Mga Batayang Estadistika

| Manajer | John Khoury |

| Profil Orang Dalam | Long Pond Capital, LP |

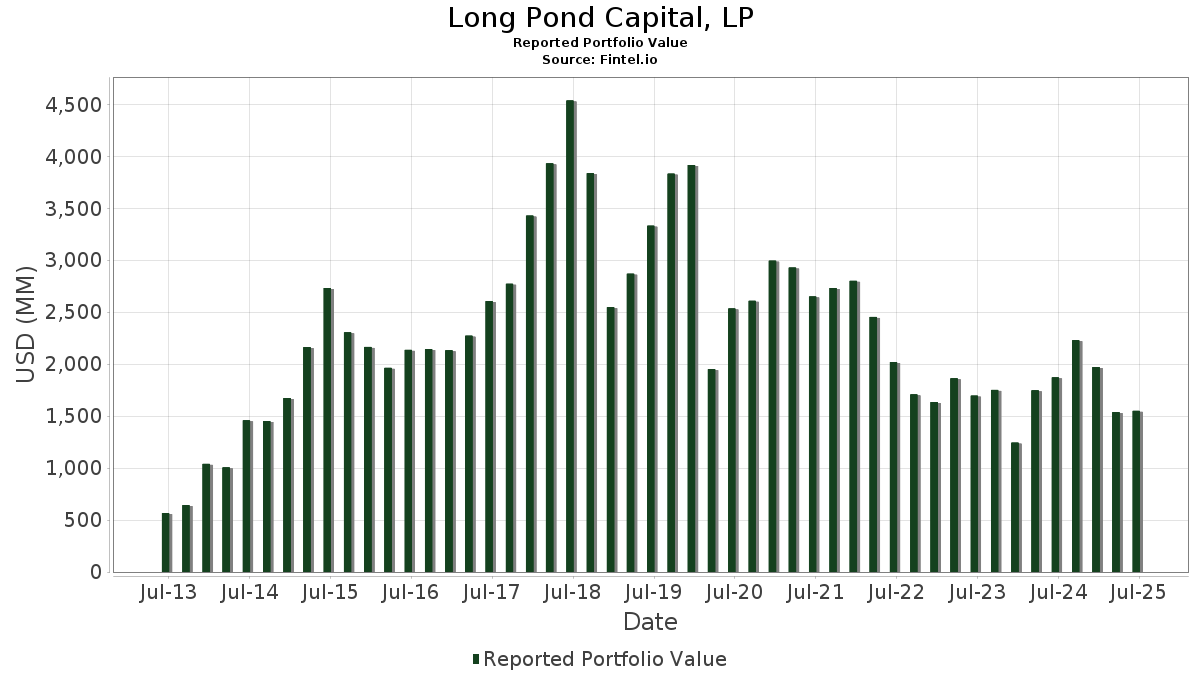

| Nilai Portofolio | $ 1,550,023,356 |

| Posisi Saat Ini | 29 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

Long Pond Capital, LP telah mengungkapkan total kepemilikan 29 dalam pengajuan SEC terbaru mereka. Manajer portofolio tercantum sebagai John Khoury. Nilai portofolio terbaru dihitung sebesar $ 1,550,023,356 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Long Pond Capital, LP adalah Hyatt Hotels Corporation (US:H) , Wyndham Hotels & Resorts, Inc. (US:WH) , Brightstar Lottery PLC (US:BRSL) , Camden Property Trust (US:CPT) , and Six Flags Entertainment Corporation (US:FUN) . Posisi baru Long Pond Capital, LP meliputi: Summit Hotel Properties, Inc. (US:INN) , Simon Property Group, Inc. (US:SPG) , M/I Homes, Inc. (US:MHO) , . Industri unggulan Long Pond Capital, LP adalah "Non-depository Credit Institutions" (sic 61) , "Real Estate" (sic 65) , and "Automotive Dealers And Gasoline Service Stations" (sic 55) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.51 | 122.28 | 7.8892 | 6.5169 | |

| 2.50 | 79.94 | 5.1571 | 5.1571 | |

| 5.50 | 97.30 | 6.2776 | 5.1347 | |

| 1.02 | 115.25 | 7.4356 | 4.8085 | |

| 7.57 | 119.63 | 7.7180 | 4.3091 | |

| 1.56 | 95.91 | 6.1878 | 3.5642 | |

| 0.20 | 51.37 | 3.3141 | 3.3141 | |

| 9.40 | 47.85 | 3.0868 | 3.0868 | |

| 0.21 | 33.52 | 2.1624 | 2.1624 | |

| 3.30 | 100.32 | 6.4720 | 1.5440 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.92 | 128.65 | 8.2998 | -4.1806 | |

| 0.28 | 18.64 | 1.2026 | -3.9874 | |

| 0.64 | 73.25 | 4.7260 | -2.9389 | |

| 2.28 | 13.93 | 0.8984 | -2.3836 | |

| 0.09 | 2.58 | 0.1663 | -0.9412 | |

| 1.31 | 54.43 | 3.5118 | -0.9388 | |

| 0.74 | 96.00 | 6.1934 | -0.6606 | |

| 0.90 | 46.96 | 3.0299 | -0.3919 | |

| 7.30 | 56.38 | 3.6376 | -0.2332 | |

| 10.07 | 9.97 | 0.6429 | -0.1491 |

Pengajuan 13D/G

Ini adalah daftar pengajuan 13D dan 13G yang dibuat dalam setahun terakhir (jika ada). Klik ikon tautan untuk melihat riwayat transaksi lengkap. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup.

| Tanggal File | Formulir | Keamanan | Sebelumnya Saham |

Saat ini Saham |

ΔPersentase Saham | % Kepemilikan |

% ΔKepemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2025-08-13 | INN / Summit Hotel Properties, Inc. | 9,400,000 | 8.38 | |||||

| 2025-08-13 | JBGS / JBG SMITH Properties | 3,603,883 | 3,867,406 | 7.31 | 5.29 | 20.50 | ||

| 2025-05-14 | PGRE / Paramount Group, Inc. | 0 | 11,737,433 | 5.35 | ||||

| 2025-05-14 | PLYA / Playa Hotels & Resorts N.V. | 7,941,444 | 3,757,576 | -52.68 | 2.94 | -54.98 | ||

| 2025-05-14 | NLOP / Net Lease Office Properties | 861,601 | 0 | -100.00 | 0.00 | -100.00 | ||

| 2025-02-13 | SMRT / SmartRent, Inc. | 10,066,093 | 5.23 | |||||

| 2025-02-13 | TRTX / TPG RE Finance Trust, Inc. | 7,303,626 | 9.02 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-13 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| H / Hyatt Hotels Corporation | 0.92 | -41.20 | 128.65 | -32.97 | 8.2998 | -4.1806 | |||

| WH / Wyndham Hotels & Resorts, Inc. | 1.51 | 545.83 | 122.28 | 479.49 | 7.8892 | 6.5169 | |||

| BRSL / Brightstar Lottery PLC | 7.57 | 134.70 | 119.63 | 128.21 | 7.7180 | 4.3091 | |||

| CPT / Camden Property Trust | 1.02 | 209.61 | 115.25 | 185.28 | 7.4356 | 4.8085 | |||

| FUN / Six Flags Entertainment Corporation | 3.30 | 55.17 | 100.32 | 32.37 | 6.4720 | 1.5440 | |||

| IRT / Independence Realty Trust, Inc. | 5.50 | 564.46 | 97.30 | 453.68 | 6.2776 | 5.1347 | |||

| DHI / D.R. Horton, Inc. | 0.74 | -10.18 | 96.00 | -8.92 | 6.1934 | -0.6606 | |||

| TMHC / Taylor Morrison Home Corporation | 1.56 | 132.39 | 95.91 | 137.73 | 6.1878 | 3.5642 | |||

| NSA / National Storage Affiliates Trust | 2.50 | 79.94 | 5.1571 | 5.1571 | |||||

| TOL / Toll Brothers, Inc. | 0.64 | -42.50 | 73.25 | -37.85 | 4.7260 | -2.9389 | |||

| JBGS / JBG SMITH Properties | 3.83 | 6.39 | 66.33 | 14.24 | 4.2792 | 0.5038 | |||

| TRTX / TPG RE Finance Trust, Inc. | 7.30 | 0.00 | 56.38 | -5.28 | 3.6376 | -0.2332 | |||

| HGV / Hilton Grand Vacations Inc. | 1.31 | -28.36 | 54.43 | -20.47 | 3.5118 | -0.9388 | |||

| JLL / Jones Lang LaSalle Incorporated | 0.20 | 51.37 | 3.3141 | 3.3141 | |||||

| INN / Summit Hotel Properties, Inc. | 9.40 | 47.85 | 3.0868 | 3.0868 | |||||

| RRR / Red Rock Resorts, Inc. | 0.90 | -25.60 | 46.96 | -10.75 | 3.0299 | -0.3919 | |||

| SPG / Simon Property Group, Inc. | 0.21 | 33.52 | 2.1624 | 2.1624 | |||||

| BRSL / Brightstar Lottery PLC | Call | 2.00 | 0.00 | 31.62 | -2.77 | 2.0400 | -0.0747 | ||

| KRC / Kilroy Realty Corporation | 0.79 | 6.36 | 26.94 | 11.39 | 1.7379 | 0.1653 | |||

| MTH / Meritage Homes Corporation | 0.28 | -75.28 | 18.64 | -76.64 | 1.2026 | -3.9874 | |||

| AIV / Apartment Investment and Management Company | 1.70 | 14.69 | 0.9474 | 0.9474 | |||||

| MAA / Mid-America Apartment Communities, Inc. | 0.09 | 0.95 | 13.97 | -10.84 | 0.9016 | -0.1176 | |||

| PGRE / Paramount Group, Inc. | 2.28 | -80.55 | 13.93 | -72.41 | 0.8984 | -2.3836 | |||

| DBRG / DigitalBridge Group, Inc. | 1.33 | 13.75 | 0.8869 | 0.8869 | |||||

| MHO / M/I Homes, Inc. | 0.12 | 13.69 | 0.8835 | 0.8835 | |||||

| SMRT / SmartRent, Inc. | 10.07 | 0.00 | 9.97 | -18.18 | 0.6429 | -0.1491 | |||

| PLD / Prologis, Inc. | 0.03 | 3.63 | 0.2343 | 0.2343 | |||||

| CZR / Caesars Entertainment, Inc. | 0.09 | -86.67 | 2.58 | -84.87 | 0.1663 | -0.9412 | |||

| LXP / LXP Industrial Trust | 0.15 | 1.24 | 0.0799 | 0.0799 | |||||

| KRG / Kite Realty Group Trust | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UHALB / U-Haul Holding Company - Series N | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HLT / Hilton Worldwide Holdings Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VNO / Vornado Realty Trust | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GDEN / Golden Entertainment, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PLYA / Playa Hotels & Resorts N.V. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| REXR / Rexford Industrial Realty, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CUBE / CubeSmart | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WYNN / Wynn Resorts, Limited | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PHM / PulteGroup, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MSGE / Madison Square Garden Entertainment Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VTMX / Corporación Inmobiliaria Vesta, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DEI / Douglas Emmett, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VAC / Marriott Vacations Worldwide Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |