Mga Batayang Estadistika

| Nilai Portofolio | $ 2,271,416,989 |

| Posisi Saat Ini | 130 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

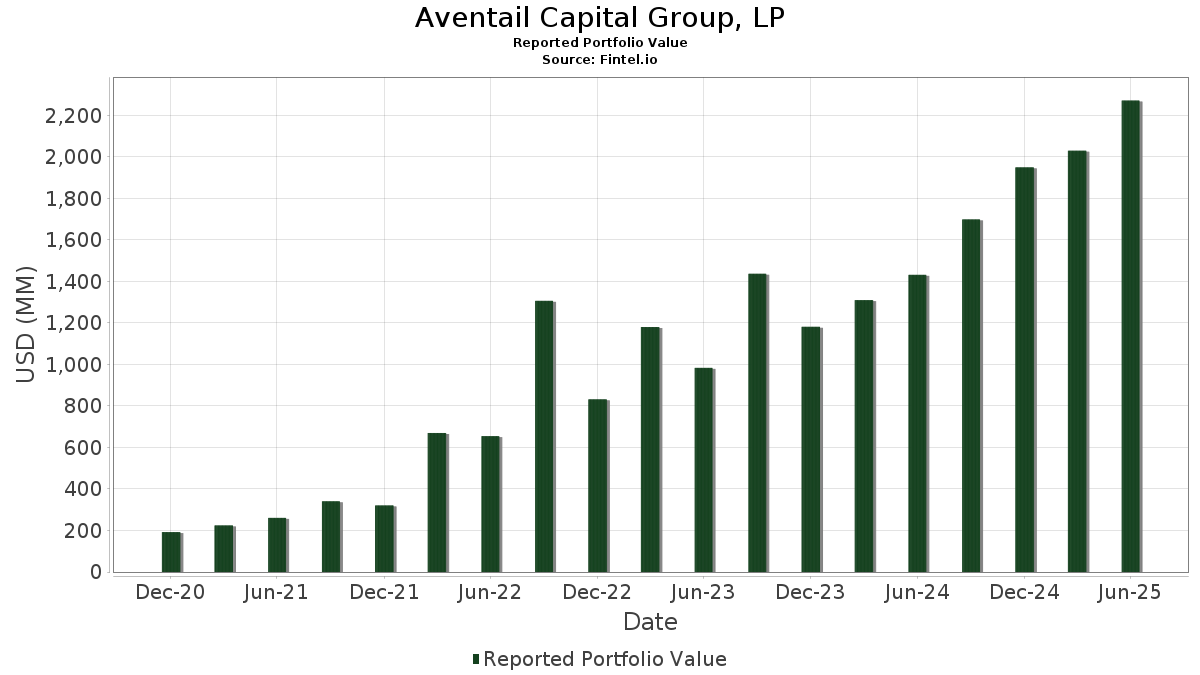

Aventail Capital Group, LP telah mengungkapkan total kepemilikan 130 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 2,271,416,989 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Aventail Capital Group, LP adalah Entergy Corporation (US:ETR) , CenterPoint Energy, Inc. (US:CNP) , PPL Corporation (US:PPL) , NRG Energy, Inc. (US:NRG) , and DT Midstream, Inc. (US:DTM) . Posisi baru Aventail Capital Group, LP meliputi: CenterPoint Energy, Inc. (US:CNP) , The AES Corporation (US:AES) , Caterpillar Inc. (US:CAT) , Venture Global, Inc. (US:VG) , and First Solar, Inc. (US:FSLR) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2.36 | 86.64 | 3.8144 | 3.8144 | |

| 0.49 | 57.62 | 2.5369 | 2.5369 | |

| 0.69 | 63.25 | 2.7846 | 2.2514 | |

| 0.87 | 50.52 | 2.2243 | 1.9782 | |

| 0.64 | 54.15 | 2.3838 | 1.8229 | |

| 1.71 | 65.69 | 2.8919 | 1.8083 | |

| 0.27 | 32.39 | 1.4260 | 1.4260 | |

| 1.83 | 24.94 | 1.0982 | 1.0389 | |

| 0.90 | 23.85 | 1.0500 | 0.9678 | |

| 0.61 | 19.90 | 0.8760 | 0.8760 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 14.97 | 0.6591 | -1.7975 | |

| 2.00 | 17.18 | 0.7564 | -1.5228 | |

| 0.51 | 22.82 | 1.0048 | -1.3861 | |

| 0.41 | 15.36 | 0.6764 | -1.1588 | |

| 0.30 | 12.36 | 0.5443 | -1.0938 | |

| 0.34 | 27.54 | 1.2123 | -0.9903 | |

| 1.56 | 49.51 | 2.1797 | -0.9292 | |

| 0.12 | 28.71 | 1.2640 | -0.9023 | |

| 0.40 | 70.01 | 3.0821 | -0.8685 | |

| 2.00 | 27.24 | 1.1994 | -0.8477 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| ETR / Entergy Corporation | 1.12 | 1.28 | 93.47 | -1.53 | 4.1150 | -0.5615 | |||

| CNP / CenterPoint Energy, Inc. | 2.36 | 86.64 | 3.8144 | 3.8144 | |||||

| PPL / PPL Corporation | 2.50 | -0.40 | 84.72 | -6.52 | 3.7301 | -0.7352 | |||

| NRG / NRG Energy, Inc. | 0.50 | -19.48 | 80.61 | 35.45 | 3.5490 | 0.6169 | |||

| DTM / DT Midstream, Inc. | 0.70 | 0.00 | 76.96 | 13.92 | 3.3882 | 0.0599 | |||

| TRGP / Targa Resources Corp. | 0.40 | 0.54 | 70.01 | -12.70 | 3.0821 | -0.8685 | |||

| BKR / Baker Hughes Company | 1.71 | 242.36 | 65.69 | 198.67 | 2.8919 | 1.8083 | |||

| SO / The Southern Company | 0.69 | 485.23 | 63.25 | 484.50 | 2.7846 | 2.2514 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.74 | 56.16 | 62.48 | 59.73 | 2.7505 | 0.8235 | |||

| DUK / Duke Energy Corporation | 0.49 | 57.62 | 2.5369 | 2.5369 | |||||

| NFG / National Fuel Gas Company | 0.64 | 344.62 | 54.15 | 375.62 | 2.3838 | 1.8229 | |||

| NEE / NextEra Energy, Inc. | 0.78 | 33.36 | 54.02 | 30.59 | 2.3784 | 0.3403 | |||

| EQT / EQT Corporation | 0.87 | 826.78 | 50.52 | 911.65 | 2.2243 | 1.9782 | |||

| DVN / Devon Energy Corporation | 1.56 | -7.75 | 49.51 | -21.54 | 2.1797 | -0.9292 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.69 | 78.56 | 48.93 | 71.57 | 2.1541 | 0.7491 | |||

| ATO / Atmos Energy Corporation | 0.27 | 11.83 | 41.94 | 11.49 | 1.8462 | -0.0068 | |||

| DTE / DTE Energy Company | 0.31 | -0.03 | 40.92 | -4.24 | 1.8016 | -0.3037 | |||

| XEL / Xcel Energy Inc. | 0.57 | -0.43 | 38.80 | -4.21 | 1.7083 | -0.2874 | |||

| KMI / Kinder Morgan, Inc. | 1.31 | -5.09 | 38.53 | -2.19 | 1.6963 | -0.2445 | |||

| ES / Eversource Energy | 0.58 | 23.59 | 37.05 | 26.60 | 1.6311 | 0.1893 | |||

| VNOM / Viper Energy, Inc. | 0.96 | 0.00 | 36.69 | -15.55 | 1.6154 | -0.5251 | |||

| CHRD / Chord Energy Corporation | 0.36 | 30.96 | 34.69 | 12.52 | 1.5273 | 0.0083 | |||

| PSX / Phillips 66 | 0.27 | 32.39 | 1.4260 | 1.4260 | |||||

| WMB / The Williams Companies, Inc. | 0.51 | 0.00 | 32.03 | 5.10 | 1.4101 | -0.0913 | |||

| VST / Vistra Corp. | 0.17 | 9.34 | 32.02 | 80.44 | 1.4099 | 0.5355 | |||

| AR / Antero Resources Corporation | 0.79 | -13.01 | 31.68 | -13.35 | 1.3946 | -0.4066 | |||

| LNG / Cheniere Energy, Inc. | 0.12 | -37.96 | 28.71 | -34.70 | 1.2640 | -0.9023 | |||

| KEX / Kirby Corporation | 0.25 | 0.00 | 28.40 | 12.28 | 1.2505 | 0.0041 | |||

| OKE / ONEOK, Inc. | 0.34 | -25.14 | 27.54 | -38.41 | 1.2123 | -0.9903 | |||

| PR / Permian Resources Corporation | 2.00 | -33.33 | 27.24 | -34.44 | 1.1994 | -0.8477 | |||

| EVRG / Evergy, Inc. | 0.39 | -1.60 | 26.83 | -1.63 | 1.1814 | -0.1626 | |||

| PNW / Pinnacle West Capital Corporation | 0.29 | -1.76 | 25.73 | -7.72 | 1.1326 | -0.2409 | |||

| CVE / Cenovus Energy Inc. | 1.83 | 2,020.37 | 24.94 | 1,973.48 | 1.0982 | 1.0389 | |||

| PARR / Par Pacific Holdings, Inc. | 0.90 | 668.53 | 23.85 | 1,329.86 | 1.0500 | 0.9678 | |||

| MTDR / Matador Resources Company | 0.50 | -0.74 | 23.77 | -7.29 | 1.0465 | -0.2167 | |||

| OGE / OGE Energy Corp. | 0.51 | -51.30 | 22.82 | -52.97 | 1.0048 | -1.3861 | |||

| BKV / BKV Corporation | 0.88 | 0.00 | 21.11 | 14.86 | 0.9292 | 0.0239 | |||

| WEC / WEC Energy Group, Inc. | 0.20 | 1.45 | 20.73 | -3.00 | 0.9125 | -0.1402 | |||

| GPOR / Gulfport Energy Corporation | 0.10 | 0.49 | 20.22 | 9.78 | 0.8900 | -0.0172 | |||

| CSX / CSX Corporation | 0.61 | 19.90 | 0.8760 | 0.8760 | |||||

| SRE / Sempra | 0.26 | 34.01 | 19.87 | 42.29 | 0.8746 | 0.1868 | |||

| VLO / Valero Energy Corporation | 0.14 | 0.00 | 18.30 | 1.78 | 0.8055 | -0.0801 | |||

| CRGY / Crescent Energy Company | 2.00 | -51.46 | 17.18 | -62.86 | 0.7564 | -1.5228 | |||

| AGX / Argan, Inc. | 0.08 | 0.00 | 16.54 | 68.10 | 0.7282 | 0.2434 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 0.26 | 0.00 | 16.06 | -5.10 | 0.7071 | -0.1267 | |||

| WTRG / Essential Utilities, Inc. | 0.41 | -56.10 | 15.36 | -58.76 | 0.6764 | -1.1588 | |||

| MPC / Marathon Petroleum Corporation | 0.09 | 0.00 | 15.32 | 14.01 | 0.6745 | 0.0125 | |||

| AES / The AES Corporation | Put | 1.43 | 15.04 | 0.6623 | 0.6623 | ||||

| TLN / Talen Energy Corporation | 0.05 | -79.38 | 14.97 | -69.98 | 0.6591 | -1.7975 | |||

| SEI / Solaris Energy Infrastructure, Inc. | 0.50 | 0.00 | 14.17 | 30.01 | 0.6238 | 0.0869 | |||

| CMS / CMS Energy Corporation | 0.20 | -1.29 | 13.97 | -8.96 | 0.6151 | -0.1409 | |||

| CAT / Caterpillar Inc. | 0.03 | 13.12 | 0.5778 | 0.5778 | |||||

| CRK / Comstock Resources, Inc. | 0.46 | 0.00 | 12.67 | 36.04 | 0.5576 | 0.0989 | |||

| GLNG / Golar LNG Limited | 0.30 | -65.70 | 12.36 | -62.82 | 0.5443 | -1.0938 | |||

| NI / NiSource Inc. | 0.25 | -1.24 | 10.18 | -0.62 | 0.4483 | -0.0565 | |||

| CNX / CNX Resources Corporation | 0.30 | 0.00 | 10.15 | 6.99 | 0.4467 | -0.0205 | |||

| MUSA / Murphy USA Inc. | 0.02 | 63.07 | 9.95 | 41.19 | 0.4381 | 0.0909 | |||

| NSC / Norfolk Southern Corporation | 0.04 | 9.14 | 0.4024 | 0.4024 | |||||

| MGY / Magnolia Oil & Gas Corporation | 0.40 | 0.21 | 9.01 | -10.82 | 0.3967 | -0.1011 | |||

| NWE / NorthWestern Energy Group, Inc. | 0.17 | 4.54 | 8.96 | -7.33 | 0.3943 | -0.0818 | |||

| AROC / Archrock, Inc. | 0.36 | -28.35 | 8.94 | -32.21 | 0.3935 | -0.2560 | |||

| VG / Venture Global, Inc. | 0.57 | 8.84 | 0.3890 | 0.3890 | |||||

| CTRA / Coterra Energy Inc. | 0.34 | 0.00 | 8.69 | -12.18 | 0.3826 | -0.1049 | |||

| SOC / Sable Offshore Corp. | 0.39 | 21.36 | 8.64 | 5.15 | 0.3805 | -0.0245 | |||

| RRC / Range Resources Corporation | 0.20 | 0.00 | 8.15 | 1.85 | 0.3589 | -0.0354 | |||

| KNTK / Kinetik Holdings Inc. | 0.18 | 0.00 | 8.10 | -15.19 | 0.3567 | -0.1140 | |||

| CEG / Constellation Energy Corporation | 0.02 | -3.16 | 8.00 | 55.02 | 0.3522 | 0.0979 | |||

| OVV / Ovintiv Inc. | 0.20 | 0.00 | 7.64 | -11.10 | 0.3362 | -0.0870 | |||

| UNP / Union Pacific Corporation | 0.03 | 7.41 | 0.3262 | 0.3262 | |||||

| AVA / Avista Corporation | 0.18 | 4.40 | 6.97 | -5.38 | 0.3067 | -0.0560 | |||

| TS / Tenaris S.A. - Depositary Receipt (Common Stock) | 0.19 | 0.00 | 6.94 | -4.37 | 0.3055 | -0.0520 | |||

| FANG / Diamondback Energy, Inc. | 0.05 | 0.00 | 6.89 | -14.06 | 0.3033 | -0.0917 | |||

| DAR / Darling Ingredients Inc. | 0.17 | 0.00 | 6.38 | 21.45 | 0.2810 | 0.0221 | |||

| CLH / Clean Harbors, Inc. | 0.03 | 213.06 | 5.94 | 267.33 | 0.2614 | 0.1817 | |||

| CWEN / Clearway Energy, Inc. | 0.18 | 292.33 | 5.60 | 314.89 | 0.2466 | 0.1801 | |||

| EXE / Expand Energy Corporation | 0.05 | 0.00 | 5.32 | 5.06 | 0.2341 | -0.0153 | |||

| D / Dominion Energy, Inc. | 0.09 | 2.37 | 5.16 | 3.18 | 0.2271 | -0.0192 | |||

| AM / Antero Midstream Corporation | 0.27 | 5.12 | 0.2256 | 0.2256 | |||||

| FSLR / First Solar, Inc. | 0.03 | 5.10 | 0.2244 | 0.2244 | |||||

| GFL / GFL Environmental Inc. | 0.10 | 0.00 | 4.91 | 4.45 | 0.2162 | -0.0154 | |||

