MACOM Technology Solutions Holdings (MTSI) Price Target Increased by 26.28% to 84.66

The average one-year price target for MACOM Technology Solutions Holdings (NASDAQ:MTSI) has been revised to 84.66 / share. This is an increase of 26.28% from the prior estimate of 67.04 dated August 1, 2023.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 65.65 to a high of 99.75 / share. The average price target represents an increase of 2.04% from the latest reported closing price of 82.97 / share.

What is the Fund Sentiment?

There are 634 funds or institutions reporting positions in MACOM Technology Solutions Holdings.

This is a decrease

of

12

owner(s) or 1.86% in the last quarter.

Average portfolio weight of all funds dedicated to MTSI is 0.28%,

a decrease

of 4.07%.

Total shares owned by institutions decreased

in the last three months by 1.11% to 68,497K shares.

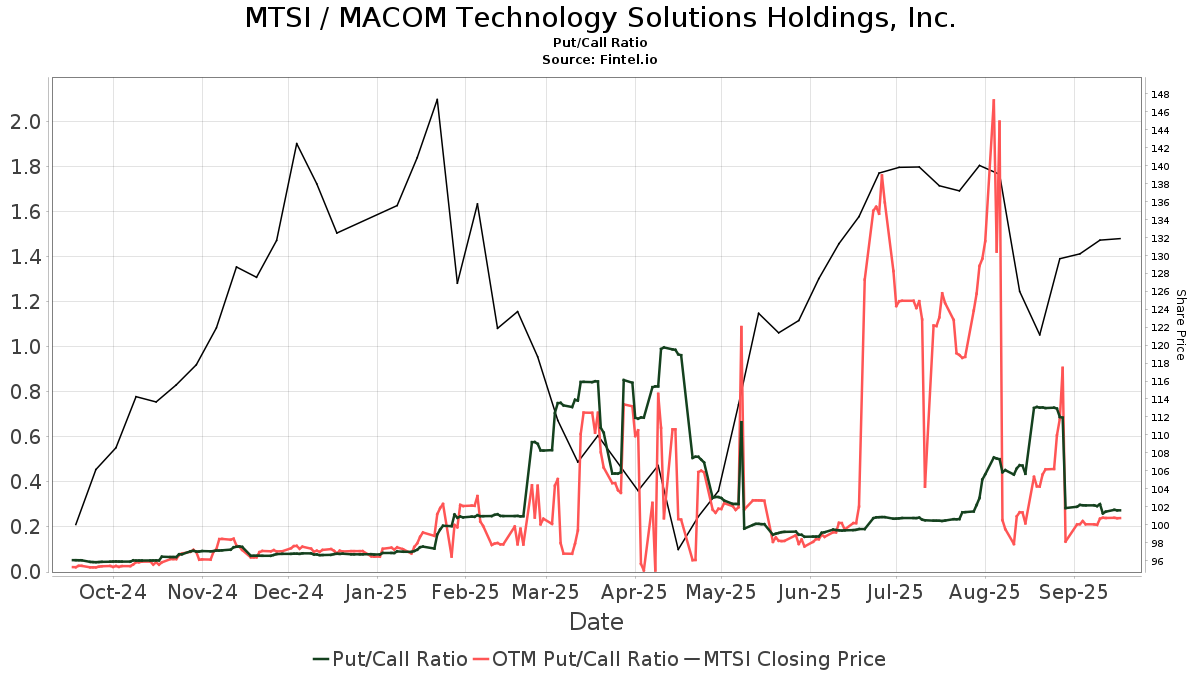

The put/call ratio of MTSI is 0.41, indicating a

bullish

outlook.

The put/call ratio of MTSI is 0.41, indicating a

bullish

outlook.

What are Other Shareholders Doing?

PRNHX - T. Rowe Price New Horizons Fund holds 2,607K shares representing 3.67% ownership of the company. In it's prior filing, the firm reported owning 2,954K shares, representing a decrease of 13.31%. The firm decreased its portfolio allocation in MTSI by 6.20% over the last quarter.

Jpmorgan Chase holds 2,191K shares representing 3.09% ownership of the company. In it's prior filing, the firm reported owning 1,771K shares, representing an increase of 19.20%. The firm increased its portfolio allocation in MTSI by 713.26% over the last quarter.

T. Rowe Price Investment Management holds 2,188K shares representing 3.08% ownership of the company. In it's prior filing, the firm reported owning 1,251K shares, representing an increase of 42.84%. The firm increased its portfolio allocation in MTSI by 53.77% over the last quarter.

Alliancebernstein holds 2,186K shares representing 3.08% ownership of the company. In it's prior filing, the firm reported owning 2,506K shares, representing a decrease of 14.61%. The firm decreased its portfolio allocation in MTSI by 23.07% over the last quarter.

FSELX - Semiconductors Portfolio holds 2,078K shares representing 2.93% ownership of the company. In it's prior filing, the firm reported owning 1,979K shares, representing an increase of 4.78%. The firm decreased its portfolio allocation in MTSI by 26.79% over the last quarter.

MACOM Technology Solutions Holdings Background Information

(This description is provided by the company.)

MACOM designs and manufactures semiconductor products for Data Center, Telecommunication and Industrial and Defense applications. Headquartered in Lowell, Massachusetts, MACOM has design centers and sales offices throughout North America, Europe and Asia. MACOM is certified to the ISO9001 international quality standard and ISO14001 environmental management standard.

Additional reading: