Mga Batayang Estadistika

| Nilai Portofolio | $ 170,670,128 |

| Posisi Saat Ini | 49 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

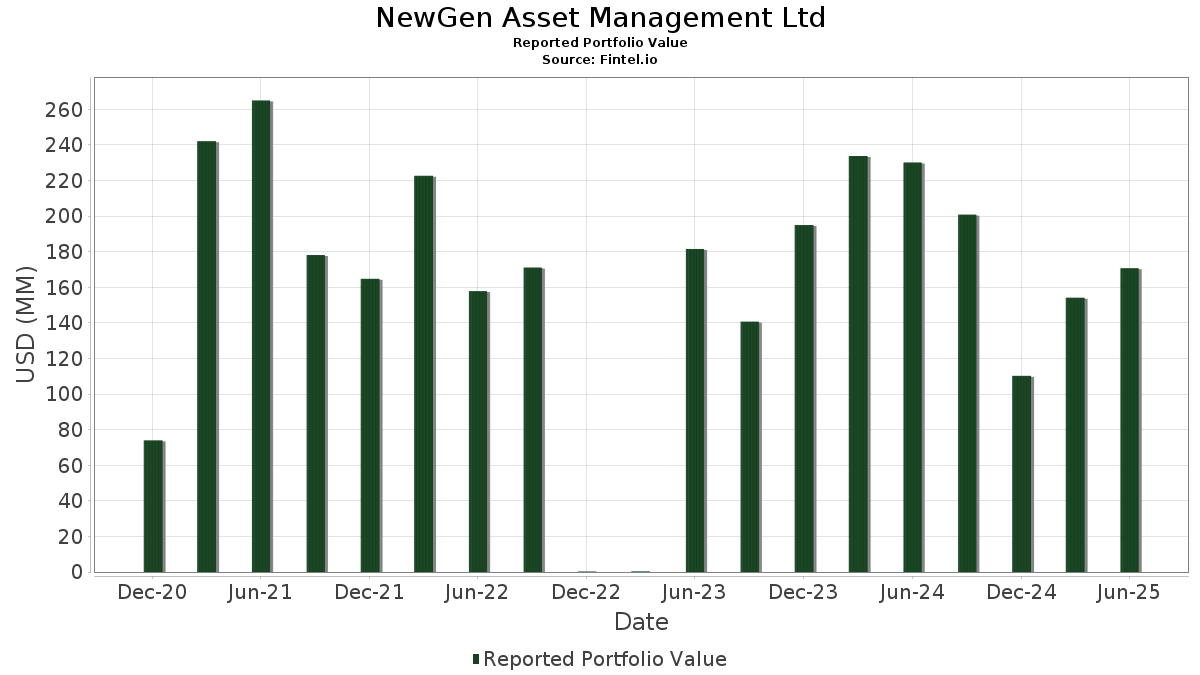

NewGen Asset Management Ltd telah mengungkapkan total kepemilikan 49 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 170,670,128 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama NewGen Asset Management Ltd adalah Americas Gold and Silver Corporation (US:USAS) , iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF (US:HYG) , Cameco Corporation (US:CCJ) , Celestica Inc. (US:CLS) , and BlackBerry Limited (US:BB) . Posisi baru NewGen Asset Management Ltd meliputi: Americas Gold and Silver Corporation (US:USAS) , iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF (US:HYG) , Cameco Corporation (US:CCJ) , Celestica Inc. (US:CLS) , and BlackBerry Limited (US:BB) . Industri unggulan NewGen Asset Management Ltd adalah "Lumber And Wood Products, Except Furniture" (sic 24) , "Restaurants, Dining, Eating And Drinking Places" (sic 58) , and "Mining And Quarrying Of Nonmetallic Minerals, Except Fuels" (sic 14) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.19 | 14.25 | 8.3507 | 8.3507 | |

| 0.19 | 14.25 | 7.9855 | 7.9855 | |

| 1.00 | 9.40 | 5.5084 | 5.5084 | |

| 1.00 | 9.40 | 5.2675 | 5.2675 | |

| 1.20 | 8.33 | 4.8796 | 4.8796 | |

| 1.20 | 8.33 | 4.6662 | 4.6662 | |

| 0.09 | 14.05 | 8.2322 | 4.6521 | |

| 32.10 | 25.93 | 15.1914 | 4.3770 | |

| 0.09 | 14.05 | 7.8722 | 4.2920 | |

| 32.10 | 25.93 | 14.5270 | 3.7126 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.20 | 16.13 | 9.0376 | -8.8811 | |

| 0.20 | 16.13 | 9.4510 | -8.4677 | |

| 0.93 | 6.82 | 3.8200 | -2.0612 | |

| 0.93 | 6.82 | 3.9947 | -1.8865 | |

| 0.09 | 4.08 | 2.2854 | -1.0215 | |

| 0.09 | 4.08 | 2.3899 | -0.9170 | |

| 0.24 | 6.97 | 3.9034 | -0.7651 | |

| 0.30 | 9.42 | 5.2780 | -0.7184 | |

| 0.24 | 6.97 | 4.0819 | -0.5866 | |

| 0.30 | 9.42 | 5.5194 | -0.4770 |

Pengajuan 13D/G

Ini adalah daftar pengajuan 13D dan 13G yang dibuat dalam setahun terakhir (jika ada). Klik ikon tautan untuk melihat riwayat transaksi lengkap. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup.

| Tanggal File | Formulir | Keamanan | Sebelumnya Saham |

Saat ini Saham |

ΔPersentase Saham | % Kepemilikan |

% ΔKepemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2025-04-09 | USAS / Americas Gold and Silver Corporation | 32,500,000 | 5.20 | |||||

| 2024-11-13 | ELBM / Electra Battery Materials Corporation | 4,452,060 | 0 | -100.00 | 0.00 | -100.00 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-19 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| USAS / Americas Gold and Silver Corporation | 32.10 | 1.55 | 25.93 | 55.59 | 14.5270 | 3.7126 | |||

| USAS / Americas Gold and Silver Corporation | 32.10 | 25.93 | 15.1914 | 4.3770 | |||||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | Put | 0.20 | 16.13 | 9.4510 | -8.4677 | ||||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | Put | 0.20 | -42.86 | 16.13 | -41.58 | 9.0376 | -8.8811 | ||

| CCJ / Cameco Corporation | 0.19 | 14.25 | 8.3507 | 8.3507 | |||||

| CCJ / Cameco Corporation | 0.19 | 14.25 | 7.9855 | 7.9855 | |||||

| CLS / Celestica Inc. | 0.09 | 14.05 | 8.2322 | 4.6521 | |||||

| CLS / Celestica Inc. | 0.09 | 28.57 | 14.05 | 154.70 | 7.8722 | 4.2920 | |||

| BB / BlackBerry Limited | 2.70 | 12.37 | 7.2456 | 3.0864 | |||||

| BB / BlackBerry Limited | 2.70 | 58.82 | 12.37 | 92.95 | 6.9287 | 2.7695 | |||

| CNQ / Canadian Natural Resources Limited | Call | 0.30 | 0.00 | 9.42 | 1.95 | 5.2780 | -0.7184 | ||

| CNQ / Canadian Natural Resources Limited | Call | 0.30 | 9.42 | 5.5194 | -0.4770 | ||||

| SAND / Sandstorm Gold Ltd. | 1.00 | 9.40 | 5.5084 | 5.5084 | |||||

| SAND / Sandstorm Gold Ltd. | 1.00 | 9.40 | 5.2675 | 5.2675 | |||||

| NXE / NexGen Energy Ltd. | 1.20 | 8.33 | 4.6662 | 4.6662 | |||||

| NXE / NexGen Energy Ltd. | 1.20 | 8.33 | 4.8796 | 4.8796 | |||||

| ASTL / Algoma Steel Group Inc. | 1.13 | 54.66 | 7.81 | 96.60 | 4.3736 | 1.7971 | |||

| PRMB / Primo Brands Corporation | 0.24 | 6.97 | 4.0819 | -0.5866 | |||||

| PRMB / Primo Brands Corporation | 0.24 | 16.03 | 6.97 | -3.16 | 3.9034 | -0.7651 | |||

| SLSR / Silver Surprize Inc | 1.50 | 6.87 | 4.0249 | 1.3849 | |||||

| SLSR / Silver Surprize Inc | 1.50 | 25.00 | 6.87 | 68.85 | 3.8488 | 1.2089 | |||

| IAG / IAMGOLD Corporation | 0.93 | -36.12 | 6.82 | -24.77 | 3.8200 | -2.0612 | |||

| IAG / IAMGOLD Corporation | 0.93 | 6.82 | 3.9947 | -1.8865 | |||||

| BEP / Brookfield Renewable Partners L.P. - Limited Partnership | 0.24 | 6.16 | 3.6115 | 0.0160 | |||||

| BEP / Brookfield Renewable Partners L.P. - Limited Partnership | 0.24 | -3.24 | 6.16 | 11.25 | 3.4536 | -0.1420 | |||

| EFXT / Enerflex Ltd. | 0.71 | 31.22 | 5.63 | 33.94 | 3.1535 | 0.4264 | |||

| EFXT / Enerflex Ltd. | 0.71 | 5.63 | 3.2978 | 0.5706 | |||||

| IAUX / i-80 Gold Corp. | 8.70 | 5.21 | 3.0501 | 3.0501 | |||||

| IAUX / i-80 Gold Corp. | 8.70 | 5.21 | 2.9167 | 2.9167 | |||||

| SQNS / Sequans Communications S.A. - Depositary Receipt (Common Stock) | 3.16 | 4.64 | 2.5988 | 2.5988 | |||||

| SQNS / Sequans Communications S.A. - Depositary Receipt (Common Stock) | 3.16 | 4.64 | 2.7177 | 2.7177 | |||||

| ENB / Enbridge Inc. | 0.09 | -21.74 | 4.08 | -19.96 | 2.2854 | -1.0215 | |||

| ENB / Enbridge Inc. | 0.09 | 4.08 | 2.3899 | -0.9170 | |||||

| US12685JAG04 / CONV. NOTE | 4.63 | 112.69 | 3.57 | 106.30 | 1.9990 | 0.8766 | |||

| US12685JAG04 / CONV. NOTE | 4.63 | 3.57 | 2.0905 | 0.9680 | |||||

| PPTA / Perpetua Resources Corp. | 0.28 | 3.34 | 1.8706 | 1.8706 | |||||

| PPTA / Perpetua Resources Corp. | 0.28 | 3.34 | 1.9561 | 1.9561 | |||||

| RBA / RB Global, Inc. | 0.03 | 2.65 | 1.5555 | 1.5555 | |||||

| RBA / RB Global, Inc. | 0.03 | 2.65 | 1.4875 | 1.4875 | |||||

| UPXI / Upexi, Inc. | 0.58 | 1.72 | 0.9637 | 0.9637 | |||||

| UPXI / Upexi, Inc. | 0.58 | 1.72 | 1.0078 | 1.0078 | |||||

| BITDEER TECHNOLOGIES GROUP / Fixed Income (09175RAA8) | 0.70 | 1.11 | 0.0000 | ||||||

| BITDEER TECHNOLOGIES GROUP / Fixed Income (09175RAA8) | 0.70 | 1.11 | 0.0000 | ||||||

| US477143AP66 / CONV. NOTE | 1.10 | 1.04 | 0.6114 | -0.0021 | |||||

| US477143AP66 / CONV. NOTE | 1.10 | 10.00 | 1.04 | 10.37 | 0.5846 | -0.0288 | |||

| US163092AF65 / CONVERTIBLE ZERO | 1.00 | 0.78 | 0.4598 | -0.0936 | |||||

| US163092AF65 / CONVERTIBLE ZERO | 1.00 | 1.01 | 0.78 | -7.98 | 0.4397 | -0.1137 | |||

| ANNA / AleAnna, Inc. | 0.03 | 0.20 | 0.1193 | -0.0189 | |||||

| ANNA / AleAnna, Inc. | 0.03 | 0.00 | 0.20 | -4.25 | 0.1141 | -0.0241 | |||

| CDE / Coeur Mining, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LW / Lamb Weston Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GFL / GFL Environmental Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PBA / Pembina Pipeline Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GROY.WS / Gold Royalty Corp. - Equity Warrant | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NOA / North American Construction Group Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RCI / Rogers Communications Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| TD / The Toronto-Dominion Bank | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SLV / iShares Silver Trust | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| RCI / Rogers Communications Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| GROY.WS / Gold Royalty Corp. - Equity Warrant | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SKE / Skeena Resources Limited | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GFL / GFL Environmental Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MEOH / Methanex Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PBA / Pembina Pipeline Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VRN / Veren Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NOA / North American Construction Group Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LW / Lamb Weston Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TD / The Toronto-Dominion Bank | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SLV / iShares Silver Trust | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| CDE / Coeur Mining, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BMEZ / BlackRock Health Sciences Term Trust | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SKE / Skeena Resources Limited | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BMEZ / BlackRock Health Sciences Term Trust | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VRN / Veren Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MEOH / Methanex Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |