Mga Batayang Estadistika

| Nilai Portofolio | $ 1,274,532,385 |

| Posisi Saat Ini | 96 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

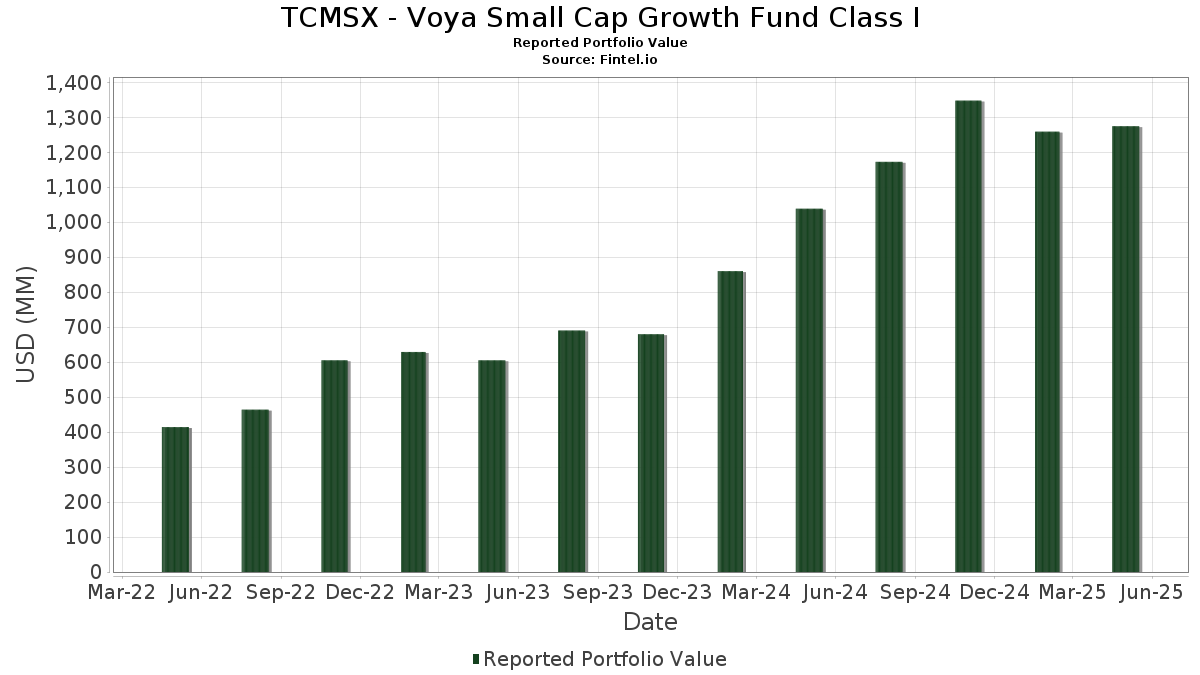

TCMSX - Voya Small Cap Growth Fund Class I telah mengungkapkan total kepemilikan 96 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,274,532,385 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama TCMSX - Voya Small Cap Growth Fund Class I adalah Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class (US:US61747C7074) , Western Alliance Bancorporation (US:WAL) , Rambus Inc. (US:RMBS) , Tower Semiconductor Ltd. (US:TSEM) , and The Ensign Group, Inc. (US:ENSG) . Posisi baru TCMSX - Voya Small Cap Growth Fund Class I meliputi: AAON, Inc. (US:AAON) , HealthEquity, Inc. (US:HQY) , The Vita Coco Company, Inc. (US:COCO) , Knife River Corporation (US:KNF) , and FirstService Corporation (CA:FSV) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.08 | 19.24 | 1.5103 | 1.5103 | |

| 0.19 | 18.45 | 1.4481 | 1.4481 | |

| 0.18 | 17.33 | 1.3601 | 1.3601 | |

| 0.17 | 17.11 | 1.3429 | 1.3429 | |

| 0.41 | 14.47 | 1.1357 | 1.1357 | |

| 0.14 | 13.48 | 1.0576 | 1.0576 | |

| 0.44 | 13.23 | 1.0384 | 1.0384 | |

| 0.07 | 13.05 | 1.0245 | 1.0245 | |

| 0.25 | 22.79 | 1.7890 | 0.9993 | |

| 0.22 | 12.63 | 0.9913 | 0.9913 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.4898 | ||

| 0.30 | 19.50 | 1.5303 | -1.0969 | |

| 0.00 | 0.00 | -1.0432 | ||

| 0.05 | 12.39 | 0.9720 | -0.7816 | |

| 0.10 | 8.81 | 0.6914 | -0.6790 | |

| 0.17 | 20.40 | 1.6011 | -0.6674 | |

| 0.05 | 4.81 | 0.3776 | -0.6562 | |

| 0.16 | 8.67 | 0.6806 | -0.6199 | |

| 0.10 | 23.51 | 1.8450 | -0.5741 | |

| 0.11 | 13.95 | 1.0948 | -0.5173 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-23 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 42.97 | -6.39 | 42.97 | -6.39 | 3.3727 | -0.2747 | |||

| WAL / Western Alliance Bancorporation | 0.37 | 19.86 | 26.64 | -0.15 | 2.0905 | -0.0290 | |||

| RMBS / Rambus Inc. | 0.49 | 16.10 | 26.21 | 11.07 | 2.0571 | 0.1822 | |||

| TSEM / Tower Semiconductor Ltd. | 0.64 | 30.83 | 25.12 | 21.41 | 1.9717 | 0.3277 | |||

| ENSG / The Ensign Group, Inc. | 0.17 | 35.70 | 24.79 | 54.73 | 1.9458 | 0.6727 | |||

| CRS / Carpenter Technology Corporation | 0.10 | -31.97 | 23.51 | -22.79 | 1.8450 | -0.5741 | |||

| KEX / Kirby Corporation | 0.21 | 42.74 | 23.27 | 51.53 | 1.8267 | 0.6063 | |||

| GVA / Granite Construction Incorporated | 0.25 | 111.71 | 22.79 | 129.32 | 1.7890 | 0.9993 | |||

| LITE / Lumentum Holdings Inc. | 0.31 | 47.42 | 22.60 | 51.51 | 1.7741 | 0.5887 | |||

| ACIW / ACI Worldwide, Inc. | 0.48 | 7.37 | 22.22 | -13.39 | 1.7436 | -0.2945 | |||

| CLH / Clean Harbors, Inc. | 0.09 | 46.74 | 20.98 | 55.84 | 1.6465 | 0.5769 | |||

| CWST / Casella Waste Systems, Inc. | 0.17 | -31.71 | 20.40 | -28.55 | 1.6011 | -0.6674 | |||

| SITM / SiTime Corporation | 0.10 | 38.27 | 20.27 | 74.75 | 1.5907 | 0.6691 | |||

| KTOS / Kratos Defense & Security Solutions, Inc. | 0.55 | 2.71 | 20.19 | 43.58 | 1.5846 | 0.4673 | |||

| SKY / Champion Homes, Inc. | 0.30 | -7.58 | 19.50 | -41.03 | 1.5303 | -1.0969 | |||

| FN / Fabrinet | 0.08 | 19.24 | 1.5103 | 1.5103 | |||||

| PIPR / Piper Sandler Companies | 0.08 | 7.37 | 19.01 | -6.78 | 1.4916 | -0.1283 | |||

| AAON / AAON, Inc. | 0.19 | 18.45 | 1.4481 | 1.4481 | |||||

| AGYS / Agilysys, Inc. | 0.17 | 32.72 | 18.24 | 73.55 | 1.4312 | 0.5964 | |||

| WNS / WNS (Holdings) Limited | 0.31 | 12.79 | 18.22 | 15.01 | 1.4303 | 0.1714 | |||

| SKWD / Skyward Specialty Insurance Group, Inc. | 0.28 | 114.69 | 17.62 | 161.47 | 1.3831 | 0.8476 | |||

| CELH / Celsius Holdings, Inc. | 0.46 | 805.73 | 17.54 | 75.01 | 1.3769 | -0.0722 | |||

| QTWO / Q2 Holdings, Inc. | 0.20 | 41.32 | 17.53 | 41.58 | 1.3756 | 0.3919 | |||

| FOUR / Shift4 Payments, Inc. | 0.18 | 17.33 | 1.3601 | 1.3601 | |||||

| PCOR / Procore Technologies, Inc. | 0.26 | 7.37 | 17.20 | -5.69 | 1.3500 | -0.0991 | |||

| HQY / HealthEquity, Inc. | 0.17 | 17.11 | 1.3429 | 1.3429 | |||||

| GENI / Genius Sports Limited | 1.76 | 7.37 | 16.88 | 18.63 | 1.3249 | 0.1942 | |||

| ROAD / Construction Partners, Inc. | 0.16 | 41.87 | 16.49 | 104.71 | 1.2940 | 0.6540 | |||

| MC / Moelis & Company | 0.28 | 64.31 | 16.27 | 32.84 | 1.2771 | 0.3039 | |||

| CYBR / CyberArk Software Ltd. | 0.04 | 7.37 | 15.54 | 12.95 | 1.2200 | 0.1266 | |||

| DY / Dycom Industries, Inc. | 0.07 | -26.91 | 15.52 | 2.56 | 1.2179 | 0.0157 | |||

| JBTM / JBT Marel Corporation | 0.13 | -8.26 | 15.26 | -20.20 | 1.1980 | -0.3218 | |||

| CAVA / CAVA Group, Inc. | 0.18 | 155.71 | 15.03 | 82.23 | 1.1798 | 0.4763 | |||

| NOG / Northern Oil and Gas, Inc. | 0.56 | 112.14 | 14.79 | 79.02 | 1.1611 | 0.5045 | |||

| KGS / Kodiak Gas Services, Inc. | 0.42 | 94.70 | 14.72 | 59.88 | 1.1552 | 0.4238 | |||

| ADUS / Addus HomeCare Corporation | 0.13 | 18.96 | 14.68 | 37.76 | 1.1519 | 0.3055 | |||

| COCO / The Vita Coco Company, Inc. | 0.41 | 14.47 | 1.1357 | 1.1357 | |||||

| EXLS / ExlService Holdings, Inc. | 0.31 | -20.75 | 14.23 | -24.77 | 1.1166 | -0.3859 | |||

| VSEC / VSE Corporation | 0.11 | -37.38 | 13.95 | -31.25 | 1.0948 | -0.5173 | |||

| BPMC / Blueprint Medicines Corporation | 0.14 | 65.35 | 13.83 | 73.54 | 1.0857 | 0.4524 | |||

| WING / Wingstop Inc. | 0.04 | 57.88 | 13.62 | 129.79 | 1.0686 | 0.5978 | |||

| INSM / Insmed Incorporated | 0.19 | 7.37 | 13.58 | -8.20 | 1.0656 | -0.1094 | |||

| KNF / Knife River Corporation | 0.14 | 13.48 | 1.0576 | 1.0576 | |||||

| FORM / FormFactor, Inc. | 0.44 | 13.23 | 1.0384 | 1.0384 | |||||

| FLS / Flowserve Corporation | 0.26 | 46.46 | 13.22 | 32.80 | 1.0374 | 0.2466 | |||

| GTLS / Chart Industries, Inc. | 0.08 | -14.78 | 13.17 | -29.85 | 1.0333 | -0.4578 | |||

| FSV / FirstService Corporation | 0.07 | 13.05 | 1.0245 | 1.0245 | |||||

| GTLB / GitLab Inc. | 0.28 | 27.30 | 12.94 | -3.78 | 1.0155 | -0.0529 | |||

| ALHC / Alignment Healthcare, Inc. | 0.83 | 22.16 | 12.81 | 19.68 | 1.0052 | 0.1549 | |||

| STEP / StepStone Group Inc. | 0.22 | 12.63 | 0.9913 | 0.9913 | |||||

| SAIA / Saia, Inc. | 0.05 | -13.11 | 12.39 | -43.89 | 0.9720 | -0.7816 | |||

| RDNT / RadNet, Inc. | 0.22 | 12.36 | 0.9704 | 0.9704 | |||||

| SITE / SiteOne Landscape Supply, Inc. | 0.11 | -10.62 | 12.35 | -17.34 | 0.9694 | -0.2178 | |||

| SXI / Standex International Corporation | 0.08 | 38.02 | 12.22 | 12.02 | 0.9592 | 0.0923 | |||

| TECH / Bio-Techne Corporation | 0.25 | -6.01 | 12.20 | -26.33 | 0.9578 | -0.3583 | |||

| PEN / Penumbra, Inc. | 0.05 | 16.32 | 12.18 | 8.80 | 0.9561 | 0.0665 | |||

| VRNS / Varonis Systems, Inc. | 0.25 | 14.84 | 11.75 | 30.72 | 0.9222 | -0.4068 | |||

| FIVE / Five Below, Inc. | 0.10 | -29.46 | 11.68 | -5.37 | 0.9164 | -0.0639 | |||

| ELF / e.l.f. Beauty, Inc. | 0.10 | 11.46 | 0.8994 | 0.8994 | |||||

| CHDN / Churchill Downs Incorporated | 0.12 | 7.37 | 11.23 | -13.50 | 0.8811 | -0.1500 | |||

| INTA / Intapp, Inc. | 0.20 | 48.50 | 11.19 | 24.10 | 0.8785 | 0.1619 | |||

| CECO / CECO Environmental Corp. | 0.42 | 7.37 | 11.19 | 16.05 | 0.8778 | 0.1120 | |||

| KRUS / Kura Sushi USA, Inc. | 0.16 | 7.37 | 10.66 | 14.03 | 0.8369 | 0.0939 | |||

| ALGM / Allegro MicroSystems, Inc. | 0.41 | 7.37 | 10.45 | 22.05 | 0.8205 | 0.1400 | |||

| MMSI / Merit Medical Systems, Inc. | 0.11 | 7.37 | 10.21 | -0.01 | 0.8011 | -0.0099 | |||

| RKLB / Rocket Lab Corporation | 0.37 | 67.97 | 10.00 | 119.63 | 0.7851 | 0.4232 | |||

| PATK / Patrick Industries, Inc. | 0.11 | -28.91 | 9.49 | -32.64 | 0.7447 | -0.3744 | |||

| GH / Guardant Health, Inc. | 0.23 | 9.48 | 0.7444 | 0.7444 | |||||

| IOSP / Innospec Inc. | 0.10 | -37.92 | 8.81 | -48.93 | 0.6914 | -0.6790 | |||

| ADMA / ADMA Biologics, Inc. | 0.44 | 7.37 | 8.77 | 29.97 | 0.6880 | 0.1521 | |||

| TREX / Trex Company, Inc. | 0.16 | 27.69 | 8.67 | -22.25 | 0.6806 | -0.6199 | |||

| WEAV / Weave Communications, Inc. | 0.87 | 31.68 | 8.40 | 0.85 | 0.6589 | -0.0025 | |||

| BLFS / BioLife Solutions, Inc. | 0.36 | -11.26 | 7.94 | -19.10 | 0.6235 | -0.1567 | |||

| ACLX / Arcellx, Inc. | 0.13 | 41.87 | 7.88 | 35.82 | 0.6188 | 0.1576 | |||

| CORT / Corcept Therapeutics Incorporated | 0.10 | -10.54 | 7.85 | 14.52 | 0.6159 | 0.0715 | |||

| RVMD / Revolution Medicines, Inc. | 0.19 | 43.45 | 7.36 | 38.73 | 0.5778 | 0.1562 | |||

| ALKS / Alkermes plc | 0.24 | 7.37 | 7.33 | -4.27 | 0.5753 | -0.0330 | |||

| HALO / Halozyme Therapeutics, Inc. | 0.13 | -22.00 | 7.11 | -26.07 | 0.5584 | -0.2061 | |||

| ADPT / Adaptive Biotechnologies Corporation | 0.72 | -49.83 | 6.89 | -42.18 | 0.5411 | -0.4062 | |||

| FTAI / FTAI Aviation Ltd. | 0.06 | -42.30 | 6.64 | -47.49 | 0.5215 | -0.4837 | |||

| NVEE / NV5 Global, Inc. | 0.30 | -44.67 | 6.54 | -32.26 | 0.5131 | -0.2536 | |||

| CWH / Camping World Holdings, Inc. | 0.39 | -27.76 | 6.36 | -39.73 | 0.4995 | -0.3395 | |||

| AXSM / Axsome Therapeutics, Inc. | 0.06 | 28.64 | 6.27 | 6.06 | 0.4921 | 0.0224 | |||

| MGY / Magnolia Oil & Gas Corporation | 0.29 | 6.17 | 0.4839 | 0.4839 | |||||

| TGTX / TG Therapeutics, Inc. | 0.17 | 31.55 | 6.04 | 53.52 | 0.4744 | 0.1615 | |||

| CRNX / Crinetics Pharmaceuticals, Inc. | 0.19 | 7.37 | 5.89 | -8.45 | 0.4620 | -0.0488 | |||

| MDGL / Madrigal Pharmaceuticals, Inc. | 0.02 | 5.10 | 0.4003 | 0.4003 | |||||

| LNTH / Lantheus Holdings, Inc. | 0.06 | -44.86 | 4.88 | -55.59 | 0.3833 | -0.4904 | |||

| PCVX / Vaxcyte, Inc. | 0.15 | 7.37 | 4.82 | -52.23 | 0.3781 | -0.4231 | |||

| GKOS / Glaukos Corporation | 0.05 | -52.93 | 4.81 | -63.03 | 0.3776 | -0.6562 | |||

| RNA / Avidity Biosciences, Inc. | 0.14 | 7.37 | 4.48 | 8.57 | 0.3519 | 0.0238 | |||

| KRYS / Krystal Biotech, Inc. | 0.03 | 7.37 | 4.07 | -24.55 | 0.3193 | -0.1091 | |||

| NUVL / Nuvalent, Inc. | 0.05 | 7.37 | 3.39 | 6.83 | 0.2662 | 0.0140 | |||

| TWST / Twist Bioscience Corporation | 0.09 | 7.37 | 2.66 | -18.97 | 0.2089 | -0.0521 | |||

| WGS / GeneDx Holdings Corp. | 0.03 | 2.31 | 0.1809 | 0.1809 | |||||

| APLD / Applied Digital Corporation | 0.32 | -45.89 | 2.21 | -53.82 | 0.1733 | -0.2064 | |||

| SNCY / Sun Country Airlines Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0432 | ||||

| AZEK / The AZEK Company Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.4898 | ||||

| ANGO / AngioDynamics, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0909 |