R&S Group Holding (SWX:RSGN) Price Target Increased by 14.06% to 37.23

The average one-year price target for R&S Group Holding (SWX:RSGN) has been revised to CHF 37,23 / share. This is an increase of 14.06% from the prior estimate of CHF 32,64 dated August 3, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of CHF 28,28 to a high of CHF 47,25 / share. The average price target represents a decrease of 1.12% from the latest reported closing price of CHF 37,65 / share.

R&S Group Holding Maintains 1.33% Dividend Yield

At the most recent price, the company’s dividend yield is 1.33%.

Additionally, the company’s dividend payout ratio is 0.45. The payout ratio tells us how much of a company’s income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company’s income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company’s 3-Year dividend growth rate is -0.33% .

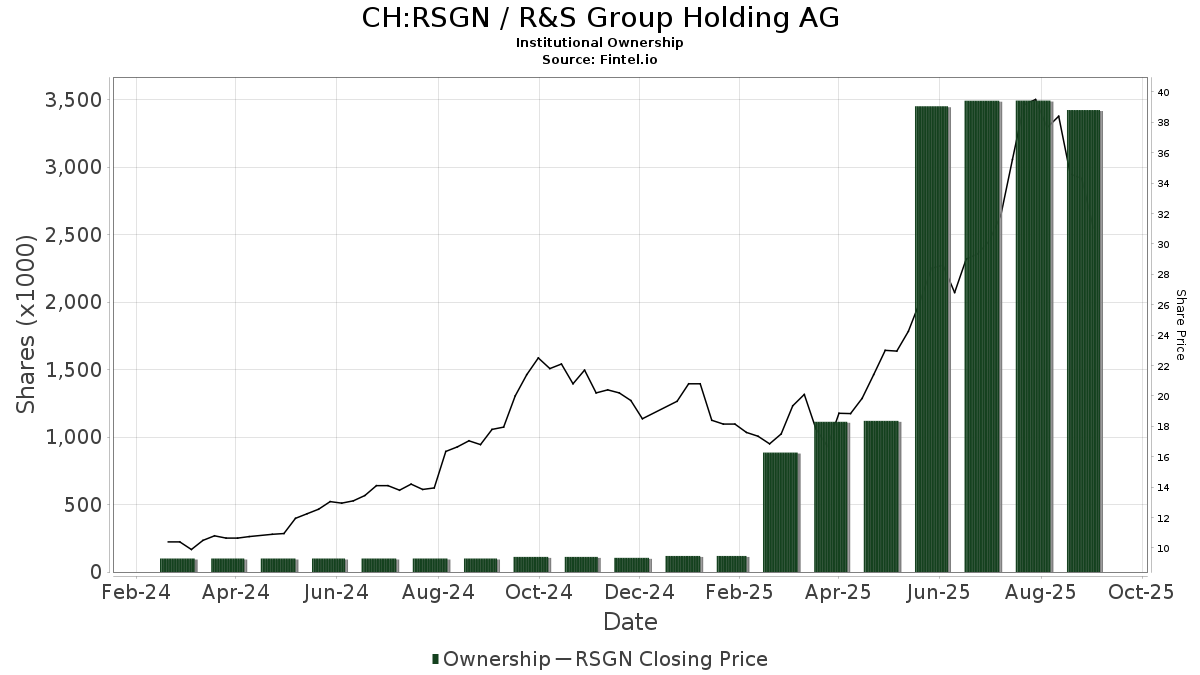

What is the Fund Sentiment?

There are 21 funds or institutions reporting positions in R&S Group Holding. This is an increase of 3 owner(s) or 16.67% in the last quarter. Average portfolio weight of all funds dedicated to RSGN is 0.30%, an increase of 3.08%. Total shares owned by institutions increased in the last three months by 211.85% to 3,494K shares.

What are Other Shareholders Doing?

SMCWX - SMALLCAP WORLD FUND INC holds 2,967K shares representing 8.02% ownership of the company. In its prior filing, the firm reported owning 754K shares , representing an increase of 74.60%. The firm increased its portfolio allocation in RSGN by 334.32% over the last quarter.

IEFA - iShares Core MSCI EAFE ETF holds 153K shares representing 0.41% ownership of the company. In its prior filing, the firm reported owning 152K shares , representing an increase of 0.99%. The firm increased its portfolio allocation in RSGN by 8.69% over the last quarter.

GRID - First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund holds 109K shares representing 0.29% ownership of the company.

Swiss Helvetia Fund holds 82K shares representing 0.22% ownership of the company. In its prior filing, the firm reported owning 87K shares , representing a decrease of 6.63%. The firm decreased its portfolio allocation in RSGN by 2.65% over the last quarter.

SCZ - iShares MSCI EAFE Small-Cap ETF holds 70K shares representing 0.19% ownership of the company. In its prior filing, the firm reported owning 68K shares , representing an increase of 3.26%. The firm increased its portfolio allocation in RSGN by 9.32% over the last quarter.