| TRP / TC Energy Corporation | 0.10 | -50.00 | 4.88 | -48.33 | 0.2148 | -0.2504 | |||

| CRC / California Resources Corporation | 0.11 | 0.00 | 4.84 | 3.87 | 0.2129 | -0.0165 | |||

| NJR / New Jersey Resources Corporation | 0.10 | -48.42 | 4.64 | -52.89 | 0.2041 | -0.2807 | |||

| IDA / IDACORP, Inc. | 0.04 | -12.44 | 4.54 | -13.02 | 0.1997 | -0.0572 | |||

| AES / The AES Corporation | 0.42 | 12.76 | 4.44 | -4.50 | 0.1955 | -0.0335 | |||

| PBF / PBF Energy Inc. | 0.20 | 0.00 | 4.34 | 13.52 | 0.1911 | 0.0027 | |||

| CCJ / Cameco Corporation | 0.06 | 0.00 | 4.34 | 80.40 | 0.1909 | 0.0724 | |||

| SM / SM Energy Company | 0.17 | 0.00 | 4.14 | -17.48 | 0.1822 | -0.0649 | |||

| DINO / HF Sinclair Corporation | 0.10 | 0.00 | 4.11 | 24.93 | 0.1811 | 0.0189 | |||

| LNT / Alliant Energy Corporation | 0.07 | -19.57 | 4.10 | -24.41 | 0.1804 | -0.0867 | |||

| PCG / PG&E Corporation | 0.29 | 0.00 | 4.05 | -18.86 | 0.1785 | -0.0677 | |||

| MUR / Murphy Oil Corporation | 0.18 | 0.93 | 3.97 | -20.02 | 0.1748 | -0.0698 | |||

| PARR / Par Pacific Holdings, Inc. | Call | 0.13 | 3.54 | 0.1557 | 0.1557 | ||||

| KGS / Kodiak Gas Services, Inc. | 0.10 | 0.00 | 3.46 | -8.11 | 0.1522 | -0.0332 | |||

| NRG / NRG Energy, Inc. | Call | 0.02 | -75.03 | 3.45 | -58.00 | 0.1520 | -0.2529 | ||

| BEPC / Brookfield Renewable Corporation | 0.10 | 3.23 | 0.1420 | 0.1420 | |||||

| CNR / Core Natural Resources, Inc. | 0.05 | 0.00 | 3.18 | -9.53 | 0.1401 | -0.0332 | |||

| CNQ / Canadian Natural Resources Limited | 0.10 | 0.00 | 3.18 | 1.92 | 0.1399 | -0.0137 | |||

| DEC / Diversified Energy Company PLC | 0.21 | 5.00 | 3.08 | 13.91 | 0.1356 | 0.0024 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.10 | 0.85 | 3.02 | -10.68 | 0.1329 | -0.0336 | |||

| FRO / Frontline plc | 0.18 | -56.81 | 2.96 | -52.27 | 0.1303 | -0.1752 | |||

| CIVI / Civitas Resources, Inc. | 0.10 | 1.61 | 2.83 | -19.88 | 0.1246 | -0.0494 | |||

| UGI / UGI Corporation | 0.07 | 2.43 | 0.1072 | 0.1072 | |||||

| CORZ / Core Scientific, Inc. | 0.14 | 2.43 | 0.1070 | 0.1070 | |||||

| FTI / TechnipFMC plc | 0.06 | -68.91 | 2.15 | -66.22 | 0.0945 | -0.2185 | |||

| CPK / Chesapeake Utilities Corporation | 0.02 | 4.22 | 2.08 | -2.44 | 0.0915 | -0.0135 | |||

