Mga Batayang Estadistika

| Profil Orang Dalam | Owl Creek Asset Management, L.P. |

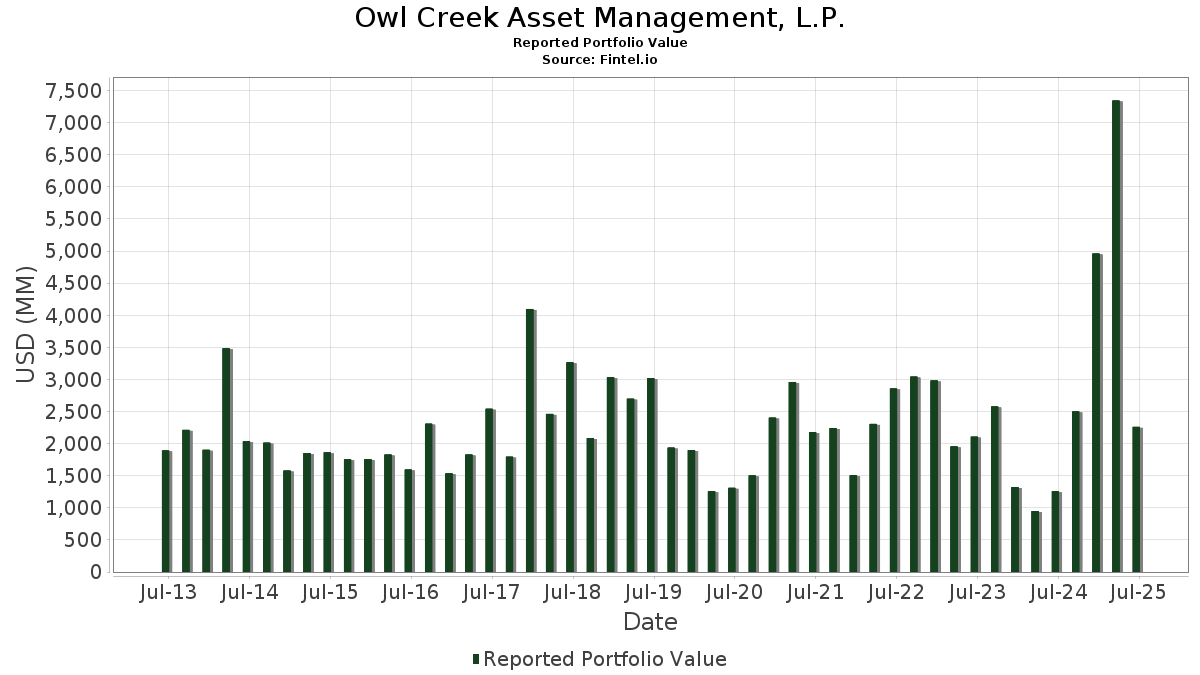

| Nilai Portofolio | $ 2,260,433,679 |

| Posisi Saat Ini | 56 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

Owl Creek Asset Management, L.P. telah mengungkapkan total kepemilikan 56 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 2,260,433,679 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Owl Creek Asset Management, L.P. adalah SPDR S&P 500 ETF (US:SPY) , iShares, Inc. - iShares MSCI South Korea ETF (US:EWY) , Anterix Inc. (US:ATEX) , Apple Inc. (US:AAPL) , and DBX ETF Trust - Xtrackers Harvest CSI 300 China A-Shares ETF (US:ASHR) . Posisi baru Owl Creek Asset Management, L.P. meliputi: iShares, Inc. - iShares MSCI South Korea ETF (US:EWY) , DBX ETF Trust - Xtrackers Harvest CSI 300 China A-Shares ETF (US:ASHR) , C3.ai, Inc. (US:AI) , Robinhood Markets, Inc. (US:HOOD) , and Talen Energy Corporation (US:TLNE) . Industri unggulan Owl Creek Asset Management, L.P. adalah "Lumber And Wood Products, Except Furniture" (sic 24) , "Health Services" (sic 80) , and "Measuring, Analyzing, And Controlling Instruments; Photographic, Medical And Optical Goods; Watches And Clocks" (sic 38) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2.10 | 150.74 | 6.6685 | 6.6685 | |

| 2.90 | 79.87 | 3.5332 | 3.5332 | |

| 5.41 | 138.81 | 6.1409 | 3.4438 | |

| 3.04 | 74.63 | 3.3015 | 3.3015 | |

| 1.80 | 77.20 | 3.4154 | 2.7137 | |

| 0.25 | 77.93 | 3.4476 | 2.6916 | |

| 0.25 | 54.09 | 2.3928 | 2.3928 | |

| 0.75 | 50.95 | 2.2539 | 2.1059 | |

| 0.24 | 45.95 | 2.0327 | 2.0327 | |

| 0.65 | 60.57 | 2.6796 | 1.8746 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.76 | 469.57 | 20.7733 | -16.4788 | |

| 0.16 | 51.65 | 2.2850 | -2.1922 | |

| 0.02 | 5.79 | 0.2561 | -0.0489 |

Pengajuan 13D/G

Ini adalah daftar pengajuan 13D dan 13G yang dibuat dalam setahun terakhir (jika ada). Klik ikon tautan untuk melihat riwayat transaksi lengkap. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup.

| Tanggal File | Formulir | Keamanan | Sebelumnya Saham |

Saat ini Saham |

ΔPersentase Saham | % Kepemilikan |

% ΔKepemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2025-07-23 | BTM / Bitcoin Depot Inc. | 945,050 | 588,006 | -37.78 | 2.60 | -49.02 | ||

| 2024-12-09 | ATEX / Anterix Inc. | 5,411,776 | 5,543,917 | 2.44 | 29.80 | 3.83 | ||

| 2024-11-14 | CPPTL / Copper Property CTL Pass Through Trust | 6,163,838 | 3,037,496 | -50.72 | 4.00 | -51.22 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | Put | 0.76 | -84.46 | 469.57 | -82.84 | 20.7733 | -16.4788 | ||

| EWY / iShares, Inc. - iShares MSCI South Korea ETF | Call | 2.10 | 150.74 | 6.6685 | 6.6685 | ||||

| ATEX / Anterix Inc. | 5.41 | 0.00 | 138.81 | -29.92 | 6.1409 | 3.4438 | |||

| AAPL / Apple Inc. | Put | 0.40 | -48.35 | 81.60 | -52.29 | 3.6098 | 1.2807 | ||

| ASHR / DBX ETF Trust - Xtrackers Harvest CSI 300 China A-Shares ETF | Call | 2.90 | 79.87 | 3.5332 | 3.5332 | ||||

| UNH / UnitedHealth Group Incorporated | Call | 0.25 | 135.66 | 77.93 | 40.37 | 3.4476 | 2.6916 | ||

| DKNG / DraftKings Inc. | Call | 1.80 | 16.02 | 77.20 | 49.83 | 3.4154 | 2.7137 | ||

| AI / C3.ai, Inc. | Call | 3.04 | 74.63 | 3.3015 | 3.3015 | ||||

| HUM / Humana Inc. | Call | 0.27 | -18.59 | 66.91 | -24.78 | 2.9602 | 1.7489 | ||

| UBER / Uber Technologies, Inc. | Call | 0.65 | -19.99 | 60.57 | 2.46 | 2.6796 | 1.8746 | ||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.25 | 54.09 | 2.3928 | 2.3928 | |||||

| TSLA / Tesla, Inc. | Put | 0.16 | -87.18 | 51.65 | -84.29 | 2.2850 | -2.1922 | ||

| XYZ / Block, Inc. | Call | 0.75 | 275.00 | 50.95 | 368.87 | 2.2539 | 2.1059 | ||

| HUM / Humana Inc. | 0.19 | 56.01 | 47.42 | 44.15 | 2.0980 | 1.6500 | |||

| AMZN / Amazon.com, Inc. | 0.21 | 84.87 | 46.80 | 113.18 | 2.0703 | 1.7714 | |||

| VST / Vistra Corp. | 0.24 | 45.95 | 2.0327 | 2.0327 | |||||

| META / Meta Platforms, Inc. | 0.06 | -2.38 | 45.57 | 25.01 | 2.0159 | 1.5195 | |||

| PDYPF / Flutter Entertainment plc | 0.14 | -7.31 | 40.12 | 19.56 | 1.7749 | 1.3180 | |||

| DKNG / DraftKings Inc. | 0.90 | 6.54 | 38.75 | 37.59 | 1.7143 | 1.3308 | |||

| HOOD / Robinhood Markets, Inc. | Call | 0.40 | 37.45 | 1.6569 | 1.6569 | ||||

| FTAI / FTAI Aviation Ltd. | 0.32 | 183.49 | 36.83 | 193.75 | 1.6295 | 1.4587 | |||

| PCG / PG&E Corporation | 2.55 | -55.48 | 35.54 | -63.88 | 1.5722 | 0.2324 | |||

| TLNE / Talen Energy Corporation | 0.12 | 35.20 | 1.5573 | 1.5573 | |||||

| CRCL / Circle Internet Group, Inc. | Put | 0.19 | 34.61 | 1.5310 | 1.5310 | ||||

| XYZ / Block, Inc. | 0.50 | 344.44 | 34.06 | 455.73 | 1.5066 | 1.4231 | |||

| GEV / GE Vernova Inc. | 0.06 | 30.04 | 1.3291 | 1.3291 | |||||

| AVB / AvalonBay Communities, Inc. | Put | 0.14 | 28.49 | 1.2604 | 1.2604 | ||||

| FI / Fiserv, Inc. | 0.15 | 26.66 | 1.1793 | 1.1793 | |||||

| PDYPF / Flutter Entertainment plc | Call | 0.08 | 23.78 | 1.0518 | 1.0518 | ||||

| EWY / iShares, Inc. - iShares MSCI South Korea ETF | 0.30 | 21.85 | 0.9666 | 0.9666 | |||||

| MSFT / Microsoft Corporation | 0.04 | 18.43 | 0.8154 | 0.8154 | |||||

| UBER / Uber Technologies, Inc. | 0.20 | -49.21 | 18.43 | -34.96 | 0.8152 | 0.4294 | |||

| THC / Tenet Healthcare Corporation | Put | 0.10 | 17.83 | 0.7887 | 0.7887 | ||||

| KBH / KB Home | Put | 0.32 | 17.14 | 0.7581 | 0.7581 | ||||

| PGR / The Progressive Corporation | Put | 0.06 | 15.40 | 0.6812 | 0.6812 | ||||

| SG / Sweetgreen, Inc. | Call | 1.00 | 14.88 | 0.6583 | 0.6583 | ||||

| FI / Fiserv, Inc. | Call | 0.08 | 13.43 | 0.5942 | 0.5942 | ||||

| CEG / Constellation Energy Corporation | 0.04 | 11.41 | 0.5048 | 0.5048 | |||||

| HIMS / Hims & Hers Health, Inc. | Call | 0.23 | 11.22 | 0.4964 | 0.4964 | ||||

| VNO / Vornado Realty Trust | Put | 0.26 | 10.04 | 0.4441 | 0.4441 | ||||

| SKYW / SkyWest, Inc. | 0.10 | 9.86 | 0.4360 | 0.4360 | |||||

| OKLO / Oklo Inc. | Call | 0.12 | 6.72 | 0.2972 | 0.2972 | ||||

| PTON / Peloton Interactive, Inc. | Call | 0.96 | 6.68 | 0.2954 | 0.2954 | ||||

| IONQ / IonQ, Inc. | Call | 0.15 | 6.45 | 0.2851 | 0.2851 | ||||

| CYH / Community Health Systems, Inc. | 1.86 | 26.37 | 6.33 | 59.15 | 0.2803 | 0.2260 | |||

| UNH / UnitedHealth Group Incorporated | 0.02 | -56.61 | 5.79 | -74.16 | 0.2561 | -0.0489 | |||

| TSE / Trinseo PLC | 1.67 | 337.05 | 5.21 | 270.55 | 0.2305 | 0.2114 | |||

| TDOC / Teladoc Health, Inc. | Call | 0.50 | 4.36 | 0.1927 | 0.1927 | ||||

| PZZA / Papa John's International, Inc. | Call | 0.09 | -63.83 | 4.16 | -56.91 | 0.1840 | 0.0526 | ||

| RKT / Rocket Companies, Inc. | Call | 0.29 | 4.16 | 0.1840 | 0.1840 | ||||

| QS / QuantumScape Corporation | Call | 0.54 | 3.60 | 0.1590 | 0.1590 | ||||

| LLY / Eli Lilly and Company | 0.00 | 3.46 | 0.1531 | 0.1531 | |||||

| BTM / Bitcoin Depot Inc. | 0.34 | -51.52 | 1.70 | 62.81 | 0.0754 | 0.0611 | |||

| BTMWW / Bitcoin Depot Inc. - Equity Warrant | 0.25 | 0.00 | 0.10 | 488.24 | 0.0044 | 0.0042 | |||

| DMYY.WS / dMY Squared Technology Group, Inc. - Equity Warrant | 0.02 | 0.00 | 0.05 | 104.55 | 0.0020 | 0.0017 | |||

| AERTW / Aeries Technology, Inc - Equity Warrant | 0.10 | 0.00 | 0.00 | 0.00 | 0.0001 | 0.0001 | |||

| EIX / Edison International | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| XHB / SPDR Series Trust - SPDR S&P Homebuilders ETF | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| UAL / United Airlines Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DAL / Delta Air Lines, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| QQQ / Invesco QQQ Trust, Series 1 | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| CNC / Centene Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CI / The Cigna Group | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RCL / Royal Caribbean Cruises Ltd. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| SPY / SPDR S&P 500 ETF | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| CVS / CVS Health Corporation | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| BIDU / Baidu, Inc. - Depositary Receipt (Common Stock) | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| MLCO / Melco Resorts & Entertainment Limited - Depositary Receipt (Common Stock) | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| KWEB / KraneShares Trust - KraneShares CSI China Internet ETF | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| CRED / Columbia ETF Trust I - Columbia Research Enhanced Real Estate ETF | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| CRWD / CrowdStrike Holdings, Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| NOVA / Sunnova Energy International Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| IWM / iShares Trust - iShares Russell 2000 ETF | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| CVS / CVS Health Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PLAY / Dave & Buster's Entertainment, Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| DELL / Dell Technologies Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 |