Mga Batayang Estadistika

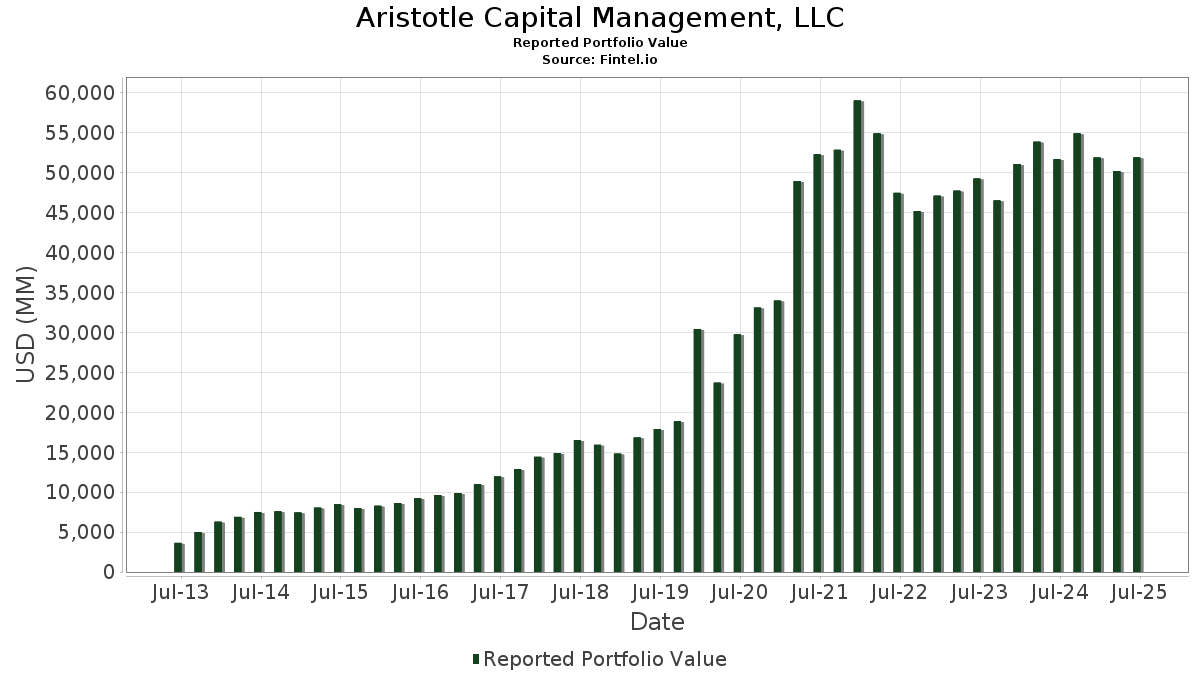

| Profil Orang Dalam | Aristotle Capital Management, LLC |

| Nilai Portofolio | $ 51,920,364,015 |

| Posisi Saat Ini | 184 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

Aristotle Capital Management, LLC telah mengungkapkan total kepemilikan 184 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 51,920,364,015 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Aristotle Capital Management, LLC adalah Parker-Hannifin Corporation (US:PH) , Microsoft Corporation (US:MSFT) , Capital One Financial Corporation (US:COF) , Corteva, Inc. (US:CTVA) , and Williams-Sonoma, Inc. (US:WSM) . Posisi baru Aristotle Capital Management, LLC meliputi: Uber Technologies, Inc. (US:UBER) , . Industri unggulan Aristotle Capital Management, LLC adalah "Lumber And Wood Products, Except Furniture" (sic 24) , "Restaurants, Dining, Eating And Drinking Places" (sic 58) , and "Railroad Transportation" (sic 40) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 11.84 | 1,104.32 | 2.1270 | 2.1270 | |

| 1.58 | 809.32 | 1.5588 | 1.3342 | |

| 5.35 | 428.31 | 0.8249 | 0.8249 | |

| 3.84 | 1,908.25 | 3.6753 | 0.7060 | |

| 13.76 | 968.11 | 1.8646 | 0.5085 | |

| 7.76 | 1,651.19 | 3.1802 | 0.4054 | |

| 3.04 | 2,122.95 | 4.0889 | 0.3434 | |

| 22.01 | 1,640.72 | 3.1601 | 0.3226 | |

| 2.28 | 1,249.24 | 2.4061 | 0.1789 | |

| 5.96 | 677.28 | 1.3045 | 0.1647 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 4.34 | 0.0084 | -1.8824 | |

| 0.90 | 316.87 | 0.6103 | -1.3210 | |

| 2.55 | 1,359.79 | 2.6190 | -0.4319 | |

| 11.08 | 977.75 | 1.8832 | -0.4263 | |

| 3.63 | 1,012.90 | 1.9509 | -0.3472 | |

| 32.57 | 826.51 | 1.5919 | -0.3158 | |

| 8.14 | 644.02 | 1.2404 | -0.2729 | |

| 6.48 | 402.82 | 0.7758 | -0.2632 | |

| 5.43 | 864.80 | 1.6656 | -0.2126 | |

| 6.59 | 916.22 | 1.7647 | -0.2067 |

Pengajuan 13D/G

Ini adalah daftar pengajuan 13D dan 13G yang dibuat dalam setahun terakhir (jika ada). Klik ikon tautan untuk melihat riwayat transaksi lengkap. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup.

| Tanggal File | Formulir | Keamanan | Sebelumnya Saham |

Saat ini Saham |

ΔPersentase Saham | % Kepemilikan |

% ΔKepemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | CBSH / Commerce Bancshares, Inc. | 8,844,209 | 6,479,179 | -26.74 | 4.86 | -28.32 | ||

| 2025-08-14 | CFR / Cullen/Frost Bankers, Inc. | 6,242,873 | 5,598,812 | -10.32 | 8.70 | -10.77 | ||

| 2025-05-15 | ATO / Atmos Energy Corporation | 8,750,234 | 7,797,730 | -10.89 | 4.91 | -15.34 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| PH / Parker-Hannifin Corporation | 3.04 | -1.75 | 2,122.95 | 12.91 | 4.0889 | 0.3434 | |||

| MSFT / Microsoft Corporation | 3.84 | -3.39 | 1,908.25 | 28.01 | 3.6753 | 0.7060 | |||

| COF / Capital One Financial Corporation | 7.76 | -0.11 | 1,651.19 | 18.53 | 3.1802 | 0.4054 | |||

| CTVA / Corteva, Inc. | 22.01 | -2.75 | 1,640.72 | 15.18 | 3.1601 | 0.3226 | |||

| WSM / Williams-Sonoma, Inc. | 9.15 | -0.05 | 1,494.09 | 3.28 | 2.8777 | -0.0039 | |||

| AMP / Ameriprise Financial, Inc. | 2.55 | -19.48 | 1,359.79 | -11.22 | 2.6190 | -0.4319 | |||

| SONY / Sony Group Corporation - Depositary Receipt (Common Stock) | 49.19 | -2.08 | 1,280.30 | 0.39 | 2.4659 | -0.0746 | |||

| MLM / Martin Marietta Materials, Inc. | 2.28 | -2.69 | 1,249.24 | 11.73 | 2.4061 | 0.1789 | |||

| ATO / Atmos Energy Corporation | 7.62 | -2.27 | 1,174.44 | -2.57 | 2.2620 | -0.1390 | |||

| ECL / Ecolab Inc. | 4.26 | -2.30 | 1,149.14 | 3.84 | 2.2133 | 0.0088 | |||

| QCOM / QUALCOMM Incorporated | 6.95 | -1.19 | 1,107.16 | 2.45 | 2.1324 | -0.0203 | |||

| UBER / Uber Technologies, Inc. | 11.84 | 1,104.32 | 2.1270 | 2.1270 | |||||

| GOOG / Alphabet Inc. | 6.05 | -1.41 | 1,073.33 | 11.95 | 2.0673 | 0.1574 | |||

| LEN / Lennar Corporation | 9.68 | -0.76 | 1,070.81 | -4.36 | 2.0624 | -0.1679 | |||

| AIG / American International Group, Inc. | 12.09 | -2.04 | 1,034.70 | -3.56 | 1.9929 | -0.1443 | |||

| AMGN / Amgen Inc. | 3.63 | -2.03 | 1,012.90 | -12.20 | 1.9509 | -0.3472 | |||

| KO / The Coca-Cola Company | 14.30 | -2.35 | 1,011.94 | -3.53 | 1.9490 | -0.1405 | |||

| USB / U.S. Bancorp | 21.82 | -1.92 | 987.29 | 5.12 | 1.9015 | 0.0307 | |||

| ADBE / Adobe Inc. | 2.54 | -0.79 | 981.57 | 0.08 | 1.8905 | -0.0632 | |||

| ALC / Alcon Inc. | 11.08 | -9.38 | 977.75 | -15.67 | 1.8832 | -0.4263 | |||

| MCHP / Microchip Technology Incorporated | 13.76 | -2.17 | 968.11 | 42.21 | 1.8646 | 0.5085 | |||

| TDY / Teledyne Technologies Incorporated | 1.88 | -1.10 | 965.67 | 1.81 | 1.8599 | -0.0295 | |||

| RPM / RPM International Inc. | 8.58 | -2.11 | 942.00 | -7.05 | 1.8143 | -0.2044 | |||

| VZ / Verizon Communications Inc. | 21.57 | -1.82 | 933.21 | -6.34 | 1.7974 | -0.1873 | |||

| AWK / American Water Works Company, Inc. | 6.59 | -1.82 | 916.22 | -7.42 | 1.7647 | -0.2067 | |||

| BX / Blackstone Inc. | 6.04 | -1.94 | 903.71 | 4.94 | 1.7406 | 0.0252 | |||

| PNC / The PNC Financial Services Group, Inc. | 4.81 | -1.49 | 897.51 | 4.48 | 1.7286 | 0.0174 | |||

| XEL / Xcel Energy Inc. | 12.90 | -1.62 | 878.34 | -5.36 | 1.6917 | -0.1570 | |||

| PG / The Procter & Gamble Company | 5.43 | -1.90 | 864.80 | -8.29 | 1.6656 | -0.2126 | |||

| APD / Air Products and Chemicals, Inc. | 3.03 | -2.67 | 855.89 | -6.91 | 1.6485 | -0.1830 | |||

| CTRA / Coterra Energy Inc. | 32.57 | -1.73 | 826.51 | -13.70 | 1.5919 | -0.3158 | |||

| LOW / Lowe's Companies, Inc. | 3.70 | -1.48 | 821.44 | -6.27 | 1.5821 | -0.1637 | |||

| MUFG / Mitsubishi UFJ Financial Group, Inc. - Depositary Receipt (Common Stock) | 59.62 | -1.57 | 817.97 | -0.92 | 1.5754 | -0.0691 | |||

| DHR / Danaher Corporation | 4.12 | -1.38 | 814.47 | -4.97 | 1.5687 | -0.1385 | |||

| GD / General Dynamics Corporation | 2.78 | -3.00 | 809.70 | 3.80 | 1.5595 | 0.0056 | |||

| SNPS / Synopsys, Inc. | 1.58 | 500.57 | 809.32 | 617.97 | 1.5588 | 1.3342 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 12.90 | -1.99 | 791.71 | -6.99 | 1.5249 | -0.1708 | |||

| CFR / Cullen/Frost Bankers, Inc. | 5.60 | -1.13 | 719.68 | 1.50 | 1.3861 | -0.0262 | |||

| OSK / Oshkosh Corporation | 5.96 | -1.92 | 677.28 | 18.37 | 1.3045 | 0.1647 | |||

| MDT / Medtronic plc | 7.68 | -1.19 | 669.91 | -4.15 | 1.2903 | -0.1019 | |||

| MRK / Merck & Co., Inc. | 8.14 | -3.88 | 644.02 | -15.23 | 1.2404 | -0.2729 | |||

| ELS / Equity LifeStyle Properties, Inc. | 9.92 | -2.84 | 611.67 | -10.16 | 1.1781 | -0.1782 | |||

| STZ / Constellation Brands, Inc. | 2.83 | -2.13 | 461.06 | -13.24 | 0.8880 | -0.1705 | |||

| WFC / Wells Fargo & Company | 5.35 | 890,856.83 | 428.31 | 995,967.44 | 0.8249 | 0.8249 | |||

| CBSH / Commerce Bancshares, Inc. | 6.48 | -22.70 | 402.82 | -22.78 | 0.7758 | -0.2632 | |||

| ANSS / ANSYS, Inc. | 0.90 | -70.55 | 316.87 | -67.32 | 0.6103 | -1.3210 | |||

| BN / Brookfield Corporation | 4.49 | -0.06 | 277.32 | 17.95 | 0.5341 | 0.0658 | |||

| CCEP / Coca-Cola Europacific Partners PLC | 1.97 | -0.07 | 183.04 | 6.47 | 0.3525 | 0.0101 | |||

| BAP / Credicorp Ltd. | 0.81 | -0.01 | 180.57 | 20.06 | 0.3478 | 0.0482 | |||

| CAMECO CORP / FOREIGN (00BPCPYT4) | 2.30 | 170.74 | 0.0000 | ||||||

| CCJ / Cameco Corporation | 2.15 | -52.11 | 159.24 | -13.63 | 0.3067 | -0.0605 | |||

| ACN / Accenture plc | 0.52 | 0.52 | 156.37 | -3.71 | 0.3012 | -0.0223 | |||

| TT / Trane Technologies plc | 0.35 | 0.00 | 151.59 | 29.83 | 0.2920 | 0.0594 | |||

| EBKDY / Erste Group Bank AG - Depositary Receipt (Common Stock) | 3.51 | -2.80 | 148.77 | 19.81 | 0.2865 | 0.0392 | |||

| NEMKY / Nemetschek SE - Depositary Receipt (Common Stock) | 1.01 | 2.85 | 145.82 | 28.72 | 0.2808 | 0.0552 | |||

| 6758 / Sony Group Corporation | 5.55 | 2.57 | 143.24 | 5.20 | 0.2759 | 0.0047 | |||

| ING / ING Groep N.V. - Depositary Receipt (Common Stock) | 6.54 | -3.07 | 142.97 | 8.22 | 0.2754 | 0.0122 | |||

| SAFRY / Safran SA - Depositary Receipt (Common Stock) | 1.70 | -2.63 | 137.81 | 20.62 | 0.2654 | 0.0378 | |||

| 3064 / MonotaRO Co., Ltd. | 6.53 | 2.48 | 128.60 | 7.89 | 0.2477 | 0.0103 | |||

| MURGY / Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München - Depositary Receipt (Common Stock) | 0.20 | 2.19 | 127.63 | 4.99 | 0.2458 | 0.0037 | |||

| DQJCY / Pan Pacific International Holdings Corporation - Depositary Receipt (Common Stock) | 3.66 | -2.53 | 125.56 | 22.28 | 0.2418 | 0.0373 | |||

| 7532 / Pan Pacific International Holdings Corporation | 3.63 | 2.56 | 124.67 | 28.77 | 0.2401 | 0.0473 | |||

| D05 / DBS Group Holdings Ltd | 3.27 | 1.18 | 115.20 | 3.19 | 0.2219 | -0.0005 | |||

| MONOY / MonotaRO Co., Ltd. - Depositary Receipt (Common Stock) | 5.83 | -2.35 | 114.80 | 2.83 | 0.2211 | -0.0013 | |||

| MS / Morgan Stanley | 0.80 | 0.00 | 112.05 | 20.73 | 0.2158 | 0.0309 | |||

| SAF / Safran SA | 0.35 | 2.73 | 112.03 | 27.28 | 0.2158 | 0.0404 | |||

| EBS / Erste Group Bank AG | 1.29 | 2.89 | 109.32 | 26.87 | 0.2105 | 0.0389 | |||

| IR / Ingersoll Rand Inc. | 1.31 | -0.06 | 109.00 | 3.88 | 0.2099 | 0.0009 | |||

| DBSDY / DBS Group Holdings Ltd - Depositary Receipt (Common Stock) | 0.76 | -2.54 | 107.46 | -0.54 | 0.2070 | -0.0082 | |||

| MURGY / Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München - Depositary Receipt (Common Stock) | 8.21 | -2.81 | 106.22 | -0.15 | 0.2046 | -0.0073 | |||

| CVX / Chevron Corporation | 0.66 | 0.00 | 94.99 | -14.41 | 0.1830 | -0.0381 | |||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 2.21 | -2.86 | 89.80 | -3.83 | 0.1730 | -0.0131 | |||

| SPY / SPDR S&P 500 ETF | 0.14 | 24.26 | 86.91 | 37.28 | 0.1674 | 0.0413 | |||

| MGDDY / Compagnie Générale des Établissements Michelin Société en commandite par actions - Depositary Receipt (Common Stock) | 4.65 | -2.83 | 86.17 | 2.78 | 0.1660 | -0.0010 | |||

| HLN / Haleon plc - Depositary Receipt (Common Stock) | 8.20 | -2.86 | 84.99 | -2.10 | 0.1637 | -0.0092 | |||

| 00BJT1GR5 / Alcon Inc Bond | 0.96 | 15,856.01 | 84.77 | 14,876.68 | 0.1633 | 0.1621 | |||

| ASHTY / Ashtead Group plc - Depositary Receipt (Common Stock) | 0.33 | -1.19 | 84.68 | 18.03 | 0.1631 | 0.0202 | |||

| FRCOY / Fast Retailing Co., Ltd. - Depositary Receipt (Common Stock) | 2.45 | -0.84 | 83.98 | 15.32 | 0.1618 | 0.0167 | |||

| OTSKY / Otsuka Holdings Co., Ltd. - Depositary Receipt (Common Stock) | 3.31 | -2.57 | 82.01 | -7.00 | 0.1579 | -0.0177 | |||

| EXPGY / Experian plc - Depositary Receipt (Common Stock) | 1.56 | -2.43 | 80.14 | 8.88 | 0.1544 | 0.0077 | |||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0.24 | 3.22 | 77.07 | 2.05 | 0.1484 | -0.0020 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 1.26 | 2.98 | 76.76 | -2.28 | 0.1478 | -0.0086 | |||

| ASAZY / ASSA ABLOY AB (publ) - Depositary Receipt (Common Stock) | 4.75 | -2.51 | 73.65 | 1.15 | 0.1419 | -0.0032 | |||

| DSFIY / DSM-Firmenich AG - Depositary Receipt (Common Stock) | 6.77 | -2.22 | 72.38 | 5.91 | 0.1394 | 0.0033 | |||

| AHT / Ashtead Group plc | 1.13 | 1.87 | 72.18 | 21.79 | 0.1390 | 0.0210 | |||

| OTSKF / Otsuka Holdings Co., Ltd. | 1.42 | 1.66 | 70.32 | -2.93 | 0.1354 | -0.0089 | |||

| HALEON PLC / FOREIGN (G4232K100) | 13.63 | 69.94 | 0.0000 | ||||||

| 9983 / Fast Retailing Co., Ltd. | 0.20 | 3.24 | 67.70 | 20.13 | 0.1304 | 0.0181 | |||

| EXPN / Experian plc | 1.25 | 1.90 | 64.50 | 13.76 | 0.1242 | 0.0113 | |||

| ASAZY / ASSA ABLOY AB (publ) - Depositary Receipt (Common Stock) | 2.06 | 1.48 | 63.72 | 5.28 | 0.1227 | 0.0022 | |||

| SYIEY / Symrise AG - Depositary Receipt (Common Stock) | 2.41 | -2.32 | 63.15 | -1.13 | 0.1216 | -0.0056 | |||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 1.63 | -2.65 | 62.63 | -3.50 | 0.1206 | -0.0087 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 1.00 | -2.31 | 61.40 | 0.36 | 0.1183 | -0.0036 | |||

| DKILF / Daikin Industries,Ltd. | 0.51 | 1.37 | 60.31 | 10.70 | 0.1162 | 0.0076 | |||

| HKXCY / Hong Kong Exchanges and Clearing Limited - Depositary Receipt (Common Stock) | 3.15 | 2.23 | 60.04 | 3.19 | 0.1156 | -0.0003 | |||

| ML / Compagnie Générale des Établissements Michelin Société en commandite par actions | 1.56 | 1.40 | 57.84 | 7.23 | 0.1114 | 0.0040 | |||

| 1299 / AIA Group Limited | 6.44 | 1.06 | 57.76 | 20.33 | 0.1113 | 0.0156 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.57 | 0.61 | 57.64 | -3.18 | 0.1110 | -0.0076 | |||

| AKZOY / Akzo Nobel N.V. - Depositary Receipt (Common Stock) | 2.40 | -2.69 | 55.76 | 10.83 | 0.1074 | 0.0072 | |||

| HEINY / Heineken N.V. - Depositary Receipt (Common Stock) | 1.27 | -3.04 | 55.21 | 3.49 | 0.1063 | 0.0001 | |||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.11 | 2.39 | 55.21 | -13.47 | 0.1063 | -0.0208 | |||

| HEIA / Heineken N.V. | 0.63 | 0.71 | 55.09 | 7.46 | 0.1061 | 0.0040 | |||

| FANUY / Fanuc Corporation - Depositary Receipt (Common Stock) | 4.01 | -3.39 | 54.75 | -2.98 | 0.1054 | -0.0070 | |||

| H0245V108 / DSM-Firmenich AG | 0.51 | 0.89 | 53.75 | 8.32 | 0.1035 | 0.0047 | |||

| DKILY / Daikin Industries,Ltd. - Depositary Receipt (Common Stock) | 4.43 | -1.96 | 52.25 | 6.97 | 0.1006 | 0.0033 | |||

| RTO N / Rentokil Initial plc | 10.81 | 1.57 | 52.15 | 9.23 | 0.1004 | 0.0053 | |||

| AAGIY / AIA Group Limited - Depositary Receipt (Common Stock) | 1.43 | -2.70 | 51.35 | 15.88 | 0.0989 | 0.0106 | |||

| SY1 / Symrise AG | 0.48 | 0.47 | 50.58 | 1.70 | 0.0974 | -0.0017 | |||

| DGE / Diageo plc | 2.00 | 3.18 | 50.21 | -0.59 | 0.0967 | -0.0039 | |||

| LVMUY / LVMH Moët Hennessy - Louis Vuitton, Société Européenne - Depositary Receipt (Common Stock) | 0.47 | -4.90 | 49.29 | -19.59 | 0.0949 | -0.0272 | |||

| FANUY / Fanuc Corporation - Depositary Receipt (Common Stock) | 1.79 | 3.62 | 48.79 | 4.11 | 0.0940 | 0.0006 | |||

| AMUN / Amundi S.A. | 0.58 | 0.47 | 46.82 | 4.17 | 0.0902 | 0.0007 | |||

| UNILEVER PLC / FOREIGN (00BLRB262) | 0.76 | 46.29 | 0.0000 | ||||||

| RTO / Rentokil Initial plc - Depositary Receipt (Common Stock) | 1.92 | 1.68 | 46.02 | 6.57 | 0.0886 | 0.0026 | |||

| SAMSUNG ELECTRONICS CO LTD / FOREIGN (006771720) | 1.03 | 45.64 | 0.0000 | ||||||

| KUBTY / Kubota Corporation - Depositary Receipt (Common Stock) | 0.71 | -2.71 | 39.99 | -10.78 | 0.0770 | -0.0123 | |||

| AKZA / Akzo Nobel N.V. | 0.53 | 0.75 | 37.00 | 14.74 | 0.0713 | 0.0070 | |||

| FCFS / FirstCash Holdings, Inc. | 0.25 | 1.25 | 33.94 | 13.73 | 0.0654 | 0.0059 | |||

| NJDCY / Nidec Corporation - Depositary Receipt (Common Stock) | 6.27 | -3.23 | 30.46 | 12.77 | 0.0587 | 0.0049 | |||

| NIDEC N / Nidec Corporation | 1.39 | 1.37 | 26.99 | 18.13 | 0.0520 | 0.0065 | |||

| 59O / Tokyo Century Corporation | 2.34 | 0.23 | 26.35 | 15.41 | 0.0507 | 0.0053 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.28 | -14.18 | 25.40 | -6.13 | 0.0489 | -0.0050 | |||

| 6326 / Kubota Corporation | 2.14 | 2.26 | 24.00 | -6.22 | 0.0462 | -0.0048 | |||

| DLB / Dolby Laboratories, Inc. | 0.25 | 1.50 | 18.80 | -6.14 | 0.0362 | -0.0037 | |||

| ITW / Illinois Tool Works Inc. | 0.07 | -0.62 | 18.07 | -0.92 | 0.0348 | -0.0015 | |||

| JAZZ / Jazz Pharmaceuticals plc | 0.17 | 4.22 | 17.57 | -10.92 | 0.0338 | -0.0054 | |||

| 8306 / Mitsubishi UFJ Financial Group, Inc. | 1.25 | 5.01 | 17.11 | 7.21 | 0.0330 | 0.0012 | |||

| NCLH / Norwegian Cruise Line Holdings Ltd. | 0.73 | 6.23 | 14.72 | 13.63 | 0.0284 | 0.0025 | |||

| ABBV / AbbVie Inc. | 0.07 | -0.11 | 12.42 | -11.51 | 0.0239 | -0.0040 | |||

| BC94 / Samsung Electronics Co., Ltd. - Depositary Receipt (Common Stock) | 0.01 | -36.04 | 11.27 | -27.63 | 0.0217 | -0.0093 | |||

| FMC / FMC Corporation | 0.22 | 4.29 | 9.06 | 3.20 | 0.0175 | -0.0000 | |||

| CTAS / Cintas Corporation | 0.04 | -1.30 | 8.43 | 7.02 | 0.0162 | 0.0005 | |||

| LENB / Lennar Corp. - Class B | 0.07 | -0.92 | 7.83 | -4.38 | 0.0151 | -0.0012 | |||

| ABT / Abbott Laboratories | 0.05 | 0.00 | 7.38 | 2.53 | 0.0142 | -0.0001 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.04 | -24.60 | 6.94 | -22.16 | 0.0134 | -0.0044 | |||

| CATH / Global X Funds - Global X S&P 500 Catholic Values ETF | 0.09 | -3.33 | 6.77 | 7.99 | 0.0130 | 0.0006 | |||

| EWY / iShares, Inc. - iShares MSCI South Korea ETF | 0.07 | 0.06 | 4.94 | 32.89 | 0.0095 | 0.0021 | |||

| RY / Royal Bank of Canada | 0.03 | 0.00 | 4.40 | 16.70 | 0.0085 | 0.0010 | |||

| XYL / Xylem Inc. | 0.03 | -99.58 | 4.34 | -99.54 | 0.0084 | -1.8824 | |||

| JNJ / Johnson & Johnson | 0.03 | -1.91 | 3.93 | -9.64 | 0.0076 | -0.0011 | |||

| AXP / American Express Company | 0.01 | 0.00 | 3.68 | 18.54 | 0.0071 | 0.0009 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | -0.02 | 3.52 | 18.18 | 0.0068 | 0.0008 | |||

| AER / AerCap Holdings N.V. | 0.03 | -1.67 | 3.46 | 12.60 | 0.0067 | 0.0005 | |||

| XOM / Exxon Mobil Corporation | 0.03 | 0.00 | 3.42 | -9.36 | 0.0066 | -0.0009 | |||

| PEP / PepsiCo, Inc. | 0.02 | -2.78 | 3.23 | -14.39 | 0.0062 | -0.0013 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 2.92 | -8.71 | 0.0056 | -0.0007 | |||

| CHD / Church & Dwight Co., Inc. | 0.03 | -0.71 | 2.71 | -13.29 | 0.0052 | -0.0010 | |||

| 00B10RZP7 / Inpex Corp. Bond | 0.04 | 2.43 | 0.0047 | 0.0047 | |||||

| HON / Honeywell International Inc. | 0.01 | -57.13 | 2.17 | -52.85 | 0.0042 | -0.0050 | |||

| GWW / W.W. Grainger, Inc. | 0.00 | 0.00 | 1.91 | 5.30 | 0.0037 | 0.0001 | |||

| SYY / Sysco Corporation | 0.02 | -4.08 | 1.68 | -3.22 | 0.0032 | -0.0002 | |||

| SCI / Service Corporation International | 0.02 | -31.27 | 1.68 | -30.25 | 0.0032 | -0.0016 | |||

| AAPL / Apple Inc. | 0.01 | 0.00 | 1.64 | -7.65 | 0.0032 | -0.0004 | |||

| FELE / Franklin Electric Co., Inc. | 0.02 | 0.00 | 1.61 | -4.39 | 0.0031 | -0.0003 | |||

| MTB / M&T Bank Corporation | 0.01 | 1.56 | 0.0030 | 0.0030 | |||||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.01 | -29.28 | 1.28 | -27.66 | 0.0025 | -0.0011 | |||

| EMR / Emerson Electric Co. | 0.01 | 0.00 | 1.28 | 21.58 | 0.0025 | 0.0004 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 1.23 | 4.67 | 0.0024 | 0.0000 | |||

| ADSK / Autodesk, Inc. | 0.00 | -22.99 | 1.20 | -8.88 | 0.0023 | -0.0003 | |||

| PFE / Pfizer Inc. | 0.05 | 0.00 | 1.12 | -4.37 | 0.0022 | -0.0002 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 1.01 | -8.87 | 0.0019 | -0.0003 | |||

| MMM / 3M Company | 0.01 | 0.00 | 0.96 | 3.67 | 0.0019 | 0.0000 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | 0.00 | 0.90 | -9.36 | 0.0017 | -0.0002 | |||

| SJM / The J. M. Smucker Company | 0.01 | 0.00 | 0.88 | -17.06 | 0.0017 | -0.0004 | |||

| V / Visa Inc. | 0.00 | 0.00 | 0.78 | 1.30 | 0.0015 | -0.0000 | |||

| WFC.PRL / Wells Fargo & Company - Preferred Stock | 0.00 | 0.00 | 0.76 | -2.18 | 0.0015 | -0.0001 | |||

| BAC / Bank of America Corporation | 0.01 | 0.00 | 0.63 | 13.33 | 0.0012 | 0.0001 | |||

| 05935 / Samsung Electronics Co Ltd | 0.02 | -7.69 | 0.57 | 5.73 | 0.0011 | 0.0000 | |||

| DOV / Dover Corporation | 0.00 | 0.00 | 0.48 | 4.39 | 0.0009 | 0.0000 | |||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.47 | -2.08 | 0.0009 | -0.0000 | |||

| PSX / Phillips 66 | 0.00 | -39.69 | 0.45 | -41.68 | 0.0009 | -0.0007 | |||

| DCI / Donaldson Company, Inc. | 0.01 | 0.00 | 0.42 | 3.48 | 0.0008 | -0.0000 | |||

| UNP / Union Pacific Corporation | 0.00 | 0.00 | 0.40 | -2.67 | 0.0008 | -0.0000 | |||

| RTX / RTX Corporation | 0.00 | 0.04 | 0.38 | 10.23 | 0.0007 | 0.0000 | |||

| SBUX / Starbucks Corporation | 0.00 | 0.00 | 0.37 | -6.63 | 0.0007 | -0.0001 | |||

| MDLZ / Mondelez International, Inc. | 0.01 | 0.00 | 0.36 | -0.55 | 0.0007 | -0.0000 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.00 | 0.00 | 0.35 | -19.40 | 0.0007 | -0.0002 | |||

| ORCL / Oracle Corporation | 0.00 | 0.00 | 0.33 | 56.46 | 0.0006 | 0.0002 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.01 | -8.61 | 0.31 | 2.68 | 0.0006 | -0.0000 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.08 | 0.24 | 14.90 | 0.0005 | 0.0000 | |||

| WMT / Walmart Inc. | 0.00 | 0.00 | 0.24 | 11.32 | 0.0005 | 0.0000 | |||

| CINF / Cincinnati Financial Corporation | 0.00 | -69.71 | 0.22 | -69.46 | 0.0004 | -0.0010 | |||

| KTB / Kontoor Brands, Inc. | 0.00 | 0.20 | 0.0004 | 0.0004 | |||||

| GOOGL / Alphabet Inc. | 0.00 | -40.99 | 0.16 | -32.77 | 0.0003 | -0.0002 | |||

| JWN / Nordstrom, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VLTO / Veralto Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ILSIX / Context Insurance Linked Income Fund | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PYPL / PayPal Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0186 | ||||

| MCD / McDonald's Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |