Mga Batayang Estadistika

| Nilai Portofolio | $ 3,406,979,397 |

| Posisi Saat Ini | 240 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

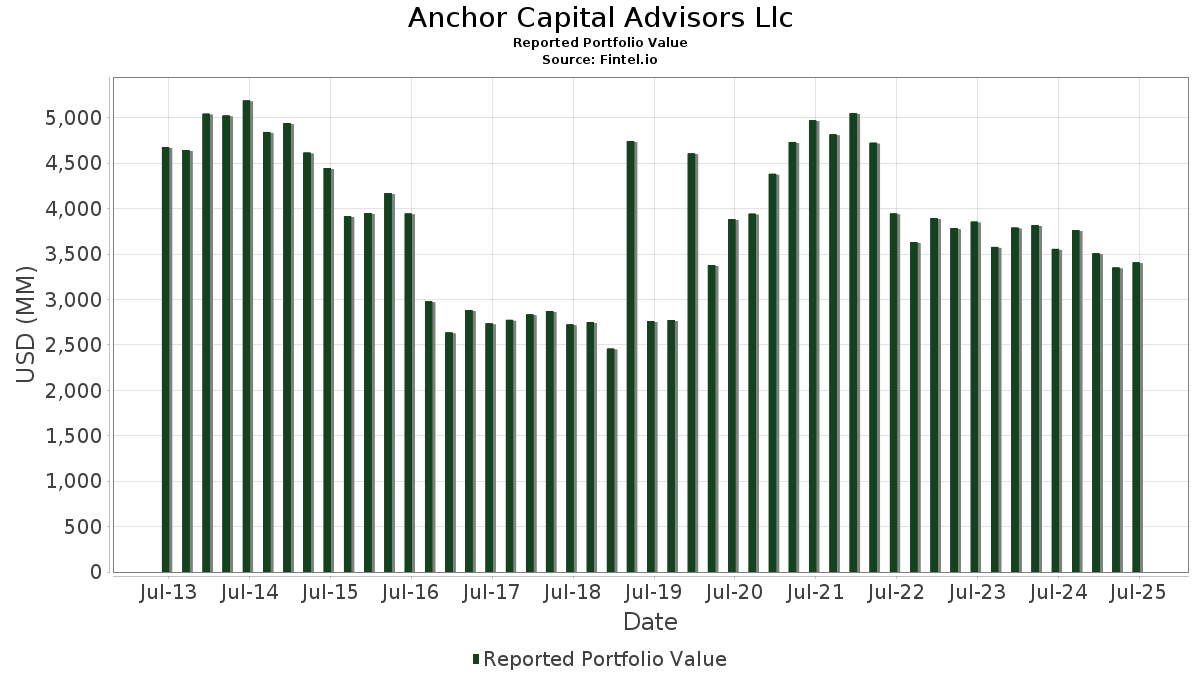

Anchor Capital Advisors Llc telah mengungkapkan total kepemilikan 240 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 3,406,979,397 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Anchor Capital Advisors Llc adalah W. R. Berkley Corporation (US:WRB) , McKesson Corporation (US:MCK) , Ferguson Enterprises Inc. (US:FERG) , Cboe Global Markets, Inc. (US:CBOE) , and Markel Group Inc. (US:MKL) . Posisi baru Anchor Capital Advisors Llc meliputi: Rexford Industrial Realty, Inc. (US:REXR) , ConnectOne Bancorp, Inc. (US:CNOB) , The Toro Company (US:TTC) , Mr. Cooper Group Inc. (US:WMIH) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.66 | 45.29 | 1.3292 | 1.3235 | |

| 1.13 | 40.37 | 1.1849 | 1.1849 | |

| 0.36 | 77.94 | 2.2877 | 1.0109 | |

| 0.09 | 16.16 | 0.4742 | 0.4649 | |

| 0.31 | 45.11 | 1.3240 | 0.3543 | |

| 0.46 | 56.32 | 1.6531 | 0.2935 | |

| 0.36 | 49.20 | 1.4440 | 0.2892 | |

| 0.08 | 14.77 | 0.4334 | 0.2717 | |

| 0.28 | 67.70 | 1.9872 | 0.2696 | |

| 0.19 | 25.63 | 0.7521 | 0.2635 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 4.75 | 0.1395 | -1.1263 | |

| 0.05 | 1.62 | 0.0474 | -1.0314 | |

| 0.01 | 0.95 | 0.0280 | -0.9427 | |

| 0.26 | 21.64 | 0.6352 | -0.4051 | |

| 0.02 | 2.61 | 0.0766 | -0.3063 | |

| 0.29 | 40.42 | 1.1864 | -0.2600 | |

| 0.18 | 25.15 | 0.7381 | -0.2207 | |

| 0.73 | 29.68 | 0.8711 | -0.2178 | |

| 0.08 | 34.94 | 1.0257 | -0.2140 | |

| 0.06 | 11.86 | 0.3483 | -0.2099 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-06 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| WRB / W. R. Berkley Corporation | 1.18 | -4.14 | 86.98 | -1.03 | 2.5529 | -0.0703 | |||

| MCK / McKesson Corporation | 0.12 | -3.58 | 85.75 | 4.99 | 2.5170 | 0.0790 | |||

| FERG / Ferguson Enterprises Inc. | 0.36 | 34.07 | 77.94 | 82.20 | 2.2877 | 1.0109 | |||

| CBOE / Cboe Global Markets, Inc. | 0.32 | -5.01 | 75.77 | -2.10 | 2.2241 | -0.0862 | |||

| MKL / Markel Group Inc. | 0.04 | -5.48 | 71.10 | 0.98 | 2.0868 | -0.0147 | |||

| MTB / M&T Bank Corporation | 0.36 | 5.63 | 70.45 | 14.63 | 2.0680 | 0.2335 | |||

| ADI / Analog Devices, Inc. | 0.28 | -0.31 | 67.70 | 17.65 | 1.9872 | 0.2696 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.35 | 0.10 | 66.14 | 6.17 | 1.9412 | 0.0819 | |||

| CRH / CRH plc | 0.67 | -2.75 | 61.79 | 1.48 | 1.8137 | -0.0037 | |||

| CNH / CNH Industrial N.V. | 4.67 | -0.82 | 60.57 | 4.67 | 1.7778 | 0.0506 | |||

| CASY / Casey's General Stores, Inc. | 0.11 | -4.09 | 58.12 | 12.75 | 1.7059 | 0.1673 | |||

| LAMR / Lamar Advertising Company | 0.46 | 15.92 | 56.32 | 23.65 | 1.6531 | 0.2935 | |||

| MAA / Mid-America Apartment Communities, Inc. | 0.36 | 18.34 | 52.79 | 4.52 | 1.5495 | 0.0419 | |||

| BSX / Boston Scientific Corporation | 0.48 | -3.05 | 51.69 | 3.22 | 1.5171 | 0.0225 | |||

| CTVA / Corteva, Inc. | 0.69 | -4.00 | 51.07 | 13.70 | 1.4990 | 0.1583 | |||

| SNX / TD SYNNEX Corporation | 0.36 | -2.58 | 49.20 | 27.16 | 1.4440 | 0.2892 | |||

| LNT / Alliant Energy Corporation | 0.80 | -1.84 | 48.54 | -7.75 | 1.4247 | -0.1459 | |||

| ADSK / Autodesk, Inc. | 0.16 | -3.35 | 48.09 | 14.28 | 1.4114 | 0.1555 | |||

| CCI / Crown Castle Inc. | 0.46 | 2.73 | 47.71 | 1.25 | 1.4004 | -0.0061 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.63 | 6.14 | 46.83 | -2.59 | 1.3745 | -0.0604 | |||

| SOLV / Solventum Corporation | 0.61 | -3.42 | 46.36 | -3.67 | 1.3607 | -0.0758 | |||

| HUBB / Hubbell Incorporated | 0.11 | -1.49 | 46.36 | 21.58 | 1.3606 | 0.2226 | |||

| KDP / Keurig Dr Pepper Inc. | 1.38 | 0.40 | 45.55 | -3.00 | 1.3370 | -0.0647 | |||

| DD / DuPont de Nemours, Inc. | 0.66 | 17,836.78 | 45.29 | 16,610.70 | 1.3292 | 1.3235 | |||

| BWXT / BWX Technologies, Inc. | 0.31 | -4.92 | 45.11 | 38.85 | 1.3240 | 0.3543 | |||

| XEL / Xcel Energy Inc. | 0.66 | 2.42 | 44.97 | -1.47 | 1.3199 | -0.0423 | |||

| JPM / JPMorgan Chase & Co. | 0.15 | -1.18 | 44.73 | 16.79 | 1.3130 | 0.1698 | |||

| FLR / Fluor Corporation | 0.86 | -12.45 | 44.24 | 25.31 | 1.2984 | 0.2447 | |||

| HSY / The Hershey Company | 0.26 | 0.61 | 42.96 | -2.38 | 1.2610 | -0.0526 | |||

| BR / Broadridge Financial Solutions, Inc. | 0.17 | -4.69 | 41.75 | -4.47 | 1.2253 | -0.0790 | |||

| YUM / Yum! Brands, Inc. | 0.28 | 19.13 | 41.57 | 12.18 | 1.2202 | 0.1141 | |||

| ACGL / Arch Capital Group Ltd. | 0.45 | -3.20 | 41.27 | -8.37 | 1.2113 | -0.1329 | |||

| FANG / Diamondback Energy, Inc. | 0.29 | -2.94 | 40.42 | -16.59 | 1.1864 | -0.2600 | |||

| REXR / Rexford Industrial Realty, Inc. | 1.13 | 40.37 | 1.1849 | 1.1849 | |||||

| EXPD / Expeditors International of Washington, Inc. | 0.35 | -2.06 | 40.35 | -6.94 | 1.1843 | -0.1099 | |||

| TEL / TE Connectivity plc | 0.24 | -22.30 | 40.00 | -7.26 | 1.1740 | -0.1133 | |||

| AJG / Arthur J. Gallagher & Co. | 0.12 | -1.45 | 39.74 | -8.62 | 1.1666 | -0.1316 | |||

| TOL / Toll Brothers, Inc. | 0.34 | -7.70 | 38.30 | -0.23 | 1.1242 | -0.0217 | |||

| WSO / Watsco, Inc. | 0.08 | -3.16 | 34.94 | -15.86 | 1.0257 | -0.2140 | |||

| SSNC / SS&C Technologies Holdings, Inc. | 0.42 | -3.29 | 34.74 | -4.14 | 1.0197 | -0.0620 | |||

| FIS / Fidelity National Information Services, Inc. | 0.42 | -8.53 | 33.86 | -0.28 | 0.9939 | -0.0197 | |||

| NSC / Norfolk Southern Corporation | 0.13 | -2.46 | 33.36 | 5.41 | 0.9792 | 0.0346 | |||

| GMED / Globus Medical, Inc. | 0.56 | 4.84 | 33.23 | -15.47 | 0.9752 | -0.1980 | |||

| MSFT / Microsoft Corporation | 0.07 | -2.61 | 33.12 | 29.05 | 0.9721 | 0.2061 | |||

| AVY / Avery Dennison Corporation | 0.19 | -0.44 | 32.69 | -1.83 | 0.9595 | -0.0345 | |||

| GPC / Genuine Parts Company | 0.26 | -1.97 | 31.77 | -0.19 | 0.9326 | -0.0176 | |||

| CPAY / Corpay, Inc. | 0.09 | -2.93 | 30.39 | -7.63 | 0.8920 | -0.0900 | |||

| POR / Portland General Electric Company | 0.73 | -10.70 | 29.68 | -18.65 | 0.8711 | -0.2178 | |||

| TT / Trane Technologies plc | 0.06 | -4.98 | 28.26 | 23.36 | 0.8293 | 0.1456 | |||

| IT / Gartner, Inc. | 0.07 | -0.41 | 27.66 | -4.09 | 0.8120 | -0.0490 | |||

| RTX / RTX Corporation | 0.18 | -2.62 | 26.54 | 7.35 | 0.7791 | 0.0411 | |||

| IWS / iShares Trust - iShares Russell Mid-Cap Value ETF | 0.19 | 49.21 | 25.63 | 56.53 | 0.7521 | 0.2635 | |||

| GS / The Goldman Sachs Group, Inc. | 0.04 | -0.12 | 25.33 | 29.40 | 0.7436 | 0.1592 | |||

| NSIT / Insight Enterprises, Inc. | 0.18 | -14.96 | 25.15 | -21.72 | 0.7381 | -0.2207 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.05 | -2.13 | 23.91 | -10.74 | 0.7018 | -0.0977 | |||

| IEI / iShares Trust - iShares 3-7 Year Treasury Bond ETF | 0.20 | -2.96 | 23.90 | -2.18 | 0.7016 | -0.0278 | |||

| JNJ / Johnson & Johnson | 0.15 | -0.36 | 23.45 | -8.22 | 0.6883 | -0.0744 | |||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | 0.23 | 42.20 | 22.23 | 42.80 | 0.6524 | 0.1878 | |||

| SHY / iShares Trust - iShares 1-3 Year Treasury Bond ETF | 0.26 | -38.01 | 21.64 | -37.91 | 0.6352 | -0.4051 | |||

| CB / Chubb Limited | 0.07 | -2.00 | 21.58 | -5.98 | 0.6335 | -0.0517 | |||

| PGR / The Progressive Corporation | 0.07 | -3.23 | 19.64 | -8.76 | 0.5766 | -0.0660 | |||

| IDA / IDACORP, Inc. | 0.17 | -2.49 | 19.51 | -3.13 | 0.5726 | -0.0285 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.27 | 0.01 | 18.86 | -3.90 | 0.5536 | -0.0322 | |||

| ABT / Abbott Laboratories | 0.14 | -2.06 | 18.46 | 0.42 | 0.5420 | -0.0068 | |||

| CME / CME Group Inc. | 0.07 | -0.63 | 18.08 | 3.24 | 0.5307 | 0.0080 | |||

| SHV / iShares Trust - iShares Short Treasury Bond ETF | 0.16 | -1.67 | 18.04 | -1.71 | 0.5296 | -0.0183 | |||

| AXP / American Express Company | 0.06 | 20.67 | 18.00 | 43.06 | 0.5282 | 0.1528 | |||

| TECK / Teck Resources Limited | 0.43 | -10.21 | 17.52 | -0.47 | 0.5143 | -0.0112 | |||

| IGSB / iShares Trust - iShares 1-5 Year Investment Grade Corporate Bond ETF | 0.33 | -2.46 | 17.34 | -1.73 | 0.5089 | -0.0177 | |||

| PG / The Procter & Gamble Company | 0.11 | -2.11 | 17.07 | -8.48 | 0.5011 | -0.0557 | |||

| CVX / Chevron Corporation | 0.12 | -0.96 | 16.99 | -15.22 | 0.4987 | -0.0995 | |||

| ETR / Entergy Corporation | 0.20 | -3.75 | 16.97 | -6.42 | 0.4979 | -0.0432 | |||

| BDX / Becton, Dickinson and Company | 0.09 | 6,761.89 | 16.16 | 5,061.98 | 0.4742 | 0.4649 | |||

| HON / Honeywell International Inc. | 0.07 | -0.37 | 16.10 | 9.57 | 0.4726 | 0.0340 | |||

| HAL / Halliburton Company | 0.79 | 22.80 | 16.08 | -1.36 | 0.4720 | -0.0146 | |||

| WMT / Walmart Inc. | 0.16 | -24.86 | 15.94 | -16.31 | 0.4678 | -0.1006 | |||

| MCD / McDonald's Corporation | 0.05 | -2.23 | 15.62 | -8.56 | 0.4583 | -0.0514 | |||

| AMT / American Tower Corporation | 0.07 | -1.85 | 15.09 | -0.31 | 0.4429 | -0.0089 | |||

| AMAT / Applied Materials, Inc. | 0.08 | 116.11 | 14.77 | 172.62 | 0.4334 | 0.2717 | |||

| LMT / Lockheed Martin Corporation | 0.03 | 21.21 | 14.50 | 25.68 | 0.4255 | 0.0812 | |||

| APD / Air Products and Chemicals, Inc. | 0.05 | -0.91 | 14.32 | -5.22 | 0.4202 | -0.0307 | |||

| UNP / Union Pacific Corporation | 0.06 | -1.29 | 14.00 | -3.87 | 0.4109 | -0.0238 | |||

| LOW / Lowe's Companies, Inc. | 0.06 | -1.05 | 13.89 | -5.86 | 0.4076 | -0.0327 | |||

| V / Visa Inc. | 0.04 | -2.36 | 13.84 | -1.09 | 0.4063 | -0.0114 | |||

| ALC / Alcon Inc. | 0.15 | -2.09 | 13.38 | -8.95 | 0.3926 | -0.0459 | |||

| PEP / PepsiCo, Inc. | 0.10 | -0.14 | 13.26 | -12.06 | 0.3892 | -0.0609 | |||

| O / Realty Income Corporation | 0.22 | -0.80 | 12.92 | -1.49 | 0.3793 | -0.0122 | |||

| IGIB / iShares Trust - iShares 5-10 Year Investment Grade Corporate Bond ETF | 0.23 | -2.61 | 12.20 | -1.18 | 0.3582 | -0.0104 | |||

| CMCSA / Comcast Corporation | 0.34 | -1.83 | 11.97 | -5.04 | 0.3513 | -0.0249 | |||

| ABBV / AbbVie Inc. | 0.06 | -28.38 | 11.86 | -36.55 | 0.3483 | -0.2099 | |||

| MPC / Marathon Petroleum Corporation | 0.07 | -1.44 | 11.74 | 12.37 | 0.3445 | 0.0327 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.03 | -5.44 | 11.18 | -22.94 | 0.3282 | -0.1050 | |||

| PH / Parker-Hannifin Corporation | 0.02 | -2.40 | 10.88 | 12.16 | 0.3192 | 0.0298 | |||

| SLB / Schlumberger Limited | 0.27 | -3.98 | 9.28 | -22.36 | 0.2724 | -0.0844 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.09 | 1.46 | 9.17 | -2.36 | 0.2693 | -0.0112 | |||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.15 | -2.80 | 8.95 | -5.63 | 0.2628 | -0.0204 | |||

| MBB / iShares Trust - iShares MBS ETF | 0.09 | -2.62 | 8.69 | -2.50 | 0.2550 | -0.0110 | |||

| OTIS / Otis Worldwide Corporation | 0.08 | -1.74 | 8.19 | -5.72 | 0.2405 | -0.0189 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.12 | -26.80 | 8.14 | -30.41 | 0.2389 | -0.1102 | |||

| CRM / Salesforce, Inc. | 0.03 | -0.84 | 8.02 | 0.75 | 0.2353 | -0.0022 | |||

| UNH / UnitedHealth Group Incorporated | 0.03 | -7.67 | 7.84 | -45.00 | 0.2301 | -0.1953 | |||

| FCX / Freeport-McMoRan Inc. | 0.16 | 0.16 | 6.78 | 14.69 | 0.1991 | 0.0226 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.08 | -5.89 | 6.34 | -5.23 | 0.1862 | -0.0136 | |||

| AAPL / Apple Inc. | 0.03 | -2.16 | 6.17 | -9.63 | 0.1810 | -0.0227 | |||

| AHR / American Healthcare REIT, Inc. | 0.17 | -1.45 | 6.14 | 19.49 | 0.1802 | 0.0268 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.01 | 3.41 | 5.97 | -14.40 | 0.1752 | -0.0329 | |||

| IWB / iShares Trust - iShares Russell 1000 ETF | 0.02 | -6.02 | 5.27 | 4.05 | 0.1546 | 0.0035 | |||

| VCIT / Vanguard Scottsdale Funds - Vanguard Intermediate-Term Corporate Bond ETF | 0.06 | -1.58 | 5.07 | -0.20 | 0.1487 | -0.0028 | |||

| SUI / Sun Communities, Inc. | 0.04 | -88.60 | 4.75 | -88.79 | 0.1395 | -1.1263 | |||

| ETN / Eaton Corporation plc | 0.01 | -31.96 | 4.62 | -10.65 | 0.1355 | -0.0187 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.02 | 33.38 | 4.60 | 37.69 | 0.1350 | 0.0353 | |||

| MINT / PIMCO ETF Trust - PIMCO Enhanced Short Maturity Active Exchange-Traded Fund | 0.04 | -20.00 | 3.92 | -20.09 | 0.1151 | -0.0313 | |||

| LQD / iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF | 0.03 | -0.62 | 3.19 | 0.22 | 0.0935 | -0.0014 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.05 | -1.99 | 3.15 | 0.67 | 0.0923 | -0.0009 | |||

| TPL / Texas Pacific Land Corporation | 0.00 | -0.07 | 3.10 | -20.32 | 0.0910 | -0.0252 | |||

| DAKT / Daktronics, Inc. | 0.20 | -2.22 | 2.96 | 21.40 | 0.0869 | 0.0141 | |||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.03 | -12.49 | 2.83 | -5.38 | 0.0832 | -0.0062 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.01 | -14.77 | 2.81 | -7.83 | 0.0826 | -0.0085 | |||

| BSV / Vanguard Bond Index Funds - Vanguard Short-Term Bond ETF | 0.04 | -0.98 | 2.78 | -0.47 | 0.0816 | -0.0018 | |||

| NIC / Nicolet Bankshares, Inc. | 0.02 | -3.49 | 2.75 | 9.36 | 0.0806 | 0.0057 | |||

| REVG / REV Group, Inc. | 0.06 | -7.93 | 2.71 | 38.67 | 0.0796 | 0.0212 | |||

| BAH / Booz Allen Hamilton Holding Corporation | 0.03 | -11.07 | 2.65 | -11.48 | 0.0777 | -0.0115 | |||

| APO / Apollo Global Management, Inc. | 0.02 | -80.36 | 2.61 | -79.65 | 0.0766 | -0.3063 | |||

| MGNR / American Beacon Select Funds - American Beacon GLG Natural Resources ETF | 0.08 | 6.94 | 2.52 | 19.32 | 0.0740 | 0.0109 | |||

| EG / Everest Group, Ltd. | 0.01 | 13.04 | 2.48 | 5.75 | 0.0729 | 0.0028 | |||

| SENEA / Seneca Foods Corporation | 0.02 | -3.41 | 2.30 | 10.03 | 0.0676 | 0.0051 | |||

| RPM / RPM International Inc. | 0.02 | 0.79 | 2.28 | -4.28 | 0.0670 | -0.0042 | |||

| AON / Aon plc | 0.01 | -6.46 | 2.27 | -16.38 | 0.0665 | -0.0144 | |||

| MGY / Magnolia Oil & Gas Corporation | 0.10 | -3.04 | 2.15 | -13.71 | 0.0632 | -0.0113 | |||

| ATMU / Atmus Filtration Technologies Inc. | 0.06 | -0.83 | 2.10 | -1.69 | 0.0616 | -0.0021 | |||

| JCI / Johnson Controls International plc | 0.02 | 0.00 | 2.09 | 31.90 | 0.0613 | 0.0140 | |||

| HWKN / Hawkins, Inc. | 0.01 | -3.04 | 2.00 | 30.05 | 0.0588 | 0.0128 | |||

| CNOB / ConnectOne Bancorp, Inc. | 0.09 | 2.00 | 0.0587 | 0.0587 | |||||

| CBU / Community Financial System, Inc. | 0.03 | -0.34 | 1.88 | -0.32 | 0.0551 | -0.0011 | |||

| PJT / PJT Partners Inc. | 0.01 | -3.02 | 1.87 | 16.08 | 0.0549 | 0.0068 | |||

| CVCO / Cavco Industries, Inc. | 0.00 | -17.01 | 1.84 | -30.62 | 0.0539 | -0.0251 | |||

| CL / Colgate-Palmolive Company | 0.02 | -7.53 | 1.82 | -10.28 | 0.0533 | -0.0071 | |||

| MSA / MSA Safety Incorporated | 0.01 | -1.13 | 1.81 | 12.88 | 0.0530 | 0.0053 | |||

| ICFI / ICF International, Inc. | 0.02 | 1.74 | 0.0511 | 0.0511 | |||||

| UBSI / United Bankshares, Inc. | 0.05 | -2.55 | 1.74 | 2.36 | 0.0510 | 0.0003 | |||

| VGSH / Vanguard Scottsdale Funds - Vanguard Short-Term Treasury ETF | 0.03 | 0.00 | 1.72 | 0.12 | 0.0505 | -0.0008 | |||

| TTC / The Toro Company | 0.02 | 1.72 | 0.0504 | 0.0504 | |||||

| STAG / STAG Industrial, Inc. | 0.04 | -2.40 | 1.63 | -1.99 | 0.0477 | -0.0018 | |||

| NSA / National Storage Affiliates Trust | 0.05 | -94.49 | 1.62 | -95.53 | 0.0474 | -1.0314 | |||

| UTL / Unitil Corporation | 0.03 | 0.64 | 1.62 | -9.01 | 0.0474 | -0.0056 | |||

| SKYW / SkyWest, Inc. | 0.02 | -3.26 | 1.58 | 14.02 | 0.0463 | 0.0050 | |||

| MDLZ / Mondelez International, Inc. | 0.02 | -39.84 | 1.56 | -40.21 | 0.0459 | -0.0322 | |||

| NNI / Nelnet, Inc. | 0.01 | -3.42 | 1.56 | 5.41 | 0.0458 | 0.0016 | |||

| MEC / Mayville Engineering Company, Inc. | 0.10 | -3.18 | 1.56 | 15.07 | 0.0457 | 0.0053 | |||

| ROCK / Gibraltar Industries, Inc. | 0.03 | -1.23 | 1.55 | -0.64 | 0.0456 | -0.0011 | |||

| CHRD / Chord Energy Corporation | 0.02 | -20.70 | 1.54 | -31.87 | 0.0451 | -0.0222 | |||

| FBND / Fidelity Merrimack Street Trust - Fidelity Total Bond ETF | 0.03 | -38.86 | 1.37 | -38.71 | 0.0402 | -0.0265 | |||

| GOOGL / Alphabet Inc. | 0.01 | 0.00 | 1.35 | 13.98 | 0.0395 | 0.0043 | |||

| HIFS / Hingham Institution for Savings | 0.01 | -1.40 | 1.31 | 2.98 | 0.0386 | 0.0005 | |||

| KO / The Coca-Cola Company | 0.02 | -10.44 | 1.30 | -11.50 | 0.0382 | -0.0057 | |||

| SAFT / Safety Insurance Group, Inc. | 0.02 | -3.39 | 1.29 | -2.79 | 0.0379 | -0.0017 | |||

| VV / Vanguard Index Funds - Vanguard Large-Cap ETF | 0.00 | -7.41 | 1.29 | 2.71 | 0.0379 | 0.0004 | |||

| WINA / Winmark Corporation | 0.00 | -2.83 | 1.27 | 15.48 | 0.0372 | 0.0044 | |||

| ORCL / Oracle Corporation | 0.01 | 0.00 | 1.26 | 56.54 | 0.0369 | 0.0129 | |||

| ETON / Eton Pharmaceuticals, Inc. | 0.09 | 45.67 | 1.25 | 59.92 | 0.0367 | 0.0133 | |||

| CHCT / Community Healthcare Trust Incorporated | 0.08 | -2.03 | 1.25 | -10.27 | 0.0367 | -0.0049 | |||

| SYK / Stryker Corporation | 0.00 | 0.00 | 1.24 | 6.27 | 0.0363 | 0.0016 | |||

| ULH / Universal Logistics Holdings, Inc. | 0.05 | -1.25 | 1.23 | -4.49 | 0.0362 | -0.0023 | |||

| IWN / iShares Trust - iShares Russell 2000 Value ETF | 0.01 | 17.77 | 1.18 | 23.15 | 0.0347 | 0.0060 | |||

| FI / Fiserv, Inc. | 0.01 | -2.01 | 1.18 | -23.47 | 0.0346 | -0.0114 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | -84.16 | 1.15 | -83.58 | 0.0337 | -0.1752 | |||

| BV / BrightView Holdings, Inc. | 0.07 | -3.05 | 1.14 | 25.72 | 0.0334 | 0.0064 | |||

| ASUR / Asure Software, Inc. | 0.12 | -3.31 | 1.14 | -1.22 | 0.0334 | -0.0010 | |||

| SSD / Simpson Manufacturing Co., Inc. | 0.01 | -0.43 | 1.12 | -1.59 | 0.0328 | -0.0011 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -2.31 | 1.11 | -11.47 | 0.0326 | -0.0048 | |||

| GOOG / Alphabet Inc. | 0.01 | 0.00 | 1.11 | 13.60 | 0.0326 | 0.0034 | |||

| EA / Electronic Arts Inc. | 0.01 | -12.53 | 1.10 | -3.34 | 0.0323 | -0.0017 | |||

| HLMN / Hillman Solutions Corp. | 0.15 | 2.90 | 1.09 | -16.44 | 0.0319 | -0.0069 | |||

| UFPT / UFP Technologies, Inc. | 0.00 | -2.57 | 1.05 | 17.95 | 0.0307 | 0.0042 | |||

| MGRC / McGrath RentCorp | 0.01 | -2.62 | 1.03 | 1.38 | 0.0303 | -0.0001 | |||

| PYPL / PayPal Holdings, Inc. | 0.01 | -4.66 | 1.03 | 8.58 | 0.0301 | 0.0019 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.01 | -5.76 | 1.02 | 3.02 | 0.0301 | 0.0004 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 70.50 | 1.01 | 96.88 | 0.0296 | 0.0143 | |||

| IGF / iShares Trust - iShares Global Infrastructure ETF | 0.02 | -0.70 | 0.98 | 7.56 | 0.0288 | 0.0016 | |||

| CXT / Crane NXT, Co. | 0.02 | -26.83 | 0.98 | -23.29 | 0.0286 | -0.0093 | |||

| HOLX / Hologic, Inc. | 0.01 | 0.00 | 0.96 | 5.52 | 0.0280 | 0.0010 | |||

| AOS / A. O. Smith Corporation | 0.01 | -97.08 | 0.95 | -97.07 | 0.0280 | -0.9427 | |||

| CTRN / Citi Trends, Inc. | 0.03 | -2.97 | 0.94 | 46.50 | 0.0277 | 0.0084 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 78.32 | 0.92 | 97.20 | 0.0269 | 0.0130 | |||

| MDT / Medtronic plc | 0.01 | -5.75 | 0.88 | -8.53 | 0.0258 | -0.0029 | |||

| FLOT / iShares Trust - iShares Floating Rate Bond ETF | 0.02 | 0.00 | 0.83 | 0.00 | 0.0243 | -0.0004 | |||

| MAR / Marriott International, Inc. | 0.00 | -2.06 | 0.82 | 12.35 | 0.0240 | 0.0023 | |||

| FAF / First American Financial Corporation | 0.01 | -28.78 | 0.82 | -33.44 | 0.0240 | -0.0127 | |||

| BA / The Boeing Company | 0.00 | 0.00 | 0.74 | 22.85 | 0.0218 | 0.0038 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | -0.58 | 0.72 | 11.84 | 0.0211 | 0.0019 | |||

| ACWI / iShares Trust - iShares MSCI ACWI ETF | 0.01 | -9.97 | 0.71 | -0.56 | 0.0210 | -0.0005 | |||

| FDS / FactSet Research Systems Inc. | 0.00 | 0.00 | 0.67 | -1.62 | 0.0197 | -0.0007 | |||

| JILL / J.Jill, Inc. | 0.05 | -3.08 | 0.66 | -27.31 | 0.0194 | -0.0077 | |||

| CROX / Crocs, Inc. | 0.01 | -2.71 | 0.66 | -7.19 | 0.0193 | -0.0019 | |||

| STT / State Street Corporation | 0.01 | -1.45 | 0.65 | 17.12 | 0.0191 | 0.0025 | |||

| ES / Eversource Energy | 0.01 | -42.10 | 0.61 | -40.66 | 0.0179 | -0.0128 | |||

| RMD / ResMed Inc. | 0.00 | 0.00 | 0.60 | 15.33 | 0.0177 | 0.0021 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 0.60 | -5.69 | 0.0175 | -0.0014 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -4.47 | 0.60 | 5.66 | 0.0175 | 0.0006 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | 0.00 | 0.58 | 10.63 | 0.0171 | 0.0014 | |||

| TXN / Texas Instruments Incorporated | 0.00 | 0.00 | 0.58 | 15.51 | 0.0171 | 0.0020 | |||

| SAIC / Science Applications International Corporation | 0.01 | -1.54 | 0.57 | -1.22 | 0.0167 | -0.0005 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | 0.00 | 0.54 | -0.37 | 0.0159 | -0.0003 | |||

| DFH / Dream Finders Homes, Inc. | 0.02 | -6.36 | 0.53 | 4.31 | 0.0157 | 0.0004 | |||

| AME / AMETEK, Inc. | 0.00 | 0.00 | 0.49 | 5.11 | 0.0145 | 0.0005 | |||

| COP / ConocoPhillips | 0.01 | -1.04 | 0.47 | -15.47 | 0.0138 | -0.0028 | |||

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 0.00 | 0.00 | 0.42 | 10.37 | 0.0122 | 0.0010 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 2.45 | 0.41 | 13.15 | 0.0121 | 0.0012 | |||

| VNT / Vontier Corporation | 0.01 | -13.94 | 0.41 | -3.28 | 0.0121 | -0.0006 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 0.41 | 0.00 | 0.0121 | -0.0002 | |||

| ULTA / Ulta Beauty, Inc. | 0.00 | -6.16 | 0.41 | 19.77 | 0.0121 | 0.0018 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.00 | -13.24 | 0.41 | -13.01 | 0.0120 | -0.0020 | |||

| MAGS / Listed Funds Trust - Roundhill Magnificent Seven ETF | 0.01 | -36.90 | 0.38 | -23.66 | 0.0113 | -0.0037 | |||

| BND / Vanguard Bond Index Funds - Vanguard Total Bond Market ETF | 0.01 | 0.00 | 0.38 | 0.27 | 0.0110 | -0.0002 | |||

| SPGI / S&P Global Inc. | 0.00 | 0.00 | 0.37 | 3.92 | 0.0109 | 0.0002 | |||

| XPO / XPO, Inc. | 0.00 | -6.41 | 0.37 | 9.85 | 0.0108 | 0.0008 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 0.36 | 17.43 | 0.0105 | 0.0014 | |||

| AMGN / Amgen Inc. | 0.00 | 0.00 | 0.34 | -10.42 | 0.0101 | -0.0014 | |||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.00 | 0.00 | 0.31 | 6.08 | 0.0092 | 0.0004 | |||

| VCLT / Vanguard Scottsdale Funds - Vanguard Long-Term Corporate Bond ETF | 0.00 | 0.00 | 0.31 | 0.00 | 0.0092 | -0.0002 | |||

| K / Kellanova | 0.00 | 0.00 | 0.30 | -3.51 | 0.0089 | -0.0005 | |||

| KR / The Kroger Co. | 0.00 | 0.00 | 0.29 | 5.93 | 0.0084 | 0.0003 | |||

| SO / The Southern Company | 0.00 | 0.00 | 0.28 | 0.00 | 0.0081 | -0.0001 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.00 | -1.76 | 0.27 | -3.55 | 0.0080 | -0.0004 | |||

| USMV / iShares Trust - iShares MSCI USA Min Vol Factor ETF | 0.00 | 0.00 | 0.27 | 0.37 | 0.0079 | -0.0001 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.27 | 28.37 | 0.0078 | 0.0016 | |||

| C / Citigroup Inc. | 0.00 | -22.50 | 0.25 | -7.06 | 0.0074 | -0.0007 | |||

| WWD / Woodward, Inc. | 0.00 | 0.25 | 0.0072 | 0.0072 | |||||

| HCI / HCI Group, Inc. | 0.00 | 10.53 | 0.24 | 12.74 | 0.0070 | 0.0007 | |||

| CP / Canadian Pacific Kansas City Limited | 0.00 | -9.85 | 0.23 | 1.78 | 0.0067 | 0.0000 | |||

| WAT / Waters Corporation | 0.00 | -2.38 | 0.23 | -7.29 | 0.0067 | -0.0007 | |||

| LIN / Linde plc | 0.00 | 0.00 | 0.23 | 0.90 | 0.0066 | -0.0001 | |||

| IJJ / iShares Trust - iShares S&P Mid-Cap 400 Value ETF | 0.00 | -52.29 | 0.22 | -50.67 | 0.0065 | -0.0069 | |||

| IWX / iShares Trust - iShares Russell Top 200 Value ETF | 0.00 | -20.19 | 0.22 | -18.18 | 0.0064 | -0.0015 | |||

| WMIH / Mr. Cooper Group Inc. | 0.00 | 0.21 | 0.0062 | 0.0062 | |||||

| HES / Hess Corporation | 0.00 | 0.00 | 0.21 | -13.22 | 0.0062 | -0.0011 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.00 | 0.21 | 0.0061 | 0.0061 | |||||

| WTW / Willis Towers Watson Public Limited Company | 0.00 | 0.00 | 0.20 | -9.42 | 0.0059 | -0.0007 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.00 | -4.00 | 0.20 | -1.46 | 0.0059 | -0.0002 | |||

| EVLV / Evolv Technologies Holdings, Inc. | 0.02 | 0.00 | 0.10 | 102.00 | 0.0030 | 0.0015 | |||

| SPB / Spectrum Brands Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HELE / Helen of Troy Limited | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VOE / Vanguard Index Funds - Vanguard Mid-Cap Value ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BIO / Bio-Rad Laboratories, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NEE / NextEra Energy, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PFE / Pfizer Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FLIC / The First of Long Island Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ROST / Ross Stores, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PLOW / Douglas Dynamics, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |