Mga Batayang Estadistika

| Nilai Portofolio | $ 2,276,228,736 |

| Posisi Saat Ini | 48 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

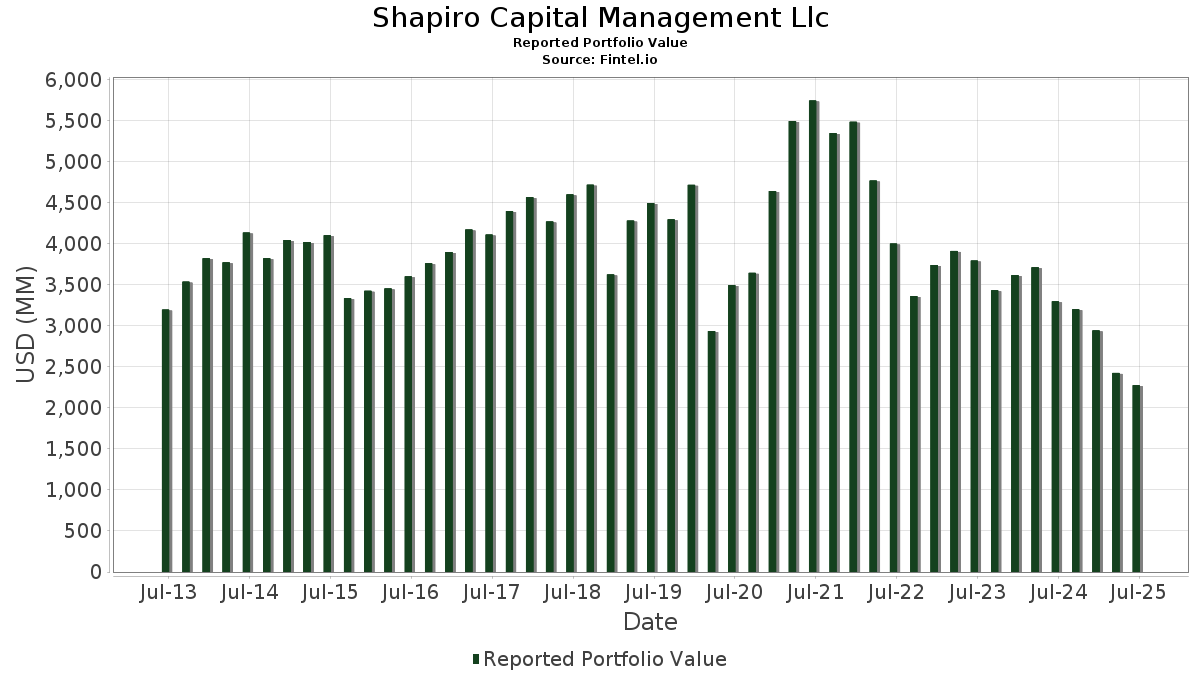

Shapiro Capital Management Llc telah mengungkapkan total kepemilikan 48 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 2,276,228,736 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Shapiro Capital Management Llc adalah Elanco Animal Health Incorporated (US:ELAN) , NCR Voyix Corporation (US:VYX) , PENN Entertainment, Inc. (US:PENN) , Ultra Clean Holdings, Inc. (US:UCTT) , and Graphic Packaging Holding Company (US:GPK) . Posisi baru Shapiro Capital Management Llc meliputi: Lionsgate Studios Corp. (US:LION) , Truist Financial Corporation (US:TFC) , Target Corporation (US:TGT) , Lantheus Holdings, Inc. (US:LNTH) , and Starz Entertainment Corp. (US:STRZ) . Industri unggulan Shapiro Capital Management Llc adalah "Automotive Dealers And Gasoline Service Stations" (sic 55) , "Miscellaneous Retail " (sic 59) , and "Water Transportation" (sic 44) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 13.26 | 77.07 | 3.3857 | 3.3857 | |

| 2.60 | 87.90 | 3.8616 | 1.9746 | |

| 0.99 | 42.77 | 1.8788 | 1.8788 | |

| 0.98 | 64.11 | 2.8166 | 1.8409 | |

| 0.38 | 37.11 | 1.6303 | 1.6303 | |

| 0.18 | 26.33 | 1.1568 | 1.1568 | |

| 6.43 | 114.93 | 5.0492 | 0.9676 | |

| 0.53 | 32.96 | 1.4480 | 0.8209 | |

| 0.36 | 18.49 | 0.8122 | 0.8122 | |

| 5.60 | 46.06 | 2.0235 | 0.7537 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.70 | 21.26 | 0.9340 | -2.1761 | |

| 0.13 | 62.22 | 2.7333 | -1.5494 | |

| 0.41 | 33.70 | 1.4806 | -1.2874 | |

| 1.54 | 46.23 | 2.0311 | -1.1657 | |

| 4.37 | 91.97 | 4.0406 | -1.0355 | |

| 0.75 | 68.40 | 3.0049 | -0.9965 | |

| 3.27 | 15.65 | 0.6876 | -0.9725 | |

| 1.37 | 43.49 | 1.9105 | -0.6648 | |

| 1.32 | 30.53 | 1.3412 | -0.4630 | |

| 0.08 | 13.45 | 0.5909 | -0.4125 |

Pengajuan 13D/G

Ini adalah daftar pengajuan 13D dan 13G yang dibuat dalam setahun terakhir (jika ada). Klik ikon tautan untuk melihat riwayat transaksi lengkap. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup.

| Tanggal File | Formulir | Keamanan | Sebelumnya Saham |

Saat ini Saham |

ΔPersentase Saham | % Kepemilikan |

% ΔKepemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | VYX / NCR Voyix Corporation | 12,245,723 | 10,396,478 | -15.10 | 7.50 | -14.77 | ||

| 2025-06-03 | LGFB / Lions Gate Entertainment Corp. - Class B | 16,751,733 | 0 | -100.00 | 0.00 | |||

| 2025-05-15 | UCTT / Ultra Clean Holdings, Inc. | 2,746,282 | 4,083,404 | 48.69 | 9.00 | 47.54 | ||

| 2024-11-14 | VREX / Varex Imaging Corporation | 2,118,994 | 0 | -100.00 | 0.00 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| ELAN / Elanco Animal Health Incorporated | 9.29 | -24.66 | 132.67 | 2.46 | 5.8286 | 0.4916 | |||

| VYX / NCR Voyix Corporation | 10.40 | -15.10 | 121.95 | 2.14 | 5.3576 | 0.4365 | |||

| PENN / PENN Entertainment, Inc. | 6.43 | 5.93 | 114.93 | 16.06 | 5.0492 | 0.9676 | |||

| UCTT / Ultra Clean Holdings, Inc. | 4.14 | 1.51 | 93.55 | 7.00 | 4.1099 | 0.5065 | |||

| GPK / Graphic Packaging Holding Company | 4.37 | -7.99 | 91.97 | -25.32 | 4.0406 | -1.0355 | |||

| DIS / The Walt Disney Company | 0.73 | -19.23 | 89.97 | 1.48 | 3.9525 | 0.2986 | |||

| TENB / Tenable Holdings, Inc. | 2.60 | 98.81 | 87.90 | 91.99 | 3.8616 | 1.9746 | |||

| PINS / Pinterest, Inc. | 2.32 | -11.08 | 83.07 | 2.85 | 3.6493 | 0.3206 | |||

| LHX / L3Harris Technologies, Inc. | 0.31 | -21.91 | 77.51 | -6.42 | 3.4053 | -0.0087 | |||

| LION / Lionsgate Studios Corp. | 13.26 | 77.07 | 3.3857 | 3.3857 | |||||

| MODG / Topgolf Callaway Brands Corp. | 9.26 | -11.27 | 74.51 | 8.38 | 3.2734 | 0.4399 | |||

| GOOG / Alphabet Inc. | 0.41 | -6.83 | 72.74 | 5.79 | 3.1955 | 0.3615 | |||

| BAC / Bank of America Corporation | 1.50 | -21.57 | 71.04 | -11.06 | 3.1211 | -0.1713 | |||

| NDAQ / Nasdaq, Inc. | 0.77 | -18.47 | 68.94 | -3.89 | 3.0286 | 0.0721 | |||

| MU / Micron Technology, Inc. | 0.56 | -39.86 | 68.86 | -14.70 | 3.0253 | -0.3019 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.75 | -12.58 | 68.40 | -29.55 | 3.0049 | -0.9965 | |||

| HOLX / Hologic, Inc. | 0.98 | 156.75 | 64.11 | 170.84 | 2.8166 | 1.8409 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.13 | -34.35 | 62.22 | -40.12 | 2.7333 | -1.5494 | |||

| AXTA / Axalta Coating Systems Ltd. | 1.70 | 25.95 | 50.40 | 12.74 | 2.2142 | 0.3716 | |||

| ST / Sensata Technologies Holding plc | 1.54 | -51.95 | 46.23 | -40.39 | 2.0311 | -1.1657 | |||

| ECVT / Ecovyst Inc. | 5.60 | 12.63 | 46.06 | 49.51 | 2.0235 | 0.7537 | |||

| MSGS / Madison Square Garden Sports Corp. | 0.22 | -3.92 | 45.19 | 3.10 | 1.9855 | 0.1788 | |||

| DVN / Devon Energy Corporation | 1.37 | -18.17 | 43.49 | -30.40 | 1.9105 | -0.6648 | |||

| ASH / Ashland Inc. | 0.85 | 9.72 | 42.87 | -6.95 | 1.8834 | -0.0156 | |||

| TFC / Truist Financial Corporation | 0.99 | 42.77 | 1.8788 | 1.8788 | |||||

| BATRK / Atlanta Braves Holdings, Inc. | 0.90 | -15.29 | 42.32 | -0.98 | 1.8591 | 0.0977 | |||

| BWXT / BWX Technologies, Inc. | 0.27 | -37.95 | 39.60 | -9.39 | 1.7399 | -0.0615 | |||

| MKSI / MKS Inc. | 0.39 | -29.31 | 38.87 | -12.37 | 1.7074 | -0.1206 | |||

| TGT / Target Corporation | 0.38 | 37.11 | 1.6303 | 1.6303 | |||||

| SSNC / SS&C Technologies Holdings, Inc. | 0.41 | -49.37 | 33.70 | -49.82 | 1.4806 | -1.2874 | |||

| DFIN / Donnelley Financial Solutions, Inc. | 0.53 | 53.60 | 32.96 | 116.64 | 1.4480 | 0.8209 | |||

| RPD / Rapid7, Inc. | 1.32 | -20.07 | 30.53 | -30.26 | 1.3412 | -0.4630 | |||

| GNRC / Generac Holdings Inc. | 0.18 | 26.33 | 1.1568 | 1.1568 | |||||

| BAX / Baxter International Inc. | 0.70 | -68.15 | 21.26 | -71.83 | 0.9340 | -2.1761 | |||

| SNV / Synovus Financial Corp. | 0.36 | 18.49 | 0.8122 | 0.8122 | |||||

| NEOG / Neogen Corporation | 3.27 | -29.52 | 15.65 | -61.14 | 0.6876 | -0.9725 | |||

| INGR / Ingredion Incorporated | 0.11 | -17.63 | 15.52 | -17.38 | 0.6819 | -0.0924 | |||

| LNTH / Lantheus Holdings, Inc. | 0.18 | 14.45 | 0.6348 | 0.6348 | |||||

| EA / Electronic Arts Inc. | 0.08 | -50.00 | 13.45 | -44.75 | 0.5909 | -0.4125 | |||

| STRZ / Starz Entertainment Corp. | 0.82 | 13.25 | 0.5819 | 0.5819 | |||||

| IWN / iShares Trust - iShares Russell 2000 Value ETF | 0.08 | -21.69 | 11.84 | -18.18 | 0.5202 | -0.0762 | |||

| ABCB / Ameris Bancorp | 0.17 | 11.30 | 0.4964 | 0.4964 | |||||

| JEF / Jefferies Financial Group Inc. | 0.15 | 8.41 | 0.3693 | 0.3693 | |||||

| BLKB / Blackbaud, Inc. | 0.12 | 7.73 | 0.3395 | 0.3395 | |||||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.01 | 83.68 | 2.85 | 98.68 | 0.1254 | 0.0662 | |||

| BATRA / Atlanta Braves Holdings, Inc. | 0.03 | -26.31 | 1.24 | -17.34 | 0.0543 | -0.0073 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.00 | 0.58 | 18.16 | 0.0255 | 0.0053 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | 0.00 | 0.38 | 4.96 | 0.0168 | 0.0018 | |||

| LGFA / Lions Gate Entertainment Corp. - Class A | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SPSM / SPDR Series Trust - SPDR Portfolio S&P 600 Small Cap ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DNB / Dun & Bradstreet Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SPY / SPDR S&P 500 ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LION / Lionsgate Studios Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LGFB / Lions Gate Entertainment Corp. - Class B | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| OKTA / Okta, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |