Mga Batayang Estadistika

| Nilai Portofolio | $ 3,753,739,100 |

| Posisi Saat Ini | 56 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

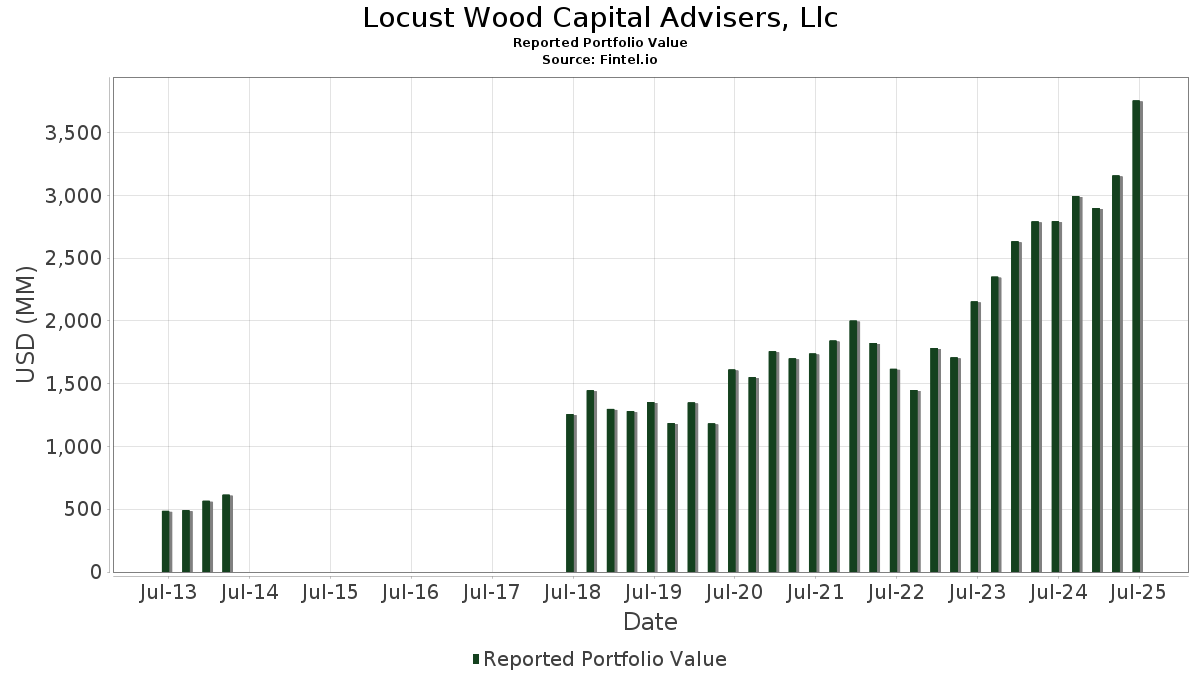

Locust Wood Capital Advisers, Llc telah mengungkapkan total kepemilikan 56 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 3,753,739,100 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Locust Wood Capital Advisers, Llc adalah SPDR S&P 500 ETF (US:SPY) , Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) , Linde plc (US:LIN) , Amazon.com, Inc. (US:AMZN) , and Microsoft Corporation (US:MSFT) . Posisi baru Locust Wood Capital Advisers, Llc meliputi: NVIDIA Corporation (US:NVDA) , ServiceNow, Inc. (US:NOW) , Ball Corporation (US:BALL) , Cummins Inc. (US:CMI) , and nVent Electric plc (US:NVT) . Industri unggulan Locust Wood Capital Advisers, Llc adalah "Petroleum Refining And Related Industries" (sic 29) , "Miscellaneous Retail " (sic 59) , and "Holding And Other Investment Offices" (sic 67) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.74 | 116.74 | 3.1101 | 3.1101 | |

| 1.32 | 170.09 | 4.5313 | 1.7705 | |

| 0.47 | 291.93 | 7.7772 | 1.2647 | |

| 1.10 | 249.61 | 6.6495 | 1.2122 | |

| 0.04 | 45.42 | 1.2101 | 1.2101 | |

| 1.01 | 221.03 | 5.8881 | 0.8562 | |

| 1.93 | 136.88 | 3.6464 | 0.7930 | |

| 8.16 | 114.95 | 3.0623 | 0.5351 | |

| 0.77 | 134.93 | 3.5946 | 0.3373 | |

| 1.57 | 124.31 | 3.3116 | 0.3308 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.48 | 108.84 | 2.8996 | -2.5160 | |

| 3.24 | 96.22 | 2.5633 | -1.5489 | |

| 0.33 | 126.73 | 3.3762 | -1.1044 | |

| 0.48 | 223.44 | 5.9525 | -1.0754 | |

| 0.07 | 32.42 | 0.8636 | -0.7526 | |

| 2.30 | 86.20 | 2.2963 | -0.6986 | |

| 7.78 | 108.45 | 2.8891 | -0.6945 | |

| 0.48 | 99.24 | 2.6436 | -0.6363 | |

| 1.95 | 144.17 | 3.8406 | -0.6193 | |

| 0.24 | 85.12 | 2.2677 | -0.3119 |

Pengajuan 13D/G

Ini adalah daftar pengajuan 13D dan 13G yang dibuat dalam setahun terakhir (jika ada). Klik ikon tautan untuk melihat riwayat transaksi lengkap. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup.

| Tanggal File | Formulir | Keamanan | Sebelumnya Saham |

Saat ini Saham |

ΔPersentase Saham | % Kepemilikan |

% ΔKepemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2025-08-13 | CMPO / CompoSecure, Inc. | 7,168,470 | 8,259,527 | 15.22 | 8.10 | 15.71 | ||

| 2025-04-03 | RHLD / Resolute Holdings Management, Inc. | 547,128 | 6.40 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-13 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | Put | 0.47 | 28.57 | 291.93 | 42.01 | 7.7772 | 1.2647 | ||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 1.10 | 6.59 | 249.61 | 45.43 | 6.6495 | 1.2122 | |||

| LIN / Linde plc | 0.48 | -0.04 | 223.44 | 0.72 | 5.9525 | -1.0754 | |||

| AMZN / Amazon.com, Inc. | 1.01 | 20.67 | 221.03 | 39.15 | 5.8881 | 0.8562 | |||

| MSFT / Microsoft Corporation | 0.44 | -10.93 | 219.83 | 18.02 | 5.8564 | -0.0443 | |||

| VRT / Vertiv Holdings Co | 1.32 | 9.74 | 170.09 | 95.18 | 4.5313 | 1.7705 | |||

| GEHC / GE HealthCare Technologies Inc. | 1.95 | 11.58 | 144.17 | 2.40 | 3.8406 | -0.6193 | |||

| ABT / Abbott Laboratories | 1.04 | 12.00 | 141.14 | 14.84 | 3.7600 | -0.1334 | |||

| NKE / NIKE, Inc. | 1.93 | 35.79 | 136.88 | 51.96 | 3.6464 | 0.7930 | |||

| GOOGL / Alphabet Inc. | 0.77 | 15.15 | 134.93 | 31.23 | 3.5946 | 0.3373 | |||

| ELV / Elevance Health, Inc. | 0.33 | 0.20 | 126.73 | -10.40 | 3.3762 | -1.1044 | |||

| CP / Canadian Pacific Kansas City Limited | 1.57 | 17.01 | 124.31 | 32.11 | 3.3116 | 0.3308 | |||

| SPGI / S&P Global Inc. | 0.22 | 16.27 | 117.35 | 20.66 | 3.1261 | 0.0452 | |||

| NVDA / NVIDIA Corporation | 0.74 | 116.74 | 3.1101 | 3.1101 | |||||

| CRM / Salesforce, Inc. | 0.43 | 10.50 | 116.14 | 12.28 | 3.0941 | -0.1828 | |||

| CMPO / CompoSecure, Inc. | 8.16 | 11.16 | 114.95 | 44.09 | 3.0623 | 0.5351 | |||

| WM / Waste Management, Inc. | 0.48 | -35.58 | 108.84 | -36.33 | 2.8996 | -2.5160 | |||

| PCG / PG&E Corporation | 7.78 | 18.15 | 108.45 | -4.13 | 2.8891 | -0.6945 | |||

| STE / STERIS plc | 0.42 | 12.35 | 100.07 | 19.08 | 2.6659 | 0.0037 | |||

| AAPL / Apple Inc. | 0.48 | 3.77 | 99.24 | -4.15 | 2.6436 | -0.6363 | |||

| ESI / Element Solutions Inc | 4.31 | 17.07 | 97.59 | 17.28 | 2.5998 | -0.0363 | |||

| AXTA / Axalta Coating Systems Ltd. | 3.24 | -17.19 | 96.22 | -25.88 | 2.5633 | -1.5489 | |||

| SU / Suncor Energy Inc. | 2.30 | -5.73 | 86.20 | -8.82 | 2.2963 | -0.6986 | |||

| V / Visa Inc. | 0.24 | 3.19 | 85.12 | 4.54 | 2.2677 | -0.3119 | |||

| APO / Apollo Global Management, Inc. | 0.45 | 3.69 | 63.45 | 7.42 | 1.6903 | -0.1808 | |||

| CZR / Caesars Entertainment, Inc. | 1.94 | 6.26 | 55.17 | 20.67 | 1.4697 | 0.0214 | |||

| NOW / ServiceNow, Inc. | 0.04 | 45.42 | 1.2101 | 1.2101 | |||||

| BRK.B / Berkshire Hathaway Inc. | 0.07 | -30.34 | 32.42 | -36.46 | 0.8636 | -0.7526 | |||

| ELV / Elevance Health, Inc. | Call | 0.08 | 0.00 | 30.46 | -10.58 | 0.8113 | -0.2676 | ||

| PCG / PG&E Corporation | Call | 1.65 | 156.28 | 23.04 | 107.94 | 0.6139 | 0.2628 | ||

| RHLD / Resolute Holdings Management, Inc. | 0.58 | 7.76 | 18.54 | 9.58 | 0.4940 | -0.0421 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 17.49 | -8.72 | 0.4660 | -0.1411 | |||

| ABT / Abbott Laboratories | Call | 0.11 | -32.64 | 15.44 | -30.93 | 0.4112 | -0.2968 | ||

| NKE / NIKE, Inc. | Put | 0.05 | -66.67 | 3.73 | -62.70 | 0.0994 | -0.2174 | ||

| SGU / Star Group, L.P. - Limited Partnership | 0.14 | -3.93 | 1.69 | -14.77 | 0.0451 | -0.0178 | |||

| FIX / Comfort Systems USA, Inc. | 0.00 | 0.00 | 1.14 | 66.47 | 0.0304 | 0.0087 | |||

| URI / United Rentals, Inc. | 0.00 | -2.25 | 0.82 | 17.55 | 0.0218 | -0.0003 | |||

| BALL / Ball Corporation | 0.01 | 0.81 | 0.0215 | 0.0215 | |||||

| ETN / Eaton Corporation plc | 0.00 | 0.80 | 0.0214 | 0.0214 | |||||

| CMI / Cummins Inc. | 0.00 | 0.80 | 0.0213 | 0.0213 | |||||

| SAIA / Saia, Inc. | 0.00 | 0.79 | 0.0211 | 0.0211 | |||||

| TDY / Teledyne Technologies Incorporated | 0.00 | 0.00 | 0.78 | 2.89 | 0.0209 | -0.0032 | |||

| MMM / 3M Company | 0.01 | 0.78 | 0.0208 | 0.0208 | |||||

| NVT / nVent Electric plc | 0.01 | 0.78 | 0.0208 | 0.0208 | |||||

| UFPI / UFP Industries, Inc. | 0.01 | 0.77 | 0.0206 | 0.0206 | |||||

| EXPD / Expeditors International of Washington, Inc. | 0.01 | 0.77 | 0.0205 | 0.0205 | |||||

| PPG / PPG Industries, Inc. | 0.01 | 0.77 | 0.0205 | 0.0205 | |||||

| CNH / CNH Industrial N.V. | 0.06 | 0.76 | 0.0203 | 0.0203 | |||||

| PKG / Packaging Corporation of America | 0.00 | 7.73 | 0.76 | 2.56 | 0.0203 | -0.0032 | |||

| PCAR / PACCAR Inc | 0.01 | 0.75 | 0.0200 | 0.0200 | |||||

| SSD / Simpson Manufacturing Co., Inc. | 0.00 | 0.75 | 0.0199 | 0.0199 | |||||

| AVY / Avery Dennison Corporation | 0.00 | 0.73 | 0.0193 | 0.0193 | |||||

| GPK / Graphic Packaging Holding Company | 0.03 | 0.68 | 0.0181 | 0.0181 | |||||

| AAON / AAON, Inc. | 0.01 | 0.56 | 0.0150 | 0.0150 | |||||

| FTV / Fortive Corporation | 0.01 | 2.94 | 0.55 | -26.68 | 0.0146 | -0.0091 | |||

| CZR / Caesars Entertainment, Inc. | Call | 0.02 | 0.00 | 0.52 | 13.48 | 0.0139 | -0.0007 | ||

| AIT / Applied Industrial Technologies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ABT / Abbott Laboratories | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.3068 | |||

| CE / Celanese Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SEE / Sealed Air Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LII / Lennox International Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GWW / W.W. Grainger, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IP / International Paper Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TT / Trane Technologies plc | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IFF / International Flavors & Fragrances Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BLD / TopBuild Corp. | 0.00 | -100.00 | 0.00 | 0.0000 |