Mga Batayang Estadistika

| Profil Orang Dalam | NUANCE INVESTMENTS, LLC |

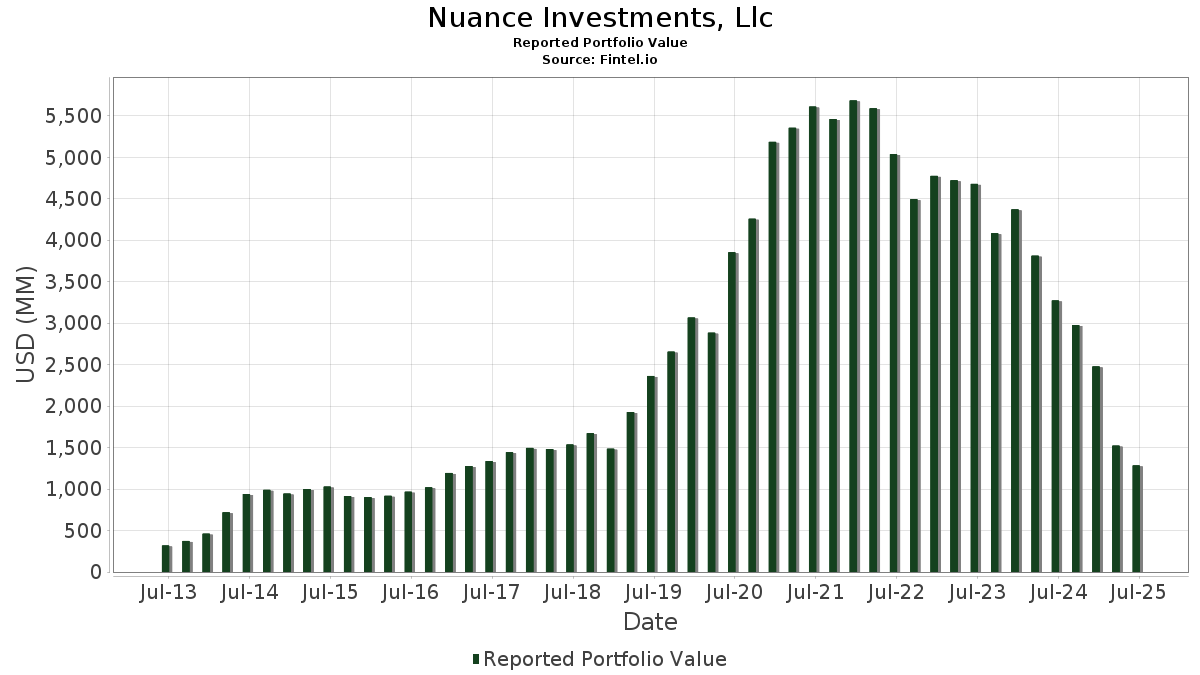

| Nilai Portofolio | $ 1,283,683,890 |

| Posisi Saat Ini | 46 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

Nuance Investments, Llc telah mengungkapkan total kepemilikan 46 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,283,683,890 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Nuance Investments, Llc adalah The Clorox Company (US:CLX) , Hologic, Inc. (US:HOLX) , The Estée Lauder Companies Inc. (US:EL) , California Water Service Group (US:CWT) , and Marten Transport, Ltd. (US:MRTN) . Posisi baru Nuance Investments, Llc meliputi: Informatica Inc. (US:INFA) , . Industri unggulan Nuance Investments, Llc adalah "Food Stores" (sic 54) , "Apparel And Other Finished Products Made From Fabrics And Similar Materials" (sic 23) , and "Fabricated Metal Products, Except Machinery And Transportation Equipment" (sic 34) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.85 | 101.83 | 7.9328 | 5.0287 | |

| 1.79 | 43.56 | 3.3933 | 3.3933 | |

| 1.38 | 89.85 | 6.9991 | 2.6119 | |

| 0.09 | 35.64 | 2.7762 | 2.5611 | |

| 0.25 | 43.39 | 3.3799 | 2.4238 | |

| 0.88 | 67.00 | 5.2191 | 1.7211 | |

| 5.75 | 74.64 | 5.8145 | 1.0947 | |

| 0.05 | 24.87 | 1.9372 | 0.9957 | |

| 0.39 | 48.85 | 3.8055 | 0.7639 | |

| 0.57 | 71.04 | 5.5341 | 0.7365 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.10 | 88.94 | 6.9285 | -3.6837 | |

| 1.36 | 65.26 | 5.0836 | -2.2433 | |

| 0.65 | 17.38 | 1.3539 | -1.4355 | |

| 0.02 | 4.10 | 0.3197 | -0.6507 | |

| 0.02 | 1.99 | 0.1549 | -0.6477 | |

| 0.40 | 27.64 | 2.1529 | -0.5854 | |

| 0.07 | 11.40 | 0.8881 | -0.5222 | |

| 0.04 | 7.19 | 0.5600 | -0.5190 | |

| 0.97 | 11.38 | 0.8866 | -0.4483 | |

| 1.73 | 78.62 | 6.1244 | -0.2974 |

Pengajuan 13D/G

Ini adalah daftar pengajuan 13D dan 13G yang dibuat dalam setahun terakhir (jika ada). Klik ikon tautan untuk melihat riwayat transaksi lengkap. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup.

| Tanggal File | Formulir | Keamanan | Sebelumnya Saham |

Saat ini Saham |

ΔPersentase Saham | % Kepemilikan |

% ΔKepemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2025-07-03 | CVGW / Calavo Growers, Inc. | 1,878,348 | 653,633 | -65.20 | 3.70 | -64.76 | ||

| 2025-05-12 | MRTN / Marten Transport, Ltd. | 5,237,442 | 6.43 | |||||

| 2025-05-12 | WERN / Werner Enterprises, Inc. | 3,943,893 | 2,833,654 | -28.15 | 4.58 | -28.21 | ||

| 2025-05-12 | XRAY / DENTSPLY SIRONA Inc. | 13,545,981 | 8,987,359 | -33.65 | 4.52 | -33.63 | ||

| 2024-11-08 | AVO / Mission Produce, Inc. | 4,621,456 | 2,922,979 | -36.75 | 4.12 | -36.91 | ||

| 2024-11-08 | MWA / Mueller Water Products, Inc. | 13,161,657 | 1,833,217 | -86.07 | 1.18 | -86.00 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-07 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| CLX / The Clorox Company | 0.85 | 182.45 | 101.83 | 130.32 | 7.9328 | 5.0287 | |||

| HOLX / Hologic, Inc. | 1.38 | 27.51 | 89.85 | 34.51 | 6.9991 | 2.6119 | |||

| EL / The Estée Lauder Companies Inc. | 1.10 | -55.03 | 88.94 | -44.95 | 6.9285 | -3.6837 | |||

| CWT / California Water Service Group | 1.73 | -14.32 | 78.62 | -19.59 | 6.1244 | -0.2974 | |||

| MRTN / Marten Transport, Ltd. | 5.75 | 9.71 | 74.64 | 3.87 | 5.8145 | 1.0947 | |||

| GL / Globe Life Inc. | 0.57 | 3.07 | 71.04 | -2.74 | 5.5341 | 0.7365 | |||

| WERN / Werner Enterprises, Inc. | 2.59 | -8.61 | 70.86 | -14.66 | 5.5198 | 0.0664 | |||

| SOLV / Solventum Corporation | 0.88 | 26.13 | 67.00 | 25.80 | 5.2191 | 1.7211 | |||

| QGEN / Qiagen N.V. | 1.36 | -51.13 | 65.26 | -41.50 | 5.0836 | -2.2433 | |||

| HSIC / Henry Schein, Inc. | 0.81 | -11.20 | 59.06 | -5.29 | 4.6006 | 0.5048 | |||

| HTO / H2O America | 0.96 | -17.39 | 50.14 | -21.50 | 3.9060 | -0.2896 | |||

| NTRS / Northern Trust Corporation | 0.39 | -17.92 | 48.85 | 5.49 | 3.8055 | 0.7639 | |||

| INFA / Informatica Inc. | 1.79 | 43.56 | 3.3933 | 3.3933 | |||||

| BDX / Becton, Dickinson and Company | 0.25 | 296.36 | 43.39 | 198.07 | 3.3799 | 2.4238 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.09 | 1,235.38 | 35.64 | 988.18 | 2.7762 | 2.5611 | |||

| ROG / Rogers Corporation | 0.40 | -34.63 | 27.64 | -33.71 | 2.1529 | -0.5854 | |||

| NOC / Northrop Grumman Corporation | 0.05 | 77.66 | 24.87 | 73.48 | 1.9372 | 0.9957 | |||

| KMB / Kimberly-Clark Corporation | 0.15 | 35.07 | 19.26 | 22.44 | 1.5003 | 0.4671 | |||

| AWK / American Water Works Company, Inc. | 0.13 | -8.80 | 18.15 | -14.00 | 1.4138 | 0.0277 | |||

| CVGW / Calavo Growers, Inc. | 0.65 | -63.08 | 17.38 | -59.08 | 1.3539 | -1.4355 | |||

| IEX / IDEX Corporation | 0.08 | -15.65 | 14.11 | -18.16 | 1.0992 | -0.0333 | |||

| KNX / Knight-Swift Transportation Holdings Inc. | 0.30 | -7.82 | 13.48 | -6.25 | 1.0501 | 0.1057 | |||

| NKE / NIKE, Inc. | 0.17 | 31.27 | 12.35 | 46.90 | 0.9621 | 0.4099 | |||

| TTC / The Toro Company | 0.17 | -32.56 | 12.17 | -34.48 | 0.9479 | -0.2720 | |||

| ATR / AptarGroup, Inc. | 0.07 | -49.64 | 11.40 | -46.91 | 0.8881 | -0.5222 | |||

| AVO / Mission Produce, Inc. | 0.97 | -49.93 | 11.38 | -44.00 | 0.8866 | -0.4483 | |||

| A / Agilent Technologies, Inc. | 0.08 | 13.55 | 9.52 | 14.56 | 0.7419 | 0.1958 | |||

| NDSN / Nordson Corporation | 0.04 | 19.18 | 7.63 | 26.66 | 0.5944 | 0.1987 | |||

| GGG / Graco Inc. | 0.09 | -14.72 | 7.54 | -12.21 | 0.5871 | 0.0232 | |||

| LNN / Lindsay Corporation | 0.05 | -21.75 | 7.53 | -10.79 | 0.5867 | 0.0322 | |||

| CNH / CNH Industrial N.V. | 0.57 | 16.15 | 7.40 | 22.59 | 0.5762 | 0.1799 | |||

| WAT / Waters Corporation | 0.02 | 7.34 | 0.5719 | 0.5719 | |||||

| AVA / Avista Corporation | 0.19 | 7.27 | 0.5666 | 0.5666 | |||||

| RGA / Reinsurance Group of America, Incorporated | 0.04 | -56.56 | 7.19 | -56.24 | 0.5600 | -0.5190 | |||

| EG / Everest Group, Ltd. | 0.02 | 28.24 | 7.15 | 19.95 | 0.5569 | 0.1654 | |||

| TGT / Target Corporation | 0.05 | -9.19 | 5.19 | -14.16 | 0.4040 | 0.0072 | |||

| POR / Portland General Electric Company | 0.13 | -34.02 | 5.16 | -39.89 | 0.4016 | -0.1617 | |||

| THRM / Gentherm Incorporated | 0.18 | -12.90 | 5.12 | -7.85 | 0.3986 | 0.0339 | |||

| AMAT / Applied Materials, Inc. | 0.02 | -77.98 | 4.10 | -72.22 | 0.3197 | -0.6507 | |||

| RJF / Raymond James Financial, Inc. | 0.03 | 4.05 | 0.3156 | 0.3156 | |||||

| MTB / M&T Bank Corporation | 0.02 | -41.19 | 3.88 | -36.18 | 0.3026 | -0.0971 | |||

| IDA / IDACORP, Inc. | 0.03 | -20.28 | 3.87 | -20.81 | 0.3018 | -0.0195 | |||

| DOC / Healthpeak Properties, Inc. | 0.21 | -1.62 | 3.71 | -14.81 | 0.2887 | 0.0030 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 0.05 | 7.53 | 3.67 | -15.56 | 0.2861 | 0.0004 | |||

| INDB / Independent Bank Corp. | 0.06 | -13.37 | 3.53 | -13.03 | 0.2750 | 0.0084 | |||

| IWS / iShares Trust - iShares Russell Mid-Cap Value ETF | 0.02 | -84.49 | 1.99 | -83.73 | 0.1549 | -0.6477 | |||

| NVST / Envista Holdings Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PYCR / Paycor HCM, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IJJ / iShares Trust - iShares S&P Mid-Cap 400 Value ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XRAY / DENTSPLY SIRONA Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LMT / Lockheed Martin Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MMM / 3M Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ALB.PRA / Albemarle Corporation - Preferred Stock | 0.00 | -100.00 | 0.00 | 0.0000 |