Mga Batayang Estadistika

| Nilai Portofolio | $ 1,011,976,418 |

| Posisi Saat Ini | 127 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

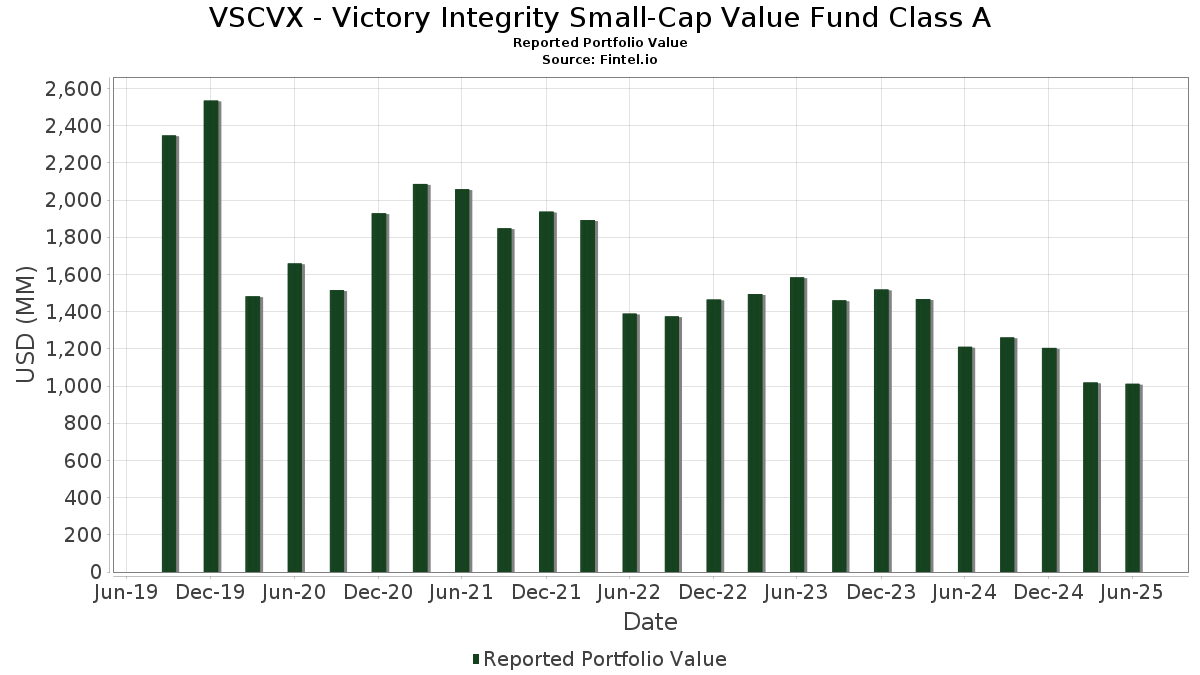

VSCVX - Victory Integrity Small-Cap Value Fund Class A telah mengungkapkan total kepemilikan 127 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,011,976,418 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama VSCVX - Victory Integrity Small-Cap Value Fund Class A adalah Glacier Bancorp, Inc. (US:GBCI) , Essent Group Ltd. (US:ESNT) , Ameris Bancorp (US:ABCB) , Hancock Whitney Corporation (US:HWC) , and Valley National Bancorp (US:VLY) . Posisi baru VSCVX - Victory Integrity Small-Cap Value Fund Class A meliputi: BOK Financial Corporation (US:BOKF) , Easterly Government Properties, Inc. (US:DEA) , Advance Auto Parts, Inc. (US:AAP) , Patterson-UTI Energy, Inc. (US:PTEN) , and Resideo Technologies, Inc. (US:REZI) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.08 | 7.55 | 0.7461 | 0.7461 | |

| 0.29 | 6.39 | 0.6321 | 0.6321 | |

| 0.13 | 6.12 | 0.6048 | 0.6048 | |

| 0.11 | 5.81 | 0.5739 | 0.5739 | |

| 0.86 | 5.12 | 0.5057 | 0.5057 | |

| 0.23 | 4.98 | 0.4924 | 0.4924 | |

| 0.75 | 4.36 | 0.4308 | 0.4308 | |

| 0.23 | 9.51 | 0.9399 | 0.3447 | |

| 0.20 | 9.27 | 0.9162 | 0.3429 | |

| 0.10 | 10.39 | 1.0271 | 0.2901 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.08 | 6.37 | 0.6298 | -0.4262 | |

| 0.18 | 9.25 | 0.9149 | -0.3449 | |

| 0.13 | 12.20 | 1.2064 | -0.3293 | |

| 0.22 | 8.94 | 0.8837 | -0.3084 | |

| 0.19 | 7.28 | 0.7199 | -0.2979 | |

| 0.14 | 9.95 | 0.9835 | -0.2879 | |

| 0.14 | 7.88 | 0.7793 | -0.2826 | |

| 0.13 | 9.46 | 0.9356 | -0.2616 | |

| 0.09 | 6.33 | 0.6254 | -0.2279 | |

| 0.09 | 8.97 | 0.8870 | -0.1952 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GBCI / Glacier Bancorp, Inc. | 0.31 | 1.29 | 13.48 | -1.31 | 1.3330 | -0.0166 | |||

| ESNT / Essent Group Ltd. | 0.22 | 1.36 | 13.14 | 6.64 | 1.2986 | 0.0820 | |||

| ABCB / Ameris Bancorp | 0.20 | 5.47 | 13.10 | 18.53 | 1.2952 | 0.2034 | |||

| HWC / Hancock Whitney Corporation | 0.22 | 8.10 | 12.91 | 18.31 | 1.2762 | 0.1984 | |||

| VLY / Valley National Bancorp | 1.41 | -3.16 | 12.58 | -2.72 | 1.2439 | -0.0338 | |||

| BOH / Bank of Hawaii Corporation | 0.18 | -2.80 | 12.44 | -4.83 | 1.2294 | -0.0612 | |||

| TMHC / Taylor Morrison Home Corporation | 0.20 | -2.18 | 12.41 | 0.06 | 1.2265 | 0.0019 | |||

| SSB / SouthState Corporation | 0.13 | -20.84 | 12.20 | -21.51 | 1.2064 | -0.3293 | |||

| FLG / Flagstar Financial, Inc. | 1.14 | 4.40 | 12.13 | -4.77 | 1.1990 | -0.0589 | |||

| CHEF / The Chefs' Warehouse, Inc. | 0.18 | -2.97 | 11.48 | 13.70 | 1.1348 | 0.1375 | |||

| FRME / First Merchants Corporation | 0.30 | -2.98 | 11.33 | -8.12 | 1.1204 | -0.0979 | |||

| NWBI / Northwest Bancshares, Inc. | 0.88 | -2.34 | 11.21 | 3.85 | 1.1080 | 0.0419 | |||

| BANR / Banner Corporation | 0.17 | -3.87 | 11.16 | -3.29 | 1.1035 | -0.0366 | |||

| IWN / iShares Trust - iShares Russell 2000 Value ETF | 0.07 | 0.00 | 10.89 | 4.49 | 1.0761 | 0.0471 | |||

| VBTX / Veritex Holdings, Inc. | 0.41 | 4.29 | 10.78 | 9.01 | 1.0656 | 0.0889 | |||

| CVBF / CVB Financial Corp. | 0.54 | 4.35 | 10.72 | 11.88 | 1.0596 | 0.1133 | |||

| FIBK / First Interstate BancSystem, Inc. | 0.37 | 16.61 | 10.60 | 17.29 | 1.0482 | 0.1554 | |||

| SKYW / SkyWest, Inc. | 0.10 | 18.15 | 10.39 | 39.24 | 1.0271 | 0.2901 | |||

| NBTB / NBT Bancorp Inc. | 0.25 | 0.00 | 10.30 | -3.15 | 1.0187 | -0.0322 | |||

| CWK / Cushman & Wakefield plc | 0.93 | 0.00 | 10.27 | 8.31 | 1.0156 | 0.0788 | |||

