Mga Batayang Estadistika

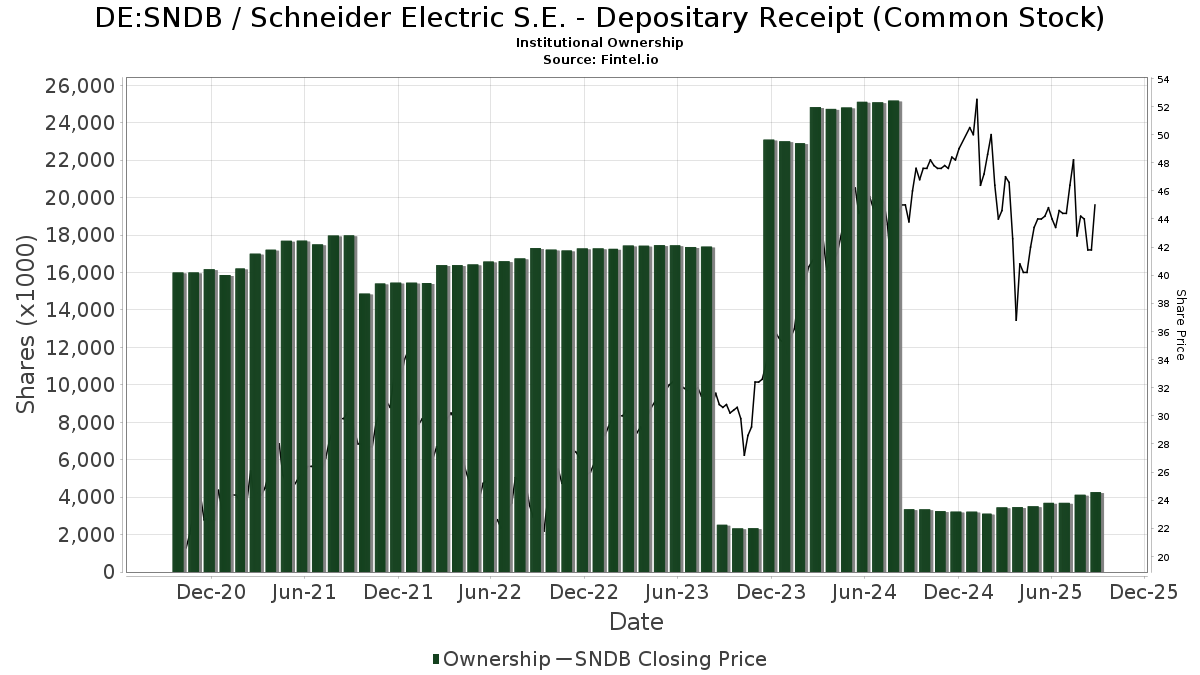

| Pemilik Institusional | 73 total, 73 long only, 0 short only, 0 long/short - change of 17.74% MRQ |

| Harga Saham | 45.60 |

| Alokasi Portofolio Rata-rata | 0.6444 % - change of -7.65% MRQ |

| Saham Institusional (Jangka Panjang) | 4,267,850 (ex 13D/G) - change of 0.57MM shares 15.51% MRQ |

| Nilai Institusional (Jangka Panjang) | $ 210,612 USD ($1000) |

Kepemilikan Institusional dan Pemegang Saham

Schneider Electric S.E. - Depositary Receipt (Common Stock) (DE:SNDB) memiliki 73 pemilik institusional dan pemegang saham yang telah mengajukan formulir 13D/G atau 13F kepada Komisi Bursa Efek (Securities Exchange Commission/SEC). Lembaga-lembaga ini memegang total 4,267,850 saham. Pemegang saham terbesar meliputi Hemenway Trust Co LLC, Cardinal Capital Management, Inc., Somerville Kurt F, BBR ALO Fund, LLC, Broderick Brian C, TRANSAMERICA SERIES TRUST - Transamerica Barrow Hanley Dividend Focused VP Initial, Douglass Winthrop Advisors, LLC, GSBIX - Goldman Sachs Income Builder Fund Institutional, Puzo Michael J, and Zevin Asset Management Llc .

Struktur kepemilikan institusional Schneider Electric S.E. - Depositary Receipt (Common Stock) (DB:SNDB) menunjukkan posisi terkini di perusahaan oleh institusi dan dana, serta perubahan terbaru dalam ukuran posisi. Pemegang saham utama dapat mencakup investor individu, reksa dana, dana lindung nilai, atau institusi. Jadwal 13D menunjukkan bahwa investor memegang (atau pernah memegang) lebih dari 5% saham perusahaan dan bermaksud (atau pernah bermaksud) untuk secara aktif mengejar perubahan strategi bisnis. Jadwal 13G menunjukkan investasi pasif lebih dari 5%.

The share price as of September 12, 2025 is 45.60 / share. Previously, on September 13, 2024, the share price was 45.20 / share. This represents an increase of 0.88% over that period.

Skor Sentimen Dana

Skor Sentimen Dana (sebelumnya dikenal sebagai Skor Akumulasi Kepemilikan) menemukan saham-saham yang paling banyak dibeli oleh dana. Ini adalah hasil dari model kuantitatif multi-faktor yang canggih yang mengidentifikasi perusahaan dengan tingkat akumulasi institusional tertinggi. Model penilaian menggunakan kombinasi dari total peningkatan pemilik yang diungkapkan, perubahan dalam alokasi portofolio pada pemilik tersebut, dan metrik lainnya. Angka berkisar dari 0 hingga 100, dengan angka yang lebih tinggi menunjukkan tingkat akumulasi yang lebih tinggi dibandingkan dengan perusahaan sejenisnya, dan 50 adalah rata-ratanya.

Frekuensi Pembaruan: Setiap Hari

Lihat Ownership Explorer, yang menyediakan daftar perusahaan dengan peringkat tertinggi.

Pengajuan 13F dan NPORT

Detail pada pengajuan 13F tersedia gratis. Detail pada pengajuan NP memerlukan keanggotaan premium. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup. Klik tautan ini ikon untuk melihat riwayat transaksi selengkapnya.

Tingkatkan

untuk membuka data premium dan mengekspor ke Excel ![]() .

.

| Tanggal File | Sumber | Investor | Ketik | Presyo ng Avg (Silangan) |

Saham | Δ Saham (%) |

Dilaporkan Nilai ($1000) |

Nilai Δ (%) |

Alokasi Port (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-15 | 13F | DB Fitzpatrick & Co, Inc | 28,864 | 19.57 | 1,541 | 38.99 | ||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 87,438 | -23.51 | 4,385 | -20.49 | ||||

| 2025-07-30 | NP | SEEFX - Saturna Sustainable Equity Fund | 17,100 | 0.00 | 858 | 3.88 | ||||

| 2025-07-30 | NP | ENDW - Cambria Endowment Style ETF | 1,763 | 88 | ||||||

| 2025-05-09 | 13F | L & S Advisors Inc | 0 | -100.00 | 0 | |||||

| 2025-08-06 | 13F | Zevin Asset Management Llc | 146,234 | 8 | ||||||

| 2025-04-21 | 13F | ORG Partners LLC | 0 | -100.00 | 0 | |||||

| 2025-07-29 | NP | RBB FUND, INC. - Aquarius International Fund | 4,025 | 0.00 | 202 | 3.61 | ||||

| 2025-08-18 | 13F | Front Row Advisors LLC | 400 | 21 | ||||||

| 2025-08-14 | 13F | Ancora Advisors, LLC | 64 | 3 | ||||||

| 2025-07-23 | 13F | Kidder Stephen W | 139,789 | 0.54 | 7,462 | 16.87 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 59,249 | 0.45 | 3,163 | 16.77 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 843 | 0 | ||||||

| 2025-07-15 | 13F | Riverbridge Partners Llc | 3,967 | 212 | ||||||

| 2025-08-12 | 13F | Trivant Custom Portfolio Group, LLC | 18,444 | 985 | ||||||

| 2025-05-09 | 13F | Liberty Wealth Management Llc | 36,231 | 1 | ||||||

| 2025-07-23 | 13F | Notis-McConarty Edward | 79,564 | 1.82 | 4,247 | 18.37 | ||||

| 2025-07-23 | 13F | Puzo Michael J | 172,000 | -2.12 | 9,181 | 13.78 | ||||

| 2025-04-29 | NP | BFSIX - BFS Equity Fund Institutional Class | 10,000 | 482 | ||||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 201 | -31.16 | 11 | -23.08 | ||||

| 2025-08-28 | NP | JINTX - Johnson International Fund | 8,500 | 0.00 | 454 | 16.15 | ||||

| 2025-07-21 | 13F | Copeland Capital Management, LLC | 60 | 0.00 | 3 | 50.00 | ||||

| 2025-08-06 | 13F | Paradigm Asset Management Co Llc | 1,481 | 0.00 | 79 | 16.18 | ||||

| 2025-07-31 | 13F | Fedenia Advisers LLC | 7,393 | 395 | ||||||

| 2025-07-23 | 13F | Canopy Partners, LLC | 5,662 | -3.25 | 302 | 12.69 | ||||

| 2025-08-15 | 13F | SkyView Investment Advisors, LLC | 14,837 | -3.64 | 1 | |||||

| 2025-07-10 | 13F | Myriad Asset Management US LP | 25,191 | 1,345 | ||||||

| 2025-07-25 | 13F | Richardson Financial Services Inc. | 13 | 0.00 | 1 | |||||

| 2025-05-14 | 13F | Boston Private Wealth Llc | 0 | -100.00 | 0 | |||||

| 2025-08-05 | 13F | Westside Investment Management, Inc. | 283 | 15 | ||||||

| 2025-07-28 | 13F | Elefante Mark B | 62,982 | 3.24 | 3,362 | 19.99 | ||||

| 2025-06-26 | NP | TDFAX - Transamerica Dividend Focused A | 82,663 | 0.00 | 3,825 | -8.34 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 7,353 | 25.31 | 393 | 45.72 | ||||

| 2025-07-29 | 13F | Salomon & Ludwin, LLC | 32 | 2 | ||||||

| 2025-08-27 | NP | ACIFX - Advisors Capital International Fund | 10,200 | 88.89 | 544 | 120.24 | ||||

| 2025-07-23 | 13F | Hemenway Trust Co LLC | 633,444 | 2.10 | 33,813 | 18.68 | ||||

| 2025-07-29 | NP | BLUIX - BLUEPRINT GROWTH FUND Institutional Class | 4,210 | -76.35 | 211 | -75.41 | ||||

| 2025-05-14 | 13F | Estabrook Capital Management | 0 | -100.00 | 0 | |||||

| 2025-07-29 | NP | FFND - The Future Fund Active ETF | 14,681 | 18.24 | 736 | 22.87 | ||||

| 2025-03-27 | NP | PTIN - Pacer Trendpilot International ETF | 23,370 | 1.13 | 1,179 | 6.03 | ||||

| 2025-08-08 | 13F/A | Sterling Capital Management LLC | 27,339 | -4.37 | 1,449 | 11.38 | ||||

| 2025-08-27 | NP | RYEUX - Europe 1.25x Strategy Fund Class H | 480 | -85.06 | 26 | -82.99 | ||||

| 2025-08-14 | 13F | Murphy & Mullick Capital Management Corp | 1,320 | 0.00 | 69 | 13.33 | ||||

| 2025-07-11 | 13F | Cardinal Capital Management, Inc. | 381,875 | 6,793.05 | 20,384 | 7,925.20 | ||||

| 2025-07-30 | 13F | Rnc Capital Management Llc | 6,497 | 11.31 | 347 | 29.10 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 1,593 | 89.64 | 84 | 121.05 | ||||

| 2025-06-25 | NP | ALIBX - ALPS | Smith Balanced Opportunity Fund Investor Class | 1,360 | -46.67 | 63 | -51.56 | ||||

| 2025-06-27 | NP | TEC - Harbor Transformative Technologies ETF | 791 | 37 | ||||||

| 2025-06-27 | NP | DSEFX - Domini Impact Equity Fund Investor Shares | 92,100 | -1.07 | 4,261 | -9.30 | ||||

| 2025-07-25 | 13F | Delaney Dennis R | 95,215 | 2.15 | 5,083 | 18.74 | ||||

| 2025-06-25 | NP | GENW - Genter Capital International Dividend ETF | 319 | -31.55 | 15 | -39.13 | ||||

| 2025-06-27 | NP | SPWO - SP Funds S&P World (ex-US) ETF | 8,839 | 33.50 | 409 | 22.16 | ||||

| 2025-07-29 | NP | NIAGX - Nia Impact Solutions Fund | 44,501 | -6.71 | 2,232 | -3.04 | ||||

| 2025-07-23 | 13F | Dempze Nancy E | 88,445 | 2.54 | 4,721 | 19.22 | ||||

| 2025-08-27 | NP | RYDEX VARIABLE TRUST - Europe 1.25x Strategy Fund Variable Annuity | 492 | -42.92 | 26 | -33.33 | ||||

| 2025-07-16 | 13F | ORG Wealth Partners, LLC | 1,793 | 0.00 | 94 | 13.25 | ||||

| 2025-08-12 | 13F | Foster Dykema Cabot & Partners, Llc | 347 | 0.00 | 19 | 20.00 | ||||

| 2025-07-09 | 13F | Byrne Asset Management LLC | 174 | 0.00 | 9 | 28.57 | ||||

| 2025-07-23 | 13F | Broderick Brian C | 241,194 | -2.96 | 12,875 | 12.81 | ||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 56,608 | 0.91 | 3 | 50.00 | ||||

| 2025-08-27 | NP | TRANSAMERICA SERIES TRUST - Transamerica Barrow Hanley Dividend Focused VP Initial | 207,134 | 0.00 | 11,057 | 16.24 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 5,918 | -13.83 | 316 | 0.00 | ||||

| 2025-07-24 | 13F | Ramirez Asset Management, Inc. | 128,132 | 45.65 | 6,792 | 69.59 | ||||

| 2025-06-17 | NP | GSBIX - Goldman Sachs Income Builder Fund Institutional | 180,088 | 0.23 | 8,333 | -8.12 | ||||

| 2025-08-29 | NP | DIVGX - Guardian Dividend Growth Fund Class I | 22,031 | 22.20 | 1,176 | 42.20 | ||||

| 2025-07-30 | NP | RFFC - RiverFront Dynamic US Flex-Cap ETF | 5,303 | -20.14 | 266 | -17.19 | ||||

| 2025-08-08 | 13F | Everett Harris & Co /ca/ | 11,530 | 27.69 | 615 | 48.55 | ||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 56 | 0.00 | 3 | 0.00 | ||||

| 2025-07-25 | 13F | Mitchell Capital Management Co | 50,187 | -11.78 | 2,751 | 5.32 | ||||

| 2025-06-30 | NP | TRFM - AAM Transformers ETF | 5,610 | -12.85 | 260 | -20.06 | ||||

| 2025-08-12 | 13F | Pacer Advisors, Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Corient IA LLC | 20,000 | 0.00 | 1,060 | 16.48 | ||||

| 2025-08-28 | NP | BBR ALO Fund, LLC | 248,132 | 0.00 | 13,154 | 16.43 | ||||

| 2025-07-22 | 13F | Boston Common Asset Management, LLC | 143,832 | -10.31 | 7,625 | 4.42 | ||||

| 2025-04-09 | 13F | Fulton Bank, N.a. | 0 | -100.00 | 0 | |||||

| 2025-04-23 | 13F | Alpine Bank Wealth Management | 0 | -100.00 | 0 | |||||

| 2025-07-25 | NP | AIWEX - World Energy Fund Institutional | 30,000 | 1,504 | ||||||

| 2025-07-23 | 13F | Somerville Kurt F | 260,863 | 3.00 | 13,925 | 19.74 | ||||

| 2025-08-29 | NP | MPLAX - Praxis International Index Fund Class A | 4,885 | 0.00 | 261 | 16.07 | ||||

| 2025-08-14 | 13F | Douglass Winthrop Advisors, LLC | 184,336 | -3.17 | 9,840 | 12.56 |

Other Listings

| US:SBGSY |