Will Ashworth

Will Ashworth is a Toronto native who has worked as a professional writer since 2004, covering business news and investment topics. In addition to Investopedia, Will has written on finance and investing topics for a number of well-known websites, including Kiplinger's, The Motley Fool, Investor Place, and Yahoo Finance. Will has built a successful career out of following his true passion of writing about finance and investment. Through his writing, Will hopes to help his readers become more financially-savvy investors. For several years, Will wrote a monthly column, Business of Leaside, for the local news website Leaside Life. Will currently writes about stock market news for Investor Place. His previous experience also includes producing B2B print, digital, and video content for KMI Media. Will’s passion for writing about investments was born when, for two years from 2001 to 2003, he wrote and distributed among his friends and colleagues a free investment newsletter, the IS Review. Before embarking on his writing career, Will enjoyed a career in financial services. He worked in customer service for organizations like MRS Trust Inc. and in sales at Opus 2 Direct.com Inc. He operated a franchise coaching business, The Entrepreneur’s Source, at which he worked with clients to help find and buy franchises that would help them meet their personal goals and fulfill their financial needs. With 15 years of customer service experience, and more than a decade of writing experience, Will is a seasoned communicator in addition to being a skilled finance professional.

by Will Ashworth

- 2023-09-07

BRP (US:DOOO) reported record second-quarter 2024 results last week, delivering revenue and normalized earnings that were better than analyst expectations.

DOOO

BC

by Will Ashworth

- 2023-08-31

Canada’s Royal Bank (CA:RY) came out as the winner in the latest round of the country’s Big Six bank earnings, reporting that third-quarter 2023 earnings per share increased by 8.

RY

VBNK

ZEB

by Will Ashworth

- 2023-08-29

Loblaw Companies’ (CA:L) Shoppers Drug Mart will start selling beauty brand The Body Shop’s products at 25 Shoppers locations across Canada and Shoppers’ online site, expanding to 50 stores in 2024.

L

NTCO

WN

LRLCY

by Will Ashworth

- 2023-08-24

If there were any doubt that Nvidia (US:NVDA) is the king of artificial intelligence, the company's Aug.

NVDA

CVO

CVOSF

SKYY

by Will Ashworth

- 2023-08-22

The 2024 new product lineup that BRP (CA:BRP, US:DOOO) debuted at last weekend’s Quebec powersports manufacturer’s annual dealer show should give BRP stock investors confidence.

DOOO

by Will Ashworth

- 2023-08-17

Regulator penalties are just getting bigger for Emera (CA:EMA) subsidiary Nova Scotia Power and that should have investors concerned.

EMA

NEE

SPY

by Will Ashworth

- 2023-08-15

Rogers Sugar (CA:RSI) reported its Q3 2023 earnings on Aug. 14. The company delivered solid revenue and earnings growth in the third quarter. However, Canada’s largest sugar producer’s expansion plans put investors in a buying mood. Its shares rose more than 3% on the news. RSI stock has struggled over the past 12 months, down almost 11% while the S&P/TSX Composite Index is off less than 2% in the

RSI

by Will Ashworth

- 2023-08-10

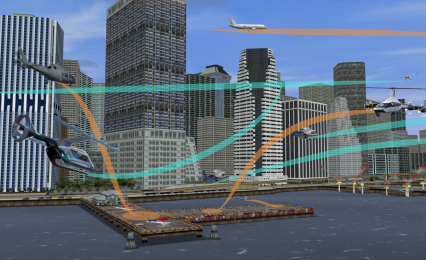

CAE Inc. (CA:CAE, US:CAE) reported outstanding first-quarter 2024 results on Aug. 9. Cue the puns: The flight simulator company’s shares took off, climbing more than 7% But the journey isn't over (right, more puns…) There’s plenty ahead for investors to be excited about. You might want to consider CAE stock for your portfolio if you don't own the name. Up nearly 21% year-to-date, the Quebec tech m

CAE

PPA

by Will Ashworth

- 2023-08-08

On the same day late last week that Telus (CA:T) reported laying off 6,000 people, Magna International (CA:MG) delivered a report revealing healthy revenue and earnings growth in the second quarter.

MG

by Will Ashworth

- 2023-08-03

On a scale of 1 to 10, this week's earnings reports fall between 3 and 4. It’s been a downright train wreck. It didn’t help that the U.S. credit rating was downgraded on Aug. 2. Due to the double dose of bad news, the S&P/TSX Composite Index heads into Friday down 1.5%. The index is now up less than 4% on the year while the S&P 500 Index is up 17.7%. If investors aren’t worried about the latest ro

SHOP

BCE

T

MFI

NTR

by Will Ashworth

- 2023-08-01

The roster of big TSX-listed oil and gas companies is about to get a new name. The five incumbents are Cenovus Energy (CA:CVE), Suncor Energy (CA:SU), Imperial Oil (CA:IMO), Enbridge (CA:ENB), Canadian Natural Resources (CA:CNQ). The new name will be the firm formed via Strathcona Resources’s acquisition of Calgary-based Pipestone Energy (CA:PIPE), announced on Tuesday. It will be Canada’s fifth-l

PIPE

SU

IMO

ENB

BN

ZEO

by Will Ashworth

- 2023-07-27

Loblaw Companies (CA:L, US:LBLCF) provided shareholders with a lot to be happy about in its second-quarter 2023 results reported on July 26.

L

KR

ACI

by Will Ashworth

- 2023-07-25

As part of its growth strategy for 2023, Calgary, Alberta-based TC Energy (CA:TRP, US:TRP) announced last November that it would divest more than $5 billion in assets to help pay for its $34 billion in secured capital projects expected over the next five years.

TRP

TRP

MLPX

by Will Ashworth

- 2023-07-20

DRI Healthcare Trust (CA:DHT.UN, CA:DHT.U) announced on July 19 it had completed a $98 million bought deal, issuing 9.223 million units of its stock at $10.60, a 6% discount to the drug royalty investor’s unit price. The bought deal was led by CIBC Capital Markets, Scotiabank and RBC Capital Markets with help from several other firms, including National Bank Financial and Canaccord Genuity. The tr

by Will Ashworth

- 2023-07-18

The latest battle for the Biden Administration’s firebrand Federal Trade Commissioner, Lina Khan, is playing out in a Northern California court.

CSU

ICE

BKI

by Will Ashworth

- 2023-07-14

Every once in a while, a company announces a seemingly trivial piece of news that makes investors take notice.

DE

by Will Ashworth

- 2023-07-13

Fidelity Investments Canada ULC announced on July 12 that it had entered into an agreement with Brookfield Asset Management (CA:BAM, US:BAM) that sees the alternative asset manager build a portfolio of Canadian real estate assets for Fidelity’s Canadian clients.

BN

BN

BAM

BAM

by Will Ashworth

- 2023-07-12

What’s to become of Laurentian Bank (CA:LB) after Tuesday’s announcement that its board of directors and management initiated a strategic review of its business to generate additional value for shareholders? One outcome of the strategic review is that the company is officially put up for sale to the highest bidder, with numbers likely to be north of $2 billion.

LB

BNS

NA

EQB

CWB

RY

BMO

HSBC

by Will Ashworth

- 2023-07-11

Is it time for investors in Canada to apply a 25-year-old investment strategy to the S&P/TSX 60 Index? The Globe and Mail contributor Norman Rothery recently wrote about a stock-picking strategy that invested in 10 stocks included in the Dow Jones Industrial Average (DJIA) with the lowest price-to-earnings ratios (P/E) each year.

XCV

XCG

RY

TD

ENB

XIU

SHOP

by Will Ashworth

- 2023-07-09

Richelieu Hardware (CA:RCH) reported Q2 2023 results on July 6. Against the backdrop of a powerful Q2 2022, the Montreal-based distributor and manufacturer of specialty hardware delivered revenues and earnings that were down from a year ago. On the top line, its revenues were 3.2% lower than a year ago, at $472.1 million. On the bottom line, its earnings before interest, taxes, depreciation and am

RCH

IXUS

FNDC

by Will Ashworth

- 2023-07-06

Maple Leaf Sports and Entertainment (MLSE), the owner of the Toronto Maple Leafs, Toronto Raptors, and several other sports properties, has been thrust into the middle of a partnership spat that could carry on for some time if Rogers Communications (CA:RCI.

RCI.B

BCE

CMCSA

by Will Ashworth

- 2023-07-05

According to the Bloomberg Billionaires Index, the world's 500 richest people added $852 billion to their wealth in the first half of 2023.

TRI

TRI

by Will Ashworth

- 2023-07-04

As Americans celebrated all that makes their country great yesterday, I wonder how many included Apple (US:AAPL) on their list? After all, the $3 trillion-plus market capitalization was a nice Fourth of July gift for the country and its investors.

AAPL

BRK.B

BRK.A

BLK

XIU

QQQM

by Will Ashworth

- 2023-07-03

The S&P/TSX 60 Index gained 3.90% in the first half of 2023. The Canadian dollar version of the S&P 500 Index, the S&P/TSX Composite index, gained 13.20% in the first half of the year, 930 basis points higher. The S&P/TSX 60 represents the large-cap segment of the Canadian equity market. Its components will have to improve their stock performance in the second half if the index hopes to catch the

SHOP

OTEX

TD

XIU

SPY

FHN

SAP

by Will Ashworth

- 2023-06-30

It's not surprising that Alimentation Couche-Tard (CA:ATD) reported rising profits on June 28.

ATD

BB

IDG

CJR.B

by Will Ashworth

- 2023-06-29

Vancouver billionaire Jim Pattison has been busy gobbling up the shares of Westshore Terminals Investments (CA:WTE) in June.

WTE

:format(webp)/https://www.thestar.com/content/dam/thestar/news/gta/2020/05/30/through-world-wars-and-newspaper-wars-the-star-has-never-lost-its-progressive-streak/starillustration.jpg)

by Will Ashworth

- 2023-06-28

When news surfaced that Network Canada (CA:PNC.A, CA:PNC.B) was in merger talks with Nordstar Capital LP, the parent company of the Toronto Star, Postmedia’s shares shot up by 45%. The two companies are at the table to figure out the best way forward together in a less-than-ideal operating environment. The Canadian print media industry - as elsewhere - has withered on the vine over the past decade

PNC.A

PNC.B

by Will Ashworth

- 2023-06-27

Power Corp. (CA:POW) CEO Jeffrey Orr acquired 25,000 shares of the financial conglomerate’s stock at an average price of $34.89 a share for an outlay of nearly $873,000, according to a June 13 filing. That bumps up his position in POW stock by 4.2% to 625,000 shares. There’s a saying that insiders sell company stock for all sorts of reasons, but there’s only one reason they buy: the stock is a goo

POW

GWO

IGM

GBLBY

PDRDY

ADDYY

by Will Ashworth

- 2023-06-26

The Canada Revenue Agency (CRA) is coming for Shopify (CA:SHOP). The government agency responsible for collecting taxes from Canadian individuals and businesses has requested that Shopify hand over records for its Canadian stores from the past six years. On June 23, responding on Twitter to the CRA’s request, Shopify CEO Tobi Lutke struck a defiant tone: “I don't particularly want a fight with the

SHOP

PYPL

EBAY

SHOP

by Will Ashworth

- 2023-06-22

A move by Canada’s bank regulator may have just put shares of the country’s lenders in investor quarantine for the next four months.

TD

CM

ZEB

by Will Ashworth

- 2023-06-21

While 2023 is expected to be another record year for data center investment, Allied Properties (CA:AP.

AP.UN

ZRE

by Will Ashworth

- 2023-06-20

The Canada Mortgage and Housing Corporation (CMHC) reported last June that the country needed to build 3.

CAR.UN

MKP

by Will Ashworth

- 2023-06-19

Air Canada (CA:AC) stock holders have much to be happy about. AC stock is up almost 22% in 2023, keeping pace with the global air carriers share rebound. And last week brought news of a competitor's exit. Sunwing Airlines president Len Corrado announced in a June 14 internal memo to company employees that the airline was shutting down with the low-cost carrier’s business integrated into WestJet. T

AC

ONEX

JETS

by Will Ashworth

- 2023-06-16

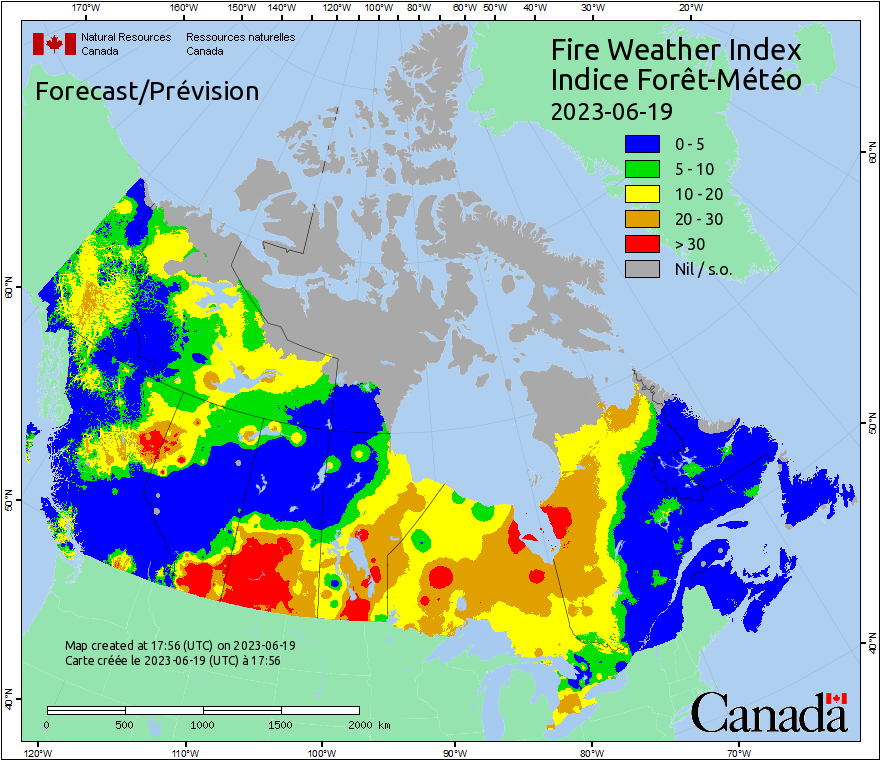

Thanks to the Canadian wildfires in Alberta, Quebec, Ontario and Nova Scotia, New York City became the most polluted major city in the world for a brief moment in early June.

IFC

BBCA

by Will Ashworth

- 2023-06-15

The Canadian media sector took a direct hit on June 14 when BCE (CA:BCE) announced plans to eliminate 1,300 positions at the company.

BCE

T

VZ

RCI.B

by Will Ashworth

- 2023-06-14

Monday’s announcement that Toronto-based Corby Spirit and Wine (CA:CSW.A, CA:CSW.B) will acquire 90% of Ace Beverage Group is music to the ears of long-time CSW stock holders. Its Class A voting shares are down more than 14% year-to-date and 31% over the past five years. Its relative valuation, based on Fintel’s proprietary scoring model, ranks the stock at close to undervalued, putting name at 3,

CSW.A

CSW.B

PDRDY

BUD

by Will Ashworth

- 2023-06-13

In what appears to be a win-win transaction, Brookfield Renewable (CA:BEP.UN, US:BEP) announced on June 12 that it would acquire North Carolina-based Duke Energy’s (US:DUK) unregulated commercial renewables business for $2.8 billion (all figures in U.S. dollars), including the assumption of debt and non-controlling tax-equity interests. Duke’s commercial renewables portfolio includes 3,400 megawat

BEP.UN

BEPC

DUK

BEP

by Will Ashworth

- 2023-06-12

Rising interest rates and inflation have dented the private equity industry in 2023 after delivering back-to-back record-breaking years in 2021 and 2022.

IAUM

IEFA

VWO

by Will Ashworth

- 2023-06-09

It would be easy for hotshot individual retail investors to view the single-digit annual return generated by Canada’s PSP Investments as mediocre.

BAM

ONEX

POW

FFH

CVG

SEC

by Will Ashworth

- 2023-06-08

It looks like Dollarama (CA:DOL) investors took Wednesday’s earnings report as an opportunity to sell on the news.

DOL

DG

DLTR

by Will Ashworth

- 2023-06-07

When VersaBank (CA:VBNK) reported second-quarter results Wednesday, the little-known bank was able to do something that none of Canada’s big five lenders did: Increase net earnings from Q1 2023.

VBNK

ZEB

by Will Ashworth

- 2023-06-07

In its latest move in what’s already been a very busy year, Fairfax Financial (CA:FFH, US:FRFHF) announced on June 5 that it would acquire $2 billion in real estate construction loans from Kennedy-Wilson Holdings (US:KW).

FFH

KW

PACW

VGTSX

VTMGX

by Will Ashworth

- 2023-06-06

With the shares of Winnipeg-based NFI Group (CA:NFI) down more than 6% year-to-date and 82% over the past five years, investors could use a bit of good news.

NFI

BLBD

PTRA

by Will Ashworth

- 2023-06-02

Montreal-based Alimentation Couche-Tard (CA:ATD, US:ANCTF) has recently made minor cuts to its non-frontline staff in the U.

ATD

TTE

ADP

PAYX

ANCTF

by Will Ashworth

- 2023-06-02

Reading through BRP's (CA:DOO) first-quarter 2024 earnings report issued on Thursday, what's clear is that despite recessionary threats, the Quebec-based company continues to deliver record results.

by Will Ashworth

- 2023-05-31

Great-West Lifeco (CA:GWO), the insurance subsidiary of Montreal-based Power Corporation of Canada (CA:POW), announced on May 31 that it was selling its Putnam Investments subsidiary in the U.

GWO

POW

BEN

IGM

by Will Ashworth

- 2023-05-31

When Canopy Growth (CA:WEED) announced in October 2021 that it had acquired the option to buy 100% of Wana Brands, the number one cannabis edibles brand in North America, investors knew it was only a matter of time before some arrangement with Indiva Limited (CA:NDVA), the exclusive producer and distributor of Wana’s products in Canada, was announced.

WEED

NDVA

MJ

by Will Ashworth

- 2023-05-30

Freedom Mobile’s May 25 press release launching a nationwide mobile plan for $50 is a shot across the bow of its larger peers, including Rogers Communications (CA:RCI.

RCI.B

BCE

QBR.B

TU

.jpg)

by Will Ashworth

- 2023-05-26

Brookfield Asset Management’s (US:BAM) real estate subsidiary, Brookfield Property Partners (CA:BPYP-A), recently defaulted on $275 million of CMBS (commercial mortgage-backed securities) underpinning the financing on its 41-story office tower at 725 South Figueroa St.

BAM

VNQ

by Will Ashworth

- 2023-05-25

The last of the big Canadian banks - TD Bank (CA:TD), Royal Bank (CA:RY) and CIBC (CA:CM) - reported earnings on May 25.

TD

RY

CM

BNS

TD

FHN

by Will Ashworth

- 2023-05-24

The words “profit down” are beginning to sound like a broken record for Canadian banks.

BMO

BNS

by Will Ashworth

- 2023-05-23

Two of North America's largest proxy advisory firms, Institutional Shareholder Services Inc.

QSR

MCD

DPZ

by Will Ashworth

- 2023-05-19

Bombardier (CA:BBD.B) announced on May 18 that it was partnering with the Canadian division of General Dynamics (US:GD) to develop a military reconnaissance aircraft to replace the current CP-140 Aurora aircraft made by Lockheed Martin (US:LMT). Never mind that General Dynamics makes Gulfstream private jets, thus competing directly with Bombardier’s business jet division. Bombardier management, fr

BBD.B

GD

LMT

BA

by Will Ashworth

- 2023-05-18

The Bank of Canada released its quarterly Senior Loan Officer Survey a week ago. It likely slid under the radar of investors getting an early start to the weekend. The news, while not good, wasn’t surprising. The survey found that Canadian banks are tightening their lending standards, especially in the consumer segment, where higher interest rates have forced financial institutions to scale back t

DOL

BAM

REI.UN

CTC.A

by Will Ashworth

- 2023-05-17

ECN Capital (CA:ECN, US:ECNCF) reported its Q1 2023 results on May 15. Unfortunately, they weren’t very good. The provider of large-scale manufactured home loans, as well as recreational vehicle (RV) and boat loans, delivered adjusted net income of $1.4 million, or 1 cent a share, down 59% from $3.4 million, or 1 cent a share a year earlier. It provides credit portfolios to 90 U.S. financial insti

ECN

EFN

TFC

by Will Ashworth

- 2023-05-16

Less than a week after CI Financial (CA:CIX) CEO Kurt MacAlpine triumphantly announced its deal to sell 20% of its U.

CIX

by Will Ashworth

- 2023-05-15

Algonquin Power & Utilities (CA:AQN) reported its first-quarter 2023 results on May 11.

AQN

CNRG

by Will Ashworth

- 2023-05-12

News last week that CI Financial (CA:CIX) is selling 20% of its U.S. wealth management business sent the Toronto-traded shares up 50% by one point on May 11. The CIX stock price pulled back a bit, but still posting a 23% gain by the close. By Friday, some of the glow had worn off as investors reassessed the deal and the shares gave back more than 17%. An investment group led by Bain Capital and th

CIX

WT

SCHW

IYG

FOCS

by Will Ashworth

- 2023-05-11

Canadian Tire (CA:CTC.A) said it was the weather that was the big factor in its May 11 first-quarter 2023 earnings report, as the multi-brand retailer explained why revenue and sales were lower than a year ago. CTC stock dropped 2.5%. “Our Q1 financial results were impacted by a number of factors. Our Retail segment was impacted by the fire at our A.J. Billes distribution centre, as well as unseas

CTC.A

by Will Ashworth

- 2023-05-10

The 5% drop in the share price that followed yesterday’s Pet Valu Holdings’ (CA:PET, US:PTVLF) earnings could be a sign that PET stock investors are in for a bumpier ride.

PET

CHWY

PAWZ

by Will Ashworth

- 2023-05-09

Open Text (CA:OTEX) reported its third-quarter 2023 results last week. Revenues were up 44.9%, excluding currency effects, to $1.28 billion, with a 41.1% increase in annual recurring revenues. If you only read the first paragraph, you would assume it generated a significant profit increase in the third quarter. That didn’t happen. Its GAAP-based net income fell 22.9% to $58 million. However, on a

OTEX

ITX

by Will Ashworth

- 2023-05-08

Any assessment of an airline stock, like Air Canada (CA:AC), must begin with two external factors: demand and fuel costs.

AC

by Will Ashworth

- 2023-05-05

Shopify’s (CA:SHOP, US:SHOP) May 4 announcements could go down in history as one of the most monumental days in the company's existence.

SHOP

SHOP

by Will Ashworth

- 2023-05-04

In what is the least surprising turn of events in North American banking, Toronto-Dominion Bank (CA:TD) and Tennessee-based First Horizon (US:FHN) have mutually agreed to call off their $13.

TD

FHN

TD

by Will Ashworth

- 2023-05-03

From the looks of Loblaw Companies’ (CA:L) first-quarter 2023 results reported on May 3, nearly a decade after it acquired Shoppers Drug Mart, the deal continues to pay big dividends for the grocery store chain.

L

by Will Ashworth

- 2023-05-02

From a look at Restaurant Brands International (CA:QSR, US:QSR) pre-market report on Tuesday, the multi-brand restaurant conglomerate appears to be benefiting from the steady hand of the new executive chairman, Patrick Doyle.

QSR

DPZ

VDC

by Will Ashworth

- 2023-05-01

Imperial Oil’s (CA:IMO) first-quarter results, reported on April 28, were, for the most part, a reasonable success.

IMO

XOM

by Will Ashworth

- 2023-04-28

Suncor Energy (CA:SU) announced on April 26 that it was acquiring Total Energies’ (US:TTE) Canadian operations for $5.

SU

TTE

COP

by Will Ashworth

- 2023-04-26

It looks like H&R Real Estate Investment Trust (CA:HR.UN) is ready to play nice with activist investor K2 Principal Fund L.P. and K2 & Associates Investment Management Inc., with the April 25 announcement that the parties have reached a support agreement. The activist investor had pushed for the nomination of four trustees at the REIT’s June 15, 2023, meeting of unitholders. As part of the agreeme

HR.UN

DRM

FCR

CRR.UN

by Will Ashworth

- 2023-04-26

Only days after Canadian Pacific Railway (CA:CP) merged with Kansas City Southern to create Canadian Pacific Kansas City Limited, Canadian National Railway (CA:CNR, US:CNI) reported record first-quarter 2023 results.

CP

UNP

GMXT

CP

by Will Ashworth

- 2023-04-24

SNDL Inc. (US:SNDL), the vertically integrated cannabis company and liquor retailer, delivered record net revenue in its April 24 report fourth-quarter and full-year results on April 24. Q4 revenue was $240.4 million, 4% higher than in the previous quarter and more than 10x its Q4 2021 sales. For the full year, it generated $712.2 million in revenue, 1,170% higher than in 2021. Still, on the botto

SNDL

NOVC

by Will Ashworth

- 2023-04-21

For most of 2023, Canadian investors have speculated whether Toronto-Dominion Bank (US:TD, CA:TD) would follow through with its $13.

TD

TD

FHN

by Will Ashworth

- 2023-04-20

New York-based short-seller Spruce Point Capital Management issued an update on April 18 to its December 2021 report highlighting what it believes are the many unsavoury business practices at Nuvei Corporation (US:NVEI, CA:NVEI), a Canadian mid-cap fintech.

NVEI

NVEI

by Will Ashworth

- 2023-04-18

Nuvei Corporation (US:NVEI, CA:NVEI) announced on April 17 that Canadian actor Ryan Reynolds had invested in the payments company.

NVEI

NVEI

TMUS

by Will Ashworth

- 2023-04-19

Investors are all over a Bloomberg News report earlier this week that Lululemon Athletica (US:LULU) is exploring selling Mirror, the company’s fitness equipment maker.

LULU

NKE

by Will Ashworth

- 2023-04-17

Long-time shareholders of Vancouver-based Teck Resources (CA:TECK.B, CA:TECK.A) have probably never seen the company so busy. On the one hand, management has proposed splitting its business into two separate companies: Teck Metals, which would retain its copper and zinc operations; and Elk Valley Resources, which would own its steelmaking coal business. At the same time, Glencore PLC (US:GLCNF) ha

TECK.B

TECK.A

TECK

GLCNF

VALE

NGLOY

FCX

by Will Ashworth

- 2023-04-17

Loblaw Companies' (CA:L) April 14 announcement that it would invest $2 billion into its business in 2023 ought to be music to the ears of Canadian shoppers.

L

EWC

by Will Ashworth

- 2023-04-13

The first-quarter results that MTY Food Group Inc. (CA:MTY) reported on April 12 were good enough that National Bank analyst Vishal Shreedhar raised his target price for the stock by $2 to $74. He has an 'outperform' rating on the stock. Outperform, indeed. (All figures in Canadian dollars, unless otherwise specified.) Also raising his target price on one of Canada’s largest restaurant franchisors

MTY

by Will Ashworth

- 2023-04-12

It's been a busy week for Brookfield Infrastructure (CA:BIPC, US:BIPC) as it's acquired two infrastructure-related businesses for $8.

TRTN

BAM

BEP.UN

by Will Ashworth

- 2023-04-11

First Capital Realty Inc (FCR.UN) announced on April 11 that it would sell four properties for $184 million. The properties include the Hazelton Hotel in Toronto’s Yorkville neighborhood, a 50% interest in the ONE Restaurant located in the hotel, a residential development site at Montreal’s Wilderton Shopping Centre, and 5146-5164 Queen Mary Road, also in Montreal. [All figures in Canadian dollars

FCR.UN

AX.UN

VRE

by Will Ashworth

- 2023-04-05

A March 29 report from New York-based S3 Partners, a provider of financial data analytics, says Toronto-Dominion Bank (CA:TD, US:TD) is the most-shorted bank stock anywhere in Canada, the U.

TD

RY

FHN

SCHW

JPM

C

FRC

by Will Ashworth

- 2023-04-04

Power Corporation of Canada’s (CA:POW) is about to shake up its org chart. Its 100%-owned Power Financial subsidiary owns 62.2% of IGM Financial (CA:IGM), the Winnepeg-based financial services business whose brands include IG Wealth Management and Mackenzie Investments, and several strategic investments. On April 4, IGM made a couple of moves that suggest Power Corp. believes IGM is the holding co

POW

IGM

GWO

by Will Ashworth

- 2023-04-03

Ovintiv (CA:OVV) announced on April 3 that it would acquire 65,000 acres of undeveloped land in the Permian Basin.

OVV

RY

CVE

VSCAX

VVOAX

MSAVX

PXI

by Will Ashworth

- 2023-03-31

It is fair to say that Desjardins Securities analyst Lorne Kalmar is enthusiastic about Canadian retail-related real estate investment trusts (REITs) in the months ahead.

FCR.UN

REI.UN

CHP.UN

CRR.UN

L

EMP.A

MRU

by Will Ashworth

- 2023-03-30

Constellation Software (CA:CSU) reported fourth-quarter 2022 results on March 29 after the markets closed.

CSU

TOI

by Will Ashworth

- 2023-03-29

Dollarama (CA:DOL) reported very strong fourth-quarter 2023 results on March 29. Yet its stock was up less than 3% on the news. Inflation has hurt Canadians, but the Montreal-based company has taken it in stride. As a result, its Q4 results were some of the best in the company’s 30-year history. Revenue in the fourth quarter was 20.3% higher than a year earlier, at a reported $1.47 billion. Its sa

DOL

COST

DG

IXUS

IDEV

by Will Ashworth

- 2023-03-28

Cameco (US:CCJ, CA:CCO) issued a press release on March 27 announcing that it would receive a $300 million refund from the Canada Revenue Agency (CRA) for revised reassessments between 2007 and 2013.

CCJ

BEP.UN

BEP.UN

by Will Ashworth

- 2023-03-27

(Updated to clarify compensation detail beginning in second paragraph.) Rogers Communications (CA:RCI.A, CA:RCI.B) CEO Tony Staffieri has been the chief executive of one of Canada’s leading cable and wireless companies for 14 months. Officially appointed on Jan. 11, 2022, The Globe and Mail reported that in his first full year as CEO, Staffieri earned $31.52 million. Rogers will argue that a big p

RCI.A

RCI.B

CMCSA

BCE

TU

NVEI

GFL

TTD

by Will Ashworth

- 2023-03-26

On a sleepy Friday with the week’s trading winding down, Onex Corp. (CA:ONEX, US:ONEX) announced on March 24 that it was shuttering its Gluskin Sheff private wealth management business almost four years to the day after the private equity firm announced it was buying the Toronto-based independent wealth manager for $445 million. “Gluskin Sheff has a long and successful track record of delivering i

ONEX

CDZ

by Will Ashworth

- 2023-03-23

The latest fourth-quarter results from BRP Inc. (CA:DOO, US:DOOO) were a thing of beauty. Yet after the powersports vehicle maker's premarket March 23 report, investors sent its stock down nearly 5% on the news. One factor for the drop could be the 0.25% interest rate hike. Eventually, the theory goes, consumers will run out of money and credit to buy the Quebec company's SSVs (side-by-side vehicl

DOOO

by Will Ashworth

- 2023-03-22

Activist investor Engine Capital told Parkland Corp.’s (CA:PKI, US:PKIUF) board on Wednesday that the investment firm believes shareholders would be better served if the Calgary-based fuel and convenience store retailer sold non-core assets, such as its British Columbia refinery. New York-based Engine owns approximately 2% of Parkland’s stock. The activist’s letter to the board focuses on the stoc

PKI

PKIUF

by Will Ashworth

- 2023-03-21

With Tuesday's announcement that KKR (US:KKR) has agreed to sell its 50% interest in global renewables developer X-ELIO to joint-venture partner Brookfield Renewable (CA:BEPC, US:BEPC), it's time for investors to consider Brookfield as an solid solar play.

KKR

BEPC

BEPC

BAM

BAM

by Will Ashworth

- 2023-03-20

Premium Brands Holdings (CA:PBH, US:PRBZF), the Vancouver-based specialty food products company, in January 2021 undertook a 50/50 partnership with the Membertou First Nation in Nova Scotia, Miawpukek First Nation in Newfoundland and Labrador, and five other Mi’kmaq communities in Atlantic Canada, to acquire Nova Scotia-based Clearwater Foods for $1 billion including the assumption of debt.

PBH

PRBZF

JATTX

VTMGX

by Will Ashworth

- 2023-03-20

It’s been a week since the California Department of Financial Protection closed the Silicon Valley Bank (US:SIVB) and appointed the Federal Deposit Insurance Corporation (FDIC) as a receiver.

JPM

SIVB

FRC

by Will Ashworth

- 2023-03-16

It's been about six months since Alimentation Couche-Tard (CA:ATD) CEO Brian Hannasch told analysts that the convenience store operator had the financial strength to make a US$10 billion to US$15 billion acquisition.

ATD

TTE

XCG

by Will Ashworth

- 2023-03-15

First Horizon Corp. (US:FHN) closed March 7 at $21.29. As of Wednesday, it's down 26%, as the banking sector melts down from Silicon Valley Bank (US:SIVB) to Credit Suisse Bank (US:CS). So, if you’re Toronto-Dominion Bank (CA:TD) CEO Bharat Masrani, you’ve got to be working at extracting your bank from its deal to buy First Horizon for US$13.4 billion, or US$25 a share. If TD had to close the deal

FHN

TD

CS

SIVB

by Will Ashworth

- 2023-03-14

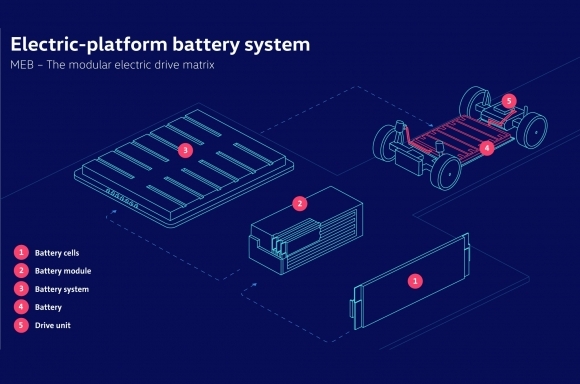

Is it possible that the best electric vehicle stock for Canadian investors is based in Wolfsburg, Germany? It's certainly looking that way after the Ontario provincial government and Volkswagen (US:VLKAF DE:VOW3) announced that it would build its first North American EV battery manufacturing plant in St.

VLKAF

TSLA

VOW

F

STLA

VTMGX

by Will Ashworth

- 2023-03-14

Was it overreach when WSP Global's (CA:WSP, US:WSPOF) CEO Alexandre L’Heureux told participants on last week's fourth-quarter 2022 conference call that he thinks the engineering firm is ready to compete with the world’s largest management consultants, including McKinsey & Company and Deloitte? That depends on whether investors believe WSP Global’s profitability is sufficient to compete with the big firms.

WSP

WSPOF

by Will Ashworth

- 2023-03-10

BMO Financial Group, the marketing face of the Bank of Montreal (CA:BMO), announced on March 10 that it had acquired the Air Miles loyalty program from Loyalty Ventures (US:LYLT), which is seeking bankruptcy protection in both the U.

BMO

LYLT

DIV

by Will Ashworth

- 2023-03-09

Shares of Kinaxis (CA:KXS, US:KXSCF), an Ottawa-based supply chain software company, gained 6% in the week following its March 1 fourth quarter earnings announcement.

KXS

KXSCF

SXUS

WTAI