Volkswagen Becomes the EV Stock Canadians Should Get Behind

The German auto maker's electric vehicle battery plant anchors CEO's North America plan

Is it possible that the best electric vehicle stock for Canadian investors is based in Wolfsburg, Germany?

It's certainly looking that way after the Ontario provincial government and Volkswagen (US:VLKAF DE:VOW3) announced that it would build its first North American EV battery manufacturing plant in St. Thomas, Ontario, about halfway between Toronto and Windsor.

The announcement comes nearly a year after the Ontario government began meeting with the German car maker's representatives to secure the plant. Discussions heated up in October, culminating in this past Monday’s big news.

This announcement is one more step in the provincial government’s Driving Prosperity plan, which seeks to position Ontario as a North American leader in EV automotive technology.

In 2020, the global battery electric vehicle market reached just over US$47 billion. Projections forecast a market increase by a compound annual growth rate of 14.1% between 2019 and 2030, amounting to over US$212 billion in 2030, data from Next Move Strategy Consulting shows.

From cows to cars

The plant, which is expected to be operational by 2027, will employ as many as 2,500 people, with an additional 7,500 jobs from the spinoff benefits of the plant. It will be built on 1,500 acres currently used for agriculture.

While the township of Central Elgin loses control of the land, the opportunity was too great for the Ontario government to pass up. St. Thomas, a city of 42,000, used to have a Ford (US:F) plant in the area. The battery plant will jumpstart the local economy.

“The fact that the 1,500-acre plot has been turned over to a likely 2,500-job site that resurrects a car town is probably a suitable sacrifice most would be willing to make,” said Flavio Volpe, president of the Automotive Parts Manufacturers’ Association.

The St. Thomas plant could be an even bigger investment than the nearly $5 billion Stellantis NV (US:STLA) and LG Energy Solutions are investing in Windsor for a battery plant also employing 2,500.

Although no terms were disclosed, the federal government’s Industry Minister François-Philippe Champagne said it was “probably the largest single investment in the auto sector in Canada’s history.”

All in on EV

Volkswagen, understandably, is very excited about its soon-to-built Canadian plant. It’s part of the company’s 10-point plan for growth that it revealed last September. Point 4 of CEO Oliver Blume’s plan concerns North America.

“Our North American strategy is a key priority in our 10-point-plan that we’ve laid out last year. With the decisions for cell production in Canada and a Scout site in South Carolina we’re fast-forwarding the execution of our North American strategy,” Blume stated in the company’s March 13 press release.

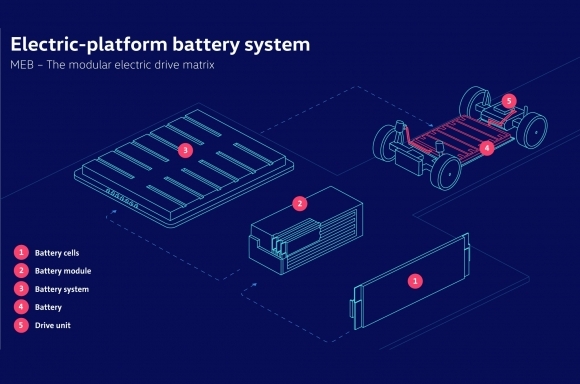

Over the next five years, Volkswagen plans to spend nearly $200 billion to reduce its EV production costs while enabling it to maintain and grow its market share. Approximately two-thirds of its investment will be for electrification, including more than $15 billion for EV batteries, with a significant portion invested in Ontario.

In 2023, Volkswagen expects to grow revenues by 12.5% at the midpoint of guidance on a 14% increase in deliveries.

The company started U.S. production of its electric ID.4 SUV last August. In the fourth quarter, it sold 9,439 ID.4’s, more than double a year earlier. Almost 14% of its production in Q4 2022 was all-electric. The ID.4 reached monthly output of 7,000 at its Tennessee plant.

Likely, none of this is lost on the institutional investors who've gone all in on EVs. On Fintel's Institutional Ownership dashboard, the $165.7 billion Vanguard Developed Markets Index Fund Admiral Shares (US:VTMGX) was a recent big purchaser, taking a new position of 217,850 shares.

All of this is excellent news if you are a shareholder. However, if you’re not, Monday's announcement suggests Canadians might want to pass on Tesla (US:TSLA) and invest in Volkswagen, which is actually investing in their country.