Mga Batayang Estadistika

| Pemilik Institusional | 133 total, 129 long only, 0 short only, 4 long/short - change of % MRQ |

| Alokasi Portofolio Rata-rata | 0.1664 % - change of % MRQ |

| Jumlah Saham Beredar | shares (source: Capital IQ) |

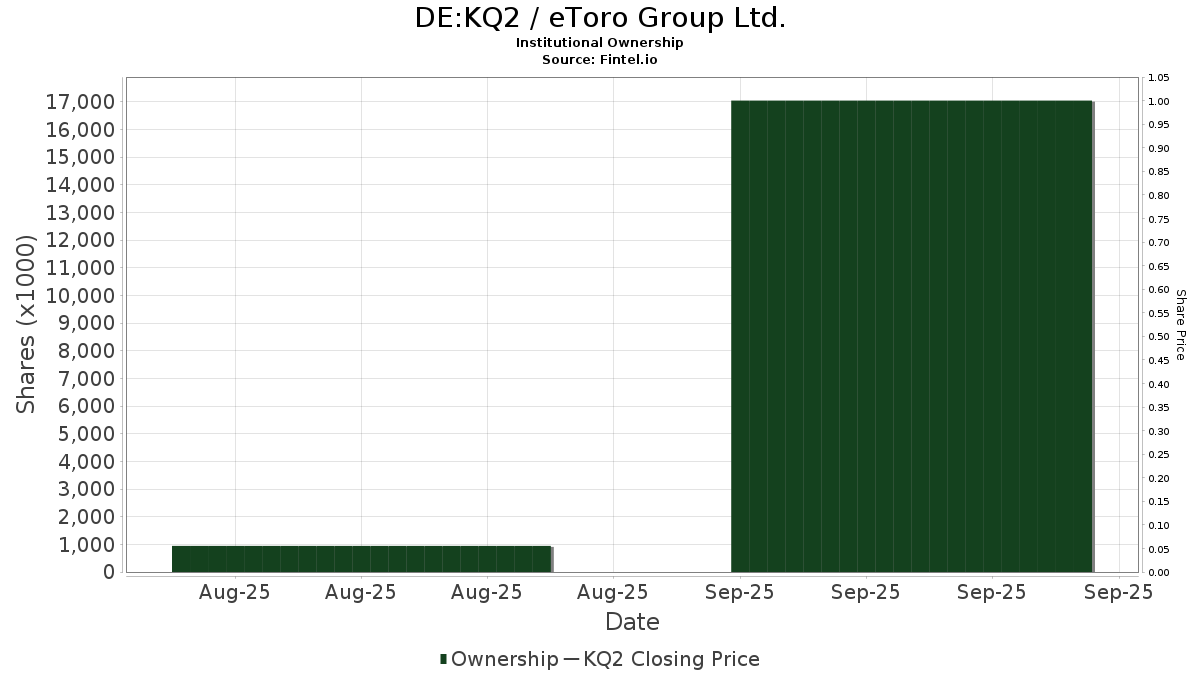

| Saham Institusional (Jangka Panjang) | 17,040,245 - 36.09% (ex 13D/G) |

| Nilai Institusional (Jangka Panjang) | $ 969,144 USD ($1000) |

Kepemilikan Institusional dan Pemegang Saham

eToro Group Ltd. (DE:KQ2) memiliki 133 pemilik institusional dan pemegang saham yang telah mengajukan formulir 13D/G atau 13F kepada Komisi Bursa Efek (Securities Exchange Commission/SEC). Lembaga-lembaga ini memegang total 17,040,245 saham. Pemegang saham terbesar meliputi BlackRock, Inc., T. Rowe Price Investment Management, Inc., GQG Partners LLC, Balyasny Asset Management Llc, Capital World Investors, Fmr Llc, ExodusPoint Capital Management, LP, Adage Capital Partners Gp, L.l.c., Wellington Management Group Llp, and Price T Rowe Associates Inc /md/ .

Struktur kepemilikan institusional eToro Group Ltd. (DB:KQ2) menunjukkan posisi terkini di perusahaan oleh institusi dan dana, serta perubahan terbaru dalam ukuran posisi. Pemegang saham utama dapat mencakup investor individu, reksa dana, dana lindung nilai, atau institusi. Jadwal 13D menunjukkan bahwa investor memegang (atau pernah memegang) lebih dari 5% saham perusahaan dan bermaksud (atau pernah bermaksud) untuk secara aktif mengejar perubahan strategi bisnis. Jadwal 13G menunjukkan investasi pasif lebih dari 5%.

Skor Sentimen Dana

Skor Sentimen Dana (sebelumnya dikenal sebagai Skor Akumulasi Kepemilikan) menemukan saham-saham yang paling banyak dibeli oleh dana. Ini adalah hasil dari model kuantitatif multi-faktor yang canggih yang mengidentifikasi perusahaan dengan tingkat akumulasi institusional tertinggi. Model penilaian menggunakan kombinasi dari total peningkatan pemilik yang diungkapkan, perubahan dalam alokasi portofolio pada pemilik tersebut, dan metrik lainnya. Angka berkisar dari 0 hingga 100, dengan angka yang lebih tinggi menunjukkan tingkat akumulasi yang lebih tinggi dibandingkan dengan perusahaan sejenisnya, dan 50 adalah rata-ratanya.

Frekuensi Pembaruan: Setiap Hari

Lihat Ownership Explorer, yang menyediakan daftar perusahaan dengan peringkat tertinggi.

Pengajuan 13F dan NPORT

Detail pada pengajuan 13F tersedia gratis. Detail pada pengajuan NP memerlukan keanggotaan premium. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup. Klik tautan ini ikon untuk melihat riwayat transaksi selengkapnya.

Tingkatkan

untuk membuka data premium dan mengekspor ke Excel ![]() .

.

| Tanggal File | Sumber | Investor | Ketik | Presyo ng Avg (Silangan) |

Saham | Δ Saham (%) |

Dilaporkan Nilai ($1000) |

Nilai Δ (%) |

Alokasi Port (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Symmetry Peak Management Llc | Call | 14,600 | 972 | |||||

| 2025-08-14 | 13F | Limestone Investment Advisors LP | 45,000 | 2,997 | ||||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 1,917 | 128 | ||||||

| 2025-08-11 | 13F | Monashee Investment Management LLC | 77,500 | 5,161 | ||||||

| 2025-08-14 | 13F | Ghisallo Capital Management LLC | 100,000 | 6,659 | ||||||

| 2025-08-13 | 13F | Capital World Investors | 588,250 | 39,172 | ||||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 200 | 13 | ||||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 10,048 | 669 | ||||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 87,960 | 5,857 | ||||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 837 | 54 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 23,024 | 2 | ||||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 207,733 | 13,833 | ||||||

| 2025-08-14 | 13F | Millennium Management Llc | 256,910 | 17,108 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 500 | 33 | ||||||

| 2025-08-14 | 13F | Tiger Global Management Llc | 80,000 | 5,327 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | 340 | 23 | ||||||

| 2025-08-14 | 13F | Alyeska Investment Group, L.P. | 160,000 | 10,654 | ||||||

| 2025-08-14 | 13F | Softbank Group Corp | 397,998 | 26,503 | ||||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 55,998 | 3,729 | ||||||

| 2025-08-01 | 13F | Teacher Retirement System Of Texas | 20,000 | 1,332 | ||||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 651,703 | 43,397 | ||||||

| 2025-08-14 | 13F | Weiss Asset Management LP | 37,685 | 2,509 | ||||||

| 2025-08-14 | 13F | Militia Capital Partners, LP | 13,900 | 926 | ||||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 2,500 | 160 | ||||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 1,000 | 67 | ||||||

| 2025-08-14 | 13F | Adage Capital Partners Gp, L.l.c. | 507,763 | 33,812 | ||||||

| 2025-08-13 | 13F | Seven Grand Managers, Llc | 25,000 | 1,665 | ||||||

| 2025-08-12 | 13F | Eisler Capital Management Ltd. | 50,000 | 3,325 | ||||||

| 2025-08-14 | 13F | Whetstone Capital Advisors, LLC | 34,562 | 2,301 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 48,817 | 3,251 | ||||||

| 2025-08-14 | 13F | Jain Global LLC | 61,365 | 4,086 | ||||||

| 2025-08-13 | 13F | Invesco Ltd. | 231,148 | 15,392 | ||||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 1,803 | 120 | ||||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | 14,801 | 986 | ||||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 4,601 | 289 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 118,795 | 7,911 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Norges Bank | 245,000 | 16,315 | ||||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 260,703 | 17,360 | ||||||

| 2025-08-12 | 13F | LPL Financial LLC | 3,482 | 232 | ||||||

| 2025-08-13 | 13F | Federated Hermes, Inc. | 170,000 | 11,320 | ||||||

| 2025-08-07 | 13F | Mitsubishi UFJ Kokusai Asset Management Co., Ltd. | 87,900 | 5,853 | ||||||

| 2025-08-06 | 13F | Atlantic Union Bankshares Corp | 100 | 7 | ||||||

| 2025-08-14 | 13F | Fmr Llc | 529,811 | 35,280 | ||||||

| 2025-08-14 | 13F | Sandia Investment Management LP | 10,000 | 666 | ||||||

| 2025-08-14 | 13F | Zimmer Partners, LP | 11,000 | 732 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 34,215 | 2,278 | ||||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 167,143 | 11,130 | ||||||

| 2025-08-14 | 13F | T. Rowe Price Investment Management, Inc. | 1,351,228 | 90 | ||||||

| 2025-08-14 | 13F | Davidson Kempner Capital Management Lp | 30,000 | 1,998 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 51,000 | 3,396 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 27,000 | 1,798 | |||||

| 2025-07-21 | 13F | Hennessy Advisors Inc | 15,000 | 999 | ||||||

| 2025-08-14 | 13F | Fortress Investment Group LLC | 125,000 | 8,324 | ||||||

| 2025-08-14 | 13F | Peak6 Llc | Call | 100,000 | 6,659 | |||||

| 2025-08-28 | NP | BITQ - Bitwise Crypto Industry Innovators ETF | 55,998 | 3,729 | ||||||

| 2025-08-11 | 13F | Nikko Asset Management Americas, Inc. | 419,355 | 27,875 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 20,013 | 1,333 | ||||||

| 2025-08-14 | 13F | Cinctive Capital Management LP | 4,117 | 274 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 19,072 | 1,270 | ||||||

| 2025-08-13 | 13F | Healthcare Of Ontario Pension Plan Trust Fund | 100,000 | 6,659 | ||||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | Call | 49,700 | 3,310 | |||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 4,000 | 266 | ||||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 35 | 2 | ||||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | Put | 49,700 | 3,310 | |||||

| 2025-08-13 | 13F | MYDA Advisors LLC | Call | 100,000 | 6,659 | |||||

| 2025-08-13 | 13F | MYDA Advisors LLC | 32,000 | 2,131 | ||||||

| 2025-08-26 | NP | TTEQ - T. Rowe Price Technology ETF | 1,500 | 100 | ||||||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | 16,731 | 1,114 | ||||||

| 2025-08-14 | 13F | Arizona PSPRS Trust | 4,186 | 279 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 54,100 | 3,603 | |||||

| 2025-08-14 | 13F | Penn Capital Management Co Inc | 183,949 | 12,280 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 225,850 | 15,039 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 64,700 | 4,308 | |||||

| 2025-07-23 | 13F | Meitav Dash Investments Ltd | 5,500 | 366 | ||||||

| 2025-08-13 | 13F | Walleye Capital LLC | 20,000 | 1,332 | ||||||

| 2025-07-28 | 13F | Td Asset Management Inc | 112,620 | 7,499 | ||||||

| 2025-08-13 | 13F | GQG Partners LLC | 871,976 | 58,065 | ||||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 3,332 | 222 | ||||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 510,787 | 34 | ||||||

| 2025-08-14 | 13F | Plustick Management Llc | 30,000 | 1,998 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 100 | 7 | ||||||

| 2025-08-14 | 13F | Freestone Grove Partners LP | 35,000 | 2,331 | ||||||

| 2025-08-14 | 13F | Scientech Research LLC | 15,915 | 1,060 | ||||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 0 | 0 | ||||||

| 2025-08-14 | 13F | Price T Rowe Associates Inc /md/ | 458,926 | 31 | ||||||

| 2025-08-14 | 13F | Nebula Research & Development LLC | 4,086 | 272 | ||||||

| 2025-08-14 | 13F | Shay Capital LLC | Call | 5,000 | 333 | |||||

| 2025-08-14 | 13F | Granahan Investment Management Inc/ma | 198,140 | 13,194 | ||||||

| 2025-08-14 | 13F | Saba Capital Management, L.P. | 260,000 | 17,313 | ||||||

| 2025-08-14 | 13F | Longaeva Partners L.P. | 27,785 | 1,850 | ||||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 225,000 | 14,983 | ||||||

| 2025-07-30 | 13F | ARK Investment Management LLC | 248,032 | 16,516 | ||||||

| 2025-08-14 | 13F | Masters Capital Management Llc | 100,000 | 6,659 | ||||||

| 2025-08-27 | NP | OHIO NATIONAL FUND INC - ON Federated Strategic Value Dividend Portfolio | 2,980 | 198 | ||||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 2,768 | 184 | ||||||

| 2025-07-30 | 13F | Phoenix Holdings Ltd. | 3,723 | 248 | ||||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | Call | 13 | 0 | |||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 108,224 | 7,207 | ||||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 500,406 | 33,322 | ||||||

| 2025-07-18 | 13F | PFG Investments, LLC | 4,175 | 278 | ||||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 117,371 | 7,816 | ||||||

| 2025-08-14 | 13F | LMR Partners LLP | 61,638 | 4,104 | ||||||

| 2025-08-14 | 13F | CastleKnight Management LP | 52,000 | 3,463 | ||||||

| 2025-08-14 | 13F | Holocene Advisors, LP | 7,384 | 492 | ||||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 21 | 1 | ||||||

| 2025-08-15 | 13F | Ion Asset Management Ltd. | 200,000 | 13,318 | ||||||

| 2025-08-19 | 13F | Marex Group plc | 52,556 | 3,500 | ||||||

| 2025-08-08 | 13F | Massachusetts Financial Services Co /ma/ | 251,450 | 16,744 | ||||||

| 2025-08-12 | 13F | American Century Companies Inc | 100,083 | 6,665 | ||||||

| 2025-08-14 | 13F/A | Barclays Plc | Call | 180,000 | 12 | |||||

| 2025-07-23 | 13F | Guild Investment Management, Inc. | 22,050 | 1,468 | ||||||

| 2025-08-14 | 13F | Perbak Capital Partners LLP | 3,794 | 253 | ||||||

| 2025-08-14 | 13F | Azora Capital LP | 192,680 | 12,831 | ||||||

| 2025-08-12 | 13F | BlackRock, Inc. | 2,001,664 | 133,291 | ||||||

| 2025-08-14 | 13F | Sphera Management Technology Funds Ltd | 20,000 | 1,332 | ||||||

| 2025-08-13 | 13F | Intrinsic Edge Capital Management LLC | 5,000 | 333 | ||||||

| 2025-08-14 | 13F | Prana Capital Management, LP | 20,143 | 1,341 | ||||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 35 | 2 | ||||||

| 2025-08-14 | 13F | BlueCrest Capital Management Ltd | 252,000 | 16,781 | ||||||

| 2025-08-05 | 13F | Pier Capital, LLC | 77,743 | 5,177 | ||||||

| 2025-08-14 | 13F | Woodline Partners LP | 35,000 | 2,331 | ||||||

| 2025-08-14 | 13F | Burkehill Global Management, LP | 50,000 | 3,330 | ||||||

| 2025-08-14 | 13F | Cohen & Steers, Inc. | 2,500 | 0 | ||||||

| 2025-08-27 | NP | OHIO NATIONAL FUND INC - ON BlackRock Advantage Small Cap Growth Portfolio | 2,631 | 175 | ||||||

| 2025-08-13 | 13F | Diametric Capital, LP | 3,465 | 231 | ||||||

| 2025-08-14 | 13F | Soros Fund Management Llc | 160,000 | 10,654 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 101,674 | 6,771 | ||||||

| 2025-07-31 | 13F | Sumitomo Mitsui Trust Holdings, Inc. | 421,205 | 28,048 | ||||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 1,230 | 82 | ||||||

| 2025-08-29 | NP | JAEQX - Small Company Value Trust NAV | 4,609 | 307 | ||||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 103,617 | 6,900 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 358,778 | 23,891 | ||||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 7,270 | 0 | ||||||

| 2025-08-14 | 13F | Point72 Europe (London) LLP | 2,101 | 140 | ||||||

| 2025-07-29 | 13F | Conway Capital Management, Inc. | 5,850 | 390 | ||||||

| 2025-08-14 | 13F | Altshuler Shaham Ltd | 399,995 | 26,636 | ||||||

| 2025-07-29 | 13F | International Assets Investment Management, Llc | 7,720 | 514 | ||||||

| 2025-08-11 | 13F | Greenland Capital Management LP | 5,032 | 335 | ||||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 133,435 | 9 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 273,000 | 18,179 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 111,600 | 7,431 |

Other Listings

| US:ETOR | US$ 46.40 |