Mga Batayang Estadistika

| Manajer | Victor Morgenstern |

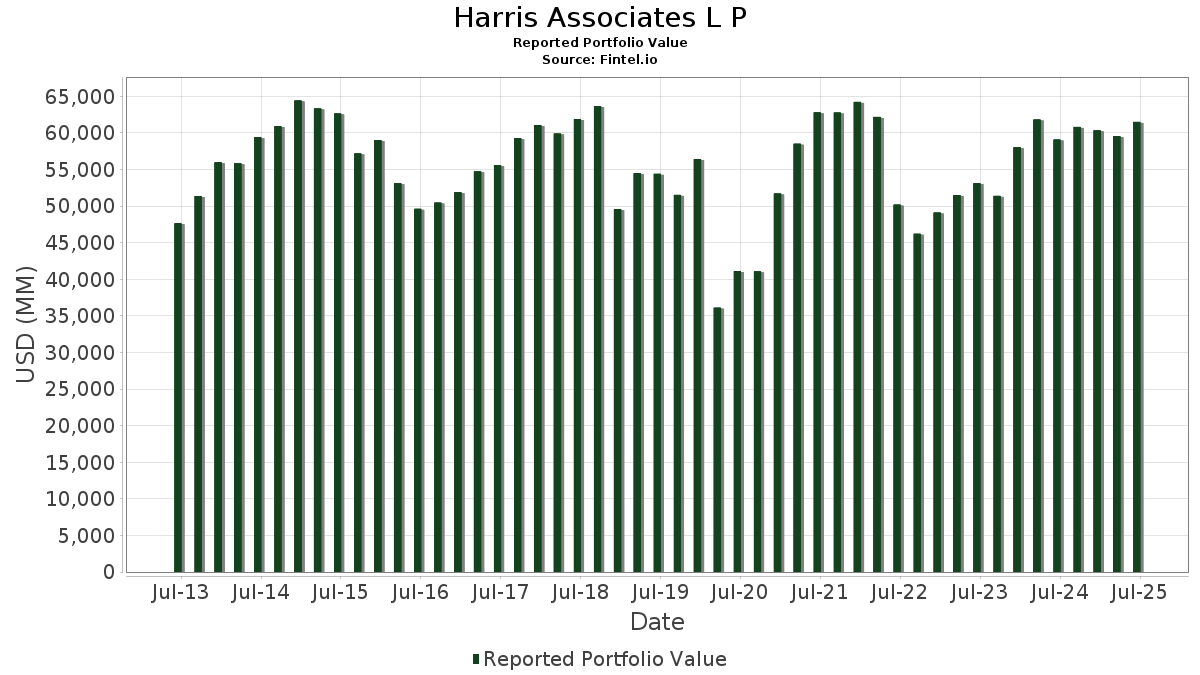

| Nilai Portofolio | $ 61,501,169,028 |

| Posisi Saat Ini | 171 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

Harris Associates L P telah mengungkapkan total kepemilikan 171 dalam pengajuan SEC terbaru mereka. Manajer portofolio tercantum sebagai Victor Morgenstern. Nilai portofolio terbaru dihitung sebesar $ 61,501,169,028 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Harris Associates L P adalah Alphabet Inc. (US:GOOGL) , Capital One Financial Corporation (US:COF) , The Charles Schwab Corporation (US:SCHW) , Intercontinental Exchange, Inc. (US:ICE) , and Airbnb, Inc. (US:ABNB) . Posisi baru Harris Associates L P meliputi: ICON Public Limited Company (US:ICLR) , Charles River Laboratories International, Inc. (US:CRL) , Owens Corning (US:OC) , CSX Corporation (US:CSX) , and Costco Wholesale Corporation (US:COST) . Industri unggulan Harris Associates L P adalah "Petroleum Refining And Related Industries" (sic 29) , "Furniture And Fixtures" (sic 25) , and "Automotive Repair, Services, And Parking" (sic 75) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2.99 | 816.05 | 1.2917 | 1.1450 | |

| 14.24 | 1,884.17 | 2.9824 | 0.9874 | |

| 8.75 | 621.52 | 0.9838 | 0.9838 | |

| 4.70 | 1,032.01 | 1.6336 | 0.9206 | |

| 4.13 | 685.77 | 1.0855 | 0.5627 | |

| 3.73 | 340.40 | 0.5388 | 0.5388 | |

| 10.07 | 2,142.09 | 3.3907 | 0.4245 | |

| 1.64 | 238.26 | 0.3874 | 0.3874 | |

| 9.67 | 716.44 | 1.1340 | 0.3705 | |

| 16.15 | 1,374.33 | 2.1754 | 0.3272 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2.19 | 1,111.13 | 1.7588 | -1.5651 | |

| 0.39 | 27.91 | 0.0442 | -1.0966 | |

| 17.27 | 1,478.09 | 2.3397 | -0.9195 | |

| 5.65 | 118.30 | 0.1873 | -0.8952 | |

| 5.33 | 919.07 | 1.4548 | -0.6406 | |

| 0.84 | 58.22 | 0.0922 | -0.5900 | |

| 6.91 | 514.83 | 0.8149 | -0.5538 | |

| 19.38 | 1,739.20 | 2.7530 | -0.4472 | |

| 4.66 | 557.41 | 0.8823 | -0.4413 | |

| 2.77 | 92.84 | 0.1469 | -0.4197 |

Pengajuan 13D/G

Ini adalah daftar pengajuan 13D dan 13G yang dibuat dalam setahun terakhir (jika ada). Klik ikon tautan untuk melihat riwayat transaksi lengkap. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup.

| Tanggal File | Formulir | Keamanan | Sebelumnya Saham |

Saat ini Saham |

ΔPersentase Saham | % Kepemilikan |

% ΔKepemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | FBIN / Fortune Brands Innovations, Inc. | 6,292,703 | 7,581,775 | 20.49 | 6.30 | 23.53 | ||

| 2025-08-14 | CNC / Centene Corporation | 26,314,183 | 20,418,731 | -22.40 | 4.10 | -18.03 | ||

| 2025-08-14 | NVST / Envista Holdings Corporation | 8,681,256 | 7,812,256 | -10.01 | 4.60 | -8.00 | ||

| 2025-08-14 | WEN / The Wendy's Company | 11,076,295 | 5.80 | |||||

| 2025-08-14 | BWA / BorgWarner Inc. | 11,839,353 | 2,772,856 | -76.58 | 1.30 | -74.95 | ||

| 2025-08-14 | PAYC / Paycom Software, Inc. | 3,040,150 | 2,081,854 | -31.52 | 3.60 | -32.08 | ||

| 2025-08-14 | IQV / IQVIA Holdings Inc. | 9,747,869 | 11,753,182 | 20.57 | 6.80 | 27.34 | ||

| 2025-05-15 | BC / Brunswick Corporation | 3,472,408 | 5.30 | |||||

| 2025-05-15 | / () | 667,011 | 5.30 | |||||

| 2025-05-15 | CNH / CNH Industrial N.V. | 116,101,645 | 84,068,624 | -27.59 | 6.70 | -27.96 | ||

| 2025-02-14 | WPP / WPP plc - Depositary Receipt (Common Stock) | 58,809,451 | 48,165,671 | -18.10 | 4.50 | -17.43 | ||

| 2025-02-14 | FMS / Fresenius Medical Care AG - Depositary Receipt (Common Stock) | 15,173,585 | 11,717,575 | -22.78 | 3.90 | -24.56 | ||

| 2025-02-14 | FCNC.A / First Citizens BancShares, Inc. | 686,473 | ||||||

| 2024-11-14 | LBTYA / Liberty Global Ltd. | 22,532,696 | 8,594,315 | -61.86 | 4.97 | -62.35 | ||

| 2024-11-14 | THO / THOR Industries, Inc. | 2,683,623 | 2,412,118 | -10.12 | 4.56 | -9.34 | ||

| 2024-11-14 | CBRE / CBRE Group, Inc. | 16,005,141 | 14,099,434 | -11.91 | 4.60 | -12.38 | ||

| 2024-11-14 | APA / APA Corporation | 15,705,693 | 24,914,699 | 58.63 | 6.74 | 31.64 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GOOGL / Alphabet Inc. | 15.75 | -5.70 | 2,775.60 | 7.46 | 4.3935 | 0.0562 | |||

| COF / Capital One Financial Corporation | 10.07 | 2.20 | 2,142.09 | 21.27 | 3.3907 | 0.4245 | |||

| SCHW / The Charles Schwab Corporation | 22.97 | -16.81 | 2,095.75 | -3.04 | 3.3174 | -0.3124 | |||

| ICE / Intercontinental Exchange, Inc. | 10.27 | -10.16 | 1,884.28 | -4.44 | 2.9826 | -0.3287 | |||

| ABNB / Airbnb, Inc. | 14.24 | 43.16 | 1,884.17 | 58.60 | 2.9824 | 0.9874 | |||

| IQV / IQVIA Holdings Inc. | 11.75 | 5.23 | 1,852.18 | -5.94 | 3.0116 | -0.2951 | |||

| COP / ConocoPhillips | 19.38 | 6.80 | 1,739.20 | -8.74 | 2.7530 | -0.4472 | |||

| PSX / Phillips 66 | 13.45 | -2.79 | 1,604.48 | -6.08 | 2.5397 | -0.3290 | |||

| KDP / Keurig Dr Pepper Inc. | 47.12 | 8.50 | 1,557.73 | 4.82 | 2.5328 | 0.0372 | |||

| CHTR / Charter Communications, Inc. | 3.67 | -11.34 | 1,501.30 | -1.65 | 2.3764 | -0.1870 | |||

| AIG / American International Group, Inc. | 17.27 | -22.64 | 1,478.09 | -23.84 | 2.3397 | -0.9195 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.74 | 10.38 | 1,440.45 | 16.47 | 2.2801 | 0.2033 | |||

| BAC / Bank of America Corporation | 29.41 | 3.70 | 1,391.84 | 17.59 | 2.2031 | 0.2154 | |||

| C / Citigroup Inc. | 16.15 | 4.14 | 1,374.33 | 24.87 | 2.1754 | 0.3272 | |||

| EFX / Equifax Inc. | 5.11 | 11.75 | 1,324.81 | 19.01 | 2.0970 | 0.2277 | |||

| CBRE / CBRE Group, Inc. | 9.09 | -6.10 | 1,274.34 | 0.61 | 2.0172 | -0.1099 | |||

| WBD / Warner Bros. Discovery, Inc. | 108.93 | 13.97 | 1,248.29 | 21.73 | 1.9759 | 0.2539 | |||

| GM / General Motors Company | 25.30 | -14.72 | 1,245.18 | -10.76 | 1.9710 | -0.3722 | |||

| WTW / Willis Towers Watson Public Limited Company | 3.79 | 6.46 | 1,160.49 | -3.45 | 1.8369 | -0.1814 | |||

| DE / Deere & Company | 2.19 | -48.18 | 1,111.13 | -43.86 | 1.7588 | -1.5651 | |||

| CNC / Centene Corporation | 20.42 | -3.39 | 1,108.33 | -13.63 | 1.8021 | -0.3527 | |||

| ALLY / Ally Financial Inc. | 26.84 | 7.71 | 1,045.29 | 15.04 | 1.6546 | 0.1287 | |||

| AMZN / Amazon.com, Inc. | 4.70 | 110.81 | 1,032.01 | 143.08 | 1.6336 | 0.9206 | |||

| CNH / CNH Industrial N.V. | 79.03 | -5.99 | 1,024.23 | -0.79 | 1.6213 | -0.1124 | |||

| TEL / TE Connectivity plc | 5.50 | 12.70 | 927.57 | 34.52 | 1.4682 | 0.3103 | |||

| FI / Fiserv, Inc. | 5.33 | -5.66 | 919.07 | -26.35 | 1.4548 | -0.6406 | |||

| WFC / Wells Fargo & Company | 11.47 | -2.66 | 918.83 | 8.63 | 1.4544 | 0.0340 | |||

