Mga Batayang Estadistika

| Nilai Portofolio | $ 1,431,956,194 |

| Posisi Saat Ini | 72 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

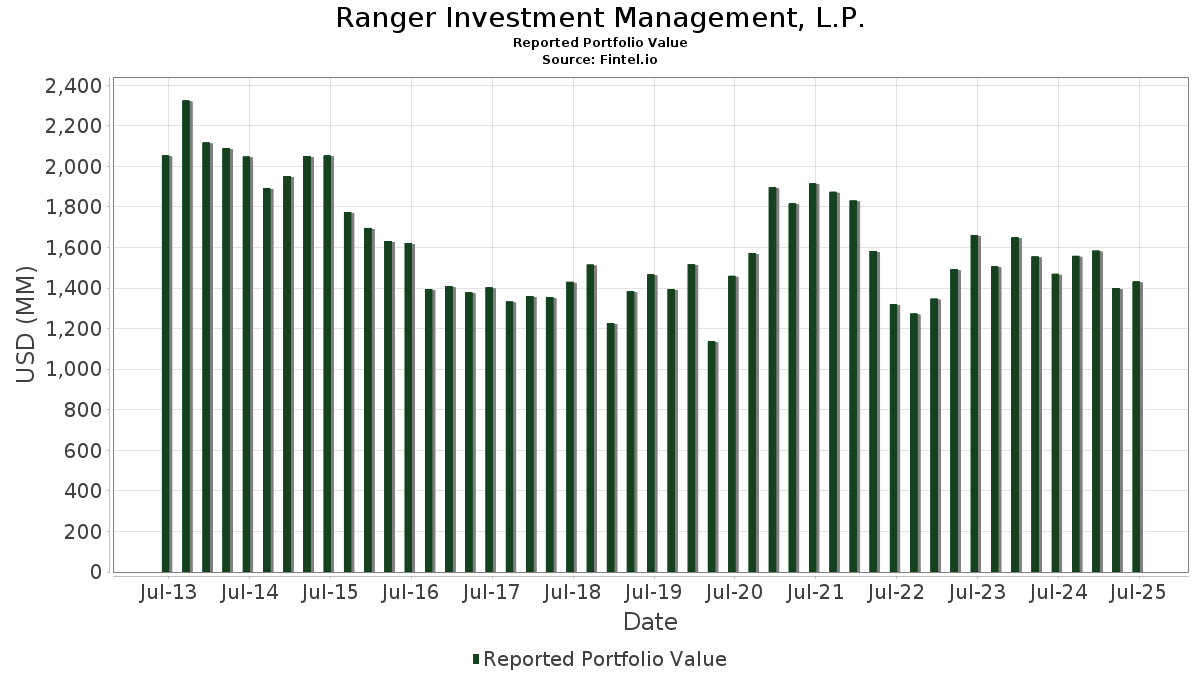

Ranger Investment Management, L.P. telah mengungkapkan total kepemilikan 72 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,431,956,194 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Ranger Investment Management, L.P. adalah Pegasystems Inc. (US:PEGA) , Texas Roadhouse, Inc. (US:TXRH) , Excelerate Energy, Inc. (US:EE) , ADMA Biologics, Inc. (US:ADMA) , and LeMaitre Vascular, Inc. (US:LMAT) . Posisi baru Ranger Investment Management, L.P. meliputi: Warby Parker Inc. (US:WRBY) , Jones Lang LaSalle Incorporated (US:JLL) , Birkenstock Holding plc (US:BIRK) , Argan, Inc. (DE:1AW) , and . Industri unggulan Ranger Investment Management, L.P. adalah "Paper And Allied Products" (sic 26) , "Transportation Services" (sic 47) , and "Wholesale Trade-non-durable Goods" (sic 51) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.01 | 22.20 | 1.5502 | 1.5502 | |

| 1.32 | 32.27 | 2.2538 | 1.3991 | |

| 0.06 | 20.82 | 1.4539 | 1.1074 | |

| 1.12 | 60.70 | 4.2389 | 1.0710 | |

| 0.42 | 30.96 | 2.1619 | 1.0540 | |

| 0.39 | 40.98 | 2.8619 | 1.0074 | |

| 0.30 | 34.11 | 2.3818 | 0.9535 | |

| 0.05 | 12.69 | 0.8865 | 0.8865 | |

| 2.39 | 43.53 | 3.0398 | 0.7662 | |

| 0.19 | 9.47 | 0.6611 | 0.6611 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.21 | 12.92 | 0.9020 | -1.1992 | |

| 1.33 | 27.06 | 1.8894 | -1.1405 | |

| 1.46 | 19.85 | 1.3864 | -0.9676 | |

| 0.56 | 12.61 | 0.8807 | -0.9535 | |

| 1.32 | 31.20 | 2.1785 | -0.7713 | |

| 0.39 | 6.74 | 0.4706 | -0.7473 | |

| 0.30 | 34.56 | 2.4138 | -0.5856 | |

| 0.17 | 20.89 | 1.4586 | -0.5667 | |

| 0.21 | 20.19 | 1.4100 | -0.5488 | |

| 0.28 | 29.59 | 2.0666 | -0.5459 |

Pengajuan 13D/G

Ini adalah daftar pengajuan 13D dan 13G yang dibuat dalam setahun terakhir (jika ada). Klik ikon tautan untuk melihat riwayat transaksi lengkap. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup.

| Tanggal File | Formulir | Keamanan | Sebelumnya Saham |

Saat ini Saham |

ΔPersentase Saham | % Kepemilikan |

% ΔKepemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2025-05-06 | ARIS / Aris Water Solutions, Inc. | 1,325,785 | 1,340,838 | 1.14 | 4.37 | -12.60 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-19 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| PEGA / Pegasystems Inc. | 1.12 | 75.87 | 60.70 | 36.94 | 4.2389 | 1.0710 | |||

| TXRH / Texas Roadhouse, Inc. | 0.29 | -5.17 | 53.47 | 6.66 | 3.7340 | 0.1514 | |||

| EE / Excelerate Energy, Inc. | 1.66 | -2.77 | 48.55 | -0.60 | 3.3904 | -0.1002 | |||

| ADMA / ADMA Biologics, Inc. | 2.39 | 49.07 | 43.53 | 36.82 | 3.0398 | 0.7662 | |||

| LMAT / LeMaitre Vascular, Inc. | 0.51 | -1.61 | 42.69 | -2.61 | 2.9815 | -0.1515 | |||

| FSS / Federal Signal Corporation | 0.39 | 9.15 | 40.98 | 57.93 | 2.8619 | 1.0074 | |||

| ANIP / ANI Pharmaceuticals, Inc. | 0.53 | -6.54 | 34.86 | -8.92 | 2.4343 | -0.3007 | |||

| CWST / Casella Waste Systems, Inc. | 0.30 | -20.41 | 34.56 | -17.64 | 2.4138 | -0.5856 | |||

| LGND / Ligand Pharmaceuticals Incorporated | 0.30 | 57.83 | 34.11 | 70.65 | 2.3818 | 0.9535 | |||

| PCTY / Paylocity Holding Corporation | 0.18 | -5.07 | 32.43 | -8.19 | 2.2649 | -0.2596 | |||

| APPF / AppFolio, Inc. | 0.14 | 17.36 | 32.40 | 22.89 | 2.2624 | 0.3785 | |||

| STVN / Stevanato Group S.p.A. | 1.32 | 125.58 | 32.27 | 169.88 | 2.2538 | 1.3991 | |||

| AAON / AAON, Inc. | 0.43 | 14.07 | 32.00 | 7.68 | 2.2350 | 0.1109 | |||

| IIIV / i3 Verticals, Inc. | 1.15 | 0.31 | 31.50 | 11.73 | 2.1996 | 0.1850 | |||

| ARIS / Aris Water Solutions, Inc. | 1.32 | 2.39 | 31.20 | -24.42 | 2.1785 | -0.7713 | |||

| ULS / UL Solutions Inc. | 0.42 | 54.58 | 30.96 | 99.70 | 2.1619 | 1.0540 | |||

| HQY / HealthEquity, Inc. | 0.28 | -31.71 | 29.59 | -19.05 | 2.0666 | -0.5459 | |||

| GWRE / Guidewire Software, Inc. | 0.12 | -5.07 | 29.14 | 19.30 | 2.0348 | 0.2893 | |||

| CHE / Chemed Corporation | 0.06 | 13.31 | 28.97 | -10.34 | 2.0234 | -0.2859 | |||

| BOOT / Boot Barn Holdings, Inc. | 0.19 | -2.69 | 28.75 | 37.68 | 2.0080 | 0.5154 | |||

| OSW / OneSpaWorld Holdings Limited | 1.33 | -47.45 | 27.06 | -36.18 | 1.8894 | -1.1405 | |||

| SFM / Sprouts Farmers Market, Inc. | 0.15 | -22.59 | 24.75 | -16.51 | 1.7285 | -0.3901 | |||

| LAZ / Lazard, Inc. | 0.51 | 43.48 | 24.25 | 58.99 | 1.6934 | 0.6034 | |||

| HOMB / Home Bancshares, Inc. (Conway, AR) | 0.85 | -5.13 | 24.14 | -4.49 | 1.6855 | -0.1205 | |||

| JJSF / J&J Snack Foods Corp. | 0.20 | 52.36 | 22.74 | 31.18 | 1.5883 | 0.3492 | |||

| PDFS / PDF Solutions, Inc. | 1.05 | 19.21 | 22.35 | 33.36 | 1.5611 | 0.3632 | |||

| WRBY / Warby Parker Inc. | 1.01 | 22.20 | 1.5502 | 1.5502 | |||||

| WSC / WillScot Holdings Corporation | 0.81 | -5.15 | 22.12 | -6.51 | 1.5445 | -0.1462 | |||

| NCNO / nCino, Inc. | 0.78 | 24.15 | 21.85 | 26.41 | 1.5260 | 0.2906 | |||

| MEDP / Medpace Holdings, Inc. | 0.07 | -5.13 | 21.26 | -2.28 | 1.4849 | -0.0701 | |||

| RGEN / Repligen Corporation | 0.17 | -24.60 | 20.89 | -26.30 | 1.4586 | -0.5667 | |||

| WING / Wingstop Inc. | 0.06 | 187.64 | 20.82 | 329.41 | 1.4539 | 1.1074 | |||

| TFIN / Triumph Financial, Inc. | 0.37 | -2.10 | 20.28 | -6.66 | 1.4161 | -0.1365 | |||

| MLAB / Mesa Laboratories, Inc. | 0.21 | -7.23 | 20.19 | -26.34 | 1.4100 | -0.5488 | |||

| PR / Permian Resources Corporation | 1.46 | -38.71 | 19.85 | -39.73 | 1.3864 | -0.9676 | |||

| MMSI / Merit Medical Systems, Inc. | 0.21 | 28.04 | 19.66 | 13.23 | 1.3732 | 0.1321 | |||

| MNDY / monday.com Ltd. | 0.06 | 27.11 | 18.26 | 64.40 | 1.2754 | 0.4814 | |||

| SSD / Simpson Manufacturing Co., Inc. | 0.12 | -5.09 | 18.06 | -6.16 | 1.2612 | -0.1142 | |||

| SAIA / Saia, Inc. | 0.06 | -5.08 | 16.09 | -25.57 | 1.1235 | -0.4212 | |||

| WK / Workiva Inc. | 0.22 | -5.06 | 15.31 | -14.40 | 1.0689 | -0.2089 | |||

| KRUS / Kura Sushi USA, Inc. | 0.15 | 7.82 | 13.33 | 81.27 | 0.9307 | 0.4053 | |||

| OZK / Bank OZK | 0.28 | 8.01 | 13.32 | 16.99 | 0.9299 | 0.1164 | |||

| MSA / MSA Safety Incorporated | 0.08 | -4.98 | 12.95 | 8.52 | 0.9044 | 0.0515 | |||

| SKY / Champion Homes, Inc. | 0.21 | -33.51 | 12.92 | -56.07 | 0.9020 | -1.1992 | |||

| IRMD / IRADIMED CORPORATION | 0.21 | 7.36 | 12.85 | 22.32 | 0.8970 | 0.1465 | |||

| OII / Oceaneering International, Inc. | 0.61 | -31.23 | 12.73 | -34.66 | 0.8888 | -0.5033 | |||

| JLL / Jones Lang LaSalle Incorporated | 0.05 | 12.69 | 0.8865 | 0.8865 | |||||

| MGY / Magnolia Oil & Gas Corporation | 0.56 | -44.79 | 12.61 | -50.86 | 0.8807 | -0.9535 | |||

| CADE / Cadence Bank | 0.37 | -5.13 | 11.90 | -0.06 | 0.8307 | -0.0200 | |||

| MCB / Metropolitan Bank Holding Corp. | 0.15 | 7.41 | 10.54 | 34.29 | 0.7357 | 0.1751 | |||

| BLD / TopBuild Corp. | 0.03 | -5.30 | 9.98 | 0.53 | 0.6971 | -0.0125 | |||

| BIRK / Birkenstock Holding plc | 0.19 | 9.47 | 0.6611 | 0.6611 | |||||

| UFPT / UFP Technologies, Inc. | 0.04 | 22.55 | 9.39 | 48.35 | 0.6559 | 0.2034 | |||

| PAHC / Phibro Animal Health Corporation | 0.36 | 101.11 | 9.14 | 140.52 | 0.6385 | 0.3668 | |||

| PNTG / The Pennant Group, Inc. | 0.30 | 56.57 | 9.10 | 85.87 | 0.6356 | 0.2856 | |||

| VITL / Vital Farms, Inc. | 0.24 | 7.37 | 9.10 | 35.75 | 0.6352 | 0.1563 | |||

| KRT / Karat Packaging Inc. | 0.32 | 105.70 | 9.03 | 117.91 | 0.6304 | 0.3344 | |||

| BFST / Business First Bancshares, Inc. | 0.34 | 7.41 | 8.47 | 8.74 | 0.5917 | 0.0348 | |||

| PLOW / Douglas Dynamics, Inc. | 0.28 | 58.21 | 8.21 | 100.71 | 0.5736 | 0.2811 | |||

| NVEC / NVE Corporation | 0.11 | 7.41 | 8.21 | 24.05 | 0.5732 | 0.1003 | |||

| COCO / The Vita Coco Company, Inc. | 0.23 | 7.26 | 8.13 | 26.33 | 0.5677 | 0.1078 | |||

| LMB / Limbach Holdings, Inc. | 0.05 | -16.34 | 7.65 | 57.40 | 0.5345 | 0.1870 | |||

| SLP / Simulations Plus, Inc. | 0.39 | -44.43 | 6.74 | -60.46 | 0.4706 | -0.7473 | |||

| BLFS / BioLife Solutions, Inc. | 0.29 | -14.26 | 6.22 | -19.13 | 0.4345 | -0.1154 | |||

| QNST / QuinStreet, Inc. | 0.36 | 26.37 | 5.80 | 14.06 | 0.4050 | 0.0416 | |||

| EPM / Evolution Petroleum Corporation | 1.15 | 7.43 | 5.39 | -2.53 | 0.3763 | -0.0188 | |||

| PWP / Perella Weinberg Partners | 0.25 | 8.41 | 4.81 | 14.40 | 0.3356 | 0.0354 | |||

| CVLG / Covenant Logistics Group, Inc. | 0.18 | 4.45 | 0.3108 | 0.3108 | |||||

| GRBK / Green Brick Partners, Inc. | 0.06 | 7.33 | 3.66 | 15.75 | 0.2556 | 0.0296 | |||

| WTTR / Select Water Solutions, Inc. | 0.38 | 7.45 | 3.24 | -11.58 | 0.2266 | -0.0357 | |||

| 1AW / Argan, Inc. | 0.01 | 2.95 | 0.2059 | 0.2059 | |||||

| NCMI / National CineMedia, Inc. | 0.46 | -25.24 | 2.21 | -37.98 | 0.1542 | -0.1002 | |||

| AZEK / The AZEK Company Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| INFU / InfuSystem Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| KWR / Quaker Chemical Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SHOO / Steven Madden, Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MITK / Mitek Systems, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DV / DoubleVerify Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RPAY / Repay Holdings Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ELF / e.l.f. Beauty, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |