Mga Batayang Estadistika

| Pemilik Institusional | 2 total, 2 long only, 0 short only, 0 long/short - change of -6.12% MRQ |

| Alokasi Portofolio Rata-rata | 0.0264 % - change of -54.46% MRQ |

| Saham Institusional (Jangka Panjang) | 169,923 (ex 13D/G) - change of -7.29MM shares -97.72% MRQ |

| Nilai Institusional (Jangka Panjang) | $ 168 USD ($1000) |

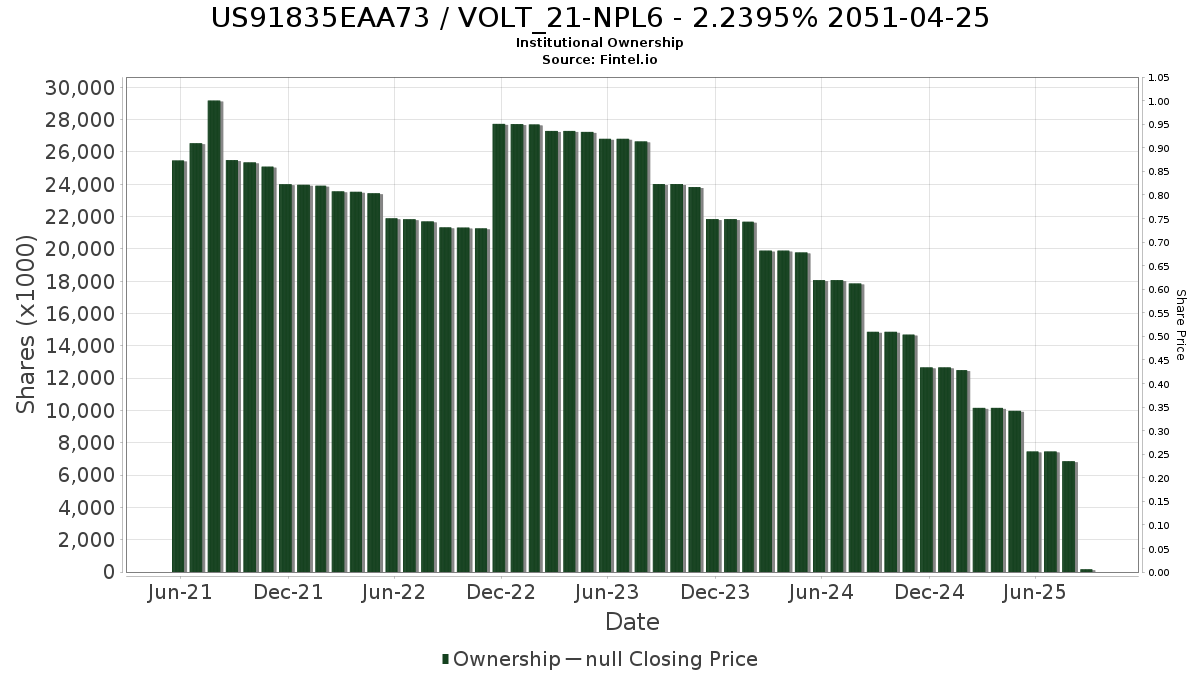

Kepemilikan Institusional dan Pemegang Saham

VOLT_21-NPL6 (US:US91835EAA73) memiliki 2 pemilik institusional dan pemegang saham yang telah mengajukan formulir 13D/G atau 13F kepada Komisi Bursa Efek (Securities Exchange Commission/SEC). Lembaga-lembaga ini memegang total 169,923 saham. Pemegang saham terbesar meliputi MXEDX - Great-West Core Strategies: Flexible Bond Fund Institutional Class, and MXLMX - Great-West Multi-Sector Bond Fund Investor Class .

Struktur kepemilikan institusional VOLT_21-NPL6 (US91835EAA73) menunjukkan posisi terkini di perusahaan oleh institusi dan dana, serta perubahan terbaru dalam ukuran posisi. Pemegang saham utama dapat mencakup investor individu, reksa dana, dana lindung nilai, atau institusi. Jadwal 13D menunjukkan bahwa investor memegang (atau pernah memegang) lebih dari 5% saham perusahaan dan bermaksud (atau pernah bermaksud) untuk secara aktif mengejar perubahan strategi bisnis. Jadwal 13G menunjukkan investasi pasif lebih dari 5%.

Pengajuan 13F dan NPORT

Detail pada pengajuan 13F tersedia gratis. Detail pada pengajuan NP memerlukan keanggotaan premium. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup. Klik tautan ini ikon untuk melihat riwayat transaksi selengkapnya.

Tingkatkan

untuk membuka data premium dan mengekspor ke Excel ![]() .

.