Mga Batayang Estadistika

| Nilai Portofolio | $ 391,213,592 |

| Posisi Saat Ini | 170 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

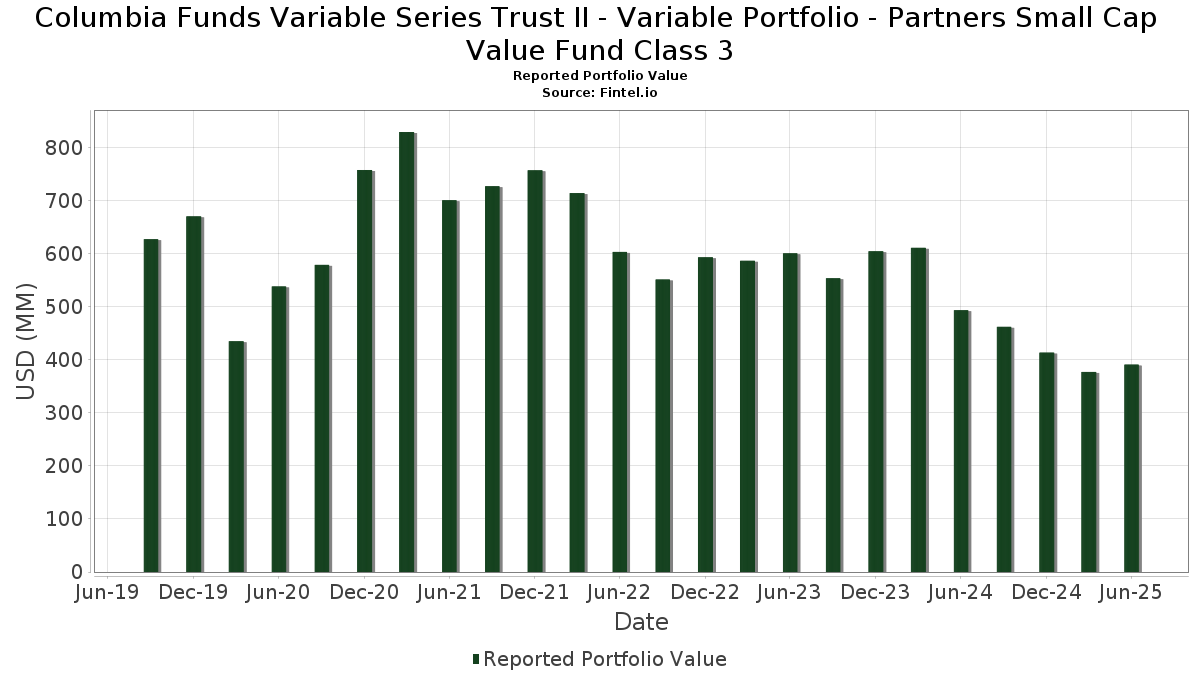

Columbia Funds Variable Series Trust II - Variable Portfolio - Partners Small Cap Value Fund Class 3 telah mengungkapkan total kepemilikan 170 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 391,213,592 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Columbia Funds Variable Series Trust II - Variable Portfolio - Partners Small Cap Value Fund Class 3 adalah COLUMBIA SHORT TERM CASH FUND (US:19766H239) , Texas Capital Bancshares, Inc. (US:TCBI) , Belden Inc. (US:BDC) , Ameris Bancorp (US:ABCB) , and Seacoast Banking Corporation of Florida (US:SBCF) . Posisi baru Columbia Funds Variable Series Trust II - Variable Portfolio - Partners Small Cap Value Fund Class 3 meliputi: Kirby Corporation (US:KEX) , Alaska Air Group, Inc. (US:ALK) , YETI Holdings, Inc. (US:YETI) , GXO Logistics, Inc. (US:GXO) , and Vishay Precision Group, Inc. (US:VPG) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 2.38 | 0.6077 | 0.6077 | |

| 0.05 | 2.24 | 0.5734 | 0.5734 | |

| 0.08 | 4.35 | 1.1100 | 0.5510 | |

| 0.04 | 5.68 | 1.4497 | 0.4367 | |

| 0.02 | 2.19 | 0.5586 | 0.3903 | |

| 0.43 | 4.44 | 1.1339 | 0.3599 | |

| 0.04 | 1.25 | 0.3186 | 0.3186 | |

| 0.08 | 4.06 | 1.0361 | 0.3087 | |

| 0.12 | 3.85 | 0.9822 | 0.2353 | |

| 0.10 | 5.16 | 1.3169 | 0.2249 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 0.55 | 0.1401 | -0.2395 | |

