Mga Batayang Estadistika

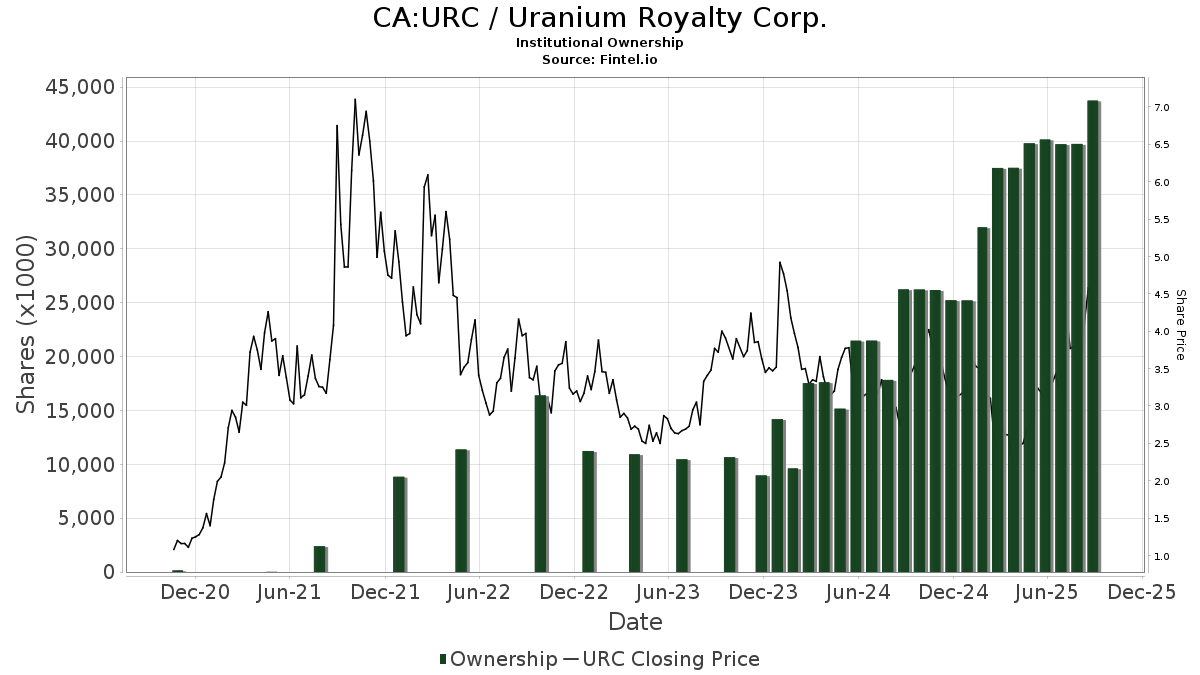

| Saham Institusional (Jangka Panjang) | 43,752,203 - 32.74% (ex 13D/G) - change of 3.61MM shares 8.99% MRQ |

| Nilai Institusional (Jangka Panjang) | $ 104,326 USD ($1000) |

Kepemilikan Institusional dan Pemegang Saham

Uranium Royalty Corp. (CA:URC) memiliki 82 pemilik institusional dan pemegang saham yang telah mengajukan formulir 13D/G atau 13F kepada Komisi Bursa Efek (Securities Exchange Commission/SEC). Lembaga-lembaga ini memegang total 43,752,203 saham. Pemegang saham terbesar meliputi MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd., URA - Global X Uranium ETF, Sprott Funds Trust - Sprott Uranium Miners Etf, Alps Advisors Inc, SPROTT FUNDS TRUST - Sprott Junior Uranium Miners ETF, Accordant Advisory Group Inc, Winnow Wealth Llc, Citadel Advisors Llc, Millennium Management Llc, and Sprott Inc. .

Struktur kepemilikan institusional Uranium Royalty Corp. (TSX:URC) menunjukkan posisi terkini di perusahaan oleh institusi dan dana, serta perubahan terbaru dalam ukuran posisi. Pemegang saham utama dapat mencakup investor individu, reksa dana, dana lindung nilai, atau institusi. Jadwal 13D menunjukkan bahwa investor memegang (atau pernah memegang) lebih dari 5% saham perusahaan dan bermaksud (atau pernah bermaksud) untuk secara aktif mengejar perubahan strategi bisnis. Jadwal 13G menunjukkan investasi pasif lebih dari 5%.

The share price as of September 5, 2025 is 4.50 / share. Previously, on September 6, 2024, the share price was 2.60 / share. This represents an increase of 73.08% over that period.

Skor Sentimen Dana

Skor Sentimen Dana (sebelumnya dikenal sebagai Skor Akumulasi Kepemilikan) menemukan saham-saham yang paling banyak dibeli oleh dana. Ini adalah hasil dari model kuantitatif multi-faktor yang canggih yang mengidentifikasi perusahaan dengan tingkat akumulasi institusional tertinggi. Model penilaian menggunakan kombinasi dari total peningkatan pemilik yang diungkapkan, perubahan dalam alokasi portofolio pada pemilik tersebut, dan metrik lainnya. Angka berkisar dari 0 hingga 100, dengan angka yang lebih tinggi menunjukkan tingkat akumulasi yang lebih tinggi dibandingkan dengan perusahaan sejenisnya, dan 50 adalah rata-ratanya.

Frekuensi Pembaruan: Setiap Hari

Lihat Ownership Explorer, yang menyediakan daftar perusahaan dengan peringkat tertinggi.

Pengajuan 13F dan NPORT

Detail pada pengajuan 13F tersedia gratis. Detail pada pengajuan NP memerlukan keanggotaan premium. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup. Klik tautan ini ikon untuk melihat riwayat transaksi selengkapnya.

Tingkatkan

untuk membuka data premium dan mengekspor ke Excel ![]() .

.

| Tanggal File | Sumber | Investor | Ketik | Presyo ng Avg (Silangan) |

Saham | Δ Saham (%) |

Dilaporkan Nilai ($1000) |

Nilai Δ (%) |

Alokasi Port (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Mountain Lake Investment Management LLC | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 554,200 | -33.44 | 1,386 | -5.46 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 126,503 | 21.35 | 316 | 72.68 | ||||

| 2025-08-04 | 13F | Integrity Alliance, Llc. | 15,788 | 36.39 | 39 | 95.00 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 646,276 | 435.48 | 1,616 | 662.26 | ||||

| 2025-07-22 | 13F | Sage Investment Counsel LLC | 25,000 | 0.00 | 62 | 40.91 | ||||

| 2025-03-19 | NP | NWHDX - Nationwide Bailard Cognitive Value Fund Class A | 60,700 | 0.00 | 144 | -14.29 | ||||

| 2025-07-22 | 13F | Grimes & Company, Inc. | 30,000 | 0.00 | 75 | 44.23 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | -100.00 | 0 | ||||

| 2025-07-31 | 13F | City State Bank | 7,400 | 2,860.00 | 18 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 1,000 | 0.00 | 2 | 100.00 | ||||

| 2025-08-13 | 13F | Natixis | 264,292 | 6.23 | 657 | 50.46 | ||||

| 2025-06-27 | NP | URA - Global X Uranium ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 6,212,997 | -6.51 | 11,245 | -28.56 | ||||

| 2025-07-31 | 13F | Buckingham Strategic Partners | 60,000 | 0.00 | 150 | 42.86 | ||||

| 2025-05-08 | 13F | Geneos Wealth Management Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 18,115 | 0.00 | 43 | 38.71 | ||||

| 2025-07-25 | 13F | Welch Group, LLC | 17,610 | 0.00 | 44 | 41.94 | ||||

| 2025-08-12 | 13F | Accordant Advisory Group Inc | 2,441,702 | 4.59 | 6,104 | 48.59 | ||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 104,520 | -1.91 | 261 | 39.57 | ||||

| 2025-05-15 | 13F | Squarepoint Ops LLC | 0 | -100.00 | 0 | |||||

| 2025-06-26 | NP | CCSO - Carbon Collective Climate Solutions U.S. Equity ETF | 5,899 | -3.31 | 11 | -28.57 | ||||

| 2025-08-14 | 13F | UBS Group AG | 776,721 | -9.83 | 1,942 | 28.03 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 158,095 | 2.10 | 395 | 45.22 | ||||

| 2025-08-20 | 13F/A | Thompson Davis & Co., Inc. | 13,044 | 33 | ||||||

| 2025-08-07 | 13F | Zurcher Kantonalbank (Zurich Cantonalbank) | 29,319 | -4.40 | 73 | 35.19 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-01 | 13F | Riverwater Partners LLC | 13,155 | 33 | ||||||

| 2025-08-11 | 13F | Banque Cantonale Vaudoise | 85,114 | 0 | ||||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 12,700 | 18.69 | 31 | 66.67 | |||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 8,000 | 0.00 | 20 | 42.86 | ||||

| 2025-07-31 | 13F | Acuitas Investments, LLC | 1,012,976 | 0.00 | 2,532 | 42.09 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 2,009,915 | 159.48 | 5,025 | 268.60 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 14,161 | 2.91 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 299,300 | 14.41 | 748 | 62.61 | |||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 19,800 | -69.63 | 48 | -58.26 | |||

| 2025-08-15 | 13F | Morgan Stanley | 732,199 | -4.21 | 1,830 | 36.06 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 66,178 | 0.41 | 165 | 43.48 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 63,166 | -26.62 | 158 | 3.97 | ||||

| 2025-08-13 | 13F | Smith, Moore & Co. | 22,000 | 0.00 | 55 | 44.74 | ||||

| 2025-08-14 | 13F | Cantor Fitzgerald, L. P. | 17,343 | 43 | ||||||

| 2025-08-27 | NP | TIFF INVESTMENT PROGRAM - TIFF Multi-Asset Fund | 7,595 | -96.79 | 19 | -95.67 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 0 | -100.00 | 0 | |||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 11,580 | 29 | ||||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 303,700 | 6.15 | 759 | 50.89 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 175,300 | 74.95 | 438 | 148.86 | |||

| 2025-08-27 | NP | URAN - Themes Uranium & Nuclear ETF | 13,987 | 20.29 | 35 | 75.00 | ||||

| 2025-08-12 | 13F | Winnow Wealth Llc | 2,441,702 | 6,104 | ||||||

| 2025-07-30 | 13F | Blume Capital Management, Inc. | 0 | -100.00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 26,425 | 0.00 | 66 | 43.48 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 240 | 0.00 | 1 | |||||

| 2025-05-02 | 13F | Bailard, Inc. | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 1,993,195 | 1,617.55 | 4,983 | 2,342.65 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 113,837 | -19.09 | 285 | 14.98 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 6,345 | 762.09 | 16 | 1,400.00 | ||||

| 2025-08-06 | 13F | Stone House Investment Management, LLC | 1,668 | 0.00 | 4 | 100.00 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Legato Capital Management LLC | 27,326 | 99.59 | 68 | 183.33 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 16,006 | 0.00 | 40 | 42.86 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 1,649 | 6.39 | 4 | 100.00 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 7,750 | 19 | ||||||

| 2025-08-12 | 13F | Virtu Financial LLC | 13,660 | -84.50 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Modern Wealth Management, LLC | 11,000 | 0.00 | 28 | 42.11 | ||||

| 2025-08-25 | NP | SPROTT FUNDS TRUST - Sprott Junior Uranium Miners ETF | 3,268,598 | 10.33 | 8,171 | 56.71 | ||||

| 2025-04-17 | 13F | Bayshore Asset Management, Llc | 0 | -100.00 | 0 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 36,997 | -45.79 | 0 | |||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 16,740 | -1.10 | 42 | 36.67 | ||||

| 2025-04-23 | 13F | Creative Financial Designs Inc /adv | 0 | -100.00 | 0 | |||||

| 2025-08-01 | 13F | Brookwood Investment Group LLC | 17,100 | 43 | ||||||

| 2025-07-28 | NP | AVDS - Avantis International Small Cap Equity ETF | 4,120 | 9 | ||||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 12,093 | 0 | ||||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 12,684 | -18.08 | 32 | 14.81 | ||||

| 2025-08-11 | 13F | Sprott Inc. | 1,574,477 | 106.56 | 3,936 | 193.51 | ||||

| 2025-08-14 | 13F | Snowden Capital Advisors LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-25 | NP | SETM - Sprott Energy Transition Materials ETF | 36,619 | 28.44 | 92 | 82.00 | ||||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 65,908 | 0.00 | 146 | 9.02 | ||||

| 2025-08-12 | 13F | CenterBook Partners LP | 809,446 | -52.69 | 2,024 | -32.81 | ||||

| 2025-05-15 | 13F | Tower Research Capital LLC (TRC) | 0 | -100.00 | 0 | |||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 10,000 | 25 | ||||||

| 2025-07-21 | 13F | Hilltop National Bank | 1,500 | 0.00 | 4 | 0.00 | ||||

| 2025-08-14 | 13F | Gen-Wealth Partners Inc | 100 | 0.00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 121,732 | 372.27 | 0 | |||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 17,198 | -39.85 | 43 | -16.00 | ||||

| 2025-08-07 | 13F | Fourth Sail Capital LP | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | SIH Partners, LLLP | 0 | -100.00 | 0 | |||||

| 2025-07-16 | 13F | Brave Asset Management Inc | 16,000 | 0.00 | 40 | 42.86 | ||||

| 2025-08-01 | 13F | Transcend Wealth Collective, Llc | 54,700 | 0.00 | 137 | 41.67 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 6,759 | -81.93 | 10 | -77.78 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 422 | -77.79 | 1 | -66.67 | ||||

| 2025-08-25 | NP | Sprott Funds Trust - Sprott Uranium Miners Etf | 5,594,835 | -2.33 | 14,010 | 37.49 | ||||

| 2025-08-29 | NP | JOHN HANCOCK INVESTMENT TRUST - John Hancock Diversified Real Assets Fund Class NAV | 104,520 | -1.91 | 261 | 39.57 | ||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 6,583,031 | -13.28 | 16,452 | 19.93 | ||||

| 2025-07-16 | 13F | Eagle Global Advisors Llc | 127,900 | 0.00 | 320 | 41.78 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 0 | -100.00 | 0 | |||||

| 2025-07-24 | 13F | Total Wealth Planning & Management, Inc. | 10,400 | 26 | ||||||

| 2025-08-11 | 13F | Alps Advisors Inc | 3,305,217 | 10.50 | 8,263 | 56.97 | ||||

| 2025-07-24 | 13F | Total Wealth Planning & Management, Inc. | Call | 5,000 | 17 | |||||

| 2025-08-12 | 13F | XTX Topco Ltd | 33,247 | -75.28 | 83 | -64.83 | ||||

| 2025-08-06 | 13F | MMCAP International Inc. SPC | 22,824 | -96.27 | 57 | -94.71 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 1,480,151 | 47.11 | 3,700 | 107.23 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 74,532 | -0.74 | 187 | 39.85 | ||||

| 2025-08-07 | 13F | Rathbone Brothers plc | 25,000 | 0.00 | 62 | 40.91 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 36,600 | 92 | |||||

| 2025-08-14 | 13F | Hrt Financial Lp | 0 | -100.00 | 0 |