Mga Batayang Estadistika

| Nilai Portofolio | $ 703,310,000 |

| Posisi Saat Ini | 136 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

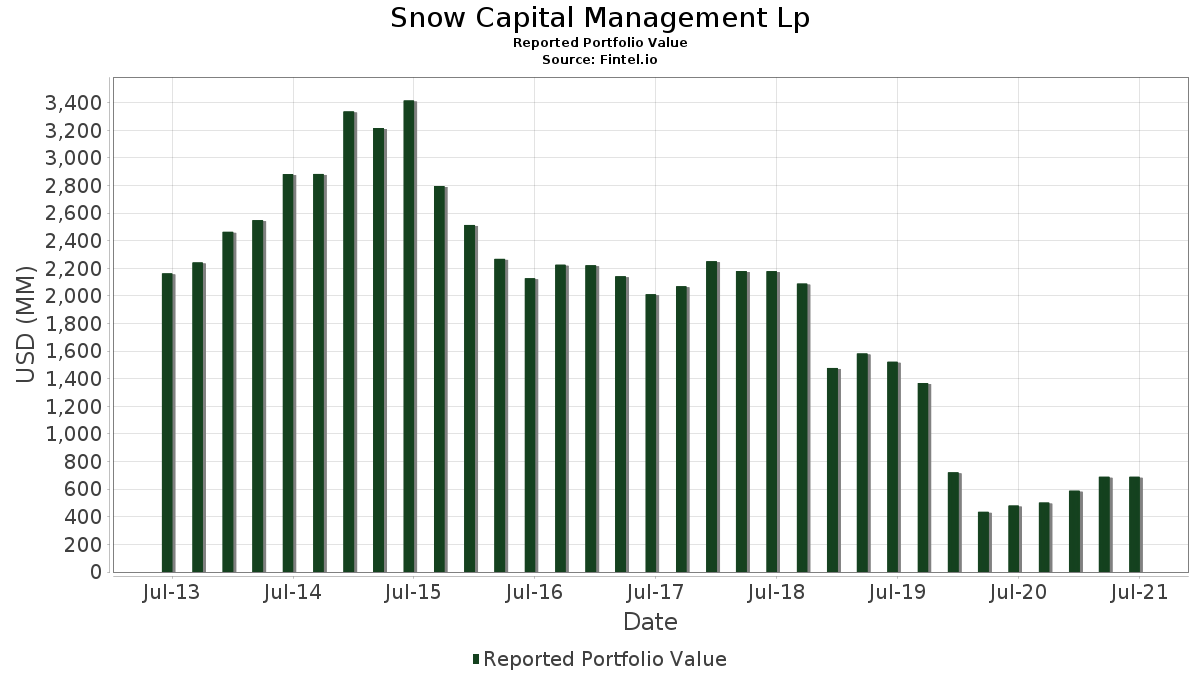

Snow Capital Management Lp telah mengungkapkan total kepemilikan 136 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 703,310,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Snow Capital Management Lp adalah WESCO International, Inc. (US:WCC) , Commercial Metals Company (US:CMC) , JPMorgan Alerian MLP Index ETN - Corporate Bond/Note (US:AMJ) , Centene Corporation (US:CNC) , and Bank of America Corporation - Preferred Stock (US:BAC.PRB) . Posisi baru Snow Capital Management Lp meliputi: Lumentum Holdings Inc. (US:LITE) , Check Point Software Technologies Ltd. (US:CHKP) , NN, Inc. (US:NNBR) , Vistra Corp. (US:VST) , and Sage Therapeutics, Inc. (US:SAGE) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.14 | 11.67 | 1.6599 | 1.6599 | |

| 0.59 | 13.06 | 1.8566 | 1.5161 | |

| 0.06 | 7.04 | 1.0007 | 1.0007 | |

| 0.10 | 9.84 | 1.3991 | 0.8694 | |

| 0.23 | 24.00 | 3.4124 | 0.5901 | |

| 0.06 | 5.48 | 0.7796 | 0.5225 | |

| 0.25 | 9.80 | 1.3930 | 0.3512 | |

| 0.04 | 3.94 | 0.5596 | 0.3057 | |

| 0.11 | 11.49 | 1.6334 | 0.2991 | |

| 0.30 | 21.74 | 3.0915 | 0.2983 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 2.91 | 0.4132 | -1.4150 | |

| 0.88 | 14.69 | 2.0881 | -0.6475 | |

| 0.16 | 9.12 | 1.2962 | -0.6383 | |

| 0.72 | 22.25 | 3.1629 | -0.5098 | |

| 0.72 | 12.48 | 1.7752 | -0.4376 | |

| 0.20 | 8.40 | 1.1938 | -0.4351 | |

| 0.12 | 6.28 | 0.8932 | -0.3850 | |

| 0.03 | 0.83 | 0.1184 | -0.2224 | |

| 0.23 | 16.94 | 2.4089 | -0.2075 | |

| 0.23 | 14.46 | 2.0557 | -0.1849 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2021-08-24 untuk periode pelaporan 2021-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| WCC / WESCO International, Inc. | 0.23 | 3.79 | 24.00 | 23.33 | 3.4124 | 0.5901 | |||

| CMC / Commercial Metals Company | 0.72 | -11.81 | 22.25 | -12.15 | 3.1629 | -0.5098 | |||

| AMJ / JPMorgan Alerian MLP Index ETN - Corporate Bond/Note | 0.14 | -2.95 | 21.84 | -0.84 | 3.1055 | -0.0891 | |||

| CNC / Centene Corporation | 0.30 | -1.07 | 21.74 | 12.90 | 3.0915 | 0.2983 | |||

| BAC.PRB / Bank of America Corporation - Preferred Stock | 0.52 | -7.69 | 21.25 | -1.63 | 3.0219 | -0.1116 | |||

| CNO / CNO Financial Group, Inc. | 0.82 | -1.62 | 19.32 | -4.34 | 2.7472 | -0.1821 | |||

| MPC / Marathon Petroleum Corporation | 0.31 | -6.85 | 18.97 | 5.22 | 2.6977 | 0.0824 | |||

| HGH / Hartford Financial Services Group Inc. - FXDFR DB REDEEM 15/04/2042 USD 25 | 0.31 | 6.64 | 18.93 | -1.05 | 2.6913 | -0.0831 | |||

| MET / MetLife, Inc. | 0.30 | -1.34 | 17.66 | -2.87 | 2.5107 | -0.1259 | |||

| TSN / Tyson Foods, Inc. | 0.23 | -5.40 | 16.94 | -6.09 | 2.4089 | -0.2075 | |||

| XEC / Cimarex Energy Co. | 0.23 | -9.01 | 16.63 | 11.00 | 2.3647 | 0.1916 | |||

| JBLU / JetBlue Airways Corporation | 0.88 | -5.62 | 14.69 | -22.14 | 2.0881 | -0.6475 | |||

| LNC / Lincoln National Corporation | 0.23 | -7.26 | 14.46 | -6.41 | 2.0557 | -0.1849 | |||

| BKU / BankUnited, Inc. | 0.34 | -2.18 | 14.36 | -4.98 | 2.0419 | -0.1501 | |||

| FNB / F.N.B. Corporation | 1.16 | -2.26 | 14.32 | -5.10 | 2.0355 | -0.1525 | |||

| GD / General Dynamics Corporation | 0.07 | -2.40 | 13.98 | 1.21 | 1.9885 | -0.0156 | |||

| NCR / NCR Corp. | 0.30 | -19.36 | 13.83 | -3.08 | 1.9663 | -0.1031 | |||

| CNK / Cinemark Holdings, Inc. | 0.59 | 417.09 | 13.06 | 456.13 | 1.8566 | 1.5161 | |||

| FHN / First Horizon Corporation | 0.72 | -19.92 | 12.48 | -18.17 | 1.7752 | -0.4376 | |||

| LITE / Lumentum Holdings Inc. | 0.14 | 11.67 | 1.6599 | 1.6599 | |||||

| PVH / PVH Corp. | 0.11 | 2.25 | 11.49 | 4.07 | 1.6341 | 0.0325 | |||

| BFH / Bread Financial Holdings, Inc. | 0.11 | 34.34 | 11.49 | 24.87 | 1.6334 | 0.2991 | |||

| BTG / B2Gold Corp. | 2.56 | 0.17 | 10.79 | -2.15 | 1.5345 | -0.0651 | |||

| LGF.A / Lions Gate Entertainment Corp. | 0.49 | -26.31 | 10.21 | 2.03 | 1.4518 | 0.0003 | |||

| JNJ / Johnson & Johnson | 0.06 | -1.43 | 10.02 | -1.19 | 1.4244 | -0.0461 | |||

| LMT / Lockheed Martin Corporation | 0.03 | 7.91 | 9.99 | 10.49 | 1.4201 | 0.1090 | |||

| HAS / Hasbro, Inc. | 0.10 | 174.02 | 9.84 | 169.44 | 1.3991 | 0.8694 | |||

| PFE / Pfizer Inc. | 0.25 | 26.18 | 9.80 | 36.39 | 1.3930 | 0.3512 | |||

| CSCO / Cisco Systems, Inc. | 0.18 | -5.47 | 9.51 | -3.11 | 1.3527 | -0.0714 | |||

| BIIB / Biogen Inc. | 0.03 | -0.36 | 9.28 | 23.32 | 1.3188 | 0.2280 | |||

| INTC / Intel Corporation | 0.16 | -22.09 | 9.12 | -31.65 | 1.2962 | -0.6383 | |||

| COG / Cabot Oil & Gas Corp. | 0.51 | 4.68 | 8.96 | -2.67 | 1.2740 | -0.0612 | |||

| URBN / Urban Outfitters, Inc. | 0.20 | -32.55 | 8.40 | -25.24 | 1.1938 | -0.4351 | |||

| IP / International Paper Company | 0.13 | -7.48 | 8.01 | 4.91 | 1.1385 | 0.0316 | |||

| AEL / American Equity Investment Life Holding Company | 0.24 | -1.36 | 7.60 | 1.12 | 1.0800 | -0.0095 | |||

| AMGGF / Alamos Gold Inc. | 0.98 | -0.28 | 7.50 | -2.32 | 1.0667 | -0.0472 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.06 | 7.04 | 1.0007 | 1.0007 | |||||

| ORCL / Oracle Corporation | 0.09 | -0.06 | 6.74 | 10.88 | 0.9580 | 0.0767 | |||

| PHM / PulteGroup, Inc. | 0.12 | -31.49 | 6.28 | -28.72 | 0.8932 | -0.3850 | |||

| DIS / The Walt Disney Company | 0.03 | 0.28 | 6.04 | -4.47 | 0.8595 | -0.0583 | |||

| UMPQ / Umpqua Holdings Corp | 0.31 | -16.04 | 5.78 | -11.74 | 0.8213 | -0.1279 | |||

| BLMN / Bloomin' Brands, Inc. | 0.20 | 13.66 | 5.55 | 14.02 | 0.7897 | 0.0832 | |||

| LUMN / Lumen Technologies, Inc. | 0.41 | 3.14 | 5.55 | 5.00 | 0.7886 | 0.0225 | |||

| NUE / Nucor Corporation | 0.06 | 158.78 | 5.48 | 209.25 | 0.7796 | 0.5225 | |||

| ACCO / ACCO Brands Corporation | 0.62 | 9.83 | 5.37 | 12.31 | 0.7640 | 0.0701 | |||

| OTEX / Open Text Corporation | 0.10 | 0.97 | 5.04 | 7.51 | 0.7162 | 0.0367 | |||

| TFC / Truist Financial Corporation | 0.09 | 15.16 | 5.04 | 9.60 | 0.7162 | 0.0496 | |||

| ABBV / AbbVie Inc. | 0.04 | 27.86 | 4.79 | 33.08 | 0.6806 | 0.1589 | |||

| KSS / Kohl's Corporation | 0.08 | 12.28 | 4.47 | 3.81 | 0.6360 | 0.0110 | |||

| DK / Delek US Holdings, Inc. | 0.20 | 3.31 | 4.43 | 2.55 | 0.6293 | 0.0033 | |||

| SIMO / Silicon Motion Technology Corporation - Depositary Receipt (Common Stock) | 0.07 | 36.70 | 4.27 | 47.53 | 0.6077 | 0.1875 | |||

| MOD / Modine Manufacturing Company | 0.25 | -7.39 | 4.17 | 4.04 | 0.5932 | 0.0116 | |||

| TPR / Tapestry, Inc. | 0.10 | -0.06 | 4.14 | 5.45 | 0.5886 | 0.0192 | |||

| JCOM / J2 Global Inc. | 0.03 | -11.61 | 4.08 | 1.44 | 0.5794 | -0.0032 | |||

| WFC / Wells Fargo & Company | 0.09 | 3.69 | 3.95 | 20.19 | 0.5611 | 0.0849 | |||

| CRI / Carter's, Inc. | 0.04 | 93.72 | 3.94 | 124.79 | 0.5596 | 0.3057 | |||

| ARGO / Argo Group International Holdings, Inc. | 0.01 | -90.35 | 3.80 | -0.63 | 0.5409 | -0.0143 | |||

| MHK / Mohawk Industries, Inc. | 0.02 | 45.76 | 3.63 | 45.67 | 0.5166 | 0.1548 | |||

| PPC / Pilgrim's Pride Corporation | 0.16 | -2.40 | 3.53 | -9.01 | 0.5025 | -0.0608 | |||

| PACW / Pacwest Bancorp | 0.08 | -15.24 | 3.45 | -8.55 | 0.4900 | -0.0565 | |||

| SU / Suncor Energy Inc. | 0.13 | 9.15 | 3.17 | 25.15 | 0.4507 | 0.0834 | |||

| CAH / Cardinal Health, Inc. | 0.05 | 0.05 | 3.01 | -5.99 | 0.4281 | -0.0364 | |||

| NTAP / NetApp, Inc. | 0.04 | -79.53 | 2.91 | -76.95 | 0.4132 | -1.4150 | |||

| DRI / Darden Restaurants, Inc. | 0.02 | -0.28 | 2.87 | 2.54 | 0.4076 | 0.0021 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.11 | 21.71 | 2.86 | 32.07 | 0.4069 | 0.0926 | |||

| SMCI / Super Micro Computer, Inc. | 0.08 | 1.55 | 2.75 | -8.54 | 0.3912 | -0.0451 | |||

| VSH / Vishay Intertechnology, Inc. | 0.12 | 32.23 | 2.74 | 23.85 | 0.3892 | 0.0686 | |||

| PXD / Pioneer Natural Resources Company | 0.02 | 0.04 | 2.69 | 2.40 | 0.3826 | 0.0015 | |||

| FCF / First Commonwealth Financial Corporation | 0.19 | -5.69 | 2.63 | -7.66 | 0.3738 | -0.0391 | |||

| HPQ / HP Inc. | 0.09 | 3.30 | 2.60 | -1.78 | 0.3694 | -0.0142 | |||

| FLXN / Horizon Funds - Horizon Flexible Income ETF | 0.31 | 0.05 | 2.58 | -8.02 | 0.3668 | -0.0400 | |||

| AMGN / Amgen Inc. | 0.01 | -0.04 | 2.50 | -2.07 | 0.3562 | -0.0148 | |||

| PLAB / Photronics, Inc. | 0.18 | 110.27 | 2.41 | 115.95 | 0.3427 | 0.1808 | |||

| VRA / Vera Bradley, Inc. | 0.19 | 254.16 | 2.40 | 334.18 | 0.3414 | 0.2612 | |||

| NVT / nVent Electric plc | 0.08 | -5.49 | 2.40 | 5.78 | 0.3410 | 0.0122 | |||

| FMBI / First Midwest Bancorp, Inc. | 0.12 | -0.53 | 2.31 | -9.94 | 0.3286 | -0.0436 | |||

| AM / Antero Midstream Corporation | 0.20 | -0.00 | 2.04 | 15.07 | 0.2899 | 0.0329 | |||

| OFG / OFG Bancorp | 0.09 | -6.27 | 2.02 | -8.34 | 0.2874 | -0.0324 | |||

| TMHC / Taylor Morrison Home Corporation | 0.07 | -1.22 | 1.93 | -15.30 | 0.2747 | -0.0561 | |||

| GS.PRJ / Goldman Sachs Group, 5.50% Dep Shares Fixd/Float Non-Cumul Preferred Stock Ser J | 0.01 | -13.24 | 1.91 | 0.74 | 0.2710 | -0.0034 | |||

| GDXJ / VanEck ETF Trust - VanEck Junior Gold Miners ETF | 0.04 | 29.01 | 1.87 | 34.03 | 0.2660 | 0.0636 | |||

| GER / GE Capital Global Holdings, LLC - Preferred Security | 0.16 | 0.25 | 1.83 | 18.57 | 0.2596 | 0.0363 | |||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | 0.05 | -17.63 | 1.70 | -1.68 | 0.2419 | -0.0091 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.01 | 0.44 | 1.70 | 12.06 | 0.2417 | 0.0217 | |||

| AXP / American Express Company | 0.01 | 0.05 | 1.51 | 16.83 | 0.2151 | 0.0273 | |||

| CPS / Cooper-Standard Holdings Inc. | 0.05 | 7.81 | 1.50 | -13.96 | 0.2138 | -0.0397 | |||

| NNBR / NN, Inc. | 0.20 | 1.48 | 0.2109 | 0.2109 | |||||

| MPLX / MPLX LP - Limited Partnership | 0.05 | 0.00 | 1.48 | 15.52 | 0.2106 | 0.0246 | |||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.02 | 0.07 | 1.40 | 8.11 | 0.1989 | 0.0112 | |||

| CAT / Caterpillar Inc. | 0.01 | 0.06 | 1.38 | -6.08 | 0.1956 | -0.0168 | |||

| EAT / Brinker International, Inc. | 0.02 | 116.40 | 1.25 | 88.40 | 0.1779 | 0.0816 | |||

| AEO / American Eagle Outfitters, Inc. | 0.03 | -22.02 | 1.24 | 0.08 | 0.1765 | -0.0034 | |||

| CODX / Co-Diagnostics, Inc. | 0.14 | 177.89 | 1.18 | 140.20 | 0.1674 | 0.0963 | |||

| PFF / iShares Trust - iShares Preferred and Income Securities ETF | 0.03 | 408.21 | 1.06 | 420.20 | 0.1501 | 0.1207 | |||

| AMZN / Amazon.com, Inc. | 0.00 | -40.00 | 1.03 | -33.29 | 0.1467 | -0.0776 | |||

| AAWW / Atlas Air Worldwide Holdings Inc. | 0.01 | -12.63 | 0.96 | -1.53 | 0.1369 | -0.0049 | |||

| OXY / Occidental Petroleum Corporation | 0.03 | 0.00 | 0.94 | 17.40 | 0.1334 | 0.0175 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.01 | 0.00 | 0.92 | 3.95 | 0.1311 | 0.0024 | |||

| VST / Vistra Corp. | 0.05 | 0.91 | 0.1292 | 0.1292 | |||||

| MJ / Amplify ETF Trust - Amplify Alternative Harvest ETF | 0.04 | 0.00 | 0.84 | -10.12 | 0.1200 | -0.0162 | |||

| NCLH / Norwegian Cruise Line Holdings Ltd. | 0.03 | -66.74 | 0.83 | -64.55 | 0.1184 | -0.2224 | |||

| IWP / iShares Trust - iShares Russell Mid-Cap Growth ETF | 0.01 | 0.00 | 0.78 | 10.94 | 0.1110 | 0.0089 | |||

| UNM / Unum Group | 0.03 | 0.00 | 0.71 | 2.01 | 0.1010 | 0.0000 | |||

| AMG / Affiliated Managers Group, Inc. | 0.00 | -17.77 | 0.71 | -14.82 | 0.1005 | -0.0199 | |||

| SAGE / Sage Therapeutics, Inc. | 0.01 | 0.71 | 0.1005 | 0.1005 | |||||

| CENX / Century Aluminum Company | 0.05 | -11.68 | 0.70 | -35.51 | 0.0997 | -0.0580 | |||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.01 | 0.00 | 0.69 | 3.44 | 0.0984 | 0.0014 | |||

| SKX / Skechers U.S.A., Inc. | 0.01 | -10.28 | 0.64 | 7.26 | 0.0903 | 0.0044 | |||

| GS.PRD / The Goldman Sachs Group, Inc. - Preferred Stock | 0.02 | 0.00 | 0.59 | 3.68 | 0.0840 | 0.0014 | |||

| JPM.PRC / JPMorgan Chase & Co. - Preferred Stock | 0.02 | 0.00 | 0.58 | 4.91 | 0.0820 | 0.0023 | |||

| HFC / HollyFrontier Corp | 0.02 | 0.39 | 0.58 | -7.69 | 0.0819 | -0.0086 | |||

| LHX / L3Harris Technologies, Inc. | 0.00 | 0.00 | 0.56 | 6.64 | 0.0799 | 0.0035 | |||

| PLAY / Dave & Buster's Entertainment, Inc. | 0.01 | 0.31 | 0.53 | -14.99 | 0.0758 | -0.0152 | |||

| OPTN / OptiNose, Inc. | 0.16 | 8.34 | 0.49 | -8.61 | 0.0694 | -0.0081 | |||

| LTSK / Osaic Financial Services, Inc. - Corporate Bond/Note | 0.02 | 0.00 | 0.46 | 9.38 | 0.0647 | 0.0044 | |||

| DEA / Easterly Government Properties, Inc. | 0.02 | 0.43 | 0.0617 | 0.0617 | |||||

| INDA / iShares Trust - iShares MSCI India ETF | 0.01 | 0.00 | 0.43 | 4.85 | 0.0614 | 0.0017 | |||

| MRK / Merck & Co., Inc. | 0.01 | 0.00 | 0.41 | 0.73 | 0.0586 | -0.0007 | |||

| LIVX / LiveXLive Media Inc | 0.09 | 0.40 | 0.0570 | 0.0570 | |||||

| VZ / Verizon Communications Inc. | 0.01 | 0.18 | 0.38 | -3.53 | 0.0545 | -0.0031 | |||

| IWO / iShares Trust - iShares Russell 2000 Growth ETF | 0.00 | 0.00 | 0.36 | 3.69 | 0.0519 | 0.0008 | |||

| FAX / Abrdn Asia-Pacific Income Fund Inc | 0.08 | 0.00 | 0.34 | 8.49 | 0.0491 | 0.0029 | |||

| AAPL / Apple Inc. | 0.00 | -0.81 | 0.34 | 11.30 | 0.0476 | 0.0040 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | -0.93 | 0.32 | 7.64 | 0.0461 | 0.0024 | |||

| VLO / Valero Energy Corporation | 0.00 | 0.32 | 0.0454 | 0.0454 | |||||

| ATHA / Athira Pharma, Inc. | 0.03 | 0.31 | 0.0437 | 0.0437 | |||||

| GILD / Gilead Sciences, Inc. | 0.00 | 0.27 | 0.0384 | 0.0384 | |||||

| BGS / B&G Foods, Inc. | 0.01 | 1.14 | 0.24 | 6.70 | 0.0340 | 0.0015 | |||

| XOP / SPDR Series Trust - SPDR S&P Oil & Gas Exploration & Production ETF | 0.00 | 0.20 | 0.0291 | 0.0291 | |||||

| VOT / Vanguard Index Funds - Vanguard Mid-Cap Growth ETF | 0.00 | 0.20 | 0.0290 | 0.0290 | |||||

| PG / The Procter & Gamble Company | 0.00 | 0.00 | 0.20 | -0.49 | 0.0287 | -0.0007 | |||

| KMI / Kinder Morgan, Inc. | 0.01 | -23.13 | 0.19 | -15.84 | 0.0264 | -0.0056 | |||

| GE / General Electric Company | 0.01 | 0.00 | 0.18 | 2.33 | 0.0250 | 0.0001 | |||

| VLY / Valley National Bancorp | 0.01 | 0.00 | 0.17 | -2.29 | 0.0243 | -0.0011 | |||

| NLY / Annaly Capital Management, Inc. | 0.02 | 1.15 | 0.14 | 4.41 | 0.0202 | 0.0005 | |||

| TDW.WSA / Tidewater Inc. | 0.05 | 0.00 | 0.06 | -18.18 | 0.0090 | -0.0022 | |||

| / MCDERMOTT INTL INC TRANCHE B WTS 1:1 @ USD 15.98 07-01-27 (NOT LISTED OR TRADING) | 0.13 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| / MCDERMOTT INTL INC TRANCHE A WTS 1:1 @ USD 12.33 07-01-27 (NOT LISTED OR TRADING) | 0.12 | 0.00 | 0.00 | -100.00 | -0.0001 |