Mga Batayang Estadistika

| Pemilik Institusional | 445 total, 435 long only, 0 short only, 10 long/short - change of 8.80% MRQ |

| Alokasi Portofolio Rata-rata | 0.2269 % - change of 3.60% MRQ |

| Saham Institusional (Jangka Panjang) | 491,491,529 (ex 13D/G) - change of -43.69MM shares -8.16% MRQ |

| Nilai Institusional (Jangka Panjang) | $ 3,380,263 USD ($1000) |

Kepemilikan Institusional dan Pemegang Saham

Telefonaktiebolaget LM Ericsson (publ) - Depositary Receipt (Common Stock) (US:ERIC) memiliki 445 pemilik institusional dan pemegang saham yang telah mengajukan formulir 13D/G atau 13F kepada Komisi Bursa Efek (Securities Exchange Commission/SEC). Lembaga-lembaga ini memegang total 491,491,529 saham. Pemegang saham terbesar meliputi Hotchkis & Wiley Capital Management Llc, Acadian Asset Management Llc, VWNFX - Vanguard Windsor II Fund Investor Shares, Primecap Management Co/ca/, Renaissance Technologies Llc, VPMCX - Vanguard PRIMECAP Fund Investor Shares, Arrowstreet Capital, Limited Partnership, Morgan Stanley, UBS Group AG, and Optiver Holding B.V. .

Struktur kepemilikan institusional Telefonaktiebolaget LM Ericsson (publ) - Depositary Receipt (Common Stock) (NasdaqGS:ERIC) menunjukkan posisi terkini di perusahaan oleh institusi dan dana, serta perubahan terbaru dalam ukuran posisi. Pemegang saham utama dapat mencakup investor individu, reksa dana, dana lindung nilai, atau institusi. Jadwal 13D menunjukkan bahwa investor memegang (atau pernah memegang) lebih dari 5% saham perusahaan dan bermaksud (atau pernah bermaksud) untuk secara aktif mengejar perubahan strategi bisnis. Jadwal 13G menunjukkan investasi pasif lebih dari 5%.

The share price as of September 5, 2025 is 8.01 / share. Previously, on September 9, 2024, the share price was 7.30 / share. This represents an increase of 9.73% over that period.

Skor Sentimen Dana

Skor Sentimen Dana (sebelumnya dikenal sebagai Skor Akumulasi Kepemilikan) menemukan saham-saham yang paling banyak dibeli oleh dana. Ini adalah hasil dari model kuantitatif multi-faktor yang canggih yang mengidentifikasi perusahaan dengan tingkat akumulasi institusional tertinggi. Model penilaian menggunakan kombinasi dari total peningkatan pemilik yang diungkapkan, perubahan dalam alokasi portofolio pada pemilik tersebut, dan metrik lainnya. Angka berkisar dari 0 hingga 100, dengan angka yang lebih tinggi menunjukkan tingkat akumulasi yang lebih tinggi dibandingkan dengan perusahaan sejenisnya, dan 50 adalah rata-ratanya.

Frekuensi Pembaruan: Setiap Hari

Lihat Ownership Explorer, yang menyediakan daftar perusahaan dengan peringkat tertinggi.

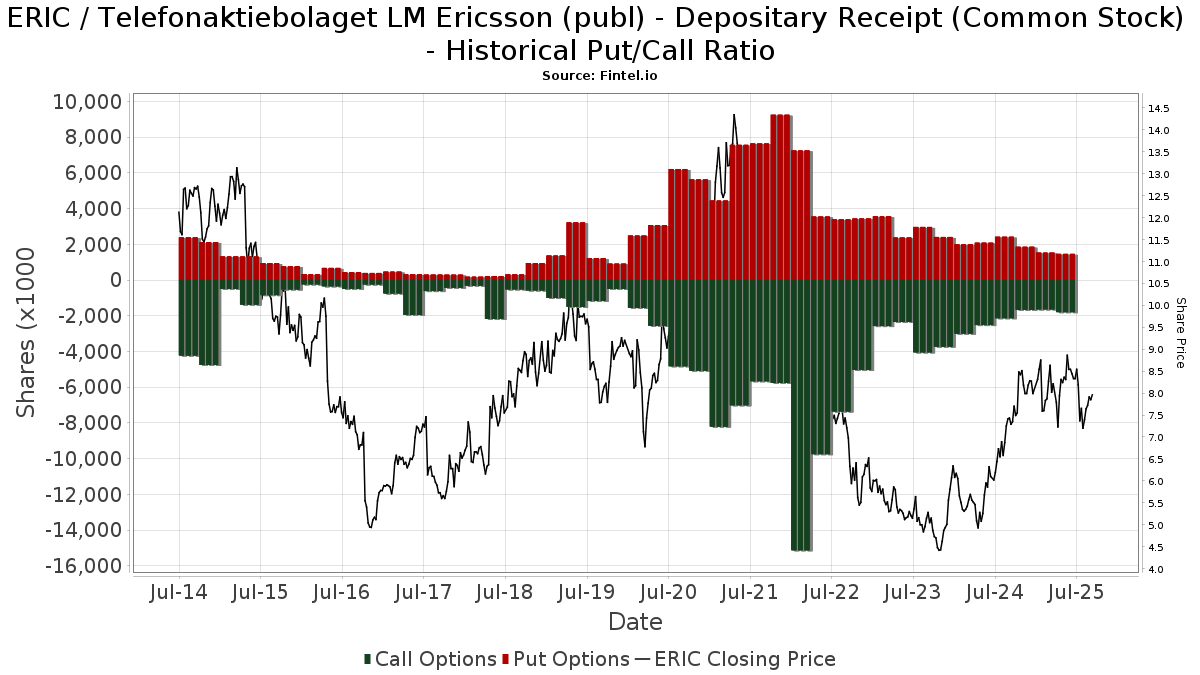

Rasio Put/Call Institusional

Selain melaporkan isu ekuitas dan utang standar, institusi dengan aset di bawah manajemen lebih dari 100 juta dolar AS juga harus mengungkapkan kepemilikan opsi put dan call mereka. Karena opsi put umumnya menunjukkan sentimen negatif, dan opsi call menunjukkan sentimen positif, kita dapat mengetahui sentimen institusional secara keseluruhan dengan memplot rasio put terhadap call. Grafik di sebelah kanan memplot rasio put/call historis untuk instrumen ini.

Menggunakan Rasio Put/Call sebagai indikator sentimen investor mengatasi salah satu kekurangan utama dari penggunaan total kepemilikan institusional, yaitu sejumlah besar aset yang dikelola diinvestasikan secara pasif untuk melacak indeks. Dana yang dikelola secara pasif biasanya tidak membeli opsi, sehingga indikator rasio put/call lebih akurat dalam melacak sentimen dana yang dikelola secara aktif.

Pengajuan 13D/G

Kami menyajikan pengajuan 13D/G secara terpisah dari pengajuan 13F karena perlakuan yang berbeda oleh SEC. Pengajuan 13D/G dapat diajukan oleh kelompok investor (dengan satu pemimpin), sedangkan pengajuan 13F tidak bisa. Hal ini mengakibatkan situasi di mana seorang investor dapat mengajukan 13D/G yang melaporkan satu nilai untuk total saham (mewakili semua saham yang dimiliki oleh kelompok investor), tetapi kemudian mengajukan 13F yang melaporkan nilai yang berbeda untuk total saham (mewakili kepemilikan mereka sendiri). Ini berarti bahwa kepemilikan saham dari pengajuan 13D/G dan pengajuan 13F seringkali tidak dapat dibandingkan secara langsung, sehingga kami menyajikannya secara terpisah.

