Mga Batayang Estadistika

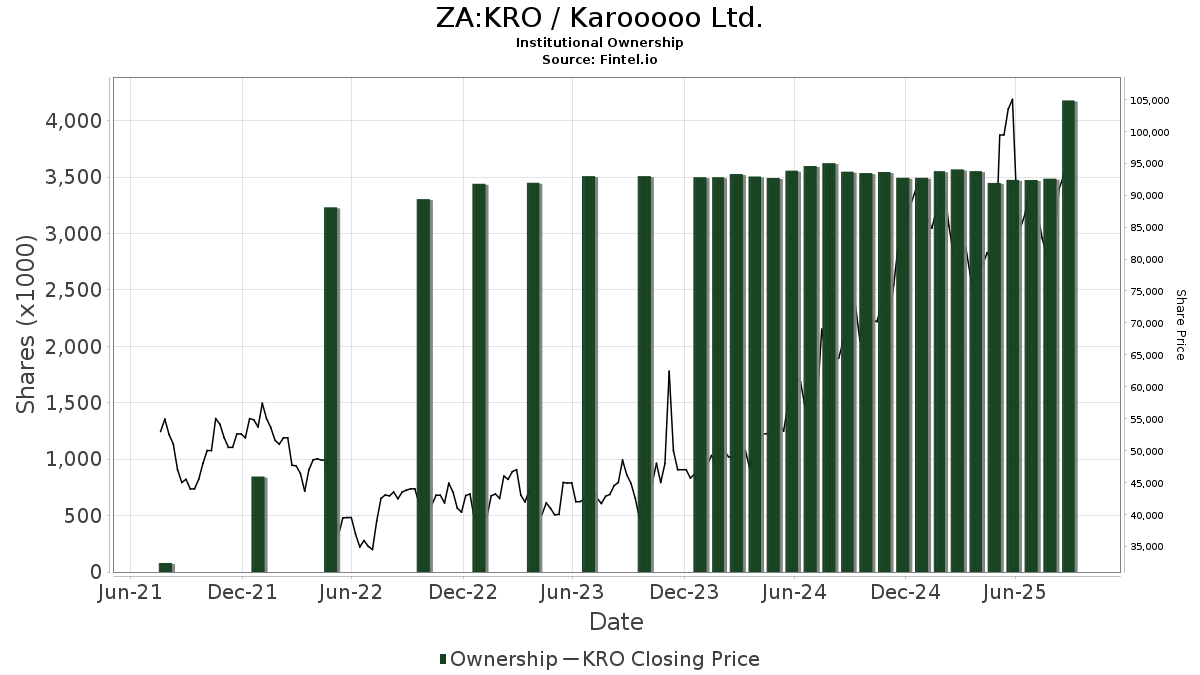

| Saham Institusional (Jangka Panjang) | 4,178,968 - 13.53% (ex 13D/G) - change of 0.70MM shares 20.25% MRQ |

| Nilai Institusional (Jangka Panjang) | $ 199,064 USD ($1000) |

Kepemilikan Institusional dan Pemegang Saham

Karooooo Ltd. (ZA:KRO) memiliki 72 pemilik institusional dan pemegang saham yang telah mengajukan formulir 13D/G atau 13F kepada Komisi Bursa Efek (Securities Exchange Commission/SEC). Lembaga-lembaga ini memegang total 4,178,968 saham. Pemegang saham terbesar meliputi Gobi Capital Llc, Telemark Asset Management, LLC, Capricorn Fund Managers Ltd, Millennium Management Llc, Fiera Capital Corp, Schwarz Dygos Wheeler Investment Advisors Llc, IEGAX - INVESCO International Small Company Fund Class A, Invesco Ltd., Polen Capital Management Llc, and Morgan Stanley .

Struktur kepemilikan institusional Karooooo Ltd. (JSE:KRO) menunjukkan posisi terkini di perusahaan oleh institusi dan dana, serta perubahan terbaru dalam ukuran posisi. Pemegang saham utama dapat mencakup investor individu, reksa dana, dana lindung nilai, atau institusi. Jadwal 13D menunjukkan bahwa investor memegang (atau pernah memegang) lebih dari 5% saham perusahaan dan bermaksud (atau pernah bermaksud) untuk secara aktif mengejar perubahan strategi bisnis. Jadwal 13G menunjukkan investasi pasif lebih dari 5%.

The share price as of September 5, 2025 is 90,101.00 / share. Previously, on September 9, 2024, the share price was 68,001.00 / share. This represents an increase of 32.50% over that period.

Skor Sentimen Dana

Skor Sentimen Dana (sebelumnya dikenal sebagai Skor Akumulasi Kepemilikan) menemukan saham-saham yang paling banyak dibeli oleh dana. Ini adalah hasil dari model kuantitatif multi-faktor yang canggih yang mengidentifikasi perusahaan dengan tingkat akumulasi institusional tertinggi. Model penilaian menggunakan kombinasi dari total peningkatan pemilik yang diungkapkan, perubahan dalam alokasi portofolio pada pemilik tersebut, dan metrik lainnya. Angka berkisar dari 0 hingga 100, dengan angka yang lebih tinggi menunjukkan tingkat akumulasi yang lebih tinggi dibandingkan dengan perusahaan sejenisnya, dan 50 adalah rata-ratanya.

Frekuensi Pembaruan: Setiap Hari

Lihat Ownership Explorer, yang menyediakan daftar perusahaan dengan peringkat tertinggi.

Pengajuan 13F dan NPORT

Detail pada pengajuan 13F tersedia gratis. Detail pada pengajuan NP memerlukan keanggotaan premium. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup. Klik tautan ini ikon untuk melihat riwayat transaksi selengkapnya.

Tingkatkan

untuk membuka data premium dan mengekspor ke Excel ![]() .

.

| Tanggal File | Sumber | Investor | Ketik | Presyo ng Avg (Silangan) |

Saham | Δ Saham (%) |

Dilaporkan Nilai ($1000) |

Nilai Δ (%) |

Alokasi Port (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-29 | NP | SSEAX - SIIT Screened World Equity Ex-US Fund - Class A | 688 | 0.00 | 38 | 22.58 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 5,045 | 154.54 | 247 | 194.05 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 22,787 | -19.98 | 1,116 | -7.84 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 78,789 | 45.13 | 3,859 | 67.13 | ||||

| 2025-08-26 | NP | ENTIX - ERShares Global Fund Institutional Class | 4,865 | 0.00 | 238 | 15.53 | ||||

| 2025-08-14 | 13F | Gobi Capital Llc | 2,200,668 | 0.00 | 107,789 | 15.14 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 5,709 | 0.05 | 0 | |||||

| 2025-05-13 | 13F | Wells Fargo & Company/mn | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Murphy & Mullick Capital Management Corp | 250 | 12 | ||||||

| 2025-08-14 | 13F | Moneta Group Investment Advisors Llc | 7,477 | 366 | ||||||

| 2025-08-14 | 13F | GWM Advisors LLC | 191 | 9 | ||||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 3,176 | 156 | ||||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 7,585 | 371 | ||||||

| 2025-08-14 | 13F | Winton Capital Group Ltd | 5,154 | -32.67 | 252 | -22.46 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 6,772 | -2.72 | 0 | |||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 8,089 | 215.98 | 396 | 266.67 | ||||

| 2025-08-14 | 13F | Ghisallo Capital Management LLC | 28,000 | 1,371 | ||||||

| 2025-08-12 | 13F | Bullseye Asset Management LLC | 14,040 | 1 | ||||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 310 | 313.33 | 15 | 366.67 | ||||

| 2025-08-14 | 13F | Longaeva Partners L.P. | 4,999 | 245 | ||||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 4,436 | 217 | ||||||

| 2025-08-27 | NP | IEGAX - INVESCO International Small Company Fund Class A | 98,180 | 0.00 | 4,809 | 15.13 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 255 | 12 | ||||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 69,705 | 50.05 | 3 | 200.00 | ||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 3,258 | 465.62 | 0 | |||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 50 | 0.00 | 2 | 0.00 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 17,590 | 150.04 | 862 | 187.96 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 372 | -92.23 | 18 | -91.13 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 29,892 | 56.56 | 1,464 | 80.30 | ||||

| 2025-08-15 | 13F | State of Tennessee, Treasury Department | 4,372 | 214 | ||||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 5,296 | -29.86 | 259 | -19.31 | ||||

| 2025-08-19 | 13F | State of Wyoming | 1,327 | -86.71 | 64 | -84.69 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 4,914 | 241 | ||||||

| 2025-05-14 | 13F | Credit Agricole S A | 14,049 | 95.45 | 598 | 84.26 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 3 | 0 | ||||||

| 2025-08-26 | NP | AVEWX - Ave Maria World Equity Fund | 60,566 | 0.00 | 2,967 | 15.14 | ||||

| 2025-04-14 | 13F | Swedbank AB | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-15 | 13F | SJS Investment Consulting Inc. | 20 | 1 | ||||||

| 2025-08-13 | 13F | Invesco Ltd. | 98,180 | 0.00 | 4,809 | 15.13 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 5,501 | 269 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 35,254 | 193.00 | 1,727 | 237.77 | ||||

| 2025-07-22 | 13F | Capricorn Fund Managers Ltd | 154,756 | 7.87 | 7,580 | 24.18 | ||||

| 2025-08-08 | 13F | Calamos Advisors LLC | 5,522 | 270 | ||||||

| 2025-08-14 | 13F | Infinitum Asset Management, Llc | 5,000 | 245 | ||||||

| 2025-07-30 | 13F | Schwartz Investment Counsel Inc | 60,566 | 0.00 | 2,967 | 15.14 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 100 | 0.00 | 5 | 0.00 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 8,369 | -15.45 | 0 | |||||

| 2025-08-08 | 13F | Jupiter Asset Management Ltd | 9,257 | -95.96 | 453 | -95.35 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 14,290 | 700 | ||||||

| 2025-08-12 | 13F | Nipun Capital, L.P. | 5,700 | 0.00 | 279 | 15.29 | ||||

| 2025-08-13 | 13F | Polen Capital Management Llc | 84,767 | 1,128.69 | 4,152 | 1,316.72 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 5,100 | 17.24 | 250 | 34.59 | ||||

| 2025-08-14 | 13F | UBS Group AG | 46,301 | 18.52 | 2,268 | 36.48 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 28,132 | 1,378 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 12,163 | 26.11 | 596 | 45.12 | ||||

| 2025-08-14 | 13F | Alyeska Investment Group, L.P. | 70,000 | 3,429 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 88 | -18.52 | 4 | -20.00 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 10 | 0.00 | 0 | |||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 55,602 | 699.11 | 2,723 | 823.05 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 6,523 | 319 | ||||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 34,421 | 1,686 | ||||||

| 2025-08-12 | 13F | Telemark Asset Management, LLC | 225,150 | 11,028 | ||||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 28,327 | -17.74 | 1,387 | -5.26 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 13,940 | -10.15 | 683 | 3.49 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 148,293 | 85.14 | 7,263 | 113.18 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 8 | -97.31 | 0 | -100.00 | ||||

| 2025-08-08 | 13F | Schwarz Dygos Wheeler Investment Advisors Llc | 106,215 | -11.52 | 5,202 | 1.88 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 1,644 | 80 | ||||||

| 2025-08-14 | 13F | Jain Global LLC | 20,000 | 980 | ||||||

| 2025-08-14 | 13F/A | Barclays Plc | 4,282 | -49.98 | 0 | |||||

| 2025-05-09 | 13F | Mitsubishi UFJ Trust & Banking Corp | 0 | -100.00 | 0 | |||||

| 2025-08-11 | 13F | Monashee Investment Management LLC | 45,000 | 2,204 | ||||||

| 2025-06-26 | NP | ESSAX - Ashmore Emerging Markets Small-Cap Equity Fund Class A | 1,618 | -38.20 | 69 | -43.33 | ||||

| 2025-08-08 | 13F | Fiera Capital Corp | 120,000 | 5,878 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | 10 | 0 |

Other Listings

| US:KARO | US$ 52.98 |