Baird Initiates Coverage of Lionsgate Studios (LION) with Outperform Recommendation

Fintel reports that on September 5, 2025, Baird initiated coverage of Lionsgate Studios (NYSE:LION) with a Outperform recommendation.

Analyst Price Forecast Suggests 42.92% Upside

As of September 3, 2025, the average one-year price target for Lionsgate Studios is $8.86/share. The forecasts range from a low of $7.07 to a high of $10.50. The average price target represents an increase of 42.92% from its latest reported closing price of $6.20 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Lionsgate Studios is 3,621MM, a decrease of 9.18%. The projected annual non-GAAP EPS is 0.76.

What is the Fund Sentiment?

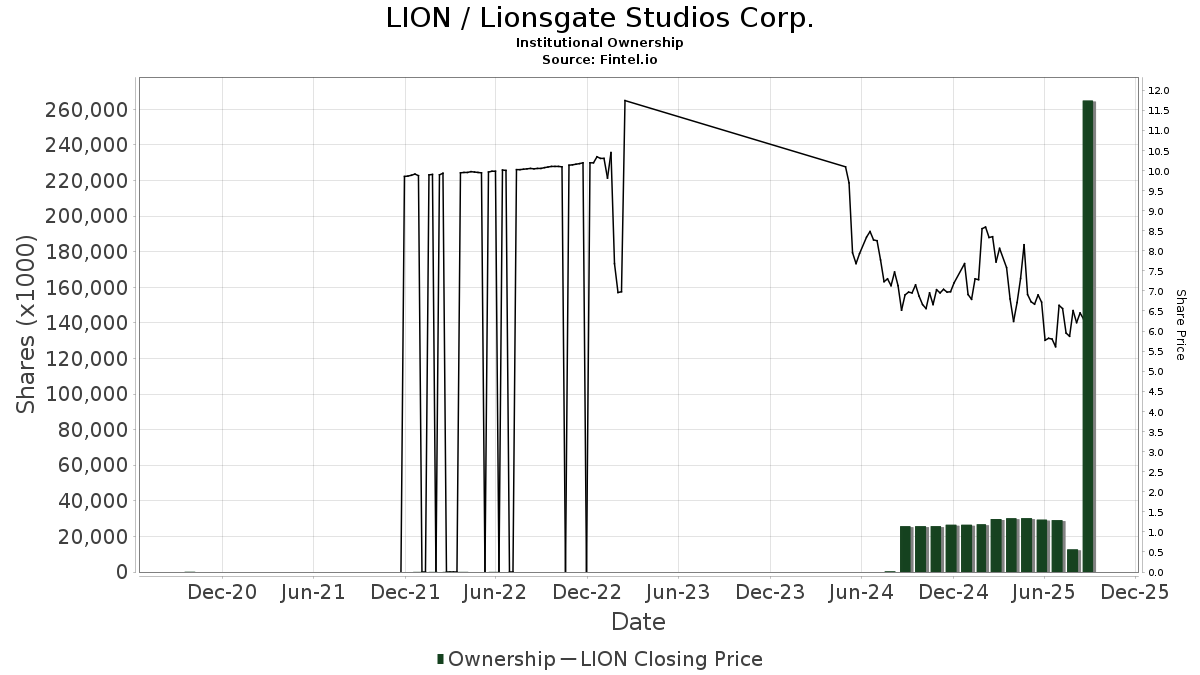

There are 358 funds or institutions reporting positions in Lionsgate Studios.

This is an increase of 265 owner(s) or 284.95% in the last quarter.

Average portfolio weight of all funds dedicated to LION is 0.27%, an increase of 32.00%.

Total shares owned by institutions increased in the last three months by 800.95% to 264,868K shares.

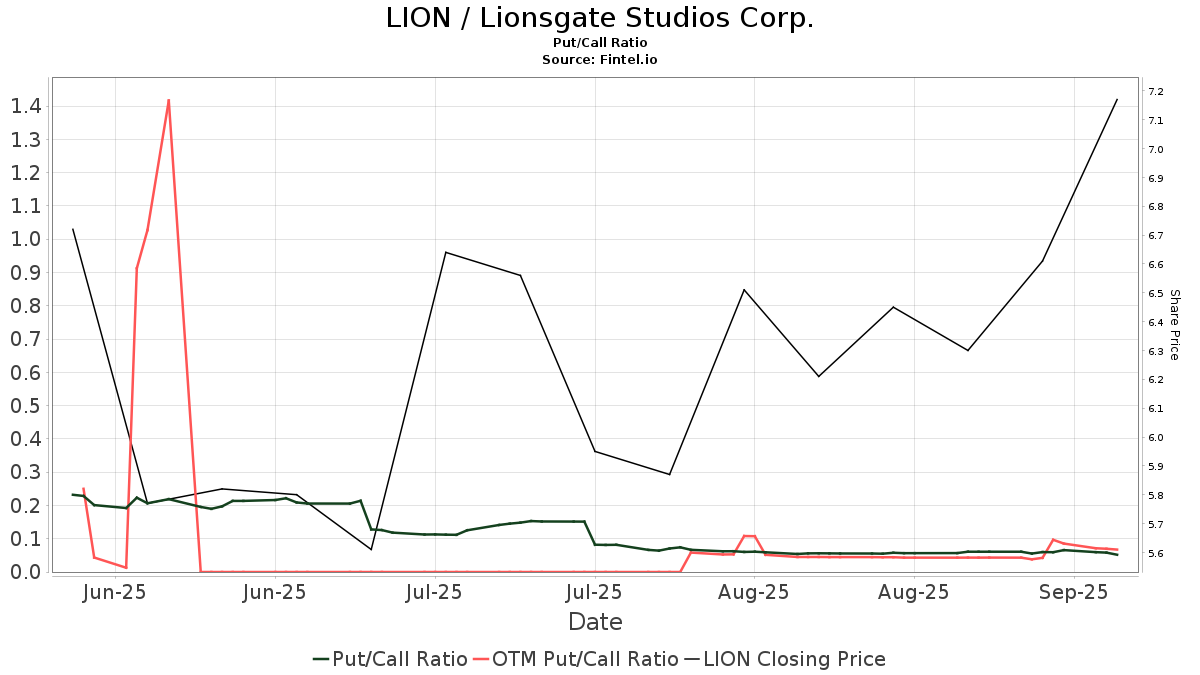

The put/call ratio of LION is 0.06, indicating a

bullish outlook.

The put/call ratio of LION is 0.06, indicating a

bullish outlook.

What are Other Shareholders Doing?

Mhr Fund Management holds 37,648K shares.

Liberty 77 Capital holds 36,976K shares.

Shapiro Capital Management holds 13,265K shares.

Capital Research Global Investors holds 10,422K shares.

SMCWX - SMALLCAP WORLD FUND INC holds 9,370K shares.