Co., Inc. | 0.02 | 5.93 | 1.70 | -6.38 | 0.7315 | -0.0757 | |||

| PLD / Prologis, Inc. | 0.01 | 5.95 | 1.55 | -7.15 | 0.6642 | -0.0750 | |||

| BMY / Bristol-Myers Squibb Company | 0.03 | 5.94 | 1.44 | -14.23 | 0.6167 | -0.1262 | |||

| MRK / Merck & Co., Inc. | 0.02 | 5.93 | 1.38 | -11.79 | 0.5913 | -0.1012 | |||

| NDAQ / Nasdaq, Inc. | 0.01 | 5.95 | 1.11 | 6.92 | 0.4782 | 0.0160 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -99.65 | 0.01 | -99.78 | 0.0049 | -2.2634 |