| ELV / Elevance Health, Inc. | 2.29 | 0.32 | 889.77 | -10.29 | 1.4084 | -0.2571 | |||

| CRM / Salesforce, Inc. | 2.99 | 818.86 | 816.05 | 833.69 | 1.2917 | 1.1450 | |||

| STT / State Street Corporation | 7.62 | -0.89 | 810.46 | 17.72 | 1.2829 | 0.1268 | |||

| CMCSA / Comcast Corporation | 21.40 | 3.92 | 763.85 | 0.51 | 1.2091 | -0.0671 | |||

| MRK / Merck & Co., Inc. | 9.13 | 22.25 | 722.84 | 7.81 | 1.1442 | 0.0183 | |||

| GEHC / GE HealthCare Technologies Inc. | 9.67 | 71.68 | 716.44 | 57.56 | 1.1340 | 0.3705 | |||

| CRBG / Corebridge Financial, Inc. | 20.14 | -3.82 | 714.91 | 8.15 | 1.1316 | 0.0216 | |||

| NDAQ / Nasdaq, Inc. | 7.77 | -10.60 | 694.95 | 5.38 | 1.1000 | -0.0074 | |||

| DAL / Delta Air Lines, Inc. | 14.05 | 24.41 | 690.91 | 40.33 | 1.0936 | 0.2669 | |||

| MPC / Marathon Petroleum Corporation | 4.13 | 93.21 | 685.77 | 120.29 | 1.0855 | 0.5627 | |||

| LAD / Lithia Motors, Inc. | 1.99 | -0.65 | 672.76 | 14.33 | 1.0649 | 0.0768 | |||

| SYY / Sysco Corporation | 8.73 | 1.92 | 661.31 | 2.87 | 1.0468 | -0.0327 | |||

| LBRDK / Liberty Broadband Corporation | 6.41 | -3.40 | 630.71 | 11.74 | 0.9983 | 0.0504 | |||

| NKE / NIKE, Inc. | 8.75 | 621.52 | 0.9838 | 0.9838 | |||||

| CG / The Carlyle Group Inc. | 11.32 | 28.78 | 581.64 | 51.85 | 0.9207 | 0.2775 | |||

| EOG / EOG Resources, Inc. | 4.66 | -24.18 | 557.41 | -29.28 | 0.8823 | -0.4413 | |||

| GPN / Global Payments Inc. | 6.68 | 23.24 | 534.42 | 0.74 | 0.8459 | -0.0449 | |||

| CTVA / Corteva, Inc. | 6.91 | -46.67 | 514.83 | -36.83 | 0.8149 | -0.5538 | |||

| BDX / Becton, Dickinson and Company | 2.92 | 125.81 | 502.50 | 69.81 | 0.7954 | 0.2985 | |||

| APA / APA Corporation | 26.61 | 3.49 | 486.63 | -9.95 | 0.7703 | -0.1372 | |||

| PAYC / Paycom Software, Inc. | 2.08 | -31.52 | 481.74 | -27.47 | 0.7833 | -0.3321 | |||

| RGA / Reinsurance Group of America, Incorporated | 2.38 | 11.35 | 472.80 | 12.18 | 0.7484 | 0.0406 | |||

| MAS / Masco Corporation | 7.32 | 16.68 | 470.89 | 7.99 | 0.7454 | 0.0131 | |||

| MOH / Molina Healthcare, Inc. | 1.54 | 47.15 | 459.16 | 33.08 | 0.7268 | 0.1474 | |||

| BK / The Bank of New York Mellon Corporation | 4.91 | -32.47 | 447.00 | -26.64 | 0.7076 | -0.3157 | |||

| FBIN / Fortune Brands Innovations, Inc. | 7.58 | 13.90 | 390.31 | -3.68 | 0.6178 | -0.0627 | |||

| GPC / Genuine Parts Company | 2.91 | 3.15 | 352.94 | 5.03 | 0.5587 | -0.0057 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 3.73 | 340.40 | 0.5388 | 0.5388 | |||||

| STZ / Constellation Brands, Inc. | 1.75 | 1.44 | 285.22 | -10.08 | 0.4515 | -0.0812 | |||

| BAX / Baxter International Inc. | 9.35 | 3.83 | 283.07 | -8.15 | 0.4481 | -0.0695 | |||

| MGA / Magna International Inc. | 7.30 | 2.50 | 281.96 | 16.43 | 0.4463 | 0.0396 | |||

| V / Visa Inc. | 0.77 | -7.66 | 274.76 | -6.45 | 0.4349 | -0.0583 | |||

| BLK / BlackRock, Inc. | 0.26 | 13.78 | 273.56 | 26.14 | 0.4330 | 0.0688 | |||

| GOOG / Alphabet Inc. | 1.37 | -8.41 | 242.14 | 3.99 | 0.3833 | -0.0077 | |||

| ICLR / ICON Public Limited Company | 1.64 | 238.26 | 0.3874 | 0.3874 | |||||

| FLUT / Flutter Entertainment plc | 0.81 | 40.97 | 231.05 | 81.82 | 0.3657 | 0.1523 | |||

| RYAAY / Ryanair Holdings plc - Depositary Receipt (Common Stock) | 3.92 | -38.58 | 225.86 | -16.40 | 0.3575 | -0.0962 | |||

| ORCL / Oracle Corporation | 1.02 | -7.29 | 223.69 | 44.97 | 0.3541 | 0.0950 | |||

| BC / Brunswick Corporation | 3.81 | 9.64 | 210.30 | 12.47 | 0.3329 | 0.0189 | |||

| CE / Celanese Corporation | 3.56 | 57.76 | 196.70 | 53.76 | 0.3114 | 0.0965 | |||

| CRL / Charles River Laboratories International, Inc. | 1.16 | 176.45 | 0.2869 | 0.2869 | |||||

| SEE / Sealed Air Corporation | 5.34 | -16.10 | 165.74 | -9.91 | 0.2624 | -0.0466 | |||

| OTEX / Open Text Corporation | 5.50 | -38.77 | 160.76 | -29.08 | 0.2545 | -0.1262 | |||

| MTN / Vail Resorts, Inc. | 0.97 | -6.11 | 152.82 | -7.80 | 0.2419 | -0.0364 | |||

| NVST / Envista Holdings Corporation | 7.81 | -10.01 | 152.65 | 1.88 | 0.2416 | -0.0100 | |||

| WEN / The Wendy's Company | 11.08 | 13.59 | 126.49 | -11.33 | 0.2057 | -0.0339 | |||

| ABM / ABM Industries Incorporated | 2.62 | 14.44 | 123.60 | 14.08 | 0.1957 | 0.0137 | |||

| KVUE / Kenvue Inc. | 5.65 | -78.97 | 118.30 | -81.65 | 0.1873 | -0.8952 | |||

| THO / THOR Industries, Inc. | 1.33 | -9.71 | 117.86 | 5.77 | 0.1866 | -0.0006 | |||

| APTV / Aptiv PLC | 1.39 | -56.09 | 94.50 | -49.66 | 0.1496 | -0.1656 | |||

| BWA / BorgWarner Inc. | 2.77 | -76.46 | 92.84 | -72.49 | 0.1469 | -0.4197 | |||

| HCA / HCA Healthcare, Inc. | 0.24 | -20.60 | 92.78 | -11.98 | 0.1469 | -0.0301 | |||

| MDLZ / Mondelez International, Inc. | 1.36 | -41.93 | 92.01 | -42.28 | 0.1456 | -0.1221 | |||

| KAR / OPENLANE, Inc. | 3.59 | -6.83 | 87.79 | 18.16 | 0.1390 | 0.0142 | |||

| AXP / American Express Company | 0.25 | -5.28 | 79.39 | 12.30 | 0.1257 | 0.0069 | |||

| WMG / Warner Music Group Corp. | 2.76 | -31.39 | 75.18 | -40.38 | 0.1190 | -0.0928 | |||

| MA / Mastercard Incorporated | 0.13 | -1.73 | 71.43 | 0.75 | 0.1131 | -0.0060 | |||

| ALSN / Allison Transmission Holdings, Inc. | 0.71 | 86.85 | 67.70 | 85.52 | 0.1072 | 0.0459 | |||

| IPG / The Interpublic Group of Companies, Inc. | 2.40 | -54.18 | 58.64 | -58.70 | 0.0928 | -0.1456 | |||

| CVS / CVS Health Corporation | 0.84 | -85.92 | 58.22 | -85.67 | 0.0922 | -0.5900 | |||

| KKR / KKR & Co. Inc. | 0.43 | -15.46 | 57.29 | -2.72 | 0.0907 | -0.0082 | |||

| ACVA / ACV Auctions Inc. | 3.04 | 1.72 | 49.34 | 17.10 | 0.0781 | 0.0073 | |||

| GS / The Goldman Sachs Group, Inc. | 0.07 | -15.78 | 46.78 | 9.11 | 0.0740 | 0.0020 | |||

| TRGP / Targa Resources Corp. | 0.26 | 260.76 | 45.28 | 213.28 | 0.0717 | 0.0474 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.15 | -11.60 | 39.64 | 3.47 | 0.0627 | -0.0016 | |||

| ALV / Autoliv, Inc. | 0.33 | -3.49 | 37.43 | 22.10 | 0.0593 | 0.0078 | |||

| OC / Owens Corning | 0.26 | 36.04 | 0.0586 | 0.0586 | |||||

| CDW / CDW Corporation | 0.20 | 35.49 | 0.0562 | 0.0562 | |||||

| CWK / Cushman & Wakefield plc | 2.92 | -4.95 | 32.33 | 2.95 | 0.0512 | -0.0016 | |||

| GRFS / Grifols, S.A. - Depositary Receipt (Common Stock) | 3.13 | -9.10 | 28.26 | 15.57 | 0.0447 | 0.0037 | |||

| KR / The Kroger Co. | 0.39 | -96.12 | 27.91 | -95.89 | 0.0442 | -1.0966 | |||

| AAPL / Apple Inc. | 0.13 | 1.77 | 26.84 | -6.00 | 0.0425 | -0.0055 | |||

| LEA / Lear Corporation | 0.24 | -10.32 | 22.43 | -3.45 | 0.0355 | -0.0035 | |||

| SPNS / Sapiens International Corporation N.V. | 0.67 | 35.92 | 19.71 | 46.75 | 0.0312 | 0.0086 | |||

| CCK / Crown Holdings, Inc. | 0.19 | -3.93 | 19.39 | 10.84 | 0.0307 | 0.0013 | |||

| CIGI / Colliers International Group Inc. | 0.11 | 25.98 | 13.90 | 36.27 | 0.0220 | 0.0049 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.03 | -3.43 | 13.46 | -11.91 | 0.0213 | -0.0044 | |||

| TXN / Texas Instruments Incorporated | 0.05 | 1.66 | 10.12 | 17.46 | 0.0160 | 0.0016 | |||

| HHH / Howard Hughes Holdings Inc. | 0.12 | -92.16 | 8.41 | -92.85 | 0.0133 | -0.1843 | |||

| CSX / CSX Corporation | 0.19 | 6.34 | 0.0103 | 0.0103 | |||||

| NFLX / Netflix, Inc. | 0.00 | -2.78 | 4.31 | 39.62 | 0.0068 | 0.0016 | |||

| MSFT / Microsoft Corporation | 0.01 | 77.77 | 3.36 | 135.58 | 0.0053 | 0.0029 | |||

| NVDA / NVIDIA Corporation | 0.02 | 284.79 | 2.64 | 461.28 | 0.0043 | 0.0035 | |||

| META / Meta Platforms, Inc. | 0.00 | 33.93 | 2.62 | 71.54 | 0.0041 | 0.0016 | |||

| CSL / Carlisle Companies Incorporated | 0.01 | -34.58 | 2.50 | -28.26 | 0.0040 | -0.0019 | |||

| DOV / Dover Corporation | 0.01 | -4.90 | 2.25 | -0.79 | 0.0036 | -0.0002 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 18.74 | 1.68 | 40.28 | 0.0027 | 0.0006 | |||

| WDAY / Workday, Inc. | 0.01 | -74.74 | 1.46 | -74.06 | 0.0023 | -0.0072 | |||

| MCO / Moody's Corporation | 0.00 | -11.40 | 1.46 | -4.57 | 0.0023 | -0.0003 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -19.64 | 1.41 | -11.24 | 0.0022 | -0.0004 | |||

| LBRDA / Liberty Broadband Corporation | 0.01 | -26.39 | 1.31 | -15.31 | 0.0021 | -0.0005 | |||

| MBC / MasterBrand, Inc. | 0.11 | 123.19 | 1.23 | 86.91 | 0.0019 | 0.0008 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.01 | 3.70 | 1.21 | -0.25 | 0.0019 | -0.0001 | |||

| TFC / Truist Financial Corporation | 0.03 | -93.23 | 1.20 | -92.93 | 0.0019 | -0.0266 | |||

| CAT / Caterpillar Inc. | 0.00 | 41.38 | 1.03 | 66.29 | 0.0016 | 0.0006 | |||

| JCI / Johnson Controls International plc | 0.01 | -23.48 | 1.00 | 0.91 | 0.0016 | -0.0001 | |||

| HRI / Herc Holdings Inc. | 0.01 | 0.00 | 0.95 | -1.95 | 0.0015 | -0.0001 | |||

| PM / Philip Morris International Inc. | 0.01 | 8.49 | 0.93 | 24.40 | 0.0015 | 0.0002 | |||

| XOM / Exxon Mobil Corporation | 0.01 | 21.11 | 0.77 | 9.82 | 0.0012 | 0.0000 | |||

| CFG / Citizens Financial Group, Inc. | 0.02 | 0.00 | 0.72 | 9.15 | 0.0011 | 0.0000 | |||

| DHR / Danaher Corporation | 0.00 | -78.86 | 0.65 | -79.63 | 0.0010 | -0.0043 | |||

| EBAY / eBay Inc. | 0.01 | -19.05 | 0.63 | -11.11 | 0.0010 | -0.0002 | |||

| ABBV / AbbVie Inc. | 0.00 | 0.59 | 0.0009 | 0.0009 | |||||

| COST / Costco Wholesale Corporation | 0.00 | 0.58 | 0.0009 | 0.0009 | |||||

| AVGO / Broadcom Inc. | 0.00 | 0.56 | 0.0009 | 0.0009 | |||||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.00 | -51.11 | 0.53 | -49.95 | 0.0008 | -0.0009 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 18.45 | 0.49 | 19.61 | 0.0008 | 0.0001 | |||

| THC / Tenet Healthcare Corporation | 0.00 | 0.00 | 0.42 | 31.06 | 0.0007 | 0.0001 | |||

| CRI / Carter's, Inc. | 0.01 | -88.64 | 0.42 | -91.65 | 0.0007 | -0.0077 | |||

| MCD / McDonald's Corporation | 0.00 | -82.21 | 0.41 | -83.39 | 0.0007 | -0.0035 | |||

| AMAT / Applied Materials, Inc. | 0.00 | 0.40 | 0.0006 | 0.0006 | |||||

| CVX / Chevron Corporation | 0.00 | 34.61 | 0.36 | 15.16 | 0.0006 | 0.0000 | |||

| PEP / PepsiCo, Inc. | 0.00 | 0.33 | 0.0005 | 0.0005 | |||||

| LLY / Eli Lilly and Company | 0.00 | 0.32 | 0.0005 | 0.0005 | |||||

| HON / Honeywell International Inc. | 0.00 | -55.58 | 0.31 | -51.18 | 0.0005 | -0.0006 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.02 | 0.30 | 0.0005 | 0.0005 | |||||

| KB / KB Financial Group Inc. - Depositary Receipt (Common Stock) | 0.00 | 0.29 | 0.0005 | 0.0005 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | -97.71 | 0.29 | -98.04 | 0.0005 | -0.0239 | |||

| ABT / Abbott Laboratories | 0.00 | 0.28 | 0.0004 | 0.0004 | |||||

| FMS / Fresenius Medical Care AG - Depositary Receipt (Common Stock) | 0.01 | -8.84 | 0.28 | 4.51 | 0.0004 | -0.0000 | |||

| PG / The Procter & Gamble Company | 0.00 | 0.27 | 0.0004 | 0.0004 | |||||

| PDX / PIMCO Dynamic Income Strategy Fund | 0.01 | 0.27 | 0.0004 | 0.0004 | |||||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | 0.27 | 0.0004 | 0.0004 | |||||

| BKNG / Booking Holdings Inc. | 0.00 | -24.59 | 0.27 | -5.34 | 0.0004 | -0.0001 | |||

| AMD / Advanced Micro Devices, Inc. | 0.00 | 0.26 | 0.0004 | 0.0004 | |||||

| WMT / Walmart Inc. | 0.00 | -86.42 | 0.26 | -84.93 | 0.0004 | -0.0025 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.25 | 0.0004 | 0.0004 | |||||

| AON / Aon plc | 0.00 | 0.25 | 0.0004 | 0.0004 | |||||

| HDB / HDFC Bank Limited - Depositary Receipt (Common Stock) | 0.00 | 0.23 | 0.0004 | 0.0004 | |||||

| SYK / Stryker Corporation | 0.00 | 0.23 | 0.0004 | 0.0004 | |||||

| PUK / Prudential plc - Depositary Receipt (Common Stock) | 0.01 | -23.24 | 0.22 | -10.89 | 0.0004 | -0.0001 | |||

| ZTS / Zoetis Inc. | 0.00 | 0.22 | 0.0004 | 0.0004 | |||||

| INTU / Intuit Inc. | 0.00 | 0.21 | 0.0003 | 0.0003 | |||||

| PH / Parker-Hannifin Corporation | 0.00 | 0.21 | 0.0003 | 0.0003 | |||||

| DIS / The Walt Disney Company | 0.00 | -67.85 | 0.20 | -59.60 | 0.0003 | -0.0005 | |||

| VOT / Vanguard Index Funds - Vanguard Mid-Cap Growth ETF | 0.00 | 0.20 | 0.0003 | 0.0003 | |||||

| BTX / BlackRock Innovation and Growth Term Trust | 0.03 | 0.18 | 0.0003 | 0.0003 | |||||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | 46.90 | 0.17 | 58.49 | 0.0003 | 0.0001 | |||

| ACWI / iShares Trust - iShares MSCI ACWI ETF | 0.00 | -42.28 | 0.14 | -36.36 | 0.0002 | -0.0001 | |||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 0.03 | -37.01 | 0.12 | -30.06 | 0.0002 | -0.0001 | |||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.00 | 0.09 | 0.0001 | 0.0001 | |||||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.00 | -24.15 | 0.06 | -18.06 | 0.0001 | -0.0000 | |||

| INDA / iShares Trust - iShares MSCI India ETF | 0.00 | 0.00 | 0.03 | 10.00 | 0.0001 | 0.0000 | |||

| EUFN / iShares Trust - iShares MSCI Europe Financials ETF | 0.00 | 0.00 | 0.02 | 5.88 | 0.0000 | 0.0000 | |||

| SEG / Seaport Entertainment Group Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LW / Lamb Weston Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TRN / Trinity Industries, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MAN / ManpowerGroup Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SPGI / S&P Global Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ETSY / Etsy, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ITA / iShares Trust - iShares U.S. Aerospace & Defense ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IGF / iShares Trust - iShares Global Infrastructure ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BMY / Bristol-Myers Squibb Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| INTC / Intel Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LPLA / LPL Financial Holdings Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VSTS / Vestis Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ACWX / iShares Trust - iShares MSCI ACWI ex U.S. ETF | 0.00 | -100.00 | 0.00 | 0.0000 |