| 0.01 | 1.53 | 0.3920 | -0.2293 | |

| 0.02 | 0.52 | 0.1339 | -0.2097 | |

| 0.05 | 0.49 | 0.1243 | -0.2029 | |

| 0.24 | 2.04 | 0.5203 | -0.1846 | |

| 0.03 | 0.60 | 0.1522 | -0.1787 | |

| 0.12 | 3.43 | 0.8757 | -0.1776 | |

| 0.38 | 3.57 | 0.9107 | -0.1744 | |

| 0.10 | 2.21 | 0.5656 | -0.1744 | |

| 0.06 | 0.86 | 0.2203 | -0.1731 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-22 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 19766H239 / COLUMBIA SHORT TERM CASH FUND | 12.13 | 11.74 | 12.13 | 11.74 | 3.0973 | 0.2242 | |||

| TCBI / Texas Capital Bancshares, Inc. | 0.08 | -0.62 | 6.71 | 5.62 | 1.7131 | 0.0321 | |||

| BDC / Belden Inc. | 0.05 | -0.45 | 6.08 | 15.00 | 1.5532 | 0.1531 | |||

| ABCB / Ameris Bancorp | 0.09 | -0.71 | 6.01 | 11.59 | 1.5349 | 0.1092 | |||

| SBCF / Seacoast Banking Corporation of Florida | 0.21 | -0.30 | 5.87 | 7.02 | 1.5001 | 0.0473 | |||

| ICUI / ICU Medical, Inc. | 0.04 | 55.87 | 5.68 | 48.33 | 1.4497 | 0.4367 | |||

| REVG / REV Group, Inc. | 0.11 | -37.75 | 5.28 | -6.26 | 1.3475 | -0.1424 | |||

| MRCY / Mercury Systems, Inc. | 0.10 | 0.00 | 5.16 | 25.00 | 1.3169 | 0.2249 | |||

| VMI / Valmont Industries, Inc. | 0.02 | 0.00 | 5.13 | 14.45 | 1.3094 | 0.1234 | |||

| HWC / Hancock Whitney Corporation | 0.09 | -0.34 | 5.12 | 9.05 | 1.3078 | 0.0649 | |||

| CTRE / CareTrust REIT, Inc. | 0.15 | -0.86 | 4.68 | 6.15 | 1.1959 | 0.0281 | |||

| COLB / Columbia Banking System, Inc. | 0.20 | -0.27 | 4.64 | -6.50 | 1.1840 | -0.1287 | |||

| DBRG / DigitalBridge Group, Inc. | 0.43 | 29.41 | 4.44 | 51.83 | 1.1339 | 0.3599 | |||

| AZZ / AZZ Inc. | 0.05 | 0.00 | 4.40 | 13.01 | 1.1250 | 0.0931 | |||

| SLGN / Silgan Holdings Inc. | 0.08 | 94.19 | 4.35 | 105.83 | 1.1100 | 0.5510 | |||

| NGVT / Ingevity Corporation | 0.10 | 0.00 | 4.27 | 8.82 | 1.0910 | 0.0520 | |||

| PZZA / Papa John's International, Inc. | 0.08 | 23.93 | 4.06 | 47.65 | 1.0361 | 0.3087 | |||

| MP / MP Materials Corp. | 0.12 | 0.00 | 3.85 | 36.30 | 0.9822 | 0.2353 | |||

| VFC / V.F. Corporation | 0.31 | 41.12 | 3.69 | 6.83 | 0.9429 | 0.0281 | |||

| AHCO / AdaptHealth Corp. | 0.38 | 0.00 | 3.57 | -13.01 | 0.9107 | -0.1744 | |||

| OI / O-I Glass, Inc. | 0.24 | 0.00 | 3.56 | 28.51 | 0.9098 | 0.1760 | |||

| QDEL / QuidelOrtho Corporation | 0.12 | 4.56 | 3.43 | -13.83 | 0.8757 | -0.1776 | |||

| GT / The Goodyear Tire & Rubber Company | 0.33 | 0.00 | 3.38 | 12.23 | 0.8630 | 0.0660 | |||

| PRGS / Progress Software Corporation | 0.05 | 0.00 | 3.33 | 23.94 | 0.8517 | 0.1394 | |||

| GPOR / Gulfport Energy Corporation | 0.02 | -1.28 | 3.33 | 7.83 | 0.8510 | 0.0331 | |||

| AGI / Alamos Gold Inc. | 0.12 | 0.00 | 3.11 | -0.67 | 0.7938 | -0.0346 | |||

| TMHC / Taylor Morrison Home Corporation | 0.05 | -1.29 | 3.10 | 0.98 | 0.7908 | -0.0209 | |||

| ALGM / Allegro MicroSystems, Inc. | 0.09 | 0.00 | 3.08 | 36.05 | 0.7877 | 0.1876 | |||

| WLY / John Wiley & Sons, Inc. | 0.07 | -1.29 | 3.04 | -1.14 | 0.7766 | -0.0376 | |||

| AAP / Advance Auto Parts, Inc. | 0.06 | 3.15 | 3.00 | 22.26 | 0.7663 | 0.1168 | |||

| ENS / EnerSys | 0.03 | 14.08 | 2.94 | 6.86 | 0.7520 | 0.0225 | |||

| NBHC / National Bank Holdings Corporation | 0.08 | 0.00 | 2.94 | -1.71 | 0.7510 | -0.0411 | |||

| APOG / Apogee Enterprises, Inc. | 0.07 | 41.13 | 2.92 | 23.69 | 0.7470 | 0.1209 | |||

| PPBI / Pacific Premier Bancorp, Inc. | 0.14 | -0.80 | 2.91 | -1.86 | 0.7424 | -0.0418 | |||

| ONB / Old National Bancorp | 0.13 | -1.29 | 2.87 | -0.59 | 0.7320 | -0.0312 | |||

| ESRT / Empire State Realty Trust, Inc. | 0.35 | -0.89 | 2.86 | 2.55 | 0.7297 | -0.0079 | |||

| LFUS / Littelfuse, Inc. | 0.01 | 0.00 | 2.85 | 15.26 | 0.7276 | 0.0732 | |||

| TXNM / TXNM Energy, Inc. | 0.05 | 21.01 | 2.76 | 27.45 | 0.7045 | 0.1315 | |||

| WSBC / WesBanco, Inc. | 0.08 | 0.00 | 2.67 | 2.18 | 0.6831 | -0.0099 | |||

| SIGI / Selective Insurance Group, Inc. | 0.03 | 49.26 | 2.64 | 41.26 | 0.6753 | 0.1799 | |||

| CADE / Cadence Bank | 0.08 | 0.00 | 2.63 | 5.32 | 0.6728 | 0.0108 | |||

| SYNA / Synaptics Incorporated | 0.04 | 0.00 | 2.63 | 1.74 | 0.6719 | -0.0127 | |||

| SXT / Sensient Technologies Corporation | 0.03 | 0.00 | 2.55 | 32.38 | 0.6508 | 0.1412 | |||

| ESE / ESCO Technologies Inc. | 0.01 | -0.49 | 2.54 | 20.00 | 0.6485 | 0.0883 | |||

| EXTR / Extreme Networks, Inc. | 0.14 | -1.29 | 2.51 | 33.96 | 0.6400 | 0.1447 | |||

| ABM / ABM Industries Incorporated | 0.05 | -1.29 | 2.49 | -1.62 | 0.6373 | -0.0340 | |||

| KRG / Kite Realty Group Trust | 0.11 | -1.29 | 2.49 | -0.04 | 0.6353 | -0.0236 | |||

| EFSC / Enterprise Financial Services Corp | 0.05 | -1.28 | 2.48 | 1.22 | 0.6344 | -0.0153 | |||

| SANM / Sanmina Corporation | 0.03 | -1.29 | 2.47 | 26.78 | 0.6314 | 0.1151 | |||

| EBC / Eastern Bankshares, Inc. | 0.16 | -1.29 | 2.47 | -8.12 | 0.6306 | -0.0806 | |||

| FCPT / Four Corners Property Trust, Inc. | 0.09 | -1.29 | 2.43 | -7.43 | 0.6202 | -0.0744 | |||

| RNST / Renasant Corporation | 0.07 | -1.20 | 2.42 | 4.63 | 0.6173 | 0.0058 | |||

| KEX / Kirby Corporation | 0.02 | 2.38 | 0.6077 | 0.6077 | |||||

| TSEM / Tower Semiconductor Ltd. | 0.05 | -1.11 | 2.37 | 20.23 | 0.6057 | 0.0834 | |||

| MMS / Maximus, Inc. | 0.03 | -1.09 | 2.36 | 1.85 | 0.6034 | -0.0108 | |||

| TPH / Tri Pointe Homes, Inc. | 0.07 | -1.29 | 2.36 | -1.21 | 0.6031 | -0.0296 | |||

| KAR / OPENLANE, Inc. | 0.10 | -1.29 | 2.36 | 25.19 | 0.6019 | 0.1035 | |||

| ANIP / ANI Pharmaceuticals, Inc. | 0.04 | -0.47 | 2.35 | -3.01 | 0.6012 | -0.0412 | |||

| AVT / Avnet, Inc. | 0.04 | -0.81 | 2.35 | 9.45 | 0.6008 | 0.0320 | |||

| LNTH / Lantheus Holdings, Inc. | 0.03 | 14.70 | 2.34 | -3.78 | 0.5978 | -0.0463 | |||

| CSGS / CSG Systems International, Inc. | 0.04 | -0.67 | 2.34 | 7.30 | 0.5970 | 0.0202 | |||

| BANC / Banc of California, Inc. | 0.17 | -1.29 | 2.33 | -2.26 | 0.5961 | -0.0361 | |||

| TGLS / Tecnoglass Inc. | 0.03 | -1.09 | 2.32 | 6.97 | 0.5919 | 0.0182 | |||

| HURN / Huron Consulting Group Inc. | 0.02 | -1.27 | 2.30 | -5.35 | 0.5883 | -0.0558 | |||

| CBU / Community Financial System, Inc. | 0.04 | 0.00 | 2.29 | 0.00 | 0.5860 | -0.0213 | |||

| HAE / Haemonetics Corporation | 0.03 | 5.37 | 2.29 | 23.69 | 0.5843 | 0.0947 | |||

| FBNC / First Bancorp | 0.05 | -1.28 | 2.29 | 8.39 | 0.5842 | 0.0257 | |||

| CBRL / Cracker Barrel Old Country Store, Inc. | 0.04 | -0.50 | 2.26 | 56.57 | 0.5786 | 0.1955 | |||

| KFY / Korn Ferry | 0.03 | -1.30 | 2.25 | 6.73 | 0.5753 | 0.0165 | |||

| ALK / Alaska Air Group, Inc. | 0.05 | 2.24 | 0.5734 | 0.5734 | |||||

| AUB / Atlantic Union Bankshares Corporation | 0.07 | -0.67 | 2.24 | -0.22 | 0.5714 | -0.0222 | |||

| MUR / Murphy Oil Corporation | 0.10 | 0.00 | 2.21 | -20.76 | 0.5656 | -0.1744 | |||

| SSB / SouthState Corporation | 0.02 | 0.00 | 2.21 | -0.85 | 0.5646 | -0.0256 | |||

| STEL / Stellar Bancorp, Inc. | 0.08 | -1.29 | 2.20 | -0.14 | 0.5616 | -0.0214 | |||

| IDA / IDACORP, Inc. | 0.02 | 246.24 | 2.19 | 244.25 | 0.5586 | 0.3903 | |||

| ESI / Element Solutions Inc | 0.10 | 7.15 | 2.18 | 7.35 | 0.5557 | 0.0191 | |||

| UMH / UMH Properties, Inc. | 0.13 | -1.29 | 2.17 | -11.39 | 0.5544 | -0.0940 | |||

| VSH / Vishay Intertechnology, Inc. | 0.14 | -0.85 | 2.16 | -1.01 | 0.5530 | -0.0258 | |||

| JBI / Janus International Group, Inc. | 0.27 | -0.47 | 2.16 | 12.50 | 0.5520 | 0.0435 | |||

| CMC / Commercial Metals Company | 0.04 | -1.30 | 2.16 | 4.96 | 0.5515 | 0.0067 | |||

| LXP / LXP Industrial Trust | 0.26 | -1.29 | 2.15 | -5.74 | 0.5493 | -0.0547 | |||

| STAG / STAG Industrial, Inc. | 0.06 | 18.61 | 2.15 | 19.13 | 0.5489 | 0.0714 | |||