| XYL / Xylem Inc. | 0.02 | 2.06 | 0.0906 | 0.0906 | |||||

| XPRO / Expro Group Holdings N.V. | 0.24 | 134.00 | 2.03 | 102.30 | 0.0892 | 0.0398 | |||

| SLB / Schlumberger Limited | 0.06 | 2.00 | 0.0881 | 0.0881 | |||||

| LBRT / Liberty Energy Inc. | 0.17 | 1.97 | 0.0869 | 0.0869 | |||||

| HESM / Hess Midstream LP | 0.05 | 0.00 | 1.93 | -8.94 | 0.0848 | -0.0194 | |||

| CTRI / Centuri Holdings, Inc. | 0.08 | 1.80 | 0.0792 | 0.0792 | |||||

| INR / Infinity Natural Resources, Inc. | 0.10 | -1.85 | 1.80 | -4.16 | 0.0791 | -0.0133 | |||

| TBN / Tamboran Resources Corporation | 0.08 | 1.76 | 0.0773 | 0.0773 | |||||

| NEXT / NextDecade Corporation | 0.19 | -9.54 | 1.70 | 3.60 | 0.0747 | -0.0060 | |||

| VTLE / Vital Energy, Inc. | 0.10 | 0.00 | 1.61 | -24.17 | 0.0710 | -0.0338 | |||

| HAFN / Hafnia Limited | 0.28 | 0.00 | 1.42 | 19.92 | 0.0626 | 0.0042 | |||

| GRNT / Granite Ridge Resources, Inc. | 0.20 | -70.02 | 1.28 | -68.59 | 0.0565 | -0.1448 | |||

| NESR / National Energy Services Reunited Corp. | 0.17 | 1.01 | 0.0445 | 0.0445 | |||||

| SMC / Summit Midstream Corporation | 0.04 | 0.00 | 1.01 | -27.61 | 0.0443 | -0.0242 | |||

| VTS / Vitesse Energy, Inc. | 0.04 | 0.00 | 0.89 | -10.25 | 0.0394 | -0.0097 | |||

| FLOC / Flowco Holdings Inc. | 0.05 | 142.94 | 0.88 | 68.92 | 0.0385 | 0.0130 | |||

| TALO / Talos Energy Inc. | 0.10 | 0.00 | 0.85 | -12.78 | 0.0376 | -0.0106 | |||

| TNK / Teekay Tankers Ltd. | 0.02 | 0.00 | 0.83 | 8.98 | 0.0364 | -0.0010 | |||

| NWPX / NWPX Infrastructure, Inc. | 0.02 | 0.00 | 0.78 | -0.76 | 0.0345 | -0.0044 | |||

| CLMT / Calumet, Inc. | 0.05 | 0.00 | 0.72 | 24.27 | 0.0318 | 0.0032 | |||

| PUMP / ProPetro Holding Corp. | 0.10 | -52.42 | 0.61 | -61.35 | 0.0267 | -0.0506 | |||

| TSSI / TSS, Inc. | 0.01 | 0.33 | 0.0143 | 0.0143 | |||||

| NOG / Northern Oil and Gas, Inc. | 0.01 | -89.14 | 0.31 | -89.84 | 0.0137 | -0.1366 | |||

| HUT / Hut 8 Corp. | 0.02 | 0.30 | 0.0131 | 0.0131 | |||||

| STR / Sitio Royalties Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ECG / Everus Construction Group, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PRIM / Primoris Services Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SDRL / Seadrill Limited | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VAL / Valaris Limited | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PHX / PHX Minerals Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LIN / Linde plc | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NE / Noble Corporation plc | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MTZ / MasTec, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PAGP / Plains GP Holdings, L.P. - Limited Partnership | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TXNM / TXNM Energy, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GEV / GE Vernova Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ITRI / Itron, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EOG / EOG Resources, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XOM / Exxon Mobil Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NUE / Nucor Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XLB / The Select Sector SPDR Trust - The Materials Select Sector SPDR Fund | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RIG / Transocean Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BKH / Black Hills Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ENB / Enbridge Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ED / Consolidated Edison, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |