Mga Batayang Estadistika

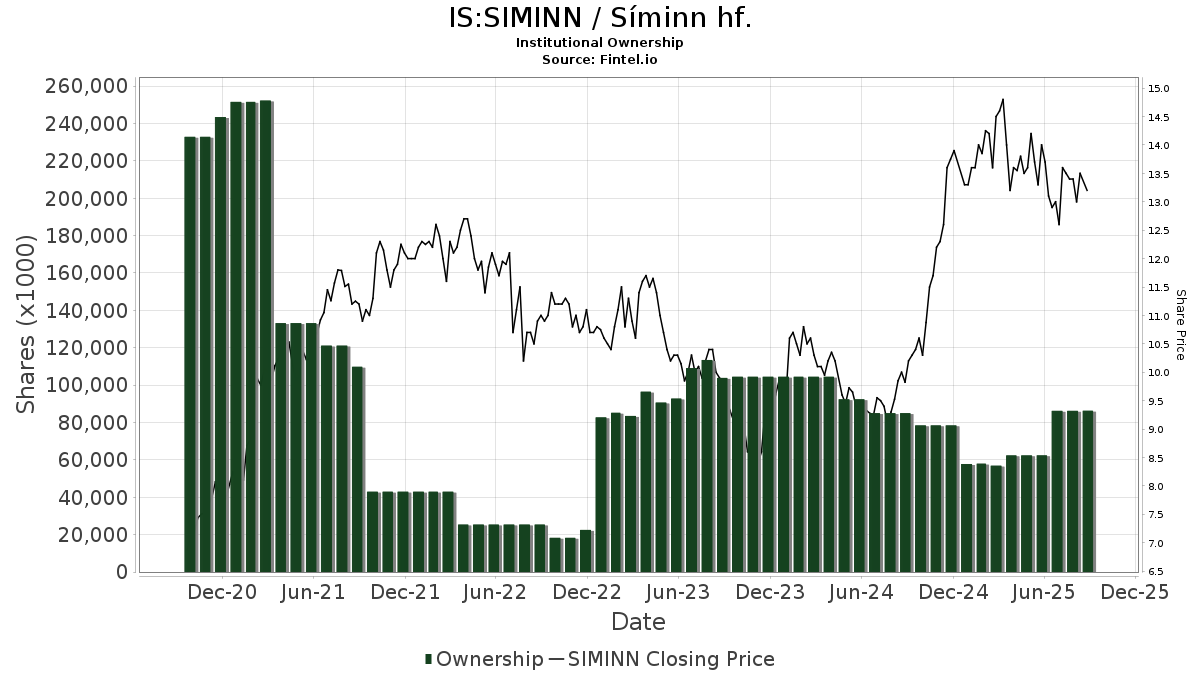

| Saham Institusional (Jangka Panjang) | 86,283,699 - 3.63% (ex 13D/G) - change of 23.86MM shares 38.23% MRQ |

| Nilai Institusional (Jangka Panjang) | $ 9,284 USD ($1000) |

Kepemilikan Institusional dan Pemegang Saham

Síminn hf. (IS:SIMINN) memiliki 11 pemilik institusional dan pemegang saham yang telah mengajukan formulir 13D/G atau 13F kepada Komisi Bursa Efek (Securities Exchange Commission/SEC). Lembaga-lembaga ini memegang total 86,283,699 saham. Pemegang saham terbesar meliputi VGTSX - Vanguard Total International Stock Index Fund Investor Shares, VEIEX - Vanguard Emerging Markets Stock Index Fund Investor Shares, Global Macro Absolute Return Advantage Portfolio - Global Macro Absolute Return Advantage Portfolio, VFSNX - Vanguard FTSE All-World ex-US Small-Cap Index Fund Institutional Shares, Global Macro Portfolio - Global Macro Portfolio, Global Opportunities Portfolio - Global Opportunities Portfolio, EITEX - Parametric Tax-Managed Emerging Markets Fund Institutional Class, VT - Vanguard Total World Stock Index Fund ETF Shares, EAEMX - Parametric Emerging Markets Fund Investor Class, and VSGX - Vanguard ESG International Stock ETF ETF Shares .

Struktur kepemilikan institusional Síminn hf. (ICSE:SIMINN) menunjukkan posisi terkini di perusahaan oleh institusi dan dana, serta perubahan terbaru dalam ukuran posisi. Pemegang saham utama dapat mencakup investor individu, reksa dana, dana lindung nilai, atau institusi. Jadwal 13D menunjukkan bahwa investor memegang (atau pernah memegang) lebih dari 5% saham perusahaan dan bermaksud (atau pernah bermaksud) untuk secara aktif mengejar perubahan strategi bisnis. Jadwal 13G menunjukkan investasi pasif lebih dari 5%.

The share price as of September 1, 2025 is 13.30 / share. Previously, on September 6, 2024, the share price was 9.90 / share. This represents an increase of 34.34% over that period.

Skor Sentimen Dana

Skor Sentimen Dana (sebelumnya dikenal sebagai Skor Akumulasi Kepemilikan) menemukan saham-saham yang paling banyak dibeli oleh dana. Ini adalah hasil dari model kuantitatif multi-faktor yang canggih yang mengidentifikasi perusahaan dengan tingkat akumulasi institusional tertinggi. Model penilaian menggunakan kombinasi dari total peningkatan pemilik yang diungkapkan, perubahan dalam alokasi portofolio pada pemilik tersebut, dan metrik lainnya. Angka berkisar dari 0 hingga 100, dengan angka yang lebih tinggi menunjukkan tingkat akumulasi yang lebih tinggi dibandingkan dengan perusahaan sejenisnya, dan 50 adalah rata-ratanya.

Frekuensi Pembaruan: Setiap Hari

Lihat Ownership Explorer, yang menyediakan daftar perusahaan dengan peringkat tertinggi.

Pengajuan 13F dan NPORT

Detail pada pengajuan 13F tersedia gratis. Detail pada pengajuan NP memerlukan keanggotaan premium. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup. Klik tautan ini ikon untuk melihat riwayat transaksi selengkapnya.

Tingkatkan

untuk membuka data premium dan mengekspor ke Excel ![]() .

.