| THR / Thermon Group Holdings, Inc. | 0.08 | -0.49 | 2.15 | 0.33 | 0.5482 | -0.0182 | |||

| DIOD / Diodes Incorporated | 0.04 | -0.81 | 2.14 | 21.50 | 0.5458 | 0.0803 | |||

| PWP / Perella Weinberg Partners | 0.11 | 19.81 | 2.13 | 26.43 | 0.5440 | 0.0981 | |||

| KN / Knowles Corporation | 0.12 | -0.81 | 2.13 | 14.99 | 0.5429 | 0.0535 | |||

| PNFP / Pinnacle Financial Partners, Inc. | 0.02 | -1.28 | 2.12 | 2.76 | 0.5423 | -0.0046 | |||

| WNS / WNS (Holdings) Limited | 0.03 | -19.40 | 2.12 | -17.12 | 0.5417 | -0.1356 | |||

| ATMU / Atmus Filtration Technologies Inc. | 0.06 | -0.47 | 2.12 | -1.30 | 0.5413 | -0.0272 | |||

| AL / Air Lease Corporation | 0.04 | -31.33 | 2.10 | -16.83 | 0.5365 | -0.1323 | |||

| AIN / Albany International Corp. | 0.03 | -0.52 | 2.09 | 1.06 | 0.5347 | -0.0137 | |||

| GBCI / Glacier Bancorp, Inc. | 0.05 | 0.00 | 2.09 | -2.61 | 0.5336 | -0.0341 | |||

| TNET / TriNet Group, Inc. | 0.03 | -0.64 | 2.09 | -8.31 | 0.5330 | -0.0694 | |||

| RUSHA / Rush Enterprises, Inc. | 0.04 | -1.18 | 2.09 | -4.71 | 0.5329 | -0.0467 | |||

| WAFD / WaFd, Inc | 0.07 | 16.15 | 2.08 | 19.00 | 0.5311 | 0.0685 | |||

| BRC / Brady Corporation | 0.03 | -1.28 | 2.06 | -5.02 | 0.5274 | -0.0481 | |||

| GVA / Granite Construction Incorporated | 0.02 | -1.28 | 2.06 | 22.43 | 0.5270 | 0.0809 | |||

| FRME / First Merchants Corporation | 0.05 | -1.29 | 2.04 | -6.51 | 0.5212 | -0.0567 | |||

| CRGY / Crescent Energy Company | 0.24 | 0.00 | 2.04 | -23.48 | 0.5203 | -0.1846 | |||

| SILA / Sila Realty Trust, Inc. | 0.08 | -0.47 | 2.00 | -11.79 | 0.5102 | -0.0894 | |||

| ELME / Elme Communities | 0.13 | -1.29 | 1.99 | -9.80 | 0.5079 | -0.0757 | |||

| AMBA / Ambarella, Inc. | 0.03 | 16.32 | 1.98 | 52.66 | 0.5068 | 0.1627 | |||

| SHOO / Steven Madden, Ltd. | 0.08 | -0.80 | 1.94 | -10.70 | 0.4947 | -0.0795 | |||

| ECVT / Ecovyst Inc. | 0.24 | -1.29 | 1.94 | 31.01 | 0.4945 | 0.1033 | |||

| ADTN / ADTRAN Holdings, Inc. | 0.21 | -0.87 | 1.91 | 1.97 | 0.4889 | -0.0081 | |||

| MTG / MGIC Investment Corporation | 0.07 | -0.65 | 1.90 | 11.68 | 0.4861 | 0.0347 | |||

| UCB / United Community Banks, Inc. | 0.06 | 0.00 | 1.90 | 5.93 | 0.4842 | 0.0103 | |||

| CENTA / Central Garden & Pet Company | 0.06 | 17.66 | 1.89 | 12.47 | 0.4840 | 0.0380 | |||

| KLIC / Kulicke and Soffa Industries, Inc. | 0.05 | -0.81 | 1.88 | 4.04 | 0.4809 | 0.0019 | |||

| NX / Quanex Building Products Corporation | 0.10 | 0.00 | 1.88 | 1.67 | 0.4808 | -0.0094 | |||

| AAMI / Acadian Asset Management Inc. | 0.05 | -33.19 | 1.85 | -8.97 | 0.4719 | -0.0653 | |||

| LZB / La-Z-Boy Incorporated | 0.05 | -0.66 | 1.84 | -5.53 | 0.4711 | -0.0458 | |||

| NWE / NorthWestern Energy Group, Inc. | 0.04 | -1.29 | 1.83 | -12.47 | 0.4662 | -0.0860 | |||

| OGE / OGE Energy Corp. | 0.04 | 0.00 | 1.82 | -3.44 | 0.4658 | -0.0342 | |||

| CPRI / Capri Holdings Limited | 0.10 | 0.00 | 1.82 | -10.28 | 0.4638 | -0.0721 | |||

| HUBG / Hub Group, Inc. | 0.05 | -1.29 | 1.80 | -11.24 | 0.4603 | -0.0771 | |||

| VRNT / Verint Systems Inc. | 0.09 | -1.29 | 1.79 | 8.76 | 0.4569 | 0.0215 | |||

| MTDR / Matador Resources Company | 0.04 | -1.29 | 1.70 | -7.81 | 0.4342 | -0.0539 | |||

| AWI / Armstrong World Industries, Inc. | 0.01 | -34.50 | 1.69 | -24.50 | 0.4309 | -0.1605 | |||

| GEF / Greif, Inc. | 0.02 | -30.31 | 1.59 | -17.62 | 0.4072 | -0.1052 | |||

| PBF / PBF Energy Inc. | 0.07 | -0.66 | 1.57 | 12.81 | 0.4004 | 0.0324 | |||

| XPRO / Expro Group Holdings N.V. | 0.18 | -1.19 | 1.57 | -14.61 | 0.4002 | -0.0856 | |||

| SR / Spire Inc. | 0.02 | -0.47 | 1.54 | -7.14 | 0.3922 | -0.0457 | |||

| MATX / Matson, Inc. | 0.01 | -75.44 | 1.53 | -66.13 | 0.3920 | -0.2293 | |||

| OLED / Universal Display Corporation | 0.01 | 0.00 | 1.52 | 10.79 | 0.3884 | 0.0249 | |||

| NEO / NeoGenomics, Inc. | 0.21 | 4.50 | 1.52 | -19.50 | 0.3881 | -0.1116 | |||

| VIAV / Viavi Solutions Inc. | 0.15 | 0.00 | 1.50 | -10.00 | 0.3840 | -0.0583 | |||

| AIR / AAR Corp. | 0.02 | 0.00 | 1.46 | 22.90 | 0.3731 | 0.0583 | |||

| PEB / Pebblebrook Hotel Trust | 0.14 | -1.29 | 1.40 | -2.64 | 0.3583 | -0.0232 | |||

| INVX / Innovex International, Inc. | 0.09 | -1.29 | 1.38 | -14.17 | 0.3514 | -0.0729 | |||

| GLPG / Galapagos NV - Depositary Receipt (Common Stock) | 0.05 | -18.83 | 1.36 | -9.57 | 0.3475 | -0.0508 | |||

| SHO / Sunstone Hotel Investors, Inc. | 0.15 | -1.29 | 1.34 | -8.94 | 0.3435 | -0.0475 | |||

| EPC / Edgewell Personal Care Company | 0.06 | -1.09 | 1.34 | -25.84 | 0.3425 | -0.1360 | |||

| RMBS / Rambus Inc. | 0.02 | 0.00 | 1.30 | 23.71 | 0.3318 | 0.0537 | |||

| MRTN / Marten Transport, Ltd. | 0.10 | -1.29 | 1.26 | -6.52 | 0.3224 | -0.0352 | |||

| ANGO / AngioDynamics, Inc. | 0.13 | 0.00 | 1.26 | 5.63 | 0.3216 | 0.0061 | |||

| YETI / YETI Holdings, Inc. | 0.04 | 1.25 | 0.3186 | 0.3186 | |||||

| ARCB / ArcBest Corporation | 0.02 | 0.00 | 1.23 | 9.11 | 0.3153 | 0.0158 | |||

| TRNO / Terreno Realty Corporation | 0.02 | 0.00 | 1.23 | -11.31 | 0.3146 | -0.0531 | |||

| NJR / New Jersey Resources Corporation | 0.03 | 0.00 | 1.22 | -8.63 | 0.3110 | -0.0419 | |||

| THRM / Gentherm Incorporated | 0.04 | 0.00 | 1.20 | 5.84 | 0.3058 | 0.0062 | |||

| GDEN / Golden Entertainment, Inc. | 0.04 | -0.65 | 1.19 | 10.78 | 0.3047 | 0.0196 | |||

| TITN / Titan Machinery Inc. | 0.06 | -1.29 | 1.19 | 14.77 | 0.3040 | 0.0294 | |||

| LASR / nLIGHT, Inc. | 0.06 | -51.41 | 1.09 | 23.09 | 0.2793 | 0.0441 | |||

| MNRO / Monro, Inc. | 0.07 | -1.29 | 1.09 | 1.77 | 0.2784 | -0.0053 | |||

| FL / Foot Locker, Inc. | 0.04 | -51.03 | 1.06 | -14.88 | 0.2703 | -0.0590 | |||

| WERN / Werner Enterprises, Inc. | 0.04 | -20.41 | 1.06 | -25.69 | 0.2699 | -0.1065 | |||

| LOCO / El Pollo Loco Holdings, Inc. | 0.09 | -1.29 | 1.00 | 5.46 | 0.2566 | 0.0045 | |||

| GERN / Geron Corporation | 0.70 | 0.00 | 0.98 | -11.39 | 0.2505 | -0.0423 | |||

| CGNT / Cognyte Software Ltd. | 0.10 | -41.82 | 0.97 | -31.03 | 0.2475 | -0.1247 | |||

| OXM / Oxford Industries, Inc. | 0.02 | -1.28 | 0.96 | -32.32 | 0.2457 | -0.1303 | |||

| FIVN / Five9, Inc. | 0.04 | 0.00 | 0.93 | -2.52 | 0.2373 | -0.0149 | |||

| WGO / Winnebago Industries, Inc. | 0.03 | -1.29 | 0.93 | -16.92 | 0.2372 | -0.0588 | |||

| ICHR / Ichor Holdings, Ltd. | 0.05 | 0.00 | 0.93 | -13.13 | 0.2367 | -0.0457 | |||

| BCRX / BioCryst Pharmaceuticals, Inc. | 0.10 | 0.00 | 0.87 | 19.45 | 0.2228 | 0.0295 | |||

| HP / Helmerich & Payne, Inc. | 0.06 | 0.00 | 0.86 | -41.95 | 0.2203 | -0.1731 | |||

| CMCO / Columbus McKinnon Corporation | 0.05 | 0.00 | 0.83 | -9.76 | 0.2126 | -0.0317 | |||

| COTY / Coty Inc. | 0.18 | 0.00 | 0.82 | -15.05 | 0.2107 | -0.0462 | |||

| EPAC / Enerpac Tool Group Corp. | 0.02 | 0.00 | 0.81 | -9.60 | 0.2071 | -0.0303 | |||

| ASTE / Astec Industries, Inc. | 0.02 | 0.00 | 0.79 | 20.96 | 0.2007 | 0.0288 | |||

| GXO / GXO Logistics, Inc. | 0.02 | 0.77 | 0.1975 | 0.1975 | |||||

| VAL / Valaris Limited | 0.02 | 0.00 | 0.77 | 7.24 | 0.1969 | 0.0066 | |||

| MD / Pediatrix Medical Group, Inc. | 0.05 | -15.22 | 0.75 | -16.01 | 0.1917 | -0.0450 | |||

| THS / TreeHouse Foods, Inc. | 0.03 | -33.48 | 0.60 | -52.36 | 0.1522 | -0.1787 | |||

| SM / SM Energy Company | 0.02 | -53.63 | 0.55 | -61.76 | 0.1401 | -0.2395 | |||

| RYI / Ryerson Holding Corporation | 0.02 | -57.02 | 0.52 | -59.60 | 0.1339 | -0.2097 | |||

| OEC / Orion S.A. | 0.05 | -51.45 | 0.49 | -60.65 | 0.1243 | -0.2029 | |||

| PEBO / Peoples Bancorp Inc. | 0.02 | 0.00 | 0.49 | 2.97 | 0.1243 | -0.0008 | |||

| VPG / Vishay Precision Group, Inc. | 0.02 | 0.46 | 0.1173 | 0.1173 | |||||

| KDNY / Chinook Therapeutics Inc | 0.00 | 0.00 | 0.00 | 0.00 | 0.0006 | -0.0000 | |||

| NEOG / Neogen Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1349 |