Catatan: Mulai 16 Mei 2021, kami tidak lagi menampilkan pemilik yang belum mengajukan 13D/G dalam setahun terakhir. Sebelumnya, kami menampilkan riwayat lengkap pengajuan 13D/G. Secara umum, entitas yang diwajibkan untuk mengajukan pengajuan 13D/G harus mengajukan setidaknya setiap tahun sebelum mengirimkan pengajuan penutupan. Namun, terkadang dana keluar dari posisi tanpa mengirimkan pengajuan penutupan (misalnya, mereka menghentikan operasi), sehingga menampilkan riwayat lengkap terkadang menyebabkan kebingungan tentang kepemilikan saat ini. Untuk mencegah kebingungan, kami sekarang hanya menampilkan pemilik 'saat ini' - yaitu - pemilik yang telah mengajukan dalam setahun terakhir.

Upgrade to unlock premium data.

| Tanggal File | Formulir | Investor | Sebelumnya Saham |

Terbaru Saham |

Δ Saham (Persen) |

Kepemilikan (Persen) |

Δ Pagmamay-ari (Persen) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-04-04 | INVESTOR AB | 170,982,932 | 190,729,738 | 11.55 | 6.20 | 10.71 |

Pengajuan 13F dan NPORT

Detail pada pengajuan 13F tersedia gratis. Detail pada pengajuan NP memerlukan keanggotaan premium. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup. Klik tautan ini ikon untuk melihat riwayat transaksi selengkapnya.

Tingkatkan

untuk membuka data premium dan mengekspor ke Excel ![]() .

.

| Tanggal File | Sumber | Investor | Ketik | Presyo ng Avg (Silangan) |

Saham | Δ Saham (%) |

Dilaporkan Nilai ($1000) |

Nilai Δ (%) |

Alokasi Port (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-23 | 13F | Bear Mountain Capital, Inc. | 200 | 0.00 | 1 | 0.00 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 192,245 | 30.68 | 1,630 | 42.86 | ||||

| 2025-07-17 | 13F | Archford Capital Strategies, LLC | 143,502 | 1,217 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 28,482 | 95.04 | 238 | 110.62 | ||||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 14,760 | 125 | ||||||

| 2025-06-25 | NP | GENW - Genter Capital International Dividend ETF | 2,695 | 19.99 | 22 | 37.50 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 757,985 | -8.64 | 6,428 | -0.17 | ||||

| 2025-08-13 | 13F/A | StoneX Group Inc. | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-13 | 13F | Federated Hermes, Inc. | 3,096 | -12.54 | 26 | -3.70 | ||||

| 2025-05-02 | 13F/A | Mackenzie Financial Corp | 19,585 | 158 | ||||||

| 2025-07-22 | 13F | Checchi Capital Advisers, LLC | 15,443 | -10.88 | 131 | -2.99 | ||||

| 2025-06-30 | NP | PTIN - Pacer Trendpilot International ETF | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-12 | 13F | Personal Cfo Solutions, Llc | 26,002 | 6.87 | 220 | 17.02 | ||||

| 2025-07-30 | 13F | Wallace Advisory Group, LLC | 11,034 | -1.51 | 86 | -5.56 | ||||

| 2025-08-11 | 13F | Dorsey Wright & Associates | 180,798 | -38.61 | 1,533 | -32.91 | ||||

| 2025-07-29 | NP | WEUSX - Siit World Equity Ex-us Fund - Class A | 3,556,980 | -0.31 | 30,092 | 2.36 | ||||

| 2025-08-12 | 13F | Foster Dykema Cabot & Partners, Llc | 6,552 | 0.00 | 56 | 7.84 | ||||

| 2025-05-01 | 13F | Schechter Investment Advisors, LLC | 18,476 | 9.54 | 143 | 5.93 | ||||

| 2025-07-30 | NP | ENDW - Cambria Endowment Style ETF | 51 | 0 | ||||||

| 2025-06-27 | NP | ZABDFX - American Beacon Diversified Fund AAL Class | 286,240 | -11.75 | 2,359 | -2.92 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 1,282,032 | 229.27 | 10,872 | 259.85 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 60 | 0.00 | 1 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 8,526 | -12.74 | 72 | -4.00 | ||||

| 2025-07-07 | 13F | Hedges Asset Management LLC | 18,000 | 0.00 | 153 | 9.35 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 53,474 | -38.94 | 453 | -33.28 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 36,199 | 876.50 | 307 | 992.86 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 279,043 | -39.01 | 2,366 | -33.35 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 79,819 | 5.71 | 677 | 15.56 | ||||

| 2025-08-14 | 13F | Fmr Llc | 3,217,109 | 12.68 | 27,281 | 23.14 | ||||

| 2025-08-22 | NP | FENI - Fidelity Enhanced International ETF | 227,620 | 277.24 | 1,930 | 312.39 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 14,133 | 23.09 | 120 | 33.71 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 449,153 | -46.33 | 4 | -50.00 | ||||

| 2025-05-14 | 13F | Estabrook Capital Management | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Capital Fund Management S.a. | 924,442 | 29.92 | 7,839 | 41.99 | ||||

| 2025-08-20 | NP | NATIONWIDE VARIABLE INSURANCE TRUST - NVIT International Equity Fund Class I | 21,334 | 181 | ||||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 95,858 | -0.44 | 1 | |||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Put | 0 | -100.00 | 0 | -100.00 | |||

| 2025-08-27 | NP | RYDEX VARIABLE TRUST - Internet Fund Variable Annuity | 5,316 | -9.50 | 45 | 0.00 | ||||

| 2025-07-18 | 13F | Institute for Wealth Management, LLC. | 60,275 | 0.00 | 511 | 9.42 | ||||

| 2025-08-20 | NP | HWCIX - Hotchkis & Wiley Diversified Value Fund Class I | 276,150 | -14.31 | 2,342 | -6.36 | ||||

| 2025-07-29 | 13F | Beverly Hills Private Wealth, LLC | 21,932 | -4.58 | 186 | 3.93 | ||||

| 2025-07-29 | 13F | Salomon & Ludwin, LLC | 33 | 135.71 | 0 | |||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 2,261 | 2,412.22 | 19 | |||||

| 2025-07-16 | 13F | Five Oceans Advisors | 21,739 | 0.00 | 184 | 9.52 | ||||

| 2025-07-24 | NP | ONEQ - Fidelity Nasdaq Composite Index Tracking Stock This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 65,109 | -43.17 | 551 | -41.74 | ||||

| 2025-07-31 | 13F | Whipplewood Advisors, LLC | 175 | 130.26 | 1 | 0.00 | ||||

| 2025-08-08 | 13F | Creative Planning | 23,295 | -25.45 | 198 | -18.60 | ||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 22,210 | -29.57 | 188 | -24.50 | ||||

| 2025-08-26 | NP | Profunds - Profund Vp Europe 30 | 52,802 | 2.99 | 448 | 12.59 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 15,873 | -84.85 | 135 | -83.52 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 2,756 | 0.00 | 23 | 9.52 | ||||

| 2025-08-29 | 13F | Total Investment Management Inc | 1 | 0 | ||||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 107,411 | 911 | ||||||

| 2025-06-27 | NP | HAOSX - Harbor Overseas Fund Institutional Class | 541,270 | 11.16 | 4,460 | 22.29 | ||||

| 2025-07-28 | 13F | RFG Advisory, LLC | 16,927 | -0.32 | 144 | 9.16 | ||||

| 2025-08-06 | 13F | Penserra Capital Management LLC | 1,231,869 | 10 | ||||||

| 2025-06-26 | NP | HTECX - Hennessy Technology Fund Investor Class | 13,622 | -41.04 | 112 | -2.61 | ||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 26,050 | 18.48 | 221 | 29.41 | ||||

| 2025-08-11 | 13F | Annis Gardner Whiting Capital Advisors, LLC | 399 | 3 | ||||||

| 2025-05-14 | 13F | Credit Agricole S A | 3,000 | 0.00 | 23 | -4.17 | ||||

| 2025-08-25 | NP | TDIV - First Trust NASDAQ Technology Dividend Index Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 750,073 | 2.47 | 6,361 | 11.97 | ||||

| 2025-08-01 | 13F | Ashton Thomas Private Wealth, LLC | 213,455 | 12.51 | 1,810 | 20.75 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 20,485 | 57.18 | 174 | 71.29 | ||||

| 2025-08-12 | 13F | Wayfinding Financial, LLC | 0 | -100.00 | 0 | |||||

| 2025-05-14 | 13F | EntryPoint Capital, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 82,587 | -11.00 | 700 | -2.78 | ||||

| 2025-08-14 | 13F | Optiver Holding B.V. | 8,048,918 | 298.65 | 68,255 | 337.08 | ||||

| 2025-08-14 | 13F | Optiver Holding B.V. | Put | 757,200 | 35.97 | 6,421 | 49.08 | |||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 24,371 | -11.98 | 207 | -3.74 | ||||

| 2025-08-14 | 13F | Optiver Holding B.V. | Call | 576,900 | 103.64 | 4,892 | 123.28 | |||

| 2025-08-13 | 13F | Quantbot Technologies LP | 247,903 | 2,102 | ||||||

| 2025-08-12 | 13F | MAI Capital Management | 643 | 3,115.00 | 5 | |||||

| 2025-08-07 | 13F | Retirement Solution Inc. | 14,057 | 0.00 | 119 | 9.17 | ||||

| 2025-08-13 | 13F | Employees Retirement System of Texas | 0 | -100.00 | 0 | |||||

| 2025-06-30 | NP | VWNFX - Vanguard Windsor II Fund Investor Shares | 49,576,280 | -11.52 | 408,509 | -2.66 | ||||

| 2025-07-31 | 13F | Moser Wealth Advisors, LLC | 1,500 | 0.00 | 13 | 9.09 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 21,545 | 31.40 | 183 | 43.31 | ||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 1,376,301 | -15.51 | 11,671 | -7.67 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 23,511 | 199 | ||||||

| 2025-07-11 | 13F | Diversified Trust Co | 338,477 | -1.60 | 2,870 | 7.53 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 139,272 | -0.50 | 1,181 | 8.75 | ||||

| 2025-06-26 | NP | DFIC - Dimensional International Core Equity 2 ETF | 4,325 | 36 | ||||||

| 2025-08-08 | 13F | Gts Securities Llc | 142,821 | 58.46 | 1,211 | 73.25 | ||||

| 2025-07-25 | 13F | Concord Wealth Partners | 20 | 0.00 | 0 | |||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 134 | 0.00 | 1 | 0.00 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 19,954 | -66.95 | 169 | -63.89 | ||||

| 2025-07-24 | 13F | Callan Family Office, LLC | 107,750 | 210.02 | 914 | 239.41 | ||||

| 2025-06-23 | NP | UEPIX - Europe 30 Profund Investor Class | 9,426 | 74.07 | 78 | 92.50 | ||||

| 2025-08-08 | 13F | D'Orazio & Associates, Inc. | 0 | -100.00 | 0 | |||||

| 2025-07-17 | 13F | Vermillion Wealth Management, Inc. | 1,520 | -11.63 | 13 | -7.69 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 3,955,281 | 475.78 | 33,541 | 529.27 | ||||

| 2025-08-13 | 13F | Grantham, Mayo, Van Otterloo & Co. LLC | 37,929 | 322 | ||||||

| 2025-07-17 | 13F | Wolff Wiese Magana Llc | 2,603 | 0.00 | 22 | 10.00 | ||||

| 2025-08-01 | 13F | Boyd Watterson Asset Management Llc/oh | 1,767 | 0.00 | 15 | 7.69 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 18,152 | -3.97 | 154 | 4.79 | ||||

| 2025-05-09 | 13F | Delta Asset Management Llc/tn | 0 | -100.00 | 0 | |||||

| 2025-08-27 | NP | VANGUARD VARIABLE INSURANCE FUNDS - Diversified Value Portfolio This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1,780,205 | -12.62 | 15,096 | -4.51 | ||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 48,442 | 0 | ||||||

| 2025-08-14 | 13F | Bnp Paribas | 30,000 | 0.00 | 254 | 9.48 | ||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 136,068 | -17.37 | 1,154 | -9.71 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 11,452 | -12.42 | 97 | -3.96 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 775,373 | 40.42 | 6,575 | 53.44 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 894 | 0.00 | 8 | 16.67 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 10,975 | 28.03 | 93 | 40.91 | ||||

| 2025-07-31 | 13F | R Squared Ltd | 11,480 | 97 | ||||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 575,000 | 1,050.00 | 5 | |||||

| 2025-08-04 | 13F | Atria Investments Llc | 52,846 | -0.56 | 448 | 8.74 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 322,558 | 2,735 | ||||||

| 2025-08-01 | 13F | Shilanski & Associates, Inc. | 28,798 | -0.44 | 244 | 8.93 | ||||

| 2025-06-26 | NP | Dfa Investment Trust Co - The Dfa International Value Series This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 208,667 | 0.00 | 1,719 | 10.05 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 291,779 | 46.31 | 2,474 | 59.92 | ||||

| 2025-06-27 | NP | PCLVX - PACE Large Co Value Equity Investments Class P | 527,561 | -19.34 | 4,347 | -11.25 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 0 | -100.00 | 0 | |||||

| 2025-05-30 | NP | EHLS - Even Herd Long Short ETF | 15,147 | 118 | ||||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 15,975,909 | -48.77 | 135,476 | -44.01 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 67 | 0.00 | 1 | |||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 1,029 | 9 | ||||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 10,624 | 90 | ||||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 4,198,406 | -11.42 | 36 | -2.78 | ||||

| 2025-07-25 | NP | CMIEX - Multi-Manager International Equity Strategies Fund Institutional Class | 685,421 | 0.00 | 5,799 | 2.67 | ||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 28,743 | 55.57 | 244 | 69.93 | ||||

| 2025-08-13 | 13F | M&t Bank Corp | 11,141 | 0.00 | 94 | 9.30 | ||||

| 2025-07-09 | 13F | Bruce G. Allen Investments, LLC | 239 | 2 | ||||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 269,333 | 104.27 | 2,284 | 123.17 | ||||

| 2025-08-27 | NP | RYIIX - Internet Fund Investor Class | 16,570 | 7.03 | 141 | 16.67 | ||||

| 2025-07-31 | 13F | Azzad Asset Management Inc /adv | 319,296 | -8.59 | 2,708 | -0.11 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 250,389 | 0.67 | 2,123 | 10.00 | ||||

| 2025-08-12 | 13F/A | Boston Partners | 173,430 | -9.22 | 1,471 | -0.81 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 12,135 | 103 | ||||||

| 2025-08-29 | NP | GCPAX - Gateway Equity Call Premium Fund Class A | 29,041 | 0.00 | 246 | 9.33 | ||||

| 2025-08-14 | 13F | UBS Group AG | 9,652,286 | 45.49 | 81,851 | 58.99 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 11,576 | 38.52 | 98 | 49.23 | ||||

| 2025-08-14 | 13F | UBS Group AG | Put | 23,000 | 195 | |||||

| 2025-07-18 | 13F | Truist Financial Corp | 35,325 | -8.63 | 300 | -0.33 | ||||

| 2025-08-04 | 13F/A | 626 Financial, LLC | 11,460 | 0.00 | 97 | 10.23 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 68,377 | 20.68 | 580 | 31.89 | ||||

| 2025-08-04 | 13F | AdvisorShares Investments LLC | 122,151 | 17.57 | 1,036 | 27.94 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 0 | -100.00 | 0 | |||||

| 2025-08-26 | NP | WIREX - Wireless Fund | 11,540 | 0.00 | 98 | 8.99 | ||||

| 2025-07-10 | 13F | NorthCrest Asset Manangement, LLC | 79,179 | -3.44 | 676 | 6.29 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 3,117,281 | 20.44 | 26,435 | 31.62 | ||||

| 2025-08-14 | 13F | Sei Investments Co | 5,007,077 | -0.28 | 42,460 | 8.97 | ||||

| 2025-08-14 | 13F | Henry James International Management Inc. | 291,016 | 0.00 | 2,468 | 9.26 | ||||

| 2025-08-07 | 13F | Sierra Ocean, Llc | 883 | 68.19 | 7 | 75.00 | ||||

| 2025-08-13 | 13F | Diametric Capital, LP | 10,561 | 90 | ||||||

| 2025-05-15 | 13F | Wolverine Trading, Llc | Put | 0 | -100.00 | 0 | -100.00 | |||

| 2025-07-29 | NP | BPLSX - Boston Partners Long/Short Equity Fund INSTITUTIONAL | 92,358 | 2.29 | 781 | 5.11 | ||||

| 2025-07-15 | 13F | Td Private Client Wealth Llc | 40,774 | 40.27 | 346 | 53.33 | ||||

| 2025-05-14 | 13F | Walleye Capital LLC | Put | 0 | -100.00 | 0 | -100.00 | |||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 1,361 | 10 | ||||||

| 2025-08-13 | 13F | Northern Trust Corp | 1,837,949 | -49.78 | 15,586 | -45.12 | ||||

| 2025-08-01 | 13F | MorganRosel Wealth Management, LLC | 200 | 0.00 | 2 | 0.00 | ||||

| 2025-04-30 | 13F | Valeo Financial Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-21 | NP | IEQ - Lazard International Dynamic Equity ETF | 8,238 | 70 | ||||||

| 2025-08-21 | NP | MNCSX - Mercer Non-US Core Equity Fund Class I | 250,056 | 0.00 | 2,120 | 9.28 | ||||

| 2025-07-18 | 13F | Trust Co Of Vermont | 0 | -100.00 | 0 | |||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 613 | -95.08 | 5 | -94.79 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 1,242,381 | 197.15 | 11 | 233.33 | ||||

| 2025-07-25 | 13F | CBOE Vest Financial, LLC | 23,082 | 21.35 | 196 | 32.65 | ||||

| 2025-08-11 | 13F | United Capital Financial Advisers, Llc | 31,136 | -8.54 | 264 | 0.00 | ||||

| 2025-07-22 | NP | DSHFX - Destinations Shelter Fund Class I | 13,618 | 0.00 | 115 | 2.68 | ||||

| 2025-08-06 | 13F | Hallmark Capital Management Inc | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 2,258,600 | 0.96 | 19,153 | 10.33 | ||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 168,138 | 1,426 | ||||||

| 2025-06-25 | NP | IIGIX - Voya Multi-Manager International Equity Fund Class I | 155,892 | 1,285 | ||||||

| 2025-08-14 | 13F | Diversify Advisory Services, LLC | 42,021 | 24.84 | 320 | 14.34 | ||||

| 2025-07-16 | 13F | West Branch Capital LLC | 100 | 0.00 | 1 | |||||

| 2025-08-06 | 13F | Csenge Advisory Group | 16,284 | -9.91 | 138 | -6.80 | ||||

| 2025-05-06 | 13F | Venturi Wealth Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 2,000 | 0.00 | 17 | 6.67 | ||||

| 2025-08-12 | 13F | Pacer Advisors, Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 1,853,806 | 15,720 | ||||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 24,888 | -73.60 | 211 | -71.14 | ||||

| 2025-08-07 | 13F | Profund Advisors Llc | 61,046 | 3.58 | 518 | 13.13 | ||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 1,606 | 0.00 | 14 | 8.33 | ||||

| 2025-07-25 | 13F | Hemington Wealth Management | 527 | 0.00 | 0 | |||||

| 2025-08-11 | 13F | Cornerstone Planning Group LLC | 274 | 37.69 | 2 | 100.00 | ||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 71,189 | 1 | ||||||

| 2025-07-25 | 13F | Cwm, Llc | 7,769 | -7.92 | 0 | |||||

| 2025-04-29 | NP | EBI - Longview Advantage ETF | 1,520 | 13 | ||||||

| 2025-08-13 | 13F | Amundi | 498,887 | 0.00 | 4,260 | 14.18 | ||||

| 2025-08-14 | 13F | Atom Investors LP | 13,207 | 112 | ||||||

| 2025-07-14 | 13F | Legacy Capital Group California, Inc. | 34,674 | 20.49 | 294 | 31.84 | ||||

| 2025-07-10 | 13F | Contravisory Investment Management, Inc. | 29,046 | 6.97 | 246 | 17.14 | ||||

| 2025-08-27 | NP | RYMIX - Telecommunications Fund Investor Class | 18,893 | -69.15 | 160 | -66.32 | ||||

| 2025-07-30 | 13F | Denali Advisors Llc | 458,698 | 0.07 | 3,890 | 9.33 | ||||

| 2025-04-29 | 13F | Callan Capital, LLC | 71,962 | 27.04 | 558 | 22.37 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 1,494 | -4.11 | 13 | 0.00 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 133,436 | 30.60 | 1,132 | 42.80 | ||||

| 2025-07-28 | NP | AVIV - Avantis International Large Cap Value ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 172,795 | 12.32 | 1,462 | 15.31 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 328,478 | 16.48 | 2,785 | 27.29 | ||||

| 2025-08-12 | 13F | Dynamic Technology Lab Private Ltd | 25,957 | 60.09 | 220 | 74.60 | ||||

| 2025-07-15 | 13F | Mather Group, Llc. | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 106 | -96.78 | 1 | -100.00 | ||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | -100.00 | 0 | |||||

| 2025-07-07 | 13F | Investors Research Corp | 44,683 | 0.00 | 379 | 9.25 | ||||

| 2025-05-13 | NP | SA FUNDS INVESTMENT TRUST - SA International Value Fund | 11,013 | 0.00 | 85 | -3.41 | ||||

| 2025-07-31 | 13F | CVA Family Office, LLC | 473 | 0.00 | 4 | 33.33 | ||||

| 2025-08-14 | 13F | Price T Rowe Associates Inc /md/ | 0 | -100.00 | 0 | |||||

| 2025-07-24 | 13F | Baldwin Brothers Inc/ma | 35,673 | 22.18 | 303 | 33.63 | ||||

| 2025-07-18 | 13F/A | MJT & Associates Financial Advisory Group, Inc. | 1,994 | 0.00 | 17 | 6.67 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 137 | 1 | ||||||

| 2025-07-10 | 13F | Fulton Bank, N.a. | 24,316 | 61.62 | 206 | 77.59 | ||||

| 2025-07-28 | 13F | Bayforest Capital Ltd | 102,112 | -15.03 | 866 | -7.19 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 106 | -75.74 | 1 | -100.00 | ||||

| 2025-07-25 | 13F | Endowment Wealth Management, Inc. | 10,836 | 92 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 1,275,046 | 25.03 | 10,812 | 36.64 | ||||

| 2025-08-11 | 13F | Dorsey & Whitney Trust CO LLC | 40,514 | -3.11 | 344 | 5.86 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 32,769 | -31.86 | 0 | |||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 414,131 | 3,512 | ||||||

| 2025-07-24 | 13F | Brucke Financial, Inc. | 32,128 | 3.85 | 272 | 7.09 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 845,176 | 27.14 | 7,167 | 38.95 | ||||

| 2025-04-14 | 13F | Cetera Trust Company, N.A | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-11 | 13F | Integrated Quantitative Investments LLC | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 3,524,928 | 590.89 | 29,891 | 655.01 | ||||

| 2025-08-27 | NP | VPCCX - Vanguard PRIMECAP Core Fund Investor Shares | 2,188,710 | -39.93 | 18,560 | -34.36 | ||||

| 2025-08-14 | 13F | Alliance Wealth Advisors, LLC /UT | 12,354 | 1.26 | 105 | 10.64 | ||||

| 2025-07-16 | 13F | Kathmere Capital Management, LLC | 32,024 | 16.50 | 272 | 27.23 | ||||

| 2025-05-12 | 13F | FIL Ltd | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-07-16 | 13F | Highline Wealth Partners Llc | 54 | -27.03 | 0 | |||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 12,789 | 2.63 | 108 | 12.50 | ||||

| 2025-08-28 | NP | DTLVX - Large Company Value Portfolio Investment Class | 170,182 | -13.34 | 1,443 | -5.25 | ||||

| 2025-06-27 | NP | SPTE - SP Funds S&P Global Technology ETF | 33,169 | 11.27 | 273 | 22.42 | ||||

| 2025-08-14 | 13F | Diversify Wealth Management, Llc | 138,777 | 16.61 | 1,056 | 6.99 | ||||

| 2025-08-14 | 13F | Family Management Corp | 16,018 | 136 | ||||||

| 2025-07-23 | 13F | Bingham Private Wealth, Llc | 10,026 | 85 | ||||||

| 2025-08-08 | 13F | CFO4Life Group, LLC | 14,614 | 40.09 | 124 | 53.75 | ||||

| 2025-08-13 | 13F | Colony Capital, Inc. | 3,893,867 | -18.35 | 33,020 | -10.78 | ||||

| 2025-08-28 | NP | SEEIX - Sit International Equity Fund - Class I | 1,696,672 | -18.09 | 14,388 | -10.49 | ||||

| 2025-05-01 | 13F | Marks Group Wealth Management, Inc | 0 | -100.00 | 0 | |||||

| 2025-06-27 | NP | SPWO - SP Funds S&P World (ex-US) ETF | 10,092 | 35.17 | 83 | 50.91 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 69,175 | 35.11 | 587 | 47.61 | ||||

| 2025-08-27 | NP | Advanced Series Trust - Ast Hotchkis & Wiley Large-cap Value Portfolio | 1,030,842 | -13.25 | 8,742 | -5.21 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 21,832 | 36.11 | 185 | 49.19 | ||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 8,708 | 602.82 | 0 | |||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 3,397 | 13.42 | 29 | 21.74 | ||||

| 2025-07-09 | 13F | Gateway Investment Advisers Llc | 57,275 | -90.30 | 486 | -89.42 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 328 | 0.61 | 3 | 0.00 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 21,575,900 | 63.73 | 182,964 | 78.92 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 28,063 | 148.06 | 238 | 175.58 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 10,000 | -69.70 | 85 | -67.19 | ||||

| 2025-08-14 | 13F | Farringdon Capital, Ltd. | 0 | -100.00 | 0 | |||||

| 2025-08-27 | NP | VPMCX - Vanguard PRIMECAP Fund Investor Shares | 17,794,469 | -44.65 | 150,897 | -39.52 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 886,356 | -4.71 | 7,516 | 4.13 | ||||

| 2025-08-14 | 13F | Principia Wealth Advisory, LLC | 54 | 0 | ||||||

| 2025-07-14 | 13F | LCM Capital Management Inc | 12,251 | -1.67 | 104 | 7.29 | ||||

| 2025-08-20 | NP | HWSM - Hotchkis & Wiley SMID Cap Diversified Value Fund | 2,544 | 300.00 | 22 | 425.00 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 111,940 | 950 | ||||||

| 2025-07-30 | 13F | Rnc Capital Management Llc | 58,360 | 13.74 | 495 | 24.12 | ||||

| 2025-08-05 | 13F | Claro Advisors LLC | 0 | -100.00 | 0 | |||||

| 2025-07-30 | 13F | Ethic Inc. | 247,959 | -9.71 | 2,093 | -2.20 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-07 | 13F | Zions Bancorporation, National Association /ut/ | 148 | -4.52 | 1 | 0.00 | ||||

| 2025-07-30 | 13F | Forum Financial Management, LP | 252,252 | -8.13 | 2,139 | 0.42 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 665,815 | 321.18 | 6 | 400.00 | ||||

| 2025-06-25 | NP | TDVI - FT Vest Technology Dividend Target Income ETF | 21,097 | 13.40 | 174 | 24.46 | ||||

| 2025-03-25 | NP | Neuberger Berman Next Generation Connectivity Fund Inc. | 1,493,033 | -12.33 | 11,183 | -43.05 | ||||

| 2025-07-24 | 13F | Mengis Capital Management, Inc. | 22,300 | 0.00 | 189 | 9.25 | ||||

| 2025-08-12 | 13F | Dimensional Fund Advisors Lp | 525,338 | -32.02 | 4,455 | -25.72 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 226,882 | 68.20 | 1,924 | 83.32 | ||||

| 2025-08-08 | 13F | Abc Arbitrage Sa | 5,121,349 | 64.59 | 43,429 | 79.86 | ||||

| 2025-05-15 | 13F | CAPROCK Group, Inc. | 158,223 | 9.09 | 1,250 | 6.93 | ||||

| 2025-07-17 | 13F | Sage Rhino Capital Llc | 11,575 | -1.00 | 98 | 8.89 | ||||

| 2025-07-11 | 13F | Grove Bank & Trust | 8,339 | -1.24 | 71 | 7.69 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 1,900 | 0.00 | 16 | 14.29 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 208,439 | -0.63 | 1,768 | 8.60 | ||||

| 2025-08-07 | 13F | Addison Advisors LLC | 127 | 0.00 | 1 | |||||

| 2025-08-13 | 13F | Mount Yale Investment Advisors, LLC | 105,892 | 78.32 | 898 | 95.00 | ||||

| 2025-08-12 | 13F | Legal & General Group Plc | 18,752 | 159 | ||||||

| 2025-07-25 | 13F | JustInvest LLC | 241,211 | 35.85 | 2,045 | 48.51 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 0 | -100.00 | 0 | |||||

| 2025-06-27 | NP | AADEX - American Beacon Large Cap Value Fund Institutional Class | 3,749,290 | -19.69 | 30,894 | -11.65 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 73 | 1 | ||||||

| 2025-08-28 | NP | SMINX - SIMT Tax-Managed International Managed Volatility Fund Class F | 31,699 | -29.46 | 269 | -22.99 | ||||

| 2025-05-09 | 13F | Maxi Investments CY Ltd | 0 | -100.00 | 0 | |||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 25,295 | 0.25 | 216 | 10.26 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 56,595 | 3.94 | 439 | 0.23 | ||||

| 2025-07-28 | NP | AVDEX - Avantis International Equity Fund Institutional Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 43,604 | 0.00 | 369 | 2.51 | ||||

| 2025-07-30 | 13F | Legacy Wealth Asset Management, LLC | 90,934 | -11.47 | 771 | -3.26 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 34,882 | 57.26 | 296 | 71.51 | ||||

| 2025-08-27 | NP | FAIEX - PFM Multi-Manager International Equity Fund Institutional Class | 101,210 | 1.70 | 858 | 11.14 | ||||

| 2025-06-27 | NP | POSKX - PRIMECAP Odyssey Stock Fund | 4,471,530 | -0.96 | 36,845 | 8.96 | ||||

| 2025-07-15 | 13F | Burns Matteson Capital Management, LLC | 20,192 | 43.45 | 171 | 56.88 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 78,976 | -13.38 | 670 | -5.37 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 132,678 | 68.01 | 1,125 | 83.82 | ||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 1,199 | 54.51 | 10 | 66.67 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Barclays Plc | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Rhumbline Advisers | 86,158 | 0.10 | 731 | 9.45 | ||||

| 2025-09-04 | 13F | Reynders McVeigh Capital Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-06-26 | NP | DIHRX - International High Relative Profitability Portfolio Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 144,507 | 0.00 | 1,191 | 9.98 | ||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 252,258 | -4.57 | 2,134 | -2.02 | ||||

| 2025-08-14 | 13F | ICONIQ Capital, LLC | 11,819 | -6.73 | 100 | 2.04 | ||||

| 2025-08-14 | 13F | DRW Securities, LLC | 15,454 | 131 | ||||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 64,755 | 14.42 | 549 | 25.06 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 132,301 | -44.57 | 1,122 | -39.47 | ||||

| 2025-08-14 | 13F | Aprio Wealth Management, LLC | 19,946 | -57.86 | 169 | -53.95 | ||||

| 2025-05-13 | 13F | Hartland & Co., LLC | 0 | -100.00 | 0 | |||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 94,199 | -15.17 | 799 | -7.32 | ||||

| 2025-07-11 | 13F | Pinnacle Bancorp, Inc. | 4,569 | 13.63 | 39 | 22.58 | ||||

| 2025-08-13 | 13F | Manning & Napier Advisors Llc | 304,896 | 2,586 | ||||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 48,490 | 12.97 | 411 | 23.42 | ||||

| 2025-08-01 | 13F | Koss-Olinger Consulting, LLC | 11,442 | -20.77 | 97 | -13.39 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 3,350,029 | 42.88 | 28,408 | 56.14 | ||||

| 2025-08-14 | 13F | Graham Capital Management, L.P. | 0 | -100.00 | 0 | |||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | -100.00 | 0 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 380,351 | 3,225 | ||||||

| 2025-08-27 | NP | OAIEX - Optimum International Fund Class A | 759,912 | -3.69 | 6,444 | 5.26 | ||||

| 2025-08-08 | 13F | Empower Advisory Group, LLC | 16,284 | -25.51 | 138 | -18.34 | ||||

| 2025-08-13 | 13F | Great Diamond Partners, LLC | 76,543 | 1.76 | 649 | 11.32 | ||||

| 2025-08-01 | 13F | SYM FINANCIAL Corp | 11,179 | 95 | ||||||

| 2025-07-11 | 13F | International Private Wealth Advisors LLC | 14,132 | 36.67 | 120 | 48.75 | ||||

| 2025-07-09 | 13F | Aaron Wealth Advisors LLC | 32,414 | 7.61 | 275 | 17.60 | ||||

| 2025-08-07 | 13F | Vise Technologies, Inc. | 92,886 | 54.50 | 788 | 62.60 | ||||

| 2025-07-31 | 13F | MQS Management LLC | 11,518 | 98 | ||||||

| 2025-07-25 | 13F | Yousif Capital Management, Llc | 55,228 | 16.96 | 468 | 27.87 | ||||

| 2025-06-27 | NP | POGRX - PRIMECAP Odyssey Growth Fund | 1,288,800 | -2.72 | 10,620 | 7.02 | ||||

| 2025-08-14 | 13F | XY Capital Ltd | 0 | -100.00 | 0 | |||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 38,596 | 8.40 | 327 | 18.48 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 106,673 | 19.33 | 905 | 30.45 | ||||

| 2025-08-01 | 13F | Oversea-Chinese Banking CORP Ltd | 63,653 | -14.03 | 540 | -6.10 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 826,494 | 20.57 | 7,009 | 31.75 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 23,672 | -13.96 | 201 | -6.10 | ||||

| 2025-08-06 | 13F | Mark Sheptoff Financial Planning, Llc | 3,500 | 0.00 | 30 | 7.41 | ||||

| 2025-08-11 | 13F | GW&K Investment Management, LLC | 524 | 0.00 | 0 | |||||

| 2025-08-26 | NP | GMOI - GMO International Value ETF | 37,929 | 322 | ||||||

| 2025-04-24 | 13F | Decker Retirement Planning Inc. | 0 | -100.00 | 0 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 23,173 | 10.16 | 0 | |||||

| 2025-08-11 | 13F | Intrust Bank Na | 46,028 | -2.67 | 390 | 6.56 | ||||

| 2025-07-30 | NP | AIQ - Global X Future Analytics Tech ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1,208,552 | -0.10 | 10,224 | 2.57 | ||||

| 2025-07-16 | 13F | Magnus Financial Group LLC | 10,605 | 90 | ||||||

| 2025-08-14 | 13F | Macquarie Group Ltd | 759,912 | -3.69 | 6,444 | 5.24 | ||||

| 2025-07-22 | 13F | Rocky Mountain Advisers, Llc | 150 | 0.00 | 1 | 0.00 | ||||

| 2025-05-08 | NP | QGBLX - Quantified Global Fund Investor Class | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-05-02 | 13F | Sachetta, LLC | 0 | -100.00 | 0 | |||||

| 2025-05-28 | NP | HWSIX - Hotchkis & Wiley Small Cap Value Fund Class I | 79,200 | -83.67 | 615 | -84.29 | ||||

| 2025-07-31 | 13F | Moloney Securities Asset Management, LLC | 15,000 | -44.44 | 127 | -39.23 | ||||

| 2025-05-13 | 13F | Measured Risk Portfolios, Inc. | 0 | -100.00 | 0 | |||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 1,502 | 3,959.46 | 13 | |||||

| 2025-08-14 | 13F | Beaird Harris Wealth Management, LLC | 132 | 1 | ||||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 13,486 | 0.00 | 114 | 9.62 | ||||

| 2025-08-04 | 13F | Kovack Advisors, Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 1,308,676 | 5.63 | 11,097 | 15.42 | ||||

| 2025-08-13 | 13F | Blueshift Asset Management, LLC | 46,511 | 394 | ||||||

| 2025-07-23 | 13F | Nbt Bank N A /ny | 437 | 0.00 | 4 | 0.00 | ||||

| 2025-06-26 | NP | DIHP - Dimensional International High Profitability ETF | 240 | 0.00 | 2 | 0.00 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 15,952,362 | 16.61 | 135,276 | 27.43 | ||||

| 2025-08-20 | NP | HWLIX - Hotchkis & Wiley Large Cap Value Fund Class I | 1,323,500 | -12.63 | 11,223 | -4.52 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 1,288 | 11 | ||||||

| 2025-04-23 | 13F | Mascagni Wealth Management, Inc. | 0 | -100.00 | 0 | |||||

| 2025-05-14 | 13F | REAP Financial Group, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 44,531 | -22.23 | 378 | -15.09 | ||||

| 2025-08-14 | 13F | Hotchkis & Wiley Capital Management Llc | 97,029,167 | -10.30 | 822,807 | -1.97 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 11,111 | 70.28 | 94 | 88.00 | ||||

| 2025-08-08 | 13F | Wrapmanager Inc | 11,034 | -30.57 | 94 | -24.39 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 75 | 733.33 | 1 | |||||

| 2025-08-13 | 13F | Jump Financial, LLC | 2,059,036 | 17,461 | ||||||

| 2025-08-14 | 13F | Syon Capital Llc | 194,745 | 65.95 | 1,651 | 81.43 | ||||

| 2025-08-15 | 13F | Earnest Partners Llc | 338,416 | -6.36 | 2,870 | 2.32 | ||||

| 2025-07-21 | 13F | Credential Securities Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 86,249 | -91.96 | 731 | -91.22 | ||||

| 2025-05-06 | 13F | Advisors Preferred, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-11 | 13F | Primecap Management Co/ca/ | 26,493,699 | -42.17 | 224,667 | -36.81 | ||||

| 2025-08-12 | 13F | Aigen Investment Management, Lp | 279,434 | 2,370 | ||||||

| 2025-08-26 | NP | Nuveen S&p 500 Buywrite Income Fund This fund is a listed as child fund of Nuveen Asset Management, LLC and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 95,165 | -46.40 | 807 | -41.47 | ||||

| 2025-07-24 | NP | FWRLX - Wireless Portfolio This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 209,600 | 0.00 | 1,773 | 2.66 | ||||

| 2025-07-09 | 13F | Sivia Capital Partners, LLC | 20,462 | 174 | ||||||

| 2025-08-06 | 13F | Vestmark Advisory Solutions, Inc. | 14,006 | 119 | ||||||

| 2025-07-29 | 13F | Private Trust Co Na | 3,646 | 34.04 | 31 | 42.86 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 76,200 | 10.43 | 1 | ||||

| 2025-08-12 | 13F | Minot DeBlois Advisors LLC | 4,350 | 0.00 | 37 | 9.09 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 93,962 | -8.08 | 797 | 0.38 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 275,311 | -4.93 | 2,335 | 3.87 | ||||

| 2025-07-30 | NP | FILFX - Strategic Advisers International Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1,422,080 | 0.00 | 12,031 | 2.67 | ||||

| 2025-08-14 | 13F | Woodline Partners LP | 89,762 | 761 | ||||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 53,863 | 15.90 | 457 | 26.67 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 255,700 | 42.93 | 2,168 | 56.20 | |||

| 2025-08-13 | 13F | Truvestments Capital Llc | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 106,600 | -4.65 | 904 | 4.15 | |||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 3,365,879 | 28,543 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 156,300 | -47.18 | 1 | -50.00 | |||

| 2025-06-27 | NP | AADBX - American Beacon Balanced Fund Institutional Class | 109,130 | -14.16 | 899 | -5.57 | ||||

| 2025-08-01 | 13F | Bank of Jackson Hole Trust | 1,000 | 0.00 | 8 | 0.00 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 175,759 | -30.85 | 1,490 | -24.44 | ||||

| 2025-07-28 | NP | AVDE - Avantis International Equity ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 689,492 | 10.92 | 5,833 | 13.88 | ||||

| 2025-07-30 | 13F | Financial Perspectives, Inc | 4,603 | 0.00 | 39 | 11.43 | ||||

| 2025-08-20 | NP | HWAIX - Hotchkis & Wiley Value Opportunities Fund Class I | 4,689,200 | -10.15 | 39,764 | -1.81 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - International Sustainability Core 1 Portfolio Shares | 51,015 | 0.00 | 420 | 9.95 | ||||

| 2025-07-30 | 13F | Caliber Wealth Management, LLC / KS | 14,235 | 0.00 | 121 | 9.09 | ||||

| 2025-08-08 | 13F | Crossmark Global Holdings, Inc. | 267,095 | -0.03 | 2,265 | 9.21 | ||||

| 2025-05-09 | 13F | Scotia Capital Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | BCS Private Wealth Management, Inc. | 297,098 | 3 | ||||||

| 2025-07-30 | 13F | Eqis Capital Management, Inc. | 11,526 | -22.46 | 98 | -15.65 | ||||

| 2025-07-30 | 13F | Cookson Peirce & Co Inc | 141,531 | 23.68 | 1,200 | 35.29 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 732 | -27.24 | 0 | |||||

| 2025-08-05 | 13F | Huntington National Bank | 963 | 48,050.00 | 8 | |||||

| 2025-07-28 | 13F | Naviter Wealth, LLC | 34,459 | 292 | ||||||

| 2025-08-12 | 13F | Trexquant Investment LP | 648,118 | -60.80 | 5,496 | -57.17 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 131,242 | 14.19 | 1,113 | 24.80 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Put | 47,700 | -9.32 | 404 | -0.98 | |||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Call | 62,700 | -34.35 | 532 | -28.34 | |||

| 2025-07-30 | 13F | Crewe Advisors LLC | 100 | 1 | ||||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 81,043,144 | -7.18 | 687 | 1.48 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 7,232 | 126.28 | 61 | 134.62 | ||||

| 2025-07-14 | 13F | Armstrong Advisory Group, Inc | 4,232 | 0.00 | 36 | 2.94 | ||||

| 2025-08-14 | 13F | Bayesian Capital Management, LP | 343,400 | 2,912 | ||||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 932,217 | 7.06 | 7,905 | 16.99 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 43,438 | -36.58 | 368 | -30.70 | ||||

| 2025-08-14 | 13F | Guardian Wealth Management, Inc. | 0 | -100.00 | 0 | |||||

| 2025-05-29 | NP | GATEX - Gateway Fund Class A Shares | 367,832 | -38.13 | 2,854 | -40.43 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 351,600 | -47.15 | 2,982 | -42.25 | |||

| 2025-07-17 | 13F | Michels Family Financial, LLC | 80,445 | -2.62 | 682 | 6.40 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 26,060 | 129.81 | 221 | 152.87 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 470,300 | -36.58 | 3,988 | -30.69 | |||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 735,478 | -0.21 | 6,237 | 8.98 | ||||

| 2025-07-21 | 13F | Ascent Group, LLC | 22,122 | 24.83 | 188 | 36.50 | ||||

| 2025-07-09 | 13F | Baron Wealth Management LLC | 11,516 | 5.08 | 98 | 14.12 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 4,051,458 | 37.28 | 34,356 | 50.01 | ||||

| 2025-08-06 | 13F | SOUTH STATE Corp | 910 | 0.00 | 8 | 0.00 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 17,927 | 61.56 | 153 | 77.91 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 815,783 | 3.54 | 6,918 | 13.13 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 13,217 | 1.80 | 112 | 12.00 | ||||

| 2025-07-28 | NP | AVSD - Avantis Responsible International Equity ETF | 30,853 | 0.00 | 261 | 2.76 | ||||

| 2025-08-27 | NP | VANGUARD VARIABLE INSURANCE FUNDS - Capital Growth Portfolio This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 478,900 | -55.89 | 4,061 | -51.80 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 6,988,533 | 45.33 | 59,263 | 58.82 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 2,075,092 | -23.25 | 17,597 | -16.13 | ||||

| 2025-08-06 | 13F | True Wealth Design, LLC | 62 | -3.12 | 1 | |||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 14,216 | 0.33 | 110 | -3.51 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 23,763 | 47.79 | 202 | 62.10 | ||||

| 2025-07-25 | 13F | Ruedi Wealth Management, Inc. | 19,157 | 0.00 | 162 | 9.46 | ||||

| 2025-08-26 | NP | LCORX - Leuthold Core Investment Fund Retail Class | 378,070 | 49.22 | 3,206 | 63.07 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Peak6 Llc | Put | 50,000 | 0.00 | 424 | 9.28 | |||

| 2025-08-14 | 13F | Peak6 Llc | Call | 92,800 | 787 | |||||

| 2025-08-20 | NP | HWGIX - Hotchkis & Wiley Global Value Fund Class I | 161,672 | 0.00 | 1,371 | 9.25 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 212,582 | 125.81 | 1,803 | 146.85 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 799 | 0.00 | 7 | 0.00 | ||||

| 2025-05-02 | 13F | Cable Hill Partners, LLC | 31,254 | 1.40 | 258 | 3.63 | ||||

| 2025-07-28 | 13F | Private Wealth Asset Management, LLC | 96 | 0.00 | 1 | |||||

| 2025-08-13 | 13F | Leuthold Group, Llc | 602,678 | 49.12 | 5,111 | 62.95 | ||||

| 2025-05-16 | 13F/A | Kestra Investment Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 2,769,026 | -12.98 | 23,373 | -5.59 | ||||

| 2025-06-26 | NP | SNTKX - Steward International Enhanced Index Fund Class A | 143,601 | 0.00 | 1,183 | 10.05 | ||||

| 2025-08-28 | NP | IDGT - iShares North American Tech-Multimedia Networking ETF | 595,758 | -16.28 | 5,052 | -8.49 | ||||

| 2025-08-11 | 13F | Lsv Asset Management | 34,300 | 0 | ||||||

| 2025-04-22 | 13F | Mendota Financial Group, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-31 | 13F | Nilsine Partners, LLC | 18,664 | -7.00 | 158 | 1.94 | ||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 8,425 | 67.86 | 71 | 82.05 | ||||

| 2025-05-12 | 13F | Waterloo Capital, L.P. | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 15,100 | 0.99 | 128 | 10.34 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 173 | 45.38 | 1 | |||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 52,063 | 6.49 | 441 | 11.93 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 1,632 | 126.67 | 14 | 225.00 | ||||

| 2025-08-14 | 13F | Corient IA LLC | 11,000 | 93 | ||||||

| 2025-07-21 | 13F | Qrg Capital Management, Inc. | 505,096 | 2.22 | 4,283 | 11.71 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 37,711 | -9.22 | 320 | -0.93 | ||||

| 2025-07-16 | 13F | ORG Wealth Partners, LLC | 476 | 0.00 | 4 | 33.33 | ||||

| 2025-06-20 | NP | ABLG - TrimTabs All Cap International Free-Cash-Flow ETF | 120,158 | 835.74 | 990 | 1,446.88 | ||||

| 2025-08-20 | NP | HWMIX - Hotchkis & Wiley Mid-Cap Value Fund Class I | 1,756,800 | -3.74 | 14,898 | 5.19 | ||||

| 2025-08-13 | 13F | Natixis Advisors, L.p. | 899,106 | 6.09 | 8 | 16.67 | ||||

| 2025-08-14 | 13F | Turim 21 Investimentos Ltda. | 670,000 | 0.00 | 5,682 | 9.27 | ||||

| 2025-07-08 | 13F | Rise Advisors, LLC | 1 | 0.00 | 0 | |||||

| 2025-07-17 | 13F | CWA Asset Management Group, LLC | 430,741 | 15.26 | 3,653 | 25.97 | ||||

| 2025-08-19 | 13F/A | Pitcairn Co | 17,728 | -5.61 | 150 | 3.45 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 229 | 218.06 | 2 | |||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 10 | 0.00 | 0 | |||||

| 2025-07-10 | 13F | HF Advisory Group, LLC | 13,419 | 114 | ||||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 2,250 | 0.00 | 19 | 11.76 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 175 | -3.85 | 1 | 0.00 | ||||

| 2025-08-25 | NP | AADR - AdvisorShares Dorsey Wright ADR ETF | 122,151 | 17.57 | 1,036 | 28.41 | ||||

| 2025-05-12 | 13F | Financial Engines Advisors L.L.C. | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 11,620 | -33.91 | 99 | -30.50 | ||||

| 2025-08-04 | 13F | Simon Quick Advisors, Llc | 12,227 | 104 | ||||||

| 2025-07-18 | 13F | Dogwood Wealth Management LLC | 592 | 5 | ||||||

| 2025-07-18 | 13F | PFG Investments, LLC | 10,078 | 85 | ||||||

| 2025-07-21 | 13F | Cromwell Holdings LLC | 10,276 | 72.82 | 87 | 89.13 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 79,858 | 677 | ||||||

| 2025-07-15 | 13F | North Star Investment Management Corp. | 57 | 0.00 | 0 | |||||

| 2025-08-12 | 13F | American Century Companies Inc | 988,708 | 13.76 | 8,384 | 24.32 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | 67,141 | 94.12 | 569 | 112.31 | ||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 31,223 | 107.39 | 265 | 127.59 | ||||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 184,390 | 0.00 | 1,560 | 2.63 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 647 | -53.82 | 5 | -50.00 | ||||

| 2025-07-29 | NP | SSEAX - SIIT Screened World Equity Ex-US Fund - Class A | 80,029 | -19.29 | 677 | -17.14 | ||||

| 2025-07-15 | 13F | Financial Management Professionals, Inc. | 267 | -79.77 | 2 | -80.00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 41,800 | 354 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 923 | 0.00 | 8 | 0.00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 469,551 | -80.34 | 3,982 | -78.52 | ||||

| 2025-08-14 | 13F | Peak6 Llc | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 4,796 | 41 | ||||||

| 2025-08-15 | 13F | WealthCollab, LLC | 942 | -57.72 | 8 | -58.82 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 43,999 | 189.85 | 373 | 218.80 | ||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 31,170 | -4.19 | 264 | 4.76 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 16,494 | 18.68 | 140 | 29.91 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 4,249 | 36 | ||||||

| 2025-04-11 | 13F | First Affirmative Financial Network | 38,453 | -4.30 | 298 | -7.74 | ||||

| 2025-07-25 | 13F | Stephens Consulting, LLC | 281 | 2 | ||||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 6,235 | 402.82 | 53 | 477.78 | ||||

| 2025-07-15 | 13F | Drum Hill Capital, LLC | 713,002 | -1.71 | 6,046 | 7.41 | ||||

| 2025-08-26 | NP | LST - Leuthold Select Industries ETF | 23,014 | 81.57 | 195 | 98.98 | ||||

| 2025-08-27 | NP | RYDEX VARIABLE TRUST - Telecommunications Fund Variable Annuity | 12,695 | 155.07 | 108 | 181.58 | ||||

| 2025-07-28 | 13F | Ritholtz Wealth Management | 303,538 | -5.94 | 2,574 | 2.80 | ||||

| 2025-08-12 | 13F | Clear Street Markets Llc | 924,788 | 347.06 | 7,842 | 388.60 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 19,100 | 162 | |||||

| 2025-07-21 | 13F | Hennessy Advisors Inc | 13,622 | 116 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 39,458 | -27.34 | 335 | -20.43 | ||||

| 2025-08-22 | NP | SIXG - Defiance Next Gen Connectivity ETF | 1,231,869 | -1.94 | 10,446 | 7.17 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 3,089,572 | -17.42 | 26,200 | -9.76 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 11,300 | 39.51 | 96 | 53.23 | |||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | 1,227,079 | -23.00 | 10,406 | -15.86 | ||||

| 2025-08-05 | 13F | Ellevest, Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 20,800 | 4.00 | 176 | 13.55 | |||

| 2025-08-13 | 13F | Walleye Trading LLC | 14,424 | -51.61 | 122 | -47.19 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 2,300 | 475.00 | 20 | 533.33 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 141,000 | 365.35 | 1,196 | 408.51 |