| BCO / The Brink's Company | 0.11 | 26.07 | 10.23 | 30.65 | 1.0115 | 0.2380 | |||

| KFY / Korn Ferry | 0.14 | 0.00 | 10.23 | 8.11 | 1.0113 | 0.0767 | |||

| BNL / Broadstone Net Lease, Inc. | 0.63 | -2.77 | 10.14 | -8.42 | 1.0028 | -0.0912 | |||

| INDB / Independent Bank Corp. | 0.16 | -2.43 | 10.11 | -2.06 | 0.9997 | -0.0202 | |||

| SYNA / Synaptics Incorporated | 0.15 | 17.73 | 9.98 | 19.77 | 0.9870 | 0.1636 | |||

| SR / Spire Inc. | 0.14 | -17.14 | 9.95 | -22.72 | 0.9835 | -0.2879 | |||

| GT / The Goodyear Tire & Rubber Company | 0.95 | 0.00 | 9.86 | 12.23 | 0.9746 | 0.1069 | |||

| CTRE / CareTrust REIT, Inc. | 0.32 | 0.00 | 9.86 | 7.06 | 0.9744 | 0.0651 | |||

| CURB / Curbline Properties Corp. | 0.43 | -2.72 | 9.78 | -8.19 | 0.9671 | -0.0854 | |||

| DEI / Douglas Emmett, Inc. | 0.64 | 1.26 | 9.69 | -4.83 | 0.9575 | -0.0476 | |||

| EPRT / Essential Properties Realty Trust, Inc. | 0.30 | -10.83 | 9.65 | -12.83 | 0.9543 | -0.1394 | |||

| FBNC / First Bancorp | 0.22 | -2.68 | 9.59 | 6.89 | 0.9480 | 0.0619 | |||

| TTMI / TTM Technologies, Inc. | 0.23 | -20.72 | 9.51 | 57.78 | 0.9399 | 0.3447 | |||

| OGS / ONE Gas, Inc. | 0.13 | -17.87 | 9.46 | -21.92 | 0.9356 | -0.2616 | |||

| BHF / Brighthouse Financial, Inc. | 0.17 | 2.34 | 9.41 | -5.11 | 0.9302 | -0.0492 | |||

| CRC / California Resources Corporation | 0.20 | 23.70 | 9.32 | 28.48 | 0.9215 | 0.2049 | |||

| CMC / Commercial Metals Company | 0.19 | 0.00 | 9.29 | 6.30 | 0.9187 | 0.0552 | |||

| CNO / CNO Financial Group, Inc. | 0.24 | 0.00 | 9.28 | -7.37 | 0.9170 | -0.0721 | |||

| R / Ryder System, Inc. | 0.06 | 12.77 | 9.27 | 24.68 | 0.9164 | 0.1820 | |||

| TEX / Terex Corporation | 0.20 | 29.20 | 9.27 | 59.67 | 0.9162 | 0.3429 | |||

| NWE / NorthWestern Energy Group, Inc. | 0.18 | -18.15 | 9.25 | -27.44 | 0.9149 | -0.3449 | |||

| EXTR / Extreme Networks, Inc. | 0.50 | -2.71 | 9.04 | 32.00 | 0.8935 | 0.2172 | |||

| VAC / Marriott Vacations Worldwide Corporation | 0.12 | 0.00 | 8.99 | 12.56 | 0.8886 | 0.0998 | |||

| UFPI / UFP Industries, Inc. | 0.09 | -31.33 | 8.97 | -44.53 | 0.8870 | -0.1952 | |||

| POR / Portland General Electric Company | 0.22 | -18.70 | 8.94 | -25.94 | 0.8837 | -0.3084 | |||

| APAM / Artisan Partners Asset Management Inc. | 0.20 | 4.16 | 8.92 | 18.10 | 0.8817 | 0.1357 | |||

| PB / Prosperity Bancshares, Inc. | 0.13 | 7.35 | 8.84 | 5.66 | 0.8735 | 0.0474 | |||

| BDC / Belden Inc. | 0.08 | 5.42 | 8.79 | 21.77 | 0.8689 | 0.1559 | |||

| LXP / LXP Industrial Trust | 1.06 | 5.05 | 8.76 | 0.31 | 0.8664 | 0.0034 | |||

| STC / Stewart Information Services Corporation | 0.13 | 12.94 | 8.69 | 3.05 | 0.8592 | 0.0262 | |||

| PBH / Prestige Consumer Healthcare Inc. | 0.11 | -2.83 | 8.67 | -9.75 | 0.8573 | -0.0918 | |||

| LIVN / LivaNova PLC | 0.19 | 0.00 | 8.51 | 14.62 | 0.8412 | 0.1079 | |||

| SBRA / Sabra Health Care REIT, Inc. | 0.46 | -11.48 | 8.49 | -6.57 | 0.8391 | -0.0582 | |||

| VC / Visteon Corporation | 0.09 | 0.00 | 8.30 | 20.19 | 0.8209 | 0.1385 | |||

| MUR / Murphy Oil Corporation | 0.36 | 41.10 | 8.20 | 11.78 | 0.8103 | 0.0861 | |||

| KN / Knowles Corporation | 0.46 | 22.12 | 8.16 | 41.56 | 0.8065 | 0.2373 | |||

| GPOR / Gulfport Energy Corporation | 0.04 | -2.41 | 8.15 | 6.62 | 0.8054 | 0.0506 | |||

| ST / Sensata Technologies Holding plc | 0.27 | 22.09 | 8.07 | 51.47 | 0.7977 | 0.2715 | |||

| SANM / Sanmina Corporation | 0.08 | -27.24 | 7.99 | -6.56 | 0.7896 | -0.0547 | |||

| SBH / Sally Beauty Holdings, Inc. | 0.86 | 13.36 | 7.98 | 16.25 | 0.7886 | 0.1108 | |||

| BFH / Bread Financial Holdings, Inc. | 0.14 | -52.08 | 7.88 | -38.58 | 0.7793 | -0.2826 | |||

| LADR / Ladder Capital Corp | 0.73 | 3.86 | 7.84 | -2.15 | 0.7755 | -0.0164 | |||

| VRTS / Virtus Investment Partners, Inc. | 0.04 | 11.98 | 7.80 | 17.86 | 0.7711 | 0.1174 | |||

| SAIC / Science Applications International Corporation | 0.07 | 21.77 | 7.75 | 22.13 | 0.7659 | 0.1394 | |||

| SEE / Sealed Air Corporation | 0.25 | 16.14 | 7.70 | 24.70 | 0.7617 | 0.1514 | |||

| PLXS / Plexus Corp. | 0.06 | 14.19 | 7.60 | 20.58 | 0.7518 | 0.1289 | |||

| NXST / Nexstar Media Group, Inc. | 0.04 | 0.00 | 7.56 | -3.50 | 0.7476 | -0.0264 | |||

| BOKF / BOK Financial Corporation | 0.08 | 7.55 | 0.7461 | 0.7461 | |||||

| NVST / Envista Holdings Corporation | 0.39 | 0.00 | 7.54 | 13.22 | 0.7453 | 0.0875 | |||

| CNR / Core Natural Resources, Inc. | 0.11 | -9.62 | 7.47 | -18.25 | 0.7384 | -0.1640 | |||

| AGNC / AGNC Investment Corp. | 0.81 | -5.28 | 7.42 | -9.14 | 0.7332 | -0.0730 | |||

| VRE / Veris Residential, Inc. | 0.50 | 2.35 | 7.39 | -9.93 | 0.7301 | -0.0798 | |||

| SUPN / Supernus Pharmaceuticals, Inc. | 0.23 | 0.00 | 7.38 | -3.76 | 0.7292 | -0.0278 | |||

| DX / Dynex Capital, Inc. | 0.60 | 0.00 | 7.33 | -6.14 | 0.7248 | -0.0468 | |||

| STNG / Scorpio Tankers Inc. | 0.19 | 22.98 | 7.28 | -40.80 | 0.7199 | -0.2979 | |||

| UEC / Uranium Energy Corp. | 1.06 | -18.58 | 7.22 | 15.82 | 0.7137 | 0.0980 | |||

| NGVT / Ingevity Corporation | 0.17 | 0.00 | 7.18 | 8.84 | 0.7094 | 0.0582 | |||

| GBX / The Greenbrier Companies, Inc. | 0.16 | 0.00 | 7.16 | -10.10 | 0.7079 | -0.0788 | |||

| SGRY / Surgery Partners, Inc. | 0.32 | 0.00 | 7.12 | -6.40 | 0.7039 | -0.0475 | |||

| VSCO / Victoria's Secret & Co. | 0.38 | 32.72 | 7.05 | 32.30 | 0.6974 | 0.1707 | |||

| ICUI / ICU Medical, Inc. | 0.05 | 0.00 | 7.03 | -4.83 | 0.6950 | -0.0347 | |||

| HUBG / Hub Group, Inc. | 0.21 | 17.52 | 7.01 | 5.69 | 0.6927 | 0.0379 | |||

| STAG / STAG Industrial, Inc. | 0.19 | -5.00 | 6.89 | -4.58 | 0.6815 | -0.0321 | |||

| SILA / Sila Realty Trust, Inc. | 0.28 | 5.19 | 6.71 | -6.78 | 0.6634 | -0.0476 | |||

| BKE / The Buckle, Inc. | 0.15 | 0.00 | 6.68 | 18.36 | 0.6604 | 0.1028 | |||

| VMI / Valmont Industries, Inc. | 0.02 | -57.95 | 6.56 | -39.84 | 0.6489 | -0.0811 | |||

| BKD / Brookdale Senior Living Inc. | 0.93 | 0.00 | 6.50 | 11.19 | 0.6426 | 0.0651 | |||

| ARCB / ArcBest Corporation | 0.08 | 20.03 | 6.41 | 30.95 | 0.6342 | 0.1504 | |||

| KMPR / Kemper Corporation | 0.10 | 0.00 | 6.41 | -3.45 | 0.6341 | -0.0221 | |||

| DEA / Easterly Government Properties, Inc. | 0.29 | 6.39 | 0.6321 | 0.6321 | |||||

| DRH / DiamondRock Hospitality Company | 0.83 | 0.00 | 6.39 | -0.78 | 0.6316 | -0.0044 | |||

| NFG / National Fuel Gas Company | 0.08 | -44.30 | 6.37 | -40.41 | 0.6298 | -0.4262 | |||

| SHOO / Steven Madden, Ltd. | 0.27 | 57.64 | 6.35 | 41.89 | 0.6282 | 0.1859 | |||

| TKR / The Timken Company | 0.09 | -27.45 | 6.33 | -26.77 | 0.6254 | -0.2279 | |||

| VVX / V2X, Inc. | 0.13 | 9.75 | 6.29 | 8.64 | 0.6215 | 0.0499 | |||

| NWL / Newell Brands Inc. | 1.14 | 0.00 | 6.13 | -12.90 | 0.6061 | -0.0892 | |||

| AAP / Advance Auto Parts, Inc. | 0.13 | 6.12 | 0.6048 | 0.6048 | |||||

| TPH / Tri Pointe Homes, Inc. | 0.19 | -59.32 | 6.11 | -39.36 | 0.6039 | 0.1048 | |||

| AVNT / Avient Corporation | 0.19 | 2.61 | 6.10 | -10.78 | 0.6031 | -0.0723 | |||

| FLR / Fluor Corporation | 0.12 | -14.31 | 6.08 | 0.88 | 0.6011 | 0.1024 | |||

| TWI / Titan International, Inc. | 0.59 | -9.98 | 6.05 | 10.18 | 0.5980 | 0.0558 | |||

| SCS / Steelcase Inc. | 0.58 | 0.00 | 6.04 | -4.84 | 0.5973 | -0.0298 | |||

| MTX / Minerals Technologies Inc. | 0.11 | 0.00 | 6.02 | -13.37 | 0.5956 | -0.0913 | |||

| SIG / Signet Jewelers Limited | 0.07 | -58.83 | 5.88 | -49.82 | 0.5812 | -0.1614 | |||

| KLIC / Kulicke and Soffa Industries, Inc. | 0.17 | 9.55 | 5.86 | 14.94 | 0.5798 | 0.0758 | |||

| AESI / Atlas Energy Solutions Inc. | 0.43 | 14.49 | 5.81 | -14.19 | 0.5744 | -0.0945 | |||

| BC / Brunswick Corporation | 0.11 | 5.81 | 0.5739 | 0.5739 | |||||

| MXL / MaxLinear, Inc. | 0.40 | 8.14 | 5.64 | 41.52 | 0.5577 | 0.1639 | |||

| GIII / G-III Apparel Group, Ltd. | 0.25 | 9.00 | 5.62 | -10.73 | 0.5552 | -0.0662 | |||

| PRGO / Perrigo Company plc | 0.21 | 0.00 | 5.61 | -4.71 | 0.5546 | -0.0269 | |||

| TALO / Talos Energy Inc. | 0.66 | 0.00 | 5.56 | -12.77 | 0.5499 | -0.0799 | |||

| PENN / PENN Entertainment, Inc. | 0.31 | 0.00 | 5.53 | 9.56 | 0.5462 | 0.0481 | |||

| ANDE / The Andersons, Inc. | 0.15 | 0.00 | 5.44 | -14.39 | 0.5377 | -0.0899 | |||

| BXC / BlueLinx Holdings Inc. | 0.07 | 0.00 | 5.34 | -0.80 | 0.5278 | -0.0038 | |||

| RYI / Ryerson Holding Corporation | 0.24 | -15.18 | 5.25 | -20.32 | 0.5195 | -0.1319 | |||

| VECO / Veeco Instruments Inc. | 0.26 | 0.00 | 5.22 | 1.18 | 0.5162 | 0.0065 | |||

| PTEN / Patterson-UTI Energy, Inc. | 0.86 | 5.12 | 0.5057 | 0.5057 | |||||

| INN / Summit Hotel Properties, Inc. | 0.98 | -5.75 | 5.01 | -11.33 | 0.4951 | -0.0627 | |||

| REZI / Resideo Technologies, Inc. | 0.23 | 4.98 | 0.4924 | 0.4924 | |||||

| EPC / Edgewell Personal Care Company | 0.20 | 0.00 | 4.79 | -24.99 | 0.4739 | -0.1573 | |||

| COLL / Collegium Pharmaceutical, Inc. | 0.16 | 0.00 | 4.67 | -0.93 | 0.4619 | -0.0040 | |||

| LION / Lionsgate Studios Corp. | 0.75 | 4.36 | 0.4308 | 0.4308 | |||||

| GSAXX / Goldman Sachs Trust - Goldman Sachs Financial Square Government Fund | 3.05 | 15.58 | 3.05 | 15.55 | 0.3013 | 0.0408 | |||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 3.05 | 15.58 | 3.05 | 15.55 | 0.3013 | 0.0408 | |||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 3.05 | 15.58 | 3.05 | 15.55 | 0.3013 | 0.0408 | |||

| US40428X1072 / HSBC U.S. Government Money Market Fund | 3.05 | 15.58 | 3.05 | 15.55 | 0.3013 | 0.0408 | |||

| MTW / The Manitowoc Company, Inc. | 0.25 | 0.00 | 2.97 | 39.93 | 0.2935 | 0.0839 |